Key Financial and Strategic Quantitative Indicators

Compass Minerals has just completed its Initial public Offer, but this is happening at a time when the government and other environmental agencies are passing regulations that are meant to reduce usage of salt, especially in deicing the roads. This is not good news to firms in this industry given the fall in salt prices that have been experienced in the past. This may injure the financial position of the firm in the market at a time when the shareholders expect to reap handsomely from their investments following the successful IPO that had just been completed. The following areas are financial indicators that may help in explaining the financial position of the firm.

Changes in financial performance

The first area that will be given consideration in this analysis is the financial performance of the firm over the years. The following data is part of the financial performance of this firm that is given in Appendix 1 of this paper.

As shown in the figure above, between 1998 an 2003, there have been positive and negative changes in the sales.

In 1998

- Sales: 277.7

- Cost of sales (shipping and handling): 55.8

- Cost of sales (products): 111.8

- Profits= Sales –Total Cost of Sales

- = 277.7- (55.8+111.8)

- = $ 110.1 million.

In 2003

- Sales: 564.2

- Cost of sales (shipping and handling): 155.6

- Cost of sales (products): 225.8

- Profits= Sales –Total Cost of Sales

- = 564.2- (155.6+225.8)

- = $ 182.8 million.

Analysis of the financial performance of this firm in the two years shows that the profitability of the firm has improved from $ 110.1 million in 1998 to $ 182.8 million in 2003. However, the total cost of sales has also increased within this period. although this may be seen as a positive trend, the increase in firm’s profitability may be unsustainable given that years prior to 2003, the profitability had dropped significantly to levels lower than that of 2008 (See Appendix 1). This will require that this firm readjusts its strategic focus in order to find ways of lowering its costs of operations as it seeks to increase the sale of its products.

Level of achievement of strategic and financial objectives

One of the major financial objectives of a firm is to increase its assets over a period of time. The following data taken from Appendix 1 demonstrates the changes in value of asset at Compass Minerals from 1998 to 2003.

The change in the asset value of this firm is worrying. At a time when firms are struggling to expand the value of their assets, the asset value of Compass Minerals has been dropping consistently from 1998 to 2003. The value of asset in 2003 is less than half what it was in 1998. This is not convincing given that this firm has acquired other firms along the way. It would be expected that the value of its assets would be on the rise due to these acquisitions and improved performance in the market. This is an area that the management should give serious considerations in its strategic plans.

Changes in key industry indicators and measures unique to the firm

In order to determine the future of this firm, it is important to look at some of the changes in key industry indicators and measures unique to the firm. Appendix 2 of this firm shows the changes in salt production from 1910 to 2002. From this graph, it is evident that there was a consistent rise in production of salt from 1910, to the years preceding 2000. However, since 2000, the graph shows an expected decline in the production of salt in the United States.

There was a sharp drop from 2000 to 2002. This may be attributed to the researches done during this period which revealed that salt has a serious negative impact on the environment, especially when used in deicing the roads. Not only does it pollute rivers, but it also destroys aquatic lives in freshwater rivers and lakes. This led to the introduction of new policies that regulated the use of this product. The management must find ways of improving the firm’s performance despite these negative trends. These measures shows that the future may be more turbulent than they are now, and unless radical changes are made in the operational strategies of this firm, the future of this firm may not be as bright as the stakeholders may want it to be.

Changes and trends in costs or profitability of the firm

The strongest indicator of a firm’s success in the market is its profitability in the market. In the section above, changes in costs and profitability of the firm has been calculated. It was established that the profitability of the firm had improved from $ 110.1 million in 1998 to $ 182.8 million in 2003. That is about 66% increase in profitability of this firm. The cost of production has also increased within the same period as shown in the calculations below.

In 1998

- Cost of sales (shipping and handling): 55.8

- Cost of sales (products): 111.8

- Total cost of sales = 55.8+111.8

- = $ 167.6 million.

In 2003

- Cost of sales (shipping and handling): 155.6

- Cost of sales (products): 225.8

- Total cost of sales = 155.6+225.8

- = $ 381.4 million.

Percentage Increase in the Cost of Sales

- Percentage increase in cost of sales= 381.4/167.7*100

- = 227.4%.

This analysis reveals that the cost of sales from 1998 to 2003 has increased by 227.4%. Within the same period, profitability has increased by 66%. This shows an imbalance in the cost of sales and the profitability in the sales. The cost is going up at unprecedented rates, while the profitability is increasing at lesser rates. This means that going forward, the management will need a strategy that will help it increase its profitability rates and lower cost of sales in order to remain sustainable in the market. Failure to do this will mean that soon the cost of production will be higher than the profits the firm is making. If it reaches this level, the Compass Minerals will have no alternative but to stop its unsustainable operations.

External Environmental Analysis

It is important to conduct an analysis of the external environmental analysis in order to understand the position of this firm and what the future holds. The following are some of the important areas that must be given attention in order to understand the future of this firm.

