Background

This paper focuses on the financial analysis of Tesco PLC, a leading UK-based grocery retailer. In particular, the paper discusses the company’s capital structure, evaluates it using various techniques, analyzes the methods used to offset currency exchange risks, and examines the Capital Asset Pricing Model.

Tesco PLC is a British multinational grocery and general merchandise retailer headquartered in Welwyn Garden City, Hertfordshire, England (Tesco, 2023a). It is one of the largest retailers in the world by revenue, operating in several countries across Europe and Asia (Tesco, 2021). Tesco sells a range of products, including food and beverages, clothing, electronics, and financial services. The company’s history and established financial performance management practices make it a good example for discussing financial management.

Capital Structure

Tesco utilizes a wide variety of instruments to finance its operations. In particular, the company finances its operations through a combination of retained earnings, long- and medium-term debt capital market issues, bank borrowings, and leases, ensuring continuity of funding.

Equity Financing

One of the main sources of financing is shareholders’ equity. According to the company’s annual report, the company’s equity was £15,644 million with total assets of £49,351 million. In other words, 31.7% of the company’s assets were financed with equity (Tesco, 2023a). Equity financing involves raising capital by issuing shares of ownership in a company. It offers several benefits, including no obligation to repay, access to expertise from investors, lower financial risk, increased company valuation, and greater flexibility compared to debt financing (Quiry, Le Fur, and Vernimmen, 2022).

However, equity financing has some drawbacks that companies need to consider before pursuing it. These include a loss of control for existing shareholders, the sharing of profits with new shareholders, a high cost of capital, a time-consuming process of raising capital, and disclosure requirements (Quiry, Le Fur, and Vernimmen, 2022).

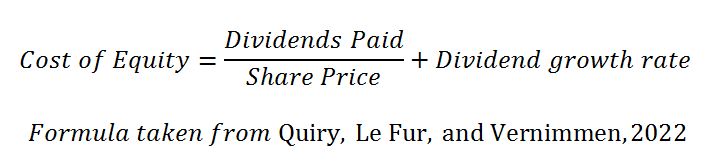

One of the most common approaches for calculating the cost of equity is the dividend valuation model, also known as the dividend discount model (DDM). This method values a company’s stock based on the fundamental assumption that the stock’s current price equals the present value of all its expected future dividend payments, discounted back to today’s dollars. The cost of equity is then derived from this valuation formula.

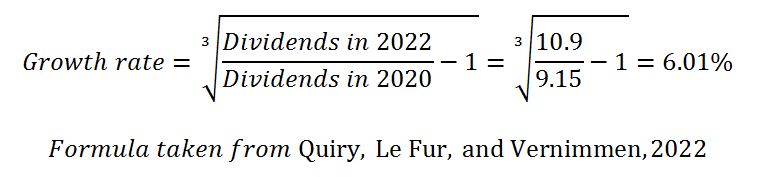

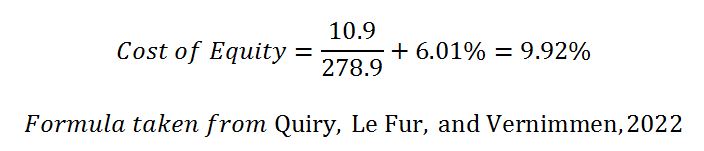

The current share price of Tesco PLC is £278.90 per share, with a last year’s dividend payout of £ 10.90. In 2021, dividends were 9.15 p per share (Financial Times, 2023). The dividend growth rate was estimated using the data from the past three years. Initially, it was proposed to use the data from four years. However, the idea was abandoned, as Tesco increased its dividends by 58.6% in 2020, which is unlikely to happen again soon (Tesco, 2021). The dividend growth rate was calculated using the following formula (data extracted from Financial Times, 2023):

Thus, the cost of equity can be calculated using the following method (data extracted from Financial Times, 2023):

Debt Financing

Debt financing refers to the process of raising capital for a company by borrowing money from lenders or investors. Debt financing can take many forms, including bank loans, bonds, and other debt securities. One of the benefits of debt financing is that it enables companies to raise capital without relinquishing ownership or control of the company (Quiry, Le Fur, and Vernimmen, 2022).

