Islamic indexing was first introduced by Dow Jones in Bahrain in 1999. It was meant for investors looking for investment opportunities which comply with the Muslim sharia ethics principles.

The Dow Jones Islamic Market Index (DJIM) regulations have been approved by Standard 21 of the Auditing & Accounting Organisation of Islamic Financial Institution (AAOIFI). The DJIM is present in the Philippines, Singapore, Thailand, Malaysia, Vietnam, and Indonesia.

This index ascertains the performance of worldwide investment securities (approximately 95 percent market coverage of 44 states) that are compliant with Sharia ethical principles and are in consistent with the Dow Jones Indexes’ rule-based appraisal method.

The DJIM is meant to show the underlying expectations from various financial packages such as exchange-traded funds (EFTs), or as a standard for well managed mutual funds (Baum, 6).

The DJIM has an independent supervisory body that is based on Sharia law. The board scrutinizes and screens the equities in two stages. The first stage involves screening out firm’s that deal in such goods and services as alcoholic products, pork-related products, weapons, entertainment services, conventional financial services.

The second stage involves screening out companies according to financial ratios and indicators. Ratios like liquidity, profitability, and long-term solvency are used to remove firms that are not in accordance to Dow Jones’ methodology. Equities that go through stages one and two are counted in the Dow Jones Islamic Index family and set as subsets of this standard.

The DJIM is measured by float-adjusted market capitalisation. It is measured in United States dollar and is evaluated quarterly per annum in March, June, September, and December. At the moment there are over 75 licensees holding more than US$7 billion in equities standardised in the DJIM (Baum, 6).

In 2006, Dow Jones Indexes and Sam Group collaborated to introduce the innovative Dow Jones Sustainability Index (DJSI). This index combines Muslim Sharia Investing laws and sustainability method by merging the criteria of DJIM and DJSI, to respond to the emerging market demand of complaint equity indexes.

The DJSI shows firm’s that are in compliance with Sharia laws and uphold corporate sustainability leadership. The companies must also be in consistence with Dow Jones methodology.

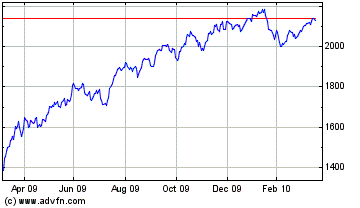

The graph below shows the performance of the DJIM since April 2009 to February 2010 (ADVN PLC, 2010).

Dow Jones Islamic Market Titans 100 Index Historical Stock Chart

There are different classes of index-related investments that an individual can add to his or her portfolio. There are large-cap value and growth, mid-cap and small-cap price and augmentation, international including developing markets, EFTs, bonds, money and others.

Most investors find it hard to screen, select, and analyze stocks that compliment their portfolio wishes thus indexed investments such as iShares assist investors to come up with an effective and efficient portfolio.

Indexed investments are an important tool in portfolio construction. Indexed securities outdo many of the managed mutual funds in terms of performance and are also cost efficient to the investor.

Even for people working and saving in 401 or 403 plans or saving without a tax-deferred account, indexed investments offer a viable option in their portfolio (Henry & Rodney, 15).

Works Cited

Baum, Eric. “Mutual Funds Report.” New York Times. 2002. p 6. Print.

ADVN PLC. Dow Jones Islamic Market Titans 100 Index Price (DOWI:IMXL). 2010. Web.

Henry, Clement & Rodney, Wilson. The Politics of Islamic Finance. Edinburgh: Edinburgh University Press, 2004. Print.