Macro-environment

Macro-environmental analysis will be important in understanding external forces that may directly affect the operations of this firm. They include the following:

Political environment

The political environment may have serious consequences to the internal activities within a firm. Political instability may lead to serious insecurity within a country. Achieving success in a lawless country is not possible. Compass Minerals has enjoyed a stable political environment both in the United States and Canada. The political class has also made an effort to avoid any direct interference with the business community.

Economic environment

The economic environment in the United States and Canada has remained relatively stable over the years. Other than the 2009 economic recession that hit the region, the markets where this firm operate have experienced economic prosperity.

Social environment

The social-cultural beliefs have a major impact on the purchasing patterns of the consumers. In the United States and Canada, there is a new trend where the society is cutting down intake of salt because of health reasons. The use of salt in de-icing the roads is also going down because of health reasons. This may have negative impact on the sales of this firm.

Technological environment

Technology has transformed the production strategies used at this firm. Compass Minerals currently uses machines to enhance speed, standardisation, and quality of the products. Technology has also transformed the marketing strategies used by this firm. The firm now uses social media such as Facebook and Twitter to reach out to its targeted customers. Technology has also enhanced the interaction between the firm and its customers.

Demographic

The demographical factor plays a negligible role in this industry. Salt is a low involving good with very low prices. Changes in the demographical factors of the customers will have almost insignificant impact in the total sales of the product.

Porter’s 5-Forces Analysis

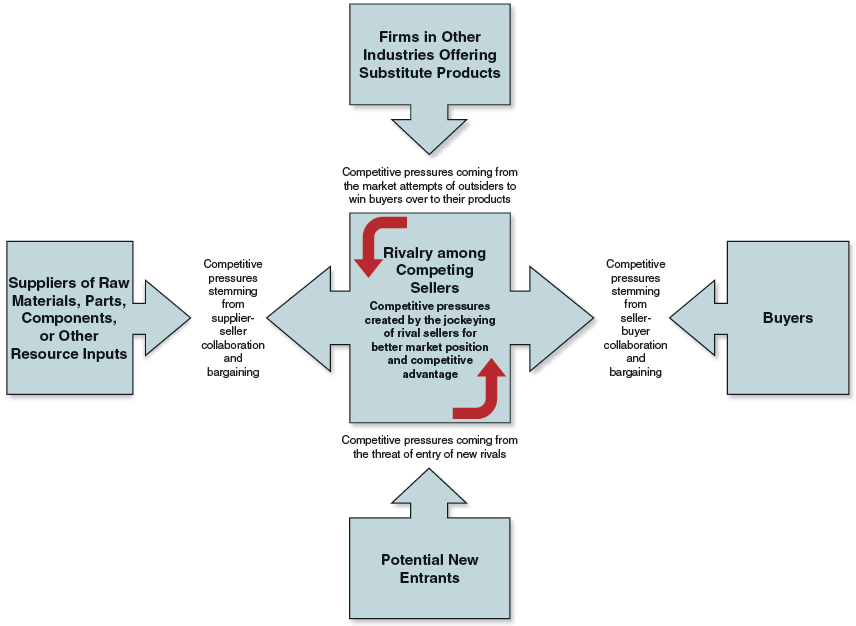

External environmental analysis may not be complete without evaluating the environment using Porters Five Forces. This tool will help determine some of the threats that Compass Minerals has to deal with in order to remain competitive in the market. The Five Forces model is shown in the figure below.

Competitive rivalry threat

The major threat in the current market in the United States and Canada is the competitive rivalry among the top players. This firm is ranked third, meaning that there are other top players in this industry. The competition has become very stiff, and this means that this firm has to reassess its strategies from time to time in order to ensure that they are relevant enough to manage the competitive forces.

Threat of new entrants

The threat of new entrants is very real in the current market. The United States and Canada have embraced an open market policy. This means that new firms have the freedom to enter or leave these markets without any restrictions. This means that the current competition can become even stiffer if new firms are introduced into the system. However, chances of new entrants getting into this market are remote given that the industry is getting unattractive.

Threat of substitutes

The threat of substitutes may also be another negative environmental factor that may affect the progress of the firm in the market. When a product has perfect substitutes that can meet the same needs but in a superior way, then swaying customers to the substitutes can be a very simple process. The government is now considering other alternative ways of de-icing the roads during winter. To deal with the problem of the substitutes, Compass Minerals will need to introduce new lines of superior products that can be used to deice the roads without causing pollution.

Bargaining power of suppliers

The bargaining power of the suppliers may also be a major threat to the success of a firm in the market. Compass Minerals has been successful in managing the power of the suppliers because it has close control of almost the entire supply chain except the machines and tools used for production.

Bargaining power of buyers

Organisational buyers such as national and state governments have a lot of power when it comes to price negotiations. They have power to dictate the purchasing terms to their favour. In order find a way of forming strategic alliance with other firms so that they can speak with one voice when dealing with these organisational buyers. This will make them stronger in the market.

