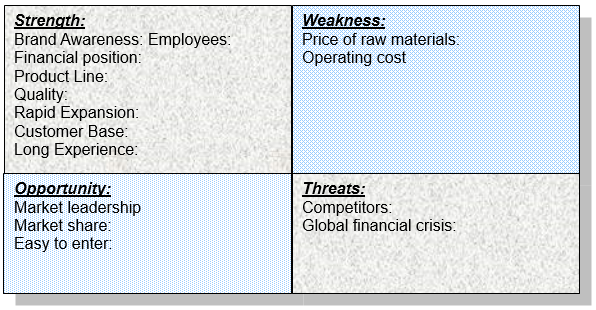

SWOT Analysis of OASIS

Strengths

The key strengths of the OASIS fashion retailer are –

Brand Awareness

OASIS has outstanding brand awareness and quality image in the UK and rest of the world, which assists this brand to increase customer base along with profit margin; besides, the experience and efficient designers of OASIS always consider customers demand to design products by customers’ need to satisfy the customers.

Technology and Brand Expansion

The management team of this brand has started business expansion using financial capabilities and along with strong brand awareness and it has a business operation in more than 25 countries; however, online purchasing system, user-friendly e-commerce website, use of iPads in flagship store, computerized designing system, advance communication tools, and other machinery enhance business operation.

Internal control

The management team of OASIS follows the rules and regulations where it operates (especially obey the provisions of Companies Act 2006) though Article of Association and Memorandum included its controlling system to avoid mismanagement and internal conflicts among the directors;

Customer relation

According to the view of the customer of this brand, it always considers the feedback of the customer to develop new products and enhance the quality of the service; thus, the customer relationship management system one of the main key success factors of this brand;

Product Line

According to the OASIS, it also offers a wide product line for the customer, such as dresses (Bird and Butterfly Foil, Faux Leather Trim Shift, Soft Frill, Midnight Garden dress, Western print, Scuba Lace Print), tops & blouses, Trousers & shorts (Leggings, Jeggings, premium coated jeans, and colored cherry jeans), Occasionwear, knitwear, jumpsuits, and so on (OASIS Store, 2012).

Weaknesses

Major weak points are –

Pricing strategy

The pricing strategy of the company was not effective to target middle-class and lower-class customers;

Operating costs

However, operating costs of the company are too high due to comparatively greater budget for advertisement along with the promotion, high remuneration for the employees, and volatility of the price of raw materials like machinery, cotton, string, and other products;

Opportunities

There are many influential factors including –

Easy to enter

Most of the countries of the world are now a member of WTO, which open a new door for this company to expand its market in the developing countries to target poor people and become a market leader by increasing customer demand within a short period; however, it has already captured a significant market share in the UK market;

Threats

Some external factors are –

Competitors

Competitors like Coach Inc., The Body Shop, and other national and international companies are the main threats for OASIS; also, the choice of the customers or quickly changing fashion trends are threats for this brand

Recessionary Impact

The purchasing power of the customer decreased from 2008 due to the adverse effect of the global financial crisis and the purchasers would not like to expend money for the luxurious brand, and now they concentrate on the reduction of debt along with rising savings (IBIS World, 2012), like, the savings rate in the UK jumped from 2.9% to 5.4% within six years.

Market Share and Company Performance

Table 1: Market share of OASIS. Source: Self-generated from Aurora (2012)

Strategy

Pricing strategy

According to Agonist (2009), the prices of the brand are quite high as it offers stylish and high fashion clothing in a better-quality shopping atmosphere; nevertheless, the store does offer a student discount of ten percent; conversely, another reason behind the high pricing strategy is its brand image. Also, some other factors that induce Oasis Fashions towards such a pricing strategy include strong product differentiation and more expenditure on its designing teams.

Promotional strategy

Oasis Fashion uses some promotional strategies to ensure continuous sales; for example, it offers various promotional packages depending on the factors such as different seasons, New Year festivals, Christmas Eve, occasions like Valentines Day, Easter Sunday, Black Friday, Earth Day, Mother’s Day, Father’s Day, Halloween, and so on; therefore, it is still a quite profitable brand. Depending on different occasions, it offers gift cards, Oasis-cards, mobile vouchers, discount vouchers, promotional codes, money-off coupon codes, and other packages for loyal customers; for example, at present, the brand is offering “snow promotion” (offering 25 percent discount), 10 dollars discount with an oasis fashion promo code or coupon, and 30 percent discount for December in certain stores (Oasis Store, 2012).

