Abstract

Luggage wrapper is not a new concept though it is not commence in UK yet. In Europe it is initiated, firstly. Now many biggest airports in USA and Europe it is using to prevent any damage, pilferage of the luggage carrying by the customers. UK entrepreneurs have vast of opportunities to start this business as no competitors are exists. Luggage wrapper is used to secure the customers luggage and related items in the Airport. The films are provided to extra support for make it strongly protected. Our company name will be “Wrapper”. Initially it will be operated in 10 biggest Airports. These 10 Airports are carrying more than 16 corer passenger per year. So, great opportunity is underlying.

Introduction

To launch and promote any business activities within a shape of organisation, a business plan is needed especially integrated with ecommerce. Without marketing plan it is not possible to penetrate in the market. The strength, weakness, opportunities, competitive advantages, distinctive competencies should be considered first. So, “Wrapper” needs a detailed marketing plan for the expansion of its business activities.

Methodology

For evaluating the business plan of “Wrapper”, a series of points have been extracted. The marketing audit has been accomplished with 7p analysis. The four marketing segments are financial institutions, student (newly graduate), and women, less educated people. For each of these segments, depending on marketing mix product, promotion, place, a detailed course of action has been elucidated. The entire process has been structured in these points, targeting, and market segmentation, positioning and choosing competitive advantages.

Theoretical aspects

According to Kotler., P., and Armstrong. G (1999), segmentation is a process by dividing a market into distinct groups of buyers with different needs, characteristics, or behavior who might require separate products or marketing mix and the process of evaluating each marketing segments attractive and selecting one or more segments to enter. Market positioning is the process of formulating competitive positioning for a product and a detailed marketing mix.

Marketing mix are product, price, place, promotion. Depending on these elements the entire marketing plan is established. Marketing audit is a study to analysis the external and internal factors. Here in this report 7p model has been analysed. According to Taylor.S (2007) CRM stands for customer relationship management and helps the management and customer service staffs cope with customer concerns and issues. B2B refers to business to business with fully ecommerce supported.

According to Fraser, L. (2001) & Ormiston, A. (2001) The available cash resources to satisfy the current obligations must come primarily from cash or the conversation to cash from of other current asset. For interpreting the liquidity of the firm, several types of ratios have been depicted.

Current ratio, quick ratio, cash flow liquidity measures the firms short term solvency. Firm’s ability to meet the current obligations can be judged. Liquidity position or effects of using debt can be evaluated. The available cash resources to satisfy the current obligations must come primarily from cash or the conversation to cash from of other current asset.

In order to judge the long term financial position of the firm, financial leverage ratios are used. Brigham, E. & Houston, J. (2007) mentioned that these ratios indicate mix of funds provided by owner and lender. According to Fraser, L. & Ormiston, A. (2001) the amount and proportion of debt in a company’s capital structure is extremely important because of the trade off between risk and return.

Gross profit margin, operating profit margin, and net profit margin represent the firm’s ability to translate sales dollars into profits as different stages of measurement. Administrative efficiency can be judged through this. Brigham, E. & Houston, J. (2007) assessed the fixed asset turnover ratio measures how effectively the firm uses its fixed assets and total asset turnover measures the turnover of the entire firm’s asset. So, Debt ratio, debt to equity ratio, long tem debt to total capitalization ratio have been drawn.

Objectives

We will have the following objectives:

- To commence revenue from service, the initiating year of operation as no competitors are available and it is easy to lure passenger, as number of customers are higher.

- To raise enough seed and bridge capital in timely to make available of working capital.

- After operating in major 3 airports, we will look forward to commence its operations in next five busiest airports. These airports are; Stansted, Glasgow, Edinburg Birmingham, and Luton.

- After one year we will add 400 more luggage wrappers in these five busiest airports.

- After two years all the next 2 busiest airports will be undertaken to control and at least 200 new luggage wrappers will be purchased.

- Its goal to reach in break even point within 5 years.

Mission

“Wrapper” has a mission to provide safe service of passenger’s luggage while traveling within low cost as its highest priority. Our service will be emphasized by the securing. We will operate our operations at the busiest airports in UK. Our luggage wrapper will save passenger’s luggage from any pilferation or tampered. Hence, we will strive to do our best and the newest service with outstanding quality of wrapping.

