Executive Summary

The main purpose of this report is to analyze Telecom New Zealand (TNZ), which is the second-largest telecommunications service provider in New Zealand and one of the major players in Australian market.

However, this company has incorporated under the Companies Act 1993 to offer diversified product range in local market, and it acquired AAPT in order to enter Australian telecommunication market and it acquired few other multinational companies in order to expand its operation.

However, this report concentrates on the internal and external analysis, Porter’s five forces, strategic issues, success factors, and strategic alternatives, overview of strategy, action plan, and risk management and so on.

Internal Analysis

Strategic Profile

New Zealand’s second major mobile operator “Telecom New Zealand” separated from the Post Office and started its journey in 1987 and functioned as a listed company in stock market since 1990.

According to the case of Telecom New Zealand, this company has invested billions of dollars in fixed line and mobile networks segment to establish itself as a monopoly service provider mobile and internet services.

However, TNZ has maintained three separated business units and acquired IT service companies Gen-i, and Australian fixed network infrastructure provider PowerTel to offer a full range of Internet service, data transmission, landline and mobile services, and fixed-line calling services to clients in the Australasia region.

Value Chain and VRIO

Telecom New Zealand’s strategic direction is based upon three significant criteria concerning integration, internet, and innovation. Therefore, distinctively tactics are using each phase, which draws some specific advantage, thus, the first stage motivates the subscribers through touchy offers to purchase its products.

However, supportive activities are technological advancement, contribution of the employees to providing exclusive services, increasing satisfactory experiences of the customers, and infrastructure development of the company while primary functions of TNZ are focusing on the pricing strategies, flight management system, CRM, appraisal of industry, and so on.

Table 1 of this report illustrates VIRO of TNZ to give clear idea about its primary and supportive activities.

Table 1. VRIO Analysis at the End of 2010. Source: TNZ (2010, p.43–47).

*** Key Words: SCA= Sustainable Competitive Advantage, TCA= Temporary Competitive Advantage, CP=Competitive Parity CD= Competitive Disadvantage

Financial Analysis

After 23 years long journey of Telecom, they have successfully installed 1,995 FTTN cabinets in New Zealand where 77 unbundled exchanges, 25,000 long fiber connections as well as 712,000 XT mobile networks are available.

In sequence of the business operation of Telecom, financial status has occupied significant successes. In brief, recent operating revenue is NZ $ 5,217.0 million along with additional earnings whereas EBITDA is about NZ $ 1,764 million.

Conversely, total income for the current fiscal year signifies NZ $ 382.0 million, EPS (Earning Per Share) 20.0 ¢, DPS (Dividend Per Share) 24 ¢.

Meanwhile, capital expenditure over the year is almost NZ $ 1,183 million and alternatively, since 2008, telecom has succeed to continue an annual cost reduction of NZ $ 249.0 million (TNZ, 2010, p.2).

Table 2: Financial Ratios. Source: Telecom (2010, p. 45-105) and TNZ (2009, p. 44-76).

External Analysis

Industry Profile

NZTE (2010) stated that the New Zealand telecommunications infrastructure has 100% digital exchange networks, and this industry consists of more than 80 leading ICT companies, which generated $19.3 billion sales revenue from goods and services.

Driving Forces and Industry Foresight

Major driving forces for the company are the globalization, government regulation, and the impact of global financial crisis on the entire industry.

However, the CEO Reynolds stated in the annual report that political and economic uncertainty adversely influenced the business operation both in local and international markets.

Porters Five Forces

Threats from new entrants for Telecom New Zealand is moderate because it should require huge investment to entering a new market with latest technology but many multinational telecommunication companies have interest on this market due to growing demand in the market.

However, many factors influence the new companies to enter this market such as local regulation, market trends, amount capital investment, emerging public demand, availability of human resources, production costs, organizational economies of scale, patents and proprietary knowledge, and other entry barriers.

On the other hand, suppliers of this industry are powerful enough and can affect TNZ’ performance by asking higher prices and providing inferior quality of raw materials; therefore, the CEO of this company concentrates on maintaining a sound and mutual relationship with the tools and software suppliers of local and overseas market.

In telecommunication industry of Australasia region, the subscribers pose adequate bargaining options because they are continuously demanding newer requirements and features in upgraded versions from the servers.

However, Rivalry among existing firms is very high considering the prices of the products, product differentiation, channels of distribution, and relationship with suppliers.

Finally, TNZ is not facing a higher competition from substitute products as many firms in the industry try to introduce new upgrade substitute products but TNZ has strong on most of the telecommunication system.

Key Success Factors

The pricing strategy is one of the most significant success factors as TNZ provides high quality products and services at extremely low price, which helps the company to develop strong customer base.

In addition, the company always considers the preference of the customers, market demands, competitors’ offerings, and external threats to introduce new services for the customers.

