Introduction

Islam as a region brings together both temporal and holy characteristics of human life. This region controls both person’s relationship with creator and human being’s financial and social aspects. Therefore, Sharia law is part of all Muslim’s social, cultural and behavioral individuality. Muslim society instituted a non-interest financial system which has been operational for centuries and its purpose was to mobilize funds to be invested into productive actions and end user needs. With modernization, the financial system has become multifaceted which has forced the Islamic society to change system which allows interest making. Muslims have always wanted to bring their up to date financial and economic activities to be in accordance with their treasured Islamic beliefs and values, has resulted into increasing attention in Islamic-accepted investment channels. In 1990s, Sharia scholars accepted equity investments which actually gave way to commencement of Islamic mutual funds that functions in accordance to moral guiding principles of the Islamic Law (Elfakhani & Hassan, 1).

In accordance with Islamic Banking and Insurance based in London, it says that there are more than 250 Islamic organizations in 75 nations that controls more than USD $200 billion funds. These resources also respond to a particular need for further liquid venture machineries. Additional, the set up of reliable equity standards by FTSE Global Islamic Index Series and Dow Jones Islamic Market Index (DJMI), subsequently the Malaysian Kuala Lumpur Syariah Index, become a defining moment for the industry, providing both conservative and Islamic financiers something to measure up to (Elfakhani & Hassan, 2). Even though there has been ever-increasing awareness of practitioners in relation to Islamic mutual funds, no extensive research has been done about the performance of these Islamic mutual funds and how they perform in contrast to non-Islamic funds. In this study we evaluate the achievements of Islamic mutual funds in comparison to conventional funds and whether we have any noteworthy penalty or reward for venturing in these funds.

A Primer on Islamic Mutual Funds

Within Islamic financial system, Islamic mutual funds sector is one of the greatest growing segments. However, an Islamic mutual fund when compared to other mutual fund industry is still at early stage of development and growth. We see that 84 % is equity found out of 126 funds, 14 percent is secured funds and 2 percent is Islamic bond called Sukuk which was set up recently. We have 126 Islamic funds of which 28% is Global equity finances, 8% is American equity finances, 4% is European and Asian equity funds,23%,10& is Malaysian and Saudi Arabian equity funds and finally we have8% and 6% for technology and cap equity finances respectively.

In 1990s, an outstanding expansion in Islamic equity finances was witnessed as a result of technology boom and therefore showing great positive income than expected. Based on these positive results, the funds were increased to 95 finances with almost USD $5 billion in property in 2000 from 8 finances in 1992.have gained experience and more returns expected, these Islamic mutual funds were increased further in 2002.following total assets decline between 2000-2001, Islamic equity finances were shifted more to energy and health sectors away from the overweight technology investments. To shield more against the risks that occurred in 2000-2002, most of the funds released were balanced finances (Elfakhani & Hassan, 3). For example out of 20 finances initiated in 2001, 5 were balanced or capital protected fund and a mere 3 being worldwide equity finances and other remaining finances were liquidated or closed in year 2001 i.e. same year(Elfakhani & Hassan, 4).

The Fundamentals of Islamic Investing

Both non-Islamic and Islamic mutual finances are same except that Islamic funds comply with Sharia venture principle. An Islamic law supports partnership schemes, forbids interest and promotes use of profit or revenue sharing. The Islamic law directs numerous aspects of these finances, as well as its property distribution (portfolio selection), trading and venture practices, and revenue allocation (purification). When choosing venture for their property allotment, non-Islamic mutual finances can liberally select between profit-bearing ventures and debt-bearing ventures, and put into any accessible industries. On the other hand, for Islamic mutual finances, screening must be done to select the companies that minimum qualities and quantities as stipulated by Shania principles for example those selling alcohol, involved in riba activities or breaches Sharia law are excluded. This works negative in some cases because these might be the best companies for better positive returns and this may explain there poor performance in some instances. On the other for non-Islamic mutual finances it is free and therefore any company or investment that proves good is invested into and thereby increasing overall performance (Elfakhani & Hassan, 5).