Keys to success

The key successes are;

- Government approvals can be obtained as government will find large source of revenue from tax.

- Financing is available as lending intuitions have keen interest.

- Experienced management as they will be hired from the major airlines.

- It is easy to lure passengers as most of them feel for sturdy safety.

- Competitors are not available now. Therefore there will be no threat for any triumph card at least for 1 year.

- Have an opportunity to move in another station like bus and train.

- Quality can be ensured as the depreciation charge is high, means every new machine will be purchased after three or four years.

- Advertisement cost is for one time the maximum portion of the passengers are regular commuter.

- As labor will be imported from South Asia region, the cost of labors will be reduced. In few session of training, the labor can be efficient. If 200 can be given it will easier to manage.

- The luggage wrapper has salvage value. After the estimated life time, it can be sold to shopping malls for wrapping to send another state.

- First mover advantages will be gained.

Highlights: The major highlights are given below:

From the first year of operation we will be able to generate revenue as there customer are obliged to secure his bag from us. The first year profit is above 20000000 and the next of four it will be same.

The above graph shows the increase in net profit before tax. It is noticeable that in the first year the difference between gross profit and net profit is high as it requires higher level of initial working capital. The next four years it represents the consistency with gross profit margin. So, the administrative efficiency will be higher.

The above graph represents the represents the opportunities for investing. Initially we will target in three major airports. The Heathrow will be our main concern and from this segment the majority of revenues will be generated. Our next concern will be Manchester and Gatwick.

Company Summary

- Formation: our “Wrapper” company will be established in Heathrow, on January 1, 2009. Preliminary its office will be located in Gatwick and Manchester. The chief executive officer (CEO) will be hired from aviation luggage maintenance expertise. In this case high profile is necessary enough. Only expertise in administrative work will be necessary.

- Ownership: “Wrapper” will not be enlisted in London Stock Exchange as capital requirement is low. We will finance our capital from lending institutions of London, 5, 00,000.00 amount of capital will be hired with the formation of syndication. Initially, two investors will finance another portion of capital and the profit will be shared on proportion of capital. Additionally commercial papers will be circulated in order to raise working capital. The seed capital will be financed by investors and lending institutions. The portion will be allocated in 50%-50%. The rest of the amount will be hired in same basis after 1 year when new luggage wrappers will be brought. Our capital structure is given below:

- Start up summary: In the second year of operation “Wrapper” company will add revenue by hiring 300 new luggage wrapper. Each luggage wrapper will take 15 minutes to accomplish a job. The major items of start up capital are listed below:

Services

Services, products description and advantages

Our company ‘Wrapper” will provide the services of wrapping of the passenger’s luggage for safety. This will prevent form any kind of damages and passenger’s will feel free while in traveling. The machine will be located at the check in point. Baggage wrapping in an easier way to guard luggage’s in a plastic bag.

It is sealed with nice finishing films for securing. No sandwich wrap plastic will be used. It reduces the waiting time for packing the luggage by airport personnel. The luggage wrapping embellished with plastic film with a thermal pressure. This machine will be installed in a plastic tray. This plastic sack is positioned on the item similar to a pillowcase.

The upper side or opening of the bag is folded beneath the bag. The tray which can be mobilized in the machine tunnel will be heated by electrical pressured. After 15 seconds the bag will be sealed and secured. We have estimated if at least 1 customer out of 20 intends to secure his bag by our services which help to earn revenue. Besides this 1 passenger is our target but this will be numbered in more as we are providing low cost. The advantages are listed below:

- The low cost will lure passengers

- Our services will protect the baggage from any kind of damage or pilferation

- Customer will feel safe and enjoy the journey without any hesitation.

- The long waiting queue for packing the baggage for traveling inside the airport is a hassle for passengers and we can save their time up to 50% as we are locating one luggage wrapper for every 10 passenger.

- The emergency packing system will reduce the hassle for late customer though additional charges will be imposed.

- We will provide another advantage for passenger that is, the passenger can send his baggage some hours ago and we will packed the luggage within given time. As a result, customers can save their time.

- Our services will reduce the harassment in the airport. Airport authorities can remove these unproductive efficiencies.

