Introduction

Strategic business plan (A strategic plan is a document that outlines the economic agenda for a given organization for some time. It stipulates resources to be used and the expected challenges and their remedies.) Proposals are created to stimulate efficiency, responsiveness, and cost-effectiveness in the business world and to also act as channels of creating wealth and potential resources for business organizations. A strategic business plan covers a period of two to five years to establish a potential investment for a given organization (Aaker & McLoughlin, 2010). Many business organizations are inspired by the need to create wealth, jobs, and improve the living standards of their targeted clients. A given business organization must make a strategic plan for resource allocation and the creation of reliable alternatives for its sustainability. Allocation of resources, especially financial ones for the creation of wealth, is a crucial subject for any commercial entity. It is usually the responsibility of the stakeholders in a business organization to devise the best way of managing the organization’s wealth. Better funding and investment creates a productive channel and a prospective market for business organizations. The strategic plan for the Zurich Cantonal bank will evaluate the various opportunities that the institution will create and the number of investments that will be made in a given period.

The international financial market will be analyzed, and credible results will be evaluated. The proposal will aim at creating not only a good strategic business plan but also an effective one. It will aim to develop a realistic, credible, and relevant plan. To maintain competitive economic standards for the bank, the proposal will recognize opportunities and create effective ways of nurturing them. The plan will be mandated to develop the best and most effective idea that will be viable in the contemporary market. The Zurich Cantonal bank will need to draft a plan that will secure it from its major competitors in the financial market like Barclays and Standard Chartered banks. The strategic business plan will address the different ways of handling the financial challenges of the Zurich Cantonal bank. Various techniques and theories of management will be exploited, and the structure of the organization will be accorded priority.

The strategic business plan will tackle the various mechanisms and methodologies of increasing competitiveness while maintaining standardization, efficiency, and productivity in the bank. The strategic business plan will equip the bank with potential resources to maintain a realistic growth plan. The proposal will also analyze the various books of accounts and asses the financial ability of the Zurich Cantonal bank concerning wealth creation (Fry, 1989). The overall target of the strategic business plan will be wealth creation for the bank. The proposal will consider the various challenges that derail wealth stimulation and, at the same time, evaluate the possibility of the Zurich Cantonal bank overlooking these challenges and improve its wealth management practices. It is the mandate of every strategic business plan to provide a better plan than the existing one. The plan of the Zurich Cantonal bank will oversee the transformation of the financial institution, which will, in turn, serve many clients, starting from Zurich to its various branches globally.

Description of the business

The business description will include the mission statement, the objectives, vision, goal, and target of the bank.

Mission and objectives

The mission of the bank will be to facilitate a self-sufficient financial unit and evaluate banking services concerning the change in the global economy. The objective of the plan will be to target at least one in every ten individuals in Zurich to accept the use of Swiss bank’s products and convince them to open accounts in the bank. It will be the goal of the business plan to ensure the creation of wealth and opportunity for the people of Switzerland by managing profits, reducing liabilities, national debt, and deficits in the national budget. The Zurich Cantonal bank will be expected to grow and conform to global standards by offering diverse bank products.

Business description

The Swiss Zurich Cantonal bank will be a leading financial institution in Zurich, Geneva, Basel, and Lugarno aimed at providing financial and other related services. Founded in 1870, the Zurich Cantonal bank is considered as the largest Cantonal bank in the world and the 4th largest in Switzerland. The plan will stipulate how the bank will have 103 outlets with offices in Beijing, Sao Paolo, Mumbai, Singapore, and Panama. Consultation and project mentorship programs will also be started with links in France, England, and Holland. The services of the bank will be found in most countries of the world, especially in the European continent. The Swiss bank has been in existence since the 18th Century to date. Its headquarters are found in Switzerland. The Swiss Financial Market Supervisory Authority will regulate the bank.

The bank will be dealing with three types of currencies, which are the dollar, the pound, and the CHF (Confoederatio Helvetica Franc), which is the Swiss currency. The shares will be sold in 1-ounce gold units. The bank will focus on Swiss society as a link to the outside world and will target merchants, investors, tourists, and other credible clients in the financial world. Its duty will be to provide better services and sufficient banking resources to all local and international clients. It is believed that a third of the world’s total money is found in Switzerland. This fact will be a major opportunity for the Swiss economy, and it will give the Swiss people pride to know that they own a 1/3 of the world’s wealth.

