Introduction

One Touch Direct, LLC (OTD), was founded in 1998 by Ron Benson who is still the company’s Chief Executive Officer. The company is in the business of offering outsourcing services in the area of customer care and marketing. Its major customers are local business people who are interested in the services and are willing to outsource instead of hire their own personnel and maintain them internally.

The company aims at developing a close link between its customers as well as developing an increased customer base for its clients through a number of advertising and marketing strategies. The business of call center service and the need for custom made marketing has led to the success of the business. In its growth the firm is faced with varying challenges however it has stayed strong and soldiered on in the changing markets (McCartney 24). This paper takes an analysis of financial statement of the company. It will use the analysis to predict the future of the company.

Financial Statements

The company has three locations two in Tampa and one in St. Catharines, Ontario, Canada; however most of its financial obligations and accounting is undertaken at a central point. Since the company is an incorporated company according to business laws in Canada, it must prepare periodical financial statements that describe the performance that it has had in the past period covered by the statements. To analyze the trend in finance, this paper will analyze balance sheet, trading account and cash flows of the company.

Ratio Analysis

Below are the calculations made on some of the important ratios for One Touch Direct, LLC (OTD) to help carry out analysis upon the condition of the organization with regard to the industry.

Return on Capital Employed = Profit before interest and tax/ Shareholders Equity.

The trend given by the analysis is not favorable since it is having a drastic change. In 2007, the company made a loss which is a sign of bad business. From a close analysis of the financial accounts it’s noted that operating expenses in these years of poorly performing business were not proportional to sales. This might have been the cause of the loss.

The ratio analyses how well management teams are utilizing owners and borrowed capital. If the ratio is high, like in our case above, it means that the company’s management is not fully effective (Brigham & Houston 113).

Current Ratio= Current assets/ current liabilities.

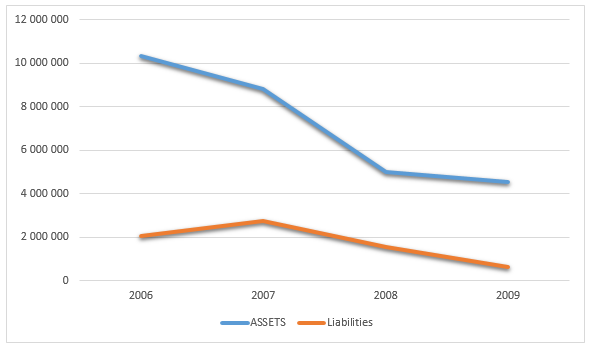

The following graph compares the rate of current liabilities and assets.

This is the rate at which current asset should cover current liability. For a health company, it should never be less than one. If it is less than one then it means that the company cannot meet its short term financial obligations. In our case the ratio is above one,

The company can meet its financial obligation effectively when they fall due. This is a test of a strong company with a base (Brigham & Ehrhardt 56).

Fixed Assets Analysis

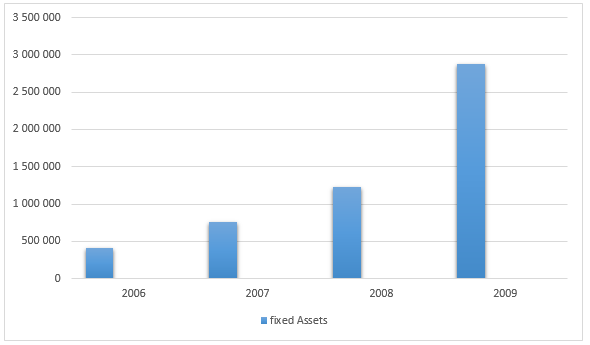

Fixed assets are used in production of goods and services. They are not consumed when a production is taking place but are retained for long durations as long as they are productive. There is a depreciation set for assets to ensure that the value determined at one particular point gives the real value of business, in the case of One Touch Direct, LLC (OTD), the trend of fixed assets is a follows;

The above chart shows the increase of fixed assets. This is a good indication of a business.

Total Revenue

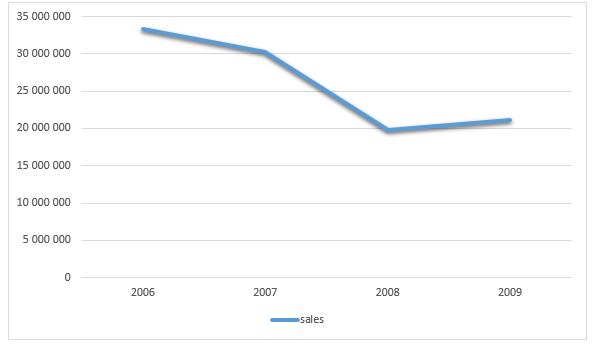

Sales are the source of income for a business; the company has a varying rate of sales. This is responsive to the trend in the market as well as the measures taken by the company to market it.

21,099,565

The sales of the company have been on a reducing trend until 2008. This is an indication of certain deficits in the company. The change in trend experienced in 2009 is a likelihood of better things to come in the future. The Company generally recognizes sales, net of estimated returns. The sale is recognized when the customer takes the possession of merchandise or receives services. In case the Company collects payments from customers before the merchandise or service is delivered (advance payments) this is recorded as a deferred payment in the balance sheet until the entire deal is completed. The Company provides for estimated sales returns based on historical trends in merchandise returns. Amounts collected from members, which under common trade practices are referred to as sales taxes, are recorded on a net basis.

Banks are one of the major users of these financial statements; they are interested in knowing how well a business operates and the strength of the balance sheet. Director’s Efficiency and management competence is the most important thing that is considered when a bank is deciding whether to conduct business with a company or not. Since most SME’s are owned by private individuals, then a bank’s interest is on trust that they can lay on the few individuals.

According to IFRS, it is required that financial statements are made to reconcile equity items. These may be any income or expense that affects the equity of the country outside the normal operation of the business. Expenses recognition is another area that has been affected by the new development. According to IFRS, research costs when incurred are expensed, development costs and borrowing costs after meeting certain criteria are capitalized and amortized over a certain period of time (Epstein and Jermakowicz 12-23). The need to cover a company’s expenses is of a great importance for the success of a company.

Conclusion

Financial statements are important for the management, shareholders, and third parties in making their decisions. The accounts of One Touch Direct, LLC (OTD) showed that there are deficits in the company however the trend is changing from 2008. The company has three locations two in Tampa and one in St. Catharines, Ontario, Canada; however most of its financial obligations and accounting is undertaken at a central point. It is able to cover its short term financial obligations; the sales of the company have been on a reducing trend until 2008. This is an indication of certain deficits in the company. The change in trend experienced in 2009 is a likelihood of better things to come in the future.

Works Cited

Brigham, Eugene and Ehrhardt Michael. Financial management: theory and practice. New York: Cengage Learning, 2008.

Brigham, Eugene and Houston, Joel. Fundamentals of financial management. New York: Cengage Learning, 2007.

Epstein, Barry and Jermakowicz, Eva. Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards. New York: John Wiley and Sons, 2010.

McCartney, James. Accounting: A Framework for Decision Making (Book). Pacific Accounting Review (Pacific Accounting Review Trust), 16(1), 77-80. Retrieved from Business Source Complete database, 2004.