Manhattan History

According to the encyclopedia Wikipedia, Manhattan is the commercial, financial, and cultural center of the United States and, to varying extents, of the world. Manhattan has many famous landmarks, tourist attractions, museums, and universities. It is also home to the headquarters of the United Nations.

Manhattan has the largest central business district in the United States, is the site of both the New York Stock Exchange and NASDAQ, and is the home to the largest number of corporate headquarters in the nation. It is indisputably the center of New York City and the New York metropolitan region, holding the seat of city government, and the largest fraction of employment, business, and recreational activities.The name Manhattan derives from the word Manna-hata. The word “Manhattan” has been translated as “island of many hills” (Manhattan).

“It is unique in the United States for its intense use of public transportation and lack of private car ownership. While 88% of Americans nationwide drive to their jobs and only 5% use public transportation, mass transit is the dominant form of travel for residents of Manhattan, with 72% of borough residents using public transportation and only 18% driving to work. According to the 2000 U.S. Census, more than 75% of Manhattan households do not own a car.

In 2007, Mayor Bloomberg proposed a congestion pricing system that would charge drivers entering Manhattan below 86th Street between 6 a.m. and 6 p.m. weekdays a fee of $8 per car or $21 per truck, with lower fees for travel within the pricing zone. The plan would be modeled on a similar system in London, and is intended to improve air quality and traffic flow, with funds raised used for mass transit improvements throughout the city” (Manhattan).

Manhattan is an Economic Engine

Manhattan is the Economic Engine of New York

“Manhattan is a great financial center, with some of the world’s largest banks and brokerage houses and such institutions as the New York and American stock exchanges. In the borough also are the headquarters of many large corporations and numerous manufacturing industries; the relative importance of the latter, however, has declined in recent decades. The chief products include clothing, printed materials, and processed food. Manhattan in addition is a leading center for international and domestic trade. The advertising and insurance industries and radio and television broadcasting are other important segments of the borough’s economy” (Manhattan, 2007).

There is no other city in the United States that relies so much on good public transportation as New York City. As Manhattan is the economic engine of the New York metropolitan region, every day more than 3.3 million people enter the island to come to work so a good public transportation is the only way to guarantee people can move about easily.

According to Virginia Fields, Manhattan Borough President,the economic engine of Manhattan is expected to keep humming, generating some 400,000 new jobs in the process over the next two decades. These new jobs are essential to all five boroughs, but this growth will be strangled unless the transit system is expanded, especially on Manhattan’s East Side, in East Midtown and in Lower Manhattan” (Manhattan Bourough President Supports 2nd Ave Subway, 2007).

According to Wikipedia “Its most important economic sector is the finance industry. The 280,000 workers in the finance industry collect more than half of all the wages paid in Manhattan, although they hold less than one of every six jobs in the borough. The pay gap between them and the 1.5 million other workers in Manhattan continues to widen, causing some economists to worry about New York City’s growing dependence on their extraordinary incomes. Those high salaries contribute to job growth, but most of this job growth occurs in lower-paying service jobs in restaurants, retail and home health care and not many jobs in highly paid areas” (Economy of New York City, 2007).

In New York City it is located the biggest number of companies headquarters in the USA and a great number of those headquarters are based in Manhattan. Midtown Manhattan is the largest central business district in the United States and in Lower Manhattan it is located both the New York Stock Exchange and NASDAQ. Seven of the world’s top eight global advertising agency networks are headquartered in Manhattan (Economy of New York City, 2007).

“2006 statistics showed that the average weekly wages paid to Manhattan workers is $1,453 (excluding bonuses), the highest in the country’s 325 largest counties, and the salary growth of 7.8% was the highest among the ten largest counties. Pay in the borough was 85% higher than the $784 pay earned weekly nationwide and nearly double the amount earned by workers in the outer boroughs. Manhattan’s workforce is overwhelmingly focused on white collar professions, with manufacturing (39,800 workers) and construction (31,600) accounting for a small fraction of the borough’s employment” (Economy of New York City, 2007).

This impressive corporate presence has been complemented significantly by many national and international retailer and food industry bringing concern that Manhattan could be homogenized by businesses only.

Manhattan Investment and Sales

No Slackening of Pace Seen in Manhattan

According to The Free Library Periodical Website in its 1999 article , “In the 1998 year-end rental report, one number sums it up. The price of all doorman apartments on the Upper East and Upper West sides increased 8.99 percent over the 1997 level. In the 1997 year-end report, that same number was 8.78 percent. Apart from the near identity of the numbers, the comparison is notable for several reasons. First, after five years of strong growth in rental prices, a slackening in the pace of increases might have been expected. Second, strong demand in the sale market must have deflected some luxury rental demand. Third, the retrenchment in the financial markets in the fall interrupted demand, but obviously did not impact overall year-end results.

The rental market’s continued buoyancy naturally reflects demand, which has become more broad-based as New York’s industries have diversified to include telecommunications, computer services and entertainment. Not only are these sectors new to the area, they are among the fastest growing components of the economy. They have brought not only more jobs, but higher paying jobs which, in turn, support the demand for other services. As businesses of every kind consolidate globally, the number of commercial capitals declines. Where previously there were two corporate headquarters, now there is one…This is one of the reasons for New York’s resurgent economy.

The other is its unique cultural environment, which attracts the highly creative, highly paid labor force in the new growth industries. More and more, wealth is being generated as an intellectual by-product rather than as a commodities-based development. New York is the native home of the world’s intelligentsia. Its increasing importance seems inevitable, given these global trends”( No Slackening of Pace Seen In Manhattan Residential Rentals, 2007).

It also adds that “ at the same time that demand for Manhattan real estate is increasing, supply, of course, is not. Unlike most commercial centers which can expand radially from their core, Manhattan is uniquely limited as an island. The peripheral boroughs and New Jersey benefit from its growth. When the market is rising, the difference in price levels minimizes. However, when the market declines, the difference in value off the island increases. During periods of decline, demand retreats to Manhattan from its offshoot markets, helping to cushion any devaluation here. In the 1990’s, the implications of Manhattan’s limited land mass have affected the pattern of residential development.

Whereas in the 1980’s, more than 10,000 units per year were added to the Manhattan residential market, beginning in 1993 to the present, a paltry three to five thousand units per year have been added. It is important to note that in the 1980’s, the addition of supply at much greater levels did not cause prices to decline in either the rental or sale markets. It was only the advent of a national recession that halted the residential markets. There is little wonder, then, that in a more robust and diverse economy, prices have increased so strongly in the 1990’s.

By 1996, residential rental prices had surpassed the old highs of the 1980’s and financing was readily available for the Manhattan market. Yet, compared to the 1980’s, there have been very few new developments in established residential areas such as the Upper East and West sides. Most of what has been developed in those areas was targeted to the sale market. Notably, there were some ultra high-end rental and sale projects. The message is clear: The traditional residential areas are mature markets with few available sites. They are approaching saturation. Going forward, these areas will be devoted increasingly to development in the sale market or very high-end rental market” (No Slackening of Pace Seen In Manhattan Residential Rentals, 2007).

“Apart from the small amount of development in the 1990’s in traditional residential areas, there was some development by neighborhood expansion in the West 50’s and East Teens and 20’s, but, again, very little. Most of what was built in the 1990’s was a new genre of development based on the tax incentivized revitalization of commercial areas such as Wall Street and the Eighth Avenue/Theatre district corridor. These developments were primarily directed to the labor markets around them, but proximity to the subway system and entry level apartment sizes and prices make all such developments competitive with each other for the price-sensitive tenant.

Although the word luxury has become ubiquitous in doorman attended properties, this type of commercial area redevelopment has special characteristics, competing in a very narrow price spectrum for the young, mostly single and share markets. The growth in development in areas around Manhattan, directed to the same markets, makes it clear that much new ground will be broken on the Lower East Side and on the West Side from 23rd to 57th Streets for the young Manhattan bound commuters. Keeping more residences in Manhattan will only further strengthen the local economy.

In looking forward, however, a cautionary note needs to be sounded. Although overall volumes of new units are historically low, still 1998 saw the highest level of new product added to the market since the 1980’s. Many new projects which came on line in 1998 were impacted in their initial rent-up by the retrenchment in the financial markets in the autumn. The pace of absorption slowed. For the most part, prices did not change, but many owners offered commissions to brokers and free rent to tenants to compensate for the drag on the market. The holiday season began just as the financial markets’ resurgence engendered renewed confidence in prospective tenants. With the annual holiday slowdown, owners have kept in place the broker and tenant incentives to rent” (No Slackening of Pace Seen In Manhattan Residential Rentals, 2007).

To end up the above mentioned article during the last quarter of 1998, there was a noticeable build-up in the supply of available apartments. While there were projects in various stages of development which produced average volumes of approximately 5,000 units per year for 1999 and 2000. For most of that year, new supply tapered.

Manhattan is One of the Top Retail Investment Markets in the World

To imply that the real estate market in 2007 is anyway different or worse from 9 years ago would be untrue. In the article “What Housing Crisis?” from the Prudential Douglas Elliman Real Estate, states that “ultrahigh-end home prices are still rising, with prices reaching up to an astronomical $175 million dollars. Why? It is a simple matter of supply and demand, say brokers from Manhattan.

While there is a national glut of in the $500,000 and up range, there’s a shortage of trophy properties on the market and an increasing number of wealthy foreign buyers from Asia and Europe looking to capitalize on the weak U.S. dollar. Those struggling to pay their monthly mortgage or buy a first home may be envious or appalled, but according to market data from DataQuick, sales for homes costing $5 million and above climbed 31 percent in the first quarter of 2007 compared to the same quarter in 2006. Sales of Manhattan apartments costing $10 million or more tripled in 2007.

And not only the Europeans who have always invested in American properties are the ones purchasing in Manhattan. New buyers are increasingly from Brazil, Russia, India and China. Shlomi Reuveni, executive vice president and senior managing director of Manhattan-based Brown Harris Stevens Select (an affiliate of Christie’s Great Estates) says that the dollar exchange is turning New York into a residential playground for the internationally wealthy” (What Housing Crisis?, 2008).

