Introduction

It has been know that over the years the Islamic finance industry has revolutionized the way Islamic businesses as well as individuals invest, acquire funds and save. The Islamic religion places strict values on regards to monetary discipline thus placing an enormous difference between conventional and Islamic forms of investment.

The rising demand for investment options in the form of bonds and securities has led to the use of Sukuk or Islamic securities which have become progressively more acceptable to the Islamic community in some Arabic countries. In almost all Islamic nations, sukuk are used as a means of procuring government finance through autonomous ventures for example infrastructure. Islamic bonds are also used by reputable corporations to secure financial support through the offer of corporate sukuk. Sukuk were initially used to a large extent in the middle ages as tenable documentation in lieu of financial responsibility acquired through business and other commercial endeavors thus they principally symbolized the possession of a given asset or service.

The Background of Sukuk

Sukuk is basically a bond that is complacent with the Islamic Sharia law (Nisar, 2007).It should be known that Sukuk was first introduced into the contemporary Islamic financial industry in the year 2000 with only three sukuk worth three hundred and thirty six millions U.S dollars. As the years progressed, there was a high demand for investment options as Islamic businesses sought to diversify their portfolio (Rabbi, 2010).With the diversification need, Sukuk turned out to be a popular option for many investors and by late 2006 the sum of sukuk was more than seventy with over twenty seven billion U.S dollars secured by the sukuk funds. The table below shows the total number of sukuk issued from their premier in 2000 until 2006:

Currently, sukuk is one of the most important modes for the acquisition of financial resources not only by Islamic governments but by multinational companies, state businesses and financial organizations that are compliant to the Islamic code of business conduct (Tariq 2004). With the known prevailing differences in maturation period, investment size and type of ownership, sukuk differ broadly in terms of variety and its application.

The organization in focus is Saudi Basic Industries Corp (SABIC), a corporation that constitutes mainly of manufacturing as the primary activity. Saudi Basic Industries Corp (SABIC) corporation has a diverse product base which mainly constitutes of intermediates, industrial polymers, compound fertilizers as well as metals (Rabbi, 2010). Furthermore, according to the official listing of Tadawul, SABIC happens to be the largest public owned company in Saudi Arabia, with the Saudi Arabian government being the majority share holder of more than sixty percent of the shares (Tariq 2004). SABIC is the lead global producer of existent and new components of fertilizer as well as ingredient chemicals which include MTBE polyether imides, mono-ethylene glycol, coarse urea, and polyphenylene. To add on, SABIC is also the second largest worldwide manufacturer of ethylene glycol and third largest manufacturer, polyolefin, polypropylene and polyethylene (Rabbi, 2010).

The company was in 2008 recognized by Fortune Global 500 as the leading chemical manufacturer in Asia and was placed in fourth position on a global scale (Rabbi, 2010).In 2009, the company became one of the most successful companies in the world after a successful sukuk public offer as well after registering revenues of more than forty billion US dollars, returns of almost six billion US dollars and holder of assets worth more than seventy billion US dollars (Rabbi, 2010).The headquarters of the organization is in Saudi though it has other nineteen affiliate or subordinate organizations through out the globe. SABIC also has a research and technology division which currently has over two hundred and twenty registered patents and a marketing business division (Nisar, 2007).

The marketing division takes on the activity of marketing and selling the products of certain of its affiliates to companies which have their activities in Saudi Arabia but the marketing division has global reach to over 100 countries. This marketing division sustains definite expenses which are associated with the marketing and selling products to customers through out the globe and receives fees in return for conducting these services. The capacity of SABIC group’s marketing and selling activities is acknowledged in marketing agreements consented upon amongst SABIC and its affiliates (Kettel, 2004).

The marketing division has been recognized for providing very good services and earning considerable net revenues for SABIC, since marketing sum earned is correlated to the sales levels realized(Nisar, 2007).Therefore, since the SABIC group’s net returns is reliant upon the sales of the group, then the marketing services earnings correspond to a superior alternative for SABIC corporate risk.

Analysis of the SABIC Sukuk

Over the years there has been an increase in the number of impressive Sukuk instruments issued in the GCC and South-East Asia. However, none of the high profile issues had been initiated from the Kingdom of Saudi Arabia up to the issuance of the SABIC Sukuk (Nisar, 2007). The Kingdom of Saudi Arabia has however had and still holds the largest domestic capital market of all of the GCC nations with reference to the market capitalization of its stock exchange and additionally, the kingdom of Saudi Arabia lead the way in the institution and expansion of Islamic banking and finance.

The kingdom of Saudi Arabia is a key constituent nation of the Organization of the Islamic Conference (OIC) and the Islamic Development Bank (IDB) because the kingdom is the host nation to the world’s largest Islamic bank which has a vat foray of assets. Through private initiatives, the kingdom of Saudi Arabia was responsible for the establishment of two of the main stream international Islamic banking conglomerates in the 1970s (Kettel, 2004).

The SABIC Sukuk was issued on the 29th July 2006 and it was the first time that the Saudi Arabian public and inhabitants were able to invest in the home currency on a fixed income instrument which had been assessed and approved by the Shariah Supervisory Committee of a Saudi Arabian Bank (SABB Amanah) hence the expectancy associated with the issue was substantial. SABIC and its lead administrator HSBC had prepared the stage for Sukuk issuance in the Saudi Arabian market and this concerned the groundwork of submission documentation meeting the highly set international standards and also attending to a number of issues, some of which are discussed below.

