Executive Summary

Reflectively, the field of human resource management captures issues of labour management, performance review, and training of the staff to meet the targets and goals of a company, corporate image, and customer relationships. These aspects include HR development, affirmative action, selection and moral in staff, humanitarian and client satisfaction initiatives. This study illustrates the importance of unfreezing, transformation, and refreezing as determinants of employee satisfaction in the Tamweel Finance Company. Through primary research, the paper discusses the main determinant of employee satisfaction in the Tamweel Financial as compared to the same situation at Abu Dhabi Islamic Bank.

In the analysis segment, the treatise attempts to expound on comparative analysis of employee satisfaction and how satisfaction of the staff in the financial industry in the UAE is different. The concluding segment explores the recommendations depending on the nature of the findings. From the analysis, employee satisfaction is better at Abu Dhabi Islamic Bank than at Tamweel Financial Company. Among the variables for better employee satisfaction at Abu Dhabi Islamic Bank include an elaborate compensation mechanism, a dynamic work environment, and a structured reward system.

Introduction

Proposal

This proposal looks at the level of employee satisfaction within the UAE’s financial industry. Specifically, the paper explores the level of employee satisfaction in the Tamweel Financial institution as compared to the same events at Abu Dhabi Islamic Bank. Also, the treatise reviews the current cultural diversity concerning performance appraisal in human resources and how the same direction and indirectly influence design management, labour, and optimal performance amidst competition.

Scope

In this project, the paper will be discussing the aspect of employee satisfaction in the TamweelCompany the United Arabs Emirates. It will provide a proposal and argue about the level of satisfaction as perceived by the employees. Afterwards, the research will be presented researches on the effect of employee satisfaction in the performance of the financial institution. Finally, the proposal will be presenting the outcome of the research and will include ways on how to overcome this problem, argue it, and try to solve it. The scope will resonate in problems experienced in the design, design management, and HR impact on the level of employee satisfaction experienced at the Tamweel Company concerning performance appraisal.

Research Background

Tamweel Company was introduced in 2004 and has grown to be the largest in Abu Dhabi real estate industry. It is a government-owned real estate firm. It is located in the Middle East. Currently, the institution has financed property worth over AED 10 billion. The Tamweel offers services, especially in the real estate industry. It is one of the most active financiers of real estate development in U.A.E. Tamweel Company specializes in financing investment projects following the Islamic Sharia and boast of more than 1000 employees (Ford, 2007).

Reflectively, Tamweel Company has a formalized process in various areas within the business, most specifically performance appraisal and recruitment, selection and induction. From a head office standpoint, there is the monitoring of procedures to address issues, including customer service, workplace culture, and performance appraisal. Thus, it is necessary to review the level of employee satisfaction in Tamweel Company and its influences on its performance appraisal to provide a proper understanding of labour management and optimal productivity.

Research Problem

In many jurisdictions, it is mandatory to have independent design management functions in any institution. Many consider the design and performance appraisal management and human resources departments as the overseers of institutional operations. The design management team is expected to offer adequate support to internal systems to ensure that internal controls are adhered to in performance appraisal. Unfortunately, there are scenarios where the internal design and HR departments are not efficient and therefore fail to take up key control issues in time. Also, the department may get compromised and collude with the management of an institution to abscond responsibility. This trend may go on for a long while for as long as the board is not efficient. Therefore, it is important to have an effective HR and design management team to review internal systems periodically that link the motivation of employees and measuring levels of satisfaction. Thus, a comparative analysis of the level of employee satisfaction between Tamweel Financial and Abu Dhabi Islamic Bank will enhance understanding of the internal and external factors that determine the level of employee satisfaction within the financial services industry in UAE.

Justification of the Research

Performance appraisal management is a systematic measure that is instituted by an organization to maintain the efficient and effective corporate image that balances the link in its staff, humanitarian and customer relationship. Therefore, it is important to have effective internal controls within an organization to ensure efficiency by offering the ideal working environment to inspire optimal performance. Currently, the actual status of internal control in Tamweel Company is certain; the system of motivation is organised, and the employees empowered through their periodic feedback responses.

Research Questions

- Q1. Can Tamweel Company manage to regain its previous strong corporate image as an ideal working environment, without significantly changing its organizational structure and Managerial style?

