Private aviation provides a pilot and one’s passengers to travel as usual but with no schedules, which is rather convenient. Such private jet charter services have existed in the UK and Europe for a long time already and are represented by different organisations, including Rubicon Aviation Ltd. This organisation deals with sales, acquisitions, maintenance, and transportation (“Rubicon Aviation Ltd”).

Today the private aviation industry is not as expanded as previously, as its clients tend to choose alternative offerings. Thus, it is significant for all organisations that operate in this sphere, including Rubicon Aviation Ltd, to consider market trends and changes. In this way, professionals can focus on the driving forces of market economies on their basis so that they remain competitive. In this framework, companies need to pay attention to supply and demand to ensure that they will not fail. Analysing them, Rubicon Aviation Ltd has an opportunity to see the “big picture” and predict market changes, having a chance to prepare for them beforehand.

In 2008, the demand for the jets that are usually used in private aviation was extremely high. However, the supply was low, as the producers were not able to manufacture enough jets so that queues occurred. Even though such a situation had adverse effects on customer satisfaction, the number of orders remained rather high. With time jet, manufacturing improved, which was expected to balance demand and supply. Still, the economic crisis decreased demand so that the number of orders became 1.5 times lower, which can be seen in Fig. 1 (Wright).

The price of the jets that are often used in private aviation tends to change. For example, Rubicon Aviation Ltd often uses second-hand Challenger 300. In 2008, the company would buy them for $5-8 million more than today, which is shown in Fig. 2 (Industry Monitor 4).

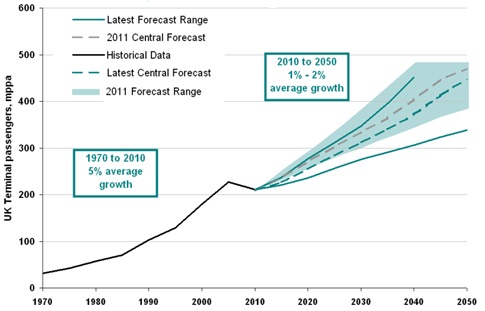

The analysis of the obtained data shows that the demand for the jets decreased while supply increased. Such results seem to be rather controversial but can be explained by the fact that jet manufacturing improved greatly and became more streamlined and less expensive while private aviation organisations still deal with the consequences of the economic crisis. It is also possible that the industry becomes less popular so that the companies can just increase the number of flights instead of purchasing new jets. The demand for passenger transportation decreased only during the years of the economic crises so that it seems to continue increasing right now, which can be seen in Fig. 3 (Department for Transport 7). Still, it seems that the representatives of the general public tend to use public aviation services that are cheaper and have their pilots. However, it also presupposes that Rubicon Aviation Ltd has a chance to implement new strategies and attract the potential market.

Considering demand and supply alterations observed during 2008-2015, it can be claimed that managerial decisions regarding operational peculiarities are greatly affected by the general economic environment.

Private aviation offers rather expensive services that are mainly used by ultra-high-net-worth individuals and high-net-worth individuals who earn enough to afford them. Rubicon Aviation Ltd, for example, was initially targeted at the representatives of Ukraine and Russian Federation who explored the Western World actively after the collapse of the USSR. Operating in the developed industry that is full of loyal clients who are not willing to alter their companies, Rubicon Aviation Ltd included the representatives of the Commonwealth of Independent States into its targeted market. Even though this population was not greatly affected by the economic crises, it tends to search for better economic alternatives, which makes private aviation organisations alter their strategies and adapt their services to the new needs of their clients.

The customers of Rubicon Aviation Ltd would give preference to energy effective jets and per flight payment that is now provided by the company. As business jets become more affordable, they have more opportunities to use them. Thus, the organisation maintains more flights this year. In fact, during the last several months the number of flights increased by almost 1.5%, which proves that demand is likely to become higher in the nearest future (Industry Monitor 1). Previously, Rubicon Aviation Ltd offered its clients an opportunity to pay for a jet once a year. It used to be rather convenient because they were able to maintain a flight on a particular jet anytime they wanted. However, trying to reduce expenses, customers started booking the flights so that the organisation allowed them to pay only for each flight separately. As a result, maintenance costs for the clients decreased. Even though now they should be covered by the company, Rubicon Aviation Ltd can make the price of one flight higher than it could be in the framework of per year payment. As a result, there will be enough funds to deal with this.

Such strategies tend to be rather effective and beneficial considering the company’s market structure. Rubicon Aviation Ltd operates in the oligopolistic market and has only a few competitors that also dominate the sphere of private aviation (International Trade Commission 6-11). Entry barriers are rather substantial, which limits the number of start-ups greatly and controls competitiveness. The largest companies except for Rubicon Aviation Ltd include the Private Jet Company, LuxAviation, ExecuJet Aviation Group, and Comlux – The Aviation Group. All organisations are independent. They tend to agree on their operations and prices so that they can increase their revenue. As a result, companies’ services and activities are both similar (as they operate in the same sphere) and different (as they emphasise their uniqueness to attract targeted markets) (Baye and Prince 257). Thus, it can be concluded that even though Rubicon Aviation Ltd faced a decrease in productivity recently, it has started improving its performance this year so that the number of flights has already increased.

Works Cited

Baye, Michael and Jeff Prince. Managerial Economics and Business Strategy, McGraw-Hill Irwin, 2014.

Department for Transport. UK Aviation Forecasts, 2013. Web.

Industry Monitor. The EUROCONTROL Bulletin, 2016. Web.

International Trade Commission. Business Jet Aircraft Industry: Structure and Factors Affecting Competitiveness, 2012. Web.

“Rubicon Aviation Ltd.” UKCompanyDB, 2016. Web.

Wright, Robert. “Aviation Industry Outlook Remains Cloudy.” FT, 2015. Web.