Company Overview

Google is a leading company in the online/technology industry founded in 1998 by Larry Page and Sergey Brin (Google, 2015). Its headquarters are in Mountain View, California, but it has several offices in different locations globally. Google became listed on the NASDAQ in 2004. The company is an internet search provider and provides access to a number of web services and online content. It generates revenue from the ads placed by third-party firms that promote their products and services on its network.

It also offers a range of products including email services (Gmail), a photo exchange tool (Picasa), news (Google news), Google maps, and Google Docs, among others (Google, 2015). Google has also been on the forefront of technology innovation, producing software and applications for mobile handsets. The key to Google’s success is its broad product offerings and continuous innovation in areas such as search software, and advertising.

Overview of the Primary Industry

Google operates in the “services – computer programming and data processing” industry whose Standard Industrial Classification (SIC) code is 7371 (U.S. Department of Labor, 2015, Para. 13). Companies in this industry offer online search services and applications. Google’s main direct rivals in the industry are Microsoft and Yahoo who operate Bing and MSN search engines, respectively (Interactive Institutional Bureau, 2014). Google is a market leader in the online search industry with a market share of 64.4%. In contrast, Microsoft and Yahoo control 19.4% and 10% of the US market, respectively (Interactive Institutional Bureau, 2014).

Google’s Customers

Google focuses on improving the way people access and share content around the world. It provides web navigation services to people searching for websites and blogs. Google serves a range of customers including households and organizations. Individual customers include internet users with diverse demographic profiles. Most of its customers are aged under 34 with a large proportion of them being male (Fallows, 2005). Most clients are educated business professionals who belong to the upper-middle class of the U.S. households. The users earn upscale incomes and have active lifestyles; hence, they need quick and convenient access to information at all times and innovative internet experiences. They use Google services to shop online, access news, and search for information, among others.

Businesses comprise another category of Google’s customers. Google’s AdWords platform allows businesses of various sizes to advertise their products and services through Google. Google gets much of its revenue from this form of B2B advertising. Publishers of websites also form Google’s organizational customers. Publishers can promote their ads to customers through Google’s Adsense platform that allows customized advertising (Google, 2015).

In this way, Google earns revenue from publishers targeting particular market segments. E-businesses also rely on Google to market their products. Academic institutions, governments, and NGOs also use Google’s business applications to reach target clients.

Google draws its customers from different market segments. Individual users include students from middle class households who use the search engine and platforms such as Google Docs. The second segment is the entrepreneurial enterprise that depends on Google’s cost-effective internet tools for customized advertising of their products. Google also targets the low-income clients. The company has also expanded to international markets where it offers online products and services in over 110 languages in 50 nations. According to Google (2015), the firm generates 52% of its revenue from its operations in international markets in Europe, Asia, Australia, South America, and Russia, among others. In recent years, Google has been trying to dominate the Chinese market, but its market share of 1.6% is lower compared to local search engine providers.

The Determinants of Demand

Google’s innovative business model accounts for most of its success in the online search industry. The main demand variables affecting Google are economic, technological, and demographic factors. Economic forces, such as recession, can affect the demand for internet-based advertising services. Additionally, a rise in internet penetration will increase the demand for Google search services among mobile phone users. People of all ages will need to search for restaurants, entertainment spots, or news using Google’s quick search options. The number of businesses using Google business solutions is likely to grow, as more firms shift to online business.

Technological factors form another category of determinants of the demand for Google’s internet search services. Google has invested in software like Android operating system to gain market share by expanding into the mobile phone market. Furthermore, as its language support becomes better, the demand for Google’s services will rise in many countries. Through its Smart TV, Google will combine its search services, allowing customers to search the internet for news and traffic updates, shop online, and share information and photos. Thus, investment in innovative technologies will increase the demand for Google’s services.

The observable variables that Google can use to track the demand for its products include the search volume and frequency of visits from customers. It can also track new customers and businesses using its networks to display ads. In January alone, 18.7 billion searches were made with 12 billion of them happening on Google sites (comScore, 2015). Percentage change in the number of completed searches over time can indicate changes in demand conditions. Currently, Google controls about 65% of internet searches in the U.S. Another variable is the number of ads placed on Google networks by third party firms. The company’s 2010 annual report indicates that 96 percent of its revenues came from advertisements (comScore, 2015). Therefore, changes in advertising revenues can indicate demand shifts in the market.