According to the second-quarter Retail Research Report released by Marcus & Millichap, real estate investment services the retail property market in Manhattan continues to exhibit steady fundamentals.

“Although vacancy has inched up recently, the borough wide rate remains relatively tight at approximately 5%. “While Manhattan remains a top retail investment market nationwide, the borough is specifically favored by buyers who desire storefront properties in heavily trafficked areas,” states Edward Jordan, regional manager of Marcus & Millichap’s Manhattan office.

Among the most significant aspects for the Manhattan Retail Research Report, it was noted that Manhattan employers are expected to create 24,000 jobs this year and builders are expected to complete 200,000 s/ft of retail space, up from 119,000 s/f last year.

A vigorous local economy will stimulate demand for retail space, leading to a 30 basis point drop in vacancy to 4.7% this year, according to the report, which states that rents are expected to rise 4.5% this year to $112.86 per square foot.” (Manhattan remains one of top retail investment markets. 2007).

The article continues stating that areas to watch for intensifying investment activity ahead include Uptown, Downtown and the Far West Side.

About Manhattan Sales: No Market Downturn Yet

“The average sales price for an apartment in Manhattan increased by a hefty 34% in the fourth quarter of 2007, compared to the same period last year. The majority of the gains were concentrated in the luxury market, apartments valued at more than $2.75 million. Despite some shaky U.S. economic conditions, the New York real estate market continues to benefit from wealthy foreign buyers and the increasing pool of Wall Street bonus money”, says Miller Samuel, a leading independent Manhattan appraisal firm (Perry Roth, Manhattan Real State Tips.

Prudential Douglas Elliman also reported that the number of sales increased 65.6 percent the last quarter of 2007 to 3,499 units as compared to the 2,113 units sold in the same quarter on 2006. In similar quarterly reports from Brown Harris Stevens, Halstead Property and the Corcoran Group, all three brokers also reported shrinking inventory (Weee, Manhattan is Doing Fine. 2007).

Market-wide, a Manhattan apartment sold for between a median price of $815,000 and $895,000 during the three months ended September 30 of 2007. The low estimate was reported by Halstead and Brown Harris Stevens, while Prudential Douglas Elliman pegged it at $864,000 (Manhattan Housing Boom Continues. 2007).

Manhattan is apparently full of sellers who think foreign buyers, or bankers who might still get big bonuses, are ready to pay full price for their apartments. These sellers do have recent history on their side. For the first three quarters of 2007 Manhattan apartments over all continued to sell at record prices (Haughney, Christine. Between Byers and Selles a Stalement. 2007).

“Now, brokers say, they see a stalemate developing between buyers and sellers in Manhattan, especially for apartments in the $1 million to $5 million range. Sales in this range made up more than half of the total dollar volume in the market in the third quarter of this year, according to data tracked by Radar Logic.” (Haughney, Christine. Between Byers and Selles a Stalement. 2007).

The same brokers also say it is the buyers in this market who are growing concerned about the impact of the weak national housing market and the effect that Wall Street losses might have on Manhattan apartment prices. So they’re lowering their bidding or stopping their searches altogether until they have more confidence in the market.

Buyers and sellers alike think that it seems that there are more motivated sellers on the market than those who “test” the market to see if they can get their price (inflated usually).

Housing: Big Ticket vs. Big Value

There are always concerns that a lot of people looking for real estate will continue to be priced out, but the media price is only $815,000 which means that half of the sales are below that.

According to a research conducted by CNN Money, “Corcoran Group reported that the average (mean) price of an apartment in Manhattan jumped to $1.41 million, up 14 percent from the same quarter in 2006. Prudential Douglas Elliman reported $1.37 million. Brown Harris Stevens and Halstead reported $1.32 million.

New Yorkers are clearly confident that their homes will retain their value. It was the only market to see price increase and inventory decrease.”.(Lamothe, Keisha. Manhattan House Boom Continues. 2007).

Corcoran also recorded that the highest average condo price of $1.65 million, had a jump of 18 percent from 2006. The media price of a condo hit $1.15 million, up 15 percent from 2006.

“The economy is very strong, and rental prices are high, which makes it a much wiser decision to buy versus rent”, said Pam Liebman, chief executive of the Corcoran Group.(Lamothe, Keisha. Manhattan House Boom Continues. 2007).

Caught in a Toxic Mortgage

Manhattan’s real estate market has been helped by the financial services industry located in the island, which has had four consecutive years of Wall Street bonus increases with the last 2 years at record levels.

A lot of people have been disappointed regarding prices, but it is going to need something a lot significant to happen before prices start to decline.”Even though home buyers nationwide have struggled with a housing slump, the Manhattan market is unique”, states Pam Liebman, from Corcoran. She adds that “the city’s real estate market doesn’t share the rest of the nation’s problems, because the rules for getting an apartment already weed out a number of unqualified buyers.” And New York’s continued economic strength is unlikely to provide any relief. “It will only have a downturn in the market in Manhattan when a large number of people need to sell”, summarized Pam Liebman. (Lamothe, Keisha. Manhattan House Boom Continues. 2007).

Will Manhattan Real Estate Prices Finally drop in 2008?

The Real Estate Market surely remain on the decline in most other parts of the country. Housing starts fell 3.7 percent in November, with construction of single-family homes sliding to the lowest level in more than 16 years.

So what happens in 2008? “Based on the plethora of economic data that I have been watching, says Douglas Heddings, certain segments of the Manhattan market may see the current imbalance of inventory and buyers tip slightly more toward the buyer’s favor. In other segments (i.e. the Classic 6 and 7 markets in prime Upper West and Upper East Side locations) it will remain business as usual.

Overall, it seems that there are a lot of buyers waiting patiently on the sidelines that will jump as soon as they see an opportunity and feel comfortable with the real estate market, the economy, and their own job security going forward.” (Heddings, Douglas, How’s The Manhattan Real Estate Market. 2007).

But here are three reasons, according to Perry Roth, a New York City Real Estate Agent, why the housing slump and shaky U.S. economy may not lead to price decreases for Manhattan real estate in 2008.

- Higher Wall Street Bonuses: although shareholders in the securities industry are having their worst year since 2002, Wall Street is still paying record bonuses, totaling almost $38 billion.

- The money, split among about 186,000 workers at Goldman Sachs Group Inc., Morgan Stanley, Merrill Lynch & Co., Lehman Brothers Holdings Inc. and Bear Stearns Cos., equates to an average of $201,500 per person, according to data compiled by Bloomberg. The five biggest U.S. securities firms paid $36 billion to employees last year.

- This money has to go somewhere. As usual, a good chunk will end up in the real estate market.”

- In 2002, 40% of the wage payroll in Manhattan was generated by the financial sector, broadly defined. This industry has stayed in the city to a surprisingly large degree, instead of moving to office parks in the suburbs. (Glaeser, Edward L. Gyourko, Joseph. Why Is Manhattan So Expensive? 2007.)

- Increased Foreign Investment: the depreciating U.S. dollar continues to encourage foreign investment to snap up new Manhattan properties. Once the dollar recovers, their luxurious condo investments are going to look even better!

- Low Inventory Levels: although properties are taking longer to sell in this market, there has yet to be a flood of new homes hitting the Manhattan real estate market. The limited supply augurs well for prices to hold up quite nicely in the near term. (Roth, Perry. Will Manhattan real estate prices finally drop in 2008?

Manhattan is an Expensive Place

Why is Manhattan So Expensive?