Accordingly, barred from Islamic-permitted securities are set or fixed revenue instruments for example treasury bills and bonds, warrants, preferred stocks corporate bonds, treasury bonds and bills, certificates of deposit (CDs) etc. while non-Islamic mutual finances can utilize interest-paying liability to fund their ventures, Islamic mutual funds cannot be used. Also Shania laws do not allow repurchase and sale contracts (buy-backs).Islamic finance administrators are not permitted to speculate except in the situations of uncertainty is assumption allowed otherwise all risks must be assessed. On the other hand non-Islamic managers are allowed to speculate and may or may not work depending with the venture. Another aspect of these funds is that some scholars permit partly “contaminated” revenue to be purified by donating. This purification process is handled before any allotment of revenue or by exposing by reporting the essential financial proportions for financier or investors to cleanse their income on their own (Elfakhani & Hassan, 7)

The Governance and Control of Islamic Mutual Funds

The Sharia management board provides management and governance structures and specific features that differentiate Islamic mutual finances from non-Islamic mutual funds. The board acts as a purchaser advocate standing in for religious welfare of the shareholder. In summary the board’s members must Islamic lawful academics and clearly understand Shania rules and board responsibility is to:

- set the fund’s venture guiding principle conforming to Shania values,

- managing the finance’s portfolio cleansing and choosing suitable charities,

- monitor finances actions and make sure that it obeys the above Shania values

- recommend on zakah (aid organization).

- supporting the finance administration with matters of concern as far as the Muslim society is concerned through investor decisions (Elfakhani & Hassan, 7).

An Assessment of Islamic Mutual Funds

Performance Measures of Mutual Funds: Theory

Earlier mutual finances performance researches never attempted to look at Islamic mutual finance’s sector and there here we will try to compare the performance with that of non-Islamic mutual funds. The best way of assessing Islamic finances in the writing is to learn the performance of moral finances. Matatko, Corner and Luther in 1992 presented weak proof that the UK moral finances do better than two market directories. Because the ethical finances have a propensity of venturing a better fraction of the finances in smaller corporations with lesser dividend returns, Matatko and Luther in 1994 believed suitable to establish a small corporation directory as the market substitute. It was found out that ethical or moral finances do better than when Financial Times All Share directory (FTSA) only is employed. In 2002 Kreander did more research and factored in European finances from few nations. It comes out that European ethical finances do well when assessed against Morgan Stanley Capital International World Index (MSCI). The research of Briston, Mallin and Saadouni in 1995 applied matched-pair investigation gave better insight of funds performance. They investigated revenue gotten from both 29 UK ethical and non-ethical finances between 1986-1993 employing the Sharpe, Treynor and Jensen performance measures (Elfakhani & Hassan, 8). Based on FTSA index, most funds from both Islamic and non-Islamic mutual funds under-perform. Additionally, non-ethical finances are outperformed by their counterparts by relatively small margin however their recent study in UK in 1997 using size-attuned procedure showed no noteworthy difference in revenue turnover and both fund groups were below according to FTSA standard category or index. In short we see that amount of finance and its moral status is not important, it is only age that affects each finances alpha gauge.

Monthly finance data between 1994 and 1997 for18 Canadian and American ethical finances was evaluated and contrasted with 10-non-ethical finances under same venture groups by Turcotte and M’Zali. Used Treynor and Sharpe approaches to evaluate and discovered market index was outperformed by four of moral finances (Elfakhani & Hassan, 7).The UK results mirror the findings of studies that analyze the performance of US ethical funds. For example, using monthly data from 1994 to 1997, M’Zali and Turcotte (1998) compare the performance of 18 American and Canadian ethical funds with 10 non-ethical funds, where both groups are managed by the same investment groups. They employ the Sharpe and Treynor measures to assess fund performance they find that four of the ethical funds outperform the market index. On the other hand, the greater part of finances under-perform the Poor’s S&P standard.

In 1993, Statman, Jo and Hamilton evaluated performance of 170 normal finances and 32 American moral funds between 1981and 1990 i.e. ten years. It turned out that average revenue for ordinary funds was lower than that of ethical finances signifying that investors still gain by venturing into comparable ethical finances. In a nutshell, even though ethical funds test results are open to doubt, it seems there is no noteworthy penalty for venturing in ethical finances in contrast to non-Islamic mutual funds. Due to risk assessment and careful selection of Shania management board, it may explain why there are better returns on Islamic mutual finances (Elfakhani & Hassan, 9).

