Company Overview and Current Mission

ENOC Group (2013) reported that the Emirates National Oil Company (ENOC) started its journey in 1973 owned and operated by the Government of Dubai under Investment Corporation of Dubai and was incorporated as a limited liability company in 1993 headquartered in Dubai, UAE along with twenty subsidiaries.

The business operation of the ENOC covered oil and gas processing, supply, and trading; terminal operations for petrochemical storage, marketing of aviation fuel and lubricants including industrial chemicals, retail fuel stations, along with oil and gas exploration, as a reliable development partner of the national economy the company extended its services in the global market with iconic image.

The vision of the company clearly states that it has aimed to turn into the regional leader in the integrated oil and gas market with highly profitable performance upholding its corporate social responsibility pointing to the communities, environment, and the employees. The Mission Statement of the ENOC strongly argued that it has been working to attain sustainable development along with extremely rising profit growth and to serving the energy requirements of Dubai by engaging the top talent employees and integrating advanced technology, superior quality and services to the customers with much more environmental awareness and employees health and safety.

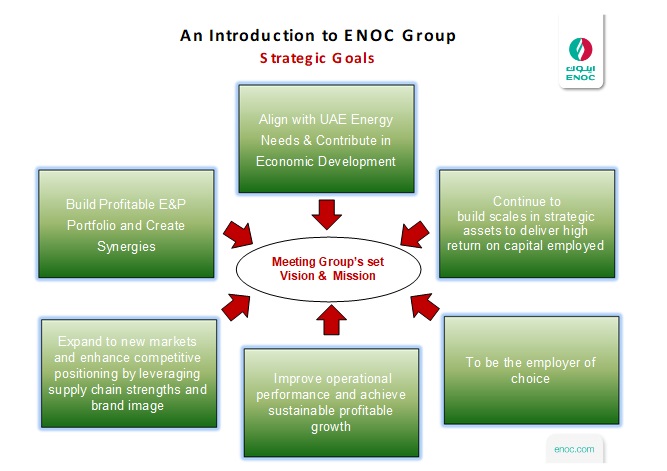

Under the chairmanship of the UAE Minister of Finance Sheikh Hamdan and his dynamic leadership turned the ENOC into a company USD 10 Billion turnover along with 7000 multicultural working force while its strategic viewpoints explored as follows:

Current financial condition

Gross profit margin

Table 1: Gross profit margin of ENOC Group. Source: Self generated.

It is clear from the chart above that there has been a gradual decrease in gross profit margin ratio of ENOC from 2008 to 2009; this is indeed very negative factor for the company as an increase in the GPM ratio indicates that the company could build practical yields on sales; however, here the company has failed to attain this. It is quite disappointing that there has been a decrease in the gross profit margin ratio of the company, which could signify that the variable costs have escalated while the selling price has remained unvarying; in addition, it can also mean that the Emirates National Oil Company has curtailed prices to make an escalation in sells from an overall viewpoint. On the other hand, if Emirates National Oil Company had escalating profit, it could have meant that it has good pricing-stratagem (it is adept to revitalize prices with small upshot on sells), or that it possesses mounting-productivity; so, this is truly essential for the firm to boost up this ratio and work hard to attain and sustain the development.

Operating profit margin or Return on Sales

Table 2: Operating profit margin. Source: Self generated.

It is notable that ROS assesses firm’s operational competency giving knowledge on how much revenue is generated with $1 sales; however, it is significant at this stage that the operating profit margin or return on sales of the corporation has amplified from 2008 to 2009, which provides a signal that it is becoming more proficient.

Net profit margin

Table 3: Net profit margin. Source: Self generated.

At this stage of the paper, it is important to note that a soaring NPM ratio gives the evidence of how flourishing ENOC is at shifting sells into earnings; in addition, it is capitalizing on some competitive-advantage, which can confer it with supplementary propensity in the problematical fiscal-periods; therefore, such ratios of the company it definitely a very positive sign. It is clearly visible from the chart above that the net profit margin ratio of Emirates National Oil Company has increased to a certain extent from 2008 to 2009 period, making it easier for the company to perform better in upcoming years.

Return on total assets

Table 4: Return on total assets. Source: Self generated.

In this portion of the paper, this ratio exemplifies how moneymaking an enterprise is in contrast to the total-assets, and a mounting ROA confers that ENOC is adeptly treating its assets to stimulate earnings; as a result, for Emirates National Oil Company, this is a very good sign particularly considering its growth prospects in longer term.

Return on shareholders’ equity

Table 5: Return on capital. Source: Self generated.

