Introduction

An unprecedented growth rates in annual vehicle production has transformed China into the world’s second largest auto market and the third largest car maker after Japan and the US, a ranking previously assigned to Germany. From a mere sector of the machinery industry before the transition from a centrally planned economy to an open market, China’s automotive industry grew in rapid fashion soon after the country’s accession into the World Trade Organisation (WTO) in 2001. The general projection is that China’s auto industry will continue its upward trajectory of growth until 2015.

These expectations are based primarily on the burgeoning purchasing power of the 1.3 billion Chinese, whose per capita income has increased six-fold from only $1,000 in 1991 to $7,600 in 2006 and still counting. The trends speak for themselves: From 2001 to 2005, car consumption rose 54.42 percent from 2001 to 2005. In 2006, a total of 7.189 million vehicles were manufactured in China, by which time all the world’s major car makers have established their presence in this nascent auto market. At end-November 2006, the registered automotive enterprises in China reached 6,322, many of which have foreign participation. Their combined output for that year was valued at $143 billion.

However, not all foreign automakers are making money in their China venture. Of 500,000 firms with foreign investment in various industries, Chung (2007) reported that some 55 percent reported losses in the period 2001-2004. This suggests that nearly half of foreign-invested businesses in China are actually losing money for reasons ranging from the difference in business culture and inconsistent policies to protectionism, higher transportation costs and geographic distance. Still, foreign automakers continue to make a beeline at China’s doorstep. In 2001, for example, whilst seven new firms entered the China market, several more were also announcing their plans to do the same (Gao, 2004).

This paper examines the factors that make China attractive to foreign car makers, why some foreign auto firms prosper and why others fail in the complex and perceptibly high-risk China market. The end goal is to formulate a road map that suggests what factors should China-bound foreign auto makers take into account and what pitfalls to avoid. For this purpose, a case study of a relatively successful foreign-invested auto firm in China will be chronicled based on the secondary method of research. Section 2 delineates the methodology used for the research, which takes the form of the causal and descriptive types of research and relies heavily on the secondary data collection method.

The Literature Review comprising Section 3 depicts the Cinderella story of China’s car industry, highlighting the important roles played by economic reform, technology transfer, WTO accession and foreign direct investment in this phenomenal growth. The chapter also discusses the problems confronting the foreign auto makers in China, their future prospects, the strategies they used and can be used by other like-minded foreign firms in entering the market. Section 4 is the case study of Volkswagen as a foreign auto maker that prospered in China through its separate joint ventures with domestic car makers Shanghai Automotive Industrial Corp. (SAIC) and First Automotive Works (FAW).

The final section summarises the research and concludes that the best strategy for foreign-invested firms is enter the market with at least two Chinese partners, set up a state-of-the-art R&D facility, bring in the experts from home to guide the local staff, and produce vehicles that fill the needs of local consumers and at the same time meet world standards.

Methodology

The first part of the study consists of a review and appraisal of the existing literature on the automotive industry in China – its astounding growth, what factors attracted multinational car makers into China; how this form of foreign direct investment influenced the development of China’s car industry; why the booming car industry in China continues to entice foreign firms. The rest of the research follows the patterns and methods associated with the descriptive, exploratory and explanatory types of research. In using the descriptive method of research, the objective is to find out which conditions unique to China did foreign investors find attractive, while exploratory and explanatory research attempts to elucidate how China’s car industry grew from scratch into the second largest in the world.

It also examines which variables are causing certain behaviours among foreign auto firms and influence their success or failure in this market. The case study methodology will also be employed by generating the secondary data of research to illustrate how a foreign auto firm overcomes the challenges and complexities of doing business in China to make the enterprise profitable. For this study, the focus is on a joint venture between foreign and domestic companies, which is the most popular mode of entry for foreign car makers in the Chinese market. The secondary data in this study will be complemented by the reference materials in the literature that present similar case studies of wholly foreign-owned and wholly Chinese-owned car manufacturers in China such as Qiu (2005), Eun & Lee (2002), Xing (2002) and Zhang (2002).

On the conduct of research, greater weight is thus given to the secondary method of research and the case study methodology because of the need to tap multiple sources and to conduct a multi-perspective analysis. The case study methodology is the most appropriate for this research because it uses multiple sources of data and analyse this data from many perspectives (Kelly, 2005). As for secondary research, this is also more useful and cost-effective than primary research in a study of China’s car industry because it does not really need data through direct contact, such as learning customer attitudes (Kelly, 2005).

All the data required for a research of this type are those related to a particular market, an industry sector and the foreign players in it, which information is readily available from secondary sources. Such secondary sources are previous research reports, journals, magazines and newspapers, government and NGO statistics. Whilst some of these sources may not be 100 percent accurate, the multiple sources in secondary research can however enable the researcher to synthesise and determine any inaccuracies. This can happen when secondary data sources are analysed, explained and combined with additional information from primary sources (Kelly, 2005).

In effect, analysis of secondary data uses the data collected by someone else in order to bring a study further. The primary advantages of secondary research then are the ease of access to data and its cost-effectiveness. It helps clarify and answer the research question without being slowed down by the difficulties related to primary research, such as conducting field surveys and face-to-face interviews. In other words, secondary research will accomplish the purpose of this research without expending so much time and resources on data collection even as it provides a larger database than is possible to collect on one’s own.

The reason is that the secondary research method will provide the research with a wider perspective through data collected from books, journals, Web sites, codified papers from seminars and forums and other institutional or government publications. In a research of this type, the primary method of research would have been of no productive use because of the vast areas of study that need to be covered.

Literature Review

The automobile industry in China started as a mere sector of the machinery industry but in a few years after China’s accession into the World Trade Organisation (WTO), auto manufacture scaled the heights to become one of the five leading industries that power the growth of China (Agarwal & Wu, 2004; Flassbeck, 2004) ). To be sure, all sectors of the Chinese economy have been recording double-digit growth rates since China abandoned the centrally planned economic system in favour of the open market, but the auto industry has been the best performing sector in the past 10 years (Hayes, 2005). According to He & Wang (2001), China became such a rich auto market because it is home to 1.3-billion people, or over one-fifth of the world’s entire population, in which all sectors of the economy have experienced fast-paced development.

From 2001 to 2005, China increased its share in the world auto market from 4 percent to 10 percent to match the output of Japan (Qiu, 2005). In 2006, a total of 7.189 million vehicles were manufactured in China, making the transition economy the world’s third largest automaker after Japan and the US, replacing Germany in the process (Bradsher, 2008b). China also became the second largest car market in the world after the US, with 13 foreign carmakers operating in the country along with their Chinese partners – Toyota, General Motors, Volkswagen, Ford, Isuzu, Mitsubishi, PSA Peugeot-Citroen, Daihatsu, Honda, Mazda, Nissan, Fiat and Suzuki.

The combined production of these automotive companies accounted for a 27.32 percent growth in 2005 as car consumption rose 54.42 percent from the 2001 figure (O’Keefe, 2005). Such increase in car consumption was attributed to the steady rise in China’s per capita income, which was pegged at $7,600 in 2006 from only $1,000 in 1991. JD Power & Associates, which has provided market analysis to firms and conducted customer satisfaction surveys in China since 2000, predicts sales to grow by 1 million vehicles yearly through 2015, with 33 million new units to be sold in 2008-2010 (China Economic Review, 2005).