- Q2. What is the role of Innovative Managerial processes, in Tamweel Company’s corporate employee management to balance the customer, staff, and humanitarian objectives?

- Q3. What is the impact of Tamweel’s cultural diversity, with its ability to manage the process of corporate transformation management and the level of satisfaction as perceived by their staff?

Research Hypothesis

Below are the null and alternative hypothesis based on the research problem.

H1o. There is no link between employee satisfaction and performance at the Tamweel Financial Company.

H1a. There is a link between employee satisfaction and performance at the Tamweel Financial Company.

Research Aims

The objective of this study is to provide sufficient information to the management of the Tamweel Company of the real management problems that have facilitated the occurrence of loose management blamed for the challenges in performance appraisal as part of the corporate image, staff and customers. This objective substantiates differences between management, employee behaviour, customer and humanitarian objectives of the company. The level of employee satisfaction is the determinant of the overall performance of the company since satisfied staff will ultimately perform optimally.

Literature Review

The aspects of social and human capital are often referred to as “the potential individual contribution to establish strong relationships, communication, working teams an effort to reach a common goal for using the crisis for opportunities” (Kinicki and Kreitner, 2009, p. 89). According to Bolton (2004), the main step towards a balanced cultural diversity in an organization is the actual provision of the diversity program characterized by periodic training. During these sessions, the entire labour community is expected to participate in the individual and group level (Bolton, 2004). As a result, quantifiable and structure-oriented diversity initiatives (Biswas, 2011).

Measures of employee satisfaction

The success of a firm’s productivity depends on the organization of human resource management. Reflectively, labour as a factor of production, determines the gross output, performance, and goal achievement at optimal resource use. Through the 360 degrees feedback commonly referred to as the multi-source assessment, Janus (2008) states that a company is in a position to manage its feedback channels when appraising performance (Janus, 2008). The 360-degree feedback is critical in facilitating the improvement of the performance of employees and evaluates different performance perspectives since it can give predictable results in the long term. When properly implemented, Janus (2008) concludes that 360-degree feedback will substantially improve staff productivity, decrease grievances, increase retention and standardize performance measurement and evaluation.

Moreover, it is inexpensive, easy to manage, and easily facilitate employee motivation. However, the system is prone to dishonest feedback and inconsistency in feedback interpretation. Moreover, uninterrupted attention should be directed towards procedures and practices that are indicated in the diversity training model (Sarwar & Abugre, 2013).

Gooderham and Nordhaug (2003) opine that:

Companies have a duty to implement the results of a cultural diversity program by developing and maintain effective diversity initiatives. Another significant aspect is accountability. Besides, Company committees have set up diversity training teams which consist of members of management, division managers, and business resource teams which represent the broad list of minority groups. Networking serves as a solid foundation which helps to foster diversity initiatives. (p. 134)

Focus performance management strategy

Uncertainty in organizations is as a result of the inability to mobilize and streamline different operation margins to align with the general goal. As a result, Janus (2008) opines that the organization may be faced with the challenge of not only dealing with intergroup conflicts but also intra group feuds which may not be good for the well-being of such an organization (Janus, 2008). Reflectively, these groupings are often assumed to be part and parcel of success, disorder, or even total failure (Bolton, 2004). Thus, the proper organization of the people in an organization forms the pinnacle determinant of performance through focus performance management strategy (Korczynski, 2005).

Through focus performance management, a company may be in a position to create clear goals on performance appraisal, manage a positive feedback channel, and offer continuous and systematic coaching to ensure that employees perform at optimal productivity level. Thus, the power of conversation surpasses the things as usual way of running organizations (Biswas, 2011). An organization measures success by meeting budgets, deadlines, and technical specifications of their project, whereas customers call a project successful when their needs are fulfilled, and their satisfaction is achieved.

Reflectively, the insufficient budget of a company may not allow it to utilize all factors of production in the economy. First, the uncertain working conditions greatly impacted on employees’ confidence and performance patterns. As employees’ incomes remain unstable and relatively low, it is natural to witness under-performance and low morale at work (Lopez, 2010). The trading conditions continued to remain a challenge, especially for middle companies. Increase in prices of factors of production directly affects budgeted cost of production, and thus low income earned by employees. Also, the inability of the company to leverage its systems and processes hindered the growth of its business as it reduced the ability of the company to attract the right labour skills and attitude. Finally, minimal employee satisfaction pushes a company to operational risks in areas such as supply chain management, communication systems, and human resource management (Saari & Judge, 2004). Given that companies operate within a predetermined budget, changes in the individual component of the budget affect the operations of the entire business (Schneider, Chung &Yusko, 1993).

