Abstract

This paper analyzes Google from various perspectives that include social, technical and financial aspects. In essence, it was established that Google is a multinational company that has a very large market share in the technological industry. The company has invested in different portfolios such as social media, emailing and analytics among other things.In its pursuit to penetrate the international market, the company incurred HR challenges, competition, and structural reformation issues.

Further, there are current challenges which face the company, including the rise of Facebook, vertical searches and limited diversification. Finally, the financial analysis indicates that the company is increasingly adding its revenue, but the rate of growth is reducing over the years.

Introductory Statements

Google is one of the most developed and popular companies in the contemporary world. The company is known for many of its technological services it offers to customers globally. The emailing service is the most used and subscribed as compared to most of its portfolios. Indeed, Gmail has earned its reputation as the most preferred emailing platform.

This came after the company staged intense competition against Yahoo which was the most popular email provider. Google has been developing new ideas and technologies in order to dominate the market. Its capability to understand the market and improve customer’s experience is admirable. In addition, this capability, innovation, and customer-oriented ideology have earned a competitive advantage.

Its competitiveness has enabled the multimedia giant to acquire about 60 percent of the market share. As such, the company has been able to employ about fifty five thousand employees. Besides the big number of employees and the market share, the technological monolith has accumulated assets worth over $70 billion (Kirkpatrick, 2010). As a result, the company is considered as one of the businesses that have risen rapidly.

The sudden rise of Google and its global acceptability makes it important to analyze some of the critical issues that define its operations. In this light, this paper will touch on some of the organizational, technical, and financial aspects of Google. In this regard, it will discuss both the historical and contemporary issues facing the company. Importantly, its financial performance will be analyzed in relation to the last three years.

History and Major Products

History of the Company

The company was conceived as a shared idea developed by two students – Serge Brin and Larry Page. They conceived this idea in 1995 while studying in the University of Stanford. When they met in 1995, they developed close friendship as colleagues. In 1996, the two scholars sought to start designing and developing a search engine which they named BackRub.

The search engine was allowed to operate in the university’s servers to an extent of over-using the bandwidth. From then, the dual have developed the company as shown the listed discussion below according to the years.

1998: -The dual launched a service known as the Google Friends Newsletter.

-The two scholars requested to be incorporated in the state of California.

-Google is highly recognized as the search engine of choice in the market.

1999: – The Company opened an office along the 165 University Avenue.

-Later they relocated to 2400 Bayshore which is just a few kilometers from Stanford.

-In addition, they hired their first chef who was the point of departure as far as the company’s food program is concerned.

2000: -The Company discovered MentalPlex which was conceived as the mind reader.

– The company won the Webby and user’s awards. The award was attributed to the technical advancement and capabilities.

-They also made other developments that included Google Adwords and Google Toolbar.

2001: -The Company makes an acquisition whereby it bought Deja.com.

-Within the same year, Eric Schmidt becomes the chair to the board.

-The company discovered and publicized the Google Images platform where people would access millions of images. This was followed by the invention of the Google Zeitgeist.

2002: – The Company sought to support business efficiency.

-It created the Google Search Appliances which enabled businesses to search their documents.

-They produced Google API which facilitate search of website documents.

-The company invented the Google Labs that facilitated the use of beta technology.

– They introduced Google News and Google Shopping within the same year.

2003-2008: – The Company bought Pyra Labs which was known for creation of blogs.

– It developed Google Adsense, Google Grant and Google Books.

-In 2004, they launched Orkut, Gmail, Picasa and the Google Scholar.

-In 2005, the company came up with the Google Maps, Google Mobile Search and Google Analytics.

-In 2006, Google developed Google Finance, Google Calendar, Google Trends, Google Wallet, and App for Education.

-In 2007, the company came up with services such as Safe Browsing, Android Platform and YouTube Partnership.

-In the same year, Forbes International declared the company as one of the best organizations to get employed.

-In 2008, Google came up with the BOLD internship program, Double-Click and Google Map Maker.

