Attending college isn’t the same as going to school. For starters, courses are more engaging and often considerably harder to understand. Assignments and requirements can be overwhelming, especially when finals are just around the corner. However, all of this is a piece of cake compared to the difficulties college students often have with money.

If you don’t want to bother your parents every month, you’ll have to learn how to manage your cash. You may be familiar with buying groceries and clothes already, but what about paying bills? Or renting furniture or buying study materials?

Don’t you worry!

IvyPanda has prepared a comprehensive guide to help you. We’ll show you every possible way to save money in college. Use our tips and concentrate on more vital matters than making ends meet. Learn how to control your spending, and live your life to the fullest.

👉 Choosing a College Wisely

Before you find out how to save money IN college, you should see how to save money ON college. Yes, you’ve read that right¬! Instead of cutting corners while studying, you can take care of finances in advance.

Check out the following:

👛 Affordable Colleges

Colleges and universities in the USA generally have tuition fees, except in a few instances, which we’ll consider later. This is the case for many countries, English-speaking in particular. Nevertheless, it’s possible to find an institution that provides education for a considerably lower price.

In the lists below, we outline colleges and universities with the lowest tuition fees (and even tuition-free ones). You have to keep in mind that there will be other expenses. These include additional fees, food, accommodation, and course materials. We’ll show you how to handle them in the following sections.

1. USA Colleges

You may be surprised, but there are indeed tuition-free colleges in the United States of America. Financial aid and scholarships make them affordable.

Some prestigious institutions, like Cornell University and Harvard, provide various grants and loans for low-income families. Princeton University is known as the most generous one. Consider every opportunity in every appealing college before applying.

Here are the cheapest institutions in the USA:

- California State University-Dominguez Hills

Area: Carson, CA

Net Price: $1,640 - University of Texas–Pan American

Area: Edinburg, TX

Net Price: $2,500 - California State University–Los Angeles

Area: Los Angeles, CA

Net Price: $2,735 - CUNY Leman College

Area: Bronx, New York

Net Price: $2,327 - University of Texas–El Paso

Area: El Paso, TX

Net Price: $5,607

Acceptance Rate: 99%

2. UK Colleges

Higher education institutions in the UK are generally cheaper than in the USA. The average price ranges from $17,000 – $25,000 annually for undergraduate and graduate degrees. There are, however, even cheaper options.

- Coventry University

Area: Coventry, England

Annual Tuition Fees: £9,000-12,600 (~US$10,975-15,370) - University of Wales Trinity Saint David

Area: campuses in Carmarthen, Lampeter, and Swansea, South Wales, with one campus in London, England

Annual Tuition Fees: £11,000 (~US$13,420) - Staffordshire University

Area: Stoke-on-Trent, Staffordshire, UK

Annual Tuition Fees: £9,250- £11,100 (~US$11,280-13,540) - Teesside University

Area: Middlesbrough, England

Annual Tuition Fees: £10,250 (~US$12,500) - University of Cumbria

Area: campuses in Lancaster, Ambleside, Penrith, Barrow, Carisle, London, and Workington

Annual Tuition Fees: £10,500 (~US$12,800)

3. Canadian Colleges

Canadian educational institutions have a good reputation. Prices differ between provinces, but there are many affordable options. You can even apply to an institution where you’ll study in English and French.

Canada offers a variety of low-cost fees for both domestic and international students. However, international students may have to pay more at some institutions. You should look into scholarships and grants.

These are the most affordable options:

- Algonquin College

Area: Ottawa, Ontario, Canada

Annual Tuition Fees: $9,054 - Bow Valley College

Area: Calgary, Alberta, Canada

Annual Tuition Fees: $6,000-$11,234 - Camosun College

Area: Greater Victoria, British Columbia, Canada

Annual Tuition Fees: $7,000 - Georgian College

Area: Ontario, Canada

Annual Tuition Fees: $13,845-$32,431 - Lambton College

Area: Sarnia, Ontario, Canada

Annual Tuition Fees: $7,000

If you want more information or insights about saving money in Canadian colleges, try out this amazing student support service – Custom-Writing.com. Experts there are graduates of the best Canadian colleges, who now work as individual student assistants. They can guide you through enrollment nuances, help write an admission essay, or conduct research about the Canadian education system.

4. Australian Colleges

Australia is famous for its cultural diversity and welcoming environment. However, studying in the country can be incredibly expensive, for domestic and international students alike. Tuition fees are on par with US ones, but living costs are considerably higher.

According to the official government site, the prices are as follows:

- Undergraduate Bachelor Degree – AUD$20,000 to AUD$45,000 (~US$13,300 to US$30,000)

- Postgraduate Master’s Degree – AUD$22,000 to AUD$50,000 (~US$15,000 to US$33,000)

There are plenty of scholarships and grants available at the top universities, which we’ll cover in the next section. For now, this is the list of most affordable institutions:

- University of Divinity

Area: Melbourne, Victoria

Annual Tuition Fees: $14,700 (~US$9,800) - University of Southern Queensland

Area: several campuses in Queensland

Annual Tuition Fees: $24,000 (~US$16,000) - University of Queensland

Area: Brisbane, Queensland, Australia

Annual Tuition Fees: $25,800 (~US$17,200) - University of Sunshine Coast

Area: Sunshine Coast, Queensland

Annual Tuition Fees: $26,600 (~US$17,700) - University of Canberra

Area: Bruce, Canberra

Annual Tuition Fees: $26,800 (~US$17,800)

5. New Zealand

If you’re looking for low-cost education, New Zealand is waiting for you. The island welcomes numerous international students annually, providing affordable options for everyone. Under the influence of the UK, the country’s education system offers opportunities for thorough research. Anyone striving to get a Ph.D. will find New Zealand an excellent option.