Economic Transition

In the words of Qiu (2005), China’s automotive industry was “very weak” previous to the country’s adoption of the open door policy. What passed for a car industry started in 1956 when the First Automotive Works (FAW) was established with the assistance of the former Soviet Union. The first vehicle produced by FAW was a line of trucks called Jiefang followed by the passenger car Hongqi, which was designed mostly for use of high-ranking government officials (Child & Tse, 2001). In the infancy stage of the industry, motor vehicles were produced for utilitarian purposes not for luxury, since the process followed the centralised system bereft of market orientation (Wu, 2003).

Thus, trucks and buses were manufactured for transportation, jeeps for military use and tractors for agriculture. The same production pattern was reflected in the activities of the automotive firms that followed FAW, first by the Second Automotive Works (SAW) and then by the Shanghai Automotive Industrial Corp. (SAIC) in 1958 (Desai & Veblen, 2004). Gradually, the pioneering Chinese companies achieved the technology to produce cars of world standards but production remained small-scale, low quality and inefficient because of the persistent orientation that looked at motor vehicles as items of luxury (Eun & Lee, 2002).

The hands of the industry were also tied by a plethora of rules, such as the restriction on the purchase of cars by private individuals, which discouraged manufacturers from producing sedans. In effect, the initial auto firms were marginal and inefficient but they stayed on because of such factors as local government assistance and protection. However, the industry presented little prospects for a profitable venture that the number of local players remained the same for years at less than 117 (Harwit, 1995; Song & Yu, 2004; Gallagher, 2002).

One of the deterrents to the lackluster growth of the domestic car industry at the initial stages was the tariff and quota system heavily imposed on the sector. The market potentials were vast, with government purchases themselves capable of stoking the development of the car market, but foreign firms that could provide the needed technology were discouraged by the regulation that limited the number of vehicles that can be imported. High levels of consumption tax and VAT were also imposed on the purchase of cars (Eun & Lee, 2002). The result was that prices of locally produced cars were much higher than world prices. Even if you throw in the price effects of import licenses and other non-tariff quotas, the auto price in the Chinese market was between 1.25 and 3.45 times higher than the world market price.

Another reason why foreign firms were not exactly crowding out the local carmakers was the fact that cars were not considered an important export product for China as these were assembled mainly for sale in the domestic market (Dullien, 2004). All these factors initially dampened the interest of foreign automotive firms in the Chinese market (Son & Yu, 1999). The Chinese government seemed to be aware of these disincentives to foreign firms and the need to liberalise the industry, but it took time in changing the rules on the rationale that if the market was opened too fast and too wide, the capability of local enterprises to adapt and adjust would be compromised and they could be overwhelmed by the strength and competitive advantage of incoming multinational firms (Song & Yu, 1999).

Then China signified its intention to join WTO at the turn of the 1970s, which came at an opportune time because the global car market was contracting (Lu, 1999), posting zero or negative growth. China had at this time embarked on the market reform program that had the economy growing by 10 percent yearly, among the immediate effects of which were the improvement of living standards and the resulting acceleration of demand for private cars (Qui, 2005). After 1979, when market entry rules were relaxed, the automotive industry grew rapidly as all Chinese provinces put up their own assembly plants and the market became less monopolised by a few players. With 1.3-billion Chinese as prospective car buyers, foreign automakers were pouring billions of dollars into developing a vibrant car industry in China (Gallagher, 2002).

A most enduring truth in economics is that people and businesses always respond to incentives (Wu, 2003). By providing attractive incentives to foreign investors, China made its market a favoured destination for FDI (HK Trade Development Council, 2003). These attractions include a reduced corporate tax of only 15 percent for foreign-invested enterprises (33 percent for domestic firms), a 2-year tax holiday after these firms would have recorded a profit, duty-free concessions for imported equipment, improved land-use rights and many others (Erskine, 2004). By 1996 alone, total foreign investment in China had reached $176 billion, or 11.8 percent of the total fixed investment in the country, as it hosted some 140,000 foreign-funded enterprises.

At the start of the Chinese reforms, the country sought industrial growth mainly through investments on labor and capital, with only about 30 percent of local enterprises allowed to rely on technology improvement. This showed in the value of industrial output, which forged ahead only two times even as fixed assets grew 3.3 times in between 1990 and 1995. For example, there were over 100 automobile companies by then but their combined annual output was only some 1.5 million vehicles. It became evident that this industry structure needed adjustments to give technology transfer a more important role (Ming & Xing, 1999).

Role of Technology Transfer

That technology transfer serves to boost the capability and global competitiveness of developing countries has been demonstrated by FAW, the first and largest auto firm in China, which opened the floodgates for the massive FDI inflows into the country’s car industry (Ming & Xing, 1999; Yan, 2005). After FAW forged a joint venture with the German producer of Audi cars, the Chinese partners in the venture set up a team of experts consisting of talents from the organization and from leading universities and institutes (Lu, 1999). The function of the team was to read and interpret all the technical documents provided by the foreign partners for the benefit of local personnel.

The idea was to make the local component of the enterprise “learn by doing,” such that the Chinese technicians used, adapted and changed the foreign technologies, combining the newly acquired technology with their own experience to develop a new product line under the Red Flag brand (Wang, 1995) based on the requirements and characteristics of the Chinese market. The Shanghai city government, which owns and operates SAIC, made use of advanced foreign technology the same way to boost and modernise the city’s capabilities not only in auto production but also in the manufacture of mobile phones and elevators. Ming & Xing (1999) believed that advanced technologies imported by Shanghai in large amounts made a profound influence in promoting the powerhouse industrial structure of Shanghai today.

A 1991 survey conducted by the Shanghai Industrial Bureau showed that 71.2 percent of the Shanghai-based firms ranked among China’s top 200 corporations in terms of profit and resources. The top 5 are all joint ventures, which accounted for 84 percent of the total; only 16 percent were wholly owned domestic firms without any foreign participation (Dunning, 1995). In the more successful firms, FDI became the principal means of technology transfer, which came to local companies in the form of hardware and software, managerial skills and market experience (Ming & Xing, 1999).

In 1997, the whole of China imported $169-billion worth of technology-based products as the country sought more advanced technology to underpin its fast shift from the planned to a market economy. According to Vernon (1996), the product life cycle that is so critical to the industrialisation effort is divided into three stages:

- New product stage – a product is manufactured in the home country and later introduced in foreign markets through exports.

- Mature product stage – technology becomes commonplace as to be transferred, which threatens a firm’s export position, so that a firm is induced to produce, generally in other advanced countries.

- Standardized product stage – as the product becomes completely standardised, production is shifted to low-cost locations in developing countries.

This could be one of the reasons for the burgeoning FDI in China coming from MNEs that are looking for low-cost locations. There is a persistent view that globalisation has dulled the effects of the product life cycle theory, but the age of technology may be correlated with the form of transfer, especially for capital-intensive projects like car manufacturing. In this case, a company invests vast amounts of resources in research and development for the purpose of creating a unique competitive advantage for itself. After this R&D activity comes up with a product that features a brand-new technology, the product sidesteps the local market for the export option.

That way, brand-new technologies are positively related to FDI, and mature technology with licensing (Nolan, 2001). Based on the product life cycle theory, developing countries thus obtain standardised technology through the licensing agreements it arranges with foreign investors (Ming & Xing, 1999). Imported technology is crucial to technological progress in developing countries and FDI made possible by licensing agreements, joint ventures and wholly owned foreign firms are the major channels for importing technology. Once China removed the entry barriers and welcomed joint ventures and wholly owned foreign firms into the country, the MNEs took the achievement of high-tech capabilities and profitability in many Chinese industries as a cue to move in (Dullien, 2004). Aside from the automobile industry, the other sectors that drew gargantuan amounts of FDI were telecom, pharmaceuticals and computers (Dunning, 1995).

