- Introduction

- The experience of the Australian economy over the last 10-15 years

- Trends in Australian economic growth

- Australian Unemployment Rate Trend

- Australian Inflation Rate Trend

- Challenges encountered by Australian Policy Makers

- Targets and Instruments in Macroeconomic Policy

- Application of Economic Theories Learnt

- Conclusion

- References List

Introduction

The world today is a global village since the economic policies applied on one end of the world have an impact on other economies on the other end. The economic conditions have also become so dynamic that the policy makers are finding it hard to determine the appropriate policy measures (Conrad, 2009). There has been recession within the last ten to fifteen years that have adversely affected many economies. However, those economies that had the appropriate policies in place experienced a small impact only. Australian economy has had mixed results in the last10 to years, which can be shown by examining its macro economic policies and macroeconomic indicators (Department of Foreign Affairs and Trade, n.d).

The experience of the Australian economy over the last 10-15 years

The four main macro-economic indicators in any given economy are unemployment rate, gross domestic product, inflation rate and the level of interest rates. Microeconomic policies are mainly used for several purposes such as to attain stable prices, full employment and register economic growth among other reasons. The Australian economy has been varying for the last 10-15 years due to economic changes within the country or in the global economy. The macroeconomic indicators as explained below can show this.

Trends in Australian economic growth

Economic growth refers to the rate at which the national income of a given economy is growing, whereby national income refers to gross domestic product (Adelman, 1961).

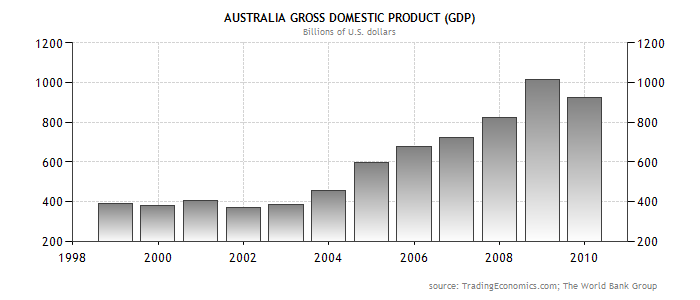

The graph below shows that the Australia gross domestic product has been experiencing an increasing trend. Between 1998 and 2001, the GDP was stable. However, in 2002, there was a decrease in growth, which was followed by an increasing growth up to 2008. There was a slight drop in 2010. According to ABS, Australia has had an average GDP of $22.44 billion from 1965 to 2010.

In 2008, the GDP reached its record high of $1015.22 billion. In the same period of 2008-2009, the global economy was experiencing recession in which many economies were hard hit. This is a clear indicator of how stable the Australian economy has become, because during that recession most countries experienced a negative economic growth.

Source: (Trading Economics, n.d)

Australian Unemployment Rate Trend

The Unemployed refers to those people who are jobless but are able to work and are actively seeking for employment. It is always given as a percentage of an economy’s labour force (Hughes & Perlman, 1984). The graph below shows a significant drop in unemployment levels for the last ten years. In the period before 1998, the country had very high unemployment rates.

For instance, the country had the highest unemployment rate of 10.90% in December of 1992. However, since 1998 the Australian economy has experienced a decreasing unemployment rate, although there was a slight increase between 2001 and 2002. The unemployment rate was at its record lowest of 4% in 2008, which was followed by a slight increase in 2009 to 2010 (Australian Bureau of Statistics, 2005).

Source: (Trading Economics, n.d)

Australian Inflation Rate Trend

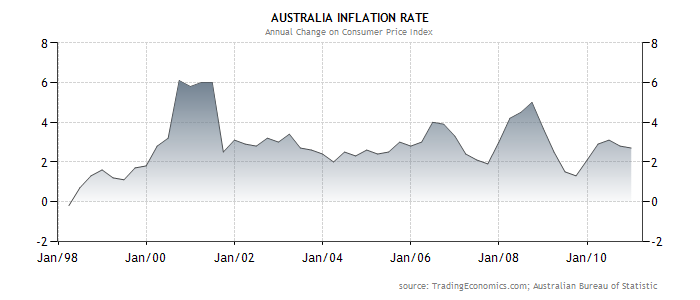

Inflation refers to a sustained rise in the price levels within an economy (Jupp, 2001). Inflation rate is calculated by finding the percentage change in price levels of a given period. While measuring inflation, the two parameters that are utilized in most cases are the GDP inflator and the Consumer Price Index (CPI). Inflation in Australia has relatively been steady within the last ten years.