In the meantime, take a look at the cheapest universities there:

- University of Canterbury

Area: Christchurch, Canterbury

Annual Tuition Fees: $22,000-$32,000 (~US$13,700-19,900) - Massey University

Area: Palmerston North, Auckland (Albany), Wellington

Annual Tuition Fees: $22,000-$32,000 (~US$13,700-19,900) - University of Auckland

Area: Auckland, New Zealand

Annual Tuition Fees: $22,000-$32,000 (~US$13,700-19,900) - Lincoln University

Area: Lincoln, Canterbury Region, South Island

Annual Tuition Fees: $22,000-$32,000 (~US$13,700-19,900) - University of Waikato

Area: Hamilton, Waikato

Annual Tuition Fees: $25,000-$36,000 (~US15,500-22,400)

✍️ Scholarships

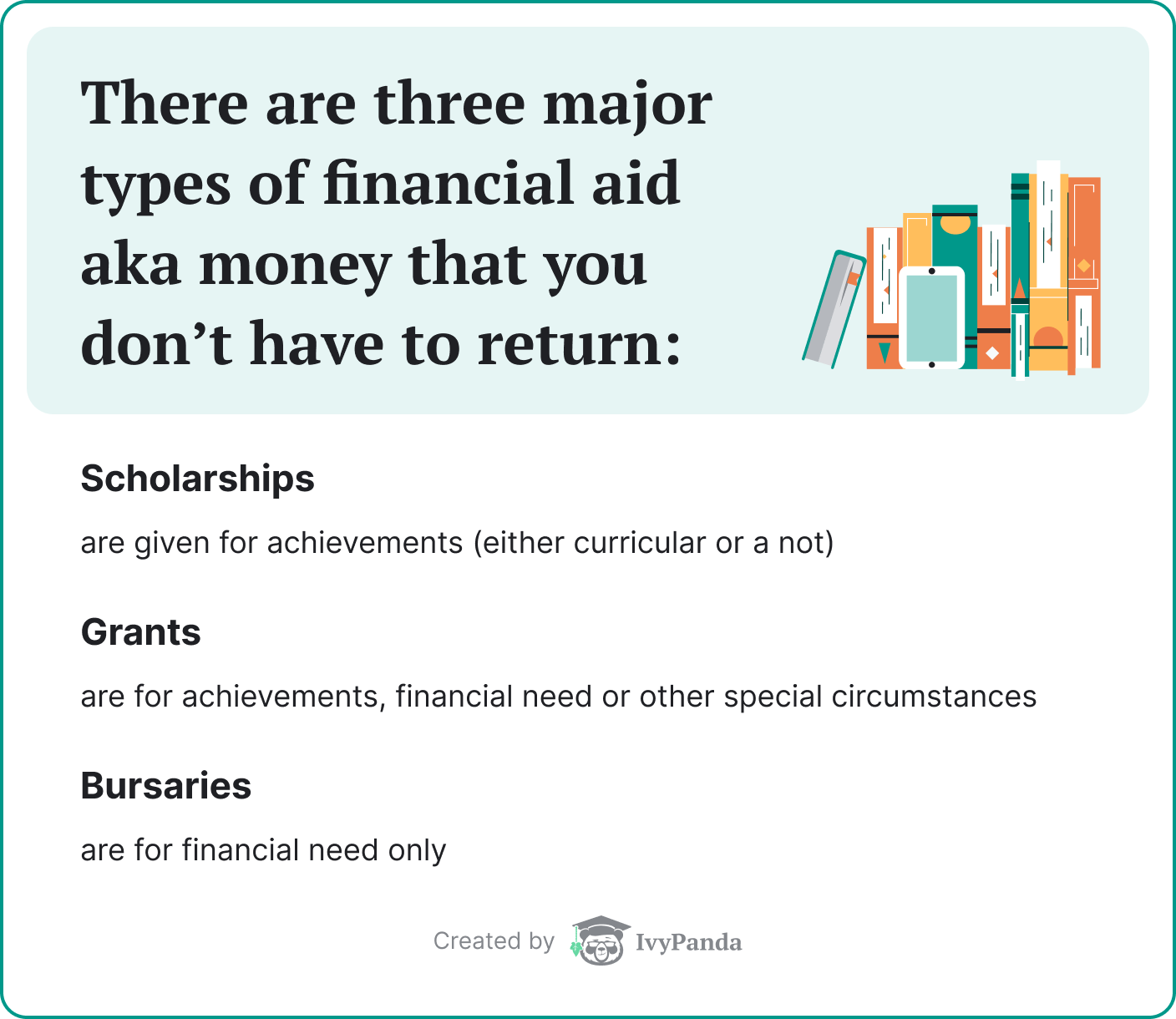

As we’ve mentioned before, another way to study for free is to receive a scholarship. Academic excellence, persistence, and passion are the main reasons scholarships are awarded. Children from low-income families can often receive financial aid from the government or university.

Each country and university has its own rules and requirements concerning scholarships. In other words, you are the one who will have to do the research to determine the most appropriate one for you. We can help out though.

Here are a few tips when looking for a scholarship:

- Collect documents. First, take a deep breath. This task is pretty time-consuming. Then, browse through the materials that prove that you qualify for financial support. You’ll have to gather them anyway, so why not do so before anything else.

- Seek guidance. You can ask a college advisor at your school for advice. In case you don’t have one, check out an official government website, like the US Department of Education.

- Reach out to financial aid offices. Each higher education institution has to have one. Explore their websites, call, or even visit the different institutions to get all the details. Requirements may differ from college to college, so investigate thoroughly.

- Research organizations. Some employers and large organizations support the studies of students in need. You’ll likely have to work for them, or in the field, after graduating. So, if you’re interested in a particular area of study, search for an association that may be able to assist.

- Use an online scholarship search. Nowadays, you can find financial aid options while sitting on the couch in your living room. There are a variety of free search tools that can assist you, showing you all the options available.

For each country, there is a specific way to find financial aid. Online tools are the quickest way to consider all available option. Websites will detail the different scholarships available in different countries. You can examine the Scholarships for Development website, for example. Consider the list of programs for various places, levels of study, and fields.

In case you’re decided on the country, here are some recommendations on the Internet search:

1. In the USA

Every US student, regardless of income, should fill out the Free Application for Federal Student Aid (FASFA). It’s the most straightforward way to see whether you’re qualified for financial support. The website can assist with finding the right scholarship, grant, and student loan. It’s solely for US citizens, with few exceptions.

Various governmental facilities support online scholarship search tools. You can see, for example, the US Department of Labor sponsored website.

There are also independent scholarship searches, like Scholarship Search (Anthony ONeal) and Scholarships.com. Their interface is more intuitive and user-friendly. Such websites as FastWeb can help you with finding both the financial aid and part-time job.

