Introduction – Problem Statement

Singapore Airlines (SAL) is one of the largest airlines in the world with a fleet of 103 aircraft that service both the domestic market within Singapore as well as several international locations (Company profile Singapore Airlines Limited SWOT Analysis, 2013).

Starting from 2008 to the present, SAL has attempted to gain greater access into various markets within Asia, the U.S., South America and Europe due to perceived gains from establishing international routes between the U.S., South America, Europe and certain Asian cities (Company profile Singapore Airlines Limited SWOT Analysis, 2013).

This paper will examine the reason behind the subsequent risks associated with such an expansion and the strategies the company may need to put in place in order to “ease into” the market segments that it is currently attempting to pursue.

Current Problems within Traditional Markets

Economic Recession

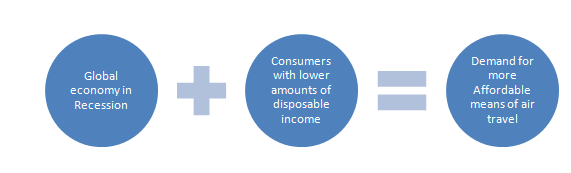

The current problem with the airline passenger market within the Singapore economy is the fact that consumer spending is at an all-time low due to the present-day economic downturn (Francis, 2012).

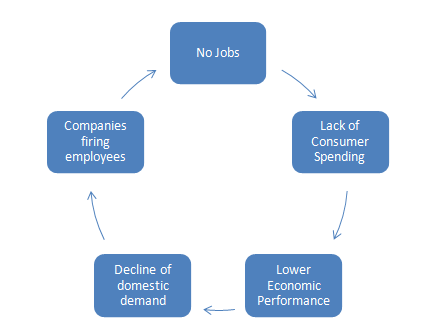

Unfortunately, the inherent problem with the current situation is that it creates a vicious cycle wherein low consumer spending results in companies reducing various aspects of their operational capacity (i.e. manufacturing of products, low-level employees, etc.) in order to remain in business which results in even lower consumer spending since people do not have jobs to support themselves anymore (Francis, 2012).

Current Cycle of Economic Decline

Another global factor that should be taken into consideration when conducting business operations is the current debt crisis in Europe that was brought about through not only the reckless actions of various banks within the region (as seen in the case of Ireland) but also through government mismanagement of finances (seen in the case of Greece) and exposure to a reckless housing market (the case of Spain) which has also adversely affected demand for products and services from Singapore.

Such factors have taken a steep toll on the airline passenger market with up to 50% of profits effectively wiped out in the period immediately during the aftermath of the 2008 recession with only a marginal improvement on domestic flights in 2013.

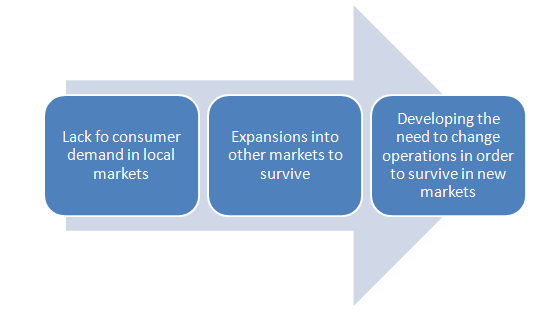

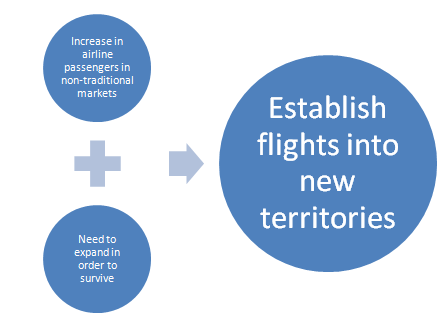

While it is expected that domestic and international demand should return to normal in time, the fact remains that SAL needs to be able to expand its services into other locations in order to survive the current downturn.

Operational Strategy of Airlines

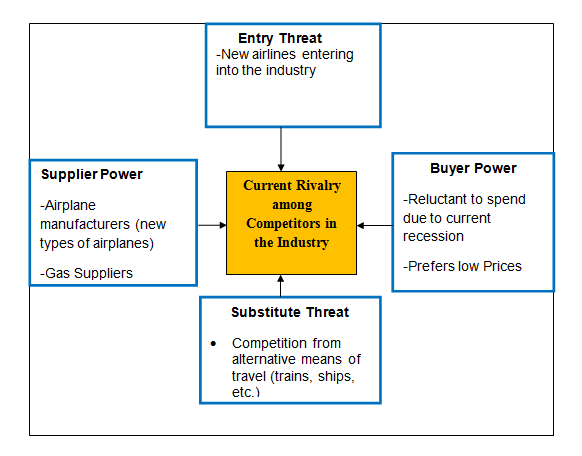

Managing Risks in the Current Airline Industry

Shifting to New Consumer Markets

With low consumer spending and an atmosphere of economic uncertainty which pervades the domestic market, this has resulted in wasteful operational costs for SAL such as storage, utilities, taxes, worker salaries and employee benefits.