Products and services

The need to provide quality and quantifiable supply of goods and services will be a crucial aspect of the bank’s strategic plan. The Swiss bank is charged with the responsibility of providing safer, better, and faster financial products and services. The bank will facilitate the provision of services that are competitive regarding interest rates with 1.0% to 1.5% margin and provide competitive dividends and returns. The bank will address challenges linked to its use of all major currencies in the market. The emerging technology will be important in facilitating the bank’s modern financial services like the use of mobile banking, visa cards, electronic transfers, and the Swiss Interbank Clearing (SIC) services.

This idea will ensure better services and transactions for the bank’s clients. Close contact and communication between the bank’s staff and its clients will be integrated into the strategic plan of the bank. In all its branches, the bank will assure its clients of maintenance of the same discipline and proximity. To enhance the concept of competitiveness, the bank will exploit technological facilities whose use will also be linked to Six Sis AG, Wir Bank, and Hinduja (Six Sis AG, Wir Bank, and Hinduja are major commercial banks in Switzerland), all major competitors of the Zurich Cantonal bank. The Zurich Cantonal bank will engage the use of competitive technology to facilitate safer and faster transfer of money across all the bank’s networks in the world. The Swiss bank will have to satisfy the changing needs of its clients by conducting structured market surveys which have, in the past, helped the bank introduce new products for its clients like telephone banking.

Major benefits and performance

The bank will provide relatively low-interest rates to its clients on loan facilities. The Cantonal Swiss bank will enhance the satisfaction of its clients by the provision of credit facilities with a reasonable period of payment depending on the individual ability of the clients to repay and the amount of money borrowed from it (Lewis & Roehrich, 2009). All the plans for the provision of credit facilities will be achieved through an understanding and collective bargaining between the clients and the bank. The bank will be targeting to increase its operations beyond Europe and open office branches in Asia, Africa, and the Caribbean regions. The existence of networks across the world will ensure that the Swiss fraternity will be able to exercise its mandate, goal, and mission efficiently and effectively.

Sourcing

The sourcing concept (Refers to the aspect of acquiring legal authorization for all initiatives by a business organization) as it pertains to management refers to the process of acquiring a legitimate business permit from a relevant authority or office. It is the obligation of the federal government of Switzerland to issue an operating permit to the Zurich branch. Any sources obtained will be aimed at ensuring that the bank meets the set standards of banking and reach its potential customers and investors. With the right source, the bank will be assured of greater and safer services, which will be satisfactory to its clients.

Bank’s landline communication services

The landline communication service is an ancient communication network which uses a fixed telephone line with a switched wire system. It offers alternative bank communication to the text message service. The bank’s clients will be able to enjoy all the benefits attached to the bank’s physical and financial resources. Communication is vital, and if enhanced by technology, it will become efficient, effective, and faster (Dumville, 2001). The people of Zurich and entire Switzerland have embraced modern technology and information systems. Even though the landline system is outdated, some people still prefer it, and its availability will suit their operations. In Switzerland, hospitality is accepted and practiced as a way of serving, supporting, and distributing new technological products.

ISDN

The ISDN digital service (is an alternative to the landline system as it is cost-effective and enhances the speedy transfer of money) Offered by telecommunication companies like Liechtenstein is an important tool for effective banking. The Cantonal Swiss bank, in connection with the telecommunication companies, will adopt the ISDN system as an alternative to the analog landline system. This option will facilitate variety in terms of communication, and the clients will prefer what is convenient for them and not for the bank. In most telecommunication companies, the ISDN facility operates at a speed of 26 to 64 kilobits per second; thus, the system will enhance the speedy transfer of financial data.

