Business Name

- Chosen company: Dunkin’ Donuts.

- Plans to expand its sales network and operations.

- Strong brand reputation and international presence.

- Target country: Australia.

The chosen company for the international business venture is Dunkin’ Donuts, which was founded in 1950. It is based in Canton, MA, USA and operates 11,000 stores worldwide including 9,200 stores in the US. It aims to expand its sales network and operations in other countries as well. The company manages its franchise-based outlets in 60 countries. The company has a strong brand reputation and experience of international partnerships. The target country selected for this plan is Australia. The company announced the decision to re-enter the country in 2013, but in 2014 the Global Chairman of the company, Nigel Travis withdrew from the decision to open its stores.

Executive Summary

- Operated in Australia from the 1980s till the late 2000s.

- Exit reasons: Warm climate and preference for local brands.

- Dunkin’ Brands Inc. announced a new name Dunkin’ for its stores in the US (“Dunkin’ without the ‘Donuts’?,” 2017).

- Changes in the product line.

- Dunkin’ can attract new customers.

Dunkin’ Donuts operated in Australia from the 1980s till the late 2000s. The reason for its exit from this market was the declining trend of donuts and hot coffees in the country due to its warm climate and preference for local brands.

Dunkin’ Brands Inc. has also announced its plan to try out a new name for its stores in the US. The new name will be Dunkin’. The Australian market is proposed as the company has changed its product line and offers many other products other than donuts and coffee. Its aim is to deliver a new message about its product diversification (“Dunkin’ without the ‘Donuts’?,” 2017).

Description of the Foreign Country

- Australia is the 6th largest country and the 13th most developed country in the world.

- Capital: Canberra.

- Native language: English.

- Religions: Christianity (54.6%), No religion (7.3%), Islam (2.6%) and others.

- Highly literary rate (“Australia – Oceania: Australia,” 2019).

- Ease of Doing Business: 18th position in the World Bank’s listing.

Australia is the 6th largest country and the 13th most developed country in the world. Its capital is Canberra and the native language is English. Major religions include Christianity (54.6%), No religion (7.3%), Islam (2.6%) and others.

It has a democratic government. The people mainly follow Anglo-Celtic Western culture. Australia ranks at the 18th position in the World Bank’s listing for the ease of doing business and its best position was 9th in 2009.

Business Description and Structure

- Dunkin’ Donuts – a global brand.

- Sells 1.5 billion coffee cups annually.

- Rebranding with a new brand name – Dunkin’.

- Primary focus: Donuts and coffees.

- Privately-owned franchised stores.

- Standardized franchise structure.

Dunkin’ Donuts is a global brand which sells coffees and miscellaneous confectionaries. It sells 1.5 billion coffee cups annually. The company is rebranding itself as Dunkin’ which is a quick service restaurant and coffee house. It primarily focused on donuts and coffee until recently as it extended it menu and added new and healthy food items as well. It owns franchised stores in 60 countries and follows a standardized franchise structure.

Market and Company Analysis

- Major competitors: McDonalds, Donut King, Grumpy Donuts, and Starbucks, etc.

- Australians prefer lattes and expressos.

- Intense competition in the Australian market.

- Strong standardized franchise structure.

- Standardized product menu.

The major competitors in Australia are McDonalds, Donut King, Grumpy Donuts, and Starbucks, etc. Over the years, Australia has emerged to be one of the best coffee producers. The consumer preference is different from US as Australians like to have lattes and expressos. The competition in the market is intense as it is highly developed and many similar businesses operate in Australia. The company has a strong standardized franchise structure which is easy to replicate in all stores. Moreover, it has a standardized product menu which is easy to manage.

Marketing and Sales Operational Plan

- Offer master franchise.

- Open multiple franchised stores.

- Stores to be opened in major cities of Australia.

- New branding strategy – “Dunkin’.”

- One-time franchise fee and royalty.

- Marketing activities approved by the company.

- Four sources of revenue:

- Royalty income and fees.

- Rental income from restaurant leased-properties.

- Sales of ice cream and other products.

- Dunkin’ Donuts brand products (“Dunkin’ Brands, Inc. Form 10-K 2017,” 2017).