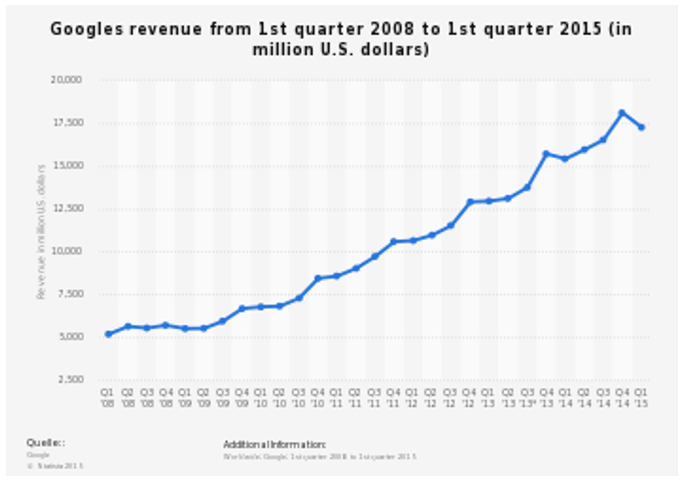

Google can also track the growth of its brands in the mobile market. As products such as smart phones and televisions continue to grow in popularity, more users will be using these devices to search the internet. Google, in 2010, entered the mobile market with its HTC handset that uses the Android software. Google can track the revenues obtained from the usage of its mobile applications and devices to determine changes in market demand. Its quarterly revenues show an upward trend since 2008. Its revenue in the last quarter of 2014 was 18 billion dollars, a 2.53 billion increase from the third quarter. Google’s quarterly revenue shows a cyclical trend between 2008 and 2015, i.e., the gap between peaks is irregular (comScore, 2015). The company earns its revenue primarily from ads and sites that use its network.

Price Elasticity

Available Substitutes

Price elasticity is the “price sensitivity of a market” relative to product demand (Colander, 2001, p. 45). It depends on the number of available substitutes, price level, and durability of the products. In a price sensitive market, a price increase reduces the demand for a product or service in favor of substitutes. The direct substitutes for Google’s search engine are Yahoo Search, Ask.com, Viacom, and MSN, among others. E-business sites such as Monster.com (job site), Amazon, WebMD (medical site), and eBay are indirect substitutes (Edelman, Ostrovsky & Schwarz, 2007). Users may choose to use these sites directly without first going through Google to search particular information.

Besides specialized search engines, Google also competes with smaller online service providers that provide entertainment and news services through Google’s networks. Social networking sites, such as Facebook, also allow users to share information and follow links posted by businesses. This means that firms can place ads on social networks and thus, avoid advertising through Google. Although there are many substitutes to Google’s search engine, the firm uses a superior technology called PageRank, which is efficient and fast. Thus, by generating quality results, Google can attract more companies to advertise through networks over other sites.

Price Level

Google’s over 65 products are available freely to users through its different platforms and sites. Its web services, including Gmail and Picasa, are offered at no cost to customers. Thus, customers face no budgetary constraints when using these services. Advertisers enter into contracts with Google to display their ads. Different business applications for customized ads are available to over a million businesses, including big corporations (premier edition) and small businesses (standard edition) (Google, 2015). Thus, businesses can choose solutions that fall within their budgets.

Product Durability

With regard to product durability, Google’s products are compatible with each other. In addition, the company is continuously innovating to provide new products, such as cloud computing, to its existing customers (Google, 2015). This makes its primary product, the search engine, relevant and desirable to customers. The Chrome browser and Android operating systems enhance the durability of the Google search engine. Based on the analysis of the substitutes, price level, and product durability, it is evident that Google’s search engine faces inelastic demand, i.e., it is less sensitive to price changes.

The Market Structure of the Industry

Competitors

The market structure of the internet portal services industry bears the characteristics of an oligopoly. These characteristics include the presence of a few players, the responsiveness of each company to rival firm’s actions, and the mutually interdependence of the firms (Colander, 2002). Google has six main competitors in the internet search market, namely, Microsoft (Live Search), Yahoo (MSN), Viacom, WPP, News Corporation, and Pay Pal Comcast (Interactive Advertising Bureau, 2014).

