Introduction

Sequestration is a practice applied in the U.S. federal government to cut the cost of spending. This follows if the government expenditure exceeds the gross revenue in the fiscal year. According to Colander (2010), sequestration dates back to 1985 when the Balance Budget and Emergency Deficit Control Act was formed to impose automatic cuts in the government spending.

It involves the cancellation of resources allocated in the budget uniformly. In 2011, the Congress passed the Budget Control Act, which was aimed at cutting about $500 billion in the defense department for a period of 10 years. This will see a cut of $47 in the first financial year.

If there rose a disagreement on additional cuts between the Senators and the Representatives, the government would be forced to impose $1.2 trillion as additional cut in a period of 10 years. Half of the cuts would come from the Federal agencies and the rest from the department of defense. The additional cuts are reffered to as sequestration.

Effects of sequestration in the multiplier model

Sequestration has an overall effect on multiplier model. As noted by Brue McConnel (1999), economists have pondered over the question of how a net increase in the exports may increase the equilibrium output of an economy by more than the actual net increase.

This idea is referred to as the ‘multiplier effect’. In generic terms, when someone spends money, this spending becomes someone else’s income, hence, creating a multiplied effect on the income and spending within an economy. A net increase in exports is supported by a net increase in the production and output of final goods.

This is because there may be several steps leading to production of the final output; the in-between production steps will create additional jobs and interim outputs generating a net higher increase in the economy. Theoretical ideas from the economists suggest that increased production encourages specialization and extension of information and knowledge from leaders in technology to laggards.

As confirmed by Sercu (2009), this transfer, rationally, would result in the increased production of both export goods for internal consumption as manufacturers capitalize on the knowledge gained and economies of scale. Increasing net exports will cause a multiplier effect on the economy as described by economists and deduced from logical observations and reasoning.

An increase in export is considered as productivity improvement which results in a positive impact to the economy. This enables realization of industries’ expansion and thus improved government revenue and creation of employment. Increase in export extents the benefits to third parties who include workers, business owners, stakeholders, and partners.

Government spending includes both limited government expenditure and consumption, but does not include transfer payment effected by the state. An increase in government spending above its potential bears both long-term and short-term effects.

According to Choi and Devereux (2005), an increase in the permanent spending results in an increase in the released money, thus, an increase in the circulating currency. An increase in government spending above the equilibrium results in the budget deficit, which means that the government has to borrow to fund its functions. This contributes to an increase in interest rates and subsequent reduction in the rate of investment.

An increase in the interest rate would translate to less borrowing from banks and other financial institutions. This would affect the performance of enterprises due to lack of finances, particularly those that depend on bank loans. This would then lead to an increase in inflation thereby affecting the real money supply.

Prices for common commodities would go up affecting the living standards and citizens’ purchasing power. The multiplier model offers a graphical display and assumes a constant level of price.

It quantifies the multiplier effect with the AS/AD model (Colander 2010, p 635). An increase or decrease in the multiplier results in an ultimate decrease or an increase by a factor, which is more than the first change contributed by the multiplier effect.

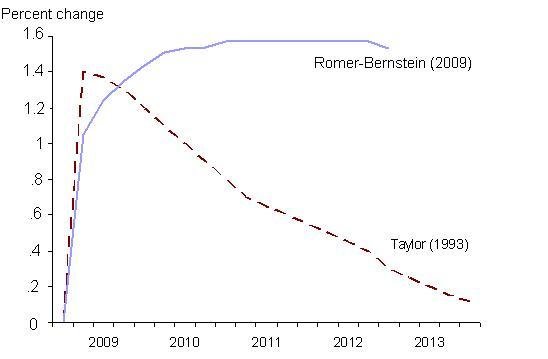

Graph showing old Keynesian versus new Keynesian government spending multipliers (Bussing-Burks & Marie 2011).

Equilibrium real interest rate tends to increase with an increase in government spending. This has to be funded either through borrowing or through selling government assets. This may increase the government debt resulting in a long-term effect when paying back the money.

As revealed by Bussing-Burks and Marie (2011), an increase in government spending on purchases by one percent of the GDP results in a rise in actual GDP by 1.6 percent above the normal. Sometimes, the government spending might give varying effects depending on the amount of resources spent and the recovery powers.

In one case, high government spending may keep on summing up to the GDP and, in another case, as indicated by the graph, the effect of government spending on the GDP reduces because non-government components becomes crowded by government spending.

Impact on unemployment and inflation in the short and long run

In the long- run, there is an increase in prices of goods and services. This is referred to as price inflation. As noted by Brue and McConnel (1999), monetary inflation is an upward movement of money supply. This leads to the price inflation; this also affects the prices of goods and services upwards.

Inflation can affect an economy negatively or positively; negatively: there is a loss of money value, a lack of investments due to uncertainties from inflation hence shortage of consumer goods.

Positively, this is an advantage since central banks can regulate nominal interest rates, which promote investments. Inflation rate is dependent on money supply, thus, higher inflation means drastic growth in money supply. This implies that there is a lot of money in circulation and the economic growth is slow.

According to Wells (2004), unemployment is one of the factors that drags an economy of a country behind. Being unemployed means no income and therefore no spending. Unemployment has direct and indirect effects on the economy. Directs effects include Output Decline, when people are unemployed, the labor market is affected. This means a fall in output. There is also a loss of income.

Conclusion

From this analysis, it is clear that sequestration has both positive and negative impacts on the government, the industries, the people and the economy in general. Krugman (2009) notes that indirect results of unemployment include Negative Multiplier Effect and this has an effect in that, when jobs are lost, there is a downfall in purchasing power.

This means that businesses will be affected in such a way that consumer goods will move slowly and eventually, the manufacturers will feel the same effect. A loss of income tax affects the economy indirectly in that there will be shortage of direct taxes that are collected from wages.

This may lead to the government borrowing or under spending and, therefore, the economy is strained. Society-unemployment leads to social groupings due to inequality in income and wealth distribution.

Reference List

Brue, S. & McConnell, C. (1999). Microeconomics: principles, problems, and policies. UK: Irwin/McGraw-Hill, London.

Bussing-Burks, M., & Marie, C. (2011). Taxes and Government Spending. The Rosen Publishing Group, New York.

Choi, W. & Devereux,M. (2005). Asymmetric Effects of Government Spending: Does the Level of Real Interest Rates Matter? International Monetary Fund, United States.

Colander, D. C. (2010). Economics, 8th edition. New York, NY: McGraw Hill Irwin.

Krugman, P. (2009). The return of depression economics and the crisis of 2008. New York, NY: W. W. Norton & Company.

Sercu, P. (2009). International Finance: Theory into Practice. Princeton University Press, New York.

Wells, D. R. (2004). The Federal Reserve System: A history. Jefferson, NC: McFarland & Company, Inc.