In 2006, the Saudi Capital Market Authority authorized the Saudi Basic Industries Corporation also known as SABIC to launch issuance of Sukuk that amounted to SAR 3 billion. The multi product corporation first introduced and launched the SABIC Sukuk Company in 2005 as a suitable platform for the long-planned sukuk issue the company had. Each of the sukuk was valued at SAR 50,000 with the least subscription being quoted as SAR 500,000; hence each investor was limited to a minimum of ten sukuk (Rabbi, 2010).

It was agreed upon that if an investor was interested in subscribing to more than the minimum value, then the overall value of the sukuk was to be calculated in multiples of SR 50,000 (Nisar, 2007). With the new Capital Market Law in place, the SABIC sukuk was the first to premier under the new law with the HSBC Group as the lead manager and chief advisor during the issuance.

The SABIC sukuk was formally restricted to financial institutions and major companies but individual investors were allowed to get involved only if they invested through bank and investment funds. However, after the establishment of the fundamental systems, issuance was later inflated in order to directly foster individual investors (Rabbi, 2010). SABIC Sukuk was the initial sukuk to be authorized by the SABB Amanah Shariah Supervisory Committee which is a Shariah Committee formed through Saudi Arabian Banks and SABIC was directly responsible for the issuance. Apart from that, the SABIC Sukuk was a pioneer in several other aspects of the Islamic financial sphere for instance it was the first to be acknowledge on the certified listing that is governed by the capital markets authority in Saudi Arabia(Nisar, 2007).

Additionally, the SABIC Sukuk was the initial entirely tradable Sukuk that was offered in Saudi Arabia as well as the first financial instrument to be recognized by the Saudi Stock Exchange also known as the Tadawul (Nisar, 2007).

Therefore, the SABIC Sukuk essentially instituted a model of leadership for other Sukuk and non-equity capital market issuances hence making it possible for additional economic improvement as well as financial expansion to take root in Saudi Arabia (Rabbi, 2010). The first well performing sukuk was the SABIC Sukuk I, with a profit rate that cumulated from the basic rate of commission (SIBOR) and an additional to 0.40 %( Nisar, 2007). Subsequent to SABIC Sukuk I, there was SABIC Sukuk II and SABIC Sukuk III in 2007 and 2008 with a profit rate of the basic rate of commission (SIBOR) in addition of 0.38% and 0.48% respectively where payments were made on a quarterly basis (Rabbi, 2010).

Performance of SABIC sukuk from 2007 to 2009

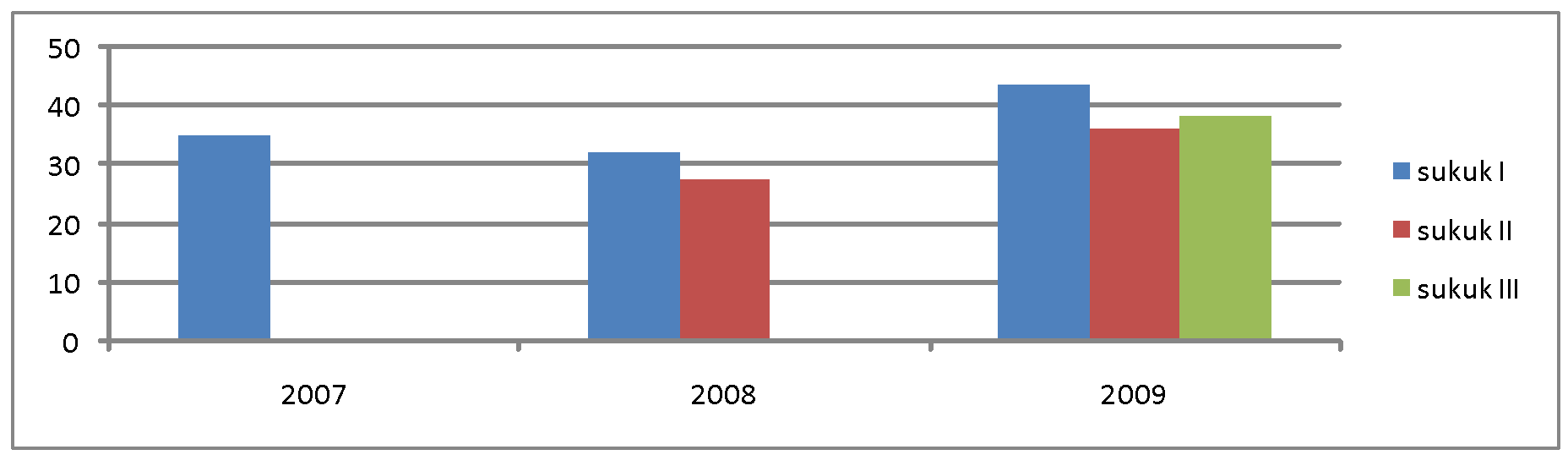

Subic sukuk performance in reference to quarterly returns began on a relatively low key in comparison with the consequent performance in subsequent years (Nisar, 2007). The SABIC sukuk issue in 2006 saw a well received offer and which was aimed to mature after a period of ten years. The following table shows the yield rate per bond over the period of 2007 to 2009.