Services 900 and 600

The Cantonal Swiss bank will employ the services 900 and 600 in telephone banking and electronic transactions. This fact will ensure cost-effectiveness and efficiency in the provision of its services. The service system provides the provision of visas, streaming of revenues, and analysis of account information. It has, however, been reported that services 900 and 600 have been challenging to use, especially when it comes to the integration of other information systems (Plunkett, 2008). The subscribers of these services will be required to pay a subscription fee of 100 US dollars or an alternative rental charge of 50 US dollars. Time is a crucial factor in the two services as the charges will depend on the speed of the services. It has also been noted that the services have been slow, but the Zurich Cantonal bank will integrate measures to improve their speed and urgency.

Market share

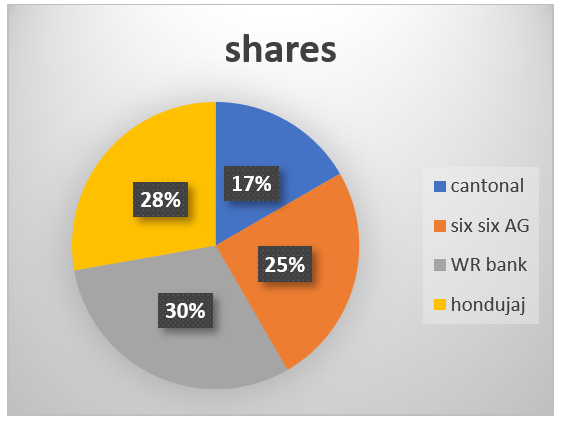

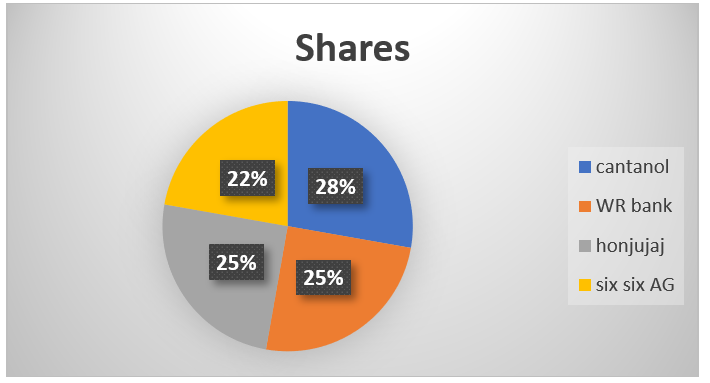

The marketing research will employ both primary and secondary research methods to analyze market-related probabilities that the bank can exploit. For the primary market research, I have gathered my data concerning the market trends that will be reflected in the pie chart as an illustration of the possibility of a good marketing scheme for the Zurich Cantonal bank.

Future projection

The secondary market research strategy will involve the use of publication journals, bank statements, magazines, newspapers, census data, and demographic profiles. The information will be found in industrial associations, commerce chambers, public libraries, government agencies, and online services. The local libraries in Zurich will be of invaluable help in the provision of secondary data.

Economics

The market size will target 1 in every 10 of Zurich’s citizens and visitors, and this idea will eventually capture about 3% of the total population. The current market demand for banking services is on the rise, and the Zurich Cantonal bank will envisage harnessing the big market opportunity by providing efficient and cost-effective products and services. The bank will have the potential for growth and development if it will expand its markets and improve its products through innovative ways. Reliable resources, technological integration, and relevant marketing strategies will be key aspects that the bank will exploit to penetrate European, Asian, and African markets. The bank will be projected to grow immensely and increase its market share index. It is, however, recognized that the banking sector faces a lot of challenges, and business risks will be likely to be experienced due to the competitiveness of the banking sector and the uncertainty of the market. The Zurich Cantonal bank will need to create alternative methods of meeting the challenges of an unreceptive market and a competitive environment.