2. In the UK

The first thing to consider for an international student is the UK Council for International Student Affairs (UKCISA). On this website, you can find out whether you can ask for financial support. Though the organization itself doesn’t provide aid, it can show you all the nuances to get one. Then you can use the UK University Scholarship Search for more detailed research.

The country has a variety of financial aid options so that everyone can count on help. To discover the perfect scholarship, you should consider tools with enormous databases. Some of them, like The Scholarship Hub, require registration to search. However, it’s free and incredibly useful.

The UK majorly supports postgraduate studies. If you’re interested in a particular college or university, you can see whether they offer scholarships on Postgraduate Search.

3. In Canada

Canada supports both domestic and international students, yet to a different degree. Nevertheless, online search tools are user-friendly and helpful for anyone:

- Scholarships Canada has an enormous database of financial support. You can refine your search according to your heritage, type of degree, years of study, and academic average.

- University Study provides financial assistance options for everyone. International and American students can examine their scholarships apart from Canadians.

- Yconic shows a variety of scholarships, grants, student awards, and bursaries for Canadian students. There is also information about universities and student loans, in case you’re considering them.

- EduCanada demonstrates what aid is available for Canadians and non-Canadians at the moment. Here you can find governmental, international, and independent organizations’ support.

4. In Australia

Studying for free in Australia is entirely possible. There are numerous programs for international students to study and work in the country. Australians can also find financial assistance with ease as online tools are for everyone.

You can start your search with the official website, which shows scholarships form the Australian government. There are options for undergraduate and postgraduate studies, available for domestic and international students.

Here’s more:

If you’re looking for assistance from an educational institution, check out Good Universities. Choose your field of study and preferable state to see the possibilities. Or you can explore the Australian Scholarship Foundation. It shows financial support for different locations inside and even outside the country.

5. In New Zealand

First things first, find out whether you can apply for a governmental scholarship in New Zealand. Take an online questionnaire on the New Zealand Ministry of Foreign Affairs and Trade website. If you’re eligible, congratulations! You can seek aid right on this website. Otherwise, consider scholarships from colleges and universities.

- Universities New Zealand provides a wide variety of financial assistance for undergraduate and postgraduate students. There are even scholarships for studying abroad available!

- Study in New Zealand is another official website that can help you. Here you’ll see scholarships provided by educational institutions. Besides, you can research the universities and colleges of the country as well.

- StudySpy offers the largest database of scholarships in New Zealand. Pick your location of choice, study level, and ethnicity to improve the search.

All in all, finding financial aid to support your studies is more than possible. We hope you’ll start doing so. Then you can learn the other tips on surviving your college with a small budget.

💰 How to Control Your Expenses

Living with your parents has its perks. You don’t have to worry about doing laundry or buying food every week. Cooking or cleaning is a task for a group of people, especially when you have siblings. Paying taxes and bills sounds like something beyond your competence.

Guess what:

Now it’s not. In college, the time has come to wrap your mind around all the daily troubles. But studying and living on your own are not your only challenges. Every month or two weeks, you’ll pay rent and bills. Buying groceries and using means of transportation become more complicated when you have to keep in mind other expenses.

Now you have a fixed budget that you have to manage. And we can help you with that. Here are some tips on spending money correctly.

📜 Plan Ahead

If you want you to save money, you have to understand where your money goes. For this exact purpose, people invented a budgeting system. It’s the most manageable way to control your expenses.

So, how do you create a budget?

1. Determine financial goals

First things first, you have to have an idea of what you’re trying to achieve. Do you want to save as much money as possible for a costly expenditure? Or you’re wishing to survive daily without worrying about future bills?

Adults set goals concerning the distant future. Such long-term objectives rely on planning way ahead and saving for a mortgage, retirement, etc. Studying in college, you may not want to think about it, and it’s okay. When you have a regular income, return to this type of goal, though.

Right now, you can concentrate on two financial objectives:

- Immediate goals that cover your present expenses. They include current rent and bills, various loans, food, and supplies. It’s the money that you spend on the necessities.

- Secondary goals that cover useful yet non-essential things. Buying clothes that you want but don’t need, dining out, visiting your parents – all these expenses should be considered.

2. Evaluate how much you gain and spend

Having set the objectives, you can start planning. Calculate your income and expenses to see what you should fix and alter to reach your goals.

Writing down how much you gain monthly is manageable. To consider all your spendings, you’re better at making a list of them. Consider:

- Fixed expenses – what you have to pay according to a schedule. Here you should include your rent, bills for gas, electricity, Internet, etc.

- Variable committed expenses – what you have to buy each month, but the cost differs. They cover paying for groceries and transportation, as you can alter what you eat and how you travel.

- Optional expenses – what you aren’t obliged to pay for but desire to. Such spendings are for entertainment and comfort. You can’t afford such life fulfilling payments if you can’t cover the ones mentioned above.

Understanding your spendings is essential for creating a budget. You won’t be able to save money if you don’t realize where it went to.

3. Analyze and make adjustments

Now that you know your income and expenditure, you have to analyze the data. To control your budget is to make sure you don’t spend more than you can afford. Estimate how much money you spend on the listed expenses, whether it’s reasonable. Make adjustments, cutting down optional costs, and variable committed ones if it’s possible.

The vital thing is to count and list all the fixed expenses. You should always have money saved for bills and rent that come monthly. This way, you don’t have to worry about loans and debt. It reduces stress immensely, trust us.

4. Commit to it!

Then the process becomes long-lasting. You have to keep track of all your incoming and outgoing money daily. If you use a credit card, you can use an app to see your cash flow.

As time goes by, you should revisit your original budget. Your initial evaluation may have been incorrect, or it needs adjustments due to new income or expenses. And the most vital thing – commit to your budget! It will work out only if you strike a balance regularly, not the day after creating a spending strategy.

The good thing is:

There are electronic tools that can boost your commitment. We’ve prepared a list of helpful planners that can remind you about your goals and responsibilities.

Here are the best digital planners for you:

- MoneyHelper Budget Planner from Money Advice Service. This tool will control and analyze your expenditure, taking all your bills and checks into consideration. It shows how you can save more money or cut specific costs.

