Business Purpose

Supply Chain Management and Competitive Strategy

Brief Background of the Company

- Etihad Airways is a state-owned carrier in the commercial aviation industry with a strong global presence. Etihad primarily competes in the commercial aviation industry that includes freight and passenger transport segments. Globally, the industry has more than 2000 players controlling over 22,000 commercial jets from various airports around the world (Etihad Airways, 2016). The UAE commercial airline industry has over four major players based in different regions, including Dubai (Emirates Airways) and Ras Al Khaimah (RAK Airways). Etihad competes through the provision of integrated freight services, passenger travel, import/export solutions, and on-board catering, among others.

- Etihad faces competition from regional and international airlines. Emirates airline has a larger market share than Etihad in the Gulf region in terms of passenger numbers (39.4m vs. 10.3m). Therefore, Etihad is a challenger to the Emirates’ market dominance. Its revenue from cargo services and passenger segment grew by 17% between 2014 and 2015 (Etihad Airways, 2016). The airline is based in the Abu Dhabi International Airport. It serves over 130 destinations spread across 46 different nations, including India, Australia, China, the UK, and the US, among others (Etihad Airways, 2016).

The Environment, the Resources, the Objectives, and the Feedback Decisions

The external environment that Etihad operates in includes markets in the Middle East and Africa region. The company operates in 130 travel destinations spread in different countries. The external environment is characterized by high rivalry between players, low threat of new entrants, presence of substitutes, and high customer and supplier bargaining power. Etihad’s resources consist of tangible and intangible resources. The tangible resources include joint ventures with travel agencies, such as BCD travels, a large fleet size of 122 aircrafts, 130 destinations and centers, and technology resources. The intangible resources include skilled workforce (management), technology, business networks, functional expertise, quality customer service (lounges), and sponsorships (Pezelj, 2015). Its core objectives include

- offer quality and competitive carrier services to clients worldwide,

- elevate the image of the UAE,

- unify the Eastern and Western nations by making Abu Dhabi a connection point.

Etihad, through its two loyalty programs called “Etihad Guest and Etihad BusinessConnect”, receives feedback to maintain customer value (Etihad Airways, 2016, para. 6).

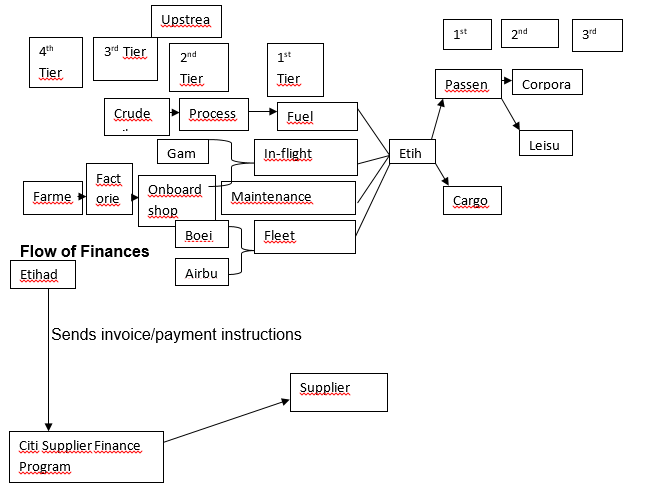

Supply Chain for Etihad

The firm’s supply management unit performs the purchase of fuel, airport services, on-board services, accommodation, and equipment, among others (Etihad Airways, 2016). Its main product is passenger transportation. Other products include airport services, cargo transport, and holiday services. The Etihad’s supply chain management brings together its facilities, information, sourcing, merchandise, transportation, and pricing.

Flow of Goods and Services

Customer Fulfillment and Environmental Scanning

How the Company Creates Value

Etihad’s warehouses are located at the Abu Dhabi International Airport to facilitate the supply of cargo to customers. In addition, the firm has expanded its network through partnerships and alliances that enhance service accessibility and flexibility. It employs technology, such as the SAP implementation, in its operations (Etihad Airways, 2016). Etihad runs innovation centers such as the Etihad Training College that train its engineers and technology experts.