The promotional strategies of the brand vary accordingly with changing consumer trends, demands, and other external circumstances; this strategy benefits Oasis Fashions by generating interest among the new clients for being loyal to gain full advantage of the promotional packages, which in turn, raises the profit margins of the parent company; however, it also undertakes several advertising-campaigns.

In the past, present, and proposed future

OASIS Stores started its journey in 1991 and experienced rapid physical expansion (Bloomberg Businessweek 2012; FE Investigate 2001). It maximized the brand’s potential to increase profit margin, and it joined LSC in 1995; furthermore, in 2001, operating profit fell by 26% 2001 though turnover rose by 5% (FE Investigate 2001).

Bloomberg Businessweek (2012) reported that it has more than 2,740 efficient employees at present; however, OASIS uses a simple organizational structure, for instance, Derek Lovelock, present CEO of the Aurora group controlled the workers of OASIS, and take major decisions regarding business operation.

SAS & Verdict (2012) reported that the growth of this industry in 2012 was only 1.2%, which is the lowest of the last 40 years; however, total costs of this sector increased by £1,031 million –

On the other hand, SAS & Verdict (2012) further specified that teenagers and middle-aged people reduce their expenses for purchasing clothes and footwear because the unemployment rate and enrolment costs of the universities increased significantly past few years.

The Guardian (2012) reported that the UK fashion industry now worth almost £21.0 billion while consumers spent was more than £46.0 billion in 2008; from the trend of the market and considering the above-mentioned facts, it can assume that OASIS has to face serious challenges near future if OASIS ignores market risks and fail to take appropriate measure on the proper time.

Company’s Current Market Position

Competitive advantage

There are several competitive advantages of Oasis Fashions; for instance, the brand never compromises on the quality and always focuses on creating differentiation, distinctiveness, and well-designed items; because of this, it has achieved Retail Week Awards 2012 and has made its way into the top five in the first global omnichannel fashion survey (Kurt Salmon, 2012). Also, unlike low-cost retailers, the brand ensures that there is no use of child labor during the production process, and also uses high-quality fabric in the clothes, and offers contemporary dresses designed by qualified fashion designers (from its in- house design team); all these factors provides the brand with significant competitive advantages.

Porter’s Generic Theory

Cost Leadership

It is essential to note that Oasis Fashion provides high-quality products along with a strong brand image, which forces the business to offer the clothing at relatively higher prices than that of the competitors; as a result, this brand is not a cost leader in the industry. However, it is arguable that companies like Tesco, Marks & Spencer, and Wal-Mart can offer lower prices due to the reason that they buy the products from very low-cost suppliers from countries like China and Bangladesh, whilst Oasis Fashions do not seek assistance from those suppliers and relies on local providers who sell the materials at higher costs. Also, Oasis Fashions currently do not have any strategy to switch on to low-cost suppliers or cut costs from persuasive advertisings, which means that it cannot stand to be a cost leader in the upcoming years.

Differentiation

According to Financial Express (2001), brand differentiation is a key factor for which Oasis Fashions cannot reduce the offered prices – differentiation is the key strategy of the brand to maintain distinctiveness despite the larger-scale of the business; moreover, Oasis Fashion invests more on its designing teams to deliver personified exclusivity and well-designed fabrication with the detailed designation.

Focus Strategies

Oasis Fashions currently focuses on offering women’s clothing that ranges from trousers, t-shirts, and party dresses, to winter, wears, jeans, and maxi dresses; besides, the parent company of Oasis Fashions, at present, do not have any strategy to diversify its brand to include men and children’s wear.

Porter’s Five Forces Model for Oasis Fashions

Bargaining Power of Suppliers

According to Oxford (2004), although there are numerous players in the market, the bargaining power of the suppliers is moderate because of several factors; for example, numerous national and international suppliers exist who compete with each other to provide quality materials, making the switching costs of the market players lower. Conversely, the presence of a huge number of industry giants means that suppliers also possess a certain amount of bargaining power

Bargaining Power of Customers

The customers in this industry possess great bargaining power, as their switching costs are very low due to the presence of many other rivals; besides, some companies offer lower prices than Oasis Fashions, and certain brands offering superior quality clothing, which means that customers can switch to other brands easily (Oxford, 2004).