- Spendee. This app shows an overview of all the incoming and outgoing money visually. It allows its users to customize every spending category, making the process creative. Now you can control your finances with fun and ease.

- Mint. Its user-friendly interface shouldn’t trick you! This planner analyzes the data concerning both your financial situation and the offers available. It will show you how to save as much money as possible based on your goals and lifestyle.

- iSaveMoney form DigitLeaf. This is another app that tries to make budgeting more colorful and intuitive. It will predict your expenses for you, relying on the previous spendings.

- Financial Consumer Agency of Canada Planner from the Financial Consumer Agency of Canada. Yes, you’ve seen it correctly. It’s an official tool from the Canadian agency. If you’d like to compare your expenditure to an average Canadian, it’s the best option for you. Here you can also personalize your budget and improve it with the suggestions.

- MoneySmart Budget Planner from MoneySmart. This Australian governmental template will show you the ways to fix your budget. Its purpose is to encourage a stable financial situation among all Australians. So, you can rely on it, giving the most appropriate recommendations.

- Budget Worksheet from the Ministry of Social Development, New Zealand Government. This tool with help to sort out your money, explaining every step. You can’t possibly omit something when this worksheet directs you from the start.

💳 Expect the Unforeseen Expenses

As we discuss the expenditure, we have to mention the unanticipated spendings. Every college student has to understand that there will be a moment when they’ll need money ASAP. That’s why we’ve mentioned savings several times before. You need them.

Unforeseen expenses for a student include:

- Health issues. A disease or injure always come unexpectedly. You may need medical assistance or medication that costs quite a lot, especially if you don’t have insurance.

- Home repair. You should be prepared that something in your house or apartment will break. It’s inevitable. No one is protected from plumbing or electrical issues. And what if a hurricane comes? Are you ready to pay for a new roof? Well, you should be.

- Laundry. For some reason, students tend to forget about such expenses. It may be due to living with the parents who took it into account for them. Living on your own, you have to keep your clothes clean by yourself. It’s when you may need to spend money on laundry.

- Computer software. One of the best things that appeared in the 20th century is a computer. It improved studying significantly, making it more convenient. At the same time, it became a reason for more investments. Your courses may force you to buy computer programs to complete assignments. And there can be quite a few of them.

- Printing. Unfortunately, even nowadays, some professors refuse to accept your homework digitally. When they require a printed version of the assignment, you have to oblige. However, it can become costly.

- Going out. Cooking and eating at home is cheaper than dining out, but is it as fun? And what can be more engaging than watching a movie in a cinema theater with your friends? Social gatherings are essential for mental health, as everyone needs entertainment from time to time. Plus, do you want to worry when someone proposes to grab a coffee?

There may be other expenses that we haven’t listed. The conclusion remains the same regardless of the reasons to spend money – you need an emergency fund. It’s a way to prevent disastrous financial situations. An emergency fund can allow you to live to the fullest and engage in fun activities, even with a strict budget.

Building an emergency fund starts with creating a budget that we’ve described before. List it as a category and determine what sum can be added each month. To ensure that you succeed in it, you can open a savings account. Or create two saving accounts – one for entertainment and another for emergencies.

How big your emergency fund should depend on you and your financial situation. Try to be ready for everything, though.

🔍 Look for Special Offers

It’s the last but not least trick to manage your budget. Being a student, you can anticipate a variety of special offers that appear almost daily.

You can count on the following options:

- Student discounts. We will elaborate on them in detail in a later section, but keep them in mind anyway. You can find such discounts everywhere – from the app store to your local restaurant.

- Free campus activities. Check your university’s website or social media to find these upcoming events. You can attend free on-campus concerts or screenings or exhibitions from the department of arts and humanities. There may be various athletic events or open-access campus dining. Keep an eye on the Student Activities Committee’s updates for current information.

- Coupons. No, they are not outdated or weird. They can save you quite a lot of money if used correctly. Today there are plenty of coupons that you don’t even have to obtain in a physical form. Find them online and use them on your phone!

Here are some essential websites and apps with coupons:

- Ibotta is a great app that offers you cashback and coupons for various stores, including grocery ones. You can add your loyalty cards to view all the options available regarding them. Besides, getting a cashback becomes a game with the app as it requires you to complete small tasks.

- Coupons.com is a website that has what its title says. It provides both printable and digital coupons and even coupon codes. The variety of instant discounts and cashback awaits a user.

- Amazon Coupons is an exclusive selection of coupons for different products on this website. Here you can see what’s on sale and what other opportunities to save money are available.

- Rakuten is another site that shows coupons and cashback for different stores. Its user-friendly interface won’t let you get lost among the offers. Besides, it has a Chrome extension that allows you to see whether sales or cash backs are available on a particular website.

- Swagbucks is a website with coupons that lets its users print their coupons or download digitally. It searches offers for various stores (online and offline ones) and shows them in one place.

To sum up:

Looking for special offers is a life-saving activity for anyone. But primarily it concerns a student who has to live off a strict budget. The Internet, in particular, can help you to cut costs—just use it correctly.

Saving even on small things can contribute to your emergency fund immensely. So, take a moment to look for special offers.

💡 How to Save Money in College: Pro Tips

We’ve already discussed how you can manage your budget, so it’s time to learn how to cut the costs even more. Fortunately, studying in college or university, you can save money on almost everything. From your kitchen table to your morning coffee—you can surround yourself with decent yet affordable things.

How can you do so?

Follow our essential tips on saving money in college. We’ll explain to you every useful trick to spend less but enjoy more.

🏠 Accommodation

There are three ways to save money on an apartment:

1. Staying with your parents or relatives

Attending an institution not far from home, you can spend the least amount of money. It’s not always possible, as your choice of college is hardly ever located in your area. But if it is, you’re a lucky one.

Another way to cut down costs is to move in with your relatives that reside beside your institution. They may be willing to accept you for a minimum rent or for free. Ask your family members whether this opportunity exists.

2. Living on campus

This option is especially preferable if you have a scholarship or a grant. The financial support covers on-campus housing, which isn’t usually the case with the off-campus one. If you don’t, look at whether the institution offers rent-free accommodation.

Paying for a dorm room can be more expensive than for a regular apartment. However, it has a few significant benefits that you should consider before picking your housing.