The current consumer market situation within Singapore and other parts of Asia is not conducive towards sales and, as such, Singapore Airlines has suffered as a direct result. One possible avenue of approach is to shift resources towards foreign markets which have not been as adversely affected by the current economic downturn and focus efforts there instead of in cathartic local markets.

Asian markets such as those within China and Japan as well as international markets within South America and the Middle East seem to be viable consumer markets due to the fact that despite the slowdown of various western economies, these economies have actually grown on average by five to eight percent annually.

This is due to the fact that as the expense of doing business within western nations rises. Companies have started to shift their manufacturing operations to other countries with far lower operational expenses (Heracleous, Wirtz & Johnston, 2004).

Guidelines of Changes to Singapore Airlines

In response to this, legacy carriers such as Singapore Airlines have focused more on business and first-class passengers who take international flights to various destinations within Asia (particularly China and Japan) due to the higher fees derived from such customers (Chong, 2007).

The problem though with the current operational approach of Singapore Airlines is that passengers these days have been focusing more on affordability rather than luxury when it comes to their choice of airline. This is in part due the current problems with the global economy, which makes passengers more hesitant to spend on higher-priced tickets when more affordable alternatives are available.

Customer Decision Matrix Diagram

Examining the Market

One of the more interesting pieces of information as of late has been numerous studies indicating that China will lead growth in air travel within the upcoming years. This is actually quite true to a certain extent given the growth of the Chinese economy as of late and the subsequent increase in wealthy Chinese tourists that have taken an interest in air travel.

What must be understood though is that upon further investigation into the current state of the airline industry it was seen that it was not just China that will be a market leader in air travel; rather, such studies indicate that Japan, South America, and Africa will become booming markets as well.

As the Singaporean economy has been estimated to barely reach a 1 to 3 percent growth rate by the end of 2013 with an uncertain growth rate in 2014, this signifies a concurrent decline in consumer spending making the future of localized air travel uncertain in light of the possibility that consumer spending within Singapore may continue to be in decline for the next 3 or 4 years.

Taking this into consideration, it becomes immediately apparent that it is necessary for Singapore Airlines to change gears and adopt a new operational strategy given the lack of sufficient passenger growth within its traditional markets.

Market Examination

Strategic Options – Risk Analysis

When entering the airline passenger market within new markets with a focus on addressing new customer buying orientations (i.e. affordability over luxury), what must be understood is that this necessitates the need to change aspects related to what type of planes to use since airports and the new market that SAL is pursuing would, of course, require different means of operations.

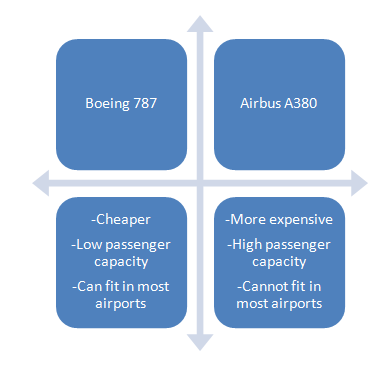

The previous decade of operations for Singapore Airlines in Asia was dominated by wide-body long-range aircraft, however, as of late the rise of low-cost carriers and regional air services, especially in Japan and China, utilizing twin-engine aircraft with small frames calls into question strategic options that focus on large-bodied aircraft that focus on passenger capacity rather than efficiency (Heracleous, Wirtz & Johnston, 2005).

Stakeholder Analysis – Airlines and Future Passengers

Within the past five years it was seen that Asian carriers had been shedding their 747 – 400 series aircraft in favor of wide-body twin-engine aircraft such as the B-787 due to their overall improved efficiency and greater range (Heracleous & Wirtz, 2010). In fact, when examining the prevalence of high capacity aircraft such as A-380s within Asian fleets, it was noted that Airbus received only a few orders.

On the other hand, population estimates examining the growth of airline passengers within the next 40 years shows an increase of at least 16 billion. Based on this data, the relevance of utilizing higher capacity aircraft such as the A-380 becomes much more important due to the necessity of meeting consumer demand (Heracleous & Wirtz, 2010).