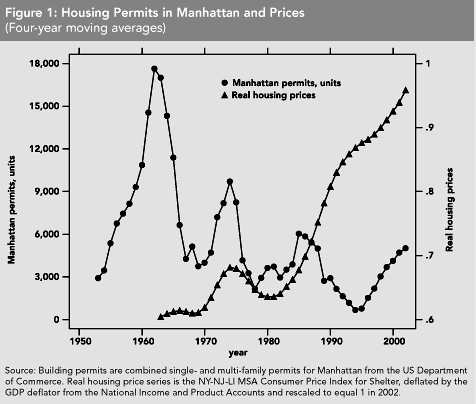

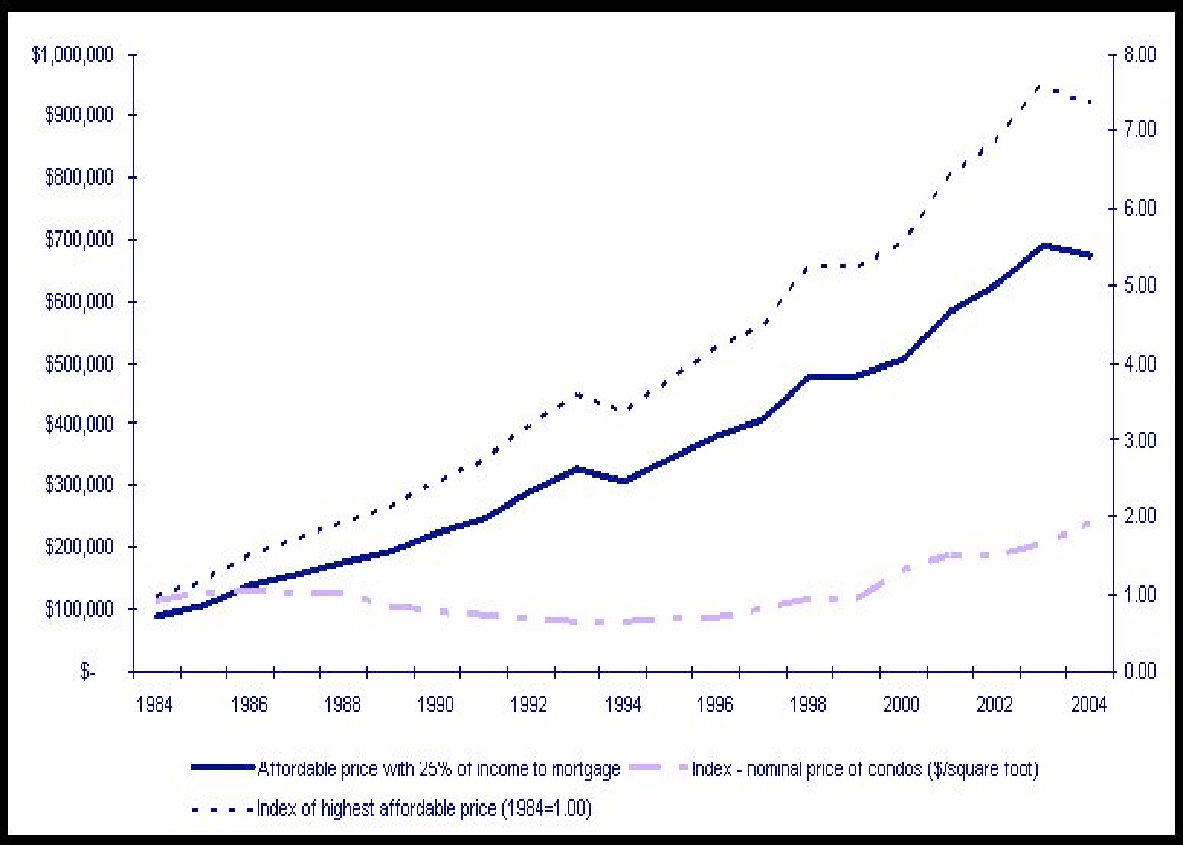

According to Edward L. Glaeser, Professor of Economics at the Harvard University and Joseph Gyourko, Professor of Real Estate and Finance, The Wharton School, University of Pennsylvania, over the past 20 years the price of the apartments in Manhattan has increased twice as fast as the rest of the nation.

However, historically this has not been the case. Between 1950 and 1980 real prices in Manhattan remained relatively flat.

The difference between pre-1980 Manhattan and today is that there has been a marked drop off in the number of new apartments in Manhattan despite a growing economy, robust demand, and escalating prices. By restricting the supply of new apartments, these regulations exert a “zoning tax” on housing prices that is responsible for much of the high cost of housing in Manhattan.

They also state that “the physical cost of construction for high-rise apartment buildings in Manhattan range from $150 to $200 per square foot; prices for both owner-occupied and rental units in Manhattan are two to three times above construction costs; 50% or more of the total price of the median Manhattan condominium—or $200+/ft2—is attributable to the zoning tax. For cooperative units the zoning tax is $110/ft2 for the median unit, and $182/ft2 at the mean. This translates into a tax of 25% and 48%, respectively; half of the condominium owners in our study incur capital costs from the zoning tax ranging from $5,000 to over $25,000 per year.” (Glaeser, Edward L. Gyourko, Joseph. Why Is Manhattan So Expensive? 2007.)

Analysis shows, however, that the cost of current zoning regulations on Manhattan housing prices exceeds way too far any benefits that they might offer. On net, the professors above mentioned study finds that an efficient zoning tax for Manhattan condominiums should be less than 20%. The current zoning tax in Manhattan is 50% on average, roughly three times the social costs generated by new development.

To many, the high price of Manhattan real estate may seem like a permanent feature of the city’s economy.

Strong demand is another reason to why Manhattan is so expensive. The financial services sector is a key driver of demand, and the past two decades have been remarkably good for Wall Street and finance more broadly.

In addition, the New York area has been very attractive for immigrants, and Manhattan undoubtedly has benefited from this. Between 1983 and 1997, there were 1.65 million legal immigrants into the New York metropolitan area, about 20 percent more than the 1983 population throughout the 1990s, there were only 21,000 new units permitted in Manhattan. In contrast, there were over 13,000 new units permitted in Manhattan in 1960 alone.

The difference between New York in 1950 and New York today, or between New York today and the high growth areas of the Sunbelt today, is housing supply.

While the benefits of urban centralization and attractiveness to immigrants help explain the robust demand for Manhattan residences, high prices do not just reflect higher demand. During an earlier era, economic expansion had a much smaller impact on housing prices. Indeed, throughout vast areas of the U.S., housing prices have remained moderate despite massive economic growth. (Glaeser, Edward L. Gyourko, Joseph. Why Is Manhattan So Expensive? 2007.)

In the graphic below, it is possible to see how the housing prices have been increasing way strongly compared to the number of house permits in Manhattan.

Manhattan is the economic machine of New York City. There are 2.3 million workers who come to work in Manhattan. Manhattan’s daytime population gets to 2.874 million, with commuters adding a net 1.337 million people to the population. The influx in the number of people coming to work in Manhattan is of 1.459 million workers and it is the largest of any other county or city in the USA. (Manhattan, 2007).

As it was stated before the most important economic sector of Manhattan is the finance industry, with 280,000 workers. They earned more than half of all the wages paid in the borough. In 2006, those in the Manhattan financial industry earned an average weekly pay about $8,300 (including bonuses), while the average weekly pay was about $2,500. (Manhattan, 2007).

Statistics from the year 2006 showed that the average weekly wages paid to Manhattan workers was $1,453 (excluding bonuses), the highest in the country’s 325 largest counties, and the salary growth of 7.8% was the highest among the ten largest counties. Pay in the borough was 85% higher than the $784 pay earned weekly nationwide and nearly double the amount earned by workers in the outer boroughs. Manhattan’s workforce is overwhelmingly focused on white collar professions, with manufacturing (39,800 workers) and construction (31,600) accounting for a small fraction of the borough’s employment. (Manhattan, 2007).

Below follows a research prepared by Miller Samuel Inc. to Prudential Douglas Elliot to the market overview in Manhattan “during the 1st quarter of 2007:

- The average price per square foot increased 6.6% to $1,070 over the prior year quarter result of $1,004 (7.2% above the prior quarter result of $998).

- The median sales price increased 1.2% to $835,000 over the prior year quarter result of $825,000 (4.5% above the prior quarter result of $799,000).

- The average sales price decreased 0.8% to $1,290,391 over the prior year quarter result of $1,300,928 (5.4% above the prior quarter result of $1,224,840).

Four bedroom units showed the most gain in market share this quarter with an 18% increase in average sales price over the prior quarter.

Co-op Market

- The average sales price of a co-op this quarter was $1,132,325, up 3.6% from last year at this time and up 8.1% from the prior quarter. Average price per square foot was $975, an increase of 11.8% from the previous quarter.

- Inventory levels for co-ops fell 26.2% to 2,929 units as compared to the prior year quarter total of 3,971 units. Co-op listings are comprised of nearly all re-sales, with only about 2.4% of new co-op development added to the housing stock.

Condo Market

- The average sales price of a condo this quarter was $1,454,768, down 1.8% from last year at this time and down 2.11% from the prior quarter.

- Average price per square foot and median sales price showed 9.8% and 1.6% gains respectively from the prior year quarter.

- Inventory levels for condos totaled 2,994 units, up 4% from the prior year quarter total of 2,933 units. New development accounted for 29.9% of condo inventory this quarter.

Luxury Market

- Upper 10% of all co-op and condo sales.

- The average sales price of a luxury apartment this quarter was $4,641,861, up 2.1% from last year at this time and up 7.3% from the prior year quarter. Average price per square foot and median sales price showed 13% and 0.7% gains respectively from the prior year quarter.

Loft Market (co-op and condo sales)

The average sales price of a loft apartment this quarter was a record $2,067,133, up 13.2% from last year at this time and up 11.9% from the prior quarter. Average price per square foot and median sales price showed 16.5% and 10.9% gains respectively from the prior year quarter.

(Manhattan Residential Market Enters 2007 with Surge in Sales Volume, Declining Inventory, Rising Prices and Shorter Time on Market – Strong Juxtaposition Against National Real Estate Trends. 2007).

In the year 2006 the market triggers rise also in Manhattan rental rates for national and international retailers.

New players and the expansion of existing brands lowered vacancies and triggered a rise in asking rental rates in the majority of the Manhattan retail submarkets, including Madison, Fifth Avenue, Soho and Lower Manhattan.

Major advances were made in Lower Manhattan during the first half of the year, as activity accelerated within and around the Financial District, as new brands entered the market.

Positive news on the development front at the World Trade Center site, strong leasing activity at the newly constructed 7 World Trade Center and the start of construction at Goldman Sachs new headquarters building were all contributing factors to a brighter retailing picture for Lower Manhattan. (Bouyant market triggers rise in Manhattan rental rates.(property rent).

The emergence of luxury retail, coupled with expected population growth to nearly 50,000 affluent Lower Manhattan residents by the end of the decade, has fired up interest.

Landlords have been standing by for the past five years, and the long wait may now be over as the pace of leasing and rental value. the amount which would be paid for rental of similar property in the same condition in the same area. Evidence of rental value becomes important in lawsuits in which loss of use of real property or equipment is an issue, and the rental value is the “measure of damages.

A variety of retailers offering an expanded menu of product and services are expected to enter the area in order to cater to the impending influx of residents, tourists and office workers.

Vacancy on Fifth Avenue below 49th Street dropped three percent from last quarter to 10.6% at midyear, as notable retailers, including H&M and Ann Taylor, entered the market.

H&M leased 24,500 s/f of retail space at 505 Fifth Ave., the brand new office tower located on the corner of 42nd Street and Fifth Avenue, while Ann Taylor took 10,000 s/f at 600 Fifth Ave.

Strong demand led to increased rental rates, with landlords asking an average of $215 per square foot for ground floor space, up from $204 at the first quarter.

Several significant transactions contributed to the decline in vacancy, as new companies entered the market.

Spring Street has become one of the tightest blocks in Soho. Von Dutch and the trendy footwear retailer, Crocs, grabbed two of the few remaining spaces there during the second quarter, adding to the balance of trendy, luxury and mainstream retailers found on the block.

