Economic Characteristics and Sustainability of the Industry

The household goods moving and storage industry, with a SIC Code 42149902, is one of the major industries in the United States. It has an annual revenue of $ 19.4 billion, an annual growth of $ 1.1 billion, and employs more than 144,000 people across the country (Al-Bari, 2022). Firms in this industry face numerous external market forces, some of which present growth opportunities, while others pose potential threats that can force a firm out of the market. Successful firms are often keen on understanding these market forces to ensure that they streamline their operations in ways that would enable them to manage threats while at the same time taking full advantage of the opportunities in the market. In this section of the paper, the focus is to discuss the unique characteristics of the industry and the sustainability efforts made by the players.

Market Size

When assessing the characteristics of an industry, one of the areas of interest is the market size. Market size is often defined by sales volume in the industry. Figure 1 below shows the revenue in the industry in 2022. It also shows the annual growth of revenue in the industry from 2017 to 2022, and a forecast of sales from 2022-2027 and 2017-2027. The statistics show that sales in this industry reached $ 19.4 billion in 2021 (Al-Bari, 2022). Compared with the top ten industries such as healthcare and medical insurance, drugs, and cosmetics, the auto industry, commercial banking, and the retail sector, all of which recorded more than $ 700 billion in sales revenue within the same period, it is evident that household goods moving and storage company is relatively small.

Its size is less than 2% of the size of the largest industry, retirement, and pension plans, which recorded a revenue of $ 1.258 trillion within the same period. Despite its relatively small size, it has been recording a steady growth in the number of companies offering these services to customers. According to Al-Bari (2022), there are more than 18,477 registered businesses in this industry. It is also one of the most competitive industries in the United States because of its numerous players.

Sales Growth Rate

The attractiveness of an industry can also be defined by the sales growth rate. When sales are growing, it is an indication that individual firms have the opportunity to grow even if the industry is currently considered small. Figure 1 above shows that there has been an increase in sales from 2017 to 2022. The statistics above show that the industry registered a steady annual growth from 2017 to 2020 when there was a sudden drop. The drop in revenue in 2020 can be directly attributed to the COVID-19 pandemic (Kurnaz & Argin, 2022). During this period, movement from one place to another was limited as the government and other stakeholders struggled to manage the pandemic. The number of people moving houses significantly dropped by over 90%, especially from late February to November 2020, when the spread of the virus peaked in the United States. Although operations of firms in this industry were not halted because they were considered to be providers of essential services, there were no clients to serve.

Besides the government directives limiting the movement of people, many people were unwilling to move out of their residences for fear of acquiring the virus along the way or in their new residence. Despite the challenge, the industry was able to recover, and statistics show that from 2017 to 2022, the industry grew by 1%. Competition from industries offering alternative services and other external challenges in the environment has seen experts in the industry predicting a reduction in sales within the next 5 years, from 2022 to 2027.

Stage of the Life Cycle of the Industry

The level of attractiveness of an industry can also be determined by the stage of the life cycle of the industry. The stage of the life cycle is classified into the four categories of introduction, growth, maturity, and decline, as shown in figure 2 below. The first three categories are considered desirable, while the last stage may pose a challenge to the existing firms because if they cannot reinvest their products, then they may be forced out of the market. According to a report by Herrera et al. (2020), the household moving and storage industry is a mature industry that has been in existence for several decades.

It is also one of the most competitive industries in the country, with small-scale players accounting for more than 80% of the market share. As a mature industry, the growth of revenue has remained relatively flat over the past years. The forecast shows that in the next five years, there may be a decline, especially if industries offering alternative products continue to grow. It is critical for individual companies in the industry to fight this threat of decline by introducing new products and improving the existing ones to enhance sustainable growth.

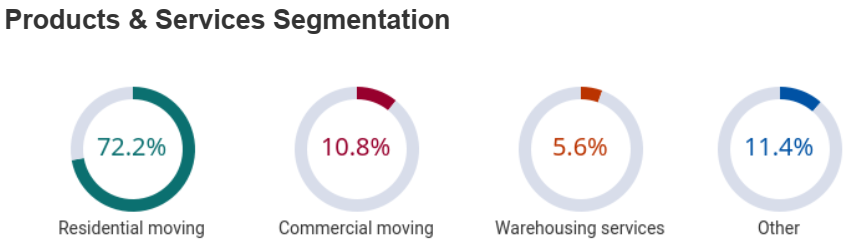

Types of Products Sold

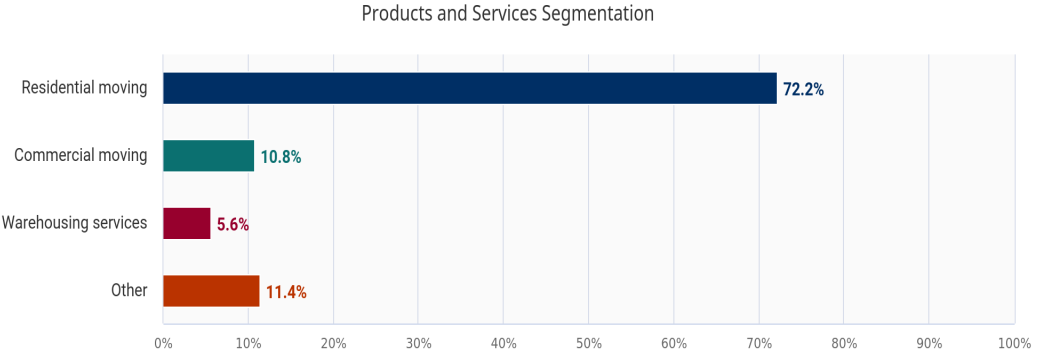

When analyzing an industry, it is essential to discuss the types of products that are offered by the players. As shown in figure 3 below, products in this industry can be broadly classified into 3 classes. Residential moving is the largest segment of products offered, accounting for 72.2% of the industry’s total. Firms in this industry rely on people who are moving from one house to another or first-time homeowners who have to purchase household items and transport them to their new residences. Commercial moving is the second-largest segment of the market, accounting for 10.8% of the market share. They mainly constitute those who need their office furniture and items moved from one location to another. Warehousing services that the industry offers account for only 5.6% of the market share. 11.4% of the services are classified as others.

