Interest Rate Parity

The theory of interest rate parity (IRP) suggests that there exists uniformity between the rates of return (RoR) on similar assets between two nations. It posits that the actions of global investors provoke adjustments in the spot exchange rate.

Similarly, the interest rate parity postulates that transaction that takes place on a financial account of a country determines the exchange rate on the Forex market. However, the theory of the purchasing power parity contradicts the IRP theory because it postulates that adjustments in the exchange rate are stimulated by the activities of exporters and importers whose transactions are captured on the current account.

The interest parity in the asset markets is typically brought about by actions of investors. Consequently, interest parity can be used to generate a model for exchange rate determination. Comparative static exercises can address an issue such as what would befall the exchange rate if the US interest rates were to rise? There are several assumptions that must be made in order to assess this question.

For example, economists assume that the values of all other exogenous variables remain constant when the interest rate is altered. In practical terms, an economist evaluates what occur to an endogenous variable (i.e. Exchange rate) following a rise in an exogenous variable (i.e. US interest rate) when all other exogenous variables are kept constant.

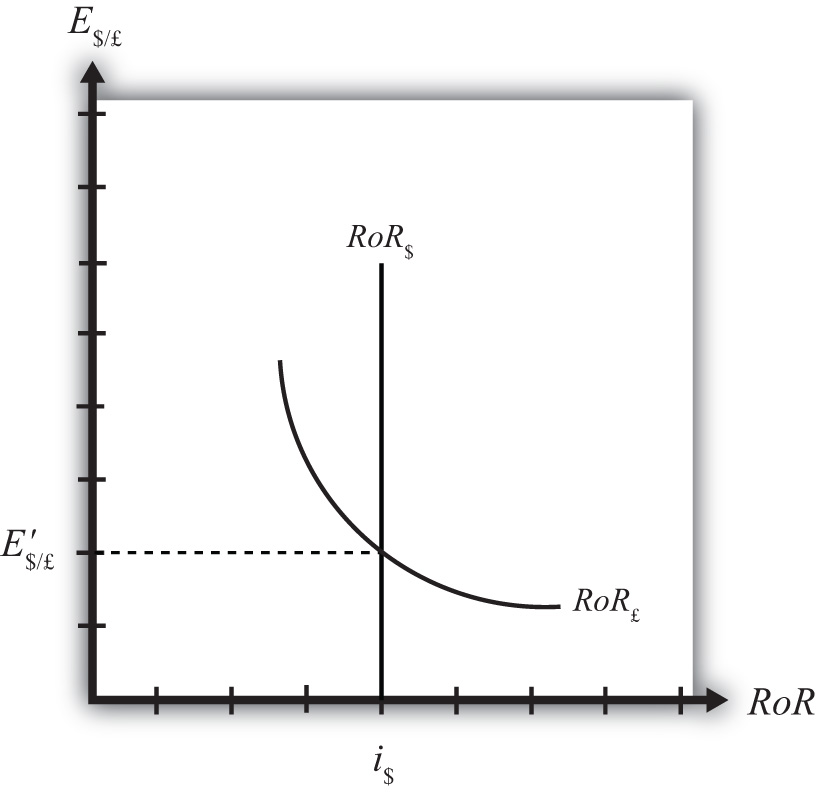

The state of equilibrium shown in the figure depicts the IRP condition. The graph shows the equilibrium exchange rate which fulfils the IRP provision. For example, the figure shows the RoR diagram where the RoR equations are plotted against the exchange rate (E$/£).

The RoR$ is plotted as a vertical line at the US interest rate level (i$) because the former is independent of the exchange rate. The RoR$ stays constant as the exchange rate fluctuates. Conversely, there is an inverse relationship between the RoR£ and the exchange rate. In other words, as E$/£ increases, the RoR£ decreases.

The exchange rate ratio depicts the anticipated percentage adjustment with respect to the value of the British pound. If the percentage change assumes a positive value, then investors will be optimistic that the value of the British pound will increase during the investment period.

Since the value of the pound is expected to appreciate, it will augment the aggregate RoR on the British investment. When the $/£ exchange rate is inferior to the equilibrium rate in the IRP model, the RoR on British pounds will surpass the rate of return on US dollars. This means that the demand for the British pound will increase due to the associated superior rate of return.

Accordingly, the value of the British pound will increase until the equilibrium level is attained. Similarly, when the $/£ exchange rate is below the equilibrium level, the RoR on US assets will surpass the rate of return on British assets. Consequently, the demand for US assets will increase because of the associated higher rate of return.

An anticipated rise in the exchange rate implies that if investors had anticipated the value of the British pound to increase, they now anticipate it to increase all the more. On a similar note, if they anticipated the value of the US dollar to decrease, they now anticipate it devalue even more.

