Budgetary deficit is a serious economic challenge especially if it is sustained for a relatively long time. As it stands now, lesser amount is raised in taxes than the actual government spending in the United States. It is highly likely that the gap may grow even wider if the current deficit is not balanced expeditiously. Earlier on, economists estimated that the 2014 budgetary deficit would expand to about $700 billion (Edwards par.1). There are a number of measures that the federal government can put in place in order to lower the deficit.

To begin with, it is vital to mention that the budget must be balanced in spite of the political difficulty in place. One of the key areas of the federal government expenditure is social security. When the latter budgetary allocation is combined with that of Medicare and Medicaid, approximately 20% of the total federal budget is consumed. As much as the nation cannot do without a robust social security system in place, budget planners can seek alternative ways to cut down the current expenditure on general security.

Since the 2003 invasion of Iraq, expenditure on social security has been extremely high. Worse still, consistent fights against acts of terror across the globe have posed additional expenditure. In any case, the US government has been on the frontline to wage war against terrorism beyond the US borders. It is apparent that the government has prioritized social security for a long time. While such a move is highly welcomed, there are myriads of approaches that can still be instituted to lower the federal budget on this domain.

As a starting point, it is high time the US government fully withdraws its troops from Iraq, Iran, Afghanistan and other regions. Global security should remain the concern of individual nations and geographical regions. It is irrelevant and perhaps unnecessary for the federal government to attempt to appeal to various groups and opinions.

Needless to say, any slight cut on the social security budget is highly likely to ease the 2014 budgetary burden to the American public. The roles played by the Department of Homeland Security (DHS) should not be duplicated by other related government agencies at the state and local levels. In other words, the mandate and operations of the department ought to be streamlined with the aim of effecting budgetary cuts as much as possible.

Proposals have also been made in relation to the creation of a small administrative government that specifically deals with security issues. However, such an option might polarize the present security apparatus bearing in mind that they are already firmly established as constitutional offices. Budget reduction on social security can be implemented by automating most of the security systems that do not require the presence of physical human beings.

We acknowledge the fact that all the levels of government have striven to modernize security systems. Nonetheless, there are still key areas that have not been addressed (Kuhnhenn par.2). For example, DHS can make use of more intelligence reports than it has been the case. Intelligent security information has been used for a long time. Interestingly, if the government can deploy professional and competent security experts to manage intelligence reports, then recurrent expenditures (salaries, wages, allowances and other fringe benefits) can be eliminated altogether.

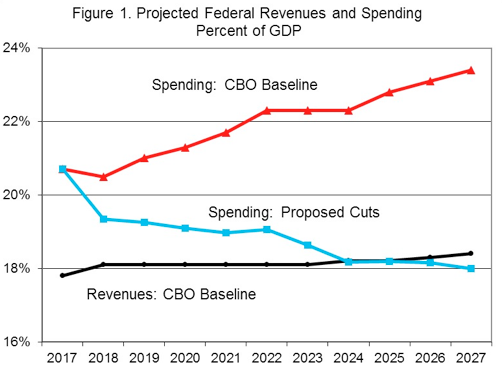

If the Keynesian theory is to be followed, then any cut in government spending may translate into economic turmoil. However, the graph below illustrates the expected gains that may be accrued when the proposed cuts are implemented in the current budget. In fact, when the trend is extrapolated within a period of ten years, revenues under the CBO baseline will be higher than the expenditures. At that point, the United States will be able to boast of a brilliant economic performance.

It can be recalled that Canada faced a similar budgetary deficit way back in the early 1990s. After implementing gradual cuts in its expenditure for a period of one decade, it resumed a stable state of economic growth (Kuhnhenn par.6). This explains why Canada was not extremely hit by the just-concluded global recession.

In the above graph, the projected spending is indicated by the green line. If the above proposal is executed within a period of ten years, a drop to 17.6% from 20.4% of Gross Domestic Product will be realized. Towards the close of 2023, the federal government will be in a position to completely eliminate the current level of deficit. In addition, it will be possible to generate growth in surplus after the year 2023. A total of $ 228 billion might also be generated in terms of interest savings after the 10 years.

The tax code can also be reformed by policy makers in such a manner that the federal incomes are not lowered. As already mentioned, expenditure on social security is still very high and beyond a level that can be comfortably sustained by the government. If the federal government eventually opts to lower the budget, then the social security docket should be among the top dockets to be targeted.

The corporate income tax can still be reduced further by a margin of 10% (35%-25%). This is a high-priority change that can indeed create a significant ripple effect on the current budget. The most interesting point to note about this cut is that it will not lower the federal revenue when projected over a long period. In any case, the corporate income tax is expected to minimize instances of tax avoidance. Consequently, it will propel economic growth.

A closer look at the social security, Medicaid and Medicare dockets reveal a lot that deserve to be discussed. In the attached table, a number of proposed cuts have been indicated. These proposals are all geared towards lowering the federal government spending to about 17.6% of the Gross Domestic Product. As can be seen from the attached table, social security and healthcare expenditures have been extremely high in the recent years and hence, they can be gradually reduced.

If the suggested reforms are executed with minimum delay, the benefits will be realized after the projected ten years. This implies that any delay to implement the reforms will result into continued harm of the US economy especially through consistent budgetary deficits. The reforms are also anticipated to produce significant yearly savings that will completely eliminate the chronic deficits (Edwards par.4).

Apart from the measures discussed above, the current deficit in the US budget can be reduced through public assistance. In other terms, the respective state and local governments can be assisted through aid programs. Unfortunately, the current constitution does not give a lot of powers to the federal government. There several vital government functions delegated to individual states by the constitution. Hence, the federal government is hampered from making certain express authorizations.

Nonetheless, the Congress can still chip in and authorize grants so that the current deficit can be minimized. Grants act as subsidies and can largely assist in lowering the budgetary burden in various states. There are more than 1,100 programs across various states that will benefit from the 2014 federal aid. Besides, public assistance can be manifested through internal borrowing from financial institutions. The federal government has the option to borrow locally to supplement its budget instead of imposing tax burden to the public.

When formal estimates are made, it is evident that the federal expenditure will continue to skyrocket if the proposed reforms are not put into action. In about three decade’s time, nearly 50% of the overall US economy might be consumed by the government unless drastic measures are put in place right now. However, it is quite unlikely that voters will permit extravagant governments in office for that long. If the federal expenditure rises to almost 40% of the Gross Domestic Product, then the entire budget will be unbearable to the American public owing to the high cost of living.

In a nutshell, implementing budgetary cuts on the social security docket will yield positive results. However, employees under the Department of Homeland Security (DHS) might be negatively impacted due to layoffs and reduced remuneration. On the other hand, public borrowing (assistance) from financial institutions will significantly lower the lending interest rates imposed by banks and other financial institutions (Kuhnhenn par.5). As a result, the process will spur economic growth especially at the local and state levels.

Works Cited

Edwards, Chris. A Plan to Cut Federal Spending. 2014. Web.

Kuhnhenn, Jim. New Obama budget proposal abandons Social Security cuts. 2014. Web.