Data and Methodology

Data Sources

We have limited information concerning Islamic mutual finances as to non-Islamic mutual funds. Financial data can be found on Failaka International Incorporation website (www.failaka.com) and Standard and Poor’s website (www.sp-funds.com) for about 156 Islamic mutual funds. The middle age of all samples for 75 collected funds was 2.5 years and 3.25 years. Employing a model of 46 Islamic mutual finances categorized into 8 sector-based groups, individual’s fund finance group is gauged and contrasted to the performance conventional and Islamic index. Further 8 groups was formed basing on their sector venture exposure namely: American equity finances, Asian equity funds, Global equity finances, European equity finances, , Emerging markets equity finances, Technology / Small Cap finances, Malaysian equity finances and Emerging Markets-South Africa funds. These subdivisions give more understanding into sector performance of both non-Islamic and Islamic mutual funds. Research period is for about 7 years which an acceptable period for research. Both booming period of till early 2000 and declining phase from 2000 is covered. Therefore, 68-month research period was further grouped into 2 identical sub-periods i.e. 34 months period covering booming and other 34 months declining period.

Conservative broad market category and Islamic market category or indexes were used as standards in this research to examine non-Islamic and Islamic funds. Monthly NAVs figures for the S&P 500 were collected for a whole research from1997 to 2002. The risk-free property U.S treasury bills for 3 months interval were used. Concerning Islamic indices, Dow Jones Islamic market index and FTSE Islamic Index Series are considered and these indices rules out all stocks whose main businesses are not allowed by Sharia laws. The Dow Jones index covers Islamic market category in U.S, UK, Canada, Europe and Asia/Pacific. Additionally, it also covers technology stocks and further cash securities of FTSE series lack. FTSE series includes the worldwide Islamic index and following country coverage; South Africa, Europe, America and Pacific Basin with data from 1994 Elfakhani & Hassan, 10). Lastly, because Emerging markets do not have definite nation Islamic index, we use FTSE Global Islamic Index as the standard or benchmark for finances in this group (Elfakhani & Hassan, 10).

Methodology

The entire sum for every month revenues (NAV-based) for every single finance and finance group are computed, plus S&P 500 category returns( as alternative for conventional finances) and the Dow Jones Islamic Technology Index (as proxy for Islamic finances benchmark) and 5 FTSE Islamic Indices. Therefore, average portfolio returns, betas and standard deviations for every single portfolio are gain computed. The quadratic Treynor-Mazury measure (1996) and Transformed Sharpe Measure (1981) are employed in gauging performance of every portfolio and weigh against its standard. ANOVA test method is as well applied to check the theory of means parity and examine and directions and strengths of the variation in means. The Sharpe relation signifies the portfolio surplus revenues for each unit of entire risk, and the greater this ratio is beyond the standard; the enhanced is (Elfakhani & Hassan, 12).

The Sharpe relation is given by the following equation:

- Sharpe = (Rp – RF) / σ (1)

The Treynor relation represents the portfolio or collection excess return for every systematic risk (beta) and for this ratio, the greater it is above the standard or benchmark, implies the better it is. We use the following equation to calculate Treynor quotient or ratio:

- Treynor = (Rp – RF) / s (2)

Jensen’s alpha evaluates the extra return below or above the finance risk-attuned return as anticipated in a CAPM globe. A positive alpha value means that the portfolio is doing better than its market premium standard while negative alpha implies the portfolio is underperforming its market premium standard. Zero alpha implies normal performance as anticipated by CAPM globe setting. Jensen’s alpha is computed by the regression model below (Elfakhani & Hassan, 13):

- (Rp – RF) = α + s (RM – RF) (3)

In 1972, Fama put together the work of Treynor, Sharpe and Jensen to come up with a better regression model. He says that it is not easy to attain faultless or ideal diversification and hence investors or financier ought to be rewarded in absence of diversification. Moreover, extra net selectivity ought to be rewarded for. For this reason, in a world of flawed expansion, Fama evaluation is better than Treynor, Sharpe and Jensen procedures. Further threat or risk and net selectivity must be rewarded for. Employing Security Market Line (SML) representation, Fama way of analysis separates the general collection return into 3 mechanisms namely: return or revenue on net selectivity, compensation for absence of expansion and return payment when completely diversified. Portfolio or collection R‾p is given by the following equation (Elfakhani & Hassan, 14).