Interest payments on debt are often tax-deductible, providing a tax benefit to the company. However, the company must make regular interest payments, regardless of its financial performance, which can create a financial burden if the company is not generating sufficient cash flow. Additionally, taking on too much debt can increase the company’s financial risk, making it more challenging to obtain additional financing in the future (Quiry, Le Fur, and Vernimmen, 2022).

Tesco PLC finances 68.3% of its assets with debt, with £33.7 billion in liabilities (Tesco, 2023a). The cost of debt was estimated based on the calculation of the cost of debt after a 30% tax deduction for bond XS2592302330. This bond was issued in 2022 with an interest rate of 5.5%, a maturity date of 2035, and a face value of £96.17 (Tesco, 2023b). The cost of debt was calculated as the Internal Rate of Return (IRR) for the payouts, as demonstrated in Table 1 below.

Table 1. Cost of Debt Calculations

Weighted Average Cost of Capital

The cost of capital was estimated using the Weighted Average Cost of Capital (WACC). WACC is a financial metric used to measure the cost of financing a company’s operations. It takes into account the various sources of capital that a company utilizes, including debt and equity. It calculates the average cost of these sources weighted by their respective proportions in the company’s capital structure. WACC is used to assess the feasibility of potential investment opportunities and projects, and it is also used in valuation models such as discounted cash flow analysis (Robinson et al., 2015). The formula for WACC is:

WACC=(E/V*Re)+(D/V*Rd*(1-Tc))

Where:

- E = market value of the company’s equity

- D = market value of the company’s debt

- V = E + D

- Re = cost of equity

- Rd = cost of debt

- TC = corporate tax rate

While there are numerous types of debt the company uses, it was assumed that the cost of debt was equal to the cost of debt of the XS2592302330 bond. The cost of capital is provided below.

WACC=9.92*31.7%+2.77*68.3%=5.03%

Note that the weight for different parts of the capital was discussed previously in the paper. Thus, the WACC for Tesco PLC was estimated at 5.03%.

Short-Term Valuation Techniques

There are three commonly known valuation techniques used by investors and decision-makers. Net Asset Value (NAV) valuation technique is a method used to determine the value of a company calculated by subtracting the liabilities of a company from the value of its assets, and then dividing this figure by the number of outstanding shares of the company, mutual fund, or REIT (Robinson et al., 2015).

On the one hand, NAV provides investors with transparency regarding the value of the company’s assets and flexibility, as it can be applied to a variety of asset types and adjusted to reflect changes in asset value over time. On the other hand, NAV may not always provide a precise or accurate valuation of the company’s assets, as it is based on accounting values rather than market values, which are prone to manipulation (Robinson et al., 2015).

Price-to-earnings (P/E) multiple is a commonly used valuation technique in finance that measures the current market price of a company’s stock relative to its earnings per share. This metric is calculated by dividing the current market price per share by the company’s EPS over the past 12 months (Robinson et al., 2015).

One potential limitation of the P/E multiple is that it may not apply to companies that are not yet profitable or have negative earnings. In such cases, alternative valuation techniques, such as discounted cash flow analysis or price-to-sales ratios, may be more suitable. Another potential limitation of the P/E multiple is that it can be influenced by accounting practices that can affect a company’s reported earnings (Robinson et al., 2015).

Dividend yield is a valuation technique that measures the amount of cash dividends paid out by a company relative to its stock price. It is calculated by dividing the annual dividend per share by the current market price per share. The dividend yield is commonly used by investors to evaluate the income potential of a stock. A high dividend yield indicates that a company is paying out a larger percentage of its earnings as dividends, which may be attractive to income-seeking investors (Pinto, 2020).