Secondly, the human resource department is fairly responsive to sudden swings and also very sensitive to changes in income. When restructuring, companies suffer heavily, as a communication system for implementing these changes often break down. Due to redundancy, lack of performance evaluation processes, employee testing, and healthy work culture, a company is likely to perform dismally since the input of human will be compromised. These systems are critical in improving leadership skills, evaluation skills, promoting creativity, and rewarding outstanding achievement.

Indicators of employee satisfaction

According to Korczynski (2005), the best way to motivate employees is by giving them responsibilities for achieving something and the authority to do it in their way. Through this approach, employees will be empowered, and they will feel trusted and valued by the management personnel and the company as a whole. Naturally, human beings would wish for motivation through mutual consent and internalized empowerment and appreciation (Korczynski, 2005). Empowerment unleashes plenty of energy and motivation (Bolton, 2004). Reflectively, the motivation and energy aspects of appreciation function simultaneously at micro and macro levels to facilitate optimal functionality or productivity.

Empowering employees ensures a stable and sustainable win-win situation as employees will be motivated to work without much supervision from the management or their supervisors. When properly incorporated within and without different departmental segmentations as an active component of the company goals and vision, the complete manger between the management and other staff will contribute to value addition, good performance and healthy working environment (Biswas, 2011). In the end, the employees will form happy Intra and interpersonal working relationships and appreciate the need for quality service delivery along the production process channel.

Companies in the contemporary society strive to set performance targets as a means of fast racking goal achievement, understanding the position of the company in performance ladder, and allocating percentages as desired by the initiatives put in place. In business organizations, performance plays a role in determining success, sustainability, and relevance within a competitive edge. When aligning opportunity cost, performance is a key indicator before deciding on the foregone alternative (Society for Human Resources Management, 2011). Therefore, performance indicator analysis is vital and necessary to monitor operational success. Vital performance indicators are employed by the management of a business entity in decision making science to actively align the goals of the entity with the performance of the employees. Reflectively, these tools of analysis are essential in the quantification of performance, especially in settings that prove difficult to quantify. Besides, the same is necessary for process improvement fast racking through employee productivity and process efficiency calculations (Korczynski, 2005).

Research Methodology

Research methodology encompasses elements like research design, study location, target population, sample and sampling procedures, research instruments, pilot testing of the instruments, data collection process, and data analysis procedures. These elements will be discussed in a more coherent manner. It must be noted that this section is very important to this study because it gives the methods used to collect the primary data from the source

Selection of the Empirical Context and Research Participants

This research will be conducted using research survey study approach. The researcher chose the qualitative approach rather than a quantitative because the scope of the research is focused, subjective, dynamic, and discovery-oriented. The qualitative approach is best suited to gain proper insight into the situation of the case study. Besides, qualitative data analysis is more detailed than a quantitative one (Kothari, 2004). Moreover, this approach will create room for further analysis using different and divergent tools for checking the degree of error and assumption limits (Mugenda and Mugenda, 2003).

Target Population

This research will target junior staff at the Tamweel Financial Company. A sample space of 80 participants will be interviewed. To generate the sample size for this study population, the research will adopt the formulae created in 1972.

Sampling Formula: n=N/ (1+N (e2))

Where:

- n = sample size

- N= Target population

- e= Degree of freedom

- n= 80/ (1+80*0.052)

- n=80/1.2

- n= 66.67

Data Sources and Rights of the Participants

Primary data will be used in addressing each research question. The primary data collection method includes the use of observation, questionnaires (both close-ended and open-ended), interviews, and focus discussion groups. The study opts for open and close-ended questionnaire in data collection since it is economical on time, finance, and energy, unlike qualitative method which may not be economical especially when the sample size is put into the picture (Kothari, 2004).

Data Collection Procedure

In the collection of data procedure, the research will adopt a drop and pick module for the sample population. Each respondent will be given a time frame of a week to respond to questions in the questionnaire. Where necessary, further clarification will be accorded to participants.