Living on campus saves you from buying or renting furniture as every dorm room has the essentials. You won’t have to look for a roommate as the institution provides you with one. All the costs of transportation will be cut because your college is around the corner. Most vitally, some dorm programs take care of groceries and bills for gas, water, electricity, and maybe the Internet.

What’s more:

You can become an integral part of the community. Staying close to other students will get you to know each other quicker. Plus, participating in on-campus activities is more accessible when you live there. Networking is the key to a memorable college experience.

3. Renting with a roommate off-campus

When you’re trying to spend less money, don’t consider living alone. Paying for a single room apartment is more expensive than for half of a two-bedroom one. So, having decided to live off-campus, you have to look for both a suitable accommodation and a flatmate.

For obvious reasons, start with selecting a roommate or a few of them. Though relying on several people that you’ve just met may not be the best decision. If you don’t have a group of friends, wishing to share a rent with you, you’re better to look for one or two top.

Where can you find a roommate?

Fastest way is through social media. Nowadays, there are plenty of groups on Facebook, where people gather in search of a flatmate. You can check the webpage of your college devoted to the issue or ask around as well.

Interviewing a potential roommate, you have to find out the following:

- Whether your lifestyles and schedules correspond enough;

- Whether you can communicate and understand each other without any trouble;

- Whether you have a pet;

- How you can develop cleaning habits;

- How you will share the space;

- What furniture and other things you will bring to the apartment;

- What financial situation the potential roommate is in;

- What health issues the person has.

This checklist is essential to pick an appropriate person to live with. However, it’s only half of the task—you still have to find housing. It can be achieved through social media or Internet searches as usual.

Looking for accommodation, pay attention to the next aspects:

- Safety of the neighborhood. The crime rates are usually available on the Internet. Otherwise, you can examine related thematic blogs or discussions.

- Commute. The closer to the college you reside, the less money you spend on transportation. Besides, you can save a lot of time living close to the campus.

- Convenience. You have to understand whether the accommodation is near other places that you have to visit. Is there a grocery store around the corner? A bus or metro station? Examine a map of the area to find all the relevant locations.

- Rent rate. Investigating a region, you should learn the average price for an apartment. Then you’ll have a precise number to compare the rent to, thus avoiding high costs.

Figuring out the rent, you have to ask the owner what it includes. Whether you have to pay bills and utilities separately is crucial information to learn before signing a contract. And, yes, you should insist on having the official document and read it thoroughly.

💻 Furniture & Electronics

Moving in a rented apartment off-campus, in most cases, you have to get some furniture and electronics. Beds, couches, chairs, fridges—the stuff that you get with your new residence can be of poor quality. Even if you bring some things with you, it may not be enough. In other words, consider obtaining new stuff.

Trying to save money, you can consider three options:

- Getting things for free

- Buying for a lower than average price

- Renting

We can combine the first two alternatives because only the outcomes of the search differ. The processes of looking for free or cheap stuff remain the same for both:

- Garage sales. Such events provide a perfect opportunity to find free pieces of furniture or used electronics. People get rid of various things, including stuff in good condition, to clean out some space. Usually, they propose stuff for free or cheaper if you can come and pick it up. Besides, if you feel like the price is too high, you can try to negotiate.

- Charities. It can be your chance to save money on essential devices and furniture. Consider whether there are such non-profitable organizations in your area that can give you specific items. Figure out the requirements for obtaining them and whether it’s possible for you.

- Moving out of college housing. Vacating a dorm room or apartment, students tend to abandon large furniture that they cannot take home. Check the Facebook groups linked to your institution with offers from such students. Plus, there may be tents and areas on-campus, where people can leave stuff at the end of the semester.

- Websites. In the 21st century, the fastest way to find free furniture or electronics is through the Internet. There are plenty of sites where you can contact sellers directly. You can find opportunities to swap or buy used things for a lower than average price.

Top 10 websites where a student can get free or affordable furniture or electronics:

- Craiglist (worldwide) is a website with advertisements for everything. In the section “for sale,” you’ll see free or cheap offers of used furniture or electronics.

- Gumtree (UK) is a place with a part “for sale,” where you can look for affordable options, including furniture and electronics. There is also an Australian version of this UK site.

- Wayfair (UK, Canada) is an online furniture store with a wide variety of sales. Each day there are new special offers among which you can find stuff almost for nothing. Plus, shipping is free.

- Ziilch (Australia) is a place on the Internet where Australians can get free stuff. They can also submit second-hand pieces of furniture, electronics, clothes, etc.

- Neighbourly (New Zealand) is a site where you can get news about your neighborhood in New Zealand. Sing up to find out what pieces and devices you can obtain for a free or small price from your community.

- Offerup (US) is an app and website where Americans look for anything. There are sections for free and cheap pieces and devices, as well.

- Preloved (UK) is another British website with cheap furniture. You can also rent a property there.

- Freecycle (worldwide) is a place where you can get free things or barter. It’s a non-profitable organization that enables people to give and obtain items in their areas.

- FreeStuff (New Zealand) is a website whose purpose you can see in its title. Residents of New Zealand can get and request furniture and electronics of high quality.

- Facebook Marketplace (worldwide) is an opportunity to obtain cheap stuff from all around the globe. You should have an account on the website, though. Then, you become open to a variety of affordable furniture and devices.

Renting is a whole other ordeal. It’s an incredibly useful option if you need an item for a limited amount of time. For example, if you need a particular microphone for one college project, you’re better to borrow it. It will be both cheaper and more convenient as you won’t have to deal with it once it served its purpose.

The same goes for furniture. As we’ve mentioned above, students are inclined to abandon or sell things after graduation. In case you don’t want to take your new bed or drawer home after college, you should consider renting.

Look for temporary furniture and electronics on the Internet. We’ve discussed Facebook groups enough for you to understand how it works. However, in some countries, there are services for students in particular:

- CORT is the most popular option in the US. It offers rental furniture for domestic and international students, providing numerous additional utilities. You can count on them being convenient, affordable, and trust-worthy. Besides, they offer help in Canada, Australia, and New Zealand.

- Room Service by CORT is the same service but for the UK students. Pick and rent affordable yet useful pieces of furniture for your new apartment.

- In-lease is another rental service that helps students who study abroad. If going to Europe, you can contact them and ensure comfortable living. They propose short-term and long-term contracts.