Plan Viability Diagram

When examining whether Singapore Airlines should cover its potential new routes with Boeing 787s or Airbus 380s beginning in January 2014, it thus becomes a question of whether the company should focus on conforming with present-day trends or future need.

Analysis Method Diagram

When examining the particulars of this case you have to take into consideration present-day market studies that indicate that business travelers will pay a 15-25% premium to fly to their initial destinations non-stop or direct, rather than change carriers on the way to their intended destination (Park, 2013).

Since Singapore Airlines considers business travelers as one of its more profitable target segments due to its current market orientation as a 5 star airline, maximizing the amount of business travelers per flight through the use of the A-380 would seem to be the most logical choice especially when taking into consideration estimates on the increase in the number of passengers in the near future (Cendrowski, 2010).

On the other hand, shifting towards the primary use of A-380s does present several problems such as the plane’s size requiring special modifications necessary to existing airports in Asia which are more used to B-787 airplane sizes.

When examining whether SAL should proceed with B-787s or A- 380s, it is important to examine the current market features of the market that SAL will need to penetrate in order to determine which particular type of aircraft would be the most effective.

Various studies have shown that there is a current predilection within the Asian region for utilizing wide-bodied twin-engine aircraft such as the B-787. In fact, such studies indicate that this is a trend that began at least five years ago wherein there was a dramatic shift in the region towards planes with small frames.

The reason behind this can actually be connected to the rise of several Asian budget airlines within the region whose business models emphasized affordability rather than luxury.

Not only that, due to the effects of globalization within the Asian region, various regional hubs have been created to service a variety of far-flung destinations resulting in budget carriers being the plane of choice for travel to such areas (Airline of the year: Singapore Airlines, 2008).

As a result of such events, budget airlines within the Asian region have outstripped the growth of network carriers resulting in more airports having structural frames designed for receiving planes like the B-787 rather than the A-380.

On the other hand, other examinations of the A-380 and its place in the future of aviation indicates that as the number of airline passengers per year in the world reaches an estimated 16 billion within the next 40 years, this is indicative of massive growth potential (Airlines Industry Profile: Singapore, 2012).

This means that utilizing the B-787, while affordable, will set Singapore Airlines back in terms of being able to handle increased passenger capacity and, as such, would cause the company to lag behind its rivals. This is due to models such as A-380 having the necessary increased capacity to deal with the passenger increase as compared to the B-787 models.

Ethicality Statement

During the process of conducting this study, an appropriate ethical framework was utilized during the data gathering procedure, which consists of the following steps:

- Data that was utilized in this study was acquired through relevant academic sources that specifically pertained to the study.

- Practices related to data falsification were not utilized.

- There was no inherent bias introduced during the data collection and analysis

- This study made sure not to malign or criticize any of the corporations that were part of the examination

Through these specific procedures, this report was able to follow proper research ethics in examining and presenting the results of the study.

Client Report

Potential Risk Mitigation Strategies to be Pursued

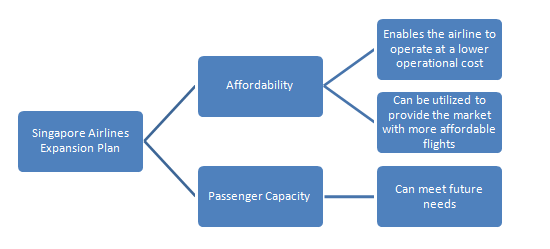

Singapore Airlines can proceed under two potential strategies when examining what particular type of plane to purchase:

- SAL could focus on maximizing present-day passenger capacity by utilizing the A-380. Not only would this enable the company to meet the present need of business class passengers who are willing to pay 15 to 20 percent more for non-stop flights but it enables the company to meet potential increases in the amount of passengers within the coming years.

- By utilizing B-787 SAL will be able to easily enter into most airports in Japan, Asia, South America and the Middle East that are used to the planes of the B-787’s capacity thus allowing the company to add more potential destinations for its clientele. Not only that, it will be able to charge far less for its tickets which will entice more passengers to choose SAL.

When examining the current Asian. Latin American, Middle Eastern and U.S. markets, it can be seen that wide-body two engine planes dominate a large percentage of the airplanes currently being utilized. This is due to the rise of various low budget airlines that have grown within the past five years and, as such, the entry of the much larger A380 into this current market sparks several questions regarding compatibility with several regional airports.

On the other hand, what must be taken into consideration is the fact that in terms of long-range capability and overall passenger accommodation the A380 far outstrips the B-787 but in terms of fuel efficiency and compatibility with regional airport infrastructures, the B-787 would be a better contender.