- The airport authorities can save their time and money as no employee will be kept for packing purpose. This will help them to reduce the cost.

Competitive comparison

At present we have no competitors. So, we are going to get the first mover advantage. However, the airport authorities will be main barriers. They may not permit us for several reasons. These reasons and possible cure are listed below:

Sales literature

Our sale will be must if we can convince airport authorities. The advertisement will be operated for a short period. The possible solutions of advertisements are;

- Collect passenger’s profile to aware them about the current strategy for wrapping via phone call, letter, message, or email. This will reduce the cost of massive advertisement. This expenditure will be done for on e time. No advertisement will be required after this because passengers are obligated to carry out their luggage through us.

- An online booking system will be placed for customer who can send their baggage for wrapping. Our home taking system will lure the passenger.

Fulfillment

Luggage wrapper will be purchased from SHIBA. Around 750 machines will be bought in the first year. In the second and third year 250 and 160 machine will be purchased for rest of the busiest airport. The first payment will be about 50% of the total cost and rest of the payment will be made fewer than two or three installments.

The installment will be paid by judging the quality of the machine. The next year’s purchase will be adjusted with current year’s installment. The advantages of SHIBA’s machines are- although it requires no reservation but customer who intends to pack his luggage can send us via home taking system. So, a channel of taking luggage will be placed our company. The details are outlined in the technology section.

Other services

The maintenance cost will be performed by the labour imported from south Asia. The maintenance cost divided by in three categories:

- Machine handling labour cost,

- Ground Handlings,

- Food service.

For machine handling cost, labour’s payment will be paid on full time basis. For these purposes three shifts of work is categorised in three segments. The cost structure is given below:

Total 32 workers will be responsible for machine handling. Numbers of workers are in different airports are categorized below:

For parking services, baggage loading or unloading will be done by workers who will be appointed as full time basis. The workers will be imported from south Asia. In a small corner, a canteen for workers will be established. There is no aim for commercial purpose. The reasons behind importing human resources from south Asia are cheap labour, half baked education gainer that can be shifted into qualified workers.

Technology

“Wrapper” will utilize all necessary equipment and system that will be evaluated diligently. Management believes that the machine will be imported from supreme quality provider. Our possible suppliers are SIBA.

Wrapper machine advantage

We will use “XL-01 series luggage wrapper”. From the market survey, it was found that this is durable and lifetime will at least 4 years. The machine will take 15 second each luggage to seal. At least 4lac luggage it can seal. So, it is matched with our cost benefit principle. The machine has a value of 5000 each. The major specification of the machine in listed below:

- Powered Pre-stretch film (200%to min film consumption)

- Control adjustment of Film Tension on the panel

- vertical rods to secure bag is adjusted by operator

- Adjusted wrap timer

- Speed 20RPM(Platform)

- One person can moved the machine easily

Technical specifications are;

- Shape Dimensions(mm): 650(W)x1570(L)x1200(H)

- Machine Weight: 200 kg

- Weight Capacity: 100 kg

- Power supply: 220V/50HZ/1 Phase 0.5 kw

- Maximum Load Size(mm):180-350(W) x400-800(L) x300-500(H)

- Packing Materials: Stretch film width :500 mm

The described above machine can save operating costs up to 20% than other and also reliable in terms of lifetime. The depreciation will be. In Europe who initiated the business first has proposed for the machine. In addition the machine will be complied the rules of the airports. An airport authority shows their interest to use the machine.

Since these were built in 1985 the parts are available. On the other hand the “XL-01 series luggage wrapper” is noise free machine and it is complying the noise standard. If the machine falls in trouble the SIBA will have 24 hours customer service and these are dedicated as the market survey indicated.

Reservation advantage

Though our services needs no reservation but customer who has no time for reservation can place the order for a definite time. So, from CMS a tiny size of reservation system is introduced. The CMS system integrates the management functions in a whole process. Another tool will be used for queue system.

Who has placed order first and who will be later is determined by the CMS system. The training costs are low here. As it takes few time to learn the operating procedure of the machine. In this case our competitive advantage is that we are getting cheap labor which will boost our revenue as we will use “No frill” theory.