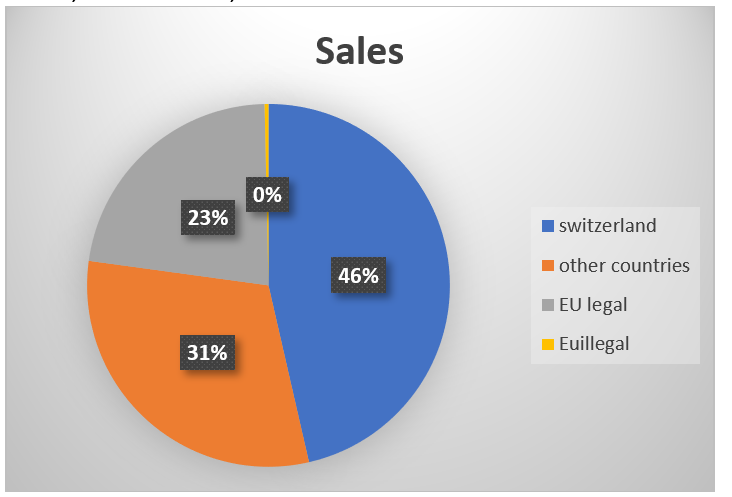

The challenges that the bank is likely to be faced with will include increased costs in the market, capital, transport, insurance, operations, and problems related to consumer recognition and acceptance of its products. The bank will also be likely to encounter reduced levels of cooperation and relations with the various economic and legal bodies in various countries concerning matters of compliance with market standards and regulations. Insurance costs alone will be expected to take about 1% of the total share approximated to be 0.9 billion US dollars. Effective mapping of alternative dimensions in its marketing strategy will be important in deciding whether the bank will be able to overcome its wealth management challenges. The following chart will give an expression that will amount to a challenge if not properly effected.

Personnel

The Swiss bank will employ approximately 100 employees, including main and support staff, to deal with its different operations. After the bank’s opening of new office branches in various strategic locations, the need for additional personnel will be expected to rise steadily depending on the market trend and demand. The initial cost of employee recruitment will take a share of about 3 million US dollars annually. An enthusiastic and adequately trained workforce will be crucial to the delivery of the bank’s strategic plan, which includes expansion of its branches to reach new global markets and integration of new approaches of service delivery. The bank will allocate monetary, physical, and human resources towards the training of its staff and enhancing its capacity to embrace a dynamic market and clients’ needs. The growth of the bank will ensure reduced levels of unemployment, and its expansion will lead to the absorption of jobless people. Consequently, this will also lead to the growth of the economies of the various states in which the bank will be operating.

Customer’s policy

Slow and delayed payment from clients, especially on credit facilities given to them by the bank, will have adverse effects on the wellbeing of the bank. The Zurich Cantonal bank will explore legal mechanisms to enhance prompt payments of its products like overdue standing orders, debts, loans, and overdrafts. Letters, emails, and phone calls will be sent to the clients to alert them of the need to make prompt payments before the agreed dates are due, and the bank will employ a mechanism of helping the clients to pay the money through third-party agencies and alternative sourcing. The bank will assert its authority regarding payments of its money by clients through a legislative contract signed between the bank and the clients. The bank will also conduct a technological upgrade of its bookkeeping system to enhance the efficiency and accuracy of all transacted business.

The idea will reduce the risk of deficits or data loss due to clients’ failure to pay or their breach of contract. Reports indicate that the Swiss National Bank (SNB) has been depending on the labor target range of 3 months, and its charges on deferred payments by the banks’ clients have been 0.0% to 0.25%. The SNB is also reported to leave the minimum state of exchange at 1 euro = 1.20 CHF (1 euro=1.20 CHF means that a single euro equals 1.20 Swiss francs). The appreciation of the dollar has been a disadvantage to the Swiss franc, which may compromise the stability of the market price resulting in dire consequences on the economy of Switzerland with a minimum rate of exchange.

It is thus possible to avoid the undesirable plummeting of the value of certain currencies at the disadvantage of certain economies in Europe as it happened to Greece in the year 2011. Regional exchange regulatory controls should be set up to deal with the economic uncertainties in banks’ exchange rates. The Swiss Cantonal bank will employ a strategy to determinate exchange rates and will also try to purchase the foreign exchange currencies at an unlimited scope. The Swiss bank’s inflation forecast will be adjusted downwards to alter the forecast from the previous status. In 2012, the inflation rate in Switzerland was reported to have been lower than projected due to the perpetual fall in import duties. The economic forecasts appear uncertain in Europe with the adoption of the use of the euro as a currency within the European region. This inflation forecast is due to the unchanged three month, suggesting 0.0% up to 2015. The SBN has set the projection for inflation at 0.3% (2013), 0.4% (2014) and 0.9% (2015). The international economic growth rate has taken a negative progression though there has been an improvement in the global financial market. Economic activities have slowed down than predicted in Europe in the last three years.