Differentiation is a critical issue in a highly competitive industry. A firm will always make an effort to ensure that its products are superior to what its rivals offer in the market. The challenge in this industry is that the services that these firms offer are the same, moving household and office items from one location to the other. Individual firms have been making an effort to differentiate their products in this industry in different ways. One of the strategies of differentiation is to offer an experience that other competitors do not. It includes the speed of facilitating the movement, care taken when moving and arranging the items, how a client is handled in the entire process, and the ease with which a client can make payment. Even with those efforts, there is still a weak differentiation because such strategies can easily be replicated by rivals in the market. Stiff competition in the market and the fact that there are no dominant players in the industry means that pricing, as a differentiation strategy, is not an option.

Variations in Sales

Sales variation in the industry defines the operational strategies of a firm in the industry. According to Sallerström et al. (2022), in some industries, sales rarely vary because the product offered is used throughout the year. In such a case, the only variation that would be recorded is a consistent rise or a fall, which is often caused by socio-political and economic forces. On the other hand, some industries experience seasons of highs and lows in terms of sales. Figure 4 below shows the trend, in terms of sales variation, that is experienced in the household moving and storage industry.

The figure above shows the seasonality in revenue within the industry. There are seasons when revenue is high, while in other seasons, sales are significantly low. The variation is expected because of various factors that directly affect the industry. Owen (2022) explains that there is a significantly higher number of people who move houses at the end of the month when their lease comes to an end. However, the number would significantly drop around the mid of the month when those moving from one house to another is low. It is also common for the demand to be high when there is an economic boom, as people purchase new household items while others upgrade from one house to a better one. During the economic meltdown, the demand for services in this industry may also grow as the number of those downgrading or selling what they consider unnecessary is high.

Profit Margins for the Industry

The profit margin is another angle that one can take when analyzing the attractiveness of the household moving and storage industry. The industry may be small in terms of sales volume, but when the profit margins are high, it can be attractive to firms keen on making an entry into it. Statistics shown in figure 5 above show that there has been an attractive growth in profit margins in the industry. From 2017 to 2020, the profit margins grew by 5.7%, as shown in the figure below. The growth in profit margin can be attributed, in part, to the usage of technology by the industry players. Emerging technologies in this industry have improved efficiency, hence cutting the overall cost of operation. The growth can also be attributed to the increasing skills and experience of the employees. The more they understand what they need to do, the better they can do it. With improved efficiency, they are less likely to cause costly damages when moving these items from one place to the next.

The statistics shown in the figure above indicate that the rate of growth of the profit margin has slowed since 2017. Although the firms in the industry are making profits, the rate at which it is happening has reduced by 2.6% from 2017 to 2022. This drop in profit margin is partly caused by the growing competition in the industry over the same period. Small players are struggling to maintain their market share, and as such, some are forced to offer attractive pricing as a way of attracting more clients. Such actions tend to create price wars within the industry, effectively reducing the profit margins.

Scope of Rivalry

The scope of rivalry in the market is another factor that has to be considered when assessing the industry. As Bressanelli et al. (2020) explain, the level of rivalry in the market is often defined by the number of firms competing to offer products in a given market. At a local level, competition among small-scale companies in this industry remains significantly high, especially in urban centers where there is a high concentration of people. At a regional level, small firms have to compete against larger companies operating in different stages. At a national level, all the players have to compete for the market in the United States.

As shown in figure 6 below, more than 18,477 companies are operating in the household moving and storage industry in the country. From 2017 to 2022, there was a 3% increase in the number of firms within the industry. The statistics show that the number is likely to increase by another 1.6% in the period running to 2027. The growth will be slower within the next 5 years. That is partly attributed to the fact that the industry has matured and is becoming less receptive to new firms. The current level of rivalry is less likely to get higher than it currently is unless the industry redefines its products to attract more customers and becomes more attractive. Most household moving and storage companies in the United States prefer operating locally instead of going global. Similarly, the industry has not attracted a significant number of foreign firms. An overwhelming majority of these companies are locally owned. As such, global rivalry in this industry is relatively low when compared to other sectors such as pharmaceuticals.

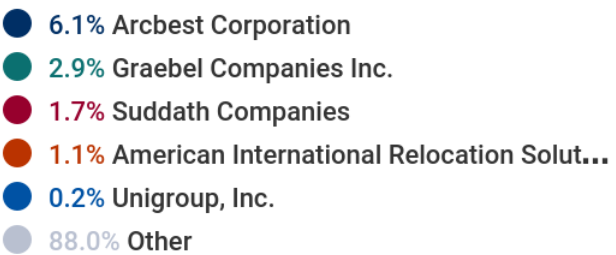

Comparative Analysis of Key Competitors in the Industry Using EGS Criteria

The level of competition in the household moving and storage company has been discussed in the section above. It has been reported that in this mature industry, the level of competition is significantly high. It is necessary to identify the key competitors and the market size that they control. It is necessary to use EGS guidelines or criteria to compare the leading rivals in this industry. The industry leader in this industry is Arcbest Corporation, which controls 6.1% of the market share. Headquartered in Fort Smith, Arkansas, United States, the company is across many states in the country. The competitiveness of this firm can be assessed by looking at how it is performing, against its main rivals, in the fields of environmental conservativeness, governance, and social forces since the time it was founded.

The company was founded in 1966 and is currently headed by Judy McReynolds who is the chairperson and chief executive officer of the company. It is a publicly-traded company with numerous subsidiaries that specifically focus on some segments of the market. Arcbest lacks clear policies regarding environmental consciousness, but it has an excellent governance structure that defines how different activities are to be undertaken to achieve specific goals. The firm also outperforms its competitors in terms of the social aspect of the EGS model. It has been investing a significant portion of its income on corporate social responsibility (CSR) and other social forums in its major markets.