Dunkin Donuts will sell its master franchise to a Australian business. The franchise holder can open multiple stores according to the business requirements. It will require stores to be opened in major cities of Australia including Sydney, Melbourne, Brisbane, Perth, Adelaide, and Gold Coast. Dunkin Donuts will use its new branding strategy and use the new brand name “Dunkin’.” The company will charge one-time franchise fee and earn royalty based on store sales. It requires franchise holders to carry out marketing activities.

There are four sources of revenue including:

- royalty income and fees associated with franchised restaurants;

- rental income from restaurant properties that the company leases or subleases to franchisees;

- sales of ice cream and other products to franchisees in certain international markets;

- other income including fees for the licensing of the Dunkin’ Donuts brand for products sold in certain retail channels (such as Dunkin’ K-Cup® pods, retail packaged coffee, and ready-to-drink bottled iced coffee), refranchising gains, transfer fees from franchisees, and online training fees” (“Dunkin’ Brands, Inc. Form 10-K 2017,” 2017).

Investment Planning

- Initial cash funding: $250,000

- Single or multiple franchised stores.

- Franchise fee: $40,000 – $90,000.

- Liquid capital requirement: $125,000.

- Additional store investment: $250,000.

- Applicant’s net worth: $500,000.

- Training provided to franchisees.

Dunkin’ Donuts requires initial cash funding of $250,000 to acquire its franchise. The franchise holder can have single or multiple stores. The franchise fee is between $40,000 and $90,000. However, it is expected to be $40,000 in Australia. Liquid capital required to acquire the company’s franchise is $125,000 and each additional store requires minimum investment of $250,000. The applicant must have a net worth of $500,000. The company provides training to franchisees to ensure that business standards are followed.

