Official cash rate (OCR)

The official cash rate (OCR) is defined as the market interest rate for overnight borrowing and lending (King et al. 2011). King et al (2011) define it as the rate that banks charge to lend funds from other financial institutions on an overnight unsecured basis.

This rate is a means of implementing a monetary policy by the Reserve Bank of Australia. According to King et al (2011), the cash rate strongly influences other interest rates thereby determining the level of short term interest rates for the macro economy. Consequently, RBA can influence the aggregate economy by adjusting the official cash rate.

The market interest rate (nominal interest rate) is defined by Arnold (2010) as the interest rate actually charged in the market. It can be expressed as the sum of the real interest rate and the expected inflation rate.

Market interest rate is a consequence of the action of the law of demand and supply on loanable funds. If there is a surplus of loanable funds, the market interest rates fall (Arnold 2010).

The RBA controls this through cash-fund-add and cash-fund-drain transactions. By controlling the exchange settlement funds that the commercial banks hold through the official cash rate, the RBA can influence the nominal interest rate.

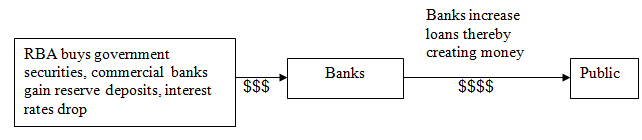

To influence the cash rate, the RBA carries out open market operations in the financial markets to influence the supply of primary liquidity available to the financial institutions. This control is achieved by the RBA buying and selling Commonwealth Government Securities from the banks for cash. Consequently, this action influences the bank’s liquidity thereby altering the short term interest rates in the financial markets (Layton, Robinson & Tucker 2012).

Suppose RBA wants to decrease the cash rate. The RBA will decide that it is necessary to increase the monetary base thereby reducing the interest rates. In order to achieve this, the RBA will offer to buy government securities from banks and other financial institutions (Layton, Robinson & Tucker 2012).

This is based on the repurchase agreement (repo) between the RBA and a financial institution that the securities will be reversed to the original owner at an agreed time in the future. When a bank buys a number of the securities on offer, RBA credits the bank’s exchange settlement account.

By doing so, the RBA will immediately increase the monetary base of that bank. Layton, Robinson & Tucker (2012) argue that if several banks sell the securities, then the net result is that each of these banks has increased liquidity.

When RBA buys these securities, the bank’s deposit reserves rise. The banks use the extra deposits to grant loans which in turn expand the broader money supply. By increasing the amount of cash flow in the market, the RBA sets the price of money thus lowering the cash rate.

Effects of decreased interest rate

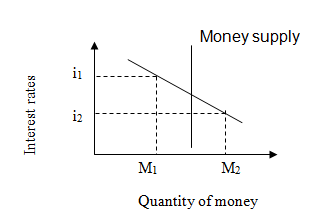

The demand curve for money is downward sloping. Since the interest rate determines the demand for money, this curve can be used to relate the change of the interest rate on various factors (King et al. 2011). When the interest rate is above the equilibrium level e.g. at i1, the amount of money people want to hold M will be less than the amount the RBA has created.

This extra money puts a downward pressure on the interest rate. When the interest rate is below an equilibrium level say i2, the amount of money people want to hold M2 is greater than the amount the RBA has created. This shortage puts an upward pressure on the interest rate.

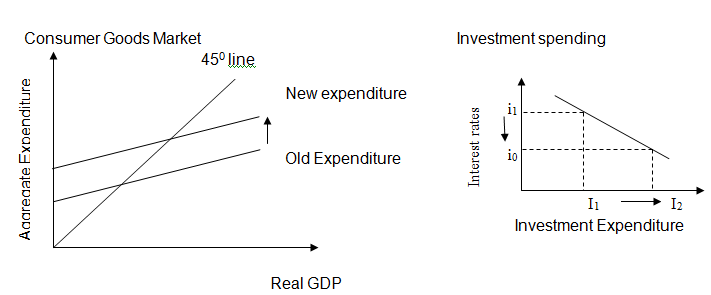

The rate of interest is the price of money. Reduced interest rates lead to increased cash flows. This encourages consumers to spend more. As interest rates drop from i1 to i0, investment becomes an attractive option.

Thus, the level of investment expenditure rises from I1 to I2. Again, low interest rates make borrowing for investment attractive thereby increasing the investment expenditure (Hossain 2009).

Low interest rates facilitate a cheaper purchase of goods and services on credit. Consequently, households and businesses have more buying power. Households are likely to increase their purchase of interest sensitive goods such as consumer durables.

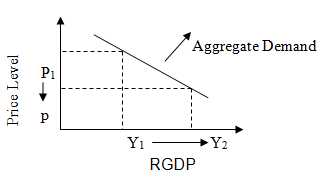

Likewise, businesses invest more in expansion and construction. This thus raises the aggregate demand on goods and services (Hossain 2009).

Low interest rates lower the rate of inflation according to Taylor & Weerapana (2009). Reduced interest rates imply that businesses are facing low borrowing costs. The low interest rates also imply a reduced cost of doing business.

Low interest rates also cause an increase in the aggregate demand of goods and services. This increase in demand needs more laborers to satisfy. This creates new job opportunities. Thus, low interest rates will lead to reduced unemployment rates (Taylor & Weerapana 2009).

Reduced price levels will lead to an increased real gross domestic product. The aggregate demand curve shifts to the left in the long term.

Credit Creation

The power of commercial banks that enable them to expand their secondary deposits either through making loans or investment securities is referred to as credit creation. By credit creation, the commercial banks facilitate monetary flows, i.e. continuous deposits and withdrawals from the bank.

This is how commercial banks create credit. The Reserve Bank of Australia has the power to influence the volume of money in circulation by adjusting the official cash rate through the open market operations. Through this, it can alter the volume of credit created by the commercial banks.

Influence of expansionary monetary policy on credit creation

Credit creation is influenced by the quantity of deposits made. A part of a deposit made into a bank is loaned out. The loan creates a debt for the loanee to service in agreed deposits. Thus, the bank has created a new deposit using the original deposit.

It is noteworthy that the quantity of deposits made determines the amount of cash available for loaning. The simple deposit multiplier is the inverse of the reserve ratio (RR) i.e. the bank’s ratio of reserves to deposits.

A small RR (large deposits), implies a large simple deposit multiplier. However, in reality simple deposit multiplier is less than the theoretical value.

An expansionary monetary policy increases the supply of money in the markets. The supply can be increased by buying government securities from the commercial banks by the RBA or by printing more money.

A rise in money supply lowers the interest rates and raises the aggregate demand. When commercial banks have more money to lend, they can grant more loans. Thus, an expansionary monetary policy will lead to more credit creation due to the increased cash flow.

Reference List

Arnold, RA 2010, Economics, 9th edn, South Western Cengage Learning, Ohio.

Hossain, AA 2009, Central banking & monetary policy in the Asia-Pacific, Edward Elgar, Massachusetts.

King, S, Gans, J, Stonecash, R, & Mankiw, N. G 2011, Principles of economics, 5th edn, Cengage Learning, Melbourne.

Layton, A, Robinson, T, Tucker, I. B 2012, Economics for today: Asia Pacific edition, 4th edn, Cengage Learning, Melbourne.

Taylor, JB & Weerapana, A 2009, Economics, 6th edn, Cengage Learning, Boston.