It is highly notable that return on shareholders’ equity shows the sum of net-profits restored as proportion of shareholders equity; as a result, it is important to state that return on equity (ROE) fundamentally calculates the prosperity of an enterprise through illuminating the extent to which the business has engendered proceeds with the wealth, which the shareholders spent. It is noteworthy from the above calculations that ENOC had its ratio increasing from of 2008 to 2009, and this increase was more than one percent; however, this is a sign that ENOC was able to make additional income on stockholder outlay within the corporation; therefore, it can be said that throughout the past few years, it made better revenue.

Liquidity Ratios

Current ratio

Table 6: Current Ratio analysis.Source: Self generated.

The current ratio of ENOC has slightly decreased in 2009 in comparison to 2008; it is notable that an enhanced current ratio means that the firm is better proficient to pay its obligations; however, here, ENOC has a ratio above one, which is a very positive sign because a ratio below one means that it cannot pay off the obligations.

Working Capital

Table 10: Working Capital. Source: Self generated.

It indicates operating liquidity available to a business; however, ENOC Group is able to carry on its operations since it has adequate funds to assure both maturing short-term debt and upcoming operational costs.

Leverage Ratios

Debt-to-assets ratio

Table 7: Debt-to-assets ratio. Source: Self generated.

The debt-to-assets ratio of Emirates National Oil Company has lowered in 2009 in comparison to 2008; however, it is important to state that a lowering debt-to-assets ratio means that the business is gradually turning less reliant on debt to expand and develop their activities; as a result, this decrease is also optimistic for ENOC.

Long-term debt-to-capital ratio

Table 8: Long-term debt-to-capital ratio. Source: Self generated.

It demonstrates the financial-leverage of the company, which permits the investors to recognize the amount of control used by the company and compare it to other organizations to examine the aggregate risk experience of that particular organization; however, the result of above table indicates it has enough capacities to manage risks.

Debt-to-equity ratio

Table 9: Debt to equity ratio. Source: Self generated.

Debt-to-equity ratio of the company has lowered from 2008; however, if this ratio remains elevated, it would indicate that the business was hostile in funding its expansion with debt, which can in turn cause unstable income for extra interest-expense; therefore, it is also optimistic for ENOC that this ratio is lowering.

Long-term Debt-to-equity ratio

Table 10: Long-term Debt to equity ratio. Source: Self generated.

Usually, firms with higher ratios should be considered more risky since they have more liabilities as well as less equity; however, in 2009, ENOC Group has successfully able to reduce this ratio from 2008, which indicates that it can minimize financial risks.

Times-interest earned (or coverage) ratio

Table 11: Debt-to-equity ratio. Source: Self generated.

At this point, it is notable that there had been an augmentation in the TIE of Emirates National Oil Company from 2008 to 2009; this provides a signal that the business has a short of debt or is paying off excess debt with income, which could have been exploited in some other purposes.

Activity Ratio

Inventory turnover Ratio

Table 12: Inventory turnover Ratio. Source: Self generated.

From the above-mentioned table, it can be said that inventory is old out and restocked since it has been increased over time; however, it sells through its stock of inventory each quarter.

Key Opportunities

Economic recovery

Fuelling strategic transformation gives the opportunity to the company to generate healthy sales revenues and profit margins; in addition, the company will be able to boost Supply, Trading and Processing business by overcoming barriers like volatility and uncertainty that struck business after the global financial turmoil.

Mogas price deregulation

Kumar (2013) reported that ENOC decided to increase retail price of diesels as deregulation means increase or decrease price based on the global price trends; therefore, if this process will apply for Mogas, then it will provide enormous opportunities to ENOC to gain competitive advantages and maximize profits in some extent.

High demand projections for Petroleum Products in MENA and Asia

According to the statement of the CEO of this company, the economy of Middle East countries extremely depend on the petroleum industries for which the demand for petroleum products is anticipated to increase to 90.70m barrels for every day; therefore, it has scope to expand market to boost profit margin (Khoory, 2013).

Debt capital market financing and bond issuance

The UAE Sukuk market is expanding rapidly and it is popular method to the oil based companies to generate funds in this country; as a result, ENOC has the opportunity to issue new bond to implement different projects in Dubai; however, government committed on enhancing infrastructure within UAE, such as, Airport expansion, metro, etc.

Key Threats

Political Instability in the Region

MF reported that many oil based companies in the Middle East failed to make projected profits because of unstable political conditions; according to the report of Davids (2011), the economic condition of the UAE had boosted in 2011 in spite of political stability, but it can be major threat for the company at any time.

