Introduction

Over the past two decades, the information technology sector has become very competitive. Google Incorporation and Microsoft Corporation are some of the largest companies that operate in this sector. Considering the dynamic nature of the business environment, a firm’s management teams should not only base the success on the effectiveness with which they offer their product and services.

However, they should also take into consideration the complex and dynamic nature of the environment. To succeed in the long term as going concern entities, it is critical for firms’ management to consider integrating effective business model (Lynn, 2007, p.354). Business model is considered as the building block that contributes towards a firm’s success. It is composed of different elements such as customer attraction and retention, ability to meet the customers’ needs, and to increase its market share. Every business has a business model. This paper compares and contrasts the business model adopted by Google Incorporation and Microsoft Corporation.

Analysis of the business model

Core business

In its operation, Google Incorporation has focused on two main areas which include internet search and advertising. During the early 2000s, Google identified an opportunity whereby individuals were increasingly using the internet to search for information. Google developed a database to help customers’ meet their needs. The company has experienced significant growth in the number of users who search for information using its search engine.

Google has also integrated advertising as one of its core businesses (Hill & Jones, 2008, p.87). Due to an increment in the number of companies that are integrating online advertising, the firm has experienced significant growth in its profitability. For example, at the end of its 3rd quarter in 2011, Google earned $ 2.7 billion from advertising (Financial Report, 2011, para. 1).

On the other hand, Microsoft Corporation has integrated several core businesses. These include developing Operating Systems, Software, and Office Applications. The firm also deals in licensing of software products and designing servers.

Leading products and services

According to Oz (2008, p. 43), it is paramount for firms to develop products and services that enhance their competitive advantage. One of the ways through which they can attain this is by diversifying their product and service offering. In their operation, Google Incorporation and Microsoft Incorporation have incorporated the concept of product diversification. Google manages and maintains several Web sites to meet its user’s needs. Some of these programs include the AdSense program, AdWords, Google Display, DoubleClick Ad Exchange, and You Tube (Yahoo Finance, 2011, para. 1). Google has also ventured into the mobile phone industry by developing Google Mobile.

About internet search, the company has developed Google Search Appliance. This product enables individuals to search for information from a wide range of sources such as online printed books. The firm also provides several Google Apps and collaboration tools such as Google Calendar, Google Sites, Google Docs, Google Site Search, Google Commerce Search, Google Earth Enterprise, Google Maps Application Programming Interface, and Google Check Out (Yahoo Finance, 2011, para. 1).

Microsoft Corporation has also diversified its product and services offering. Its Windows & Windows Live Division department deals with the production of personal computer operating systems. Some of the products from this department include operating systems such as Windows Vista and Windows 7. The firm’s operating systems are utilized on a global scale (Yahoo Finance, 2011, para. 1).

Microsoft also develops diverse Microsoft Personal Computer hardware products. On the other hand, the Server and Tools division offers several leading products which include Windows Intune, Visual Studio, Microsoft SQL Server, Windows Azure, and SQL Azure. The firm also offers computer technology consulting services. Through this department, the firm can train professionals such as system and software developers.

In addition, the firm also specializes in other businesses which include internet browsing and the development of entertainment devices such as video games. The firm offers internet search through several search engines which include MSN, Bing, and adCenter.

Through its business division, Microsoft provides several products such as Microsoft Exchange, Microsoft Lync, Microsoft Office, Microsoft SharePoint, Web Apps, and Microsoft Dynamic CRM and ERP. Some of its entertainment products include Xbox Live, Mediaroom, Windows Phone, and Xbox 360 (Yahoo Finance, 2011, para. 1).

Leadership style

Organizational leadership determines whether a firm will succeed in the long term (Adeniyi, 2007, p.19). This arises from the fact that it ensures that all the employees’ efforts are aimed at attaining the organizational goals. Considering the challenging nature of the technology sector, it is critical for firms within this sector to incorporate an effective leadership style. The two firms have integrated visionary leadership style. According to Hybels (2009, p.123), visionary leaders can visualize what the future holds. As a result, an organization can be able to safeguard itself from future challenges. Visionary leaders do not strategize on how to deal with the foreseen challenges. However, they allow the employees to be creative and innovate on how to deal with the issue on their own.

The success of the two firms is a result of good visionary leadership by the firms’ CEOs. Google’s’ CEO Eric Schmidt and Microsoft’s CEO Bill Gates are visionary leaders. Through their visionary leaders, the two firms have been effective in developing and introducing products in the market. Google has also integrated a democratic leadership style. The firm has achieved this by delegating tasks to employees and encouraging them to participate in various tasks. Its free-reign leadership style has contributed to the attainment of a high level of employee motivation. Despite giving employees the freedom to pursue different projects, the management team reviews the projects proposed to determine those that are of high value to the organization (Boone & Kurtz, 2010, p. 235).

Contrary to Google, Microsoft Corporation has adopted an autocratic leadership style. This refers to a style of leadership where everything is controlled by one individual. As the CEO of the firm, Bill Gates controlled all the activities within the firm. Additionally, he undertook all organizational decisions without involving other employees. Over the years, the firm has put the effort into trying to decentralize its decision-making process. However, this has not been achieved and most of the decisions are made by the top management (Wagner & Hollenbeck, 2009, p. 198). This is one of the reasons why Microsoft has experienced slow growth over the past decades.