It offers luxurious customer lounges, customized in-flight iPads, and sophisticated chairs called ‘GoSleep’ at the airport. It has deployed technology to detect aircraft faults and increase operational efficiency and safety, leading to service quality. Its loyalty products differ in price range. They include the “Diamond first class, the Pearl business class, and the Coral economy class” (Etihad Airways, 2016).

How the Company Could Monitor Satisfaction

Etihad has a loyalty program called the Frequent Flyer Program. Customers give feedback and views about the quality of the services and frequent travelers receive instant rewards. The loyalty program has the Etihad Guest and the Etihad BusinessConnect (Etihad Airways, 2016). Etihad also relies on surveys done by research firms to monitor customer satisfaction. On the other hand, Etihad’s partners have an option to obtain early payments through its Supply Chain Finance (SCF). The SCF program provides finance to suppliers for receivables at a lower cost (Hogan, 2014). Thus, it deepens the relationship with the supplier.

Environmental Scanning

Environmental scanning helps define the strengths, weaknesses, opportunities, and threats in the market or industry. Etihad’s SWOT analysis is as shown below.

Forces of Change

The most important forces of change for Etihad include:

- Global capacity – Etihad relies on the Etihad Training College to produce unique products and capabilities that could give it a competitive advantage in the market (Etihad Airways, 2016)

- Technological innovation – Etihad utilizes technology to enhance safety, improve customer experience, and promote efficiency. Examples include the SAP implementation, the ‘GoSleep’ chair, and the customized on-board iPads. It also collaborates with Boeing in the BIOjet project to develop aircrafts that use bio-fuels.

- Globalization – Etihad forms alliances with other airports to give premium services to its clients. It has formed partnerships with travel agencies in the 130 destinations it serves.

Supply Chain Process Thinking and Order Fulfillment

Strategies Used by the Firm

Etihad uses partnerships as a strategy to reduce operational costs and increase its revenues. The strategy entails code-share partnerships with other airlines to provide Etihad with passengers. For example, its partnership with Berlin Airline increased traffic by 300,000 travelers (Etihad Airways, 2016). The firm also uses product differentiation to attract customers from different socioeconomic classes. It has the Diamond first, Pearl business, and Coral economy classes, which are relatively cheaper than the comparable competitor products. Another strategy used by Etihad is partnerships with travel and tour companies, such as the Dubai Marina, to offer tourists integrated ground services and customer lounges.

Order Fulfillment Process

The SCOR model consists of five elements, namely, plan, source, make, deliver, and return used to manage supply chain processes.

- Plan – encompass processes that leverage on demand and supply to meet production, supply, and delivery needs. Etihad’s has a code-sharing and equity plan that helps it meet supply and demand needs of the market. The plan has seen the airline report up to 23% increase in passengers flying with Etihad (Etihad Airways, 2016). In addition, Etihad used the code-sharing plan to provide cargo services and reduce costs.

- Source – includes the actual purchase processes that meet the demand. Airbus and Boeing supply Etihad the aircrafts that make up its fleet. The firm collaborates with the manufactures to produce customized in-flight amenities and ensure timely completion of projects through projects like the BIOject project in Abu Dhabi.

- Make – entails processes that produce a finished product to meet demand. Etihad, through backward integration processes with providers to offer online check-in systems and in-flight entertainment (Panasonic eX2 system) (Hogan, 2014).

- Deliver – covers processes that provide finished goods and services to customers. The online check-in system allows passengers to obtain advance services. Etihad Cargo runs warehouses based at the Abu Dhabi airport that handles inbound and outbound logistics (Hogan, 2014). Goods destined for Asia, Europe, and Australia pass through the airport to the depots in various destinations.

- Return – covers processes that facilitate the return of damaged or misplaced products. Etihad Cargo provides post-delivery customer support through its offices located in the destinations it serves.