Table representing the average performance of SABIC sukuk from 2007-2009.

A graphical representation of the performance is as follows;

The SABIC sukuk have grown in popularity demand and yield since their introduction in 2006 as shown in the table below:

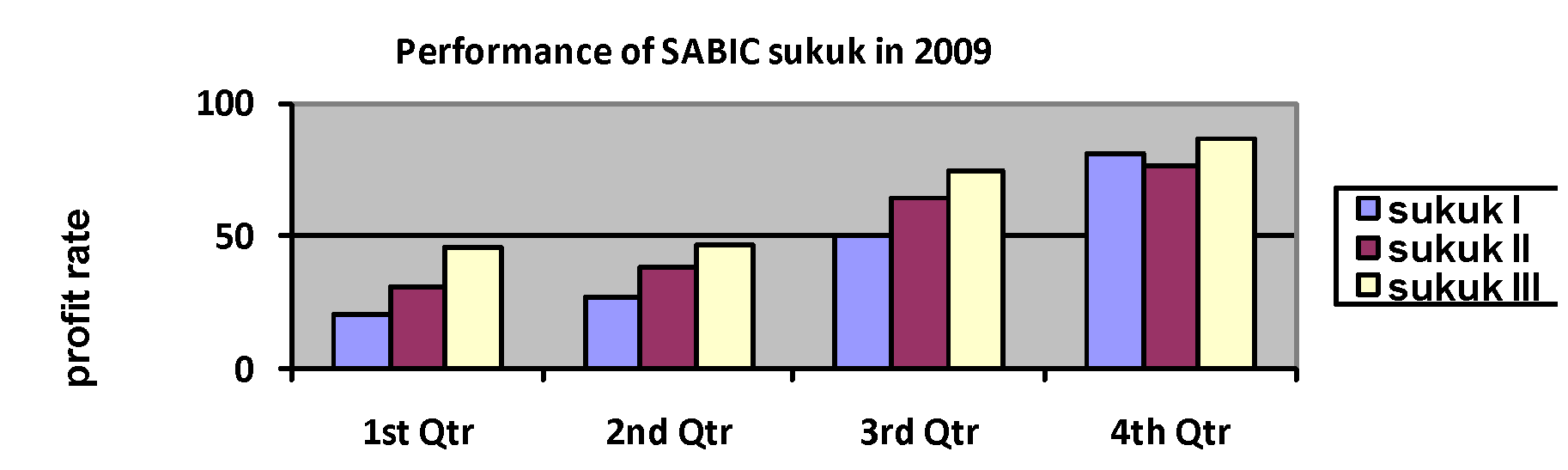

Table representing the performance of SABIC sukuk in 2009.

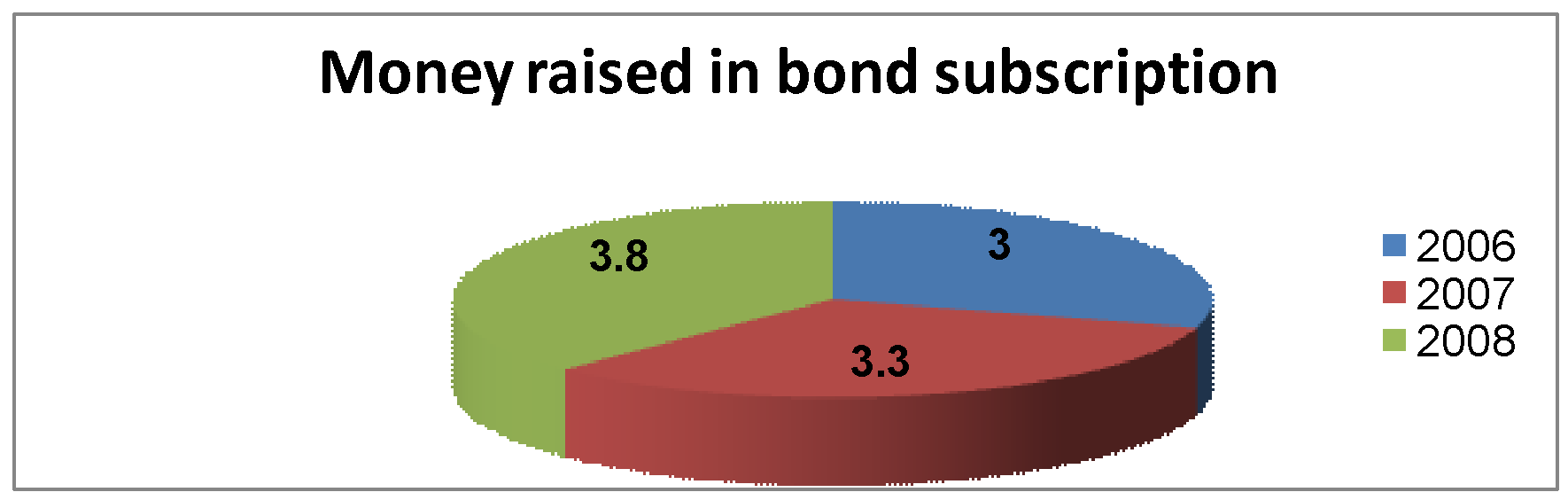

Indeed the SABIC sukuk grew in reputation after the first subscription due to the acceptance by the capital markets authority hence the introduction of individual investments led to an increase of capital to SAR 3.3 billion in SABIC sukuk II and SAR 3.8 billion SABIC sukuk III(Rabbi, 2010).A tabular representation of the money raised would be;

Table representing the amount of money collected through SABIC sukuk 2006-2008.

