Executive Summary

This report analyses in detail the overall environment in which the Abu Dhabi Commercial Bank operates with a view of identifying particular areas where the management needs to put in measures that can enhance growth and performance. The Abu Dhabi Commercial Bank operates in the banking industry of the United Arab Emirates and is currently one of the leading commercial banks.

The bank targets enterprises and individuals who require retail and credit facilities. The bank is positioned as the largest single lender within the UAE. From the environmental analysis, it is apparent that this bank is well positioned and has series of opportunities for expansion.

However, the bank is facing the challenge of offering affordable and sustainable electronic banking services in the conservative market of the UAE.

Company Background

Founded in 1985, the Abu Dhabi Commercial Bank (ADCB) following the merger of the Khaleel Commercial bank and Emirates Commercial Bank. The government has a sixty five percent control stake with the private individuals holding the remaining part. The bank has strong interest in funds management, commercial and retail investment financing, and brokerage activities.

The bank has 48 branches within the UAE and three branches abroad. The external branches are located in the United Kingdom and India. Currently, the bank has an asset base of 148 billion dollars. The headquarters of the bank is at Abu Dhabi (ADCB, 2013).

The ADCB specializes in financing investment projects following the Islamic Sharia. Among the finance models it adopts include the Ijara. Ijara is a contractual agreement in which ADCB purchases an asset from the owner for a defined amount as demanded by the client. Later, this property is rented to the same client on a periodic lease agreement.

On the other hand, Murabaha is another finance model practiced by the bank. In this model, the bank enters into a contract with a client following a mutual agreement based on the promise made by the client to honour the pledge.

In addition, the Istisna’ finance model operates on an agreement with the client in which the bank erects a premise in line with the particulars defined in the requirement blue print which automatically becomes valuable upon completion as per the set deadline. The main competitors of the ADCB include the Doha bank and the Qatar National Bank among others (ADCB, 2013).

Industry Analysis of the ADCB

Macro-environmental analysis

The macro environment analysis studies external forces whose influence in one way or the other affects the performance of the banking industry in general and the ADCB in particular. Players in any business industry often lack the ability to control these external forces.

Political environment

The closer economic relations in the UAE have benefited the ADCB business performance for a long time. The country enjoys political stability which is a perfect environment for doing business (Ford, 2007). This is a good assurance for shareholders, both domestic and foreign, that their investment is safe and it is an incentive to them to add even more.

With continued political stability, ADCB is poised to grow and expand even more as many investors are assured of safety in the event that they decide to put their money into the venture. There are no fears of political wars and uprisings that can affect the bank’s business performance.

Economic factors

The UAE offers economically sound environment that is good for business activity. The World Bank acknowledged UAE as a rich country in 2005 while the country’s GDP hit the $ 1 trillion mark in 2006. The UAE economy has one of the highest Purchasing Power Parity (PPP) in the world. The country has very low inflation and interest rates with one of the best infrastructures in the world.

UAE’s stable economy with the high living standards of her population portends a lucrative market for ADCB’s business performance. More citizens of the UAE have a high demand for financial services due to the country’s high per capita income and very low unemployment levels.

The UAE is on the recovery path of her economy following bad economic times between 2008 and 2011 (Ford, 2007). This implies that the country’s living standards are set to improve in the short term period as the problem of unemployment is tackled. UAE’s improved demand for financial services will prove substantial for the overall performance of the ADCB.

Technological factors

ADCB continues to invest heavily in information communication technology as it aims at improving service delivery and customer satisfaction. The electronic banking product is as a result of the company’s initiative and has continued to be emulated by other players in the industry due to its convenience in business performance.

The Service Oriented Architecture is yet another technological initiative by ADCB which enables the bank management to monitor general trends in performance at a glance and spot out any existing bottlenecks that could be slowing down business.

The speed with which this happens helps the management to put corrective measures into place that eventually averts losses or negative growth (Ford, 2007). These technological advances have attracted more customers to the bank due to the improved efficiency with which clients are being attended to.

Legal factors

The Abu Dhabi Commercial Bank is a registered business entity that is licensed to operating UAE with more than 40 branches spread across this region. The company remits taxes to both governments as a legal requirement and the funds go a long way to finance activities such as building and improving infrastructure, financing public goods paying salaries and buying necessities such as medicines.

As a legal requirement, the company is expected by the regulatory authorities to be tax compliant. The taxes are remitted directly to the government of Abu Dhabi. In the UAE laws on commerce, certificate of compliance to taxes is issued to business that remit their returns accurately form which taxes are deducted. The ADCB has complied with the above laws (Ford, 2007). This has created an easy environment for its business activities.