The rate of unemployment has risen in various states in Europe, especially in Greece. The SNB (SNB refers to the Swiss National Bank) is still optimistic and anticipates a 1.0% to 1.5% growth of Switzerland’s economy in the year 2013. The subject of development uncertainty is creating tension by deterring investments and posing as a risk to the Swiss fraternity. The world economy and the landscape of financial markets remain vulnerable to recession, and the Swiss bank must correct the said anomalies. The Swiss Franc (CHF) has shown stability in the last three years compared to the dollar and pound. It is recorded that due to the power of the CHF, the financial sector in the year 2009 contributed to11.5% of the Swiss GDP (Gross Domestic Product).

The sector employed 196,000 individuals, with 137,000 of them working in banks. The workers represented 5.4% of the total workforce in Switzerland. In abroad, the Swiss bank employs about 102,000 people. Switzerland has managed to assert itself as a neutral state after World War 1 and 2. It is not a member of the European Union and joined the UN in 2012. In 2001, the Swiss banks collected a total of 2.9% trillion US dollars and 400 trillion US dollars in 2003. In 2007, the value had risen to 6.5 billion US dollars. The major banks in Switzerland are UBS (Union Bank of Switzerland), Credit Suisse, Central Bank, and Raiffeisen.

The issue of bank accounts, according to the Swiss bank, is a private matter with major banks’ accounts limited to the access of only Swiss bank officers. The financial accounts and statements of major banks are not usually accessible to members of the public.

Future products and services

Future products of the Zurich Cantonal bank will depend on the current performance of the existing ones. Still, the bank will continue to improve service communication networks across its branches, enhance timely money transfers, and ICT (ICT is a term that refers to information communication technology) channels. This idea will facilitate safer and convenient banking with the profit margin and interest rates expected to rise by a reasonable margin.

Technology

Innovative technological inventions have not only changed the way banks market their products but also enhanced banks’ service delivery to their clients. Banks’ clients enjoy services and products that are delivered to them using recent technology, as has been reported by various market trend studies (Saylor, 2012). According to the strategic plan, the people of Zurich and its environs will have the opportunity to bank their money in an institution that embraces technology and dynamism (John, 2010). They will experience faster and safer services like electronic money transfers, mobile banking, and online accounting. The Zurich Cantonal bank will employ qualified information telecommunication experts, computer technologists, competent accounting officers, and analysts to link the bank’s products to technology.

The existence of quick network services like the 3G system will facilitate the fast and effective transfer of both ideas and funds. The internet service will transform the world into a global village, with the bank’s clients being linked to the bank through the internet options developed by the bank for their use. The Zurich Cantonal bank will keep close contact with its clients, investors, and other corporate entities by using technological alternatives in the market and will provide necessary information about itself to the clients through various technological channels. The use of modern technology will assure the Swiss bank community of Swiss interbank clearing (SIC)(Swiss Interbank Clearing) refers to an internal mechanism used by Swiss banks to transfer money internally) as a faster way of inter-bank transfers.

Market analysis

Economic reports in Switzerland show that by the year 2008, the Swiss bank had collected an average leverage ratio of 28:1 (asset: net worth). The short term liabilities were equal to 263% of the GDP, which is the same as 1,274% of the national debt of Switzerland. The interest rates in Switzerland are handled by the Swiss National Bank (SNB), and they range from 1.3% to 3.5%.

The Central Bank’s interest rate acts as a prototype, one by which it controls rates for other banks under its jurisdiction. The Central Bank is mandated by law to determine interest rates for banks and exchange rates for different currencies. The bank is also allowed by law to control inflation rates in Switzerland. The reduction in interest rates will lead to an improved economy and business environment in Switzerland because many people will be able to borrow money from banks to invest in various sectors of the economy which will, in turn, lead to the rise in employment levels and increase in need for a big labor force. If better measures are put to control inflation and the cost of living, the people residing and working in Switzerland will be assured of a better quality of life with better pay and service provision.