- R‾p = RF + [E (Rp) – RF] + [E (Rp*) – E (Rp)] + [R‾p – E (Rp*)] (4)

In this equation R‾p portfolio return p, anticipated return from collection or portfolio p is represented by E (Rp) in a CAPM globe, and expected speed of return for aimed beta i.e. E(Rp*) = RF + sT (RM – RF) is represented by E(Rp*). For this computation, the payment received on a wholly expanded portfolio is given by [E(Rp) – RF], compensation for absence of expansion is given by[E(Rp*) – E(Rp)] and net selectivity return is given by[R‾p – E(Rp*)]. That is the capability to choose property in order that beta of the collection one that is being referred to theoretically.

In 1981, Sharpe performance evaluation model was modified by Korkie and Jobson dwelling on statistical importance of varied performance using Sharpe relation. The modified Sharpe performance relation is given by the following equation:

- SHik,Q = σk,Q μ i,Q – σi,Q μ k,Q (5)

Where SHik,Q= stands for Transformed Sharpe performance analysis for collections or portfolio k and I for the whole period Q.

- μ k,Q = is Portfolio k or i mean revenue return payments for whole period of time Q.

- σi,Q = is portfolio Standard deviation for i return premiums for whole time period Q.

- σk,Q = is portfolio Standard deviations for k return premiums for whole time period Q.

For any given couple of portfolios, the applicable analysis is to establish if the variation in the Transformed Sharpe evaluations, SHik,Q, is statistically equivalent to zero. The shown above associations of equation gives us the Transformed Sharpe analysis data to gives more insight into the study of Islamic and non-Islamic mutual funds. In this research, the Transformed Sharpe analysis is basically devoted for contrasting between fund benchmarks and fund groups and not among individual finances. For security-selection capability and market-timing capability of Islamic mutual finances is analyzed by Treynor-Mazury (TM) model given by the following quadratic equation (Elfakhani & Hassan, 15)

- Rpt = αp + β1 Rmt + β2 R2mt + εpt (7)

Empirical Results: Comparison of Islamic Versus Conventional Funds

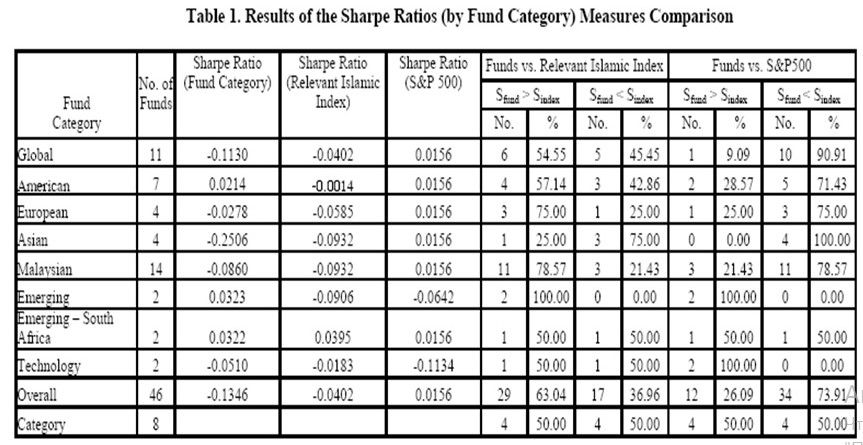

Average return and standard deviation of the finance group were used to calculate Sharpe measure. For every finance and finance group, one Sharpe relation is computed for the applicable Islamic index and other for the S&P 500, applying the average return and standard deviation of the category and the average return of non-risk property that match with the same length of time. The Sharpe relation or ratio corresponds to the portfolio extra return for every unity of entire risk. Superior finance performance is indicated by high ratio. As indicated by Sharpe quotient, Emerging markets finance is the best performing, then Emerging markets-South Africa finances and finally American finances. They all have a positive quotient or ratio indicating better returns are fetched from this kind of investment due to risk assessment and careful selection of Shania management board and business investment, it may explain why there are better returns on Islamic mutual finances (Elfakhani & Hassan, 15). On other hand, we have the European, Technology, the Malaysian, the Global and finally the Asian finance group all with negative Sharpe quotient or ratio respectively. This explains why around 1999 to 2002 there was shift of business investment from technology ventures to more profitable energy and healthcare sector. See table 1.