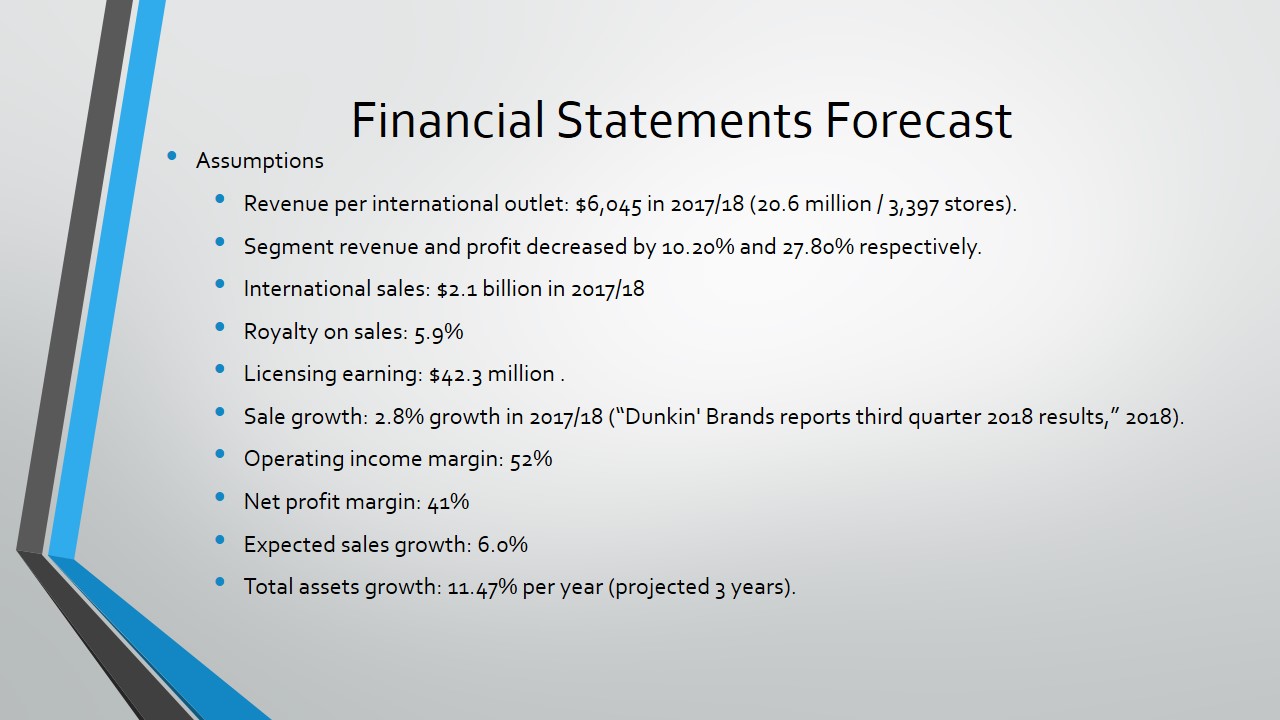

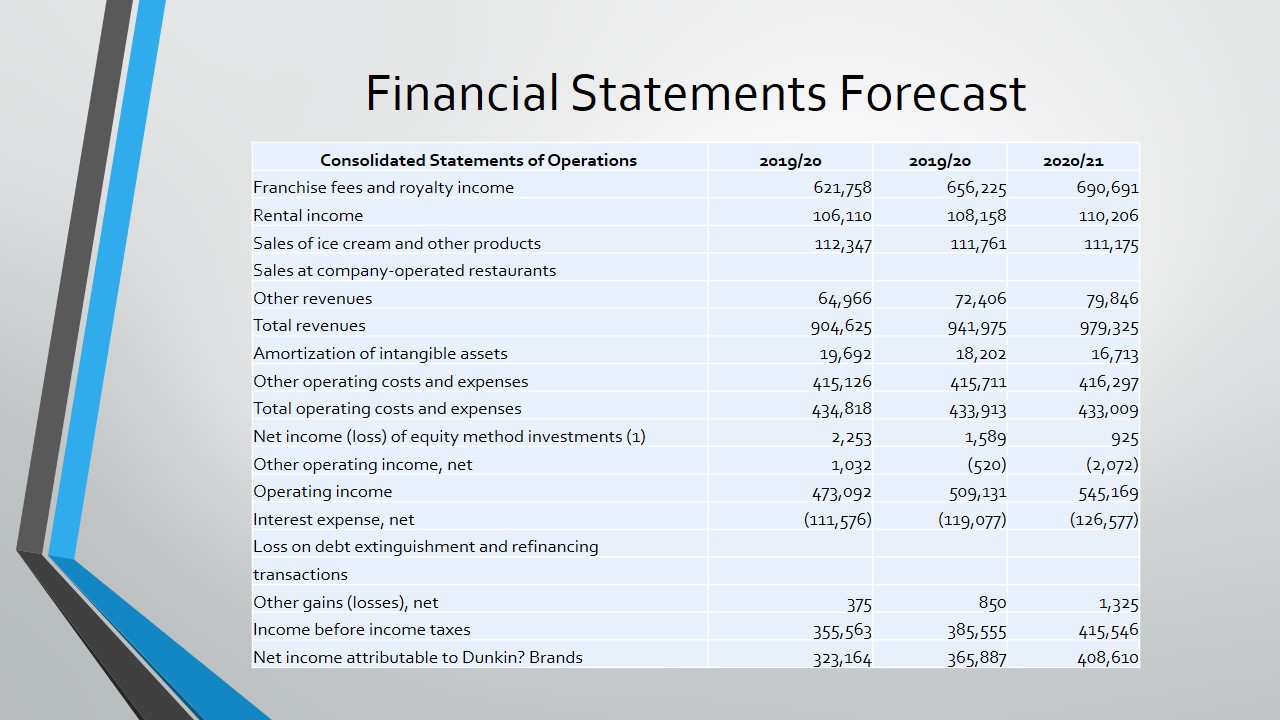

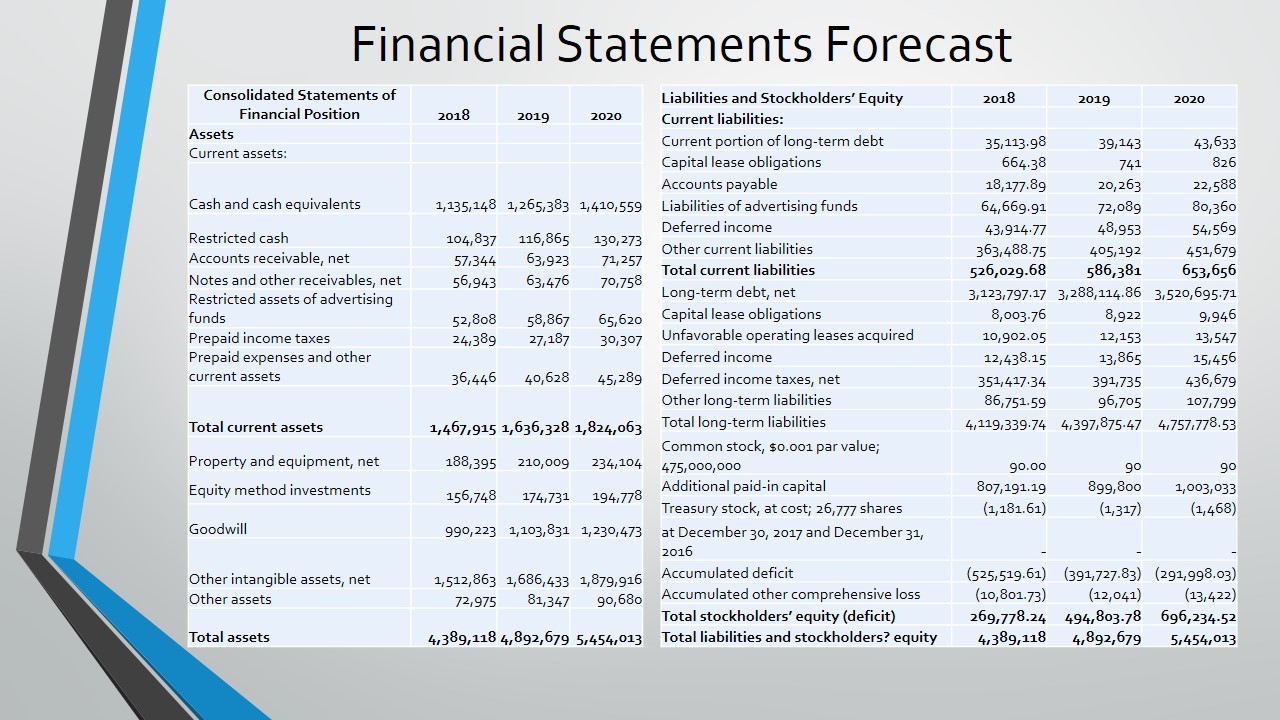

Financial Statements Forecast

- Assumptions:

- Revenue per international outlet: $6,045 in 2017/18 (20.6 million / 3,397 stores).

- Segment revenue and profit decreased by 10.20% and 27.80% respectively.

- International sales: $2.1 billion in 2017/18

- Royalty on sales: 5.9%.

- Licensing earning: $42.3 million .

- Sale growth: 2.8% growth in 2017/18 (“Dunkin’ Brands reports third quarter 2018 results,” 2018).

- Operating income margin: 52%.

- Net profit margin: 41%.

- Expected sales growth: 6.0%.

- Total assets growth: 11.47% per year (projected 3 years).

Dunkin’ Donuts revenue per international outlet was $6,045 in 2017/18 (20.6 million / 3,397 stores). Dunkin’ Donuts international franchises and ventures generated sales of $2.1 billion in 2017/18 and it earned 5.9% royalty on sales. It is equal to an average of $36,473 per international outlet. The company earned $42.3 million from other sources including licensing of the Dunkin’ Donuts brand for other products. It is equal to an average of $3,373 per outlet. It reported 2.8% growth in its sales in 2017/18. Its operating income margin was 52% and the net profit margin attributable to Dunkin’ brand was 41% in 2017/18.