Legal environment

The licensing procedures to be undertaken by the Zurich Cantonal bank will be adhered to by all the bank’s expansion plans as the permits will be obtained from the Switzerland Licensing Board or FINMA and other environmental licensing bodies to ensure that new structures adopted for the bank’s use will comply with environmental laws. Health concerns of the bank’s staff will also be addressed through relevant bodies. The bank will verify compliance with community health standards and policies through coordination with WHO (World Health Organization) (Market analysis involves an assessment of the ability of a given market to sustain economic programs) and affiliated health organizations. Medical covers and insurance policies will be obtained by the bank for its clients and staff with the starting deposit amounting to 300 million US dollars. The bank will also address legal brand requirements and certification by administering copyrights, trademarks, and patents tagged by the bank’s logo and recognizable symbols. The strategic business plan will put up measures to improve the interest trends for the concern of its clients, as shown below in the next one year.

Business trends

Major competitors of the bank will be expected to be Six Sis AG, Wir bank, and Hinduja. The Zurich Cantonal bank will maintain an upward trend in interest rates and marginal profits of 30% annually.

Sales and revenues

The Zurich Cantonal bank’s revenue generation will be important for the nation and especially for the Swiss government as it will promote economic development through employment creation for the citizens of the country. Support from the government towards the bank’s goal, mission, and objectives will ensure a constant flow of revenue for the government.

Financial projections

In financing the strategies of the Zurich Cantonal bank and the requirements needed to expand the market realms; the bank will engage in consultations with investors, well-wishers and other branches under the Swiss Accord in generating funds amounting to 10 billion dollars. The collected funds will be used by the bank for future expansion in (WHO refers to the branch of the UN that deals with health matters in the world) terms of commerce, marketing strategies, and communal ventures in a competitive banking sector. As reflected in the marketing strategy and business trends of the bank, adequate finances will be a major priority for the Swiss bank, and any programs that will raise the financial and market indices of the bank will be highly integrated into the strategic plan as its monitoring and evaluation process continues. It will be important for the bank to facilitate its mobility through diversification of its revenue programs and thus safeguard itself from competition from other banks in the financial market.

Project financing

In Switzerland, the Swiss bank maintains its leading role as a financial institution with a global outlook. The financing of a new or existing project involves several considerations. First, for better financing of a new project, the bank will have to evaluate its state, and this fact will be achieved by examining various books of accounts like balance sheets and profit and loss accounts. Secondly, the existing project will require adjustments in terms of marketing and advertisement procedures. The Swiss Cantonal bank will lay down workable approaches to address the subject of project financing.

Startup expenses

The startup expenses (Project financing involves the establishment of communal support mechanisms by commercial, government, and social organizations) that will involve an accumulated amount of 10 billion US dollars that will include initial capital, insurance, medical cover, transport and training of personnel, registration, and acquisition of permits. This stage will be given the necessary attention to avert any inconveniences that may arise.

Organization

The organization plan for the Zurich Cantonal bank will be built based on cost-effectiveness, efficiency, and equity of resources. The organization will be constituted of the shareholders, clients, the structured bank committee, and the credited investors. The structure of the bank will take the form of a chart. The vertical patterns will be more pronounced as the unity of command; objective, directives, and the span of control of the bank are aligned to organizational principles of management. For the cost-effectiveness and efficiency of its operations, the bank will adopt the lean organizational structure. The structure will also ensure that there is the optimal use of human resources. The allocation of resources will be done upon consideration of the management’s priorities, duties, and responsibilities (Brown, 2001). The bank will facilitate programs that encourage teamwork, collective participation of all stakeholders, and motivation of its employees and clients. Cases of fraud and financial insecurities will be addressed through the creation of specific departments to curb the said crimes, and the bank will ensure the credibility of its services for prospective investors and financiers to harness.