Sourcing Processes

- Supplier selection – involves four stages, namely, identification, evaluation, approval, and monitoring. Buyers search for suppliers from databases before evaluating them based on price, quality, and expertise, among others (Harrison & Van Hoek, 2008). An eligible supplier is then approved. Monitoring is done to ensure high levels of performance during the contract. Etihad sources its maintenance spare parts from FAA approved suppliers, namely, Airbus and Boeing.

- Transaction management – utilizes price and purchase orders to evaluate the sourcing group’s performance. The aim is to obtain the best price through competitive bidding or negotiation. Etihad collaborates with Citi group to identify suppliers from Asia, America, and Europe that would deliver the highest returns (Etihad Airways, 2016). Citi offers Etihad a solution called the supply chain finance (SCF) for the transaction (orders and payments) management.

- Relationship management – entails the supplier and customer relationships. Etihad’s efficient invoice clearance procedures (SCF) strengthen supplier relationships. In addition, the loyalty program that rewards frequent travelers helps in customer relationship management (Hogan, 2014).

- Communication management – entails internal and external communication channels. Etihad communicates with its customers directly through online check-in systems and travel agencies (Hogan, 2014).

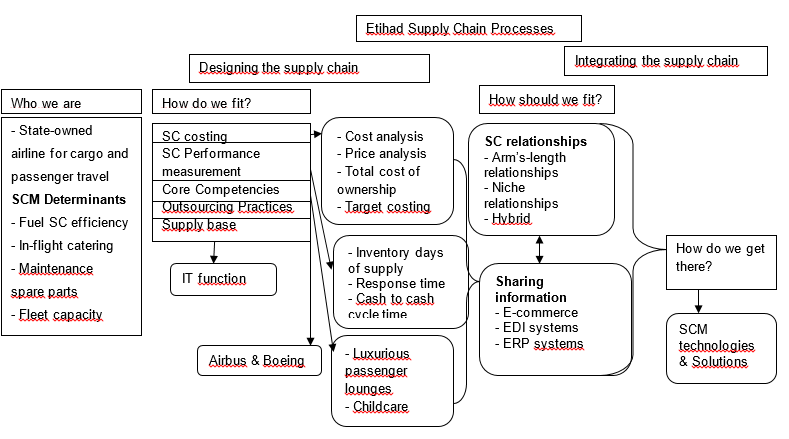

As-Is Supply Chain

Strategic Supply Chain Costing and Performance Measurement

Strategic Cost Management Principles

The aim of strategic cost management is to reduce operational costs and increase revenue while creating customer value. The three principles of strategic cost management include, supply chain analysis, value proposition analysis, and cost driver analysis (Gattorna, 2006).

- Supply chain analysis – involves the analysis of the flows of information, inventory, business processes, and finance throughout the supply chains, i.e., from the supplier to the consumer.

- Value proposition analysis – reflects a company’s competitive strategy in the market. A value proposition can be the cost leadership or differentiation strategies of a firm. A firm may use more than one value proposition or change value propositions during the product life cycle (Harrison & Van Hoek, 2008).

- Cost driver analysis – helps identify company processes, operations, and decisions that lead to costly supply chains. Cost drivers depend on the number of outsourced functions, the quality of the materials or parts used, and the scale of operations (Harrison & Van Hoek, 2008).

Tools Used to Support Strategic Cost Management

The tools that can be used to support strategic cost management include:

- Cost analysis – entails zero-based pricing and a breakdown of the operational costs related to purchased solutions (Simchi-Levi, Kaminsky & Simchi-Levi, 2008).

- Price analysis – helps compare prices offered competitors in the market.

- Total cost of ownership – helps analyze the actual cost of purchasing, maintaining, or selling a product, service, or equipment.

- Target costing – helps determine the production and marketing costs to estimate the profit margin.

The importance of a supplier to a firm is determined using a decision matrix that considers the nature of the purchase and the relationship sought. Using this matrix, suppliers can be classified into low impact, critical, strategic, and ‘leverage’ providers (Gattorna, 2006). In this regard, an appropriate supplier can be selected using the decision matrix.

