Introduction

Package storage and the delivery system combine electronically controlled lockers arranged at or near customer locations. Each locker is unlocked by a courier, preferably with a short-range transceiver or transmitter carried on the courier’s person. The customer can unlock the compartment and receive the delivered parcel. Cryptographically signed communications are employed along with nonvolatile usage logs to diminish the risk of loss of a package or deception by a courier or customer. The cells may be stackable, permitting a delivery courier to add divisions in the event a customer receives too many deliveries to fit into a single portion. Each cubicle has, of course, a physical location, and has linked with it an address code indicative of the physical location, for example by means of a legible or definite representation of the precise latitude and longitude. A batch hand-carried to such a box suitably bears the address code. A merchant can considerably reduce the risk of credit card fraud by requiring the use of such codes for the straightforward reason that a fraudulent transaction may be traced to a specific physical location. A substantial amount of airfreight consists of express-delivery bulk shipments that are carried by integrated carriers. Integrated carriers are companies such as Federal Express, United Parcel Service, and DHL, all of which specialize particularly in the air transportation of small packages and the related ground collection and distribution. Such carriers fly high-value or time-sensitive parcels on airplanes that carry only such parcels. UPS is a bigger company than FedEx, it is also more profitable and more financially stable than its rival. This paper analyzes the financial statements and the financial ratios of the two companies to understand where UPS is doing better and where FedEx has the upper hand so to speak and make some recommendations based on the analysis.

FED-eX history

FDX Corporation is a holding company for Federal Express Corporation and other businesses that provide prompt delivery of packages, letters, and other shipments within the United States and worldwide. Federal Express Corporation, also called FedEx, virtually invented the overnight-delivery industry, and within ten years rose from a startup operation to a $1 billion company.

Among the company’s few delinquents was Zap Mail, a satellite-based system for electronic delivery of documents that was overtaken by the facsimile (fax) machine. In 1986 Federal Express Corporation lost $300 million on the service. Although Federal Express Corporation enjoyed a strong reputation and substantial market lead, competitors began making gains in the 1980s. United Parcel Service of America, Inc. (UPS), a longtime leader in package delivery, invested heavily in technology and aircraft in the mid-1980s and slowly but surely increased its share of the express-delivery market (STACEY, p.20).

UPS’s history

United Parcel Service of America, Inc. (UPS), and largest package-delivery corporation in the world. The company provides shipment of letters, parcels, and freight worldwide. Based in Atlanta, Georgia, UPS is one of the largest privately-owned companies in the United States. The business was founded in 1907 in Seattle, Washington, by 19-year-old Jim Casey, who saw the need for private delivery service. At the time, the United States Postal Service had not yet familiarized its parcel post system. Casey named his company American Messenger Company, and with a team of six messengers, began delivering messages and meals by bicycle. Soon the company acquired a Ford Model T automobile and seven motorcycles to bear parcels for retail businesses. In 1913 the company merged with an ambitious service to form Merchants Parcel Delivery. By 1918 it was delivering packages from three of Seattle’s major department stores to their customers. By this time the company had adopted its signature brown color used on all of its trucks and uniforms (Friedman, p. 123).

In the late 1970s and early 1980s, Federal Express Corporation began drifting business from UPS by specializing in overnight deliveries with airplanes. UPS began offering a comparable air-delivery service in the early 1980s and invested profoundly in technology and aircraft. The company as well expanded its presence in the international shipping market. In 1991 the company budged its headquarters to Atlanta. (Friedman)

Competition

FedEx Ground implements its stock courier on a self-substantial expert model – UPS does not. The differences between these two companies and their methods of doing business are unhindered, and observers are watching with interest as the opposing worldviews emerge into evident results subsequently. FedEx has had ingressive success in the last several years since they scooped in to fill the void that was created by the UPS Teamsters strike in 1997. At the time UPS fired 10,000 workers when the load supply crashed and FedEx bought RPS (a ground package delivery service based in Pittsburgh) as an outcome. RPS was dependent on a contractor model using self-reliant builders to dispatch packages rather than outright employees and FedEx kept this unmarred. FedEx may have initially used expert drivers as a way to deteriorate costs and use the competitive side to win market share from their contender UPS. Now it is a way of life (Friedman, p.3).