Taking this into consideration, it can be seen that the A380 with its ability to accommodate more passengers for nonstop flights to particular airports would make it an attractive option for catering to business class clientele. The interior of the B-787, while large, is still quite small when compared to the interior of the A380 and, as such, can have only limited amenities in comparison.

On the other hand, interior modifications can be made on the B-787 however; this comes with a lot of drawbacks. A B-787 can be fitted with the desired amenities requested by the company, but it would result in reducing the number of passengers that can be seated on the aircraft.

It must be noted though that the current global economic downturn has negatively affected carriers in such a way that many are reluctant to shift into the A380 model. Issues such as cost reductions, maintaining current fleet status as well as the practicality of using such aircraft were taken into consideration and, as such, delays in their construction were actually welcomed.

While it may be true that sales for the A380 have increased within the Middle East and Europe, the fact remains that the markets which Singapore Airlines is trying to expand into call for another approach rather than the A380 at the present.

The end result, when taking risk mitigation practices into consideration, is that in order to both effectively assimilate itself into its markets as well as reduce costs related to gas and the overall price of the planes while at the same time maximizing the amount of business class customers it can handle, the recommended strategy for Singapore Airlines is to opt to have a diversified fleet of 787s and A380s with the 787s serving regional hubs within its new target markets while only a few A380s would fly directly towards airports that could handle its rather specialized needs due to their size.

Overall, opting for such a strategy is not surprising given the fact that SAL still needs to take into account both the subsequent increase in airline passengers within the next few years as well as the fact that passengers these days want more affordable options.

Project Log

Anticipating the Problems

During this week, it has yet to be determined whether the expansion of Singapore Airlines into other markets will prove to be successful. The reason behind this is that while SAL has been shifting its resources towards accommodating business and 1st class passengers, the fact remains that this strategy has resulted in considerable financial losses given lackluster demand.

It is based on this that in the next project log I will elaborate on the possible results and effectiveness of the recommended SAL risk mitigation strategy by examining relevant data and trends that will enable the creation of a plausible timeline and strategy outline between now and when the SAL expansion strategy reaches its zenith.

Potential for the Success of the Recommendations

During this week of examining the data for the study, I noted that the number of passengers that use airlines will increase by several billion within the next 50 years with a large percentage of this growth primarily being centered in the growing economies of Asia, Latin America and South East Asia.

China, Brazil, the Philippines, Japan, and a variety of other countries have all shown increased rates of international travel as a direct result of their booming economies.

With the implementation of the potential market risk mitigation strategy that I developed for the client report involving the use of 787s within regional hubs and the A380 for cross-pacific flights, it can be assumed that the company will be well poised in taking advantage of the increased passenger growth.

Overall Summary

Overall, I can say that my experience in making this report has been a positive and fruitful one. It has to lead me to be more aware of the different processes that can be implemented in order to resolve a problem that a company is currently facing using my knowledge and imagination. Through this report, I can say I have become a much more capable individual and look forward to the various challenges that will head my way.

Reference List

‘Airlines Industry Profile: Singapore’ 2012, Airlines Industry Profile: Singapore, pp. 1-31

‘Airline of the year: Singapore Airlines’ 2008, Air Transport World, vol. 45, no. 2, pp. 28-29

Cendrowski, S 2010, ‘SINGAPORE AIRLINES’, Fortune, vol. 161, no. 8, p. 22

Chong, M 2007, ‘The Role of Internal Communication and Training in Infusing Corporate Values and Delivering Brand Promise: Singapore Airlines’ Experience’, Corporate Reputation Review, vol. 10, no. 3, pp. 201-212

‘Company profile Singapore Airlines Limited SWOT Analysis’ 2013, Singapore Airlines, Ltd. SWOT Analysis, pp. 1-9 Business Source Premier, EBSCOhost.

Francis, L 2012, ‘Maxed Out’, Aviation Week & Space Technology, vol. 174, no. 34, p. 40

Heracleous, L, Wirtz, J, & Johnston, R 2004, ‘Cost-Effective Service Excellence: Lessons from Singapore Airlines’, Business Strategy Review, vol. 15, no. 1, pp. 33-38.

Heracleous, L, Wirtz, J, & Johnston, R 2005, ‘Kung-Fu Service Development at Singapore Airlines’, Business Strategy Review, vol. 16, no. 4, pp. 26-31

Heracleous, L, & Wirtz, J 2010, ‘Singapore Airlines’ Balancing Act’, Harvard Business Review, vol. 88, no. 7/8, pp. 145-149

Park, K 2013, ‘Why the Longest Flights Are Saying So Long’, Bloomberg Businessweek, vol. 4353, pp. 30-31,