Operational advantage

The entire operation will be seamless and the chief executive officer will integrate the existing operation offices with information system technology. The up to date information will available via intranet. As a result the operating expenses will be down. The major problem will be arisen from security issue. We will be collaborated with police, national and airport securities. The operational advantage will gain competitive advantage as no players are available.

Future services

Our service will be supreme than the airport authorities provided. It will more secure and the probability of occurring damage will be less than 1%. Our future services include expanding our services in train stations, sea port and interested personnel who wants to secure his bag from and damage or pilferation.

The home delivery and taking system will be an added advantage. We have a plan to expand our services for electronic appliances for sealing for ensuring security. After covering UK we will move to other neighbor countries to sell our services. Hence, we will obtain economy of scale and the costs of services will be reduced.

Market analysis summary

Though we are certain about profitability it is required to analyse the market opportunities and market survey for placing our services. Our main concern is how much population we can maintain or in what way they can be attracted. The passenger’s statistics gets the priority. The present statistics of carried passenger’s orts of UK is described below:

Market audit

Before go for depth analyzing for market audit is necessary. Market audit determines the shape of industry, its structure and segmentation. Major decisions are taken by studying market audit. This is elucidated below:

People

It is the major elements of competence. In the packing sector skilled, dynamic, energetic, effective people are must. In our organisation less skilled human resources are required. With the changes of situation, culture, “Wrapper” is adopting the best strategy with varying the position of people.

Product

To enter in market unique or qualified product is necessary. As no competitive product like us is not exists in the market, we will gain the first mover advantages.

Pricing

Pricing is one of the important factors for market penetration. As no competitors are available the pricing factor is not a matter. But this should be in a tolerance level. We will charge 5 each pack sealed.

Process

The important factor how the organisation will be operated. The procedure for operating the organisation and its branches are outlined below:

Promotion

No promotional or less activities are required. The regular passengers will be contacted via phone, email or any other means to let them know that they will have to pack their baggage before check in

Physical evidence

Vodafone has developed state of art technology and place in the central point of England and capital. The place is accessible from anywhere of the country.

Market segmentation

According to Kotler. P (1999) and Armstrong. G (1999) segmentation is a process by dividing a market into distinct groups of buyers with different needs, characteristics, or behavior who might require separate products or marketing mix and the process of evaluating each marketing segments attractive and selecting one or more segments to enter.

Market positioning is the process of formulating competitive positioning for a product and a detailed marketing mix. In this business we use geographic market segmentation. The major offices will be built in Heathrow, Gatwick and Manchester. Later in the upcoming year, depends on economy of scale we will move to Stansted, Birmingham, and Glasgow. Edinburgh, Luton, Belfast international and Bristol. In the first year of operation our targeted segments are:

Heathrow will be our main resource for revenue earning. In the upcoming year the number of passenger will be increasing as the travel, business is expanding. The number of carrying passenger is given below:

When the products are offered some measurement will be undertaken. These ensures the product’s sustainability. These are:

- Measurable: The size, purchasing power and profits of the segments can be measured.

- Substantial: The market segments are large or profitable enough to serve.

- Accessible: The market segment can be effectively reached and served

- Differentiable: The segments are conceptually distinguishable and respond differently to different marketing mix elements and programs

- Actionable: Effective programs can be designed for attractive and serving segments

Business participants

As the business is surrounding with various customers, suppliers and manufacturers, the participants are more. For advertisement we will contact with “WRAPPER” and AT & T to circulate the advertisement. “WRAPPER” and AT & T will act as intermediaries between clients and our company. The manufacturer will be SHIBA. The warehouse provider will be Hertz as they are providing cheap instruments. The motor vehicle will be purchased form BEDFORD. Toyota will be our car sponsor.

Distribution patterns

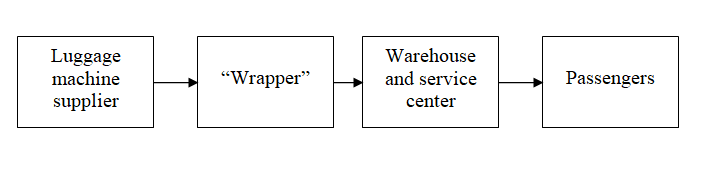

The distribution pattern is simple. The luggage wrapper machines will be located on various busiest airports. These machines will be collected from SHIBA. The customer will place their order and get after specific time. Some machines are reserved for emergency purpose. The distribution pattern is given below:

Positioning for competitive advantages

A product’s position is the complex set of perceptions, impression and feelings. Consumers hold this concept for the product compared with competing products. A test is given below:

- Is this resource strength hard to copy?

