Introduction

Apple is a technology company based in the US with a wide product range that includes computers and smartphones. Founded in the mid-70s, the company has grown to be one of the most valued enterprises in the world (Apple Inc., 2021). This essay evaluates how the firm applies Enterprise Risk Management (ERM) in its corporate practices to evaluate its risks and corporate decisions.

A Critical Reflection Based On ERM

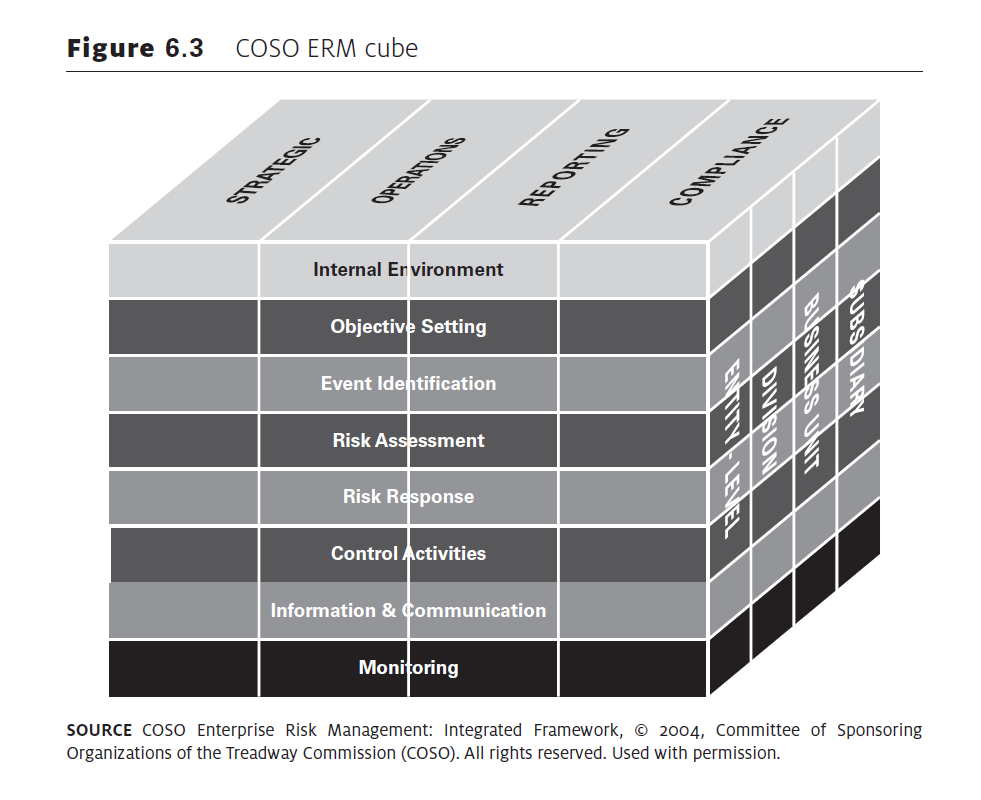

Different companies use varied frameworks for implementing their ERM policies. There are three main models used in such analyses and they include Integrated Risk Management (IRM), IS031000, and COSO-ERM standards (Hessami, 2019). IRM standards focus on four main areas of evaluation, including financial, strategic, operational, and hazard risks (Coleman, 2018). Comparatively, IS031000 decodes three areas of evaluation, including principles, frameworks, and processes of evaluation (Rael, 2017). Comparatively, the COSO-ERM cube focuses on strategic, operational, reporting, and compliance processes, as highlighted in figure 1 below.

In figure 1 above, the COSO-ERM model highlighted above evaluates a company’s internal environment through objective setting, event identification, risk assessment, risk response, control activities, information and communication, and monitoring. In the context of Apple’s risk management plan, the COSO-ERM framework will be used to analyze the firm’s risks and decisions.

Internal Environment

For purposes of this review, Apple’s internal environment is evaluated based on its management and leadership styles. Relative to this analysis, the company adopts a democratic leadership style, which takes into consideration the needs and views of all stakeholders in the organization (Apple Inc., 2021). The company’s values are also focused on the promotion of innovation as a tool for staying competitive (Apple Inc., 2021; Biberhofer et al., 2019). A critical evaluation of its leadership and management styles reveals that the company’s internal environment is responsive to its risk management objectives.