Graebel Companies, Inc., which is often referred to as Graebel Relocation, is one of the oldest firms in this industry. The firm was founded in 1950 by David Graebel, and it is currently headquartered in Aurora, Colorado. It offers its services to the global market, and in the United States, it controls 2.9% of the market share, making it the second-largest firm in the industry. The firm has invested a significant amount of resources in renewable energy and other technologies meant to ensure that its operations do not pose any threat to the environment. Although its governance structure is not as effective as that of Arcbest, it has managed to assemble and guide a team of highly motivated employees. The firm performs poorly compared to its rivals when it comes to investing in social programs in the country. It has failed to undertake significant projects meant to promote social courses such as helping the homeless.

Suddath Companies is another key player in the household moving and storage industry in the United States. It is also one of the oldest companies in this industry, having been founded in 1919. The firm currently has its headquarters in Jacksonville, Florida, United States. Through its subsidiaries, it operates in different states and controls 1.7% of the market share in the country. The company has one of the poorest environmental-sensitive programs in this industry. It has always focused on rapid growth, paying little attention to the need to reduce its emissions. However, it has a governance structure that outperforms most of the rivals in the market and matches that of Arcbest. It has a team of highly skilled employees capable of monitoring and responding to emerging market forces. Just like Graebel Companies, Inc., the performance of this firm in social programs has been considered unsatisfactory.

American International Relocation Solutions is another major company in this industry. Incorporated in 2000, the firm has its headquarters in Pittsburgh, Pennsylvania, United States, and has several subsidiaries operating across the country. The firm currently controls 1.1% of the market share. As its name suggests, it offers its logistical services both within the country and in the global market. The company has failed to put in place effective programs meant to lower its carbon emissions and other effluents meant to protect the environment. However, it has a highly effective governance system. It has been using unique governance strategies to attract and retain customers in this highly competitive market. The company has also been involved in various CSR strategies in the market, especially in terms of supporting the education sector in the poor neighborhoods.

The statistics show that the household moving and storage industry in the United States is fragmented. As shown in figure 7 above, a vast majority of the market share, which is 88%, is controlled by small-scale players spread across the country. The few major players that try to consolidate the industry only control 12% of the market share. None of these players control more than 6.5% of the industry. Moreover, these dominant players prefer operating through small subsidiaries, which reaffirm the fragmented nature of the industry.

Macro Environmental Analysis Using PESTEL Model

The moving and storage industry in the United States faces various external forces that create both opportunities and threats to the growth of individual firms. A firm in this industry needs to understand these forces to enable it to plan effectively on how to take full advantage of the opportunities while at the same time managing threats. The PESTEL model makes it possible to analyze specific elements in the external environment to understand the forces that a firm faces in its operations.

Political Environment

The political environment has a direct and major impact on the moving and storage industry. Every administration takes specific strategies to help fulfill their election promises, and these actions affect the moving industry in significant ways. When Barack Obama took over the leadership of this country in 2009, one of his main concerns was to protect the environment from greenhouse gases (Hafner & Tagliapietra, 2020). As such, there were deliberate efforts to ensure that the use of renewable energies was increased. Firms in this industry were concerned that such directives would force them to redefine their operations in many ways. They would be required to upgrade their trucks, specifically to purchase the modern ones considered to be fuel efficient. The storage facilities also had to make a shift from the use of traditional sources of energy, especially petroleum products, to the use of renewable energy. Although such changes were beneficial to the long-term growth and sustainability of the industry, they also posed a significant threat, especially to the small players. Making the shift to the use of renewable energy required a significant investment in technology.

When Donald Trump took over from the Obama administration, he took a more relaxed approach toward the use of renewable energy. He did not consider climate change to be a major threat to environmental sustainability (Hafner & Tagliapietra, 2020). This shift in focus offered players in this industry an opportunity to choose the type of energy they desired to use. It meant that these players could continue using traditional methods, which are currently less expensive, as they planned for a shift to renewable energy. However, things have changed since Joe Biden took office from Trump. He is shifting focus towards the use of renewable energy, which means that firms that made the shift might benefit from this administration. Each administration will have its unique policies that would directly or indirectly affect the operations of the industry.

When assessing the political environment, it is also important to consider the stability of the country and how it affects law and order. Bressanelli et al. (2020) explain that industry cannot grow if there is lawlessness and a lack of security. The United States has enjoyed many decades of political stability since the end of the Second World War. Changes in administration from one political leader and party to the next have generally been peaceful. The political stability in the country has created an enabling environment for individual players in the industry to flourish. The current political environment presents attractive growth opportunities for firms in this industry. However, there is a need for the individual players to be dynamic enough to adjust to policy changes that might arise when there is a change in administration.

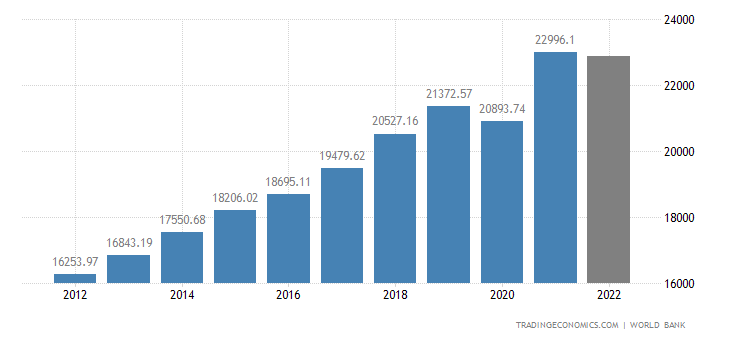

Economic Environment

The economic environment also has a direct impact on the growth of the moving and storage industry in the country. According to Sallerström et al. (2022), the growth in the economy often has a direct positive impact on the growth of an industry because of increased purchasing power. It means that consumers have increased purchasing power and will be willing to pay a reasonable price for the service that this industry offers. As shown in figure 8 below, the economy of the United States has been growing steadily since 2012. There was a negative growth in 2020, which is directly attributed to the outbreak of the COVID-19 pandemic, which significantly affected the moving and storage industry. However, the statistics show that the economy was able to recover in 2021. This growth presents opportunities for individual firms in this industry to expand their market share.