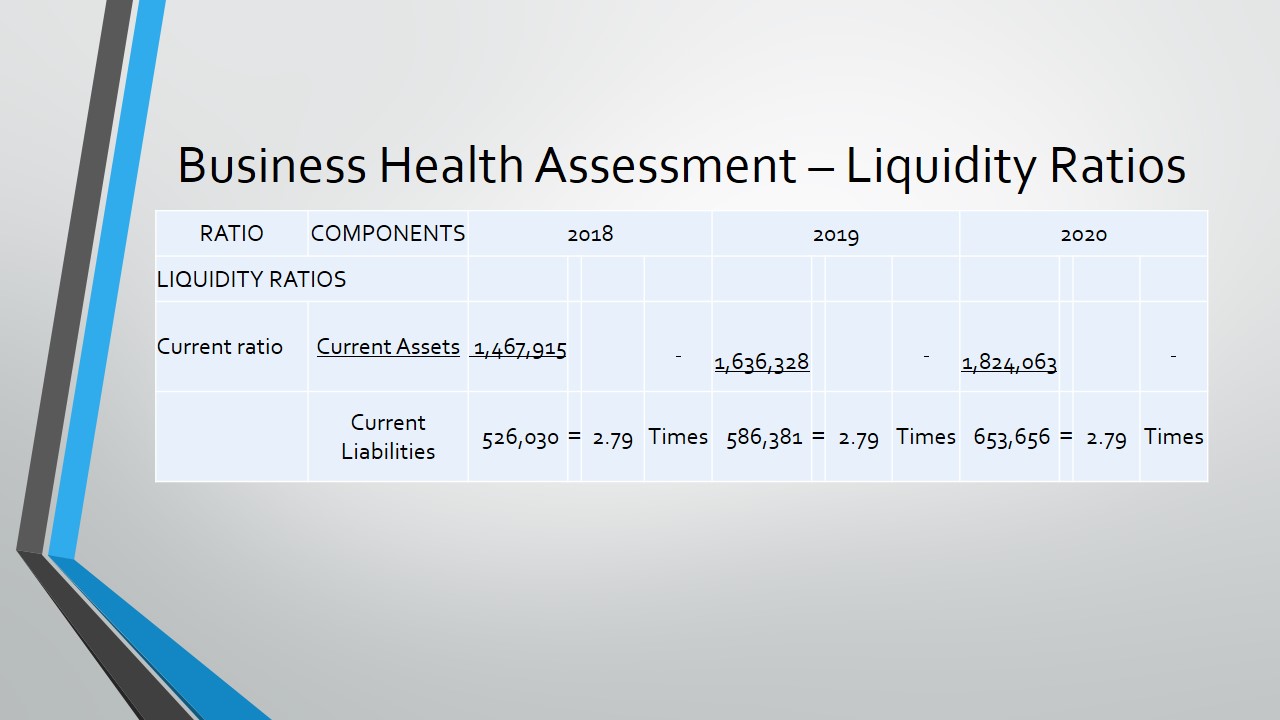

Business Health Assessment – Liquidity Ratios

The company’s liquidity position will remain strong as it will control its current liabilities by paying its suppliers on time. There is no change expected in the liquidity position because the company will maintain its cash position by generating sufficient cash flows from operating activities, It will manage its payables and receipts in the short term to ensure that there are no immediate financial problems.