Conversely, a low dividend yield may indicate that a company is retaining more of its earnings to reinvest in the business. However, it is important to note that a high dividend yield may not always be sustainable or indicative of a healthy company. A company may be paying out a high dividend yield to compensate for a lack of growth opportunities or to support an unsustainable dividend policy. Another limitation of the dividend yield as a valuation technique is that it may not apply to companies that do not pay dividends (Pinto, 2020). In such cases, alternative valuation techniques, such as the price-to-earnings ratio or discounted cash flow analysis, may be more suitable.

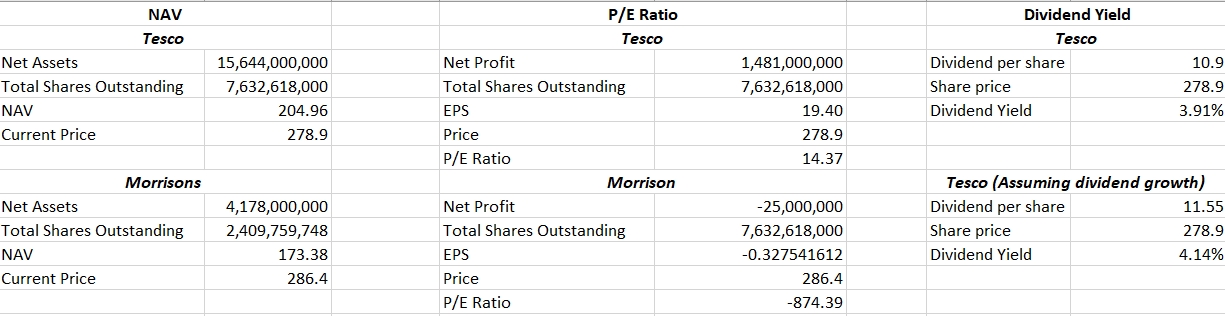

Table 2 presents valuations obtained using various methods. The calculations were made using data from Tesco’s financial statements (2023a).

Table 2. Valuation calculations

NAV can be calculated by dividing net assets by the number of shares outstanding (Robinson et al., 2015). Net assets of Tesco PLC in 2022 were reported as £15,644 million, while the total number of shares outstanding was 7,632,618 thousand (Tesco, 2023a). The calculations of NAV are provided below:

NAV=£15,644,000/7,632,618=£2.05=205 p.

The last-traded price of Tesco PLC as of April 24, 2023, was £278.9 (Financial Times, 2023). Thus, it can be said that the company’s stock is overvalued. This may mean that the price of Tesco PLC is expected to decline shortly due to being overvalued. However, it is crucial to compare Tesco’s metrics to those of its competitors.

One of the company’s central competitors is Morrisons Supermarkets. Calculations demonstrated that the NAV of Morrison Supermarkets is £173.38, with the last price of the share as of April 24, 2023, at £286.40 (ADVFN, 2023). This may mean that the NAV metric in the grocery store industry in UK companies tends to be overvalued. Thus, the company may still be a good investment opportunity.

To calculate the P/E ratio, it is first crucial to determine a company’s net profit (earnings) and the total number of shares. Since Tesco’s net profit was 1,481 million and the number of shares outstanding was 7,632,618, the company’s earnings per share (EPS) were £19.40 (Tesco, 2023). To calculate the P/E ratio, the stock’s current price needs to be divided by EPS. Thus:

P/E=278.9/19.4=14.37.

The P/E ratio of 14.37 implies that an investor will need 14.37 years to recoup the market value of a share. To determine if it is a good or bad decision, it is beneficial to compare the number to that of its competitor, WM Morrisons Supermarkets. The calculations demonstrated that Morrison’s P/E ratio was -874.39 due to the negative profits in 2022 (ADVFN, 2023). Thus, Tesco appears to be a more attractive investment in comparison with Morrisons as per the P/E ratio, which makes Tesco a more attractive investment in comparison with WM Morrison PLC

The dividend yield ratio can be calculated by dividing the current price by the expected dividends per share paid in the current year (Robinson et al., 2015). Assuming that Tesco PLC will pay the same amount of dividends in 2023 as it did in 2022 (10.9 p per share) with a share price of 278.9, the dividend yield ratio will be (Financial Times, 2023):