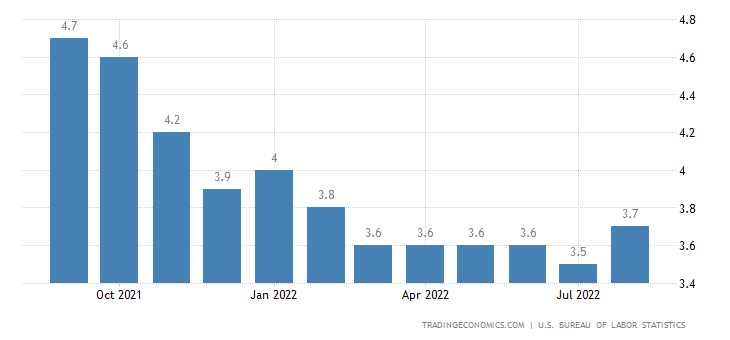

The rate of unemployment is another indicator that helps to determine opportunities and threats in the external market. Owen (2022) explains that when youth is gainfully employed, they will have motivated to move out of their parent’s home and get their place to stay. Similarly, if an individual has an improved income, they are likely to move to a bigger house that matches their new social class. Such movements present growth opportunities for firms in this industry. As shown in figure 9 below, there has been a consistent decline in the rate of unemployment in the United States. In early 2021, the unemployment rate was at 4.7%, as shown in the figure below. However, this has consistently declined to a low of 3.5% by July 2022. It means that the purchasing power of individual consumers has also increased, taking into consideration the increase in the GDP per capita in the country within the same period. More people are likely to look for better places to stay, which creates growth opportunities for growth.

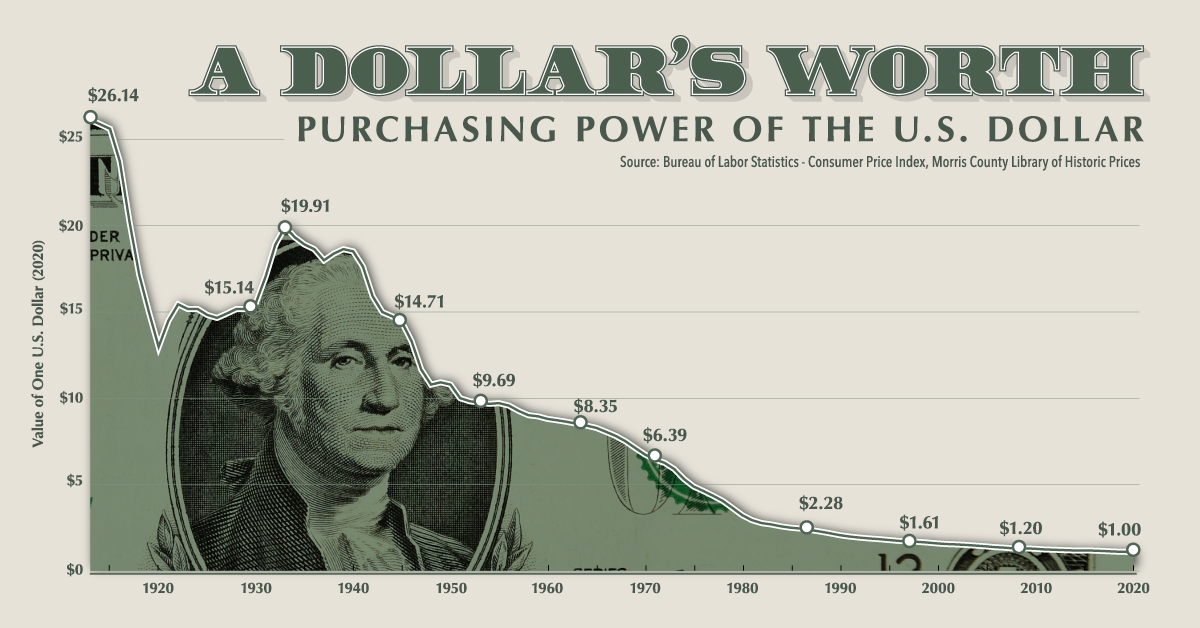

Despite the attractive economic environment in the United States, there is a major challenge that players in this industry. As shown in figure 10 below, there has been a consistent drop in the purchasing power of the US dollar over the years. Over the last 10 years, the dollar has lost almost 20% of its value because of inflation. It means that for companies in the industry to maintain their profitability, they would be expected to have increased their price by at least 20% within the same period. The challenge is that when competition is stiff, as it is in the moving and storage industry in the US, a change in pricing will elicit an immediate and significant response from consumers. Some large firms may consider trimming down their expenses as a way of maintaining their profitability instead of increasing their price. It becomes a major challenge for those that cannot do the same. This problem may force some players out of the market.

Social/Demographical Environment

The social environment is another critical factor that defines the ability of firms within an industry to achieve success in the market. In the moving and storage industry, the behavior of people when they climb the social ladder is an important issue. In the United States, there is a consumer belief that one’s place of residence should reflect their social status. It means that when a person’s income increases, they are likely to purchase new household items or even move from one residence to another. In so doing, they will have to seek the services of firms in this industry to facilitate the movement of their household items (Familia & Horne, 2022). On the other end, when there is a sudden drop in income, as was the case during the 2008 recession, one may be forced to move to a smaller and cheaper house, or even stay with family or a friend. In such a case, they will want to move their household items to their next residence. Others may even be forced to find storage services if offered by firms in this industry. It means that both upward and downward mobility offer great opportunities for the industry.