The increased activity on Spring Street also caused a rental hike on the street, with average ground floor rents up $62 per square foot from the first quarter.

Of the few available retail units on Madison Avenue there are few that are less than 1,500 s/f, which led to a spike in rental rates for smaller-format stores in the second quarter.

Average asking ground rents increased $10 per square foot to $885 per square foot at midyear. However, we’ve seen instances in which tenants have paid more than $1,000 per square foot to secure prime locations on Madison Avenue.

The activity on the Upper Westside was similar, as vacancy in the area declined to 4.6%, down from 6.5% at the first quarter, and asking rents jumped to $286 per square foot for ground floor units. However, new developments, notably 2075 Broad way, 1889 Broadway and 1880 Broadway, still offer great opportunities for big-box tenants seeking a new or expanded Manhattan retail presence.

Manhattan Real State

No Real Estate Crisis in Manhattan

The normal physics of real estate does not hold sway a place so special, those who reside there are seemingly inoculated from the everyday concerns of mere mortals.

The housing bubble may burst; the credit may crunch; the mortgage industry may go so far south that Bolivia would be akin to the North Pole. And yet, on this special island, those charmed through luck, perseverance or family fortune can go about their lives all but oblivious to the calamity of the outside world.

According to the Times, “in the area from 56th to 59th between Madison and Park, average household income increased almost 700 percent between 1980 and 2000.” Think that might keep real estate prices high?

It is not only possible, but likely, one could spy an 18 year old emerge from a gleaming 5 million dollar one bedroom condo in the former Meat Packing district—now the “in place” to live and play in Manhattan for the under 40 crowd–affording his new abode courtesy of either wealthy parents or foreign money or both. After all, there are not many 18 year olds who can afford 5 million dollar condos on their own dime.

For real estate developers, this is great. No shortage of cash and credit bloated customers in line for Manhattan properties. Of course, this does tend to drive up costs for those who actually live on Earth as opposed to floating above it. No matter, though. What matters is, Manhattan, at the moment, is like no other place in the United States–on this charmed isle, apples fall upward once detached from trees; water flows uphill to the surprise of no one and the expectation of everyone; and the mortgage/housing/credit “crisis” is nothing more than a burp for which a bit of Alka Seltzer will set all right.

Manhattan Real Estate Market

The surprising surge in buying activity during the last two weeks of 2006, usually quite slow due to the holidays, has carried over with a vengeance in early 2007. Open houses were packed with hungry buyers this past weekend. In the meantime, the fourth quarter sales numbers have been released. According to Miller Samuel, a leading independent appraisal firm, average sales prices in Manhattan increased by a respectable 3.2% in the fourth quarter of 2006, compared to the same period last year.

New York State officials estimate that between 2002 and 2005, reported income from capital gains nearly tripled. Capital gains in 2005 likely exceeded $70 billion, delivering more than $4 billion in tax revenue for the state. More importantly, nearly half of the increases over the past two years have been derived from the Manhattan real estate market. The state’s budget division estimates that in 2004 and 2005, the real estate sector contributed a total of $1.4 billion in capital gains taxes. Consequently, there is a good reason why Manhattan home sellers are happy people!

Manhattan Real Estate Still Booming

According to New York Times article Summer is typically a time when the housing market takes a siesta from the spring selling season, but that wasn’t the case in Manhattan this year — according to a report from New York real-estate brokerage Brown Harris Stevens.

The borough’s market appears to be relatively unaffected by the U.S.’s credit and housing-market woes..

Condos hit a record median price of just over $1 million, up 20% from third quarter 2006, and apartment sales reached a record median price of $815,000, an increase of 12% from a year ago, Brown Harris Stevens says. Sales of homes priced above $10 million shot up 118% in the third quarter from the same period a year earlier.

However, many of the sales measured in Brown Harris Stevens’ report closed before the summer subprime meltdown.

All types of apartments from small units in less desirable areas to luxury homes on the Upper East Side saw price increases, with four-bedroom apartments on the Upper East Side selling for an average of $6.6 million, an increase of 17% from third quarter 2006. Four-bedroom condos averaged just over $7.23 million, according to the Brown Harris Stevens report.

There are signs that the slowdown has settled into sections of Brooklyn and Queens, however, where foreclosure auctions were up 64% from last year, according to the Times.

And Bloomberg is reporting that the most-expensive metropolitan areas in New York, California and Washington, D.C., will see home prices drop by as much as 11% within the next three and one-half years. (Praying To the Patron Saint of Real Estate, 2007)

Manhattan real estate continues to be the strongest

After looking at The London property echo Manhattan today and looking at another reverberation in the echo of these vigorous real estate markets. Josh Barbanel wrote in the New York Times about the most recent indication that the Manhattan marketplace is still alive and well in a piece simply titled Manhattan Market Remains Stable. He writes, “Last month, the number of closed sales just about matched the number closed in November 2006, and prices were considerably higher, but roughly flat compared with the prices in the previous quarter, according to a review of sales records filed with the city.”. There have been a fairly consistent number of deals being made and inventory in any particular property size is pretty slim in any one neighborhood, causing a modest, but equally steady rise in prices.

Sellers, who really want to shoot themselves in the foot, can do so by simply ignoring the most recent comparable property sales and overreaching for the highest, most unrealistic pricing advertised by a competing property. Asking prices are almost irrelevant in this market. Recently sold and closed data are the most important measurements. There is an agent who received 30 bids on a Greenwich Village co-op apartment which was under priced to attract a number of qualified candidates to pass some stringent Co-op Board requirements. The perception was that a “deal” existed. The property was quickly bid up to its true market value.

In this more price sensitive market, the mindset that says price higher because you can only negotiate downward, is destined to do so. Using attractive pricing to stand out from the crowd will still get an enthusiastic response if the home is exposed widely. The buyers are out there, waiting and wondering where it is all going, give them a reason to come see your property, and try to buy it.( Peter Comitini foreign buyers in Manhattan 2008)

New York’s Real Estate Boom

The New York property market has remained aloof to troubles in the rest of the country. A limited amount of housing, especially in Manhattan, has kept prices stable while the boom on Wall Street has propelled the market forward in more desirable residential areas. But even a limited supply of housing does not explain the $1.5 million two-bedroom co-op or condo. Wall Street salaries and record bonuses have contributed to the dizzying levels witnessed over the last five years. The spillover has affected all levels of housing in the metropolitan area, most severely in Manhattan.

A similar effect has occurred in London, where the financial services industry has triggered a record boom, sending property values to levels that make Manhattan actually seem sensible. But the run-ups can only be sustained if Wall Street earnings continue to increase at record levels. The current market crisis suggests that the boom is over.

Wall Street salaries and bonuses are only part of the story behind the giddy housing market. Many brokers and bankers benefit from generous mortgage packages provided by their employers. While those packages differ, they need to continue if the market is to remain robust. Without them, trouble will appear quickly.

And the spillover effect here should not be underestimated. Wall Street traditionally contributes about 20 to 25 percent of New York City’s economic output. (No wonder Mayor Michael Bloomberg worried about the U.S. markets losing business to London and other overseas markets.) Jobs are at stake, and less employment on Wall Street has consequences for the city.

The phenomenon has happened before. After the 1987 stock market rout, the market for one and two bedroom condos and co-ops in Manhattan was hard hit, with prices falling significantly. It took several years before they recovered and began an upward spiral fueled by low mortgage rates. Apartments of that size were frequently bought by younger traders and investment bankers – the first casualties of securities firms feeling the pinch of losses and lower revenues. That market problem also caused many securities firms to trim back their staffs, contributing to the recession that followed.

The problem lasted a few years and was felt across the board in the real estate market. The popular joke circulating at the time was that pigeons were leaving the only deposit on BMWs in Manhattan. Today the problem is a bit more complicated, just like the markets themselves.

So far, the major damage has been in the market for subprime mortgages and all of those who make a living from it – from investment bankers to securities lawyers and accountants. The junk bond market has also felt the pain as investors who once bought every new security in sight quickly readjust their risk tolerances. These bonds have been among the most profitable lines of business on Wall Street over the last five years. It is no coincidence that during the same period the amount of mortgage debt outstanding in the U.S. has exploded exponentially as well.

Recent government statistics show that Wall Street and Fairfield, Connecticut, have income levels 10 times the national average. A week or two’s salary in those places can easily equal a year’s salary in other parts of the country where people do not work in the financial services industry. That multiple is about to fall due to the current crisis and the real estate market undoubtedly will feel the pinch. Whether the higher end of the market is affected remains to be seen, because its values are attainable by only relatively few investment bankers, traders and hedge fund managers.

After the 1929 crash, a photo of a Wall Streeter trying to sell a car with a sign requesting $20 has become an enduring memory. Real estate brokers tend to be a bit subtler, but the fire sale prices will soon start appearing in Manhattan as the fall in prices whipsaws on many who helped create the problem in the first place. (Charles Geisst will sub-prime crisis reach Manhattan?? 2007).

Mortgage Mess Not Affecting Manhattan

If you own or are looking to buy an apartment in New York City, you have nothing to worry about. To buy an apartment in Manhattan you either need to put at least 10% (condo) or 20% (coop) down to even sign a contract. More importantly, it is far more difficult to pass a Manhattan coop board than to qualify for a mortgage. There would be no mortgage scandal at all if other cities and states even closely approached the stringent New York City requirements to purchase a home. (Mortgage Requirements Tightening, 2007)

Manhattan Real Estate Expected to Get Push

If you are looking to buy a luxury condo in Manhattan in the next few months, you may want to get started now before Wall Street cuts their bonus checks. The influx of significant bonus dollars (expected to be 20–25 percent higher than last years record payouts) has real estate agents across Manhattan salivating to sell in the market for a shiny new Manhattan apartment? You might not want to wait until spring. An analysis by The New York Observer found that the median sale price for Manhattan co-ops and condos tends to spike in the second quarter of the year — not long after Wall Street’s top workers cash their bonus checks.