It also faces competition from e-commerce providers like Amazon and eBay that offer specialized search services. Competition also comes from social networking sites like Twitter and Facebook that offer firms a platform to place ads on their web pages. Nevertheless, Google is a dominant player in the internet search market with a 64.4% market share. Its two closest rivals, Yahoo and Microsoft, have a combined market share of 29%.

Product Similarity

The dominant position allows Google to enhance the efficiency of its product to generate quality search results. However, the search engine bears some similarity with the product offerings of rival firms. Google, like MSN or Yahoo, operates internet browsers to enrich the customer’s search experience. According to Garner (2015), since its launch, Google Chrome’s market share has grown to 11.9%. Google and Apple have developed internet browsers for handheld devices such as smart phones. However, Google’s product contains ads and sites, which have made it popular among users. Internet providers also offer services tailored to their browsers, which is a source of competitive advantage. Microsoft and Google provide internet search services as default choices in their operating systems.

Barriers to Entry

The internet search industry is hard to penetrate because of the huge infrastructural investment required. In addition, attracting and retaining users to achieve greater usage is very costly. As Evans (2008) notes, entry costs relate to marketing, buying of content and quality delivery services. The providers offer a range of portal services freely to users, but generate revenue from the advertising market. In this view, the economies of scale constitute a barrier to entry this industry. New entrants with low online usage may find this revenue model risky and unreliable.

Non-Price Competition

Internet portal providers offer free content to users. They generate revenue from the advertising market. Competition in the industry relates to the provision of quality and innovative content services. Providers such as Google, Yahoo, and Amazon have invested in a range of services to provide multi-purpose portals to users. The market can be best described as international, as the firms offer portal services to users globally. Google generally has little pricing power because it depends on content and internet bandwidth from operators to attract users.

Revenue and Profit Growth Rates

Google generates its revenue from two sources, namely, Google websites and Network member websites (Google, 2014). The revenue from its websites and member sites in the first quarter of 2015 stood at $11,932 and $3,576 million, respectively (Google, 2014). The total revenue in this quarter was $17,258 million representing a 12% growth rate. Its profits during the same period grew at a rate of 26% as a percentage of revenues. During the 2012/2014 period, Google’s revenue growth rate increased to 43.35% based on the revenues collected. The firm’s revenue in the past three years is as shown in the table below.

Over the past three years, rival firms have recorded a significant increase in their revenues and profits. Between 2012 and 2014, Microsoft recorded a revenue growth of $5.09 billion, representing a 29.9% growth. In contrast, Yahoo’s revenues dropped by 3.6% to $1.253 billion over the same period (Interactive Advertising Bureau, 2014). AOL also reported a revenue increase of 15.5% over the same period. The revenue generated by players is shown in the graph below.

From the data, Google’s revenue growth rate is much higher than that of other firms. It is evident that Google is a dominant player in the internet search market. Its revenues from advertising and market share have increased steadily over the past three years.

References

Colander, D.C. (2001). Microeconomics. Burr Ridge, IL: Irwin/McGraw-Hill.

comScore: comScore Releases January 2015 U.S. Desktop Search Engine Rankings. (2015). Web.

Edelman, B., Ostrovsky, M., & Schwarz, M. (2007). Internet Advertising and the Generalized Second-price Auction: Selling Billions of Dollars Worth of Keywords. American Economic Review, 91(1), 242-259.

Evans, D. S. (2008). The Economics of the Online Advertising Industry. Review of Network Economics, 7(3), 359-391.

Fallows, D. (2005). Search Engine Users: Internet Users are Confident, Satisfied and Trusting -But They are Also Unaware and Naïve. Washington, D.C.: Pew Internet and American Live Project.

Garner, P. (2015). The Evolution of Online Advertising. Web.

Google. (2014). Google Annual Report 2014. Mountain View, CA: Google Inc.

Google. (2015). Company Overview. Web.

Interactive Advertising Bureau. (2014). IAB Internet Advertising Revenue Report-Full Year Results 2013. New York: Interactive Advertising Bureau.

U.S. Department of Labor. (2015). Occupational Safety & Health Administration: SIC Division. Web.