Price volatility and Pressure on Margins

Sambidge (2011) stated that it expected about US$735 million losses on fuel price subsidies due to volatility of the fuel price in the international market in the immediate aftermath of the global economic downturns; as a result, retail segment of this company was adversely affected to meet the growing demand.

Increase of Subsidy burden

This Company suffered many problems linked with fuel shortages from the very beginning of 2011; therefore, the top management assumed that it needs support of the concerned authorities since it would not be possible for ENOC to sustain the sale of fuel at heavily subsidized prices because its expenses were elevated on global markets.

Competition

Though it has competitive advantages as a state owned company, it has to consider the threat of new entrants as foreign oil based companies can capture large market share due to globalization; however, the largest competitor like Abu Dhabi National Oil Company (ADNOC) tried to take over several stations of ENOC.

Key Strengths

Dubai Government Owned Company

ENOC Group was listed as a wholly owned Government of Dubai company in 1993; it was consisted with four other firms, such as, ENOC Processing Company LLC, ENOC Aviation, and EPPCO Aviation; however, this company is now the member of Supreme Energy Council, which gives full supports for the good governance of the energy sector.

Diversified operations across value chain

It has highly diversified operational system for which it can exclude possible financial risks from global economic downturn, poor strategic management or project design, volatility of the oil price, lose of the any units among five segments of ENOC.

Strong market position with strategic infrastructure

According to the report of Galadari, Verma & Lemaitre (2013), ENOC generated more than U$15.60 billion revenues in 2012, customer satisfaction rate increased by 3% (from 76% to 79%), profit per employee increased by 95%, aggregate profits boosted by 62% at this period.

Geographic spread / strategic location

The CEO of this company stated that ENOC operates in more than 20 nations all over the world and it has strategic goal to expand operation in global market with diversified business units, such as, oil, chemicals, gas, aviation, retail, transportation, real estates, and so on (Khoory, 2013; and Davids, 2011).

Strong business partners & relationships

Most of the business partners of ENOC had strong position in the market; however, it adopted several global best practices and applied the application of the Balanced Scorecard, which was an effective strategy to maintain relationship with the subsidiaries and partners (Khoory, 2013).

Experienced & capable workforce

It recruits efficient, well-experienced and educated employees, who have capability to lead the strategy, marketing, supply chain management, planning, business development, portfolio management; on the other hand, the officials in the managerial ranks must have corporate performance management experience as they are responsible for the successful implementation of strategic plans. However, it has more than 7000 employees and most of them are working in the subsidiaries and joint ventures companies; in addition, they are coming from different cultural background and 50 countries

Key Weaknesses

Availability of Natural Gas

Schreck (2011) stated that the government of Dubai intended to use natural gas as its key source for power and aimed to generate 70% of its power from natural gas because the policy makers tried to offer low price for the energy to make the place attractive for the investors. However, most of the deposits of oil and natural gas located in Abu Dhabi, but Abu Dhabi and Dubai never share their energy resources; in this context, ENOC needs to purchase natural gas from open market considering global pricing structure for which it has to struggle to expand its network to sustain with market demand (Schreck, 2011; and DiPaola, 2011).

Resistance to change

It had no formal strategic plans or strategy management tools for which it was difficult to coordinate the projects of the units, as well as control the subsidiaries and the employees in some extent; however, the competitors gained competitive advantages in this reason

Ageing EPPCO network

Because of the subsidy burden, EPPCO had operated at a loss and refused to supply Sharjah; the government had already cancelled licenses for the operation of many stations and ADNOC interested to take over the fuel distribution in the Northern Emirates; so, EPPCO suggested raising oil prices comparing global market.

Multiple sub brands

It is a highly diversified Group since it comprises of above 30 active subsidiaries; therefore, the leaders of this company may not be able to concentrate on the core business units particularly in the time of global financial crisis, it faced several management problems to meet strategic goals.

Capital constraints in light of Mogas subsidy

The company needs additional capital in order to carry on gas station in Dubai due to over burden of subsidy;

Corporate and business strategies

As discussed earlier, ENOC’s key missions and objectives include attaining long-term progress, obtaining cost-effective amplification, and preserving commercial benchmarks in terms of atmosphere, well-being, and security. In addition, this business wants to satisfy the rising oil demands of Dubai, gratify, expand, and store intelligence of the corporate personalities, accept newest technologies, execute paramount performances, and satisfy purchaser anticipations regarding quality.

In order to attain these missions and objectives, it is vital for the company to develop a number of corporate and business level strategies. It is important to consider the fact that the company faces huge trouble when it comes to purchasing natural gas, as Abu Dhabi does not provide the natural gas reserves to ENOC and it needs to buy natural gas at high prices from international market. This is a huge obstacle for the company in achieving its missions and objectives; therefore, the corporate strategy of the firm could be to find out new solutions by increasing expenditure on research and development in order to invent cheaper alternatives to lower down the production costs and operate business in economies of scale.