The chat below illustrates this;

Analysis of SABIC Sukuk as Islamic

Most Sukuk are structured along the Ijarah also known as leasing template, with the procurement and agreed resale of an asset to the obligor at a pre-agreed price (Kettel, 2004). These Sukuk, and other variant forms of this structure such as some of the Mudarabah and Musharakah Sukuk, may possibly not be accepted if evaluated by a Shariah committee of a Saudi Arabian bank and the agreement by the committee is that an acquisition together with a resale of a similar instrument at a fixed price is not permitted (Nisar, 2007).

One of the reasons why the committees are against this agreement is that the ownership which can also be termed as the purchase of an instrument is not true ownership and for this reason not a proper purchase since the conditions of ownership entirely limit the owner’s ability to sell the asset or other forms of investment such as the Mudarabah and Musharakah sukuk in the secondary market at the market price and thus the owner of the instrument is constrained to sell to the obligor at a pre-determined price(Rabbi, 2010).

The distinctive configuration that was specially made for SABIC is a Sukuk Istithmaar also known as Investment Sukuk and the Sukuk structure is entirely different from the structure of any previous Sukuk. Even though an investment Sukuk is one of the major classes of the types of Sukuk integrated in the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Shariah Standards (Rabbi, 2010). SABIC is a holding investment company with few tangible assets which proved to be a challenge in obtaining the necessary permits since the company also had several equity investments in its affiliates (Nisar, 2007).

The Sukuk assets represent a long term investment of 20 years with limited rights and obligations of SABIC in definite marketing contracts that add force to the marketing services that SABIC provides to its manufacturing affiliates (Wilson, 2005). SABIC which is a holding company has equity ventures in many affiliate companies that are engaged in the production of steel petrochemicals, fertilizers and other transitional commodities (Nisar, 2007).The arrangement of the Sukuk entitles Sukuk holders with the right for a certain net income for a period of twenty years from the marketing services of SUKUK depending on a number of given terms and conditions delineated in the Sukuk prospectus and in the offering circular(Rabbi, 2010).

The net income resulting from the investment is paid to Sukuk holders on a quarterly basis up to a particular sum that is based on a standard sum determined by SIBOR (Tariq 2004). The surplus income is kept as a reserve and is used as a dormant shield to protect the investment and safeguard Sukuk holders in the unlikely event that net income for any period unpredictably falls below the definite summation (Wilson, 2005). The funds that amass as the reserve are used to pay an additional sum equivalent to ten percent of the face value of the Sukuk after every five years all through the twenty years to the maturity of the Sukuk (Nisar, 2007).

Thus, by the time the SABIC sukuk matures, an amount of forty percent of the face value together with the quarterly return would have been paid to the SABIC Sukuk holders (Kettel, 2004). Additionally, at the maturation of the SABIC Sukuk which could be twenty years or earlier in case the Sukuk is purchased by SABIC before the maturation date then any outstanding balance in the reserve is awarded to SABIC as an inducement(Tariq 2004). The validation for paying the reserve money to SABIC is to provide the company with an influential spur to persist providing the marketing services to a lofty and lucrative average (Nisar, 2007).

The overall basis of the SABIC sukuk as well as other sukuk is the submission to one God. Therefore, to abide to their religious ties, Muslim investors follow the regulations which are acquired through the interpretation of the religious books and scholastic writings. The believers are then expected to apply what they gain from studying and understanding the books and writing in every aspect of their life (Rabbi, 2010). SABIC sukuk is compliant to the Islamic faith in all aspects and as thus is dedicated to the Sharia law (Nisar, 2007).

The Sharia law inculcates The Holy Quran which is the word of God as exposed to his ultimate Messenger, the Prophet Muhammad. All sukuk also consider the Sunnah of the Prophet Muhammad which are the dealings and aphorisms of the Prophet Muhammad as reported in hadith (Nisar, 2007). Another aspect of the SABIC sukuk is the obedience to the Ijma which is the agreements and beliefs of scholars that have been obtained through the elucidation of the Quran and the Sunnah which are considered divine writings (Tariq 2004). Such prohibitions have generated various reactions from individuals involved in the Islamic financial industry some of the propositions that have risen have been to develop Islamic alternatives to conventional’ financial products especially the sukuk (Nisar, 2007).

SABIC Sukuk was the first sukuk that was officially recognized by the SABB Amanah Shariah Supervisory Committee which is a Shariah Committee formed through Saudi Arabian Banks and SABIC was directly responsible for the issuance (Nisar, 2007). The committee was responsible for determining the level of compliance of the SABIC sukuk to the Islamic faith. The process involved in the presentation of SABIC sukuk was through a specific way of thinking from a known command in the Quran to a new order in man’s current financial application. According to this method, the SABIC sukuk used the edicts of the Quran and Sunnah in terms of operative costs in order to come up with the Islamic compliant bond (Tariq 2004).