Innovation track record

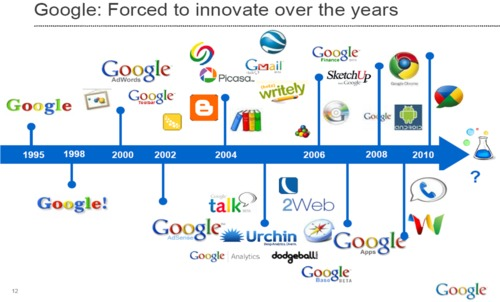

Over the past two decades, Google has positioned itself as an innovation champion (Bry, 2011, para. 1). This has arisen from the democratic leadership style that the firm has adopted. If the firm perceives a product developed by the employees in their project to have a market potential, a substantial amount of resources is provided to develop the product. Google’s innovative track record is evidenced by the numerous products that the firm has developed since the 1990s. The chart below illustrates some of the products that the firm has developed.

Microsoft has also integrated the concept of product innovation. As the firm’s CEO, Bill Gates has successfully created an environment that promotes creativity and innovation amongst the employees. The firm has achieved this by fostering brainstorming amongst the employees. To motivate its employees, Microsoft rewards them depending on their innovativeness and performance (Murthy, 2001, p.76).

The firm’s innovation track record is evidenced by the numerous products and services that it has introduced in the market over the past decades. However, despite developing several products, Microsoft has not been effective about innovation. This is evidenced by the fact that it has not been aggressive in creating a new product. However, the firm has laid more emphasis on adding value to the already existing products. This is emphasized by Wheeler (2001, para. 8) who asserts that Microsoft has become a re-implementer of its existing products.

Comparison of Google Incorporation and Microsoft Corporation financial ratios

The chart below illustrates a comparison of major financial ratios between the two companies concerning its 2010 financial year.

From the chart, it is evident that Microsoft has a relatively high net profit margin of 29.2% compared to Google which has a net profit margin of 26%. This shows that Microsoft has a strong financial performance. However, the two companies differ in their current ratio. The current ratio is used to determine the effectiveness with which a firm can meet its debt obligations. The chart above shows that Google Incorporation has a current ratio of 6.0 while Microsoft’s is 2.6.

This means that Google can be able to meet its current financial obligations more effectively compared to Microsoft. As a result, Google can be able to withstand a financial recession. Additionally, Google has a debt ratio of 0.0 while Microsoft has a debt ratio of 0.21. This means that Google does not have any debt obligations while Microsoft has. Despite the occurrence of economic recessions, firms have the responsibility of ensuring that they pay their debts.

From the analysis, Microsoft has a high return on assets and return on equity compared to Google. Microsoft’s return on asset is 21.6% while that of Google is 15.3%. This means that the company is effective in utilizing its assets to generate profit. Additionally, Microsoft has a high return on equity compared to Google. The company’s return on equity is 42% compared to that of Google which is 17.7%. This means that Microsoft is very effective in investing the owner’s capital.

When making investment decisions, investors should consider the company’s financial ratios such as current ratio, return on assets, and return on equity. This will aid in determining whether their capital will be well invested to generate desired returns. Investors should consider investing in firms that have a high current ratio, return on assets, and return on equity.

Financial-based guidelines to be used when selecting the company to invest in

- Studying the market trends- When deciding to invest in either Google Incorporation or Microsoft Corporation, investors should evaluate the prevailing market trends. The current changes in the technology sector may affect the expected returns such as their profitability. Therefore, it is paramount to evaluate changes in the market.

- High returns- Investors should consider investing in a company that has the highest returns to maximize their wealth.

- Flexibility- Investors should evaluate the degree of flexibility associated with the companies’ securities to ensure that they do not lose their investment due to the dynamic nature of the market.

Conclusion

The analysis of the two companies has revealed that they have been very effective in their operation. This is evidenced by their financial strength and the effectiveness with which they have implemented effective business models. The two companies have developed a wide range of products and services which have successfully met the customers’ needs. The success of the firms’ product diversification strategy has been enhanced by their commitment to innovation.

The two firms’ core businesses differ. Google’s core business entails internet search and advertising. On the other hand, Microsoft deals with developing Operating Systems, Software, and Office Applications. The firm also deals in licensing of software products and designing servers.

The success of the two companies has also arisen from the effectiveness with which they have integrated leadership styles. The two firms have adopted the visionary leadership style. Their leadership style differs in that Google has also adopted democratic leadership while Microsoft has adopted autocratic leadership. When investing in two companies, investors should consider several guidelines. These include studying the market trends, evaluating the companies’ returns, and the flexibility of the investment.

Reference List

Adeniyi, M. (2007). Effective leadership management: an integration of styles, skills and character for today’s CEOs. Bloomington, IN: AuthorHouse.

Bry, N. (2011). Google innovation: Sour or sweet. Web.

Financial Report. (2011). Google reported 26% profit increases for Q3 2011. Web.

Hill, C., & Jones, G. (2008). Strategic management: an integrated approach. Boston: Houghton Mifflin.

Hybels, B. (2009). Courageous leadership. New York: Zondervan.

Kurtz, D. & Boone, L. (2010). Contemporary business. Hoboken, N.J: Wiley.

Lynn, J. (2007). The entrepreneur’s almanac. 2008-2009: Fascinating figures, fundamentals and facts at your fingertips. Irvine, California: Entrepreneur Media.

Murthy, K. (2001). Management philosophy for the new millennium. New Delhi: Allied Publishers.

Oz, E. (2008). Management information systems. New York: Cengage Learning.

Wagner, J., & Hollenbeck, J. (2009). Organizational behavior: Securing competitive advantage. London: Taylor & Francis.

Wheeler, D. (2001). Microsoft the innovator. Web.

Yahoo Finance. (2011). Microsoft Corporation. Web.

Yahoo Finance. (2011). Google Incorporation: Profile. Web.