- NO

- Is the resource strength durable?

- NO

- Is the resource really competitively superior?

- YES

- Is the resource strength be trumped by other resource strengths and the competitive rivals?

- YES

From the above question we will move fast towards airports to airports to capture as the any competitor may grow up. The first mover advantages should be gained and adequate cash and quality will be provided towards airports for stopping the licensing procedure towards the organisation.

Porter’s five factor model

- The bargaining power with supplier is key important issue in determining the role of business. If the switching cost is comparatively low the business will get advantage. As, the luggage wrapper manufacturer is low in numbers “Wrapper” will face problem if they face the cost arising due to inflation.

- In terms of bargaining power with customer is low. As the airport authorities will be awarded £150000 annually this is huge in terms of their own revenue. We will maintain enough liquidity to stop the licensing to another competitor.

- Entrants of new threats will be lower as the airport authorities will be awarded with high cash flow. So, no new license will be provided.

- Bargaining power with customer will be low as they are obligated to the certain amount of money. The 5 each passenger is little amount and anyone will want to secure his luggage by paying this tiny amount of money.

SWOT analysis

Before starting the operational procedure the SWOT analysis is mandatory:

- Strengths: No threats of new entrants as the airport space will be leased for 5 years. If any competitor wants to establish another luggage wrapper, then it will be impossible to provide low cost services.

- Weakness: The weakness is only one, if the hired machine do not last long.

- Opportunities: We have opportunities to expand our market rest of the airports in London after 5 years and the global perspective is in our mind.

- Threats: Only the airport authorities will be a threat if they introduce new legislations.

Strategy and implementation summary

Implementation is the procedure to convert the theoretical study into working state. Successful implementation includes involving all of the decision makers, proper guideline for execution, segmentation innovation, boosting the power of existing products and repositioning. When it is about to implement the strategies it should be brought down under consideration that whether the product should be differentiated or low cost oriented. According to the market segmentation and availability of resources the right measurement should be conducted.

“Wrappers” market existence will be accomplished by depending on the strategy of identifying and serving a low cost and hassle free service towards passengers.

- Via email, phone, letter the luggage wrapping procedure will be broadcasted. In this personal profile of passenger will be taken form airport officials.

- Only one corporate office and 10 warehouses will be operated and these will be connected via intranet.

- There will be reservation system for passengers who intend to pack earlier.

- The pricing will be dynamic if any competitors are growing

Marketing strategy

For the marketing strategy purposes, the target is maintained like below;

Using a differentiated marketing strategy “Wrapper” decides to target several market segments or niches and design separate offer for each. Though it creates lots of cash but different types of marketing research, planning, implementation will result in higher cost.

Pricing strategy

The pricing strategy is required for building any business plan and we are no exception. The price will be followed by the pattern of increasing rate. The initial charge will GBP 5 per passenger. By depending on the condition like economic review, inflation the whole pricing system will be changed.

Parties to exchange

Several parties are engaged in Wrapper. These are:

- The person who uses the product: The air passengers are the user of the product.

- Gatekeepers: Wrapper maintains third party software that is integrated into the whole system whose work is to control the information used by others.

- Influencers: When entrepreneurs take the decision to take any services like loan, Wrapper helps to evaluate the alternatives.

- Deciders: The entrepreneurs take the decision to purchase the services.

- Buyers: The person who have the actual authority to take the decision

Maintainers

The large stuff of Wrapper and entrepreneurs are the maintainer.

Promotion strategy

Promotion will be done via collecting passengers mailing address, phone number to deliver the news of changing the pattern of luggage checking. There will be no massive advertisement to promote the activities. So, the overall advertisement cost is low. This will help for sound financial health.

Distribution strategy

For rendering the services, there will be twisted rows in the 10 multistoried building. So, the there will small number of lanes. The customer will not wait for an hours. They can give the luggage and can wander away. So, this will help as promotional activities and will attract customers to take the services.