The binding contract in all SABIC sukuk transactions is based on the official notice of the issue of the prospectus. The prospectus is required to present all information required by Sharia for the Qirad contract (Kettel, 2004). Such information includes but is not limited to the nature of capital, the percentage for profit allocation and other conditions related to the issue, which must all be similar in outlook with Sharia (Tariq 2004). If the mudarba capital, before the commencement of a given project is in the form of money, the trading of the SABIC sukuk would be like the switch of money for money and in that case the regulations of bay al-sarf would be applied (Rabbi, 2010).

Therefore, interest which is also known as riba or usury is not paid on the SABIC sukuk since the Sharia law forbids the notion of money on its own making money (Tariq 2004). Furthermore, the SABIC sukuk follows the aillah set of conditions that elicit a definite course into action (Nisar, 2007).

The SABIC sukuk should not contain an assurance from either the issuer or the administrator for the fund for the capital or a fixed profit and should not offer profit based on any fraction of the capital (Rabbi, 2010). Therefore, the prospectus or the sukuk issued subsequent to the prospectus do not stipulate payment of a specific amount to the certificate holder (Kettel, 2004). The profit is also divided as resolved by applying the rules of Sharia that is an amount excess of the capital, but not including the revenue or the yield (Rabbi, 2010).

“In addition, the prospectus can also contain a promise made by a third party who is totally not linked to the parties to the contract, in terms of legal entity or financial status, to donate a specific sum, without any counter benefit, to meet losses in the give project, provided such commitment is independent of the mudarba contract.” (Nisar, 2007) Therefore, Mudarib enters into a legal conformity with project proprietor for the construction or commissioning of project, a manager or issuer issues sukuk to raise financial resources. This is compliant to the Sunnah that the Messenger of Allah wrote where Gharar or uncertainty is strictly forbidden. Maysir also known as gambling or speculation is also forbidden in the Sharia law (Nisar, 2007).

In cases where muqarda capital is in the form of non transferable monetary obligation then it must fit the trading principles of the Islamic Sharia law (Rabbi, 2010). In the case where capital is an amalgamation of money and goods trade must be based on market price as well as mutual consent of the traders. In addition, the manager who receives the finance resources pooled together from the subscribers of SABIC sukuk can also invest his own fund and the manager will get profit for his capital contribution in addition to his share in the profit as mudarib (Kettel, 2004). Mudarib collects the profit payments and distributes it to investors before handing the owner a complete project in a future date. “As per Sharia rules, expenses related to the corpus or basic characteristics of the assets are the responsibility of the owner, while maintenance expenses related to its operation are to be borne by the lessee.” (Rabbi, 2010)

In reference to the course of action for issuance of SABIC sukuk, a legal issuer which was HBSC was created to purchase the assets that issue SABIC sukuk to the investor, enabling the imbursement for the procurement of the asset to be done with ease. The asset is then leased to third party for its use while the lessee makes regular rental payments to the legal issuer who subsequently allocates the equivalent percentage funds to the SABIC sukuk holders consecutively (Nisar, 2007).Therefore, the SABIC sukuk are completely and easily transferable and can be exchanged in the secondary markets (Wilson, 2005). According to Rabbi (2010), “SABIC Sukuk offer a high degree of suppleness from the point of view of their issuance management and marketability”. “Additionally, they can be issued by financial intermediaries or directly by users of the leased assets.” (Nisar, 2007)

The reason for the high effectiveness of such sukuk is because the obligator sells certain assets to the legal issuer at an agreed pre-determined purchase price (Kettel, 2004). According to the Sharia law, the legal issuer is then required to amass financial capital by issuing sukuk certificates but the price at which the sukuk are sold should be equal to the purchase price as Sharia requires and this is usually done by the obligator who is also considered to be the original seller.

An agreement is signed between the legal issuer and the obligator so that the obligator acquires the assets as lessee (Rabbi, 2010). The legal issuer who is HSBC will therefore receive regular rental payments from the obligator that is SABIC and the funds are distributed among the investors who are the SABIC sukuk holders (Tariq 2004). Once the contract or SABIC sukuk is mature, or in cases where dissolution is agreed upon by both parties, the legal issuer sells the assets back to the original seller at a prearranged price and according to Sharia law, the value is always equal to any amounts still outstanding under the terms of the sukuk (Rabbi, 2010).

Comparison between SABIC sukuk and J.P. Morgan Government Bond

J.P. Morgan Government Bond is a contractual debt whereby the J.P Morgan Company is required by contract to pay the holders the interest and principal when the maturation of the Government bond is attained (Tariq 2004). SABIC sukuk holders on the other hand claim a complete beneficial ownership in the underlying assets they invested in (Tariq 2004). In accordance to Sharia law, SABIC sukuk holders are to proportionately share the assets and proceeds of their investment according to the initial investment input (Tariq 2004).