How Etihad Could Measure its Sourcing, Operations and Logistics Processes, and Customer Satisfaction

Etihad could measure the efficiency of its sourcing using tools such as quantities of spare parts inventory levels, inventory obsolescence, inventory turns, return on assets (ROA), and economic value added (Gattorna, 2006). On the other hand, the measures of operations of Etihad may include work in progress inventory, inventory obsolescence, ROI, ROA, and economic value gained. The efficiency of Etihad’s logistics could be measured using indices such as inventory turns, inventory obsolescence, ROA, inventory days supply, and economic value gained.

Customer satisfaction is critical in the airline industry. Etihad can measure the satisfaction of its customers using time metrics and customer complaint monitoring (Gattorna, 2006). For firms using Etihad Cargo, on-time delivery, order to delivery cycle, shipments expedited, and complaint response time could indicate their satisfaction levels.

How Etihad Could Measure Its SCM Performance

- Inventory days of supply – refers to the number of inventory days needed to sustain the supply. According to Simchi-Levi, Kaminsky, and Simchi-Levi (2008), raw materials and final products must be maintained at optimal levels. The calendar days when consumables used in Etihad’s in-flight catering could be divided by the daily cost of sales to obtain the inventory days of supply.

- Response time – is the number of days it takes a firm to detect demand changes and increase its output by 20%. Etihad’ SCM performance could be the time it takes the firm to increase its fleet or flights per week by 20% in response to a demand rise in a particular destination (Etihad Airways, 2016).

- Cash to cash cycle time – refers to the time needed to recoup a dollar spent to purchase supplies through the sale of the final product or service. Etihad could use this measure to determine the performance of its food supply chains. It is given by the total inventory days + day’s sales outstanding – day’s payables outstanding (Simchi-Levi, Kaminsky & Simchi-Levi, 2008).

- Perfect order fulfillment – a perfect order is delivered on time, in a good condition, and with the correct enclosed documents. SCM performance can be determined based on the number of orders that arrive in a perfect condition (Simchi-Levi, Kaminsky & Simchi-Levi, 2008). In this regard, Etihad’s perfect order could be the proportion of freight or consignments that arrive in a perfect condition to the customer.

- Customer inquiry response time – Etihad’s customer relationships depends on the quality of customer service. Its performance could be measured based on the customer inquiry response time, i.e., the duration it takes for a customer’s call to be directed to the individual who could handle the issue.

- Source/make cycle time – Etihad could determine the efficiency of outbound logistics for its freight segment using the source/make cycle time. This measure estimates the duration it takes to package and ship a product or consignment.

Competencies and Outsourcing

Etihad’s Core Competencies

Core competencies are the rare capabilities, activities, or skills of a firm that give it a competitive advantage (Beamon, 2009). Etihad’s core competencies include:

- Luxurious passenger lounges – Etihad recently launched a luxurious customer lounge in Frankfurt. The other lounges are within the UAE. The passenger lounges come with 5-star restaurants and a range of entertainment products. Therefore, the lounges constitute a core competency because it indicates Etihad’s commitment to offer superior products to its customers.

- Child care services – Etihad’s premium passengers can receive nanny services at the lounges. The trained nannies provide care for children of travelling parents. This service is unique to Etihad and therefore, a core competency.

- Online booking – passengers have the option of booking for their cabs before landing or checking in through Etihad’s website. This complementary service allows passengers to commute smoothly between the airport and their hotels. The integrated service is difficult to imitate, hence, a core competency.

- Luxury air travel – Etihad’s $70 million first class suites is fitted with a 23’ screen and several entertainment options, on-board iPad, and beverages, among others. The luxurious amenities enable the airline to compete for high-end clients and corporate executives.

- Sports sponsorships – Etihad is a leading sponsor of sports tournaments, such as football. The sponsorships improve its global profile and image.