There is a general belief in the United States that moving household items should be done by professionals. As such, even if an individual has a truck, they will still consider it appropriate to pay a company to do the job as long as they can afford to pay (Bressanelli et al., 2020). The belief creates a huge market for the industry as there is a significant number of people who move houses every month. The challenge that arises is that demand would surge significantly around the end of the month, only to end after one week or so. It forces such firms to diversify their products to enable them to be engaged productively throughout the month.

The outbreak of the COVID-19 pandemic promoted the practice of working from home. Many people were forced to work from home because of movement restrictions. Although the pandemic has been controlled and people can resume their office work, there is a significant number of workers and firms that have favored the model of working from home. It not only cuts the cost of operation but also improves the efficiency of the employees (Ambrosio-Albalaa et al., 2020). This has created a temporary opportunity for firms in this industry as the demand for storage services increases. Some firms are forced to find storage for their office products as their employees work from home. Although this opportunity may not last long, some firms in this industry have taken full advantage of it.

Technological Environment

Technology has remained one of the drivers that define the growth of this industry. In the transport sector, there has been a growing demand to have environmentally sustainable trucks to facilitate movements. Tesla Motors has taken the lead with its electric semi-trucks. As shown in figure 11 below, the company is soon launching a new truck that is capable of reaching 500 miles before it can be recharged. Although the initial price of purchasing this truck is higher than that of trucks with similar load capacity, running and maintenance costs are significantly slow (Sallerström et al., 2022). It does not consume gasoline, which means that it remains unaffected by the volatile fuel prices. It also has a significantly low cost of maintenance because its engine is not using gasoline. Firms in the moving and storage industry should consider embracing such technological changes.

The concept of sustainable storage has also emerged as a major issue in the industry. Owen (2022) explains that firms are keen on cutting the cost of operations in their warehouses. One way of doing so is to significantly reduce the amount of energy that is used in these facilities. Solar energy is emerging as one of the preferred alternatives, as shown in figure 12 below. With the right amount of solar panels fitted on the roof of a warehouse, a firm can reduce or even eliminate the need to use power from the national grid. Within these storage facilities, firms are also embracing emerging technologies such as robotics, artificial intelligence (AI), and big data to improve efficiency and cut operational costs.

Marketing is another area that technology has redefined. Traditional marketing platforms are increasingly losing their appeal in the modern market. Newspapers were once one of the best platforms for promoting a brand and products. However, it is no longer as attractive as it was in the past as few people read newspapers. Television and radio are still viable platforms, but they are also losing their appeal. Facebook, YouTube, Instagram, and Tik Tok are emerging as powerful platforms for promoting brands and products. Firms in this industry will need to embrace the new trend to market their products.

Ecological Environment

The ecological factors cannot be ignored in the modern-day business environment. According to Reddy (2019), ecology is one of the three primary pillars of sustainability. The sustainability of an industry depends on how firms collectively manage their operations to protect the environment. The transport sector is one of the industries known to contribute significantly to the emission of greenhouse gases. As was mentioned above, different administrations have embraced different policies when it comes to the emission of carbon gas. However, there is a need for individual firms to find ways of ensuring that their operations are sustainable. Some of the ways of doing so would be to embrace green energy both in storage facilities and in actual transport.

There is also the need for firms to ensure that they manage their effluents to reduce environmental degradation. Besides strict government regulations that prohibit irresponsible disposal of wastes, industry players have an individual responsibility to ensure that their environment is sustainable. They need to use emerging technologies to process their wastes to ensure that they pose no environmental and health threats before being disposed of (Familia & Horne, 2022). The use of plastic containers and materials, which have been popular in this industry, needs to be reduced significantly because of their devastating impact on the environment.

Legal/Regulatory Environment

The legal environment is another critical external environmental factor that has to be considered when assessing the industry. Owen (2022) explains that a firm and an industry can only flourish in an environment where there is law and order. The United States has laws and regulations meant to guide the activities of various stakeholders in different industries. The Consumer Protection Law is meant to protect customers within the market. It prohibits deceptive practices among companies, which are meant to defraud customers. In this country, firms are required to deliver what they promise to customers once payment is made. It means that a firm is not expected to promise what it cannot deliver in its promotional campaigns and engagement with customers. When a client is promised that at a given fee, their household items will be moved from one residence to another and properly arranged, then the firm has a legal obligation to do so. Failing to deliver on the promise may lead to litigation against the firm.

The law is also meant to protect suppliers, other firms, the government, and any other stakeholder from unfair practices. For instance, individual firms are expected to pay taxes to the government based on sales (Ambrosio-Albalaa et al., 2020). A firm may be tempted to manipulate financial records to significantly reduce the amount due to the government. Such malpractices are often punished when they are discovered. It is prudent for individual firms to understand the regulations guiding practices of the industry to avoid such cases.

The Key Success Factors (KSF) for the Industry

In a highly competitive market, a firm needs to understand key success factors that can enable it to achieve the desired level of success. In the fragmented industry such as the household moving and storage industry in the United States, the success of a firm depends on its ability to uniquely manage forces that affect its operations. Owen (2022) advises that a firm needs to find ways in which it can achieve a competitive edge over its rivals. In this section, the focus is to identify success factors that specific firms in this industry have been using to gain a competitive advantage over rivals.

Use of Emerging Technologies at Arcbest

The use of emerging technologies is one of the unique ways of achieving success in a highly competitive industry. Arcbest is the market leader in this industry, controlling about 6% of the market share. This company has managed to achieve this level of success because of its emphasis on the use of emerging technologies. The company understands the significance of cutting down the cost of operation as a way of enhancing profitability. The strategy makes it possible for the firm to increase its profitability without having to increase the price of its products. For instance, the company announced in early 2022 that it is investing $25 million in Phantom Auto, a human-centered remote operation software (Mahar, 2022). The investment into this product was meant to automate its warehousing operations.