Driving Forces

Driving forces are the major causes of change within a given industry. These driving forces can be the external macro environmental factors or internal environmental forces. Globalisation is one of the most important external driving forces that have affected the competitiveness of Compass Minerals in the market. With the world turned into a small global village, geographical barrier to the market entry has been eliminated, making it easy for other firms to enter the market.

Emerging technologies is another major driving force. The new technologies have redefined the production and marketing strategies used in the market. Innovation in production and marketing is now critical for a firm to achieve success in the market. The management of Compass Minerals must be very keen on the changing attitudes, lifestyle and the general trends in the consumption of its products because this is another major driver of change. Other internal factors such as the type of leadership, the nature of the employees, and the systems that are in use also have a major impact on the ability of this firm to achieve success.

Strategic Group Map

The management of Compass Minerals will need to understand its current position in the strategic group map. As at now, this firm is ranked in position 3 among the top producers of minerals in this region. However, through effective production and marketing strategies, this position can be improved.

Key Success Factors

Understanding the key success factors is critical when analysing environmental forces that may affect the operations of the firm. One of the greatest success factors at Compass Minerals is the long experience it has had in this industry. It has an understanding of how to deal with the emerging trends in this industry. The firm has also introduced new strategies that encourage and define how to manage change in the workplace. The proactive approach to change makes it easy to deal with the new disruptive forces that may affect the normal operations of the firm.

Industry Profile and Attractiveness

It is necessary to analyse the attractiveness of the industry where Compass Minerals operates in order to determine how it can take maximum advantage of it. In the United States and Canada, the population is slightly increasing due to high rates of immigration. This means that the number of people who will need the product is on the rise. However, the management should be weary of the emerging trends in the industry that has reduced consumption of its products.

Company Situation

At this stage, it is necessary to evaluate the situation of Compass Minerals in order to determine the appropriate strategy that will be used to achieve best results based on environmental factors discussed above.

Company Value Chain Analysis

The Company has used emerging technologies to enhance its value chain, from the extraction of the raw materials, processing of the material, and finally delivering the product to its customers. Compass Minerals is keen on offering the highest value to its customers, not only in terms of the products, but also the delivery approach.

VRIO Analysis

When VRIO model is used to analyze the position of this firm, it is evident that the firm is yet to fully exploit the value of reduced threat in the market. Moreover, it does not have control of the rare products used in the manufacturing process. Its products are easily imitable, a fact that limits its competitiveness in the market. However, well-organized and capable of readjusting itself to manage emerging market forces.

Competitive Strength Assessment

The competitive strength assessment of Compass Minerals reveals that the firm deserves to be the top player in the industry. It has employed some of the best strategies in production, marketing and employee management. It has been in operation for some time now, and has laid down technological structures to take it to the next level. However, the firm is currently ranked third in the market. In order to get to the top position within this industry, the management should consider implementing the strategies suggested in the section below. The table below shows its current position vis-à-vis that of the top competitors.

The assessment confirms that currently Compass Minerals ranked third among the top salt producers.

Intended Strategy

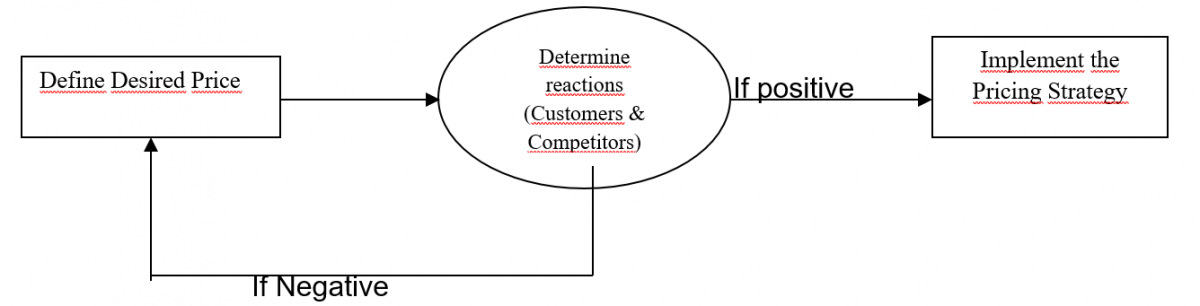

In this section, the researchers will develop a simulation game to try and explain the pricing strategy that Compass Minerals can use in the market. The strategy must be convincing to the investors who will play an important role in financing the operations of this firm. In this game, the researchers will create a virtual world that will help us explain how the firm can set appropriate price that will help it achieve the best results in the market. The following diagram shows how this game will be played

In this simulation game, the steps will be very simple. The marketing team of Compass Mineral, acting in a virtual market, will define the price that will give the investors maximum value for their money without affecting the ability of the customers to pay for the product. After setting the price, the team will determine the possible reactions from the customers and competitors. Customers can react by ignoring the possible price increase and maintaining their purchase of the product, which in this case is defined as a positive reaction, or refrain from the products, which is a negative reaction. On the other hand, competitors may ignore the change, which is a positive reaction, or decide to take advantage of these changes, which will be a negative reaction. If the reactions are positive, the strategy will be implemented. If it is negative, the process shall begin once again from stage one.