Micro-environmental analysis

Industry competitiveness analysis using Porter’s 5 forces model

Threat to market entry

It is difficult for any aspiring bank to enter into the industry in the UAE market and manage to break even easily. In UAE, the ADCB’ business magnitude together with that of its main competitors such as the Doha bank and the Qatar National Bank are well established and would easily enjoy economies of scale to the disadvantage of a new entrant (Wright, 2007).

The bank has spread across the nation, opening numerous branches in all major cities and centres. It would require massive capital for an aspiring investor to out perform their business prowess. Besides, ADCB serves an estimated 6 million customers in a year.

Given its numerous branches, reliable customer base, and a stable market niche, ADCB has the capacity to offer affordable and reliable financial services to its customers.

This eventually affords its branches the power to lower prices below what the market can offer and in the process win more customers than a new entrant could manage. The bank is well position to survive in the competitive market through gaining form economies of scale, competitive price tags, and strong customer base in the UAE.

Threat of substitutes

Doha Bank and the Qatar National Bank pose the greatest threat to ADCB’s existence and business performance. These banks have been in the industry for longer period and are well established than the ADCB which came into full operation in 1985 after a merger (Ford, 2007).

The Doha bank and the Qatar National Bank have the same financial products and sometimes offer big discounts to customers. In the UAE banking industry, loyalty to a brand plays an important role in customer behaviour. Therefore, Doha bank and the Qatar National Bank have the ability to offer an alternative perfect substitute to customers who may be unsatisfied with services offered at the ADCB.

Unsatisfied customers therefore have other alternatives from where they can get financial services (Wright, 2007). However, in order to remain relevant, the Abu Dhabi Commercial Bank has established a unique market for its customer through tailored optometry financial services.

Power of suppliers

Suppliers in the UAE banking industry have more power owing to the existence of many banks. As a matter of fact, suppliers may instigate market demand and supply variances (Wright, 2007). All the banks depend on the suppliers such as the private lending institutions and the UAE Central Bank directly for the delivery affordable financial services.

This leaves the suppliers with the power to dictate on proceedings in the industry such as the lending and the borrowing interest rates.

Through the action of these suppliers, interest rates charged on these financial services can be influenced to their own advantage while leaving the ADCB together with its clientele base at a disadvantaged position. However, the BANK has endeavoured to use its deep reservoirs as a strategy for balancing the supply forces in the fragile financial market of the UAE.

Power of buyers

Reflectively, the amount of output in terms of turn over sales depends on the buyers’ purchasing power. The higher the purchasing power, the better the turnover in total sales realised over a definite period of time. ADCB’s performance in the UAE banking industry depends highly on the power of the financial service users. On the other hand, unreliable and weak purchasing power translates into losses and underperformance.

The management must therefore do everything within their means to ensure that service delivery and quality meets the expectations of customers (Wright, 2007).

In fact, the purchasing power determines profitability and probability of survival of a business in short and long term. If buyers will feel dissatisfied because of poor service, they can easily opt to acquire the same financial services from rival banks thus loosing out on business opportunities for the ADCB.

Rivalry

There are several commercial banks operating in the same industry with virtually all of them dealing in a variety of financial products and services. For instance, the Doha bank provides the biggest competition to ADCB due to its big market share and expanded network standing at 30% (Ford, 2007).

With many customers looking for good value for their money, quality in service delivery has remained the main basis upon which customers are making their final decision to purchase financial products in the volatile banking industry of the UAE. All the players in the industry are putting measures in place to ensure they attract more customers and therefore expand their market share.

Therefore, the size, in terms of space occupied by business premises, defines the temperature of competition (Wright, 2007). In line with this, the ADCB’s Abu Dhabi branch is the biggest and busiest banking hall (ADCB, 2013).

Company internal analysis

Although the Abu Dhabi Commercial Bank has been a household name in the general banking industry, the bank has an expanded business portfolio which includes investments in real estate financing, electronic banking service, and asset financing.

The expanded portfolio provides the bank with competitive advantage in the sense that it can still maintain profitable performance even in instances where the retail banking business experiences poor performance. Through diversification and portfolio balance, the bank is in a position to survive turbulence in the harsh economic environment characterised by stiff competition and sensitivity to market dynamics (ADCB, 2013).

SWOT Analysis

Strengths

The stable and management team comprising of five directors and several managers are instrumental towards providing necessary support and guidance in provision of financial services to customers and reviewing current operational strategies in line with the demands of their clients.