J.P. Morgan Government Bond owners on the other hand are only eligible for financial benefits acquired from the Government Bond but are not obliged to associate with the assets of their investment. According to Tariq (2004), “sukuk are certificates of equal value representing after closing subscription, receipt of the value of the certificates and putting it to use as planned, common title to shares and rights in tangible assets, usufructs and services, or equity of a given project or equity of a special investment activity.”

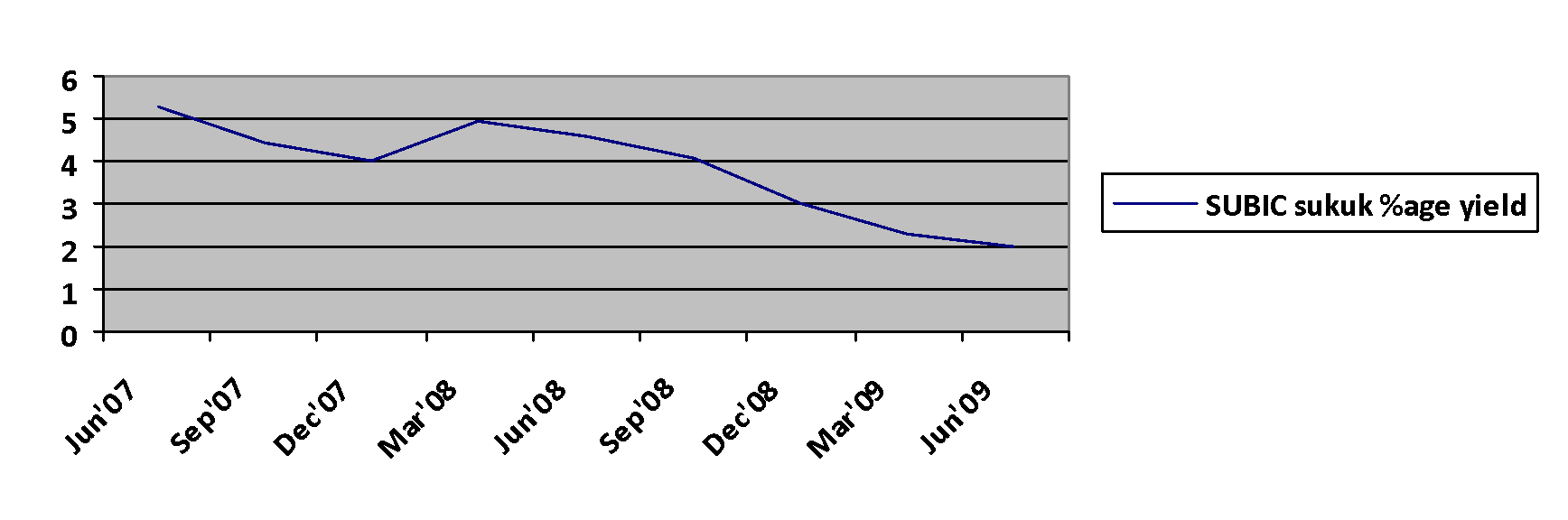

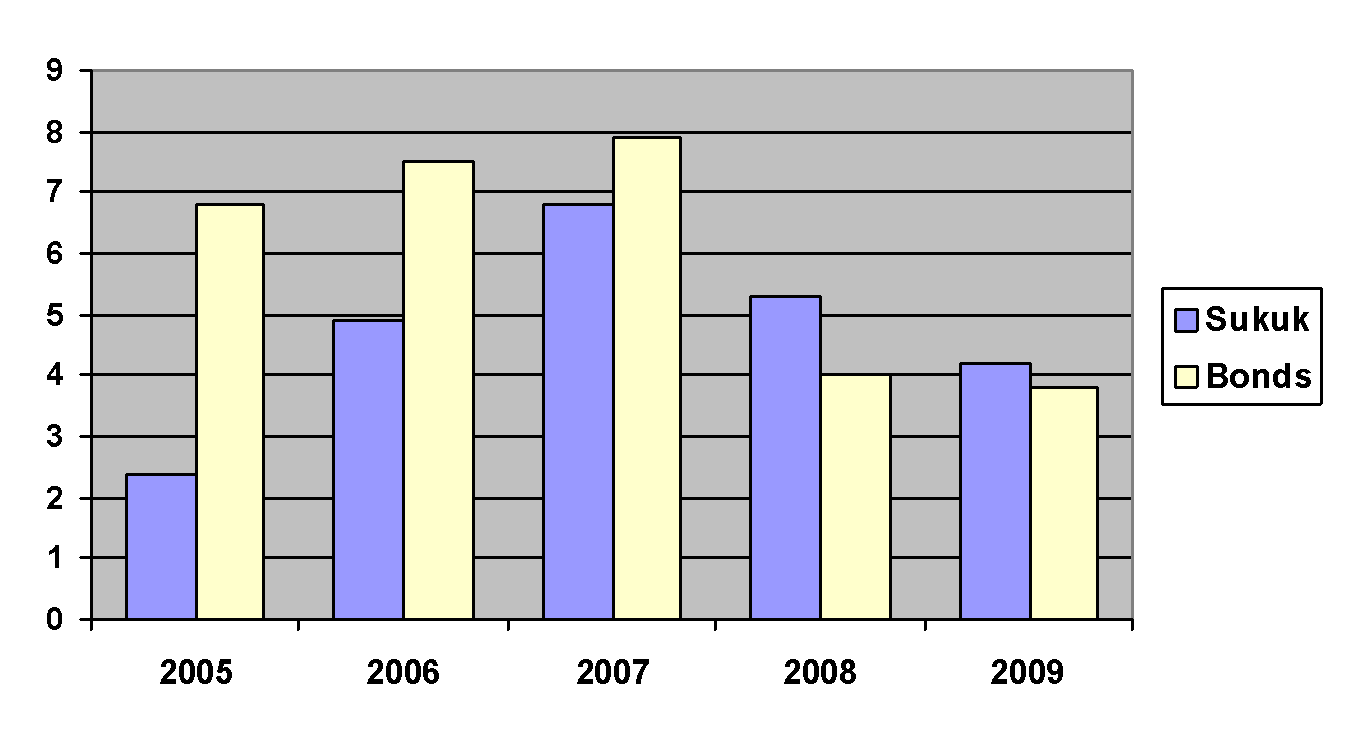

A distinctive quality of a SABIC sukuk that greatly differentiates them from common government bonds is that in paradigms where the certificate represents a debt to the holder, the certificate will not be tradable on the secondary market and instead the holder needs to retain it until maturity or sell it at face value (Rabbi, 2010). The government bonds are traditionally more popular and trusted than private company bonds. The following table shows the difference in yield between June 2007 and June 2009.

According to the table, it is easy to identify that the conventional government bonds are quite popular in comparison to the sukuk. However, the rate at which the sukuk is gaining acceptance both in the Islamic world as well as the international investment sphere is high (Nisar, 2007). The market capital raised in the SABIC sukuk was higher than the J.P. Morgan Government Bond which showed the popularity of the bond. The government bonds are however more diverse hence the higher rate of returns.

Conventional Government bonds are easily transferable and can be exchanged in the secondary market regardless of the responsibility they represent (Rabbi, 2010). On the other hand, the current configuration of SABIC sukuk is similar to the conventional perception of securitization thus making one SABIC sukuk asset issue bear a large number of investors each with a smaller portion of the larger allocation (Nisar, 2007). Therefore, in their mundane structure SABIC sukuk correspond to possession of an asset or its useful value and thus the assertion personified in SABIC sukuk is not simply a claim to cash flow as the conventional Government bonds, rather it is a claim to ownership of an asset (Rabbi, 2010).