The cause-and-effect is not entirely clear, the Observer notes. Other factors, such as a post-winter pickup in buyer interest and home purchases by recent college graduates, might be at work, the newspaper wrote. (Which made us wonder: What kind of recent college grad can afford a Manhattan co-op these days?)

One thing is not in dispute: Bonuses are expected to be big this year. One consulting firm reports that investment bankers are likely to see their end-of-year bonuses jump 20 percent to 25 percent this year from 2005. For managing directors at top investment banks, the increases are expected to be even higher. The potential windfall has purveyors of luxury goods — high-end real estate brokers among them hoping to get a piece.( Manhattan Real Estate Expected to Get Push From “Bonus Season”, 2006).

Manhattan’s Office Market Had a Good Year in 2005

Manhattan’s commercial real-estate market has made a comeback, less than five years after the tech bust and the Sept. 11, 2001, attacks depressed demand for space in the glittering towers of one of the world’s most-recognizable skylines.

The U.S.’s financial capital and the economic engine behind the country’s most-populous city of 8.1 million people, the island of Manhattan was home to six out of the country’s 10 biggest office transactions by dollar value this year. Average prices for office properties rose to $403 a square foot for the year through October, more than twice the national level of $190, according to Real Capital Analytics in New York.

The region’s improving economy, rising office-rental rates and the cachet of owning a piece of the Big Apple stoked investor interest even as prices rose and the number of supersize properties in play declined, said Darcy Stacom, executive vice president for CB Richard Ellis in New York..

The sale of the MetLife building that towers above Park Avenue became the country’s biggest office transaction this year when Tishman Speyer Properties purchased the building for $1.7 billion in May, said Dan Fasulo of Real Capital. But investors also paid up for lower-profile buildings in outlying business districts, such as a former cookie factory-turned-office building in the city’s gentrifying meatpacking district that sold for $300 million.

Though population growth is slowing, New York remains one of the country’s densest cities, with more than 26,000 people a square mile, and that density has pushed demand for places to work, shop and live at the heart of the land-constrained island.

Manhattan’s office, retail and apartment markets were among the country’s strongest and priciest during the third quarter, with rising and above-average rents and falling vacancy rates as the metro area’s job growth rose to 1.2% for the 12 months ended in September, just below the national average of 1.6%, according to consulting firm Economy.com and Property & Portfolio Research Inc, a Boston-based real estate research firm.

But just how much more New Yorkers can afford to pay for big-city life is unclear. In 2004, the metro area’s cost of living was 32% above the national average, while the median household income of $49,991 was only 11.6% above average, according to Economy.com.

Manhattan remains something of a tale of two office markets. The proposed redevelopment of the financial district downtown will soon bring new space to a submarket with average third-quarter rents about $20 a square foot below northern midtown rates, and vacancy rates several percentage points higher than midtown, PPR said. Next year 7 World Trade Center, a new 52-story tower, is scheduled to open near the pit where the Twin Towers once stood, and Goldman Sachs Group Inc. broke ground last month on its new 43-story world headquarters nearby in Battery Park City.

the crowds that usher in the New Year on Times Square this weekend will be surrounded by some of the nation’s richest commercial real estate. Office vacancies in the upper end of midtown fell to 10.4% in the third quarter, nearly half the national rate, and space fetched average rates of $52.69 per square foot in the third quarter, the highest average reported in the 54 major U.S. markets surveyed by PPR.(Maura Webber Sadovi Special to The Wall Street Journal Online “Manhattan’s Office Market Had a Good Year in 2005”).

Manhattan development

Retention and Growth of Manhattan

It is noteworthy that 100% of the employers surveyed are not considering leaving the Manhattan area. This is not to say that none of them have ever considered it or that they are not being recruited to relocate…but it does generally indicate that the business climate and attractiveness of the Manhattan area as a place to operate a business remains strong.

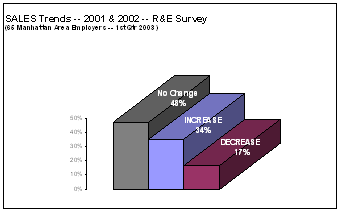

Sales and revenue

Despite an erratic national economy, more than 80% of the employers surveyed indicated that they had seen stable or increasing sales over the last two years.

Of the 11 firms that saw a sales decrease, the hardest hit being several in the manufacturing sector where the average sales decline was around 20%.

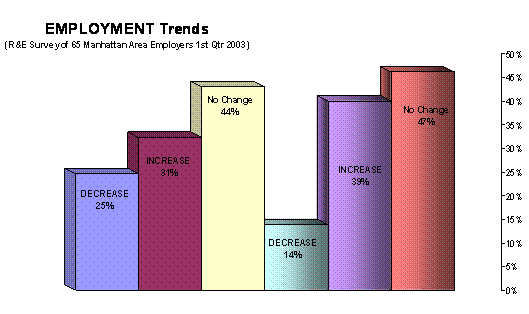

Employment

Past and future employment trends were somewhat stable with nearly half of the employers recording “no change” in employee numbers.

Future employment potential does appear a bit stronger with 40% of employers indicating they would be hiring additional employees in the next two years – compared to only 14% who intend to decrease their workforce.

Of the employers indicating they were planning to DECREASE their workforce, the average decrease in employee numbers is projected at 6%.

In contrast, employers reporting an expected INCREASE in workforce levels anticipate hiring around 27% more employees on average.

The annual employee initiated turnover rate averaged 23% when including all 65 employers. Turnover ranged from 1-100% with the highest turnover rate occurring in the service sector and the lowest rate in the manufacturing and construction sector. A frequently cited reason for employee turnover related to physical relocation needs of a military or university spouse.

Lower Manhattan Employment Recovery

- Employment in Lower Manhattan shows signs of recovery. Between the third quarter of 2003 and the third quarter of 2004, Lower Manhattan private employment increased by 20,300.5.

- Employment increased by 5,700 in leisure and hospitality5,100 in finance, insurance, and real estate, and 3,200 in information.

Employment is much lower than the 2001 level. In the third quarter of 2004, Lower Manhattan private employment was 67,400 lower than its level in the third quarter of 2000. This may be compared to the third quarter of 2003, when Lower Manhattan private employment was 87,700 lower than the third quarter of 2000.

- Lower Manhattan wage growth also shows signs of recovery..

- The employment growth recovery in Lower Manhattan and Manhattan as a whole appear to be occurring at the same time.

A weak dollar is also keeping the local market strong by attracting foreign investors in city real estate. Then, there is the age-old factor of supply and demand. Even with all the construction going on, you just can’t build housing fast enough in this city. A recent report found prices were highest in Manhattan, where the average home sold for $1.33 million, or around $1,176 per square foot. The average cost of a home went up in every borough except Staten Island, which saw a 2.8 percent drop.

Business Climate

Employers were surveyed in the following four areas…

- advantages and disadvantages of operating their business in the Manhattan area…

- labor skills needed and ease of obtaining workforce with those skills…

- workforce recruitment avenues and issues…and

- general perspectives related to the Manhattan area business climate.

Advantages

The following areas were mentioned by more than half of the respondents as the primary advantages of operating their organization in the Manhattan area:

- WORKFORCE … stable, educated, plentiful and diverse sources (K-State/MATC/Fort Riley/surrounding counties), affordable, skilled, strong work ethic

- K-STATE resources … accessible expertise in diverse areas (engineering, marketing, financial, etc…)… AMI/MAMTC right here for leading-edge manufacturing assistance

- EDUCATION … primary, secondary, technical and higher ed… in general education resources excellent overall

- CENTRAL LOCATION … trucking distribution specifically

- HIGHWAYS … strong 4-lane highway system with quick access to Interstate

- STEADY ECONOMY … strong, stable government sector absorbs large economic “swings” seen elsewhere

- QUALITY OF LIFE … “simply like living here”…nice people… cultural offerings good…”small town with big city amenities”… Big 12 sports… beautiful geography and seasonal changes

Economic Theories of Housing Development

Why have developers not built new apartments in Manhattan? there are two candidate theories to explain this behavior. First, is the classic economic theory that emphasizes the role of construction costs and land prices. According to this perspective, the constraints on development are available land and the physical cost of construction. If a fundamental scarcity of land or a technical constraint pertaining to building tall structures caused an increase in production costs, then new units would not generate enough profit to warrant the risk of bringing them to market.

The second theory is the regulation model of housing markets. According to this framework, restrictions on supply are not natural, but are the result of government policies that make it extremely difficult to build new homes. From this perspective, there is not a fundamental scarcity driving up prices, but a man-made one. While limits on construction can take many forms, we will use the general term “zoning” to refer to all such limits whether they involve actual zoning laws or other regulatory restrictions on supply.

Manhattan is an island. Is there a fundamental scarcity of buildable space that has developed over time that, when coupled with strong recent demand, is responsible for today’s high prices? This is unlikely. Even if vacant land is rare, new units can be supplied by ‘building up’.

This possibility leads us to a simple test to distinguish between competitive and regulated housing market values—namely, whether price is equal to the marginal cost of production. One of the strongest implications of the classic theory (indeed, of any economic theory) is that in an open, competitive, unregulated market, the price of a commodity will not be greater than the marginal cost of producing that commodity. If such a gap did exist, then suppliers would face strong incentives to produce more of the commodity in question. Competition among suppliers would ensure that prices are pushed down to marginal costs. This logic holds as strongly for Manhattan housing as it does for hot dogs.

Given the difficulties of accurately measuring or estimating the value of land, this makes Manhattan, a market dominated by multi-story residential buildings, an excellent laboratory for our analysis. Because additional land is not required on the margin, the production costs of an extra housing unit in this market can be well approximated by the physical costs of adding an extra floor of space. Land shortages may limit certain types of development in Manhattan, but builders always can add one extra story if new housing units are needed.