For instance, the management team introduced the electronic banking service in response to the demands of the clients. The bank also enjoys consistency in profits and high asset quality as well as strong capitalization. In the last financial year, the bank’s profitability increased by 23% as compared to the previous year. This has enabled the bank to fund different business project initiatives at affordable loan repayment interest rates.

The bank also enjoys wide network with over 45 branches and subsidiaries in the UAE and three representative offices in different regions outside the Middle East. This is important in attracting more customers in those regions where the company is yet to reach full potential. Besides, the numerous branches have improved its products visibility and accessibility (ADCB, 2013).

Weaknesses

The bank has more presence in the UAE than other parts of the Middle East. Specifically, unlike its main competitors, the bank has only three branches outside the UAE. Thus, the bank does not enjoy the substantive demand in the global market as its customer catchments area is restricted to the boundaries of the UAE.

Besides, the focus of the bank is more on corporate and investment banking. This is counterproductive in terms of revenue generation since majority of its customers are small businesses and private individuals who cannot operate in the corporate and investment platform. As a result of these weaknesses, the bank has not been able to efficiently penetrate the small business segment in the UAE (ADCB, 2013).

Opportunities

The bank has an opportunity to expand its opportunity to cater for leasing of finances since its asset base is strong enough to sustain this market. This opportunity will help in boosting the bank’s revenues and leadership position in the UAE banking industry.

Moreover, financing SSI sector could also be used as a very important venture avenue as well as power companies where the industry is still growing. As a result, the bank will be in a position to double its current revenues and increase the customer base (ADCB, 2013).

Threats

The main threat to survival of the ADCB is the competition from other local banks as the Doha bank and the Qatar National Bank. These banks have been in the market for longer period and have very strong customer base. Thus, the expansion and market penetration strategies that the ADCB proposes are likely to face opposition from these banks.

The other threat for the bank comes as a result unrest in many parts of the Gulf region. These unrests may destabilise the free markets of the UAE and interfere with the financial products’ interest rates (ADCB, 2013). However, this threat is minimal since the government has managed to maintain political stability in this region.

Issue/ Opportunity Identification

As analysed above, the Abu Dhabi Commercial Bank has embraced the significance of Porter’s approach to market forces in a business environment.

The bank has been in a position to swing these forces and manipulate them to their advantage through offering competitive prices, expansion, diversification, and cutting a market niche. However, any slow reaction to addressing these factors can cause business suffering leading to huge losses and reduced market share (Wright, 2007).

The main benefits that the bank offers to its customers are the customised financial products and free financial advice for every product, affordable and flexible loan repayment program, and affordable interest rate for the repayment plans for its financial services. Besides, customers are treated to quick services and currently enjoy the free mobile message alerts on the status of loan application, account and repayment.

These benefits are aligned to the customers’ requirements such as affordable services, reliability, and professionalism. Besides, the customers are accorded individualised attention which meets their expectations especially in the banking halls and the free financial counselling (ADCB, 2013).

Cost leadership strategy is vital in business management especially in an industry with stiff competition. Reflectively, the concept, as proposed by Porter, is a mean of establishing a sustainable competitive advantage over other player in the industry (Escrig-Tena, Bou-Llusar, Beltran and Roca-Puig, 2011).

The ADCB has adopted the cost leadership strategy to improve its efficiency through streamlining operations. As a result, this venture has developed a cumulative experience, optimal performance, quality assurance, and is in full control of their operational chains. In order to cut down cost of operations and marketing, the bank has embraced the efficient modern technology (ADCB, 2013).

The ADCB has opted for diversification and expansion of branches in order to gain from economies of scale as the overall turnover grows. Through adoption of scientific human resource management, the bank has been in a position to track redundancy and monitor employee performance and evaluations done on the basis of contract (Escrig-Tena et al. 2011).

As a result, issues of underperformance has been minimised substantially. The bank has introduced a series of efficiency monitoring systems such as performance valuation, efficiency in operations, target management, and electronic banking which has greatly improved on its sustainability (ADCB, 2013).

Thus, the bank needs to remodel its electronic banking service as a strategy for customer retention and business sustainability within the sensitive banking industry of the UAE.

Significance of the project and benefits to the company

The above project would offer the management of the Abu Dhabi Commercial Bank with an opportunity of understand the current environment of the banking industry the company operates in.

This research can assist the ADCB bank to implement financial services effectively by preparing a framework for the strategy. The study can also assist the bank to know how they can manage their customers’ expectations in order to properly adopt positioning strategies that match the UAE’s banking industry environment.