Data Analysis

The collected quantitative data will be coded and passed through the Statistical Package for Social Sciences (SPSS) version seventeen. In the process, cross-tabulation will be used to compare and contrast perception on the transition and the actual position of the same in UAE. To quantify the relationship between the independent and dependent variable, ANOVA will be essential besides figures, charts, and tabular representation of correlation analysis (Mugenda and Mugenda, 2003).

Legal Issues

Before commencing the data collection process, the researcher will have to get permission from the relevant authority in the Tamweel Company. Confidentiality and winning trust of the target population determine the success of a research project. Therefore, the study will endeavour to keep the names of research targets as confidential as possible.

Operationalisation of the Questionnaire

This research proposal aims to explore the impact of employee satisfaction on performance through a comparative analysis of Tamweel Financial Company and Abu Dhabi Bank in UAE. To operationalise this goal, a questionnaire survey was generated and sent to 80 participants within the Tamweel Company with the necessary information inquiry. As a methodology that is most suited to the aim of this report, “technological improvement in survey method techniques, such as probability sampling and standardized measurement, allow researchers to feel confident that the population sample is not biased… another benefit… is that it is, in a sense, flexible- many questions can be asked on a topic” (Mugenda and Mugenda, 2003, p. 56).

Design of the questionnaires

The questionnaire survey consisted of ten questions. The survey questionnaires were dropped the employees and later collected for three days. The result was then collected and analysed.

Research Findings

The response rate was 100%. All the respondents filled their questionnaire survey forms on time. This is summarized in the tables below.

Distribution of the respondents

(Table 1.1 summary of the respondents captured; self-generated)

Population dynamics of the respondents

(Table 1.2. Departmental summary of the respondents; self-generated)

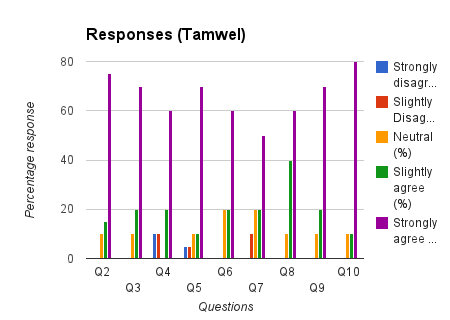

Answers to the closed-ended questions (Tamweel Financial)

(Table 1.3. Answer to other closed-ended questions: Source; self-generated)

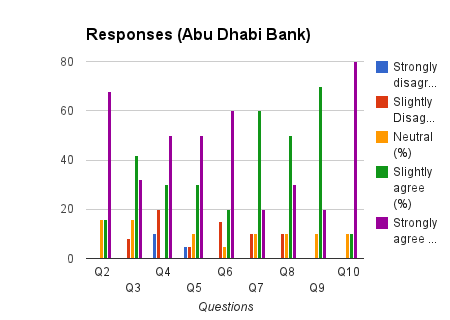

Answers to the closed-ended questions (Abu Dhabi Bank)

(Table 1.4. Answer to other closed-ended questions: Source; self-generated)

Research Analysis

Summary of responses to the question by respondents from Tamweel Financial and Abu Dhabi Bank.

Tamweel Company

Analysis of variance

Analysis of variance focuses on establishing the differences between the means of data collected from the Tamweel Financial Company and Abu Dhabi Islamic Bank. The analysis focuses on the disintegrating the variation among and between groups. Therefore, ANOVA analysis will attempt to establish if there exists statistical equality between the mean of the two groups of data. The first element of ANOVA is that it measures the variations between groups. This part will entail computing the difference between the mean for each of the financial institutions and the mean for the population. It is often denoted as

The second element is the variation within the institutions. This looks at the differences between the value of the institutions and their average. The second part is denoted as

The subsequent sections will carry out the ANOVA analysis of the two companies.

Hypothesis statements for ANOVA analysis

Null hypothesis

Ho: µ1 = µ2

The null hypothesis implies that the mean of the sample selected on employee satisfaction for the Tamweel Financial Company is equal to the

mean of Abu Dhabi Islamic Bank

Alternative hypothesis

Ho: µ1 ≠ µ2

The alternative hypothesis implies that the mean of the sample selected on employee satisfaction for the Tamweel Financial Company is not equal to the mean of Abu Dhabi Islamic Bank

The null hypothesis will be rejected when the P-value is less than the P-value at α.