The graph below shows that the inflation rates hit historical high of over six percent in 2001 and slightly lower in 1998 with a percentage of over 5 percent. However, the period of 2002 to 2006 had an inflation rate that was steady. Within the last ten years, it hit the lowest of below 2 percent in 1999 (Jupp, 2001).

Source: (Trading Economics, n.d)

Challenges encountered by Australian Policy Makers

The Australian policy makers are encountering two main challenges including how to manage unemployment rate and controlling inflation rate. An increase in both of these has a negative effect on the economy as explained below.

Inflation Rate

An increase inflation rate has negative effects on the economy because it leads to erosion of the currency value. Therefore, the purchasing power of consumers goes down as they can only afford few items with their income compared to the period before the increase. This leads to a decrease in investment level, which results in a shortage of goods and services. The policy makers therefore always strive to keep the inflation rate at low levels to minimize the effects of a high inflation rate (Boyes & Melvin, 2006).

Unemployment rate

An increase in unemployment rate also has negative effects on the economy because it leads to a decrease in demand for goods and services. When the level of unemployment goes up, the amount of disposable income decreases because income is produced by a few people but shared by a large number.

The consequence is a reduction in demand. As a result, producers will reduce the amount of goods and services produced and the level of economic growth will go down. Policy makers always try to maintain unemployment rate at low levels to minimize the effects of high unemployment rate (Boyes & Melvin, 2006).

Trade off between unemployment and inflation rate

It is evident from the graph that when unemployment goes down, inflation rate goes up and when inflation rate goes up, unemployment rate decreases.

The trade off can be seen clearly by comparing data from the graph of unemployment rate with that of inflation rate. In the period that had high inflation rate, unemployment was low. On the other hand, in the periods that had high unemployment rate, the inflation rate was low.

For instance, in 2008, the inflation rate in Australia was at a high of over 5 percent while the unemployment rate was at a low of 4 percent. On the other hand, the unemployment rate was at a high of over 8 percent when the inflation rate was at a low of 1 percent (Mastrianna, 2008).

This is a big challenge to the policy makers considering the fact that the policy makers always seek to keep both rates at low levels. When the policy makers at the Australia Reserve Bank employ monetary policies to reduce one of the rates, they will end up increasing the other.

In addition, the Federal Government can also employ fiscal policies to reduce one of the rates and the other will increase automatically. Therefore, the policy makers must ensure that they use policies that reduce one rate to a level that will ensure that the other is only increased to an acceptable level (Lilja, Santamäki-Vuori & Standing, 1990).

One other obstacle is conflicting outcomes of effected policies. In this case, fiscal policies are put in place in an attempt to raise one rate and on the other hand, monetary policies bring down the rate. This therefore calls for coordination between the monetary and fiscal policy makers.

Targets and Instruments in Macroeconomic Policy

Targets refer to the goals that the policy makers seek to achieve when they implement various macroeconomic policies (Coricelli, 1998).

They include low inflation rate, low unemployment rate, reduction of the national debt, high economic growth and favourable balance of trade. For instance in 2008, Australia targeted an economic growth of 3.3 percent while in 2010 the government wanted to decrease inflation rate by 2.7 percent.

Instruments refer to the means through which the targets set will be achieved. Most of the times, instruments attempt to regulate the economy’s aggregate supply and demand. These instruments are mainly in two forms- monetary policies and fiscal policies (Reserve Bank of Australia, 2011).

Monetary policies refer to those policies implemented by the Reserve Bank of Australia (RBA), which seek to regulate the supply of cash in the economy (Munasinghe, 2006).

For instance, when inflation rates are going up, the RBA will increase their interest rates. This will force the commercial banks to lend to the public at interest rate not lower than the one set by the RBA. As a result, few people will borrow money from banks and the supply of money in the economy will go down.

This will in turn push the inflation rates down. Fiscal policies refer to the use of taxation and government expenditure. The Government can increase the supply of money in the economy by increasing its expenditure. Taxation can be used to stimulate investment whereby the government reduces taxes in sectors that it wants to see increase in investment (Tanzi, 1984).

Application of Economic Theories Learnt

Causes of inflation and their effects

The causes of inflation can be explained through the cost-push approach or the demand-pull approach. When inflation is a consequence of increased production costs, then it is referred to as cost-push approach.

As the cost of production increases, the producers will increase the cost of their products. On the other hand, consumers’ purchasing power will go down, which leads to demand for an increase in wages.

This in turn increases production costs, which is again passed to consumers. As a result, the price levels will continue to rise. Demand pull-inflation refers to inflation caused by an increase in demand beyond the production capacity of an economy. As demand increases, producers will increase their prices and if this is prolonged, inflation will set in (Hall, 1982).