The use of robots instead of humans was meant to significantly reduce the overall cost of labor in the company. The robots can also undertake specific duties for longer and with greater precision than human labor. The technology is set to revolutionize operations at the company, making it possible for it to expand its market share. Comparatively, this firm is doing better than its rivals in the industry in terms of embracing emerging technologies

Creativity and Innovation at Graebel Companies

Creativity and innovation are key success factors that can enhance the operations of a firm in an industry. In the United States’ household moving and storage industry, Graebel Companies is one of the firms that have realized the significance of encouraging innovation among its employees. The management has created an environment that makes it possible for workers to develop unique ways of undertaking their responsibilities (Graebel, 2022). One of the ways of promoting innovation among employees is the reward system. The company rewards its workers who develop unique ways of operation meant to cut costs reduce the time that it takes to conduct specific tasks, or increase the firm’s profitability. Compared with its rivals in the industry, this firm has registered the best performance in promoting creativity and innovation among employees.

At the same time, the company does not punish employees for making mistakes in their effort to be creative, as long as the mistake can be justified. In such an environment, Sandri et al. (2021) explain that employees have enough incentives to be innovative. They know that when they develop something revolutionary, they will be rewarded. The strategy has enabled this company to protect its market share in this highly competitive industry. The firm has also worked closely with institutions of higher learning to facilitate improved innovativeness of the employees. Some of the unique strategies require testing in a controlled environment before using them to serve customers. Institutions of higher learning create an environment where such tests can be carried out effectively (Sallerström et al., 2022). Engaging such institutions also helps in empowering employees by facilitating continuous learning. Bressanelli et al. (2020) also believe that through such engagements, it is possible to identify and recruit top talents from the institutions. Such talented employees would then play critical roles in enhancing the overall performance of the firm.

Discipline and Motivation among Employees at Suddath Companies

In the household moving and storage industry, discipline is one of the critical success factors for a firm. Owen (2022) explains that when moving a family from one place to the next, employees of a given company will be handling precious items of high value, including cash and expensive jewels. Others are items of sentimental value to the client and cannot be replaced. There is always the temptation to steal some of these items while on duty. Sometimes the client may not even realize that they have lost the item until a later date when they want to use it.

Such cases of theft are common when a firm fails to instill discipline and work ethics among its employees. Fjellså et al. (2021) observe that this industry has minimum wage employees who struggle to make ends meet, and as such, they have the motivation to steal when the opportunity presents itself. The firm needs to ensure that its employees do not give in to the temptation to steal from the clients. Such practices can have serious negative implications on a firm’s image. When it is known that its employees are not honest people, clients will avoid using the firm’s services.

Suddath Companies has also been keen on investing in employees’ motivation while they are at work. It is common to find cases where the firm is overwhelmed by orders, especially around the end of the month. The task of moving a client from one residence to another or from an office to the next can sometimes be demanding. These employees have to carry heavy and fragile items from the house to trucks and from trucks to the next house. These activities cannot be performed by robots, so these employees have to be willing to do them. They need proper motivation to ensure that they do not give up. The company has been giving its workers attractive allowances to ensure that they are not only willing to undertake such physically demanding tasks but are also capable of working extra hours when necessary. The firm has registered a better performance compared with its rivals when it comes to maintaining a team of highly motivated employees.

Having a Good Reputation

In this highly competitive business environment, reputation is critical in enabling a firm to achieve growth. According to Al-Bari, S. (2022), the moving and storage industry handle very sensitive items for their clients, some of which are very costly while others are fragile. Cases have been reported where customers lose their valuables through theft or breakage when moving from one location to the other. A firm needs to build a reputation as one that has a team of highly skilled employees capable of handling such products. The reputation will also be built if customers are assured that employees of the company will not steal any item when on transit or at any of the stages of moving from one house to the next.

There is also the way in which a firm’s employees engage clients. They need to be respectful and able to answer any question or address any concern that a client might have. In the current era of social media, it is easy for a customer’s praise or complaint to go viral. A single client who has over half a million followers on Instagram account can have a powerful statement that can build or destroy the reputation of a firm (Familia & Horne, 2022). As such, the management of a firm in this industry should remain committed to protecting its reputation as one of the best ways of attracting and retaining customers. American International Relocation Solutions, LLC has emerged as one of the firms with the best reputation in this industry. It has helped it gain a competitive edge over some of the market rivals.

Structural Forces Affecting Industry’s Profitability Using Porter’s 5 Forces Analysis

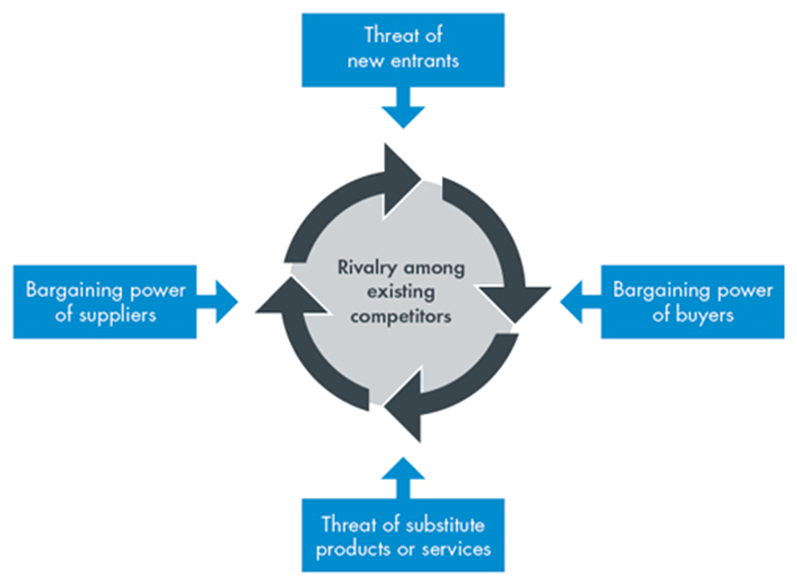

The moving and storage industry in the United States faces numerous industry-specific forces that affect its growth in different ways. Using Porter’s five forces model, shown in figure 13 below, it is possible to assess these external forces and determine how they create growth opportunities or pose threat to the development of the industry. Individual firms within the industry need to understand these forces and determine how to define their operations in ways that neutralize the identified threats while at the same time taking full advantage of growth opportunities.