However, the key success factors of Telecom New Zealand are brand image of the company, distinctive competencies, outstanding customer care, economy of scale, dynamic and high-profile employees, financial capabilities, implementation of the strategies, promotional activities, and so on.

Competitor Profiles and Strategic Groups

According to the annual report 2010 of TNZ, this company has to compete with a number of strong rivals in telecommunication segment, like- Vodafone, Telstra Clear, iiNet, Call Plus, SingTel Optus, Orcon, and so on.

However, this company has many direct and indirect competitors those have strong presence in the global market, and it has different competitors in different segments for instance large IT service companies HP and IBM also major competitors of this company (TNZ, 2010).

Most of the industry competitors of TNZ in New Zealand market are targeting young customers and operating in the market with stronger market share, and offering lower prices and advance technology.

Table 3. Key Competitors. Source: Self-generated From David (2008).

Strategic Issues

There are several issues need to consider at the corporate level stage to decide which strategic game was fundamental to adopt in different markets. Government intervention and changes in regulations has increased the complexity and uncertainty of the environment.

More and more capitals are required to meet the demands of the ever-changing technological advances. Consumers search for more services at lesser prices and the competition keeps rising squeezing margins.

In developed markets, declining fixed-line margins were expected to continue while mobile user growth was expected to slow. Uncertainty was higher due to government regulators becoming increasingly interventionist.

Partly driven by regulation – but also influenced by IP technology shifts, aggressive competition, and changing end-user behavior – the economics of telecommunications has been changing.

When these factors are combined, they are expected to adversely impact on Telecom New Zealand’s future revenues and operating costs.

Alternate Strategies

Alternate Strategy 1

The corporate strategy should be to increase sales.

Telecom New Zealand might focus on segmented marketing strategy for increasing sales, which means that the company should focus on particular groups of consumers and produce products tailored to their needs and highlight the characteristics, so that those customers find what they need in it.

Sales might also be increased by newer technologies, lower prices, more facilities, better looks and elegance of products, and advertisements. The company should also continue to support its customers. The company might accomplish a current assessment of Telecom’s strategic options for its business.

These options include divestment, retention or partnership, as described in the company. The company should also meet requirements in its undertakings.

Besides maintaining network performance and quality, the company should aware of the growth of and opportunities available in different sectors and Telecom should attempt for positioning to take advantage of those opportunities

Alternative Strategy 2

The motive of the company should be to concentrate on customers and they have the goal of being the most preferred company of New Zealand.

The most emphasis was given to terms of overall KPIs, which were Total Shareholder Returns (TSR), and this was predicted by the Return on Invested Capital (ROIC) which was at the core of Telecom’s corporate strategy.

At first, the attractiveness of the market for Telecom was driven first by the ROIC potential and secondly by the growth prospects. Market attractiveness was compared against the potential competitive advantage to develop corporate and business strategy.

Telecom operated a rigorous capital budgeting program that always involved more applications than capital to be invested. Prioritizing capital was essential and was driven by strategic priorities.

Four fundamental strategic themes were being driven across all areas of Telecom to improve returns – reducing costs, simplifying the business, retaining high-value customers, and pursuing targeted growth in attractive markets.

Strategic Evaluation

Strategy 2 was chosen as it better addresses all of the issues required for the improvement of Telecom New Zealand and provides a clear view of the steps to be taken when compared to Strategy 1, which is apparently not enough for the development of the company.

It aligns with the changing needs of the society and emphasizes the four strategic themes for increasing profits, which are – reducing costs, simplifying the business, retaining high-value customers, and pursuing targeted growth in attractive markets.

Table 4. Decision Criteria for Strategic Alternatives. Source: Self-generated.

Explanation of measurement: Each criterion was evaluated and given a score between 1 and 5, with 1 being very unfavorable and 5 being highly favorable.

Recommended Strategy

This report recommend to follow second alternative strategy as it would be more effective for the company then the first strategy and Table 4 gives clear idea about these strategies.

Overview of Strategy

The strategy illustrates that the company should aspire to be the number one in broadband, mobile and ICT in New Zealand.

The company should maintain its customer focus. Increased competition in Telecom’s market, coupled with substantial regulatory obligations, has resulted in Telecom to design plans to drive the turnaround in earnings before interest, tax expense, depreciation and amortisation through the following ways (INTEC, 2010).

Thus, the new goals are that Telecom should focus on cost reduction, value retention, business simplification and targeted growth. Telecom may reduce operational costs by rationalising sales and marketing costs, optimising procurement processes and reducing spending, and rationalising group-wide discretionary spend.

The company may also retain value by continuing successful mobile migration of high value CDMA network customers to the new WCDMA network, building on additional mass-market bundled offers, delivering sales and service excellence within high margin product lines to maximise retention and cross-selling opportunities.