Sales strategy

No major sales strategy will be taken as the passengers will be obliged to take the services. So, there will no major sales activities will be under taken. The sales strategy will not be a major issue in this regard.

Passenger services program

Personal selling is an indispensable element for “Wrapper”. For promoting the customers and make their information available personal selling is compulsory. Wrapper has specialized human resources to train up them. Mainly these personal selling is occurred at the first time. The post purchase behavior is accomplished by internet.

Wrapper sales promotion is very qualities and was nominated for GSMA award. Wrapper always organizes trade fair to promote their services. Recently the ongoing tourist exhibition is sponsored by Wrapper.

Thus Wrapper has a dynamic CRM which is a competitive advantage. Wrapper is successfully using these mixes with the integration of online system. Besides, modern selling point and customer care has been established. Wrapper has state of art call centers which are used to keep communication with current consumers.

CRM stands for customer relationship management. It is important to Wrapper because existing customer of Wrapper always queries about the market condition of upcoming events. So, a dedicated sate of art call center has been established. CRM helps the management body to think about the future prospect.

Wrapper uses a large relational database for keeping the current information of the customer. Anytime by querying specifics customer’s information can easily be retrieved. Every major call center and points are interrelated via intranet. The phone procedure and transmission is done by the computerised arrangement. With just a small number of mouse clicks, the customer support delegates such as can track the location of the customer’s package.

This is significantly far better than the oppressive process of tracking shipments previously old system. In addition, the customer service representative would be able to see the previous apprehensions of the customer. This is an enormous help in particular if the customer is calling about the same issue, since he or she need not to repeat the story all over again. These should consequences less time to resolving the issue. Thus, support staff should gain higher productivity.

By considering above points “Wrapper” should follow the process below:

- Identify bases for segmenting the market

- Develop measures of segment attractiveness

- Develop profiles of resulting segments

- Developing positioning for each target segment

- Select the target segments

- Develop marketing mix for each target

Management summary

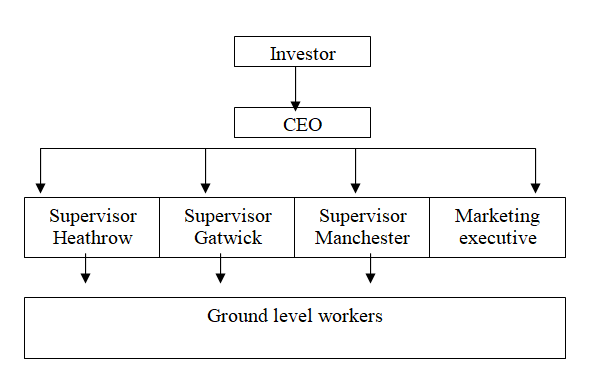

Our Company will appoint one Chief executive officer, 3 Nos. marketing executives, 10 supervisors and 405 ground workers. The supervisors would be appointed for supervising the performance of workers. These supervisors will work as human resource also. As the organisation planed activities are limited, the number high officials would be limited and low level workers are much more. The ground intensity workers would be imported from South Asia.

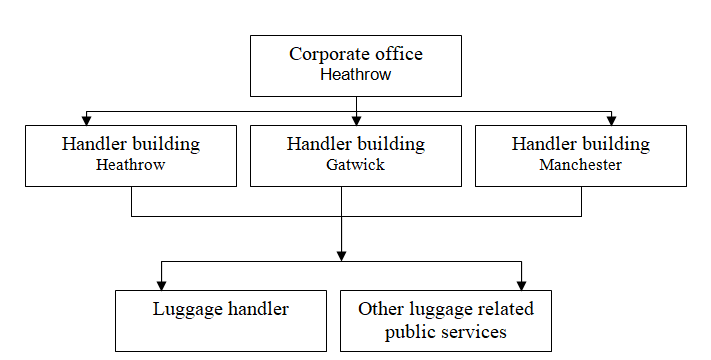

Organisational structure

Te organisational structure is given below:

Financial plan

Our primary objectives in this chapter are to explain what manager can do to make their company more valuable. Managers must understand how investors determine the value of stocks and bonds. If they can identify, evaluate and implement projects then they would be able to meet or exceed investor expectations.