Project Planning

Relevant theories/ skills needed

In the electronic banking system remodelling as a strategy for customer retention and market expansion, the Abu Dhabi Commercial Bank requires customer management and IT experts to proactively facilitate their implementation and outcome assessment.

This will involve examination of the change management approaches such as the congruence and leadership in the business strategic management. The examination will then be related to the UAE banking industry’s past and present trends and economic circumstances of the Abu Dhabi Commercial Bank.

Proposed research methods

The suitable research method for remodelling the ADCB’s electronic banking service as a strategy for customer retention and business sustainability is qualitative research. Use of the qualitative research approach will facilitate understanding of the management attributes that contribute to optimal performance of the electronic banking service.

Through qualitative research of the bank, it will be possible to capture an explicit picture of the UAE banking industry and competitors of the ADCB within an interlude of a decade and beyond. Attributes of the subjects under study will be qualitatively studied to allow the researcher to enter observed qualitative behaviour indicative the dynamics of the UAE banking industry.

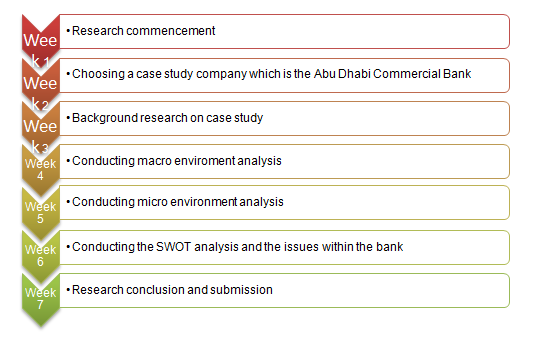

Detailed timeline

Week 1: Research Commencement

This stage will involve reviewing the research topic and rationale for the proposed hypothesis. This stage may take less than one week since choosing the topic will be dependent on available literature.

Week 2: Choosing the case study

Choosing the case study will be very challenging for different researchers and research papers adopt different approaches. Specifically, the research will have to choose the most convincing research variables from different research articles with a different approach to the research questions.

Week 3: Background research

Since materials are available for the research topic, the researcher will have an easier time in merging the relevant material to the research question. This stage may take less than three days to accomplish.

Week 5: Conducting the literature review

This stage will be very demanding for the researcher since different sources of information will be searched. Among the sources of information that will be probed include the internet, the university library, class notes and public libraries with relevant information on the topic of research.

Week 6: Conducting interviews, collecting data and analysing data

This stage will be the most difficult in the research paper. The researcher will have to balance direct interviews, questionnaires and other methods of research to present information about the topic. Data collected through one-on-one interviews will have to be scrutinized in detail.

Through open ended and closed ended, each question asked will have to be comprehensive to ensure that respondents have an opportunity to give deep and answers that provide an insight into the research problem solve through the use of Google docs software.

Transcription will be done to each of the recorded interview process. For each response, from each participant, the recorded transcripts will be perused to coin relevant and most appropriate response.

Week 7: Research conclusion

The findings will be interpreted and related to the research question. The researcher will have to manage the data findings and interpretation within the scope of the research topic despite any research dynamics that may arise in the processes. The final paper will be reviewed to confirm its comprehensiveness in answering the research question before submission. The outline is summarised in the chart below.

Summary

Conclusively, it is apparent that the Abu Dhabi Commercial Bank is a force in the banking industry in UAE. Reflectively, the bank has successfully managed to establish over 45 branches across the United Arab Emirates. Besides, the bank has remodelled its cost leadership to embrace efficiency in operations through incorporation of technology, monitoring tools, and evaluation systems.

As a result, despite stiff competition, the bank offers competitive prices and substantial discounts in its financial products since it maximizes gains from economies of scale due to large turnover per annum. In 2013, its assets stabilized at 148 billion. Incorporation of the Porters market forces in the management of this successful Abu Dhabi based bank is directly linked to its consistency, profitability, and efficiency.

Successful execution solely functions on inclusiveness, creation of quantifiable tracking devises for results, and recreating an informed support team. Generally, these recommendations should be practiced flexibly since the bank’s operation environment is characterized by constant dynamics that may make previous designs irrelevant.

References

ADCB. (2013). Financial overview. Web.

Escrig-Tena, A., Bou-Llusar, C., Beltran, M., and Roca-Puig, V. (2011). Modeling the implications of quality management elements on strategic flexibility. Advances in Decision Sciences, 1(1), 1-27.

Ford, N. (2007). Saudi banking. The Middle East Journal, 37(6), 48-53.

Wright, P. (2007). A refinement of Porter’s strategies. Strategic Management Journal, 8(1), 93-101.