Role of FDI

The foreign direct investment that went into China following its market reform has been instrumental in the development of its car industry (Cheung & Lin, 2004; HK Trade Development Council, 2003). China dislodged the US as the world’s largest recipient of foreign direct investment because it timed its market reforms beautifully. The onetime showcase of communism and command economy opened its doors to foreign investment at a time when the global economy was in a slump. China also made the right moves by adopting the market system on a slow, gradual and calibrated basis.

The government demonstrated keen awareness of the fact that if it opened its market way too fast and too profound, it would throw the fledgling local firms off balance, especially Chinese companies in the car industry that were in the doldrums during the years that the entry of foreign carmakers had been few and far between (Ma & Wang, 2001). Without rushing it, China started by letting foreign investment into labour-intensive industries, then again opened the door a bit wider by serving up the capital-intensive sectors to foreign investors. This was capped by the decision to give foreign firms free access to technology-intensive industries, which started the flood of FDI into China’s car industry that needed the technological boost that foreign car makers can give (Erskine, 2004).

It will come as a surprise to those unfamiliar with geopolitics and econometrics that China’s market deficiencies, which are the natural results of its being a longtime command economy, actually served as come-ons for FDI. This is supposed to be the workings of the theory of market imperfections, which suggests that multinational firms would avoid developed markets in favor of developing economies where the potentials are huge but largely untapped. The implications are that the potentials have been used up in developed markets while there are boundless opportunities for growth in developing economies like China (Saalman, 2004).

The FDI inflow to China intensified when the country started negotiating for its membership in WTO-GATT, which usually takes sometime. In the process, China used the incoming FDI to acquire and absorb advanced technologies for the development of its car industry, which was far behind world standards at the turn of the millennium (Graham & Wada, 2001). Progress in this sector began to grow apace, as reflected in an increase in vehicle production from only 0.22 million units in 1980 to 2.07 million in 2000, peaking at 3.26 million in 2002. Total sales also increased from only 8.6 billion worth in 1980 to 340.7 billion worth in 2002.

All these indicate that the initial batch of foreign car makers that chose to operate in China are finding the enterprise profitable. As the number of foreign auto makers in China continued to increase, and the country expanded its FDI stock, it was correctly predicted that the time was not far off when the local car industry achieved the same reputation enjoyed by car makers in the US, Germany, Japan and Korea (Yan, 2005). This happened as soon as China surpassed the US as the largest recipient of FDI ((Saalman, 2004).

The experience of the US car industry in the 1980s holds some lessons for China as far as the influence of foreign direct investment in automotive industry development is concerned (Dunning, 1995). Because of the strong competition posed by European and Japanese carmakers, the product quality, design and technology of American manufacturers at the time paled by comparison (Clark & Fujimoto, 1991).

To overcome the problem, American automakers sought relief from car imports, which call was picked up by protectionist members of the US Congress. Anticipating a protectionist measure, the three largest Japanese car firms doing business in the US embarked on a massive direct investment program (Graham & Wada, 2001). As it turned out, the US government rejected calls by Congress to impose a local content requirement on the local operations of the Japanese firms. Instead, the government undertook a 10-year restructuring program for the US automotive sector. Through the program, the US obtained world-class technology from foreign-owned but domestically located sectors of the car industry even as it assisted inefficient local firms in narrowing the gap between them and the foreign-owned companies (Lung, 2003).

In time, the efficiency of local plants improved, product design and quality achieved world-class status, and the competitive position of US-owned firms against the Japanese and German carmakers grew stronger. Thus, FDI played an important role in regaining the dominant status of auto manufacturing in the US, where the world’s first motor vehicle was developed in the first place. FDI was used in the strategy by replacing inefficient locally owned firms with efficient foreign-owned companies (Nunnenkamp & Spatz, 2003; OECD, 2000).

This strategy worked well for the US car industry but Song & Yu (1999) doubted if China can pull the same trick, stuck as it were on its dependence on foreign auto investors to influence the growth of its own car industry. Unlike carmakers in other countries, China has yet to find the unique selling point that it can identify its carmakers with. European carmakers, for example, are known for their highly differentiated and quality cars, the US for its mass-produced cars that are affordable to all. On the part of the Japanese, they are noted for their energy-efficient small car models, which were designed based on the constraints posed by the energy shortages in Japan (Legget, 2004).

There is nothing in the history of the car industry in China that it can exploit to differentiate its locally produced cars in the export market. This is a significant point in a discussion of FDI inflows to China’s car industry because Beijing is in the process of developing “national champions” among local auto firms that could compete strongly in the world markets (European Commission, 2004).

WTO Accession

Even while China was just poised to join WTO, the prospects of a liberalised giant of a market already had great appeal to foreign investors. In 2001, China’s auto industry received the largest amount of FDI rushing into the country, which contributed $12 billion to the Chinese economy, or twice the level in the 1990s (Gallagher, 2002). Over 800 Chinese firms in vehicle-related industries had received FDI (Zhang, 2002). The largest single foreign investment ever to reach the Chinese car industry was the $1.2 billion brought by the US-based General Motors.

Japan and Korea had adopted a wait-and-see attitude for years, and China’s WTO entry finally drove the Japanese and Korean carmakers into action and asserted their presence in the Chinese market through Toyota and Renault-Nissan of Japan and Hyundai of Korea. These three companies introduced their entire series and models of vehicles to China and brought large-scale investments to lift their production scale to 500,000 in the next five years. The US-based Ford itself had watched China by the sidelines early on and set its sights on the Chinese auto market only when the country joined WTO in 2001. Ford arranged a joint venture with the Chinese-owned Chongqing Chanan with a $100-million investment.

Like them, investing in China became the lead strategy of other multinationals as soon as China became a WTO member. What most multinationals did after the WTO accession of China was to place new investment or expand existing investments in the country, continuously putting out new products, even introducing a whole series of products, and lowering their prices (Song & Yu, 1999).

In effect, the whole face of China’s car industry changed after its WTO accession. Small and medium enterprises like Chery, Greely, Hafei and Huachen forged technical cooperation and joint technical development setups with foreign firms, even as new joint ventures came up – among them, Beijing-Hyundai, Changan-Ford and Tianqi-FAW. The WTO membership of China also gave local firms two strategic options to compete in the liberalised setting. The first option was to enter into a joint venture with as many MNE as possible under the longest possible cooperation terms. This saw the emergence of the multilateral tie-ups among local firms and MNEs.

The second option was to develop independently through joint development and technology imports. The first option was popular among local carmakers in the mainstream, while the second strategy appealed to newly established and small local firms (Lu, 1999; Song & Yu, 1999). The main reason why Chinese auto firms shy away from independent investment expansion and instead go for the joint venture strategy ranges from shortage of funds, outdated technology and a perceived inability to expand on their own. This was true even for FAW, supposedly the largest and most profitable of the Chinese auto firms, whose annual output was placed at only 120,000 vehicles, too small by world standards (Ghosh online).