Rivalry among Existing Competitors

The level of rivalry among existing competitors is always one of the greatest concerns for individual firms in the industry. Sandri et al. (2021) believe that when competitive rivalry is significantly high, then the action of one player will elicit an immediate reaction from the competitors. It creates an environment where every firm is keen on creating a competitive edge over rivals as a way of protecting market share and achieving growth. The fact that firms in this industry offer similar products makes the competitive rivalry to be significantly high.

The market leader in this industry, Arcbest Corporation, has a market share of 6.1%. The remaining competitors have less than 3% of the market share. Analysis of the industry shows that small-scale players in this industry control 88% of the industry. The statistics show that there is no single dominant player in the industry. None of the firms has enough market share that can enable it to dictate industry practices. In such a market, Owen (2022) explains that competition is always significantly high. Pricing as a strategy for winning customers is often the best choice for such firms when they offer similar services. The problem is that no single firm in this industry can sustain such a strategy because they control a significantly small market share.

The threat of New Entrants

The threat of new entrants is a concern that players in a given industry have to consider and manage as would be appropriate. According to Fjellså et al. (2021), the ease with which new firms can enter a given industry is defined by several factors. One of the major factors is the capital that is needed for a new firm to make a successful entry. The capital requirement in this industry is relatively low. One only needs to get the right truck capable of handling household items and a few employees who can facilitate the movement. This low barrier to market entry makes the ease of market entry to be high.

Laws and policy regulations within the industry are another factor that defines ease of entry into a given industry. In the United States, the government has created an enabling environment for business start-ups. The numerous regulatory policies that have to be observed by food handling companies and other sensitive industries do not apply to the moving and storage industry (Barja-Martinez et al, 2021). As such, a firm that is willing to start operations may not face numerous challenges. However, the analysis of the industry has shown that barriers to entry into this market by foreign firms are significantly high. Although the regulations and capital requirements can easily be met, the unique requirement of customers makes it difficult for these foreign firms to understand. It means that the new entrants are more likely to be local firms other than large foreign companies.

The threat of Substitute Products

The threat of substitute products is a major issue that can significantly affect the profitability of a firm. Owen (2022) argues that if products or services offered in one industry can easily be substituted with those in another industry, then the threat will be considered high. It is necessary to assess the nature of products that firms in this industry offer before defining the level of threat posed by substitute products. As shown in figure 14 below, the main product that the industry offers is residential moving. It accounts for more than 72% of the services that the industry offers. As Sallerström et al. (2022) observe, there is no perfect replacement for this service outside this industry. This is so because players in this industry have specialized in the delicate process of taking household items, some of which are fragile, moving them to the next residence, and then arranging them in the new place. They have staff specially trained to undertake these tasks without breaking anything. They also have trucks that are specially designed for these duties. One may opt to use normal trucks and family members to move house, but the risk of breaking fragile items is relatively high. As such, there is no perfect substitute for this unique service that this industry offers. The weak external forces, concerning this specific product, create an opportunity for increased profitability.

Figure 15 below shows that another major product that the industry offers is commercial moving, accounting for about 10.8% of what it offers. This is another unique product that presents mixed fortunes for the industry. When it comes to moving office furniture and other items from one office to another, then the threat of substitute products is significantly low because of the level of specialization needed to undertake such activities. In such a case, it will enjoy a great growth opportunity. However, the moving of general commercial goods can be replicated by other transport industries.

Warehousing is another service that the industry offers, accounting for 5.6% of its total product offerings. This is an area where there is stiff competition from other industries. The main competitor is firms that only specialize in warehousing services. Moving and storage companies have a unique edge over competing companies because they have designed their warehouses to meet the needs of their main clients, the residential customers. When an individual wants to keep their household items in a place for a while, the general warehouse may not be the best option (Ambrosio-Albalaa et al., 2020). Finding a general warehouse that would accept keeping such household items is not easy. However, they will get the service in the moving and storage industry because they have specialized in offering such products. In that respect, the threat of substitute products is low, which offers it a growth opportunity.

When assessing the threat of substitute products, it is necessary to consider industries that offer similar services and the level of threat that they pose to this industry. As shown in figure 15 below, several industries offer competing or complementing products. Rail transportation is considered to offer complementary products. When a client wants their items moved a great distance across different states in the country, a firm in the moving and storage industry may consider using rail transport to help reduce the cost of service offered without compromising quality.

Local freight and trucking in the country are considered competitors in the industry. They offer services that are in direct competition with what firms in this industry offer. Tank and refrigeration trucking in the country offer complementary products. When a firm gets a client whose goods require refrigeration or transportation using tankers, then they can subcontract the services of these trucking companies. Waste collection services in the country are also considered to offer complementary products. Wastes generated from moving items from one house to another can be taken care of by waste collection companies. The assessment shows that the threat of substitute products in this industry is significantly low.

Bargaining Power of Suppliers

The power of suppliers is another area of concern that companies in this industry have to consider. According to Sallerström et al. (2022), when a few suppliers provide the most important materials without which, firms in the industry cannot function properly, then they will dictate terms of trade. Conversely, if there are numerous companies providing materials that the industry needs, then they will have limited bargaining power because their customers will have alternatives from which to choose. In the moving and storage industry, trucks used to facilitate the movement of items from one location to the other are one of the most important things a company must have. Several auto manufacturers produce this item. Their bargaining power can be considered average because, although competition is high, they are powerful enough to dictate the market price.