Comparison between Sukuk and usual Bonds

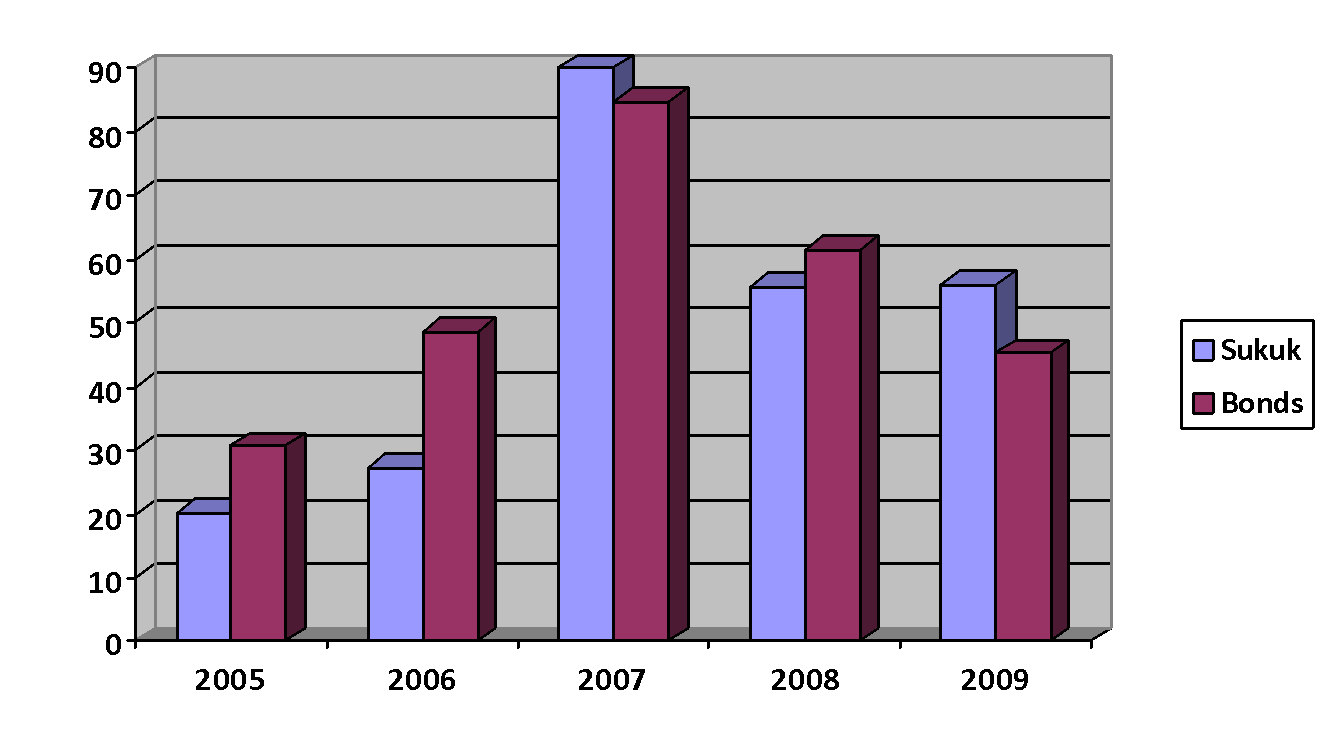

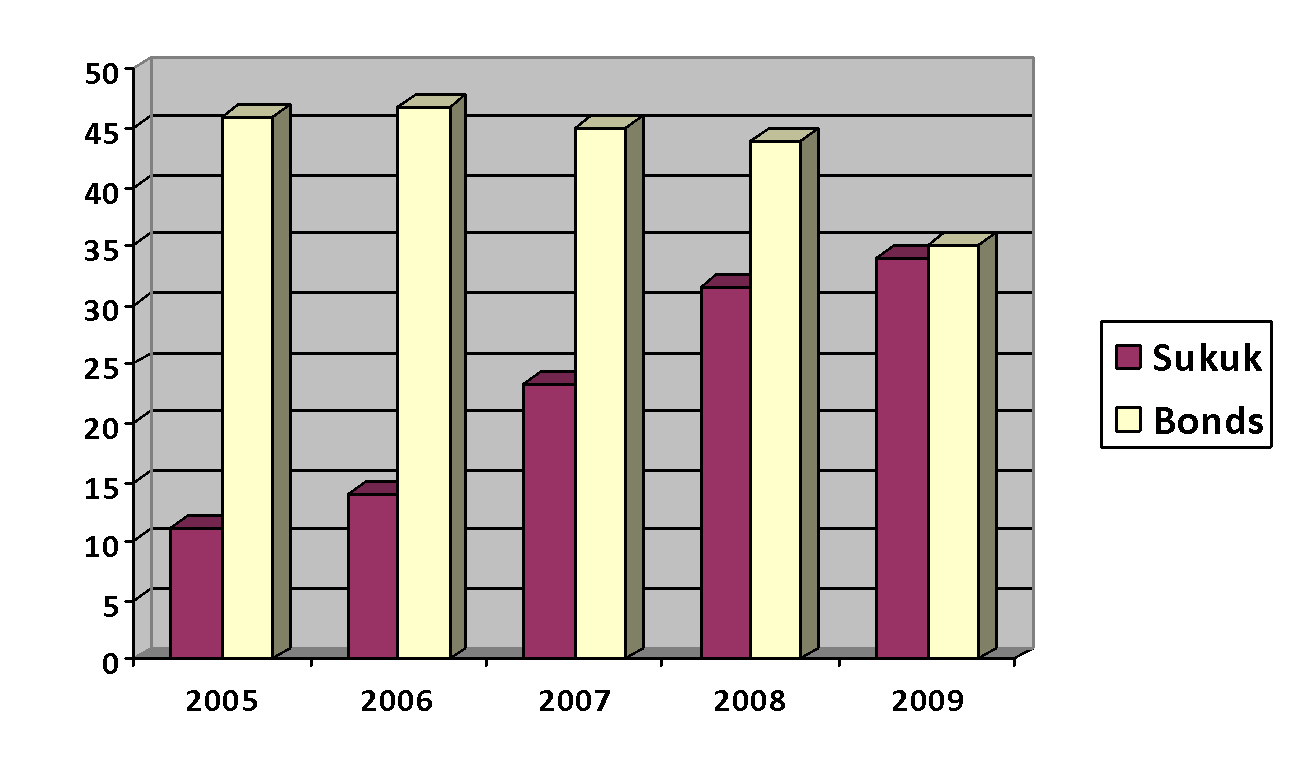

Sukuk and bonds differ greatly in the essence of their core structures and inference. The following table is designed to better illustrate the relativity of both instruments to each other from 2005 till 2009 and also considers yield, returns and market capital.

The charts below offer a graphical representation of the performance of sukuk vis-à-vis bonds.

Conclusion

The SABIC Sukuk is a significant platform in the progression of the Sukuk as a feasible Shariah compliant financial instrument. It has a solid kernel in Islamic Shariah since the sukuk is replicated on an investment in an existing business activity though it completes a credit risk profile identifiable with refined capital markets investors. It is widely anticipated that the SABIC Sukuk structure is a precursor to further development of the capital markets of the kingdom of Saudi Arabia and efficiently amalgamate the vast capital resources in the Kingdom with proficient and beneficial investors such as SABIC.

References

Kettel, B. (2004) US$ 400million Islamic Development Bank Sukuk: Hybrid Sukuk. London: Routledge. Web.

Nisar, S. (2007) Islamic Bonds (Sukuk): Its Introduction and Application. Web.

Rabbi, al-A. (2010) A promising year for sukuk market 2010. Web.

Tariq, A. (2004) Managing financial risks of sukuk structures. Web.

Wilson, R. (2005) Islamic bonds: your guide to issuing, structuring and investing in sukuk. Web.