Thus, our primary test to distinguish between the classic free market model and the regulation model is to compare the price of Manhattan housing units with construction costs, as reflected in the physical costs of building up. (2003 Employer Retention & Expansion Survey Summary)

Manhattan Home Prices Soaring to an Average 1.37 Million Dollars

Manhattan home prices and volume soared in the summer month as inventory shrunk during what is normally the slow season. With most of the country witnessing falling or stagnant prices and exploding inventory Manhattan is providing to be the outlier.

Others are concerned that the velocity of the market occurred before the credit crunch. Manhattan properties typically have a long closing window as co-op boards have to approve sales in their buildings. Jonathan Miller is quoted as saying that the fall volume may slow down when sales start being effected by credit concerns.

What Manhattan has going for it though is that the inventory of available properties is way down at just over 5,200 units. With inventory constraints buyers are forced to move quickly. If inventory starts to creep up then buyers can be more picky as we have seen in the rest of the country and the velocity of the Manhattan real estate market will slow down.

On average, buyers spent $1.37 million for a Manhattan apartment, a 6.3 percent increase from the corresponding period last year, according to one report, by Prudential Douglas Elliman. The number of apartments on the market fell by nearly a third, to 5,204, in the last quarter, compared with 7,623 a year earlier, the report said.

These numbers indicate that the real estate market was even stronger in the summer, traditionally a slower season for real estate, than it was in the spring, when prices rose in some segments of the market like new condominiums and the largest apartments but not all.

Two brokerage firms Brown Harris Stevens and Halstead Property said in their reports that prices had risen for nearly every type of apartment in almost every neighborhood of Manhattan, from bare-bones studios in the borough’s northernmost reaches to luxurious four-bedroom apartments on the Upper East Side. percent last quarter for apartments and town houses. (real estate indicators “Manhattan Home Prices Soaring to an Average 1.37 Million Dollars “, 2007).

Retails

Economic uncertainty rattles Manhattan’s retail market

Manhattan’s retail real estate market certainly enjoyed a strong performance in 2000, with increased interest from both national and international retail tenants driving rents higher and vacancies lower. However, considering the recent abundance of “doom and gloom” forecasts for the national economy in light of poor year-end retail sales; the stock market’s nosedive; the bankruptcy filings of a number of retailers; poor corporate earnings; a spate of layoffs and a bevy of dot-com failures, the forecast for the retail market is harder to predict moving forward.

Certainly the negative economic news has had a significant psychological effect on consumers and that has translated into a marked shift in the real estate market. Although the change is most pronounced in the office market, where there has been a glut of sublease space put back on the market in the first quarter and a number of leasing deals scrapped from the bargaining tables, the retail market is also starting to feel the fall out.

Among the bad news recently was that Guess is giving up stores, theater chains will abandon many sites, Labels for Less, Hit or Miss, Lechters and others have filed Chapter 11 and The Gap is not renewing some leases. Meanwhile, H&M is here to stay and both Fiorucci and Benetton are back

Retailers

They are being cautious and many have adopted a “wait and see attitude” but for the most part, deals that were signed a few months ago are still being executed and retailers continue to seek new space. The difference is that retail space is not renting as quickly as it did six months ago. Tenants are not willing to stretch as far to make a deal and landlords are being more flexible. Retailers are willing to pay fair prices for expansion space but the auctions we saw in the past are just that, a thing of the past.

I am finding that most of Manhattan’s major retail areas, such as Madison, 57th Street, Fifth Avenue, Soho, Flatiron, Upper West Side and Upper East Side, seem to be unaffected. The luxury retailers still have a big appetite for retail space in high-traffic areas and rents remain strong. Many of the “high end” European retailers took a breather waiting to see what would happen after the New Year and they’re now renewing their search but not as feverishly as before. The luxury brand names continue to want a presence in New York. Themed retailing is being replaced by fashion tenants in the Plaza District with names like LVMH (Vuitton, Christian Dior and now DeBeers diamonds), Hermes, Hugo Boss, Escada and Jill Sanders having leased space on Fifth Avenue, Madison Avenue or 57th Street.

The national chains that rely on proformas to determine ceilings on rent based on expected sales volumes couldn’t compete in the past. Now they’re ready to do deals with landlords who are offering more realistic rents and valuing credit and stability.

Manhattan Retail Real Estate Prices Jump

Manhattan real estate rental prices jumped significantly during the past year, increasing 26% to $133 a square foot, according to a report released this week by the Real Estate Board of New York.

Every neighborhood surveyed in the report showed an increase in asking rents for retail space compared to last year.

The president of REBNY, Steven Spinola, said the increases show that the city’s retail market remains healthy. “This is a strong indication of continuing retail market growth and the strength of the city’s economy,” he said.

The shopping corridor on Broadway between 42nd and 47th streets had the single largest percentage increase, surging 107% to $797 a square foot of ground floor space. The Times Square shopping area also experienced more than a doubling of its rental fees. The vice president of real estate advisory firm Lansco, Robin Abrams, said that one of the main causes of the rise in prices is the eagerness of European retailers — particularly high-end jewelry and clothing stores — to increase the exposure of their brands by relocating to New York city’s high-profile shopping districts.

“With the dollar as low as it is, this is a very good time for international retailers to be coming in,” she said. The strength of the euro is giving European retailers an edge over their American counterparts when it comes to winning bids on prime retail space.

“They’ve been jockeying for space lately, and that has driven rent prices up,” Ms. Abrams said. The highest average ground floor prices $1250 a square foot were on Fifth Avenue between 49th and 59th streets, home to stores such as Versace, Fortunoff, and Prada.( TRAVIS PANTIN “Manhattan Retail Real Estate Prices Jump 26% “.

Average price of Manhattan apartments up

The average price of a Manhattan apartment rose to more than $1.14 million in the fourth quarter of 2006, up 5 percent compared with the same period a year earlier, according to two new real estate reports.

The median price for the apartments was $760,000, a new record, beating the figure from 2005 by 9 percent, according to the reports released Wednesday.

The median value is the price at which half the sales are higher and half are lower. It is an important indicator of a market’s stability, said Greg Heym, who authored the reports for two Manhattan real estate firms, Brown Harris Stevens and Halstead Property. Heym is the chief economist for Terra Holdings, which owns both firms.

Heym, who also serves on the city’s Economic Advisory Panel, said Manhattan is experiencing a more balanced market, meaning that price increases have become more sustainable — unlike in 2004, when double-digit gains were common.

The reports also reflect the New York market’s resilience in the face of a nationwide housing slump.

One of the biggest price surges in Manhattan took place on the Upper West Side, where four-bedroom and larger apartments cost an average of $5.7 million, or a 48 percent increase over the fourth quarter of 2005.

The average price of an apartment with three or more bedrooms on the Upper East Side was about $3.8 million, up 22 percent.

The average price per square foot in Manhattan rose to a new high of $1,050 in the fourth quarter, up 7 percent from $979 a year earlier.

“The market for luxury apartments in Manhattan remains very strong, and we’re continuing to see steady growth in this sector,” said Hall F. Willkie, president of Brown Harris Stevens.

The average sale price of new condominiums remained relatively flat at $1.3 million, about $13,000 less than in the fourth quarter of 2005. Cooperative apartments in Manhattan saw their average sale price rise 3 percent to reach $953,120

Market for Manhattan apartments remained strong in 2006 despite national dip

While home prices plunged elsewhere in the United States last year, Manhattan’s real estate market was spared a fire-sale decline in the last three months of 2006, new reports show.

The average price of a Manhattan apartment rose to more than $1.14 million (€860,000) in the fourth quarter of 2005.

The median price for the apartments was a record $760,000 (€573,000), beating the figure from 2005 by 9 percent, said the reports. The median, a common real-estate market measure, is the price at which half the sales are higher and half are lower.

With solid job growth in the city, a healthy economy and low interest rates, prices are unlikely to soften in 2007, said Greg Heym, who authored the reports for Manhattan real estate firms Brown Harris Stevens and Halstead Property.

“It looks like demand will remain pretty strong,” said Heym, the chief economist for Terra Holdings, which owns both firms. He added that record Wall Street bonuses, expected to top nearly $24 billion (€18 billion), also should buoy the housing market.

Manhattan is experiencing a more balanced market, meaning that price increases have become more sustainable unlike in 2004, when double-digit gains were common.

One of the biggest price surges in Manhattan took place on the Upper West Side, where four-bedroom and larger apartments cost an average of $5.7 million (€4.3 million), or a 48 percent increase over the fourth quarter from 2005.

The average price per square foot in Manhattan rose to a new high of $1,050, or €8,800 per square meter..( Adam Goldman “Market for Manhattan apartments remained strong in 2006”, 2007).