Objective Setting

A company’s objectives influence the design of its processes and activities. Apple’s objective is to develop stellar products and services and avail them to its customers at an affordable cost (Apple Inc., 2021; Grunert, 2017). Based on an evaluation of the company’s risk environment, via the COSO-ERM framework, its objectives should be adjusted to produce high-quality technology products that meet customer standards sustainably (Ensign et al., 2016). Sustainability is added to the company’s overall objectives because the concept could be merged with ERM to manage risks.

Event Identification

It is important to identify potential sources of risk in an organization when designing its risk management plan. In the context of Apple’s operations, the recent COVID-19 pandemic is a significant source of risk based on its impact on consumer behavior and supply chain decisions. The potential for counterfeiting is also a significant source of risk that can undermine a company’s ability to generate sufficient revenue (Baack et al., 2018). This outcome is occasioned by the fact that counterfeit products may have quality issues, which could cause reputational damage to an organization.

Risk Assessment

A comprehensive assessment of Apple’s risk profile is provided in Table 1 below.

Table 1. Apple’s risk assessment (Source: Developed by Author)

According to risk events highlighted in Table 1 above, two categories affect Apple’s operations – COVID-19 and counterfeiting. The above risks have been ranked according to the risk profile matrix highlighted in Table 2 below, which highlights three key levels of probability and impact – low, medium, and high.

Table 2. Risk assessment matrix (Source: Course Materials)

The risk assessment matrix highlighted above shows the criterion for reviewing the impact and probability of various risk profiles associated with Apple Inc. Those that lead to production disruptions or more than a 10% increase in overhead are “high impact”. Comparatively, risks that have a low impact are those that cannot affect the overall operations of a firm. Alternatively, the medium impact assessment criterion is used to define risks that would have a moderate impact on the company’s operations. Legal violations, data breaches, and supply chain disruptions fall in this category.

A company’s risk management attitude defines the kind of responses that should be appropriately implemented in a given situation. There are four major types of responses that companies can initiate in any given risk setting and they include the 4Ts, which are to tolerate, treat, transfer, or terminate (Kumar et al., 2016; Hutchins, 2018; Archetti, 2021). COVID-19 is a hazard risk and the appropriate response would be to treat it. Comparatively, counterfeiting is a compliance risk and should be addressed by transferring it to third parties. Modalities for implementing these strategies are highlighted below.

Control Activities

According to the proposed strategies highlighted above, the appropriate risk response for hazard risk COVID-19 is treating the risk through administrative control. This plan involves setting up safeguards for implementing safe working practices, such as social distancing and wearing of masks. Comparatively, counterfeiting should be managed by terminating this risk through the establishment of copyright claims on intellectual property (Adhikari, 2018). This action is likely to deter offenders from imitating Apple’s products because they run the risk of being imprisoned if found guilty. If implemented correctly, this action will help Apple Inc. to terminate this risk.

Information and Communication

Information and communication play an important role in protecting Apple’s ERM activities. Particularly, it is integral to the risk assessment profile of Apple Inc., which partly relies on technology to assess some risk management profiles (Apple Inc. 2021; Chopra et al., 2021). This statement means that the information obtained from the company’s activities should be timely and efficient to be acted upon (Makrides et al., 2020). Apple’s information and communication programs are defined by three key processes, which include creating awareness, enabling the adoption of the company’s products, and empowering users (Apple Inc., 2021). Alternatively, the risks posed to its plan are information leaks because some employees may disclose the company’s risk management plan to competitors (Pesch et al., 2017). Nonetheless, if implemented correctly, Apple could benefit from increased employee buy-in.

Risk Monitoring

Risk monitoring refers to the process of evaluating and tracking various levels of risks affecting an organization. Risks associated with the COVID-19 pandemic have to be monitored on a 24-hour basis because they change frequently. At the same time, there should be room for technical monitoring of the firm’s activities through regular audits. The company’s HRM manager should be responsible for tracking and monitoring such changes because they employee-focused. However, there is the risk of data leakage if such information gets in the hands of unqualified staff (Rael, 2017). Therefore, it is important to store risk monitoring data safely and, if possible, secured with a password.