In the current setting of Australian economy, there is high employment rate, which means inflation rate is also high. This is inflation caused by high demand in goods and services because most people have high disposable income. This will make them to demand for goods beyond the production capacity of the economy.

As a result, the producers have increased their prices to match that demand leading to an increase in inflation rates. Therefore, the theory learnt in class helps in determining which type of inflation the economy is experiencing (Semmler, Greiner & Zhang, 2005).

Fiscal Policy

This refers to the use of taxation and government expenditure to achieve economic objectives. In the current economic situation, the government needs to employ contraction fiscal policies. The economy is currently faced by demand-pull inflation, which means that it needs measures that will slow economic growth.

These include increase in taxes of consumer goods and reduction in government expenditure. Increase in taxes will reduce consumer purchasing power while reduction in government expenditure will reduce money in circulation. As a result, the demand for goods and services that was putting pressure on prices will go down. Therefore inflation will be reduced (Beetsma, 2004).

Monetary Policy

Monetary policies can also be applied to control demand-pull inflation because they can be used to reduce money supply in the economy. The Reserve Bank of Australia can increase interest rates, which will force commercial banks to increase their lending rates. As a result, the level of borrowing will go down and the level of money supply will decrease.

This leads to a decrease in demand for goods and services because consumers’ disposable income has been reduced. Prices for goods and services will also go down because of reduced demand, leading to a decrease in inflation rate (Langdana, 2009).

Conclusion

The main macroeconomic indicators are inflation rate, unemployment rate and GDP. From the above discussion, it is clear that the Australian economy is doing well, considering the fact that there has been a lot of instability in the global economy for the last ten to fifteen years.

This shows the expertise of the policy makers who have developed and implemented policies that have ensured that the economy is still stable and strong. However, there are some challenges that still face the policy makers, which include balancing the effects of the policies.

For instance, they should ensure that as they implement policies that decrease inflation rates, they do not increase unemployment to unacceptable levels. The theories learnt in class have helped in understanding the current economic situation in Australia and the appropriate policy measures that can be used to correct the high inflation rate.

References List

Adelman I. (1961). Theories of economic growth and development. Stanford, CA: Stanford University Press.

Australian Bureau of Statistics (2005). Year book, Australia, Issue 87. Canberra: Australia Bureau of Statistics.

Beetsma, R. M. W. J. (2004). Monetary policy, fiscal policies, and labour markets: macroeconomic policymaking in the EMU. Cambridge: Cambridge University Press.

Boyes W. and Melvin M. (2006). Economics. Boston, MA: Cengage Learning.

Conrad, B. (2009). Profiting from the world’s economic crisis: finding investment opportunities by tracking global market trends. Hoboken, NJ: John Wiley and Sons.

Coricelli F. (1998). Macroeconomic policies and the development of markets in transition economies. Budapest: Central European University Press.

Department of Foreign Affairs and Trade (n.d). About Australia. Web.

Hall, R. E. (1982). Inflation: causes and effects. London: University of Chicago Press.

Hughes, J. J. and Perlman R. (1984). The economics of unemployment: a comparative analysis of Britain and the United States. Cambridge: Cambridge University Press.

Jupp, J. (2001). The Australian people: an encyclopedia of the nation, its people and their origins. Cambridge: Cambridge University Press.

Langdana, F. K. (2009). Macroeconomic policy: demystifying monetary and fiscal policy. Newark, NJ: Springer.

Lilja, R., Santamäki-Vuori, T. and Standing, G. (1990). Unemployment and labour market flexibility: Finland. Geneva: International Labour Organization.

Mastrianna, F. V. (2009). Basic economics. Mason, OH: Cengage Learning.

Munasinghe M. (2006). Macroeconomic policies for sustainable growth: analytical framework and policy studies of Brazil and Chile. Cheltenham: Edward Elgar Publishing.

Reserve Bank of Australia (2011). Measures of consumer price inflation. Web.

Semmler W., Greiner A. and Zhang, W. (2005). Monetary and fiscal policies in the Euro-area: macro modelling, learning, and empirics. Amsterdam: Emerald Group Publishing.

Tanzi V. (1984). Taxation, inflation, and interest rates. Washington, DC: International Monetary Fund.

Trading Economics (n.d). Australia Gross Domestic Product (GDP). Web.

Trading Economics (n.d). Australia inflation rate. Web.

Trading Economics (n.d). Australia unemployment rate. Web.