The final choice is up to use. Make sure you spend your money without regrets.

🧾 Bills

As we’ve talked about the budget, we explained that you should keep your bills in mind while creating it. Then you won’t have to suffer from debts, avoid late fees, and so on. The question of this section is whether you can save money on your bills.

And the answer is “kind of.”

You will have to pay for gas, water, and electricity anyway if you reside in an apartment. However, when you rent doesn’t cover bills, you can get a little creative:

- Use cold water when you can or heat it in the pot on the stove.

- Turn off the heat or air conditioner if the weather is manageable.

- Unplug electronics when they are charged to save energy.

- Hand wash dishes in a basin from time to time.

- Check for dripping tap or lights left on before going out.

- Study and read during the daylight to save on electricity.

Nowadays, there is at least one website for any idea. Take advantage of it to save money! Find a service that compares utility deals in your area before renting an apartment. This way, you’ll be able to choose the most affordable option or switch suppliers. Spend less on such unavoidable bills.

Take hold of one of the following websites that compare utility prices:

- Choose Energy (US)

- Energy Shop (US, Canada)

- USwitch (UK)

- Power Compare (New Zealand)

- Energy Rates (Canada)

- Energy Made Easy (Australia)

- Simply Switch (UK)

- iSelect (Australia)

- Electric Rate (US)

- Power Switch (New Zealand)

Those were the essentials that you can’t get rid of. It isn’t the case with some other bills that you pay.

The Internet is crucial for successful studies nowadays. Moreover, such entertainment like watching movies, communicating with your friends and relatives, etc. requires this connection. You have to learn how to spend less on it. Otherwise, it may become the most expensive bill.

Use the Wi-Fi available on campus or from the nearest café to save on the Internet. Find the most affordable provider, thoroughly comparing prices on Whistle Out or AllConnect. Try to find student discounts or special offers.

Another issue is:

Mobile phones can leave a hole in your budget. If you don’t monitor how much you spend on calls and Internet connection, you may receive a horrendous bill.

The ways to fix it are the same as before. Look for better offers from various provides and use Wi-Fi when possible. Download such apps like My Data Manager to track down your mobile data usage. Compare mobile phone plans on websites WireFly or Whistle Out.

Do you know what bill you can dispose of?

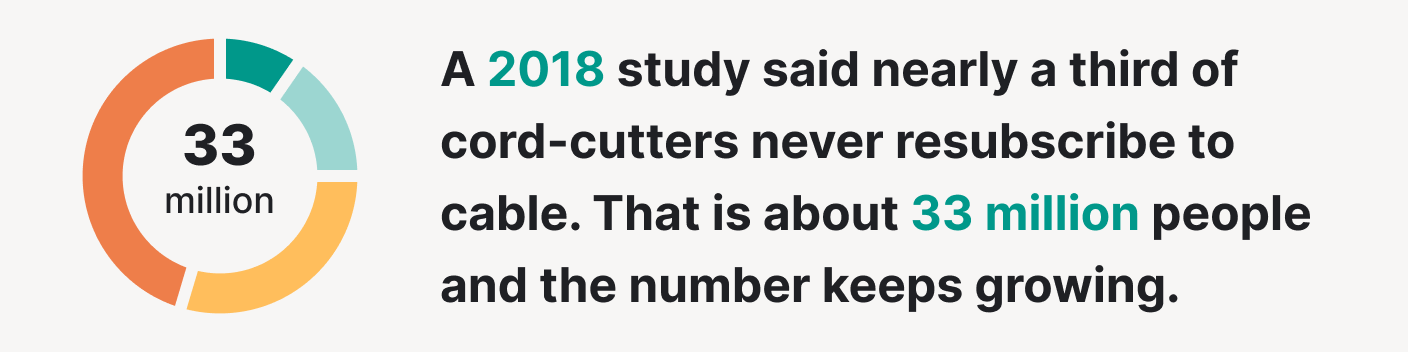

The Cable bill should be left behind. Do you need a TV in the 21st century? How much do you watch it? Ask yourself those questions and replace it with one of the streaming services. Netflix ($9/month), Amazon Prime ($13/month), Hulu ($6/month), and others offer you a variety of TV-shows and movies. You can watch them at any time, not relying on the program.

📚 Study Materials

For studying in an educational institution, you have to obtain textbooks and books. Their prices grow annually and, to be honest, become a problem for every student.

And the most disturbing aspect is that you can’t avoid them. Professors may refuse to teach you and accept your assignments if you don’t have the required materials. Such textbooks often contain information written within the walls of your college that you can’t find anywhere else.

Can you save money on them, though?

Of course, we’ve prepared a few options for you to consider:

1. Find free textbooks online.

There are plenty of resources where you can discover the book you need for a course. It can be from a non-profit organization or college as open libraries become more and more popular today. It’s the cheapest way to reduce paper use and free some space on your desk. Another way of getting useful study materials would be browsing free essays database. It can act both as an information source, and a collection of examples of how to complete certain writing tasks.

2. Go to the local library.

Get your student ID and investigate what coursebooks your institution can offer in their library first. In case, it’s out of the required items, check other local centers. Ask your professors or advisors where you can get the materials for free. They may recommend a library that you’ve missed or a bookstore where you can rent what you need.

3. Ask on campus.

Some students that have already finished this course may want to dispose of the desired textbook. Find out who is willing to sell or lend it. You can ask around or visit the Facebook group of your institution. There most definitely will be announcements dedicated to the issue. Or you can post it by yourself.

4. Switch or buy used textbooks.

In case you’ve run out of options and decided to spend money on one, look for the cheapest version. Some stores offer used books as an environmentally-friendly way to reduce paper consumption. Good for you as such materials are significantly more affordable. Check out Amazon to find one or ISBN to compare prices from different stores.

Student VIP provides opportunities for students in Australia to swap and buy cheap textbooks. It’s the biggest and the most popular market in the country.

As we’ve mentioned before, your campus can help you. Its bookstore can offer you cheaper softcover editions or used books. They usually have rental services, which you’re better to contemplate. You hardly ever need a textbook after finishing the course anyway.