Outsourcing

Outsourcing is defined as the process of contracting certain aspects of the production process or business functions to another company or supplier (Beamon, 2009). Privatization is a form of government outsourcing. Companies outsource functions for various reasons.

- Conserve capital through cost savings.

- Grow revenue – outsourcing to specialist firms can lead to improved performance and revenue.

- Reduce operating costs – outsourcing to low-wage countries can lower a firm’s operating costs.

- Focus on the core business – by outsourcing auxiliary services, a firm can concentrate on its key business function.

Examples of outsourced services include financial services, data entry, website maintenance, transcription, and secretarial services, among others (Gattorna, 2006). The three kinds of risks associated with outsourcing include:

- Strategic risk – outsourcing may lead to a loss of core capabilities and knowledge in the long-term.

- Tactical risk – outsourcing is associated with a short-term risk of capacity loss due to the reliance on suppliers.

- Effect on buyer power – the reliance on third party providers increases supplier power.

Make-or-buy Analysis

Firms often face dilemmas when deciding between outsourcing and retaining the functions. Make-or-buy decisions involve four steps. First, a cross-functional team evaluates the need for outsourcing (Gattorna, 2006). Second, the functions to be outsourced and the expected outputs are identified. Third, the costs associated with the outsourced activity are determined. The costs may include materials, staffing, transportation, quality control, and capital, among others. The fourth stage is evaluation, which entails sensitivity analysis to compare outsourcing costs and benefits. A decision to outsource part of the functions is made when the provider shares the estimated costs with the firm.

Supply Chain Rationalization

Supply-base Optimization

Creating supply effective relationships with good suppliers can be challenging. Beamon, (2009) defines the supplier base optimization as an ongoing process of evaluating suppliers to maintain an effective supply base by identifying and removing inefficient and redundant ones. The aim is to develop an optimized supply base with a low risk and build effective supplier relationships. American manufacturers often obtain supplies from many suppliers globally. Through supply base optimization, they can remove redundant suppliers to maintain a simple and efficient supply chain. Optimization can be achieved through multiple source suppliers, supplier scorecards, plant visits, and high quality requirements.

Role Shifting

Role shifting calls for a reexamination of the capabilities needed in the supply chain. It requires cross-functional skills to develop successful supply chains. Modern firms need to develop management skills to complement their supply chain expertise. Role shifting creates competitive supply chains through collaboration, better management of complexity, use of technology, and increasing responsiveness to demand changes (Simchi-Levi, Kaminsky & Simchi-Levi, 2008). The manufacturing management brings together people from technically diverse fields that employ different approaches to optimize the supply chains. Role shifting considers different production methods and decisions that obtain innovative and efficient supply chains.

To-Be Supply Chain

Supply Chain Relationships

The Right Type of Relationships for Etihad

- Arm’s-length Relationships – are appropriate for ‘routine’ purchases of products that involve no value addition by the supplier. Arm’s-length relationships are recommended for Etihad’s suppliers of hotel products for its in-flight catering (Pezelj, 2015). The supply market for hotel supplies is very competitive and non-differentiated. In addition, in arm’s-length relationships, no long-term commitment is required, and therefore, Etihad can change suppliers easily.

- Niche relationships – are the relationships between the firm and providers that are specialized in a specific, limited product or service. Unlike arm’s-length relationships, niche relationships involve high switching costs. Niche is recommended for the relationships between Etihad and providers of airline solutions, such as passenger services and e-payment systems. An example of such providers is Sabre Airline Solutions that offers specialized products for departure control (Pezelj, 2015).

- Hybrid relationships – involve providers of intermediate level services or products of moderate importance to the company. The products may involve turnkey solutions that are ready for use upon delivery. Etihad’s may have hybrid relationships with jet fuel suppliers and other airlines (code sharing relationships) (Pezelj, 2015). Hybrid relationships are characterized by higher switching costs and continuous collaboration.