The ANOVA analysis is based on a number of statistical assumptions. The first assumption is that the data for each institution will be assumed to be nearly normal. This is observed in the histograms drawn from the financial institutions. The second assumption is that the standard deviations of each group are nearly equal. This is revealed by the rule of thumb that the ratio of the least to the biggest sample should be less than 2:1. Therefore, when carrying out the ANOVA analysis, it is important to test whether the two assumptions are satisfied before using the data.

Data collected

The data collected for employee satisfaction for the two companies is presented in the table below.

(Table 1.5. Comparative analysis; Tamweel and Abu Dhabi Bank; self generated)

The line graph for the two companies tends to follow the same trend. It is an indication that the factors that affect employee satisfaction in the industry tend to be similar. This is consistent with the literature review discussed in the earlier sections. Thus, based on the factors, it can be observed that the employees at Tamweel Company are less satisfied than the employees at Abu Dhabi Islamic bank.

Descriptive analysis

Based on the data provided in the table above, it can be observed that the employee satisfaction for employees at Abu Dhabi Islamic Bank is higher than that at Tamweel Financial Company. The table presented below shows the descriptive statistics that reveal more information on the data of employee satisfaction for the two companies.

(Table 1.6. summary of the descriptive analysis; self-generated)

On the table presented, it can be observed that the average employee satisfaction in Abu Dhabi Islamic bank (67.29) is higher than the average satisfaction in Tamweel Financial Company (34.80). Despite the high difference in the mean of the two companies, it can be observed that the standard deviation and the variance of the two companies are almost equal. The standard deviation and sample variance for the Tamweel Financial Company are 14.50 and 210.15, respectively, while standard deviation and sample variance for Abu Dhabi Islamic bank are 15.23 and 232.08. This indicates that the two companies have relatively the same degree of variation from the mean. Further, it can be observed that the employee satisfaction for both companies is slightly skewed to the left. This can be observed in the low values of the skewness. The skewness for the Tamweel Financial Company is -0.1992 while the skewness for Abu Dhabi Islamic bank is -0.4464. The kurtosis of the companies is relatively low. The value of kurtosis for the Tamweel Financial Company is -0.6512 while for Abu Dhabi Islamic bank is -0.0267. The values indicate that the data for employee satisfaction for the two companies is slightly flatter than the normal distribution.

Assumptions

The ANOVA analysis is based on several statistical assumptions. The first assumption is that the data for each institution will be assumed to be nearly normal. From the descriptive analysis above, it can be observed that the data provided is slightly skewed to the left and flatter than normal data. Thus, there is a slight variation from normal data. Normality can also be observed by analysing the histogram of the data of the two companies. The graphs presented below shows the histograms for the two companies.

The histograms for the two companies reveal that the data on employee satisfaction is not normal. However, for ease of analysis, it will be assumed that the data for the two companies are normal. The second assumption is that the standard deviations of each group are nearly equal. This is revealed by the rule of thumb that the ratio of the least to the biggest sample should be less than 2:1. The ratio of the standard deviation of the two companies is 0.9516:1. This reveals that the standard deviation of the two sets of data is relatively equal and can be used for the ANOVA analysis. Therefore, when carrying out the ANOVA analysis, it is important to test whether the two assumptions are satisfied before using the data. It is because the F – test is quite sensitive to normality and non-equality of the standard deviation of data for the two groups.

Statistical technique analysis

The ANOVA analysis will be carried to test the null and alternative analysis for the data as outlined above. The tables presented below shows the results of the ANOVA single factor analysis.

Summary of mean and variance

(Table 1.7. summary of mean and variance analysis; self-generated)

Results of ANOVA

(Table 1.8. results of the ANOVA analysis; self-generated)

The presented above shows that the P-value is 5.6E-29 is less than the P-value at α = 0.05. Therefore, the null hypothesis will be rejected. This implies that the mean of the sample selected on employee satisfaction for the Tamweel Financial Company is not equal to the mean of Abu Dhabi Islamic Bank at the 5% level of significance. Therefore, the ANOVA analysis reveals that the mean employee satisfaction in the Tamweel Financial Company is statistically different from that of Abu Dhabi Islamic Bank at the 5% level of significance.