Alternatively, if investors anticipated the value of the British pound to decrease, they will now anticipate it to devalue less. In a nutshell, when the value of the British pound is expected to rise in the future, it will cause the spot $/£ exchange rate to increase. Similarly, a decline in the anticipated future value of the pound will bring about a decline in the spot $/£ exchange rate.

Purchasing Power Parity

Economists use the purchasing power parity (PPP) to evaluate the average costs of commodities that are transacted between two nations. The main assumption under the PPP theory is that the activities of exporters and importers will bring about adjustments in the spot exchange rate.

On the other hand, the purchasing power parity proposes that the exchange rate on the Forex market is affected by what transpires in the current account of the relevant nation. This proposition contradicts the IRP theory which presupposes that the activities of investors will bring about adjustments in the exchange rate.

Economists employ the CPI as an instrument to gauge the average level of prices of commodities/services in a given country using a specific base year. The consumer price index in another year symbolizes the percentage of the outlay of the market basket in a given year relative to the outlay of an identical basket in the base year.

For example, if in 2012 the outlay of the market basket increases, it means that the consumer price index will increase above 100. On the other hand, if the outlay of the same basket declines, then the consumer price index will decrease below 100. It deserves merit to note that the CPI is used to compute the inflation rate for a country.

Thus, the percentage change in the consumer price index in a given year is equivalent to the inflation rate. In a nutshell, the PPP exchange rate between country A and country B can be represented as the ratio of the CPI for both countries in that year multiplied by an amendment factor generated from the PPP exchange rate in the base period/year of the consumer price indices of both countries.

The correlation between the PPP and theory of exchange rate determination can be established by making a number of propositions regarding the actions of exporters and importers with respect to adjustments in the relative outlays of national market baskets.

Thus, if the cost of a market basket (with a variety of products) is higher in one market than the other, it follows that some traders will procure products from the cheaper market and put them up for sale in the high-cost market. Assuming that the law of one price balances the prices of a product between two markets, then it follows that PPP is equally relevant.

Economists have put forward several suggestions to explain why it is difficult to satisfy the conditions of the PPP theory. The costs of transport and trade barriers have been suggested as some of the reasons. The main assumption under the law of one price is that the costs of transport and tax differentials do not exist between two markets. However, trade barriers and transportation outlays do exist in the real world.

Consequently, the costs of identical products may vary in different markets. For instance, transportation outlays usually reduce the price of a product in the exporting country and increase the price of a similar product in the importing country.

Equally, trade barriers alter the price of an identical product in different markets. For example, import barriers increase the price of a commodity in the importing country compared to the price of a similar commodity in the exporting country. In a nutshell, when trade barriers and transportation outlays increase, it becomes extremely difficult to harmonize the costs of market baskets in different countries.

The outlay of non-tradable inputs is another challenge. A wide range of homogenous products can be sold at dissimilar prices since a non-tradable input is utilized to produce them. For instance, a McDonald’s hamburger costs more in the New York City than in the City’s outskirts.

This is due to the fact that the rent for café in the City is usually higher than that of a café in the suburbs. Consequently, the restaurant in the city will increase the price of the hamburger in order to cover part of the rental cost. Symmetric information emerges as another challenge. A key assumption of the law of price one is that traders have symmetric/perfect information regarding the prices of commodities in other markets.

What is more, the law of one price postulates that merchants can employ this perfect information to import products from the low-cost market and export them to high-priced market. Nonetheless, the reality is that markets are characterized by information asymmetry. For example, merchants are not conversant with all the price discrepancies in different markets.

As a result, the merchants may not be able to realize the volume of trade required to balance prices for a particular good. Thus, information asymmetry prevents profit seekers from taking advantage of the profit prospects. This means that market prices will not be balanced. In effect, the law of one price (including PPP) may be irrelevant for some products.

It is possible to increase (overvalue) or decrease (undervalue) the value of a currency subject to two conditions. The first condition emphasizes the value that conforms to the PPP. The second condition lends credence to the value that produces the current account balance.

It is important to mention that there are genuine explanations regarding the existence of trade imbalances. The correct exchange rate (in a floating exchange rate system) refers to the rate that balances the demand and supply for currencies. Thus, the concept of overvalued/undervalued exchange rate does not exist under this condition.

Interest Rate Determination

Money demand is a concept that economists use to denote the amount of liquid assets (i.e. Checking account deposits and currency) required by the government, business units and people to procure goods and services. The demand and supply for money can only balance at a single interest rate.

What is more, the same interest rate will balance the supply and demand of loanable funds. Therefore, the interest rate that balances the demand and supply of money in the economy is known as the equilibrium interest rate. It is important to mention that when the supply of money increases/decreases, the equilibrium interest rate decreases/increases.

There exists a correlation between the model for the money market and the Forex market. This happens because the interest rate (generated from the money market) sets the RoR on domestic assets. The interest rates in the foreign exchange market are exogenously determined (i.e. Outside the money market model).

However, some economists argue that they can be endogenously determined when the Forex market and the money market models are assimilated. To put it another way, economists use the money supply and the GDP (endogenous factors) to compute interest rates.