Even before the actual WTO accession of China, the government had started opening the local auto market to foreign investment when it reduced the tariffs by 64-68 percent, from a high 220 percent to only 70-80 percent. More liberalisation schemes came after 2001, such as the significant reduction or outright elimination of import tariffs, VAT and consumption tax, which exert a major influence on car prices, and the scrapping of the import licenses and quota requirements (Riley, 2002).

In the series of tax reforms, the tariff for auto imports was cut from 70-80 percent to 43.8-50.7 percent. As result, car prices dropped dramatically by 2-5 times of world market rates and in some models, even lower than the international price. The government provided more impetus by encouraging car purchases through such measures as reducing or eliminating the consumption tax and building new networks of roads and car parks. As the per capita income of the 1.3 billion Chinese rose, demand for cars also grew, particularly lower cost economy cars. The rule of thumb in auto consumption anywhere is that once the per capita income tops $1,000, the car industry becomes profitable.

There are provinces in the western part of China where per capita GDP still comes down to $600, but in the eastern provinces the figure reaches $1,400. In big cities like Beijing, Shanghai and Guangzhou, the per capita income is $3,000, $4,500 and $4,568, respectively. With the economy programmed to grow at over 7 percent in the next 20 years, the average per capita income in all China is expected to reach $4,000 or more, which is above the threshold for auto consumption. The appreciation of the Chinese currency, which was decided in 2004, is also expected to improve business and car ownership in China (Song & Yu, 1999).

The signs are beginning to show following the lifting of restrictions on foreign investment, such as the delegation of examination and approval rights, scrapping of local content requirements, etc. In 2001, total sales of cars in the domestic market were placed at 721,463 units. This climbed by 56.08 percent in 2002 as 1,126,029 units were sold and then by a much higher 75 percent in 2003, or 1,971,601 units. Such growth was matched by the rise in auto production, which was only 0.22 million in 1980 then jumping to 2.07 million vehicles in 2000. The growth had been steady since – 2.34 million in 2001 and 3.26 million in 2002. In terms of sales, total sales in 1980 were valued at only 8.6 billion yuan, expanding to 245.8 billion yuan in 2001, and to 340.7 billion in 2002 (Qiu, 2005).

By end-November 2006, China had a total of 6,322 automotive enterprises whose total output value for the first three quarters of that year alone was $143 billion (Kurtenbach, 2006). Purchase of vehicles by private individuals, which indicated the newfound wealth of China’s consumers, started to accelerate in 2002 when 50 percent of all motor vehicles sold in the country went to individuals. As the Chinese economy continued to grow, so did the annual growth rate of private ownership and consumer spending (BusinessWeek, 2006).

Foreign Auto Firms

As noted above, partnership with domestic investors is the only way foreign car makers can enter the auto manufacturing industry in China (Eun & Lee, 2002. The Chinese government says this partnership requirement is optional and foreign car makers can establish sole ownerships in China if they want, but the policy that prohibits full equity control tells otherwise (Huang, 2002a). Nonetheless, foreign car makers in China have generally sought the joint venture mode of entry and operations because of the comparative advantages derived from the setup. For example, they can avail of incentives and tax breaks that the government customarily provides to key industries with full domestic ownership, which wholly owned foreign firms cannot access (Keister, 2000).

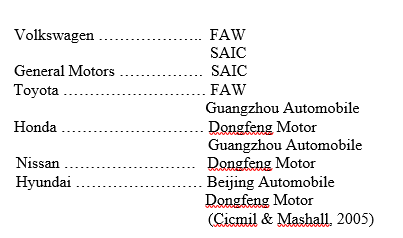

Thus, all the major players in China’s auto industry are partnerships between foreign and local interests. This phenomenon is the only one of its kind in the global car industry, along with the complex networks of partnerships that emerged in China in which a foreign auto maker has multiple relationships with local firms (Broadman, 2001). In these “one-to-many” relationships, foreign car makers can establish joint ventures with as many local enterprises as they can (Shenwei, 2007).

Dongfeng Motor

The Chinese government has encouraged this type of relationships in an effort to boost the country’s R&D and production capabilities in auto manufacturing (People’s Daily, 2001; Kurtenbach, 2006). From the start, industry analysts feared that this kind of partnerships between foreign and local firms would eventually develop into a situation where competition is heightened. Before that eventuality happens, foreign auto firms have used their R&D capabilities to enable their Chinese partners to produce successful vehicles. For example, Shanghai Automotive Industry Corp. (SAIC) developed its own vehicle called Roewe 750 using the R&D expertise of the German manufacturer Volkswagen.

The vehicle specifically designed for Chinese consumers came after the Volkswagen-SAIC partnership called Volkswagen Group China produced the Volkswagen vehicles in China such as Passat and Santana (Huang, 2003c). When Volkswagen and SAIC jointly manufactured the Santana models in 1985, there was a lack of production lines, with the localisation ratio placed at 2.7 percent ((Shenwei, 2007). No such problem was encountered when the partnership produced the Roewe 750, after which Volkswagen helped SAIC build their own auxiliary production facilities, with the localisation ratio rising to 40 percent in 1997 (Crow, 2001).

SAIC also has a local partnership with the US-based General Motors called Shanghai General Motors Co. Ltd., which started operation in China in 1997. By 2000, Shanghai GM had 390,000 employees and $185 billion in annual revenues, ranking next to Volkswagen Group China as the largest producer of SUVs, minivans and smaller cars (Leicester, 2000). The activity of GM in China actually dates back to 1922 when it began exporting cars to China, stopping only during the political upheaval in late 1980s (He & Wang, 2001). In 1995, GM started negotiations with SAIC on the joint venture and sealed the deal in 1997. The investment poured by GM in the enterprise was reported to be the largest single FDI in China at the time, whilst it brought the best of modern car technology in its China venture (Moran, 1998).

When this happened, SAIC was already co-producing with Volkswagen with highest number of passenger cars, but GM sought SAIC as its own Chinese partner because it was and still is the largest and most advanced automotive company in China. As if to demonstrate that its joint venture with SAIC is better than its partnership with Volkswagen, GM established an automotive technical center called Pan Asia Technical Center (Lippert, et al., 2002). The center’s main purpose is to provide engineering and training support to the GM-SAIC joint venture as well as other Chinese auto companies in need of modern technology (People’s Daily, 2001).

The first vehicle produced by the partnership in 1998 was the Buick Xin Shi Ji, which rolled off the assembly line when there was still little competition in the local market. What passed for its competitors were the more expensive Audi models of Volkswagen Group China and the low quality Hongqi produced by FAW on its own. The market success of Buick Xin Shi Ji, whose local content reached an unprecedented 47 percent, then inspired other joint ventures to introduce new models with a higher localisation of components. These included the Audi A6 and Passat of Volkswagen and Accord of Honda.

By 2000, Shanghai GM had achieved a 60 percent localisation rate for Buick Xin Shi Ji, for which reason it was spending much less for the importation of automotive parts from the US (Graham & Wada, 2001). This model had dual air bags and anti-lock brakes, which were considered revolutionary features in China at the time. Shanghai GM brought many new car technologies into China that other joint-venture auto companies after sought to emulate. Adaptation of the technology-related products and processes included the participation of Chinese engineers trained at PATAC.

In 2004, China changed tack on its car industry policy to allow foreign auto makers to own more than 50 percent of the stakes on engines and spare parts of their joint ventures with local partners (Chung, 2007). The new policy also enabled any foreign firm to enter into a joint venture with more than two local enterprises and produce different types of vehicles as long as it participates with its existing Chinese JV partner in acquiring other auto firms in China when such a need arises (Wang & Li-Hua, 2006). Previously, a foreign auto firm can only forge a joint venture with two local partners at most – and each JV must produce only one type of vehicle.