The business might be simplified by restructuring customer-facing business units to deliver services through a more streamlined functional organization, removing duplicate activities in support functions, and simplifying IT operations by improving key IT processes.

The company may implement targeted growth by capturing mobile market share and revenue growth opportunities, rollout of next generation broadband technologies, creating a platform for cloud computing services in the corporate and enterprise customer markets and IT services growth in New Zealand and Australia.

Market Analysis

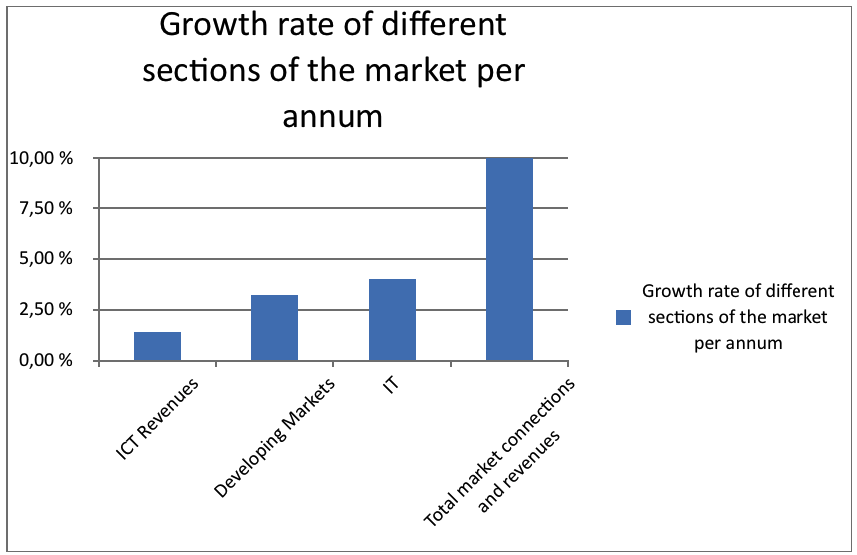

Telecommunications markets around the world were facing severe challenges. Globally ICT revenues were expected to grow at 1.4% per annum. Breaking that down – lower margin IT Services were estimated to grow at CAGR 2.4% and telecom revenues at CAGR 1%.

Telcos had captured around 5% of the global IT services market. Breaking down telecom revenues, developing markets were predicted to grow at 3.2% – masking flat to declining revenues in developed markets.

In New Zealand, the telecommunications was a $5B market in 2011. In terms of revenue, the ICT market is expected to grow at CAGR 2% through 2013. IT is intended to grow at around 4% while telecommunications may decline slightly.

On the other hand, the total profit pool for communications is predicted to decline by 3% per annum – due primarily to substitution effects and regulation.

Regulation is unlikely to be limited to the fixed market, with mobile and open next-generation access likely to be on government’s agenda. Regulation has also been a catalyst for increased capital spending – expected to be $4.5B over 2008-2012.

Telecom had been making major investments in networks, technology, and services for a number of years to improve the broadband experience (Dooley, 2011).

Total market connections and revenues grew by 10-12% during 2010 and TNZ’s average revenue per user (ARPU) had remained steady during 2010 with a Telecom Retail market share of 54%. Broadband connections were growing at the 5th fastest rate in the OECD.

The building block for much of this activity and progress had been Telecom’s Fibre-to-the-Node (FTTN) program. This is a profitable project.

Total mobile market growth had slowed by the end of 2010. Connections for Telecom had risen by 21,000 with over 1 million connections on the newer XT network.

Average revenue per user (ARPU) was up for Telecom in the second half of 2010 – driven by the conversion to the XT network and the increased use of value-added services. Smartphones accounted for 16% of devices used on Telecom’s mobile networks.

Action Plan

Since rapid change of competitive profile, Telecom has now merged with a set of significant regulatory demands as a result, current action plan of Telecom drastically emphasizes on four issues as following description.

Conversely, the four-phase action plan would enough effective for Telecom to turnaround rather superior EBITDA during 2011. Meanwhile, here it has to point out that Telecom’s market piece has segmented through five divisions, and during execution of action plan; each of them is equal considerable (TNZ, 2010, p.16).

Table 5. Action plan of Telecom since fiscal year 2009 – 2011.

Phase One – Reduction of Operational Costs

Operational costs reduction would achieved through three approaches where aggregate sales volume, marketing costs, procurement processes and discretionary spending has taken into account. In brief, marketing costs would reduce through aggregate sales reduction.

Aggregate expenditure would lessen through strategic increase of procurement processes. Finally, discretionary spending would affirmatively minimize by rationalizing entire market groups expenditures.

Phase Two – Retaining Value

Phase two is also design through three segments where value retention has planned to commencement by offering valued consumers amazing mobilize migration program that featured with the latest WCDMA network accessibility and in addition, available subscribers under CDMA network would facilitate hassle free migration at any time.