- Full service relationships – involve strategic products and services integrated into a company’s internal processes and custom solutions. The suppliers cooperate with the organization and have a high level of responsibility and accountability. Etihad could have full service relationships with aircraft manufacturers, i.e., Boeing and Airbus, which provide maintenance parts and safety features (Pezelj, 2015).

Practices that Promote Successful Alliance Creation and Management

Successful alliances require proper process management and leadership commitment. Some of the best practices for successful alliances include:

- Process management – it entails the management of the alliance as per the set objectives, regular performance evaluation, effective tackling of teething problems, and implementation of a risk mitigation strategy (Christopher & Towill, 2002). Furthermore, clear specifications of the process or products can help avoid ambiguity in production.

- Open communication – building strong relationships requires effective communication and engagement on issues that require joint decisions (Christopher & Towill, 2002). In addition, open communication helps resolve any differences between the firms and fosters collaboration. Relationships can be strengthened by holding regular stakeholder meetings to seek feedback and address pertinent issues early to avoid conflicts.

- Equitable investment – resource constraints account for most alliance failures. Building successful alliances requires dedicated resources and effective management of processes, human resource, and strategies (Christopher & Towill, 2002). The organizations should contribute resources equitably.

- Timely payment – suppliers should be paid on time after delivering products or services.

- Training – empowering customers and suppliers through training can strengthen strategic alliances.

Elements of an Effective Negotiation Strategy

Having a mutual win-win attitude can help Etihad and its partners to collaborate to raise their competitive position. In addition, planning for a successful outcome can motivate both parties to negotiate (Pezelj, 2015). Portraying the negotiation as being fair and accommodating can also increase the commitment of partners towards the process. Focusing on creating value for both parties through a mutual agreement can create trust and strengthen the SC relationships.

Etihad Airways can plan effective negotiations by formulating specific objectives of the process beforehand. Another strategy involves appointing an effective team to lead the negotiations. Effective planning also requires the collection and analysis of relevant data to identify the strengths and weaknesses of the other party. The analysis can also allow Etihad to identify the other party’s needs, identify the pertinent facts, take a stand on each issue beforehand, and formulate a negotiation strategy (Christopher & Towill, 2002). Proper planning also entails choosing the negotiation tactics.

One of the tactics suited for win-win negotiations include honesty and openness (Christopher & Towill, 2002). The process entails honesty and transparency in providing information to facilitate informed decision-making. Other tactics may include listening effectively, using positive statements, being considerate, and arguing based on facts.

Sharing Information across the Supply Chain

SC-related Information Technologies and Information Systems Used

A number of IT technologies have been applied to streamline supply chains. Examples include:

- E-commerce – refers to a suite of tools that facilitate transactions without paperwork (Beamon, 2009). It includes “data interchange, database systems, and e-mails”, among others (Beamon, 2009, p. 278). Firms use automated e-commerce systems to exchange documentation between the firm and its suppliers and customers.

- Another IT SC-related IT solution is electronic data interchange (EDI). EDI allows firms to exchange documents in an electronic format. Supply chain partners can use EDI to share documents quickly.

- Bar coding – scanners are used to track goods in transit between the supplier and the customers.

- Enterprise resource planning (ERP) system – firms use ERP tools to process transactions such as inventory control and client orders.

The Benefits of SC-related IT Systems

- ERP systems can help streamline the supply chains by promoting communication between SC partners.

- The systems can help firms know customer needs and create tailor-made products.

- ERP systems can help firms synchronize the flow of products during production or transportation.

- IT systems provide tools for billing and processing invoices at a lower cost, which increases productivity.

- Optimization tools can help in fleet management to lower costs and reduce response time.

How Companies Use the Internet and E-commerce

- Order processing and tracking – firms use the internet to monitor the flow of goods from the warehouse to customers (Simchi-Levi, Kaminsky & Simchi-Levi, 2008).

- Inventory management – EDI information programs are used by buyers to communicate stock-outs to suppliers via the internet.

- Transportation – Internet-based tracking systems facilitate order processing and payment.