On the increase in foreign stakes, Honda was amongst the first companies to take advantage by raising its controlling stake to 65 percent in its joint venture with Dongfeng Motor and Guangzhou Automobile Corp. The partnership produces a sedan that has been successfully exported to European and Southeast Asian markets at an initial production capacity of 50,000 units annually (Chung, 2007). As for the new policy that allows more than two JV partners for a foreign firm, GM seized the opportunity by establishing four joint ventures with local car makers in Liaoning province and the Southern Guangzi Zhuang Autonomous Region.

Foreign auto makers are considered successful if they make it big in the export market with China as its manufacturing base. The primary reason is that production and labour costs are relatively low in China (Runckel & Associates, 2006). However, this is easier said than done because such an overseas plant tends to export either surplus-standard products or special category vehicles, like Volkswagen using its South African plants to export right-hand-drive Golfs. In fact, Volkswagen’s China-produced vehicles are considered niche products for the local market, not standard or special category vehicles that might fill an export bill (Chung, 2007).

Nonetheless, the pressure to export among foreign auto makers in China will only increase, and the big push could come from China’s own car makers who will eventually master the craft from foreigners who brought the technology (Tay, 2003). For example, Chery Automobile has signed a contract with American auto entrepreneur Malcolm Bricklin to bring 15,000 units of China-made sedans to the US starting 2007 (Shenwei, 2007).

China Ready

A foreign auto firm, or any foreign-owned company in other industries for that matter, is believed ready for the Chinese market if it possesses the following attributes:

- prior export experience;

- commitment to export products from China, by assigning a Chinese internal sales manager, technical and sales staff, and interpreters or translators;

- ample resources for the translation of marketing brochures, participation in local trade shows and organisation of customer information seminars;

- ability to host visits by potential buyers;

- ability to identify the sources of foreign and domestic competition as well as the distribution channels;

- familiarity with export logistics unique to China in relation to negotiation of letters of credit, export documentations and licensing and freight forwarders;

- familiarity with China’s import regulations, safety certifications, labeling requirements, and cultural preferences;

- an international marketing plan and a China-specific marketing strategy;

- commitment to provide local and foreign customers the same quality of service, which requires frequent travel to China of firm technicians and establishing an equipment service and maintenance centre with Chinese partners; and

- a protection program on intellectual property rights (Plafker, 2007).

Based on studies of the market entry and progress of foreign-invested auto firms in China, Hill & Jones (2001) noted that the firms prepare for the project by, first, conducting a situation analysis, then specifying how to reach the objectives, and finally devising the actual strategic plan. The situation analysis calls for a study of the external and internal factors, the firms’ current conditions, the competition, and the micro and macro-economic environment. The three basic steps involved in this process are, first, conducting a situation analysis, then specifying how to reach the objectives, and finally devising a strategic plan (Hill & Jones, 2001).

The situation analysis calls for a study of the firm’s current conditions, the competition, internal and external factors, and the micro and macro-economic environment. This is followed by the need to set the schedules for accomplishing the plan, followed by deciding whether the strategy is a short-term or long-term plan. Then the strategic plan is drawn with details on how to achieve the objectives (Grant, 2005). It is important that this plan shows a strategic consistency between the organization and its business environment, which obtains when the organization’s actions are consistent with the expectations of management, the market and the context (Armstrong, 1996). According to Beckman & Hoech (2005), the products intended for the domestic market must meet the needs of the target customers in terms of useful purpose, with a “meaning” that customers would want to associate with..

The policy that allows foreign auto firms to enter the Chinese market through joint ventures is believed to work to the advantage especially of Western multinationals, even if the benefits are indirect (Tay, 2003). The reason is that foreign firms with Chinese partners can avail themselves of the assistance that the Chinese government provides to auto ventures owned wholly or in part by Chinese businessmen, which assistance program is unavailable to wholly owned foreign firms in China. A joint venture in the context of China’s auto industry involves the establishment of a production subsidiary and joint ownership with Chinese partners to produce vehicles for the export market (Schlotthauer, 1999).

As an investment entry mode for foreign car makers, this is considered less risky than sole ownership, in which the foreign-based firm has full control of the assembly facilities and the accruing profits (Borna, 1999). According to Brewer (2005), foreign companies especially those going international for the first time are well advised to avoid this form of direct investment because of the high risks involved. The possible risks that a sole ownership may encounter in China include currency devaluation, expropriation or a market downturn. Such a market slowdown in China’s auto industry started to happen in 2008 as a result of the global financial crisis (Bradsher, 2008b).

Lippert, et al. (2002) believes foreign car makers do not find it hard to work with two partners. For example, Toyota has two partners in China – FAW and Guangzhou Automobile – and thus maintains two different franchises, two different production channels, and two different sales networks under the same Toyota logo. For the partnership with FAW, Toyota has about 220 dealers as 2006, whilst 100 dealers had been appointed for the joint venture with Guangzhou Automobile (Business Week, 2006). There is also not much difference in selling cars in China compared with other countries. According to Treece (2003), the pay scheme at the car dealerships in China is very similar to that in the US since it is based on commission and the fixed salary is very low. It is, however, different from the pay scheme in Japan and some parts of Europe.

Problems & Prospects

Foreign car makers intending to do business in China must be aware of the country’s protectionist policies and conflicting measures. These policies, according to Managing Director Thomas Kaestelle of Rothschild investment bank in China, should be inputted in the decisions of foreign auto makers related to investment, product lineup, joint ventures, R&D and technology transfer (Chandran, 2008). In 2007, new tax rates were imposed on auto makers to encourage the sale of smaller cars. The new taxes made such a bite on the income of the automotive sector as to bring down the sales of Toyota by 7,203 units, Honda by 7,267 and Nissan by 7,201. There is the global glut in production capacity resulting from the global financial crisis that auto makers have been pressuring suppliers of components to reduce costs (Bradsher, 2008b).

There have been changes in the rules governing joint ventures in recent years but the policy barriers remain in place (Chandran, 2008). Based on the rules, for example, the Chinese shareholders in a joint venture must obtain a stake bigger than the total shares of all foreign investors if the foreign partners decide to sell their shares in it. Moreover, two foreign firms that establish a partnership with the same Chinese company will be considered as a single entity if one of these foreign firms also holds the majority stake in another foreign firm.

China’s tax policy is as much a challenge to foreign firms as evident in the income tax rates that are set at 15 percent for foreign-invested firms and 33 percent for domestic firms (Chung, 2007; Huang, 2002a). Another potential barrier is the difference in business culture that has been found to obviate whatever advantage a foreign car marker derives from labour supply, which is low-cost and abundant in China.

Now that China’s car market has reached its saturation point, there is an increasing pressure for foreign auto makers in China to export to stay profitable. However, producing an export-quality line of vehicles from China poses some problems to foreign car makers. Graeme Maxton, an industry analyst at the Economic Intelligence Unit, believes the production processes in China cannot comply with international standards for at least five years (China Economic Review, 2005). The reason is that car companies are in China precisely to serve the local market and that it would be pointless to compete with automotive plants in other markets, which are saturated as China.