Role and Impact of Governance, Technology, and Resilience

Role of Governance

Corporate governance is associated with the process of setting up rules and procedures that would be used to govern a company’s conduct and activities. Corporate governance activities are related to the nature of the relationship between companies and their stakeholders. Two major risk approaches pursued by a company’s corporate governance policies, include employees explaining or complying with a firm’s operational guidelines (Rael, 2017). Apple’s risk management approach should follow the second approach of explaining why employees have not complied with the company’s corporate governance policies because its corporate governance policies are rigid. The role of governance in managing its risks should be to standardize the approaches used by the company to address its risk events.

Apple’s Board of Directors should focus on auditing the progress made by employees in addressing the effects of its risk events on its operations through the proposed policy of requiring its workers to explain their actions by justifying why they followed or did not follow the company’s guidelines on risk management (Köbis et al., 2021). This statement stems from the views of Adhikari (2018), which highlight the need for promoting fairness in evaluation. Therefore, it is important to adopt a holistic approach in conducting risk management evaluations.

Impact of Governance

Based on the role of corporate governance on Apple’s ERM plan highlighted above, its impact varies depending on the role that accomplishing its key performance indicators will have on its performance. In the context of the company’s operations, corporate governance will play a critical role in reducing information imbalance between the firm’s managers and its key stakeholders (Haenlein et al., 2020). Alternatively, from an organizational perspective, good corporate management practices will be critical in improving the firm’s performance (Rael, 2017). Google and Samsung are competitors in the technology industry, which have similarly developed and implemented good corporate governance and management policies (Adoko, 2017). Therefore, its role cannot be overlooked when evaluating Apple’s risk management performance.

Role of Technology

The role of technology in supporting the operations of giant multinationals cannot be overlooked in this review. Technology refers to the application of information technology tools to improve a company’s business processes (Adoko, 2017). Similarly, some researchers have defined it as an innovative approach for the realization of the same goal (Dimic et al., 2019; Köbis et al., 2021). Given the nature of Apple’s risk events, technology will play a critical role in the implementation of its risk management plan (Adoko, 2017). In the context of Apple’s operations, technology may play a critical role in safeguarding the intellectual property of the firm and in protecting the health and safety of employees and customers in the organization through automation.

Impact of Technology

The application of information communication and technology tools in Apple’s operations will have far-reaching implications on its financial and market performance. From a financial perspective, technology may lead to reductions in operational costs because of its inexpensive nature (Kumar et al., 2016; Hutchins, 2018). The firm may also need to create a maintenance team that would monitor how employees manage these technological tools on the company’s operations (Hutchins, 2018; Archetti, 2021). Technology has had a similar positive impact on other enterprises, such as Google, which has maintained its market dominance from the use of advanced technological tools, including artificial intelligence and machine learning (Palmatier and Sridhar, 2017; Kemp, 2018). Overall, technology will have a positive impact on Apple’s performance and efficiency based on its role in supporting the growth of its competitors’’ operations.

Role of Resilience

A company’s resilience plays a critical role in how it responds to risks that exist in its operational environment. Some researchers define resilience as the ability of a company to adapt to the changing dynamics affecting its internal and external operations (Hernaus et al., 2021; Management Association, Information Resources, 2018). Apple has a history of market resilience that is founded on an innovation strategy (Lewis et al., 2018). Its resilience has helped the company to build a strong brand name that is globally known. This feature has made it less susceptible to the effects of competition in most of its product categories.

Impact of Resilience

Apple’s resilience has had positive effects on its overall performance. For example, it has been able to capture the market by identifying market needs that were hitherto unknown to customers and the competition (Lewis et al., 2018; Apple Inc. 2021). This impact has seen some competitors copying some of Apple’s marketing and product development strategies (Bérard and Teyssier, 2018). For example, Samsung developed a new product category of “the tablet” because of the new market created by Apple in this product category. Therefore, its resilience has helped it to maintain market dominance by preempting what customers need and how the competition will react to its strategies.

Summary

The insights highlighted in this paper have highlighted the role that ERM and corporate governance have on a company’s ability to respond to its changing risk profiles. In the context of Apple’s operations, major risk events affecting its operations include the COVID-19 pandemic and counterfeiting. It is proposed that the adoption of sound corporate governance policies and the implementation of a robust risk identification criterion will play a critical role in maintaining the company’s resilience in the competitive technology industry.

Reference List

Adhikari, A. (ed.). (2018), Strategic Marketing Issues in Emerging Markets. New York, NY: Springer.

Adoko, O. P. (2017), Risk Management Strategies in Public-Private Partnerships. New York, NY: IGI Global.