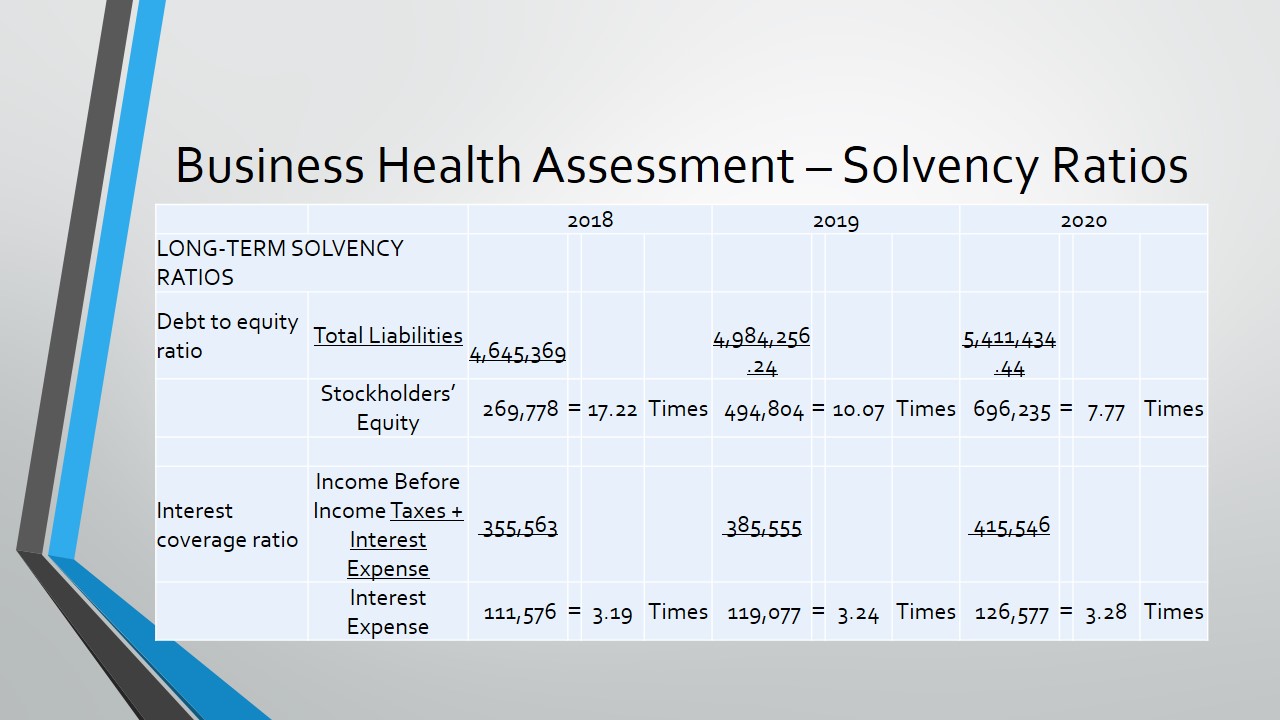

Business Health Assessment – Solvency Ratios

The company’s solvency position will remain strong as its strategy is to repay high-interest loans and use its equity for business development and operating activities. The company will generate sufficient operating profit to meet its interest obligations. It will help the company to have the option of borrowing from banks when needed.