The supply of money refers to assets (i.e. Bonds, stocks, checking account balances, and currency) that facilitate business transactions. Currency is defined as a liquid asset that can be easily used to facilitate business transactions.

Examples of currencies include pesos (Mexico), sterling pounds (Britain), and dollar bills (United States). Money can be defined in terms of the roles it plays in the economy. For example, money is defined as a unit of account, a medium of exchange, and a store of value.

There are several ways to determine the aggregate money supply in the economy. For instance, the Fed in the United States employs different instruments to gauge the aggregate money supply. For example, M1 is used to measure all liquid assets that can be readily used for transaction purposes. It comprises of checkable deposits, demand deposits, currency, and coins that circulate in the economy.

M2 measures money more broadly than M1. It consists of M1, small-time deposits, money market deposit accounts, and savings account. M3 comprises of M2, responsible party (RP) liabilities offered by depository organizations, pension funds deposits, and Eurodollars owned by residents of the United States at overseas branches of US banks.

The central bank is the main institution that controls the money supply in a country. The Fed is the main organ that regulates money supply in the United States. For example, the Fed employs discount rates, reserve requirements, and open market operations (OMO) to regulate the money supply in the US economy.

The demand for money refers to the craving of economic agents to keep assets in a form that can be readily substituted for commodities. There are two categories of money demand. These are the speculative demand and the transaction demand. The first category relates to the opportunity cost of keeping the money. It is worth mentioning that some economic agents consider keeping money as a way of holding wealth.

Money can be held in the form of real estate, stock, mutual funds, savings deposits, and certificates of deposits. Usually, economic agents hold money in stocks because they expect to earn interest. Under the second category, economic agents keep money in order to use it to purchase goods and services.

The amount of money an individual will demand is subject to the expected value of the transaction. For example, a poor household will demand less money than a rich household because the daily expenditure is lower in the former than in the latter. Finally, there is a positive correlation between the GDP and the transaction demand for money.

For example, when the GDP increases, additional money will be required to buy extra goods and services produced. There exists a positive correlation between the real demand for money, average interest rate, and real GDP. On the other hand, there is no relationship between the interest rate and the real supply of money.

This is because the interest rate is usually set by the central bank. What is more, the equilibrium interest rate is established at the point where the curve real demand curve intersects with the real supply curve.

National Output Determination

The aggregate demand (AD) under the Keynesian model refers to the demand by the government, business units, and households for goods and services generated in the economy. The national income identity shown below can be used to depict the aggregate demand:

GNP = C + I + G + X – M

Where GNP= gross national product; C= consumption; G= government spending; X= exports; and M= imports. The above equation can be rearranged as follows:

AD = CD + ID + GD + XD – MD

Where AD= aggregate demand for the gross national product; CD= demand for consumption; ID=demand for investment demand; XD= export demand and MD= import demand. In a nutshell, the AD for the GNP (in the goods and services model) represents the sum of current account demand, government demand, investment demand, and consumption demand.

The demand for consumption refers to the amount of goods and services (G&S) demanded by households and individuals within the economy. In many countries, the demand for consumption accounts for approximately 60 percent of the GNP.

Consumption demand is mainly determined by the disposable income (Yd). The latter refers to the total income that is available to meet household expenditures. The disposable income can be represented in the following equation.

Yd=Y-T+TR

Where Y=real gross national product; T=taxes and TR= transfer payments. There is a positive correlation between disposable income and consumption demand in the goods and service model. Thus, when Yd increases, consumption demand will also increase and vice versa.

What is more, autonomous/independent consumption refers to the quantity of consumption demanded when Yd is zero. The marginal propensity to consume refers to the marginal/extra demand for goods and services when the Yd increases by an extra dollar.

Investment demand represents the amount of capital (G&S) required by investors to enlarge or sustain business operations. Investment demand is autonomously determined hence it is not subject to any variables within the model. The demand for investment can be depicted in the following equation:

ID=I0

The subscript ‘0’ signifies that the investment (I) is an independent variable. The Government demand represents the amount of goods and services required by the government. The government may demand goods and services produced by the private sector (i.e. Naval ships). Government demand is also deemed to be independent and can be represented by the following equation:

GD=G0

Where the subscript ‘0’ denotes that the variable is independent. This equation basically shows that the demand for G&S by the government (GD) is exogenously determined (G0).

The demand for exports denotes the quantity of locally produced goods and services demanded by overseas countries. On the other side, the demand for imports denotes the quantity of foreign-manufactured goods and services demanded by local residents.

In addition, the disposable income and the real value of domestic currency are considered to be the main determinants of the current account demand in the goods and services model. The real exchange rate takes into account disparities in prices between the host country and other countries.

In the goods and services model, the real exchange rate is positively related to the current account demand. Furthermore, the disposable income is negatively correlated with the current account demand.