Chinese carmakers have other short-term problems related to manufacturing and cost issues. As it were, China’s car makers have achieved sales growth but not profitability (Ghosh, online). Again EIU’s Maxton was quoted as saying that exports will only happen if car makers show desperation enough to use up the capacity of their Chinese plants. In the meantime, the big auto makers need to go through the motions of developing exports because it s what the Chinese government wants to see ((O’Keefe, 2005).

The decline in demand for cars has alarmed industry analysts since August 2008. Because of the dwindling demand, Deutsche Bank had projected an oversupply of 23 percent in the China market for that year. Still, foreign carmakers are expected to invest $13 billion between 2008 and 2010 to bring annual capacity to 6 million units (Bradsher, 2008b). This is because industry analysts refuse to believe that the worsening financial turmoil around the world will have a major effect on China’s automotive industry (Chandran, 2008).

Strategy

Once a foreign auto firm decided on the appropriate entry mode for the Chinese market, it has to set the strategies on product and communication to a foreign market (Brewer, 2005). These strategies are:

- Straight Extension – in this strategy, the China-based foreign firm markets the same product in all countries, which has a bigger chance of success if the markets it select are not culture sensitive and economies of scale are present.

- Product Modification – the product is modified in features and functions based on the characteristics of the intended market.

- Communication Adaptation – in product advertising and promotion, the foreign firm purveys the same message it uses in the home country and other markets outside China, with a few changes only in language or context. However, the differences in social, economic and political conditions make product advertising difficult to standardise.

- Dual Adaptation – this requires a change in both product and advertising message based on consumer preferences in China.

- Product Invention – this calls for a product entirely different from those the car maker produces elsewhere. Ford used this strategy by selling cars in Europe that were different from those it produced in the US.

The next imperative in entering a foreign market like China is price setting, which is particularly difficult to standardise because of fluctuating exchange rates, higher transportation costs, tax policies and controls in China (Crow, 2001). Borna (1999) proposed three global pricing alternatives appropriate for China: the extension-ethnocentric, adaptive-polycentric and invention-geocentric price policies. The extension-ethnocentric policy suggests that the firm sets the same price for its product in China and overseas market, passing on such costs as import duties and freight to customers. The simplicity of this policy is its main advantage whilst its weakness is its tendency to disregard the demand, competitive and relevant conditions in local markets.

As for the adaptive-polycentric price policy, it leaves the decision on price setting to the local management, which is in a better position to do so since this function is sensitive to culture and local conditions. This policy is also conducive to product arbitrage, which enables a firm to manage the price difference between markets and the freight and duty cost. The third price policy, invention-geocentric, recognises the importance of local factors and the firm’s market objectives, such that it neither fixes a single global price nor cedes control to local management (Alvesson & Deetz, 2000).

In selecting the distribution channels for an automotive product, there are two alternatives available to a foreign firm. One, the firm may use domestic middlemen to provide marketing services from their home base, which may include export management firms, export agents, trading companies and complementary marketers (Borna, 1999). Two, if the company is reluctant to use domestic middlemen, it can choose to deal directly with middlemen in foreign markets. This effectively brings the manufacturer closer to the market since narrows the distribution channels. However, the downside is that foreign middlemen are difficult to control being some distance away from the manufacturing base (Brewer, 2005).

The Chinese market is widely acknowledged to be a high-risk playing field for foreign car markets because of fluctuating exchange rates, unstable government, high product-communication adaptation costs, etc. The first step then in considering the Chinese automotive market is to understand the marketing environment. Based on this knowledge, the firm can clearly define its objective and strategy for international operations (Chapman, 2001).

Third, the firm must analyse the host country’s business environment in relation to its cultural, social, economic, legal and political practices. Also likely to impact on a foreign firm’s viability is the competitive picture. Having given all these internal and external factors careful consideration, the next imperative for the foreign firm is to decide on the best mode of entry. This is followed by the decision on the extent to which the firm’s product, price, promotion, and distribution should be adapted to the unique conditions in China. Finally, the firm must develop an effective organisational structure for pursuing international marketing (Borna, 1999).

Case Study

The German multinational Volkswagen was the earliest and most successful foreign player in China’s auto industry. It entered this market in 1984 through Volkswagen Group China and now operates through 14 subsidiaries in the country, producing vehicles and providing parts and services to both customers and industry (Kurtenbach, 2006). The group is run by a 6-man management team that supervises all the representative companies, organises new business units as needed, and oversees sales and marketing, technology, purchasing, financing, personnel and governmental relations (Desai & Veblen, 2004).

Of its Chinese partners, the largest are SAIC and FAW in which Volkswagen has different amounts of equity holdings. Volkswagen’s with SAIC goes by the business name Shanghai Volkswagen Automotive Co. Ltd. with a 50-50 equity sharing whilst the joint venture with FAW is called FAW-Volkswagen Co. Ltd., which is a 40-60 proposition in favor of the Chinese partner (Shenwei, 2007). From 1984 to 2005, Volkswagen has poured into its joint ventures over Euro 6 billion for vehicle production, distribution and service provision. By this time, it had become the top producer of smaller cars, minivans and SUVs n China.

Through the partnership with SAIC, Volkswagen produces a variety of model that consists of Passat, Polo, Santana, Touran, Lavida, Octavia, Fabia and Skoda whilst the FAW-Volkswagen manufactures a shorter line of product made up of Audi, Magotan, Sagitar, Golf, Bora and Jetta (Lippert, et al. 2002). In effect, the Volkswagen-SAIC partnership is the larger of the two, employing 13,000 people as against 9,800 at FAW-Volkswagen. However, the latter stands out as the first modern car industrial base constructed on the economy of scale in China with the capability to produce thousands of vehicles, train equipment and components daily and to export these to other markets (Shenwei, 2007). Its Audi models also hold the distinction of being the first premium class vehicle to connect with Chinese consumers (Cooper, 2003).

This market success has been attributed to a provision in the joint venture agreement signed in 1988 that called for the technology transfer of the production and planning process for Audi and the setting up of after-sales support. Under the agreement, Volkswagen also shouldered the training of some 500 Chinese workers at Audi in Germany, whilst about 30 Audi employees from Germany were posted in China to provide production support.

With an 18 percent share of the auto market in 2007, FAW-Volkswagen is the largest foreign car maker in China today and the firm is determined to maintain its market leadership by responding to the challenges with a strong local manufacturing network (Lee, 2007). Much of the recent improvement in sales and profits was attributed to the preparations for the 2008 Beijing Olympics, which is expected to recur in the run-up to the World Expo, which will be held in Shanghai in 2010 (BusinessWeek, 2006). Meanwhile, the company is described as putting on a very domestic face but it expects to look at exports once costs and quality are improved.

For this reason, Volkswagen in 2005 announced that it would spend another $3 billion to further improved R&D and capacity in an effort to increase production to 1.3 million units in 2007 (China Economic Review, 2005). In this activity, the company is aware that it runs the risk of strengthening local competitors who may pirate their designs and models. Thus, cars are developed under wraps to protect the design and engineering systems. General Motors, Honda and other foreign car makers have already filed lawsuits against Chinese auto makers that allegedly stole their models – to no avail.

Summary & Conclusion

One of the biggest attractions of China for foreign auto makers is the sheer size of the market. China is home to 1.3-billion people, or over one-fifth of the world’s entire population, and all sectors of the Chinese economy have been experiencing fast-paced development. This translates to a burgeoning purchasing power fuels a growing consumer demand for cars. Such increase in car consumption was attributed to the steady rise in China’s per capita income, which was pegged at $7,600 in 2006 from only $1,000 in 1991. Thus, China increased its share in the world auto market from 4 percent in 2001 to 10 percent in 2005, making China the world’s third largest automaker after Japan and the US.