Exit plan

The exit plan of the Zurich Cantonal bank will be associated with the prospect of effective management of its global assets. The plan will rely on how the bank will manage its future failures and improve the low volumes of its sales, especially due to consistent failure of its key market strategies (Jeong & Nor, 2007). The failure to address risky investments will lead to the failure of the strategic plan because the plan will have lost its ability to provide alternative dimensions in case certain programs fail.

The bank will, therefore, need to evaluate areas in which it is likely to succeed by analyzing logistical prospects. Alternatively, the logistical challenges will also provide prospects of failure of certain ventures featured in the bank’s strategic plan. Withdrawal of financial advisory services, reduction of advertisement, and retrenchment of its staff will be a good exit plan because it will act as a warning before the final closure of the enterprise, and its clients will, therefore, need to move to other banks like Six Sis AG and Hinduja. The exit will plan to provide opportunities for the assessment of outcomes like an evaluation of the performance of interest rates and marketing strategies. The payment procedure for wages, bonuses, salaries, and interests will be determined by the bank’s performance and productivity (Barrow, 2005).

Loans will be repaid with a proper understanding of the criteria involved in spending. The failure to understand various challenges related to the bank will lead to a dismal reduction of the bank’s operations. The exit strategy will not be an efficient one based on its liquidity aspect. This fact will be due to its negligence of the possible results when the strategic plan fails. The acquisition of wealth is the best approach for the bank because it is safe and checks the stakeholder’s needs by making sure that the losses are minimized while carrying out the exit plan.

Executive summary

The strategic plan of the Zurich Cantonal bank will aim at targeting clients and investors from Switzerland and beyond. Swiss banks are internationally recognized for their contribution to the global economy. The banks have made a significant contribution by revolutionizing key areas of operations, interest rates, credit and loan services, and financial securities. The strategic plan will enhance unique and efficient customer services in the financial sector. The creation of jobs and maintenance of better bank and client relationships will be part of the priority of the business plan of the Zurich Cantonal bank. The plan will evaluate the different interest rates offered by different banks and provide the Zurich Cantonal bank with the opportunity to offer the best interest rates in the market.

By the year 2008, there were 327 major and authorized banks in Switzerland, with the UBS and Credit Suisse being the major banks. The proposal will provide ways for the Zurich Cantonal bank to compete with the major banks in Switzerland and contribute towards 6% of Switzerland’s financial deposits. The bank will work towards increasing its level of savings and financial investments by 5% from the usual 3% annually through collective bargaining, innovative, and informative programs. The loan facility will provide an opportunity for the Swiss bank to obtain an amount of 1 billion dollars from other Swiss banks within Switzerland. The money will be used in opening investments and foreign exchange. It will also be used in adopting new and fast technology in the banking and running of business transactions.

References

Aaker, D & McLoughlin, D 2010,Strategic Market Management – Global Perspectives, John Wiley & Sons Ltd,West Sussex.

Barrow, W 2005, Robert Bruce & the Community of the Realm of Scotland (4th ed.), Edinburgh University Press, Edinburgh.

Brown, D 2001 “Kenneth mac Alpin”. In M. Lynch. The Oxford Companion to Scottish History, Oxford University Press, Oxford.

Dumville, D 2001, “St Cathróe of Metz and the Hagiography of Exoticism”. Irish Hagiography: Saints and Scholars, Four Courts Press, Dublin.

Fry, B 1989, Mastering Public Administration; from Max Weber to Dwight Waldo, Chatham, Chatham House Publishers, Inc., New Jersey.

Jeong, C & Nor, F 2007, Principles of Public Administration: An Introduction, Karisma Publications, Kuala Lumpur.

John, R 2010, Network Nation: Inventing American Telecommunications 520 pages; traces the evolution of the country’s telegraph and telephone networks, Harvard University Press, Harvard.

Lewis, M & Roehrich, J 2009, Contracts, Relationships and Integration: Scheduling, and Controlling, John Wiley &Sons, New York City.

Plunkett, J W 2008, Plunkett’s Telecommunications Industry Almanac Etisalat Financials, Choice Magazine, Houston.

Saylor, M 2012, The Mobile Wave: How Mobile Intelligence Will Change Everything, Perseus Books/Vanguard Press, New York.