Besides:

You can exchange with students via social media or specialized websites. We’ve talked about Facebook Marketplace and other groups where you can connect with others and make an arrangement directly. But there are apps and sites created by students for students to swap:

- Student2Student allows you to exchange, sell, and buy textbooks all over the US. There are also such services as price comparison on the website.

- Swappy Books is a service available in the US, Canada, Australia, and New Zealand. Exchange books with fellow students with ease.

BookCrossing doesn’t limit itself to only students, yet can be helpful nonetheless. It’s a library, which assists in sending free books over 132 countries.

🥑 Food

Do you often hear from students that they are broke? And then, those students go and grab a cup of caramel latte in a coffee shop. Or maybe your college friend has been complaining about their financial instability? But then right away they offered you to go out and have lunch. Or you are this friend who is always broke, but still visits cafes and bars?

The situations are quite familiar to you, right? That’s because college students tend to spend money irrationally. As an excuse, they claim that they are spending money on a necessity – food.

In case you might be asking yourself how to plan a budget on food properly, we have an answer. The tips presented below will help you to save money on food:

- Cooperate with your friends. Yes, friends can be helpful not only in critical life situations. They can help you to deal even with the simplest things. For instance, with cooking. So, buy the necessary products for your meals with your friends or roommates. Then, share the expenses among everybody. Besides, purchasing by wholesale is more affordable than buying products only for you.

- Make coffee yourself. Do you often stop by Starbucks or any other coffee shop and grab a cup of coffee? Yes, the smell and flavor of the beverages are divine. But are they worth that money? Think about it: buy coffee (approximately $3 per cup) each day, spend $15 per week, and $60 per month! So, better buy a fancy thermo-mug and make your coffee at home. You will save your wallet and the environment, by the way. By refusing from bought coffee, you will reduce the usage of plastic cups.

- Do not eat out too often. Nobody tells you that going out with your friends is wrong. However, make sure you are not doing it too frequently. The best way to plan your budget wisely is to set a specific limit for expenses on cafes and restaurants. So, decide on what sum of money you are ready to spend on going out monthly and do not exceed it.

- Use coupons. Despite the frequent skepticism, we can assure you that nothing is embarrassing in using coupons. In fact, they can save you an impressive amount of money. We’ve provided a list of useful apps for this matter in one of the previous sections.

- Take your snacks from home. The vending machines are fantastic, of course. You can buy a snack without leaving college. However, the products are overpriced there. That is why it would be more rational to take lunch from home. Besides, it will help you to eat healthier than munching a chocolate bar between classes.

- Do not order food too often. No wonder, student life is busy. Sometimes, you don’t even have time to cook a meal. Here is when students usually order food from the cafes. It can save you time. But it won’t keep your money. Better find 15 minutes to fry an egg or cut banana and add it into cottage cheese. Your organism and bank account will say thank you.

- Know the benefits of your student ID card. Different types of student identification cards have various benefits to offer. Very often, you can get a discount in a cafe or pizzeria by providing your ID card. So, don’t miss this opportunity to save up.

- NEVER go hungry to the grocery store. Willing to eat everything you see, you can buy more products than you need. Before visiting the shop, grab a snack. It will definitely help you to control yourself in the store.

- Stay tuned. If you live on campus, keep track of the events that are happening here. Usually, student life coordinators organize community days, picnics, dessert evenings, international cuisine days, etc. Here you can not only have fun but also grab some food. So, be updated with campus life and take part in different events.

👖 Clothes

Being young and interested in fashion, students want to look faultless. It mainly concerns those obsessed with social media, where they see the latest fashion trends daily. Brand clothes cost a lot of money. But what to do if you are a poor student who wants to dress up fabulously?

First and foremost, don’t worry. Everybody desires to be fancy. Second, take a look at our list of advice. Here you will find some useful ideas on how to save money on clothes:

- Plan your shopping wisely. Before going to the shopping center, decide what precisely you need. For example, if you don’t have any winter jacket, focus on searching for it. Don’t by a new t-shirt or sneakers. The spontaneous purchases will only make your credit card balance poor.

- Buy clothes out of season. Yes, it might seem weird. But it is an effective way to save money. You can buy a fantastic dress in the middle of winter at a meager price. This dress will wait on a shelf by summer. You will be able to impress everybody with your incredible outfit.

- Visit second-hands. A lot of people are skeptical about second-hand shops. However, sometimes, you can find high-quality and brandy clothes here. So, just a bit more time and patience—you will find cool stuff at a low price.

- Shop online. Online shopping platforms like eBay, Amazon, AliExpress can be helpful sometimes, especially sections with sales. However, be careful here. Buy goods only from checked sellers to avoid possible troubles. Also, don’t become too obsessed with online shopping. Before clicking the button “order,” think twice if you indeed need this thing.

- Exchange. Do you have trousers that you don’t wear anymore? And your roommate has a hoodie that does not fit any of their jeans? Take advantage of it! Exchange your clothes and do not spend any cent.

- DIY. Are you concerned that you don’t have any hobbies? Then this tip is for you. How about learning the basics of dressmaking and create awesome outfits by yourself. Firstly, you save money. Secondly, you develop new skills. Thirdly, you have unique pieces of clothing that anybody else cannot buy in any shop.

- Take care of your clothes. The appropriate garment care will help you to keep your clothes in order. Be careful with washing, drying, and ironing your clothes. Then you won’t need to buy new clothes too frequently.

- Do not forget about the accessories. A fancy bracelet, an elegant hat, or a colorful scarf may make your outfit special. So if you need to dress up on a special occasion, don’t buy a new outfit. Use your imagination! Combine the clothes you already have with the accessories.

🚌 Transportation

Another factor that affects the financial situation of college students is transportation. The insignificant daily expenses result in vast sums of money by the end of the month. The unpleasant situation, right?

Are you struggling because of high expenses for transportation? Let us tell you something. We know how to deal with this problem! Check out our tips and start effectively saving money:

- Rent housing near the college. The best way to save money on transportation is not to use it. So, if it is possible, live on campus. Or choose the closest apartment to your college. Then, you will not need to waste money on any kind of transportation.

- Walk more. If you have enough time and the weather is appropriate, choose walking rather than taking a bus. Firstly, you will not waste money on a ticket. Secondly, walking is great for your health. Especially if you are a student who leads a sedentary lifestyle.