When contrasting every finance group’s Sharpe ratio to its appropriate Islamic categories, four out of eight groups do greater than the market; Emerging markets, the European, the American, and the Malaysian finance groups in order of good performance. Under S&P 500, we see that four groups do better than category or index, starting from least performing in the category of best performing in S&P 500 we have; American finance, Emerging markets – South Africa, Technology, the Emerging markets. In general, we have varied outcomes but the emerging market group is the top performer when contrasted to its two standards or benchmarks and the Asian finance group is constantly poor performer (Elfakhani & Hassan, 16). This is due to strict rules on what kind of investment to venture into with accordance to Shania law even if the business has high returns like profitable companies with shares in alcohol manufacturing firms are forbidden. For the same period of time, 29 finances (63%) of 46 investigated finances do better than their applicable Islamic index, 12 finances do better than the S&P 500 and remaining 11 funds outperform concurrently the 2 indices. Emerging market group has 100% performance as compared to applicable Islamic index and the lowly being Asian group with 25%. When matched to the S&P 500, the entire finances in the Technology groups and the Emerging markets outdo the index and as indicated by negative ratio all Asian funds group are do poorly (Elfakhani & Hassan, 18). This is probably due to reason stated above.

From table 2 for the same length of time, 13 finances of all investigated 46 finances do better than their applicable Islamic, 11 finances do better than S&P 500 and 9 fall between the 2 categories. Again Emerging markets group has greatest percentage (100%) and lowly being Technology and Asian groups with these two doing less than the index. However, Technology and Emerging market outperform index while European and Asian groups do less than the index under S&P 500. Generally, Treynor results indicate weaker Islamic finances performance contrasted to Sharpe technique results. Also table 3 based on Jensen alphas, in general the Emerging markets group outperform its two indices or benchmarks wile Asian group is still the poorly performing. Jensen alphas for the two market standards are negative. Results shows that 13 funds out of 46 examined have positive yet inconsequential alphas and the rest have negative alpha with only a single fund with a noteworthy alpha. When employing S&P 500, the entire finances in the Technology and Emerging markets groups have positive alpha, European and Asian groups indicated negative alphas meaning poor performance (Elfakhani & Hassan, 19).

Table 4show the outcomes of Fama measure for every finance group. The general return is the average of every month returns of particular finances within a finance group. The outcome indicates that the South Africa Emerging market group has greatest returns on general performance therefore the best then the Emerging markets finance and the American finance graded using applicable Islamic index as the standard. From table 4 those with positive proceeds on net selectivity are as follows; the Emerging market group, European, American finances and finally Malaysian finances meaning the do beyond market standard. For S&P 500, leading is Technology group, and then Emerging markets, South Africa Emerging Markets and finally the American group all have positive net selectivity (Elfakhani & Hassan, 22). South Africa Emerging markets group has the greatest reward for high risk finance analysis meaning has best revenue return as far as risk investment is concerned. High risk investments always have the highest returns provided that the venture has proper strategy and action plan. When matched to S&P 500 Index, the American finance group outperforms the rest on risk attuned return, afterward the Global, European, Asian, South Africa Emerging market and Malaysian group. They all have positive return on the finance’s risk implying the ventures still fetches some revenue. The Emerging market South Africa group has the superior performance, then American finance group when weighed against the applicable Islamic Index, signifying least diversification of the two finance categories (Elfakhani & Hassan, 24). Malaysian is the least spread with higher positive award under S&P 500 Index and the rest falling in between.

Table 5 is much comparable to Table 4; though it informs us on the comparative percentages of the general performance returns, in relation to the entire finance group. For this table, the general return is the average of entity average returns of finances in a finance group. We have negative value for entire sample under S&P 500 computation. The Transformed Sharpe assessment employs the standard deviation and average of monthly return payments for every finance class and the 2 market standards, the appropriate S&P 500 Index and Islamic indices and the covariance connecting the finance group’s every month return premiums and every standard in the calculation. This analysis assesses the meaning in variation among fund group and its market standard or benchmark. (Elfakhani & Hassan, 25)

Table 6 covers recessionary sub-period from November 1999 to August 2002 and during this time 6 fund groups out of 8 did better than their benchmark as indicated by positive Transformed Sharpe well above 5 percent, apart from Emerging markets with non-noteworthy results. This further confirmed under S&P 500 Index in which all except Emerging markets did better than their standards or benchmark and therefore they have a positively Transformed Sharpe, hence statistically important apart from Emerging market. It is only the Asian group that gives considerably negative Transformed Sharpe variations. For a whole test sample, the outcome is a positive noteworthy performance as weighed against the two benchmarks. For this reason, overall, it emerges that Islamic mutual finances did very well and thereby giving positive results through the recessionary sub-period (Elfakhani & Hassan, 26).

