Goldman Sachs’s success can partly be attributed to some of its internal environmental factors. The firm was seriously affected by the 2008 global economic recession, but currently it is back on its successful ways. In this section, it is necessary to look at the internal environment of this firm that makes it such a successful company.

SWOT Analysis

The main strength of Goldman Sachs is its strong financial base that enables it to support various developmental projects. The firm also has about 150 years of experience operating in the finance industry (Mandis, 2013). As such, it is aware of the market forces that might affect its operations and how to deal with them. Its team of highly dedicated and skillful managers and employees has also helped it achieve success in the market. However, it is important to identify some of the weaknesses that it needs to address. The biggest weakness of this firm is its overreliance of subprime mortgages that almost brought it to bankruptcy during the 2008 economic recession.

The market has a number of opportunities and threats that this firm needs to be aware of in order to achieve the desired success. The emerging technologies are creating new ways of banking such as online banking and mobile banking which create new business opportunities (Sinn, 2014). The firm should find a way of taking advantage of these new opportunities. The increasing globalization is also creating new markets for this firm. The major threat that this company faces is stiff competition in the global market.

Resource-Based View

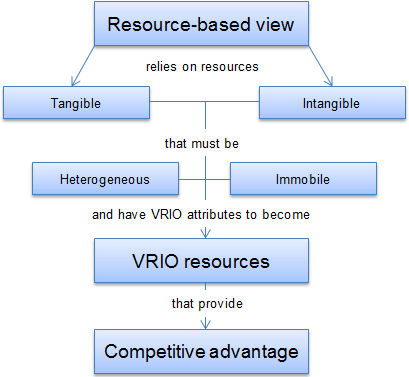

This model is often used to determine the competitive advantage of a firm in the market. It focuses on how resources can be used within a firm to enable it achieve sustainable competitive advantage over its market rivals (Williams, 2016). The following figure shows how this model is used to modify resources to achieve competitive advantage.

As shown in the above model, a firm can use its resources such as finances and other assets (both tangible and intangible) to gain competitive edge over its rivals in the market.

The Company’s Value Chain

Scherf (2014) defines value chain as “a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market.” At Goldman Sachs, the firm has been keen on creating high value to its products that it offers in the market. It has a very effective and reliable customer service that listens to and addresses issues that clients may raise from time to time. The company has some of the best financial products in the market. It also creates value for its clients by offering new products such as mobile and online banking services.

Analysis of its Financials

Goldman Sachs’ financials were massively affected during the 2008 global economic recession. However, the firm achieved full recovery after the bailout it received from the national government. Its revenues, operating income, and net income increased steadily from the year 2008 to 2014 (Hall & Yip, 2016). However, the financial year 2014-2015 saw a drop in the firm’s revenues, operating income, and net income. Based on the firm’s financial performance in the first three quarters of this financial year, it is likely that the revenues and income of this company will improve in this financial year ending in 2016.

References

Hall, D., & Yip, J. (2016). Discerning career cultures at work. Organizational Dynamics, 45(3), 174–184. Web.

Mandis, S. G. (2013). What happened to Goldman Sachs? An insider’s story of organizational drift and its unintended consequences. New York: Cengage.

Rumelt, R. (2011). Good strategy, bad strategy: The difference and why it matters. London: Profile.

Scherf, G. (2014). Financial stability policy in the Euro zone: The political economy of national banking regulation in an integrating monetary union. Wiesbaden: Springer Gabler.

Sinn, H. (2014). Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem. The World Economy, 37(1), 1–13.

Williams, E. F. (2016). Green giants: How smart companies turn sustainability into billion-dollar businesses. New York: Cengage.