Gas is the most important consumable that is needed in this industry. There are a few dominant players in the petroleum industry in the country, such as ExxonMobil and PB. There are also numerous small and mid-sized companies in that industry, making the competition relatively stiff. Firms in this industry have relatively low bargaining power because of the stiff competition. However, the price of gas in the country is often determined by market forces, especially the cost of making the product available in various locations. Consumers and suppliers have little power to dictate the price of this critical commodity.

Bargaining Power of Buyers

The bargaining power of buyers is another factor that defines the attractiveness of an industry. Owen (2022) observes that in an industry where there is stiff competition, there tend to be powerful customers who would want to purchase the best products at the lowest price possible. When targeting organizational buyers, a firm should also be ready to handle powerful clients because their purchasing power makes it possible for them to dictate market terms. On the other hand, when the level of market rivalry is low, the level of competition is low.

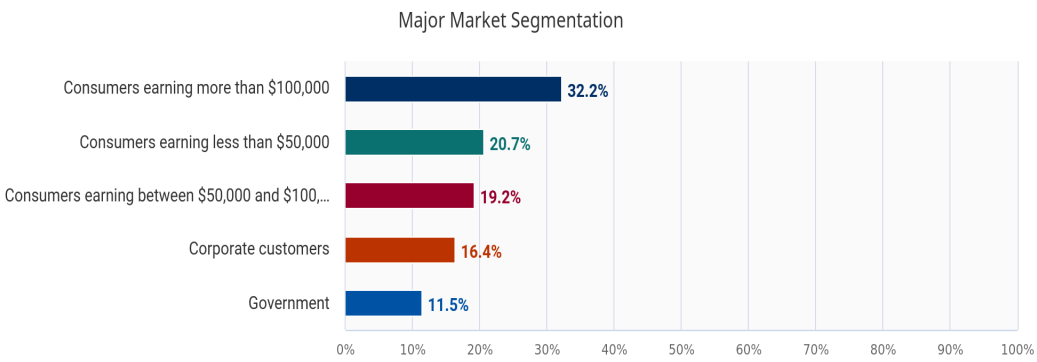

When assessing the bargaining power of consumers, it is necessary to segment the market, as shown in figure 16 above. Consumers earning more than $ 100,000 annually are the largest customer segment in this industry. They tend to move from one place to the other regularly. Consumers earning less than $ 50,000 is the next important market segment, while those earning between $ 50,000 and $ 100,000 are third on the list. These individual consumers have average bargaining power. Although they can choose from various firms offering the same service, sometimes the need to move from one place to the next is so urgent that they cannot afford to be choosy. Corporate customers and government entities are the most powerful buyers in this industry. They tend to place large orders and given the fact that there is a tendering process, a firm that offers the most competitive price will win. As such, many companies in this industry would be forced to lower their profit margin to win these clients.

References

Al-Bari, S. (2022). Moving Services in the US: Moving out, a strong residential market has driven demand for the industry’s moving services. IBIS World, 1(8), 4-45.

Ambrosio-Albalaa, P., Upham, P., Bale, C., & Taylor, G. (2020). Exploring acceptance of decentralized energy storage at household and neighborhood scales: A UK survey.Energy Policy, 138(1), 1-19. Web.

Barja-Martinez, S., Rücker, F., Aragüés-Peñalba, M., Villafafila-Robles, R., Munné-Collado, Í., & Lloret-Gallego, P. (2021). A novel hybrid home energy management system considering electricity cost and greenhouse gas emissions minimization. IEEE Transactions on Industry Applications, 57(3), 2782-2790.

Bhutada, G. (2021). Purchasing power of the U.S. dollar over time. Web.

Bressanelli, G., Saccani, N., Perona, M., & Baccanelli, M. (2020). Towards circular economy in the household appliance industry: An overview of cases.Resources, 9(11), 128-130. Web.

Familia, T., & Horne, C. (2022). Customer trust in their utility company and interest in household-level battery storage. Applied Energy, 324(1), 1-23.

Fjellså, F., Silvast, A., & Skjølsvold, T. (2021). Justice aspects of flexible household electricity consumption in future smart energy systems. Environmental Innovation and Societal Transitions, 38(1), 98-109.

Graebel Companies. (2022). Full-service talent mobility tailored to you. Web.

Hafner, M., & Tagliapietra, S. (2020). The geopolitics of the global energy transition. Springer Open.

Herrera, M., Kunaka, C., & Weisskopf N. (2020). Moving forward: connectivity and logistics to sustain Bangladesh’s success. World Bank Group.

Holding, J. (2022). Tesla semi-truck coming later this year, cybertruck in 2023. Web.

Kurnaz, S. & Argin, E. (2022). Digitalization and the impacts of covid-19 on the aviation industry. Business Science Reference.

Mahar, A. (2022). ArcBest builds on commitment to innovative technology with $25 million investment in phantom auto. Web.

Owen, J. (2022). It became an anchor for stuff I really want to keep: The stabilizing weight of self-storage when moving home and away. Social & Cultural Geography, 23(7), 990-1006.

Reddy R. (2019). Sustainable engineering: Drivers’ metrics tools engineering practices and applications. John Wiley & Sons.

Sallerström, P., Sundin, J., Kurilova-Palisaitiene, J., & Sundin, E. (2022). Scaling up repair workshops to remanufacturing facilities for household appliances as a service. Procedia CIRP, 105(1), 43-48.

Sandri, O., Holdsworth, S., Hayes, J., Will, N., & Moore, T. (2021). Hydrogen for all? Household energy vulnerability and the transition to hydrogen in Australia. Energy Research & Social Science, 79(1), 7-19.

Spacewise. (2020). Extra space storage earns top score for sustainability. Web.

Trading Economics. (2022a). United States GDP. 2. Web.

Trading Economics. (2022b). United States unemployment rate. Web.

Zic, S., & Mikac, T. (2009). Application of ADL matrix in developed industrial companies. The 20th International Daaam Symposium, 28(5), 1-11.