However, values creation is impossible unless the company has a well mentioned financial plan. As famous quote of Yogi Berra is “You’ve got to be careful if you don’t know where you’re going, because you might not get there.” To wear out weakness and strengthening the advantages financial analysis is done by the firms.

Financial statement analysis involves, comparing the performance with that of other firms in the same industry. It is used to evaluating trends in the firm’s financial position over time. This study should assist management to identify deficiencies and then take appropriate actions to improve performance.

Our projected financial plan has been broken down several steps. Project financial statements are used in these projections to analyse the effects of the operating plan on projected profits and various financial ratios. The projections may also be used to monitor operations after the plan has been finalised and put into effect. Rapid understanding of deviation from the plan is essential in a good control system, which in turn is essential to corporate success in a changing world.

This report has determined the funds needed to support the five year plan. This included funds for plant and equipment as well as for inventories and receivable. Forecast funds availability over the next five years. Our financial planning includes estimating the funds to be engendered internally as well as external sources those to be obtained from. Any restriction on operating plans obligatory by the financial boundaries must be incorporated within the plan.

Constraints including restrictions on the current ratio, debt ratio and the coverage are included. It aimed to develop procedures for adjusting the basic plan where the economic forecasts upon which the plan has based may not materialised. It also involved to establishing a performance based management compensation system. It is significantly important that such an arrangement rewards manager for serving stakeholders want them to maximum share price.

Income statement

Balance sheet

Important assumption

Some important issues are considered as assumption. These are listed below-

- The tax is not calculated

- The life time of the luggage wrapper will be 4 years.

- The first year operation will be located in top three airports in UK

- We will use no debt. The maturity bond will be used.

Key financial indicators

According to Fraser, L. & Ormiston, A., (2001), the accessible cash resources to persuade the current obligations must come primarily from cash or the conversation to cash from of other current asset. For interpreting the liquidity of the firm, several types of ratios have been depicted. Quick ratio, Current ratio, cash flow liquidity measures the firms short term solvency.

Firm’s ability to meet the current obligations can be judged. Liquidity position of the firm or effects of using debt can be evaluated. The available cash resources or capital to satisfy the current obligations must come primarily from cash or the conversation to cash from of other current asset.

To judge the long term financial position of the firm, the financial leverage ratios are used. Brigham, E. & Houston, J., (2007) mentioned that these ratios indicate mix of funds provided by owner and lender. According to Fraser, L. & Ormiston, A., (2001) the amount and proportion of debt in a company’s capital structure is extremely important because of the trade off between risk and return.

Operating profit margin, Gross profit margin, and net profit margin represent the firm’s ability to translate sales dollars into profits while different stages of measurement. Administrative efficiency can be judged through this. Brigham, E. (2007) & Houston, J. (2007) assessed the fixed asset turnover ratio measures how effectively the firm uses its fixed assets and total asset turnover measures, the turnover of the entire firm’s asset. So, Debt ratio, debt to equity ratio, long tem debt to total capitalization ratio have been drawn.

Through Ratio analysis and DU Pont system the financial analysis has been done. For evaluating the financial performance of the firm, ratio analysis and Du Pont system are used. According to Fraser, L. & Ormiston, A. (2001), the subordinate classifications of ratio analysis are:

- Liquidity ratio: Short term solvency,

- Leverage ratios: Debt financing and coverage,

- Activity ratios: Asset liquidity, Asset management efficiency,

- Profitability ratios: Overall efficiency

Liquidity ratio: Short term solvency

The current ratio of the firm indicates that at the end of year current asset covered the current liabilities 1.13 times down form the previous year. The low liquidity indicates increase of creditors and decrease of cash position of the firm. The firm will face trouble as proportion of current asset to current liability is lower. The quick ratio is in a worst condition. As a result, the firm cannot meet its current obligations unless the stock turnover is increased.

Activity ratios: Asset liquidity, Asset management efficiency

From the average collection period it is seen that firm’s credit policies is becoming lenient from previous year which is indicating credit policy is too lenient, quality of debtors is poor. As average collection period is increased by 45% from previous year it is a harbinger of becoming bad debts. It is indicating the poor quality of debtors. Inventory turnover is decreased to 2 times. It is happened for several reasons; poor quality of goods, increased in price, quality of advertisement campaign is poor and etc.