Germany has been relegated to fourth place. From the research, there is a general sentiment that despite the ups and downs and the global financial crisis notwithstanding, car sales in China will continue to grow by 1 million yearly through 2015. This would entire more foreign car makers to participate in China’s booming automotive market. The Chinese government is attempting to heighten the inducement by reducing corporate tax to 15 percent for foreign-invested enterprises, a 2-year tax holiday once these firms posted a profit, duty-free concessions for imported equipment and improved land-use rights. Foreign car makers are also now allowed to forge as many joint ventures as they want as well as increase their stake in such partnerships, which was previously limited to 50 percent.

It is interesting to note that the market imperfections in China’s transition economy are precisely the factors that draw foreign car firms into China. In effect, these multinationals avoid developed markets in favour of developing economies like China because of the vast potentials that wait to be tapped. Whilst the potentials in developed markets have all been used up, the opportunities for growth in China are limitless.

For a foreign car firm to succeed in China’s market, it is advised to conduct a situation analysis at the outset that decides how to reach the business objectives through a strategic plan. The situation analysis must study the external and internal factors, the firms’ current conditions, the competition, and the micro and macro-economic environment. This is followed by the need to set the schedules for accomplishing the plan, followed by deciding whether the strategy is a short-term or long-term plan.

Then the strategic plan is drawn with details on how to achieve the objectives. It is important that this plan shows a strategic consistency between the organization and its business environment, which obtains when the organization’s actions are consistent with the expectations of management, the market and the context. As gleaned from the case study of Volkswagen, the best strategy is to enter the market through a joint venture with at least two Chinese partners, set up a state-of-the-art R&D facility, bring in the experts from home to guide the local staff, and produce vehicles that fill the needs of local consumers and at the same time meet world standards.

Bibliography

Agarwal, J. & Wu, T. 2004. China’s Entry to WTO: Global Marketing Issues, Impact and Implications for China. International Marketing Review, Vol. 21, No. 3.

Agrawal, M., Kumaresh, T.V. & Miercer, G.A. 2001. The False Promise of Customisation. The McKinsey Report, No. 3.

Allford, D., Saekett, P. & Nelder, G. 2000. Mass Customisation – An Automotive Perspective. International Journal of Production Economics, No. 65.

Alvesson, M. & Deetz, S. 2000. Doing Critical Management Research. London: Sage.

Alysha, W. 2004. Cheap Chinese Auto Part? Maybe Not. Automotive News 78.

Amsden, A. 2001. The Rise of ‘the Rest’ – Challenges to the West from Late Industrialising Economies. 1st ed., New York University Press.

Armstrong, M. 1996. Management Process and Functions. London:CIPD.

Barney. J. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management, Vol. 7, No. 1.

Beckman, S. & Hoech, J. 2000. What does Beauty Have to do with the Bottom Line? Harvard Business Review.

Borna, S. 1999. International Marketing. 2d ed., Encyclopaedia of Business.

Bradsher, K. 2004a. China Car Culture Hits some Potholes. New York Times.

Bradsher, K. 2008b. Do Chinese Automakers Need a Bailout? New York Times.

Brewer, J.C. 2005. One More Time: Strategy not Operations is Key for Rest of Decade Performance. Automotive Industries.

Broadman, H. 2001. The Business (es) of the Chinese State. World Economy 24 (7).

BusinessWeek. 2006. Toyota in China: Full Speed Ahead.

Cicmil, S. & Marshall, D. 2005. Insights into Collaboration at Project Level: Complexity, Social Interaction and Procurement Mechanisms. Building Research Information.

Chapman, C. 2001. The Application of Knowledge-based Engineering Approach to the Rapid Design and Analysis of an Automotive Structure. Advances in Engineering Software, Vol. 32.

Chandran, R. 2008. Policy Roadblocks Test Carmakers in China and India. Reuters.

Chen, A. 2002. The Structure of Chinese Industry and the Impact from China’s WTO Entry. Comparative Economic Studies, Vol. 44, No. 1.

Cheung, K.Y. & Lin, P. 2004. Spillover Effects of FDI on Innovation in China: Evidence from the Provincial Data. China Economic Review 15.

Child, J. & Tse, D.K. 2001. China’s Transition and its Implications for International Business. Journal of International Business Studies, Vol. 32, No. 1.

China Economic Review. 2005. Car Trouble.

Chung, O. 2007. How Foreign Firms Dodge Taxes in China. Asia Times.

Clark, K. & Fujimoto, T. 1991. Product Development Performance, Strategy, Organisation and Management in the World Automotive Industry. Harvard Business School.

Cooper, B. 2003. Breakthrough! Connecting with your Audience. United Media Group, webpage Design. Web.

Crow, K. 2001. Product Development Strategic Orientation. DRM Associates.

Desai, M.A. & Veblen, M.F. 2003. The Refinancing of Shanghai General Motors. Harvard Business Publishing.

Dev, C. & Schultz, D. 2004. International Marketing Strategy. 4th ed., Thomson Learning.

Dullien, S. 2004. FDI in China: Trends and Macroeconomic Challenges. Webpage design. Web.

Dunning, J.H. 1995. Explaining the Changing Patterns of International Production: In Defense of the Eclectic Theory. Oxford Bulletin of Economics and Statistics.

Erskine, A. 2004. The Rise in China’s FDI: Myths and Realities. Paper presented at the Australian-China Free Trade Agreement Conference, Sydney. Web.

Eun, J.H. & Lee, K. 2002. Is an Industrial Policy Possible in China? The Case of the Automobile Industry. Journal of International and Area Studies 9 (2).

European Commission. 2004. Changing Competition from China: 2004 European Competitiveness Report” . Web.

Flassbeck, H. 2004. China’s Spectacular Growth since the Mid-1990s. Macroeconomic Conditions and Policy Challenges.

Gallagher, K.S. 2002. Foreign Technology in China’s Automotive Industry: Implications for Energy, Economic Development and Environment. Belfer Center for Science and International Affairs, Harvard University.

Gao, P. 2004. Shaping the Future of China’s Automotive Industry. China: McKinsey Quarterly.

Ghosh, S. Learning to Increase Competitiveness in the Automotive Industry. Webpage design. Web.

Graham, E. & Wada, E. 2001. FDI in China: Effects on Growth and Economic Performance. In Achieving High Growth: Experience of Transitional Economies In East Asia, Drysdale, P. (ed), Oxford University Press.

Grant, R.M. 2005. Contemporary Strategy Analysis. Oxford UK: Blackwell Publishing Ltd.

Harwit, E. 1995. China’s Automobile Industry: Policies, Problems and Prospects. New York and London: ME Sharpe.

Hayes, R. 2005. China’s Modern Powerhouse. Webpage design. Web.

He, D. & Wang, M. 2001. China’s Vehicle Growth in the next 35 Years: Consequences on the Motor Fuel Demand and CO2 Emissions. Paper presented at the Annual Meeting of the Transportation Research Board, Washington DC.

Hill, C. & Jones, G. 2001. Strategic Management. 5th ed., Houghton Mifflin.

HK Trade Development Council. 2003. Foreign Direct Investment in China. Web.

Huang, Y. 2002a. Analysis on Rules and Trends in the Revision of Chinese Industrial Policies Related to the Automotive Industry. Paper presented at the Joint Workshop on Cleaner Vehicle Development and Deployment, Beijing.