Dividend Yield Ratio=10.9/278.9=3.91%

However, assuming a 6.01% growth of dividends, the dividend yield ratio will be:

Dividend Yield Ratio=(10.9*1.0601)/278.9=4.14%

This implies that for every pound invested in the company, an investor can expect a return between 3.91% and 4.14% per year from dividends only. Unfortunately, since WM Morrison stopped paying dividends in 2021, it is impossible to compare Tesco’s performance in terms of Dividend Yield Ratio to that of its competitor, which highlights the limitation of the valuation technique.

Managing Foreign Exchange Risk

A company can employ several strategies to manage risks associated with foreign exchange rates, including hedging, netting, and effective balance sheet management. Hedging is a risk management strategy used to offset or minimize the potential losses that may arise from adverse price movements in a particular asset or market (Alfaro, Calani, and Varela, 2021).

The concept of hedging involves taking an opposite position in a related or correlated asset to reduce or eliminate the risk associated with the original position (Alfaro, Calani, and Varela, 2021). This can be achieved through the use of various financial instruments, including futures contracts, options contracts, swaps, and forward contracts. Hedging can be beneficial in reducing risk exposure. Still, it also comes with potential costs such as transaction costs and the possibility of missing out on potential gains if the hedged asset performs well (Tiwary, 2019). As such, companies must carefully evaluate the costs and benefits of hedging before deciding to use it as a risk management strategy.

Tesco PLC mitigates risks associated with foreign exchange rates by employing hedging as its primary risk management strategy. Tesco PLC does not engage in trading derivatives and reports them at fair value. If derivatives do not qualify for hedge accounting, any gains or losses resulting from their remeasurement are immediately recognized in the company’s income statement (Tesco, 2023a). If derivatives qualify for hedge accounting, the recognition of any gain or loss depends on the nature of the hedge relationship and the item being hedged.

At the start of a hedge, Tesco PLC documents the risk management objective and strategy for the designated hedging relationships, the risks being hedged, and the economic relationship between the hedging instrument and the hedged item. Derivative financial instruments are categorized as fair value hedges or cash flow hedges, depending on whether they hedge the company’s exposure to changes in the fair value of a recognized asset or liability or variability in cash flows, respectively. When the hedging instrument expires or is sold, terminated, or exercised, or no longer meets the company’s risk management objective, hedge accounting is discontinued (Tesco, 2023a).

Managing a company’s balance sheet to reduce its foreign exchange risk exposure typically involves a range of strategies and tactics designed to minimize the company’s exposure to currency fluctuations. One such strategy is to borrow in the same currency as the company’s revenues. By doing so, the company is essentially matching its assets and liabilities, which can help mitigate the risk of currency fluctuations affecting its debt servicing costs (Tiwary, 2019).

To minimize a company’s exposure to changes in currency exchange rates, a key strategy for managing the balance sheet involves utilizing financial hedging tools, such as forwards, options, and futures. Additionally, as previously noted, a company can have net cash flows, so they are all in a single currency. The primary objective of these actions is to manage the balance sheet in a manner that significantly reduces the risk associated with currency volatility.

Tesco PLC utilizes balance sheet management as one of its strategies to mitigate foreign currency risks. Although the annual reports do not state it directly, the analysis of the company’s bonds and long-term loans is in Pounds Sterling (Tesco, 2023a, 2023b). However, it is worth noting that 30% of the company’s bonds are denominated in Euros, while 5% of the company’s bonds are denominated in US dollars (Tesco, 2023b).

Netting is a process that aims to simplify and streamline cash flow management by consolidating all cash flows in a single currency (Das and Palit, 2019). There are two main types of netting: internal and external. Internal netting involves offsetting receivables and payables in the same currency within the same corporate entity (Tiwary, 2019). This can be achieved by coordinating the payment and collection schedules of different departments or subsidiaries within the same company.