New Entrants

Threats of new entrants are moderate in the industry because there are both advantages and disadvantages of entering the market; for instance, there are incentives (provided by the UK government), and assurance of a business-friendly environment in the country, which makes it easy to enter. However, the disadvantages of entering the market include factors such as a high level of saturation by established industry giants, and barriers such as vast amounts of capital investments, and strict labor and employment laws, which makes it tough for new entrants to start-up and sustain.

The Threat of Substitutes

There are high threats of substitute products from several rivals in the industry; for example, retail brands like Next, Body Shop, Topshop, Coach Inc, Gap, etc present strong competition to Oasis Fashions; moreover, there are certain retailers who provide cheap fashion apparels to customers, posing major threats to the brand. Notably, such cheap providers include Tesco, Marks & Spencer, and Wal-Mart, who can offer their substitute fashion apparel at competitive prices because they buy the clothing from low-cost suppliers from countries like Bangladesh; as a result, there is intense competition in the industry for Oasis Fashions.

Competitive Rivalry

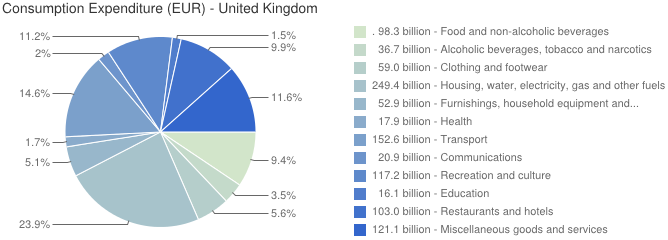

The fashion retailing industry of the United Kingdom is highly competitive and saturated with major brands like Marks & Spencer, Gap, Aurora Fashions, and so on; as a result, The Guardian (2012) has reported that it is an extremely prospective industry, which contributes approximately 21 billion pounds to the national GDP of the UK and directly employs 816000 people. Such a high level of rivalry means that the customers of the country expended 46 billion pounds on clothes merely in 2008; on the other hand, according to Fashion United (2012), total UK domestic consumption on clothing and footwear is 59 billion Euro annually (therefore, British customers expend around 900 Euro on fashion annually).

The following figure shows how much the consumers spend in this attractive industry in comparison with other sectors to show how saturated this industry is with various competitors and retail giants in the UK:

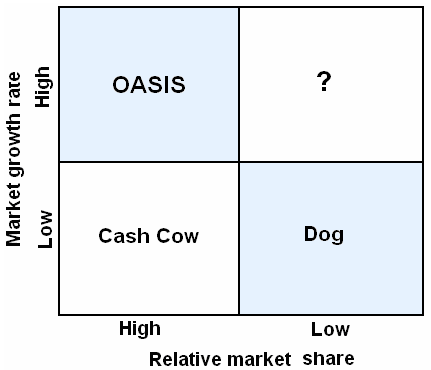

BCG Matrix and OASIS Stores

OASIS Stores occupies the upper place on the left-hand side (highest position of the matrix), which indicates that high market growth with high relative market share; therefore, this company needs no financial help of the investors at this moment while dog indicates the worst position in this matrix; however, it can classify the business units by using the subsequent Boston consulting group matrix –

Ansoff Matrix for OASIS Fashion

Table 2: Ansoff’s model for OASIS Fashion. Source- Self-generated.

Reference List

Agonist (2009). Shopping For Oasis Clothes. Web.

Aurora. (2012). OASIS. Web.

Bloomberg Businessweek.. (2012). Textiles, Apparel and Luxury Goods: Company Overview of OASIS Stores. Web.

Fashion United (2012). Facts and Figures in the UK fashion industry. Web.

FE Investigate. (2001). Oasis Stores PLC: Final Results. Web.

IBIS World. (2012). Clothing Retailing in the UK: Market Research. Web.

Kurt Salmon. (2012). UK retailer Oasis makes it into the top five in the first global omni-channel fashion survey. Web.

OASIS Store. (2012). About OASIS. Web.

OASIS Store. (2012). Snow Promotion. Web.

Oxford. (2004). Assessing the Productivity of the UK Retail Sector. Web.

SAS & Verdict. (2012). UK Retail 2012 & Beyond. Web.

The Guardian. (2012). British fashion industry now worth nearly £21bn a year, report reveals. Web.