Apple Inc. (2021). About us.

Archetti, C. (2021), ‘When public relations can heal: an embodied theory of silence for public communication’, Public Relations Inquiry, Vol. 5, No. 1, pp. 1-13.

Baack, D. W., Czarnecka, B. and Baack, D. (2018), International Marketing. London: SAGE.

Bérard, C. and Teyssier, C. (eds.). (2018), Risk Management: A Lever for SME Development and Stakeholder Value Creation. London: John Wiley and Sons.

Biberhofer, P. et al. (2019), ‘Facilitating work performance of sustainability-driven entrepreneurs through higher education: the relevance of competencies, values, worldviews, and opportunities’, The International Journal of Entrepreneurship and Innovation, Vol. 20, No. 1, pp. 21–38.

Chopra, A., Avhad, V. and Jaju, S. (2021), ‘Influencer marketing: an exploratory study to identify antecedents of consumer behavior of millennial’, Business Perspectives and Research, Vol. 9, No. 1, pp. 77–91.

Coleman, L. B. (2018), Managing Organizational Risk Using the Supplier Audit Program: An Auditor’s Guide along the International Audit Trail. London: Quality Press.

Dimic, N., Orlov, V. and Äijö, J. (2019), ‘Bond–equity yield ratio market timing in emerging markets’, Journal of Emerging Market Finance, Vol. 18, No. 1, pp. 52–79.

Ensign, P. C., Fast, J. and Hentsch, S. (2016), ‘Can a technology enterprise transition from niche to wider market appeal in the turbulent digital media industry?’, Vikalpa, Vol. 41, No. 3, pp. 247–260.

Grunert, K. G. (ed.). (2017), Consumer Trends and New Product Opportunities in the Food Sector. Wageningen: Wageningen Academic Publishers.

Haenlein, M. et al. (2020), ‘Navigating the new era of influencer marketing: how to be successful on Instagram, TikTok, and Co.’, California Management Review, Vol. 63, No. 1, pp. 5–25.

Hernaus, T., Juras, A. and Matic, I. (2021), ‘Cross-echelon managerial design competencies: relational coordination in organizational learning and growth performance’, Business Research Quarterly, Vol. 6, No. 1, pp. 445-467.

Hessami, A. G. (eds.). (2019), Perspectives on Risk, Assessment and Management Paradigms. London: Books on Demand.

Hutchins, G. (2018), Supply Chain Risk Management: Completing In the Age of Disruption. London: Greg Hutchins.

Hutchins, G. (2019), Project Risk Management. London: CERM Academy for Enterprise Risk Management.

Kemp, K. (2018), Misuse of Market Power: Rationale and Reform. Cambridge, MA: Cambridge University Press.

Köbis, C., Soraperra, I. and Shalvi, S. (2021), ‘The consequences of participating in the sharing economy: a transparency-based sharing framework’, Journal of Management, Vol. 47, No. 1, pp. 317–343.

Kumar, V., Rahman, Z. and Kazmi, A. A. (2016), ‘Assessing the influence of stakeholders on sustainability marketing strategy of Indian companies’, SAGE Open, Vol. 6, No. 2, pp. 987-1109.

Lewis, J. M., Ricard, L. M. and Klijn, E. H. (2018), ‘How innovation drivers, networking and leadership shape public sector innovation capacity’, International Review of Administrative Sciences, Vol. 84, No. 2, pp. 288–307.

Makrides, A., Vrontis, D. and Christofi, M. (2020), ‘The gold rush of digital marketing: assessing prospects of building brand awareness overseas’, Business Perspectives and Research, Vol. 8, No. 1, pp. 4–20.

Management Association, Information Resources. (ed.). (2018), Social Media Marketing: Breakthroughs in Research and Practice: Breakthroughs in Research and Practice. New York, NY: IGI Global.

Palmatier, R. W. and Sridhar, S. (2017), Marketing Strategy: Based on First Principles and Data Analytics. London: Macmillan International Higher Education.

Pesch, U. et al. (2017), ‘Niche entrepreneurs in urban systems integration: on the role of individuals in niche formation’, Environment and Planning A: Economy and Space, Vol. 49, No. 8, pp. 1922–1942.

Rael, R. (2017), Smart Risk Management: A Guide to Identifying and Calibrating Business Risks. London: John Wiley & Sons.