Fixed and total asset turnover is becoming worse compare with previous year indicating management inefficiencies in generating sales from investment asset. As lower the ratios, the bigger in the investment required to generate sales.

Leverage ratios: Debt financing and coverage

Among total asset the total liabilities is 63%, increasing from previous year by 16%, indicating firm is receiving more debt and increasing the risk as fixed interest charge is increasing. External finance is not possible as higher proportion of debt is using against total shareholder equity. Though the firm increased its debt, it also improved its ability to cover interest payments from operating profit.

Profitability ratios: Overall efficiency

Gross profit and net profit margin is increased slightly from previous year. The firm can control its cost of sales as gross profit margin is satisfactory and administrative efficiency is comparatively good as net profit margin is increasing. The firm can manage its total investment in asset and return to shareholder is quite satisfactory.

Du Pont system

Return on equity is increased because of net profit margin has been increased compare with total asset turnover. Financial leverage has been increased indicating higher fixed obligations and higher degree of risk. The firm added more debt by bank overdraft. Though the ROI is increased it threats to unavailability of funds form external sources as fund providers sees greater degree of risk as acid test ratio is below standard.

Ways of financing

Factoring: The firm can factoring its debtor and can be rise up to $5, 50,000. If the factors its debtors the following advantages can be obtained:

- Factoring helps the firm to save the cost of credit administration due to the scale of economic and specialization,

- Factoring provides specialised service in credit management, and thus, help the firm’s management to concentrate on manufacturing and marketing,

- Operating lease: normally, the firm can take lease of equipment for short term basis. This will help to meet current responsibility and the cost is comparatively lower.

- Inventory management should be efficient in order to sale the current unsold stock. The price of goods can be minimised to a small level of profit. Therefore, the cash can be increased or the credit sale resulting form stock sale can be factored.

Break even analysis

Though it is ridicules that in the first year our company will be gained the break even point. This is happen due to the non existence of competitors. The break even shows the relationship between the units sold in the year and how many years it is required. Therefore, in the first year of operation it can match its operation inconsistency with the revenue. The break even chart is given below:

Break down of cost structure

The break down of cost structure is necessary to understand the cost pattern of our company. The break down events will be among depreciations, revenues and cost structure.

Conclusion

From the above analysis it is a high opportunity for investing, the market has no players. So, who has capital should be invested through this business as it has no loss. The most unexpected thing is that it has gone into the break even point in the first year.

This is absolutely surprising. Though the sales growth rate is low and it will be constant if it is no expanding but the volume of revenue is too high. So, to gain a huge amount of money, a massive investment is required in this business. The airport authorities will feel that we can reduce their cost structure. On the other hand, our services will secure the luggage and baggage of the customer and make them feel free to fly.

Bibliography

Attitude Travels (2008), Low Cost No Frills Airlines in Europe. Web.

Brigham, E. & Houston, J. (2007), Derivatives: Concentrated on risk exposure, Thomson, Century, Homewood, Boston.

Dibb, S. Simkin, L. Pride, W. M. & Ferrell, O.C. (2001), Marketing Concepts and Strategies, 4th ed., Boston, USA: Houghton Mifflin.

ELFAA (2008), European Low Fares Airline Association Airspace Manifesto, Brussels, Belgium. Web.

Fraser, L. & Ormiston, A. (2001), Derivatives, Prentice Hall of India private ltd., New Delhi, India.

Kotler, P. & Armstrong, G. (2008), Principles of Marketing, Prentice Hall of India, 10th ed., New Delhi, India.

Porter, M. E. (1980), Competitive Strategy, the Free Press, The Free Press, Macilla.

Pandey, I. (2005), Financial management, 9th ed.,Vikash Publication House Pvt. Ltd, ISBN: 81-259-1658-X.

Stoner, J. A. F., Freeman, R. E., Gilbert, D. R. (2006), Management, 6th Edition, Prentice-Hall of India Private Limited, ISBN: 81-203-0981-2.

Thompson, A. et al (2007), Strategic Management, 13th edition, Tata McGraw- Hill Publishing Company limited, New Delhi, India.