- Customer service – customer complaints can be addressed using internet-based systems.

- Production scheduling – Firms use the Internet to schedule production processes and delivery between suppliers and customers.

The Supply Chain Road Map – Mapping the Supply Chain Design

Supply Chain Mapping

Conclusions and Recommendations

In light of the increasing competition in the global airline competition, rising fuel costs, and Abu Dhabi’s strategic location in the world map we recommend that:

- Fulfilling customers’ needs

- Etihad enhances its punctuality and reliability in flight scheduling to reduce customer complaints and increase trust and satisfaction

- The company expands its range of in-flight entertainment options and cultural sensitive hospitality products offered to the destinations it serves

- Etihad avails information in local languages to travelers via online applications

- Supply chain processes

- The airline forms SC relationships with more airports (supply network) to provide premium services to its customers in all its destinations

- Etihad reduces operational costs by forming long-term relationships with fuel suppliers (backward integration with suppliers)

- Supply Chain Costing and Performance Measurement Practices

- Etihad measures the efficiency of its sourcing using a combination of indices, such as inventory levels, and ROA.

- The carrier measures its SC operations and logistics using work in progress inventory to capture product flows

- The company uses time metrics to measure response time to increase customer satisfaction

- Etihad employs a range of indices to measure and monitor its SCP performance, including response time, inventory days of supply, and cash-to-cash cycle time, among others (Hogan, 2014).

- Core Competencies and Outsourcing Practices

- Etihad should invest in the training and development of local work force to run its operations within each of the 130 destinations as the travel attendants and pilots

- The luxurious passenger lounges should be opened up in locations outside the UAE to give its clients premium services globally

- The childcare service (trained nanny) should be replicated in the other destinations that Etihad serves besides Abu Dhabi international airport

- The luxurious suites should give customers video conferencing solutions to allow executives to hold in-flight meetings or communicate with staff in different locations

- Etihad outsource its supply chain finance function to a banking institution to facilitate transaction management and payments

- Supply Chain Relationship Management

- Etihad should develop arm’s-length relationships with the providers of in-catering food supplies because they involve low switching costs

- Etihad’s niche relationships should involve specialist firms such as providers of IT solutions

- The airline should form hybrid relationships with fuel provider, e.g., ADNOC, to lower its operational costs in the long term

- Etihad’s full service relationships with aircraft manufacturers, Boeing and Airbus, can enhance safety and reliability

- Sharing Information across the Supply Chain

- Etihad should use e-commerce tools to share documents with its suppliers and facilitate online booking and payment by customers

- The airline should use ERP systems to manage its inventory and streamline its cargo transportation segment

- Aligning All of the Above with its Supply Chain Strategy

- Etihad’s strategy is to “expand globally by adding the largest possible number of destinations” (Etihad Airways, 2016, para. 3). Etihad should explore market opportunities in Asia and South America for its cargo and passenger travel segment. The company should use the SCM tools described to develop distinctive logistics services across its destinations.

References

Beamon, B. (2009). Measuring Supply Chain Performance. International Journal of Operations and Production Management 19(3), 275-292.

Christopher, M. & Towill, D.R. (2002). Developing Market Specific Supply Chainm Strategies. The International Journal of Logistics Management, 13(1), 32-39.

Etihad Airways. (2016). About Us. Web.

Gattorna, J. (2006). Living supply chains. How to Mobilize the Enterprise around Delivering what your Customer Want. New York, NY: Prentice Hall.

Harrison, A. & Van Hoek, R. (2008). Logistics Management and Strategy. Competing through the Supply Chain. New York, NY: Prentice Hall.

Hogan, J. (2014). New era for Etihad in 2014. Web.

Pezelj, I. (2015). Differentiation in Strategy Key to Etihad Airways’ Success. Web.

Simchi-Levi, D., Kaminsky, P. & Simchi-Levi, E. (2008). Designing and Managing the Supply Chain: Concepts, Strategies, and Case Studies. Boston, MA: McGraw-Hill/Irwin.