- Use public transport. Are you are lucky enough to have a car, but not fortunate enough to have money on fuel? Leave it till better times. Buses, trolleys, or trams are always cheaper than this personal vehicle. Moreover, a car requires enormous expenses on insurance, health checks, etc. It’s not worth it in the long run.

- Get to know what a carpool is. If you want to ride by car, then a carpool is a great option for you. Gather several people who are willing to share a car with you and split the fuel check. This is a fantastic opportunity to save money.

- Use alternative vehicles. A bike, a scooter, a hoverboard may become your great helpers when it comes to saving money. And the good news? You will also improve your health while using these vehicles.

- Do not forget about your student ID card. Students usually have great discounts on public transportation. So, don’t leave your house without your student ID.

- Buy a monthly travel card. If you are using public transportation regularly, consider purchasing a monthly travel card. Typically, it is cheaper to invest money on this card than to buy a separate ticket each time you are using a bus.

🎓 Students’ Discounts

Having learned more than enough about cutting costs, you are ready for the essential part of this article. Here we’ll explain how to use student discounts. You can take advantage of them only while studying in college or university, so don’t disregard this opportunity.

The key advice:

Take your student ID everywhere. It can save you money even in the most unexpected places. Everywhere, from your local bar to a museum, you can count on a discount, especially living in a student quarter.

The places where you can get a discount:

1. Museums

Numerous countries provide free tickets to museums and exhibitions for students. In your place of living, you can get them with your ID. But traveling to Europe, for example, you should obtain the International Student Identity Card (ISIC). It allows you to get a discount not only for museums but for public transport, cinemas, cafes, etc. abroad.

2. Software

In one of the previous sections, we’ve mentioned that your studies may require various computer programs. They can be pricey and unreplaceable. Well, Microsoft offers student discounts for different products. Educators can even get Office 365 Education for free. Apple also provides opportunities to obtain their programs with a discount.

3. Electronics

Along with the software, the price of electronic devices is high, yet manageable with exclusive offers. You can buy Apple products with a discount and Adobe’s Creative Cloud for a lower price.

4. Streaming and other online services

You can watch movies and listen to music for half the price with the help of your ID. On Unidays, you can get a discount on a variety of services like iTunes. Sign up with your college or university mail (that ends with .edu) and enjoy it.

Amazon can give you a free six-month Amazon Prime trial and a lot more other features. Check RetailMeNot for other related discounts for the service. Get a free Spotify account for your college years with an additional Hulu subscription.

5. Clothes

There are plenty of shops that offer discounts if you show an ID. Necessary Clothing cut the costs on online shopping, while every J. Crew store does it offline. TopShop provides discounts everywhere, both in the shop and on the Internet. Check out sports stores like Nike and Adidas for special offers.

The thing is:

Ask your local stores for student discounts. They may have them, and you’re better to find out.

6. Journals

Majoring in English, communications, or journalism, you may be required to read articles from credible sources. With student discounts, finding good pieces of writing can be more manageable. Consider offers from The New York Times and The Wall Street Journal.

7. Food

People often forget about the special menu in restaurants and cafes. Well, you’re better not to! Hard Rock Café cuts 20% off the price internationally, if you have an ISIC card we’ve discussed above. Chick-fil-A and Chipotle offer free drinks in some locations when you show your student ID.

8. Public transport

Travel to any country in Europe and ask whether they have student discounts for transportation. The answer will be yes. So, enjoy them while you can. Use ISIC card in other countries and figure out how to get a special price for public transport where you live.

That’s it! Now you can save money in college like a pro. We hope our tips were helpful, and thank you for reading up to the end. Leave a comment below to let us know what you think about the article. Share it with other struggling students who may need a piece of advice.

🔗 References

- The Cheapest Colleges in America: Niche Blog

- Top 100 Most Affordable College and Universities: Education Corner

- 50 Most Affordable Colleges with the Best Return: Affordable Schools

- How to Create and Manage a Budget: Household Finance and Budgeting, America’s Debt Help Organization

- Where and How to Find Free Events in College: CollegeXpress

- The 50 Best Ways To Save Money In College And Live On A Tight Budget: Robert Farrington, The College Investor

- A College Student’s Complete Guide to Finding & Leasing Off-Campus Housing: Elizabeth Hoyt, Fastweb

- Discover Affordable Off Campus Housing: Affordable Colleges Online

- 118 Ways to Save Money in College: College Scholarship

- Easy Money Saving Tips and Simple Ways to Save Money: Better Money Habits, Bank of America

- How to Save Money in College: Anthony Oneal, DaveRamsey

- Good Ways to Save Money in College: College Ave, Student Loans

- Ultimate List of Stores and Restaurants with College Student Discounts: Noelle Buhidar, RetailMeNot

![Money Saving Tips for College Students [2026]](https://ivypanda.com/blog/wp-content/uploads/2020/10/happy-african-woman-in-leather-jacket-736x491.jpg)

![ADHD 101: A Definitive Guide for Students [+Tools & Resources]](https://ivypanda.com/blog/wp-content/uploads/2020/10/0-title-image-fidger-spinner-309x208.jpg)

hi

Hello Stacy. Thanks for stopping by!

I love it! Your good knowledge and kindness in playing with all the pieces were very useful. I don’t know what I would have done if I had not encountered such a step like this.

It’s so nice to hear that! Thank you very much for your kind words indeed.

Fabulous! Thanks a lot very much for the high quality and results-oriented help. I won’t think twice to endorse your blog post to anybody who wants and needs support in this area.

Thank you so much for your kind words. It means so much for us!

Thanks for sharing the info with us. I like it very much.

Glad you liked it! Thank you for your feedback!

You have it perfectly. Hello there! This is my first comment here, so I just wanted to give a quick shout out and say I genuinely enjoy reading your articles. Can you recommend any other blogs/websites/forums that deal with the same subjects? Thanks.

Thank you very much for your feedback. We greatly appreciate it. You can google Wikihow, Quora or Topuniversities to find out the content similar to ours.

Excellent! I’ve bookmarked your site, and I’m adding your RSS feeds to my Google account.

Glad you liked it! Thank you for your feedback!

This is terrific! Thank you a lot for providing individuals with a very spectacular possibility to read critical reviews from this site.

We are so grateful for your kind words. Thanks for sharing your opinion with us!