The analyst to the authorized representative questioned whether it is a long-term success stratagem or a short-term cost-cutting gimmick that instigates immediate and rapid growth, doubtful of being completely sustainable. Proposers say it is a new and better way of doing business. UPS is a very strong company that stands firmly behind its own business model and has no tenacity of adopting any of the FedEx contractor strategies. They believe their fortitude in business will win out in the long run because of a more important package offered to their employees that inculcates more sincerity and motivation, and certainly better service to the customer. FedEx Ground has replete itself in its flexible and growing business channels, trying new things and being innovative in a very competitive field. The individualistic model of FedEx is under some legal delving from court authorities, however (Greg p. 20).

Financial ratios

Comparison of the financial ratios

The Company constitutes in three segments: U.S. Domestic Package operations, International Package operations, and Supply Chain & Freight operations. As of December 31, 2006, the Company delivered stocks each business day for 1.8 million shipping customers to 6.1 million consignees in over 200 countries and territories. During the year ended December 31, 2006, UPS freighted an average of 15.6 million pieces per day worldwide. Furthermore, its hand-to-hand delivery capabilities are available to clients in over 175 countries and territories. Year over year, United Parcel Service, Inc. has been able to grow funds from $42.6B to $47.5B. Most impressively, the company has been able to trim down the percentage of sales devoted to income tax expense from 5.18% to 4.85%. This was indefatigable that led to a bottom-line growth from $3.9B to $4.2B.

In 2004 FedEx Ground had about 17,000 contract workers. In 2003 it brought in nearly $4 billion in revenue. Currently, it operates 27 centers and is planning on opening 10 new sites doubling its volume capacity to 5.8 million parcels per day. It is venturing double-digit annual revenue growth. It is estimated that most FedEx Ground contractors work 10 to 12 hour days, without overtime commission. They are paid on a complex bulk-rate formula based on how many pickups and deliveries they make, with bonuses for good service. Drivers can make $40,000 to $70,000 a year. The drivers use trucks bearing FedEx colors and logos, wear FedEx-style uniforms and serve customers of FedEx Ground. However, they must pay for and retain their own trucks, uniforms, supplies, gas, maintenance, and other costs. They get no company benefits. A FedEx contract generally covers one route, but it is possible for one person to own up to four contracts, which can raise the earning gradient to more than $100,000 per year. Because of this indubitable contracts are vendible in and of themselves, sometimes bought and sold like businesses for as much as $30,000 plus. Contract instructors go through an initial two-week training agenda and then are on their own. The business does not administer its daily routines but does conduct customer satisfaction surveys. The business is severe results-oriented, if the customers are happy that is all that counts (Benjamin, p. 34).

Ratio Comparison

Profitability Ratios

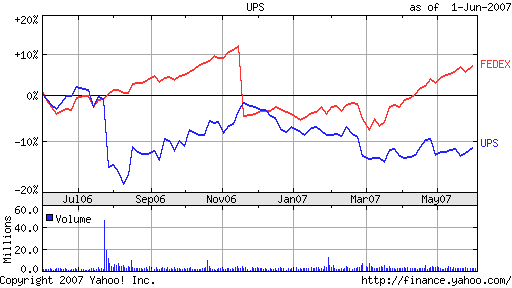

When comparing the profitability ratios the ROA and ROI for both the companies both returns on asset and return on investment are higher for UPS and in the past three years although there has been an increase in ROA and ROI for both companies UPS is doing much better than FedEx. In addition, the ratio of cash flows to margin and all the other profitability margins are significantly higher for UPS than for FedEx. It can be seen that the ROI for UPS has been consistently rising while for FedEx there was a fall experienced in both ROA and ROI in 2005 but they seemed to have recovered from that fall.

Asset utilization ratio

The asset turnover ratio shows that both companies are quite close in their asset utilization, while inventory cannot be compared as the figure is not available for UPS. Capital Expend Pct Total Assets is higher for Fed-Ex while Capital Expend Pct Sales is slightly higher for FedEx. Therefore Asset utilization ratios are quite close and there is no significant difference. The Asset turnover for FedEx is more consistent than UPS this suggests that FedEx utilizes its assets more efficiently than UPS and therefore it is more efficient. But in the final year (2006) UPS seems to have recovered significantly in its efficiency.