It is important to note that obtaining economies of scale is highly essential for this company as the production cost of the company is quite high for which it cannot offer rather lower prices to the potential customers. As a result, by relying on this strategy to invest more on research and development in order to invent cheaper alternatives and innovative and low cost production plants, it would be possible for the company to resolve the above stated problem and attain its missions to obtain long-term progress and cost-effective amplification.

On the other hand, the company could focus on geographical diversification strategy and expand its business at new locations throughout the country as part of a corporate level strategy to capture a larger segment of the market and raise sales, thus meeting the objective to satisfy the demands of mass market.

One of the corporate missions of the company is to adopt newest technologies quickly; so, the company could attain this objective by investing more on training and improving its human resources in areas of technical competencies and ICT. This is because a skilled and efficient workforce in technological segment could easily grasp any latent technological advancement in order to modify the company’s technicalities accordingly. In this way, this oil company could become highly efficient in terms of technology and other IT infrastructures, and gain competitive advantage over the rivals; in this way, the company could increase its sales and profit margins quite smartly.

In addition, in order to attain the corporate mission of upholding industrial benchmarks, assuring paramount performances, and ensuring high quality products and services, the company could undertake the strategy to introduce total quality management techniques. Through introducing total quality management techniques, the company would be able to ensure quality through constant development of procedures by turning into a consumer-oriented business, ascertaining worker engagement, introducing an all-inclusive scheme, launching methodical procedure, and offering democratic leadership.

Specific actions needed for implementation of chosen strategies

ENOC has both short-term and long-term objectives, for example, the CEO intended to expand business in the new markets and develop competitive position to achieve US$1 Billion profitability by 2014 and grow profitability by 20% per year from 2014 onwards. As a result, the leaders of this company has already participated in the training programs to develop strategic goals and adopt the Balanced Scorecard and other strategic management tool; in addition, it recruits and provide training programs for the qualified, skilled and dedicated employees of UAE citizens and expatriates.

On the other hand, ENOC would emphasis more on the Emartization percentage within the group for which it will change recruitment process and move in accordance with strategic plan, such as, observing UAE national progress as well as retention, and contributing to the general improvement of the proficiencies and competencies (ENOC Group, 2013; and Khoory, 2013).

It will concentrate on the governance framework to meet Group’s Strategic objective, and development of M&A strategy to explore opportunities to expand business in the global market to accelerate profit growth; it will create synergies between Terminalling, Trading and Marketing to enter new geographies, to sharpen operational excellence, and to mitigate inherent market inefficiencies (Galadari et al. 2013, p.2).

However, Global Technology Services (GTS) is a wholly owned subsidiary of ENOC, which provides IT solutions to the company, such as, Enterprise Resource Planning (ERP), EPM and CRM; however, the aim of the management is to leverage IT systems to create a robust ERP system that will support effective decision-making within next two years.

It will increase different petroleum products sales, monitor risks pertaining to our businesses, develop mitigation plans, improve relationship with employees, replicate business model in global market, consider new business development opportunities (particularly in refining, gas processing and petrochemicals) and closely work with the government for subsidy reimbursement and resolution, and focus on margin and cost management to meet the objectives.

Recommendation

To overcome the company from problems related with global financial crisis and capital constraints, it should essential to follow the divestiture strategy to stop lose projects both in the UAE and in international markets and should emphasis more on the main strategic units, such as, retail marketing and the Supply, Trading & Processing (STP) business segment. At the same time, the government should allow deregulation price of Mogas to save the company from increase of subsidy burden; in addition, the policy makers of Dubai should try to share the resources of Abu Dhabi, which can help ENOC to offer lower price and provide greater services.

Reference List

Davids, G. (2011).IMF raises UAE outlook on back of regional instability. Web.

DiPaola, A. (2011).Dubai to Continue to Use Natural Gas as Country’s Main Source for Power. Web.

ENOC Group (2013). ENOC. In Brief. Web.

Galadari, S. Verma, H. & Lemaitre, R. (2013). Fueling Strategic Transformation At Emirates National Oil Company. Web.

Khoory, S. (2013). Growth of Middle East and Asian economies will drive oil & gas sector. Web.

Kumar, H. M. (2013).Diesel prices to go up by 20 fils per litre. Web.

Sambidge, A. (2011).ENOC expects $735m loss on fuel price subsidies.Web.

Schreck, A. (2011). Dubai gas firm bearing subsidy burden. Web.