-Google Chrome and Google Mobile App for the iPhone were developed.

2009-2014:- Google Voice and Google Ventures were invented and launched.

-In 2010, Nexus Line, Google Crisis Response, and the Google Tv were brought to existence.

-In 2011, the company developed the Google Art Project and Larry Page was appointed as the CEO of the company.

-In 2012 the company was affected by the pursuit of the USA government to censor the usage of the internet. Amidst other companies, Google stood up against the legislation promoting the censorship.

-In 2013, the company embarked on the production of clean wind energy and the invention of the Google+ Photos.

-In 2014, the company acquired Nest, invented Android Lollipop and Google for Work among other products.

Products

Indeed, Google offers many products to its clients all over the world. In essence, most of these products have been included in the discussion regarding the history of the company. From that discussion, it is evident that the company has many products in the market.

However, there are those products that have defined the competence of the company and made a vast effect on the market share. These are some of the most crucial products:

- Gmail – This is an emailing platform which provides people with the opportunity to communicate and collaborate.

- Google Chrome – This is a browser which enables users to access website documents and download files from the internet.

- Google Map – The company enables people to find locations and residences using the online maps.

- Gmail plus – This is an upcoming social site which seeks to connect people around the world.

- Web Search – The web search allows people to find web pages over the internet.

- AdSense – It enables customers to make revenue online through advertisement.

- Google Books – Students can access textbooks online through this product.

- Google Drive – This is an amazing service where clients are allowed to store and access information remotely.

- Google Translate – The service translates text from one language to another.

- Google Docs and Sheets – This product is used to open both the word documents and spreadsheets.

- Android – This is an open source operating system which enables mobile devices to install most of the mobile applications for use. It is one of the fast growing application platforms in the world. It is posing a great threat to operating systems such as Windows and the Mac.

When and How the Company Went International

In essence, although the Google Web Search was widely used around the globe, Google officially became an international company in 2001. During this year, the company opened its first international office. This move was meant to target the Asian market segment which is highly populated.

After the office in Tokyo, the company moved forward to open another international office in Sydney. This is another international location which has a lot of financial and technological opportunities. The company opened these offices so as to tap the expertise in Asia. As such, the company benefitted from the unexploited consumer market and the rich skills. The decision can be termed as a strategic, reasonable, and competitive move.

Initial International Issues and Challenges

In essence, Google sought to explore the international market after six years of operation. Although this time had substantially equipped the company management with the needed experience to run normally, it posed some few challenges during globalization. First, the company was under stiff competition from the dominant Yahoo Company.

Indeed, before the establishment of Google, Yahoo was the most used and recognized web search engine. It also provided many customers with emailing services around the world. In addition to this, Yahoo has already penetrated the international market and connected people using the Yahoo Messenger. As a result, Google was a new entrant as far as the international market was concerned.

This implies that the stiff competition incurred by the company was a critical challenge. Second, the company faced human resource issues due to the fact that it was expanding globally. In this regard, opening the new offices in Tokyo required employees and managers to operate the premises. This implies that the company had to add financial resources to hire more experts.

Besides the issue of financial capability, the company faced the challenge to get credible and able employees in the new arena. Globalization also posed a critical challenge when it came to the acquisition of the market share. In this regard, it is understandable that Yahoo had already penetrated the global market.

The new establishments therefore presented a challenge to the marketing department and the acquisition of customers in the new territory. This was coupled with the expansion of organizational structure and the scope of operation.

Current International Issues and Challenges

Whereas Google has been successfully conquered the world’s most dominant emailing and messaging giant, technology is increasingly becoming dynamic. Companies which are not direct competitors evoke critical challenges and issues. From the social perspective, the social media has gained a lot of popularity worldwide.

In essence, Facebook is considered to be the social media monolith than encounters very weak competition. In the age of social media, Google has realized that it cannot hold its clients to its services completely. However, the company is known for its pursuit to tie customers to all its services and discouraging deviation. However, Facebook has become very popular.