Research Discussion

From the above analysis, it is apparent that the level of employee satisfaction at Abu Dhabi Bank is higher than that at the Tamweel Financial Company. Staffing at Abu Dhabi Islamic Bank involves the establishment of attractive rewards and remuneration. The rewards increase employee satisfaction, which subsequently influences their performance. A reward is a management tool that contributes to the effectiveness of the firm by influencing group and individual behaviour. A common practice at the Abu Dhabi Bank is the use of promotions, pay bonuses and other rewards to encourage and motivate higher levels of employees’ performance. When this is absent in the staffing process is poorly organized, performance is likely to be below standards as was the case at Tamweel Financial Company.

Value in a firm emanates from the employees’ satisfaction level since they develop loyalty. The satisfaction of the employees results from quality management practices, policies, and support services that enable them to satisfactorily serve customers. A special leadership tool that emphasizes on employees’ satisfaction, customer satisfaction, and quality management practices are necessary to a firm’s productivity and increase its performance.

Research recommendations

Firms should, therefore, come up with their models since firms differ in the way they define customer satisfaction and employee satisfaction as part of staffing strategy. Employee satisfaction cannot contribute to productivity directly. Other than employee satisfaction, other proactive measures of productivity include brand engagement and motivational levels. Tamweel Financial Company should undertake several career development programs. Such would be necessary for attracting and retaining human resource base. This company should consider providing a job compensation structure that supports the organizations as well as individuals’ growth and development perspectives. The firm should also evaluate employees and produce a succession pipeline for vital job positions in the organization before assigning roles.

Since the Tamweel Financial Company operates in a volatile environment, training and development will facilitate a comprehensive analysis of potential members of the staff. Thus, this will facilitate the goals aimed at remaining competitive in labour management and quality in service delivery. Therefore, through training and development, it will be possible for the firm to improve on staffing selection procedures and testing, which is directly proportional to the level of employee satisfaction.

Research Conclusion

Conclusively, this research paper largely depended on quantitative data collected via the use of close-ended questionnaires. The target population was contacted through physical interaction. The study attempted to identify the level of employee satisfaction at the Tamweel Company in comparison to the same situation at Abu Dhabi Islamic Bank within the financial service industry in the UAE. The ANOVA analysis revealed the ratio of the standard deviation of the two companies as 0.9516:1. Reflecting on the previous scenario, it is apparent that under-performance of the employees at Tamweel is as a result of improper staffing conditions and partial inconsistency in training. However, the same can be reversed by designing a proper staffing strategy that is inclusive of employee motivation, training, and qualification before assigning relevant duties.

Research Outline/Gantt Chart

Reference List

Biswas, S 2011, “Commitment, involvement, and satisfaction as predictors of employee performance.” South Asian Journal of Management, vol. 18 no. 2, pp. 92-107.

Bolton, S 2004, Emotion Management in the Workplace, Palgrave-Macmillan Publishers, Hampshire.

Ford, N 2007, “Saudi banking.” Middle East, vol. 37 no. 6, pp. 48.

Gooderham, P. N., & Nordhaug, O 2003, International management: cross-boundary challenges, Blackwell Pub, Malden.

Janus, P 2008, Pro Performance Point Server 2007: Building Business Intelligence. Apress, Alabama.

Kinicki, A., & Kreitner, R 2009, Organizational behavior: Key concepts, skills & best practices, McGraw-Hill Irwin, New York.

Korczynski, M 2005, ‘Human Resource Management in Service Work’, vol. 15 no. 2, pp. 3-14.

Kothari, C 2004, Research methodology: Methods and techniques, New Age International (P) Limited Publishers, New Delhi.

Lopez, S 2010, “Workers, Managers and Customers”. Work and Occupations, vol.37 no. 2, pp. 251-271.

Mugenda, M., and Mugenda, G 2003, Research methods: Quantitative and qualitative approaches, Acts Press, Nairobi.

Saari, L & Judge, T 2004, “Employee attitudes and job satisfaction”, Human Resource Management, vol. 43 no. 4, pp. 395-407. Web.

Sarwar, S & Abugre, J 2013, “The influence of rewards and job satisfaction on employees in the service industry”, The Business and Management Review, vol. 3 no. 2, pp. 1-31. Web.

Schneider, B., Chung, B., &Yusko, K 1993, “Service Climate for Service Quality”. Current directions in Psychological Science, vol. 12 no. 2, pp. 197-200.

Society for Human Resources Management 2011, “2011 Employee job satisfaction and engagement”, Society for Human Resources Management (SHRM), pp. 1-64. Web.