Huang, Y. 2003b. Selling China. New York: Cambridge University Press.

Huang, Y. 2003c. One Country, Two Systems: Foreign-Invested Enterprises and Domestic Firms in China. China Economic Review.

Hunt, S.D. & Morgan, R.M. 1996. The Resource Advantage Theory of Competition: Dynamics, Path Dependencies and Evolutionary Dimension. Journal of Marketing, Vol. 60.

Iwaarden, J., Wiele, A.V.D., Williams, A.R.T. & Dale, B.G. 2004. Quality Management System Development in the Automotive Sector. UK: University of Manchester Institute of Technology.

Kalish, I. 2004. Seven Risks of Doing Business in China. Deloitte Research.

Keister, L. 2000. Chinese Business Groups: The Structure and Impact of Inter-firm Relations During Economic Development. New York: Oxford University Press.

Kelly, M. 2005. Primary and Secondary Data. McKinnon Secondary College.

Kurtenbach, E. 2006. Foreign Businesses Finding China’s Welcome not so Warm. Associated Press.

Kyodo News Service. 2002. Mazda Launches Small Passenger Car in China.

Lee, D. 2007. Honda Puts China Push in Overdrive. Los Angeles Times.

Legget, D. 2004. The Automotive Industry in 2004 – Strategic Challenges and Opportunities Ahead: Global Industry Issues. Just Auto.

Leicester, J. 2000. GM targets China’s Middle-class with New Compact Car. Associated Press.

Li-Hua, R. 2004. Technology and Knowledge Transfer in China. The Chinese Economy Servces, Ashgate-Adershot.

Lilly, S. 2005. Can Consumer Purchasing Power Sustain the Current Economic Recovery? Washington DC: American Progress.

Li, S. & Wang, Z.R. 1998. The Global and Domestic Impact of China Joining the World Trade Organization. Washington Center for China Studies, Ford Foundation.

Lippert, J., Jiang, J. & Inoue, K. 2002. GM, VW and Toyota Race to China and Can’t Find Much Profit. Bloomberg Markets.

Liu, M. 2002. Road Warriors: Middle-class Chinese are going Car Crazy, Buying Autos and Hitting the Road as Never Before. Newsweek 26.

Lu, J. 1999. Take a Step Forward First – Selection of Localisation Cases of Santana and other Cars. Shanghai Financial and Economics University Press.

Lung, Y. 2003. The Challenge of the European Automotive Industry at the Beginning of the 21st Century. France: Montesquieu University.

Ma, J. & Wang, J. 2001. Winners and Losers of China’s WTO Entry. The China Business Review.

Matta, N.E. & Ashkenas, R.N. 2003. Why Good Projects Fail. Harvard Business Review 81 (9).

McGregor, R. 2000. China’s Thirst for Oil. Financial Times.

McKenzie, J. 2002. The Research Cycle. Beyond Technology, Chapter 8, Vol. 9, No. 4.

Ming, W.X. & Xing, Z. 1999. A New Strategy of Technology Transfer to China. International Journal of Operations and Production Management, Vol. 19, No. 5-6.

Moran, T.H. 1998. FDI and Development. Washington: Institute for International Economics.

Neuman, S. 2005. Globalisation Forces Companies to Align Financial and Operational Departments. St. Louis: Washington University.

Nolan, P. 2001. China and the Global Business Revolution. New Hampshire:Basingstoke.

Nunnenkamp. P. & Spatz, J. 2003. FDI and Economic Growth in Developing Countries: How Relevant are Host Country and Industry Characteristics. Kiel Working Paper No. 1176, Kiel Institute for World Economics.

Organization for Economic Cooperation and Development. 2000. Main Determinants and Impacts of FDI on China’s Economy. Working paper on International Investment, Directorate for Financial, Fiscal and Enterprise Affairs, OECD, No. 2000/4.

O’Keefe, T. 2005. China: An Evolving Market. JP Morgan Treasury Service.

People’s Daily 2001. FDI in China Turns to Technology-Intensive Industries: UN Report.

Plafker, T. 2007. Doing Business in China: How to Profit in the World’s Fastest Growing Market. Grand Central Publishing.

Qiu, L. 2005. China’s Automotive Industry. Department of Economics, School of Business and Management, Hong Kong University of Science and Technology.

Riley, K. 2002. Motor Vehicles in China: The Impact of Demographic and Economic Changes. Population and Environment 23 (5).

Runckel & Assoiciates. 2006. China Automotive Industry.

Saalman, L. 2004 The FDI Paradox: China’s Socialist Market Economy and the ‘Develop the West’ Campaign. Graduate School of International Policy Studies, Monterey Institute of International Studies.

Schlotthauer, N. 1999. Market Structure and Regulations on Chinese and Foreign Investors. Paper presented at the AIESEC China Conference, Bayreuth.

Shenwei, Z. 2007. Automaker Tie-ups a Complex Network in China. China Daily.

Shleifer, A. & Treisman, D. 2000. Without a Map. Cambridge MA: MIT Press..

Sigurdson, J. 2006. Northeast China – Cradle of Change. Journal of Technology Management in China, Vol. 1, No. 1.

Song, H. & Yu, C. 2004. Market Opening, Enterprise Learning and Industry Transformation – A Case Study of China’s Car Industry. Chinese National Natural Science Foundation.

Stratton, J. 1998. The Straight and Narrow. The China Business Review.

Stacey, R. 2003. Strategic Management and Organisational Design – The Challenge of Complexity. 4th ed., Harlow FT: Prentice Hall.

Swidler, A. 2001. Talk of Love: How Culture Matters. Chicago IL: University of Chicago Press..

Tay, H.K. 2003. Achieving Competitive Differentiation: The Challenge for Automakers. Strategy and Leadership 31 (4).

Treece, J.B. 2003. Mitsubishi Tries New Approach in China. Automotive News 77.

UN Conference on Trade and Development. 2000. Competitiveness Challenge :Transnational Corporations and Industrial Restructuring in Developing Countries. New York and Geneva: UNCTAD.

Von Corswant, F. & Fredriksson, P. 2002. Sourcing Trends in the Car Industry: A Survey of Car Manufacturers’ and Suppliers’ Strategies and Relations. International Journal of Operations and Production Management, Vol. 22, No. 1.

Vernon, R. 1966. International Investment and International Trade in the Product Cycle. Quarterly Journal of Economics.

Wang, X.M. 1995. Technology Transfer and Innovation in China. Industry and Higher Education.

Wang, Y.G. & Li-Hua, R. 2006. Marketing Competence and Strategic Flexibility in China. Palgrave MacMillan Publishing Ltd.

Webb, A. & Shari, M. 2001. The People’s Carmaker in China – for Now. Business Week 3742.

Wu, J. 2003. China Economic Reform. Shanghai: Shanghai Yuandong.

Xing, W.J. 2002. Automakers in the Fast Lane. China Business Review 28 (4).

Yan, C. 2005. FDI from China: Situation, Obstacles and Expectations. Institute of Economic Development and Cooperation, Donghua University, Hiroshima, Japan.

Zhang, J. 2002. Review and Prospects of China’s Automotive Industry. Paper presented at the Joint Workshop on Cleaner Vehicle Development and Deployment, Harvard University.

Zhang, J. & Hu, A. 2004. An Empirical Analysis of Provincial Productivity in China. Working Paper in Economics, No. 127.