Leverage ratio

In the leverage ratio section the debt to equity ratio is almost the same with the FedEx ratio being slightly higher, however, what is significant is that the ratio has come down drastically since 2005 when it was 44%, while UPS is stable. While the long-term debt to equity ratio is higher for FedEx but shows that in 2005 a large portion of the debt was short-term debt but even long-term debt of FedEx was 35%. Long-term debt as a percentage of capital is quite stable for UPS while there is a sharp rise visible in 2005 for FedEx. And it is higher for FedEx compared to UPS, while the equity to the capital ratio I am higher for UPS. The debt to asset ratio is higher for FedEx, while the Equity to asset ratio is higher for UPS. Dividend payout and the cash dividend ratio also show FedEx to be a more leveraged firm than UPS, however, the dividend ratio is much stronger for UPS than it is for FedEx.

Liquidity

In terms of liquidity of the company UPS has significantly higher quick and current ratios, the company is less risky in terms of its liquidity than FedEx. Though Cash and Equity as a percentage of Current Assets for both companies are within similar ranges, while Receivables as a percent of Current Assets is also similar. While Accounts Receivable Days are much higher for UPS than for FedEx. It should be noted that both the current and the quick ratio for UPS although more than FedEx is declining in the past three years, this trend is the very opposite of FedEx whose quick and current ratios have been improving notably over this three years period.

Recommendations

Even though Federal Express Corporation relished a strong status and significant market retinue, competitors began making benefits in the 1980s. United Parcel Service of America, Inc. (UPS), a longtime stellar in package delivery, invested overpoweringly in proficiency and aircraft in the mid-1980s and step by step increased its dividend of the express-delivery market. The ratios show that UPS is a much more stable and more profitable company for its shareholders as compared to FedEx, which is not only less profitable but has higher financial leverage as compared to UPS. In terms of Assets, utilization UPS is a stronger company and even from a lender’s perspective, it is more attractive. However, UPS is less liquid than FedEx as its receivable days are quite high and even the current and quick ratios are much higher.

In 1989 Federal Express Corporation bought Tiger International, operator of Flying Tigers cargo airline, to acquire new global routes. In 1996 Federal Express Corporation began impartment processing and ferreting capabilities on its World Wide Web site, allowing customers to go through shipment information and access details on the position of their shipments. The following year the company informed it would begin contributing three-day portage service within the United States, a move targeted at increasing its competitiveness with UPS in lower-cost, ground-based transporting services. (Niemann, Greg) In 1998 Federal Express Corporation acquired Caliber Systems, a freight company that operated a variety of delivery forces, and established the holding company FDX business. Based on the company history, business analysis, industry analysis, and performance analysis, we have the following inputs for Federal Express. Pledge that the employees, especially pilots, are well salaried. Since Federal Express is a service company, employees are critical to its success. Place pilots’ salaries at or above the industry average. They need to continue a strong presence on the Internet, in case of an endeavor and find ways to make their e-commerce user-friendly and money-making (Benjamin, p.3).

It cannot be denied that UPS is a bigger concern than FedEx and also much more profitable too as the ratios indicate however, it should be noted that UPS cannot be complacent about the lead it over its main rival, the analysis suggests that FedEx has become more efficient using leverage in one year and also it has been consistent in the rise of its profits and also its efficiency in terms of asset utilization. In addition, it is a more liquid company, UPS has high accounts receivable rate as compared to FedEx, and figures might indicate that there is a certain stabilization and maturity visible in UPS which is not present in FedEx which has been growing and becoming more efficient in its operations.

There is a need for UPS to become more efficient in its utilization of assets and even in the case of receivables, it can cut down on the high number of receivables it has compared to FedEx. These changes along with a superior profitability ratio will go a long way in making UPS a more stable and yet more efficient organization.

References

- Benjamin, Marc; (BUSINESS) The Fresno Bee (Fresno, CA); They Deliver When Federal Express needs help fast, a Fresno firm gets the call. (2000)

- Saunders, Stacey; Alaska Business Monthly; Federal Express Expands to Offer Variety of Delivery Options. (2001)

- Thomas L. Friedman, Insourcing, and The World Is Flat: A Brief History of the Twenty-first Century, New York: Farrar, Straus and Giroux, updated and expanded, 2006.

- Niemann, Greg; John Wiley & Sons; “Big Brown: The Untold Story of UPS”.., 2007.

- Thompson ONE Banker – Financials. 2007.