The strong of Manhattan

Real estate prices in Manhattan have increased strongly in recent years

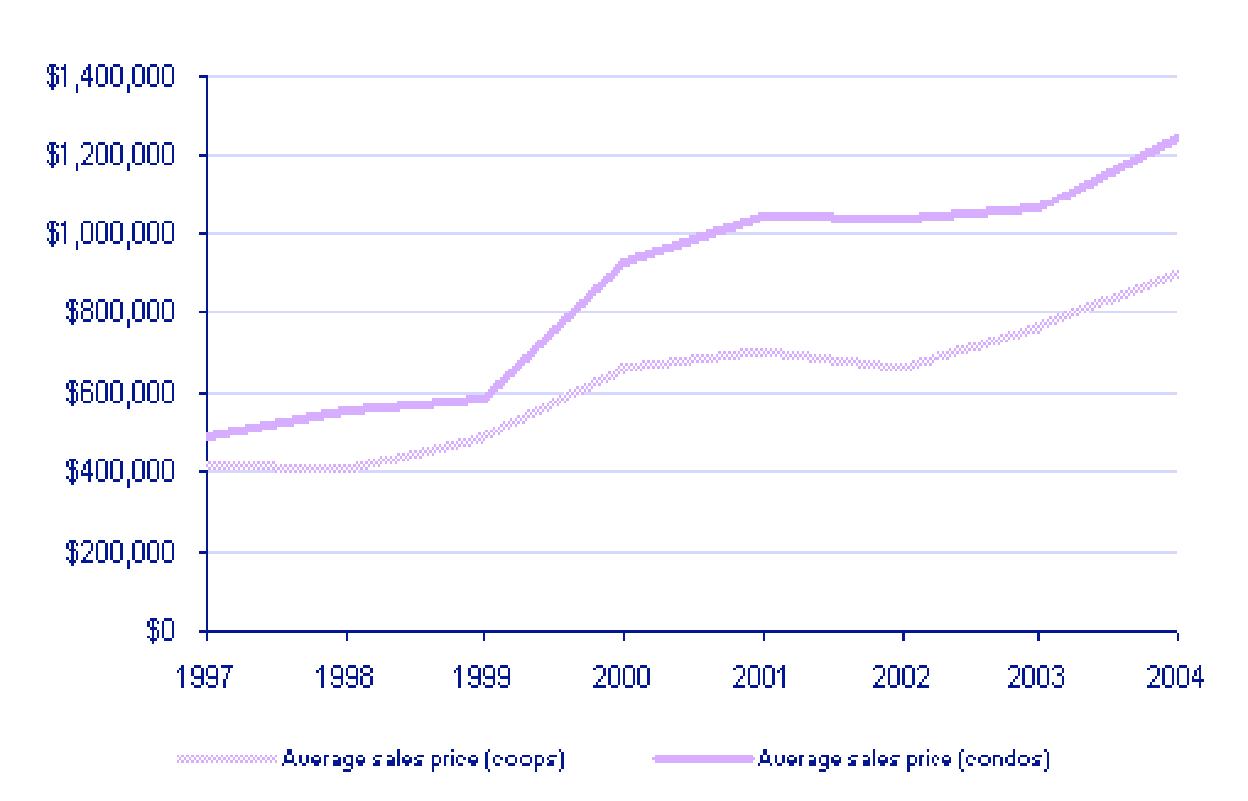

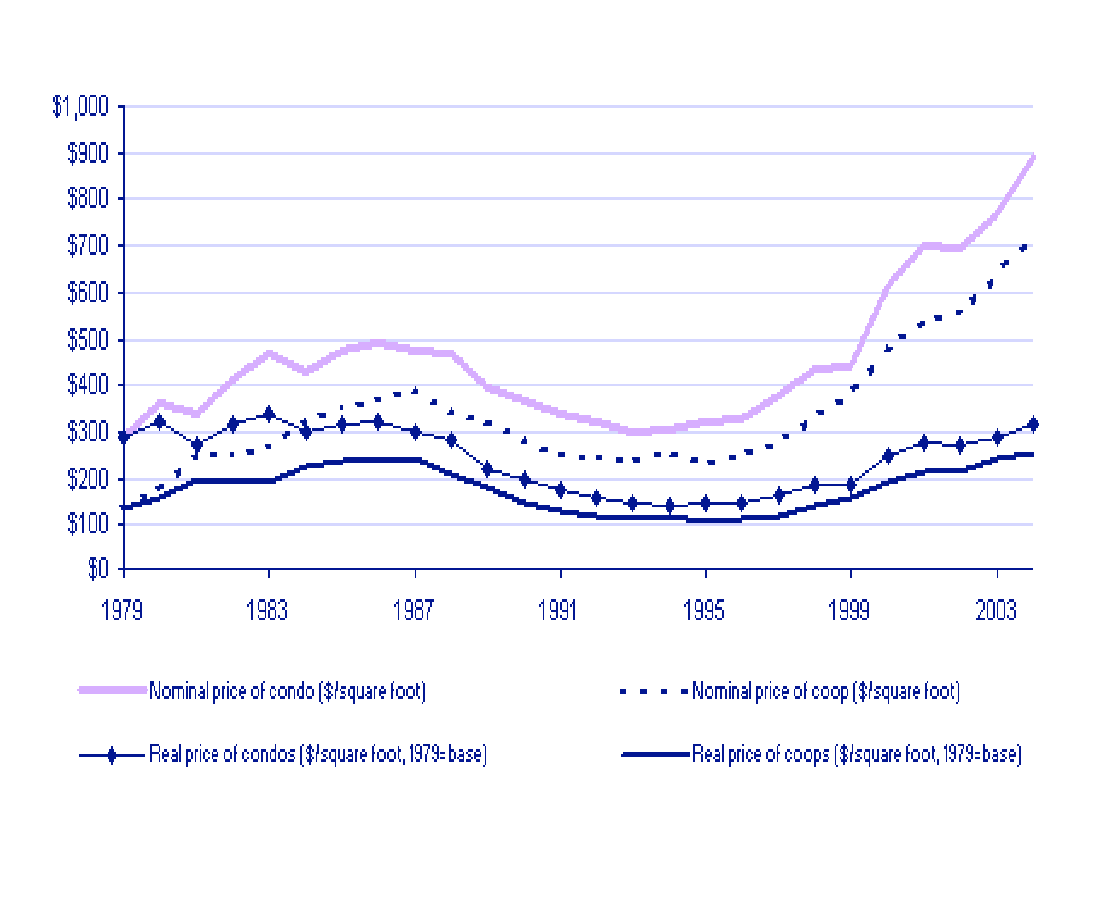

One comparison brings these findings to life: in 1981 – when Manhattan crime rates were close to their peak, the city was near bankruptcy, the economy was in recession, the population level was at a low not seen since the 1880s, and the mortgage rate reached 16% – the average selling price of a condo was $339 per square foot.

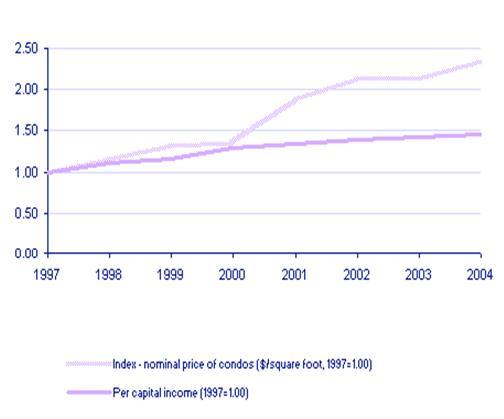

Manhattan’s population has since grown 8.5%, prices generally have risen 126%, personal income is up 377% and mortgage rates are close to multi-decade lows, yet average square foot condo prices are up only 163% to $890 (co-ops are up 189%). Had real estate prices merely kept pace with personal income over this period they would be over double current levels. Prices still look to be recovering from declines in the 1990s.

Using moderate projections of personal income growth over the next five years, and assuming a rise in interest rates of 2-3 percentage points, we expect real estate prices to rise around 10% per year for the three years to 2007 and between 5%-8% to 2010. This would put square foot condo prices at $1,185 in 2007 and as high

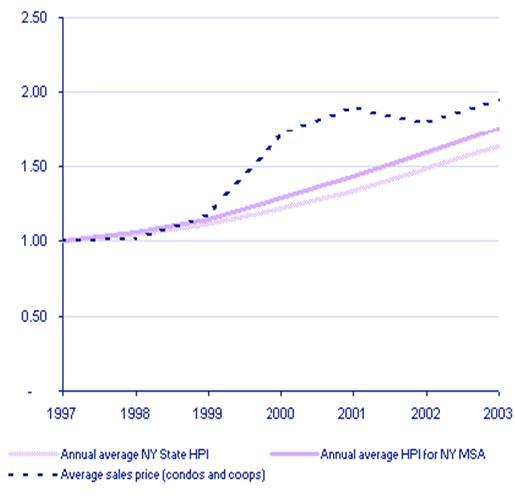

as $1,490 in 2010 Average sales prices and square foot prices of co-ops and condos in Manhattan have risen strongly and consistently since 1997, more than doubling over this seven-year period. Chart 2 graphs both these measures over this time. While the rate of increase fell even before 9/11 and the economic recession, the overall picture is of strength.

Average sales price and average price per square foot in Manhattan

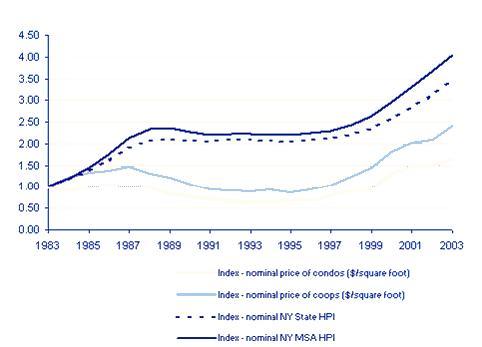

Manhattan prices have recently risen faster than those in neighboring areas Since about 1997, real estate prices in Manhattan have risen faster than those in the surrounding metropolitan area, or New York State Since we use square foot price data, which does not exist for the surrounding area, it is difficult to get a like-for-like comparison.

Instead, we use the House Price Index for NY State and the NY Metropolitan Statistical Area (MSA) as compiled by the OFHEO.

Manhattan real estate prices are emerging from a trough, and over two decades have lagged that elsewhere while it is true that real estate prices in Manhattan have risen strongly since around 1997, this follows some six straight years of decline after 1987. Nominal prices, which include inflation effects, did not regain their 1987 level until after 1999, and real prices, which exclude inflation effects, are today essentially unchanged from 1987.

This is remarkable and perhaps the single most surprising feature of Manhattan real estate prices. The real mystery is arguably, not that real estate prices are now so elevated, but that they fell so much in the early to mid-nineties. From an historical perspective there is still a way to go to catch up.

During the 1990s, prices in Manhattan fell further than those in the surrounding area. Chart 8 gives a comparison of Manhattan prices with those in NY State as well as the NY Metropolitan Statistical Area. While prices in the broader region roughly held their value in nominal terms, those in Manhattan fell over a period of six years.