External netting, on the other hand, involves offsetting receivables and payables with another entity (Das and Palit, 2019). This can be achieved through a netting agreement with a third-party provider or through a netting system operated by a bank or financial institution. Under this arrangement, businesses can consolidate their cash flows with those of other businesses to reduce the number of currency conversions required and mitigate the risk of exchange rate fluctuations (Tiwary, 2019). Overall, netting can be an effective tool for managing cash flows and minimizing foreign exchange risk.

There is no direct evidence that the company uses netting as a strategy to mitigate exchange risks. However, the company claims that it translates the profits and losses of its foreign subsidiaries into British pounds. The company also holds a translation reserve to account for possible losses associated with currency translations (Tesco, 2022a).

In summary, Tesco PLC recognizes the risks associated with exchange rates and employs suitable measures to mitigate them. In particular, the company uses hedging as the primary strategy for managing associated risks. However, there is indirect evidence that the company also uses netting and balance sheet management as supplementary strategies.

Capital Asset Pricing Model

The CAPM is one of the most widespread models for evaluating the cost of equity. The model evaluates the discount rate using the formula below:

E(Ri)=rf+β+E(Rm)

The formula implies that the expected return on an asset (E(Ri)) depends on three factors: the risk-free rate of return (rf), the expected return on the market (E(Rm)), and the asset’s beta (β). (Rossi, 2016). The formula is closely connected to the portfolio theory developed by H. M. Markowitz, which categorizes all risks into systematic and specific (Rossi, 2016). The β coefficient in the formula can be calculated using the regression analysis of action return (Ra) and the average market return (Rm) (Kolesnichenko et al., 2017).

The CAPM determines the expected return on a stock using three critical factors. The first is the risk-free rate of return, which represents the theoretical minimum return expected from a zero-risk asset, such as a government bond. This figure sets the absolute baseline return an investor should expect. Second is the expected return on the market (E(Rm)), which represents the average return an investor anticipates earning from a broad, diversified portfolio.

The final component is the asset’s beta (β), a measure of the asset’s volatility, showing how much its returns are likely to fluctuate in reaction to changes in the overall market. Simply put, the CAPM combines these three elements to estimate an investment’s expected return based on its risk profile and the market’s anticipated performance, thus providing a crucial discount rate for determining the investment’s value.

Reference List

ADVFN (2023) Morrison (WM) Supermarkets Plc. Web.

Alfaro, L., Calani, M., and Varela, L. (2021) Currency hedging: Managing cash flow exposure (No. w28910). National Bureau of Economic Research. Web.

Das, K.K. and Palit, S. (2019) ‘Foreign exchange risk management: A critical review of the literature’, International Journal of Management, IT and Engineering, 9(2), pp. 176-192.

Financial Times (2023) Tesco PLC. Web.

Kolesnichenko, E. A. et al. (2017). Valuation cost of equity capital in the conditions of economic instability in emerging markets (by the example of Russia). In Russia and the European Union (pp. 383-391). Springer, Cham.

Myers, S. C. (1984) ‘The capital structure puzzle,’ The Journal of Finance, 39(3), pp. 574-592.

Pinto, J. E. (2020) Equity asset valuation. John Wiley & Sons.

Quiry, P., Le Fur, Y., and Vernimmen, P. (2022) Corporate Finance: Theory and Practice. Germany: Wiley.

Robinson, T., Henry, E., Pirie, W., Broihahn, M., and Cope, A. (2015) International Financial Statement Analysis (3rd ed.). Wiley.

Rossi, M. (2016) ‘The capital asset pricing model: a critical literature review’, Global Business and Economics Review, 18(5), pp. 604-617.

Tesco (2021) Annual Report 2020. Web.

Tesco (2023a) Annual report 2022. Web.

Tesco (2023b) Debt investors. Web.

Tiwary, A. R. (2019) ‘Study of currency risk and the hedging strategies’, Journal of Advanced Studies In Finance (JASF), 10(19), pp. 45-55.

Wm Morrison Supermarkets Limited (2023) Annual Report and Financial Statements 2022. Web.