In order to answer to this competition, the company has invented the Gmail Plus (Arthur, 2012). Nevertheless, its clients are not prepared to leave Facebook for Gmail Plus. The tag of war regarding social media is one of the most challenging issues facing Google. Second, the company incurs critical anti-trust and frequent monitoring. The world and USA have been monitoring Google to find out whether it passes the credibility test.

For example, when Google bought the ITA, which provides information on flights, the American government hesitated to clear the deal. This hesitation lasted for a whole year and was evoked by the concerns that Google would have preferential treatment towards the acquired company. In the same breath, the EU has been conducting thorough investigations concerning complaints raised in relation to such preferential treatments.

Importantly, this is a crucial challenge due to the expected rise and growth of the online businesses. With this growth, there will be need to rethink about impartiality as far as web searches are concerned. Third, the company is facing the effects of slow growth as a result of the law of large numbers.

However, this situation cannot be ignored because most of the other companies are growing rapidly. In particular, the company slowed its financial growth in 2013 to 21 percent. The growth had slowed to 29 percent in 2011 due to the same situation. Whereas this growth has been slowing in an alarming rate, the company was growing at 100 percent during the year of its IPO.

However, the company still compares competitively with its counterparts of the same size. Nonetheless, it should develop ways to innovate new services and products in order to attract more customers and increase portfolios. Bearing in mind that companies become dormant after reaching a certain size, the technological monolith should not lie on its success.

It is time to invest more money in research and development in order to leverage its growth. Additionally, employing new expertise should also be an option of leverage. Additionally, Google is grappling with the capability to satisfy the payment and e-commerce industry. The company made an attempt to provide a phone-attached chip which was aimed to facilitate payment.

However, it failed terribly whereas companies such as PayPal, Amazon and Apple are fairing quite well (Rosen, 2011). This implies that the company has not been able to get a payment system in the hands of its clients. As such, most of its products have to be paid through other companies.

This is an indication that Google might not be able to penetrate the $1.5 trillion industry and diversify its portfolio in that sense. Consequently, acquiring a payment system is one of crucial issues facing the company currently. Another issue facing the company relates to the use of vertical searches. In this case, the users of personal computers and desktops access websites through google.com.

In principal, most of the computer users search hotels, products and services using the official Google site and web search. However, the introduction of the Smartphone and the increasing use of mobile phones have changed the manner in which searches are made. In this case, mobile and Smartphone users access these products and services using specific applications.

As such, the company is incurring a critical change of the technological landscape. This requires Google to come up with a counter strategy which will enable them to sustain the market share. Further, Google incurs the challenge of revenue diversity and its future sustenance. In this regard, it is evident that the company draws more than 80 percent of its revenue from the advertisement industry.

This implies that Google would possibly collapse if the advertisement industry encountered problems. This is a very dangerous approach to business because it increases the risk exposed to the company. In fact, the use of cost per click is reducing the desktop searches. Essentially, Google is not immune from the risks posed by the effects of product lifecycle.

This is an implication that the reduction of desktop searches will lead to a reduction of the revenue coming from this stream (Sutherland, 2011). Besides, the company’s investors have high expectations on the performance of the company. Although this is a positive aspect when it comes to the inspirational performance of the company, the question is whether the performance can be sustained.

If it is not sustained, Google will collapse because the trust of the investors is based on the performance of the company. This implies that the company is its own worst enemy as far as the future sustenance is concerned. This situation arises amidst the fact that Facebook might develop a web search service in the next five years. Given that Facebook has many subscribers, it is evident that Google might loose the war in the web search industry.

Understandably, Facebook will develop an amazing product in this regard. As a result, it will pose a great threat and competition. On the other hand, Google will be disadvantaged because it cannot pose competition on Facebook’s social media portfolio.