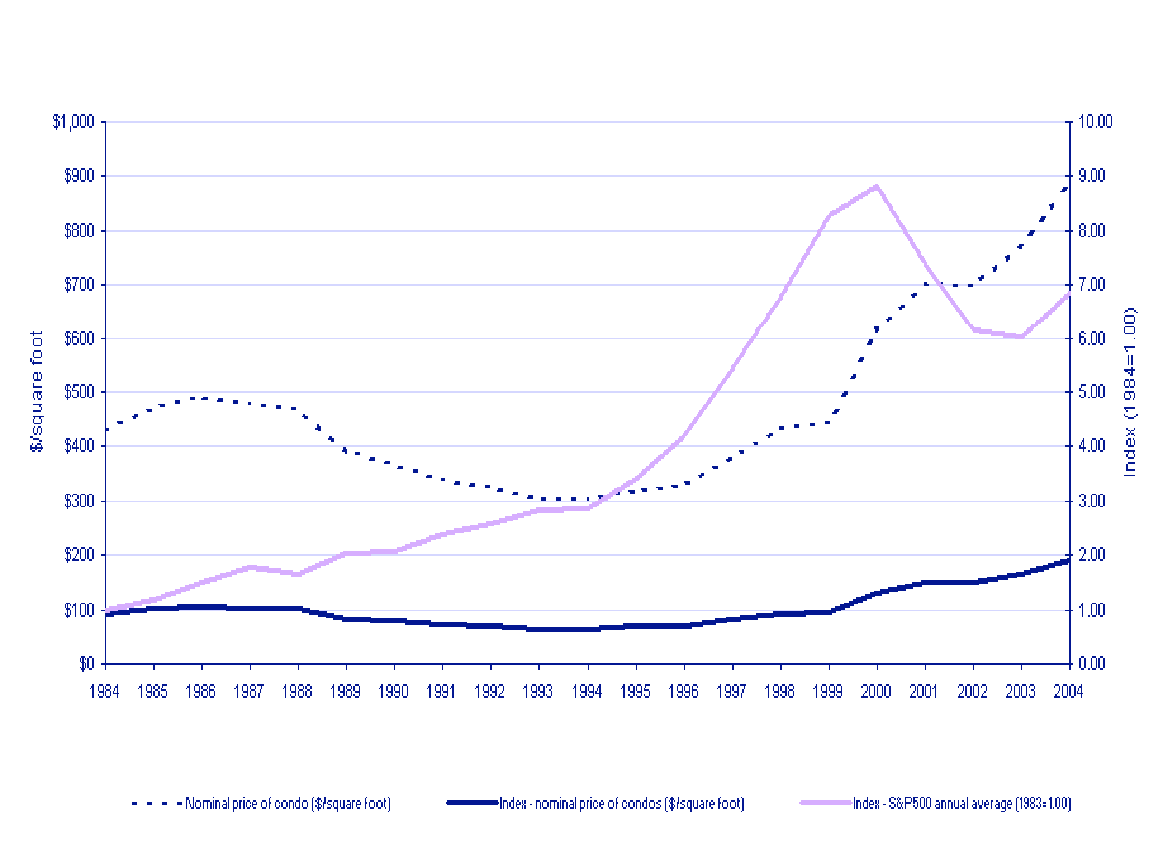

Other asset prices have raised much faster than Manhattan real estate Peak-to-peak – 1987 to 2000 – the S&P500, which is a good proxy for the value of a range of income-generating assets, rose 360% (from 329 to 1518). As of today it is still up 226% on 1987. Over the same 13-year period, square foot condo prices rose from $477 to $616 (29%), and as of today they are up about 87%. The situation is much the same for co-ops. Generally, compared with a basket of other assets, Manhattan real estate has become relatively cheaper.

1987 marks a stock market peak as well as the peak in housing values in Manhattan (for most markets real estate values peaked about 18 months later), and is an outlying reference point. But comparisons are much the same for other dates. For instance, compared to 1990, the S&P500 is today up 222% (from 332), compared with 143% for square foot condo prices.

This figure below shows the strong increase of the S&P500 compared to Manhattan real estate prices.

It is worth raising two points that affect the relative value of real estate to other assets. First, mortgage interest is tax deductible, lowering the carrying cost of real estate and making it relatively more attractive to hold. Second, capital gains tax on a primary residence have been greatly reduced following the increase in the capital gains allowance to $500k for a married couple ($250k for singles). For other assets, tax usually applies on the entire gain.

Combined, these make real estate preferred in ownership and sale. All things being equal, its value ought to have risen compared to other asset classes. However, this has not yet happened, in spite of recent price gains.

Real estate prices have recently significantly outstripped personal income gains. Over the period 1997 to 2004, square foot condo prices in Manhattan have more than doubled (rising 136%) while per capital income has increased only 46%.

Manhattan continues to buck housing trends with strong demand

Prudential Douglas Elliman said the average Manhattan apartment price, which includes cooperatives and condominiums, jumped 17.6 percent in the fourth quarter to a record $1,439,909 from the year-ago period, while Brown Harris Stevens reported a 34 percent increase to $1,430,514, another record.

The median also rose, but not as sharply. Prudential reported a 6.4 percent increase to $850,000, and Brown Harris Stevens said the median price gained 14 percent to $828,000. The median price is where half sell for more and half sell for less.

When the average price outpaces gains in median price, that typically indicates higher sales activity at the top end of the market, said Brown Harris Stevens Executive Vice President Jim Gricar.

Sales of apartments over $10 million more than tripled during the quarter, while closings at the ultra-luxury apartments The Plaza and 15 Central Park West averaged $6.95 million and made up 7 percent of all quarterly condo sales, Brown Harris Stevens said.

Many foreign buyers, capitalizing on a weaker dollar, are snapping up some of these high-end condos in the city.

price increases on two- and three-bedroom apartments helped to push up prices overall. Prices on two-bedrooms jumped 22.1 percent, while three-bedroom apartment prices surged 39.8 percent.

Prudential Chief executive Dottie Herman noted that as more families stay in the city, instead of moving to the suburbs, demand for larger apartments is growing.

However, being a small island with a growing population is Manhattan’s greatest advantage. Unlike other markets nationwide struggling with a glut of unsold homes, Manhattan inventory shrunk by 13.5 percent in the fourth quarter from the prior year, according to Prudential Douglas Elliman.( David Berson, “Economic, Housing & Mortgage Outlook to 2010” Fannie Mae, 2004)

The Manhattan Real Estate Slump

Manhattan re market has held up VERY well in the face of the nationwide housing slump

Just a year ago, as real estate brokers fretted through an ominously quiet third quarter, many Manhattanites waited for the housing market to reverse its madcap ascent and fall into line with the rest of the country.

But something happened on the way to the Great Manhattan Housing Slump. After what brokers optimistically termed a “pause” in the second half of 2006, buyers swarmed into the market. The torrent was so intense that by the end of this past June, it was clear that an astonishing gulf had opened up between Manhattan and nearly everywhere else.

On the national level, sales of existing homes slowed by 17 percent in the second quarter of 2007, compared with the second quarter of 2006, while inventory swelled by 16 percent, according to figures provided by the National Association of Realtors. New homes fared even worse: they fell by almost 19 percent, according to Commerce Department.

In Manhattan, by comparison, sales of new and existing apartments more than doubled. In a trend that could shift quickly in light of the recent problems in the credit and stock markets, inventory shed a third of its bulk. It dropped to 5,237 units, despite the influx of several thousand new condos, according to Miller Samuel Inc., the Manhattan appraisal company

Prices have been starkly different as well. By last month, the national picture was so dire that Angelo R. Mozilo, the chairman and chief executive of Countrywide Financial, the country’s largest mortgage lender, said things had not been so bleak since the Depression.

Cut to Manhattan. After a boom with annual price increases of 20 percent or more ended in mid-2005, prices have continued to rise over all, but not as sharply. In the second quarter of 2007, Miller Samuel said the average sale price of a Manhattan studio climbed 16.5 percent compared with the second quarter of 2005. The average for a one-bedroom climbed by 18.4 percent and a two-bedroom by 5.9 percent.

Apartments with three bedrooms, which make up about 6 percent of the market but appeal to an ever-more-moneyed class of buyers, rose by 17.9 percent in the same period.

Major brokerages, including Halstead Property, Bellmarc Realty, Brown Harris Stevens, Prudential Douglas Elliman and the Corcoran Group, say they are recording sales and profits that rival boom-time results. In fact, Douglas Elliman and Corcoran predict that this will be their most lucrative year by far.

Whether this momentum can be sustained remains to be seen, particularly in light of the recent gyrations in the debt market, which have led to a reduction in the availability of large mortgages and to an increase in their rates. A deepening credit-market crisis and national housing slump could squeeze the economy, the stock market and bonus pools.

For the first time in over a year, there is some negative talk — about the credit markets and whether or not this will permeate the New York City real estate market. As of right now, it hasn’t. There has been no slowdown.” She said the biggest concern among her agents is finding enough inventories to satisfy demand.

But a buying binge alone does not a housing boom make. “I’m still not characterizing the market right now as a housing boom except in the upper echelon,” said Jonathan Miller, president of Miller Samuel.

It has been years since Samantha Kleier Forbes, a broker at Gumley Haft Kleier, lost a client to the suburbs. “My last casualty was in ’04,” she said. As two-career couples work longer hours and as the city grows safer and more family-friendly, there is a big demand for large apartments like Classic 6’s — a two-bedroom apartment with living room, dining room, kitchen and maid’s room (where children can be found bunking like sailors).

Families who want to stay, brokers say, are only one segment of the more stratified and well-heeled masses clamoring for a piece of Manhattan. While the dollar’s seemingly endless slide may have crimped the foreign vacation plans of many Americans, the purchasing power of Europeans has strengthened. They are increasingly matched, if not outmatched, by buyers from countries like China and India. And foreign buyers find Manhattan real estate very appealing when they compare prices in other large international cities like London.

Whether Manhattan continues to be the land the slump forgot or is merely sunning itself before a hurricane is something of a guess. A strengthening dollar, a severe terrorist attack or a national economy hobbled by housing market woes could inflict blows of varying strengths.