Another impressive offer that proficient to build an additional mass market segment through available subscription packages and at last, deliver of after sales service packages featuring excellent high margin product and service lines.

Thus, retaining value program would succeed as well as facilitate cross selling opportunities.

Phase Three – Simplifying Business Operations

Third phase is enthusiastic to build rather superior streamlined functional organization; therefore, it would easier for Telecom to restructure consumer centered business segments during delivering products and services.

Alternatively, duplicate functions confiscation would modernize support functions and hence, simplification of IT operation would foster as well as core IT processes of Telecom would also improve drastically.

Phase Four – Redesign Positive Growth Rate

Last phase of Telecom involved with four major tasks and they are expansion of current mobile market share along with draw abundant opportunities of revenue growth.

Make available of NG broadband technologies in order to build a strong platform for the cloud computing services by means of tow new consumer market the corporate bodies and the enterprise. At last, expansion of IT service growth in New Zealand as well as in Australia.

Risk Management

Telecom has enclosed through six major risk factors for this reason, conducts their risks management and assessment by two major approaches namely, market risk management and currency risk management.

Telecom strategies for the market risk management are to employing a set of derivatives and in addition, usage of these derivatives are enough efficient in defining latest market structure along with illustrating limitations of credit risks but not for employing as financial tools during trade, delivering company status towards the senior management.

Conversely, telecom currency risk management worked for impact-free net cash flows since rapid fluctuation of foreign currencies and in doing so, Telecom preferred two key approaches which also rather effective in reducing foreign currency exposures (TNZ, 2010, p.108).

Strategy Benefits

Current core strategy of Telecom is primary focus on cost reduction, conduct simple business operation, enrich value retention and enlarge target growth.

Considering these four strategic actions core strategic benefits of Telecom has already achieved latest lean service producer model during delivering their retail as well as Gen–i business operation.

Meanwhile, Telecom has successfully cut off their discretionary spending across the five business segments.

On the other hand, business simplification goals has accomplished through restructuring four business segments, and significant overhead reduction has also drawn as well.

Then again, retain value executed by offering XT Mobile network as well as WCDMA mobile network (TNZ, 2010, p.6).

Benefits to Telecom

Strategic actions have conveyed Telecom as set of befits across all of their business operations though compared to 2009, in 2010, total revenue generation has considerably low.

Aggregate benefits at earlier stage effectively deployed NZ $ 1.40 billion fiber purchasing competency in order to node systems to delivering 10Mbit/s. in brief, new strategic action has make easier for Telecom to cover of 80.0 % network cables across New Zealand and Australia by 1177 new cabinets (PUBLIC, 2008, p.17–21).

Financial Benefits

The company’s overall operation including other operating units has generated financial results with realistic prospects and gone through key risks, by observing contains of the consolidated financial statements for the years ended 30 June 2009 and 2010 it is demonstrated that it persuaded a steady capital structure with the intention to provide sustainable operational growth.

During the financial year 2010, the company’s investment activities involved with capital as net cash outflow of NZ$ 1,091 million in 2010 but the capital investment was NZ$ 1,282 million in 2009.

In relation to 2009, the capital outflow has reduced almost 14.9 % in 2010, at the same time there was a reduction for the fixed capital expenditures.

The standard remuneration structure of the company has designed to distribute rewards to the workforce with competitive outlook to the existing labor markets while the company has paid NZ$ 893 million and NZ$ 909 million in 2010 and 2009 respectively, moreover, the company has contributed to the NZ $1 million to the governmental fund for labor pension in 2009.

The company has evidenced a refund of income tax NZ$ 71 million and NZ$ 40 million in 2009 and 20101 respectively, while interest payment continued because of lesser average levels of debt (TNZ, 2010, p.45-61 and TNZ, 2009).

Table 6. Financial benefits for the year ended 2010. Source: TNZ (2010, p. 45) and Pandey (2010).

Reference List

David, F. (2008). Strategic Management: Concepts and Cases. (12th ed.). London: Prentice Hall.

Dooley, B. (2011) Bridging the sales and technical divide. Web.

INTEC (2010) Telecom New Zealand Case Study. Web.

Nelson, R. & Shepheard, T. (2008) New Zealand Telecommunications Market 2008 – 2012 Forecast and Analysis. Web.

NZTE (2010) New Zealand telecommunications and wireless industry. Web.

Pandey, I. M. (2010). Financial Management. (9th ed.). New Delhi: Vikas Publishing House Pvt. Ltd.

PUBLIC (2008) Broadband Strategy Options for New Zealand. Web.

TNZ. (2009). Annual report 2009 of Telecom Corporation of New Zealand Limited. Web.

TNZ. (2010). Annual report 2010 of Telecom New Zealand. Web.

TNZ. (2010). Half-yearly financial report of 2010 of Telecom New Zealand. Web.