Volatility and Exchange Rates

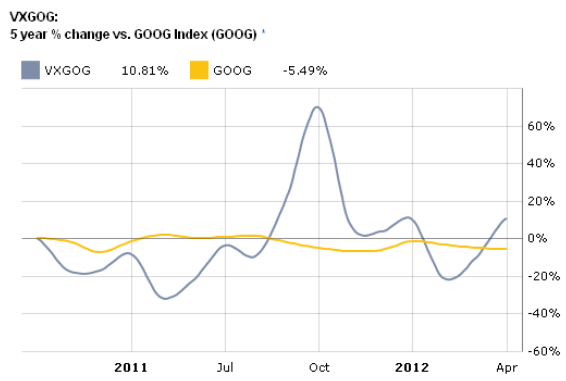

The Graph below shows the comparison between Google and the VXGOG option. In this case, it is evident that Google does not have a high volatility as compared to the other trade. It can be implied that Google’s performance is essentially predictable. Understandably, a less volatile market does not fluctuate frequently and randomly.

Instead, it fluctuates reasonably in a manner that investors can predict and then invest. However, the highly fluctuating companies are associated with the possibility of making high profits or big losses. If a sharp and experienced investor is involved, it becomes easy to make profits and avoid loss.

On the other hand, the companies whose volatilities are low form the preference of many risk-averse investors. The risk-loving investors prefer investing in highly volatile companies whose stocks rise and fall frequently and even randomly.

Hedging and Property Rights

Google hedging program is performing very well in the current situation of the world. The company is hedging actively against the prevalent exchange rates in order to reduce the profitability of other companies such as Web Search.

Towards the end of 2013, the company used about $34 billion to hedge against the possible poor performance (Miller, 2012). The company sought to raise and promote the USD amidst the worldwide credit crises and the currency fluctuations.

Efforts in Corporate Social Responsibility

Google has been known as one of the most reputable companies when it comes to the Corporate Social Responsibility. It is involved in a program known as Google Green which seeks to compel employees to use energy efficiently without waste. It also runs the Google China Social Innovation for College Students.

This program is meant to enable students come up with ideas and develop them. Also, the company undertakes the Google Grant Program to provide any kind of aid. For example, it provides free advertisement to charitable organizations.

Financial and Ratio Analysis

Revenue

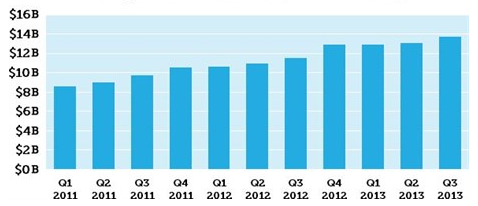

The company’s total revenue has been growing rapidly over the years due to the increasing number of customers and innovation. In essence, the revenue income of the company over the last three years is shown in this graph.

According to the graph above, it is evident that the company revenue has been increasing since 2011 to 2013. However, the rate of growth was faster between 2011 and 2012, but it reduced significantly from 2012 to 2013. This is an indicator that the earlier analysis was in order.

Financial Ratios

Conclusion

It is evident that Google is one of the most innovative and fast growing companies in the contemporary world. Indeed, the company has a deep history which dates back to 1995. The company enjoys a big revenue size which has also reduced the rate of growth. In essence, it has been noted that the company faces various challenges in regard to the social, financial, and technical issues.Importantly, the rise of Facebook, vertical search, and the lack of diversity are some of the crucial challenges facing the company. It is therefore important that the company embarks on increasing its innovative capability and growth. Lastly, it cannot be disputed that the revenue and the profitability of the company keeps on rising over the years.

References

Arthur, C. (2012). Digital wars: Apple, Google, Microsoft and the battle for the Internet. London: Kogan Page.

Kirkpatrick, D. (2010). The Facebook effect: The inside story of the company that is connecting the world. New York: Simon & Schuster.

Miller, M. (2012). Google. Emeryville, California: McGraw Hill Osborne.

Rosen, J. (2011). Constitution Freedom and Technological Change. Washington, D.C.: Brookings Institution Press.

Sutherland, A. (2011). Google. London: Wayland.