Results in table 7 are for quadratic TM regression model for the whole data examined, assessing market timing(calculated by s2) and security-selection(computed by α) and performance capabilities of Islamic mutual finances, whereas appositive figure of β2 proposes that portfolio surplus proceeds are further responsive to optimistic market excess proceeds unlike the negative ones. The F analysis illustrates a strong connection among Islamic mutual finances returns and noteworthy 1% of S&P 500 and a strong determination coefficient (68%).derived from equation 7. However, generally the representation outcome show negative cut off and β2 signifying poor performance for these finances as far as market-timing and security selection is concerned(Elfakhani & Hassan, 27). In table 8, the European Equity finance, American Equity finance, the Technology Fund and the joint Emerging finance have positive security assortment and only at 10% level being Emerging Equity Fund. While Malaysian, Asian and Global finance indicating negative under same period as this because of Asian crisis that affected the business. On the bright side, Asian Equity Finance a non-negative market timing presentation (10% level) as shown by negative correlations in table 8 apart from Asian finance (Elfakhani & Hassan, 28).

The outcome of research indicates that the performance of Islamic mutual finances are no different from the non-Islamic mutual finances, with a number of Sharia-obedient mutual finances doing better than their standard or benchmarks and some performing less than the benchmarks. One more key observation is superior performance of Islamic mutual finances during the tome of recession and this is attributed to experience gained by fund managers with time and better understanding of the business market (Elfakhani & Hassan, 29)

Conclusion

This research was carried out to see if enforcing Sharia laws in asset distribution and investment affects performance of mutual funds as compared to non-Islamic mutual funds. We see consistency in outcome across varied applied benchmarks and measure. From 1997 to 2002, the Emerging markets finance group indicates the best results (performance) out of the 8 investigated Islamic mutual finances groups. Due Asian crisis, the Asian finance performed poorly always. America funds and South Africa Emerging markets respectively performed better than their applicable Islamic Index or category ((not the S&P 500), on the other hand the Technology group did better than the S&P 500 and not its applicable Islamic category. For finance category, four out of the eight finance group performed better than their standards or benchmarks irrespective of what performance assessment was employed. What is more, ANOVA statistical analysis indicates no statistically noteworthy variation present in funds performance when weighed to every index used. Hence, the key conclusion that can be drawn from this research is that the performance of Islamic mutual finances is not different from non-Islamic funds performance, with a number of Sharia obedient or compliant mutual finances doing better than their benchmarks while other doing less than the standards (Elfakhani & Hassan, 30).

Another remarkable observation the data of the Transformed Sharpe measure indicated better results during recessionary period as compared to first booming 34 months period. This is a contrary to what would have been expected. This is due to fund managers understanding of the market and business experience with time. This suggests that Islamic mutual finances could be an excellent hedging venture for whichever equity financier or investor, if utilized to evade market recessions and downturns. The outcome indicates that there is no harm or fine linked with doing business with Islamic mutual finances, therefore individuals are allowed to follow their investment belief. Non-Islamic or conventional businessmen can think about Islamic mutual finances in their collection particularly during recession period. All investment whether Islamic, conventional or ethical must carefully selected to avoid losses (Elfakhani & Hassan, 31).

Enough challenges were faced during the research, first the age of the finances examined. Then limited information presented (0nly 46 funds) and the 2 years of data addition restraint. More research period of more than 68 months period may give better insight into funds performance. Another challenge was infancy of Islamic bond finance and secured finances with less than two years. If these funds are included in further research in future, results will definitely be different since they are less risky as weighed against the other groups. In future research, the mentioned limitations will be evaded with more data being available on the Islamic mutual finances. a matched-pair assessment of funds performance can be performed between non-Islamic and Islamic mutual funds (non-ethical and ethical). This pair analysis may be carried out on the foundation of age, country, size etc (Elfakhani & Hassan, 32).

References

Elfakhani, Hassan M.K. (2005).”Comparative Performance of Islamic Versus Secular Funds”2005. Web.

Tables