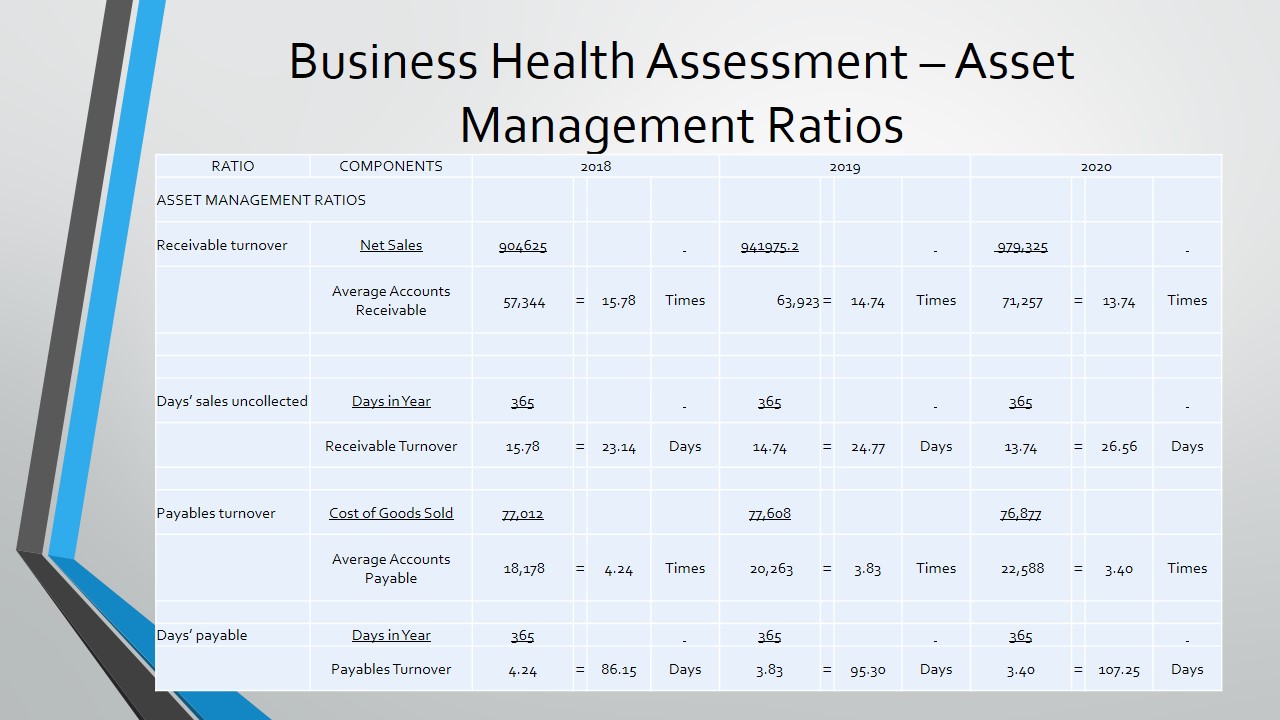

Business Health Assessment – Asset Management Ratios

The company’s will remain efficient to manage its accounts receivable and accounts payable and keep a control over its cash position to avoid any liquidity issues. It is important for the company to manage its operating accounts efficiently to avoid any cash flow problems. Moreover, the company must have good relationships with its customers and suppliers for its business.

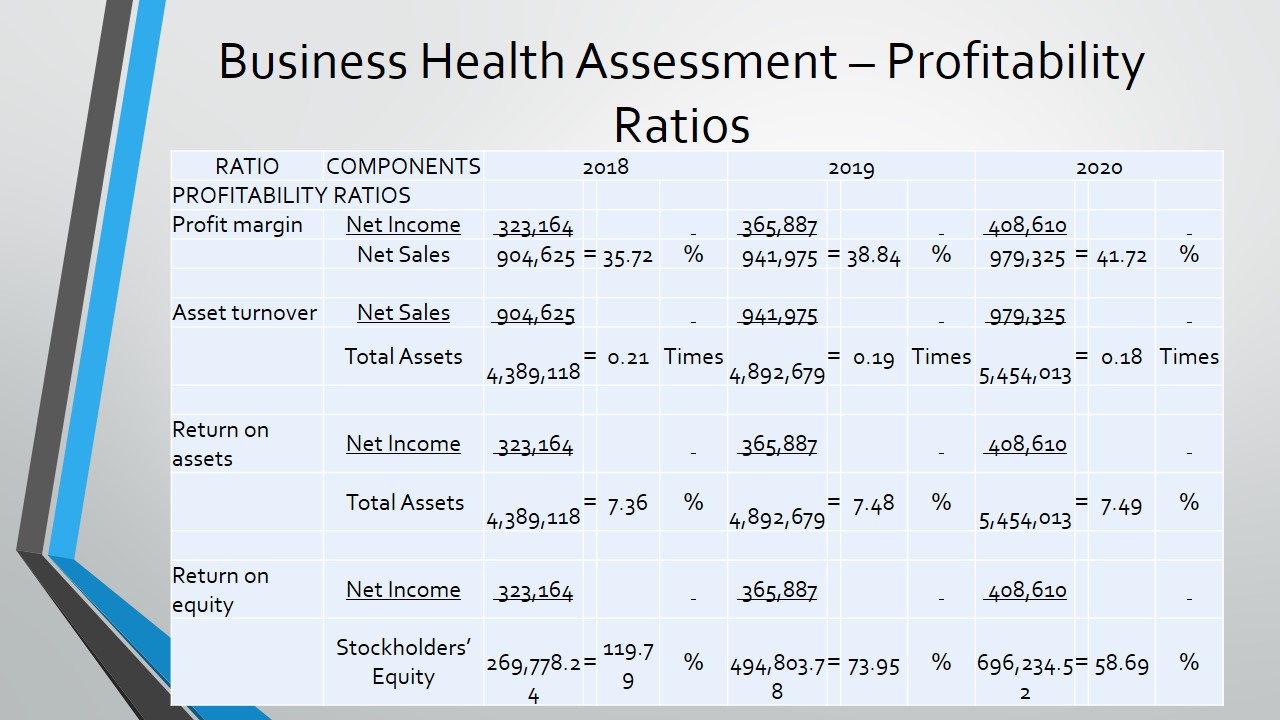

Business Health Assessment – Profitability Ratios

The company’s profitability position will improve as the company will generate more sales and high profit margins.

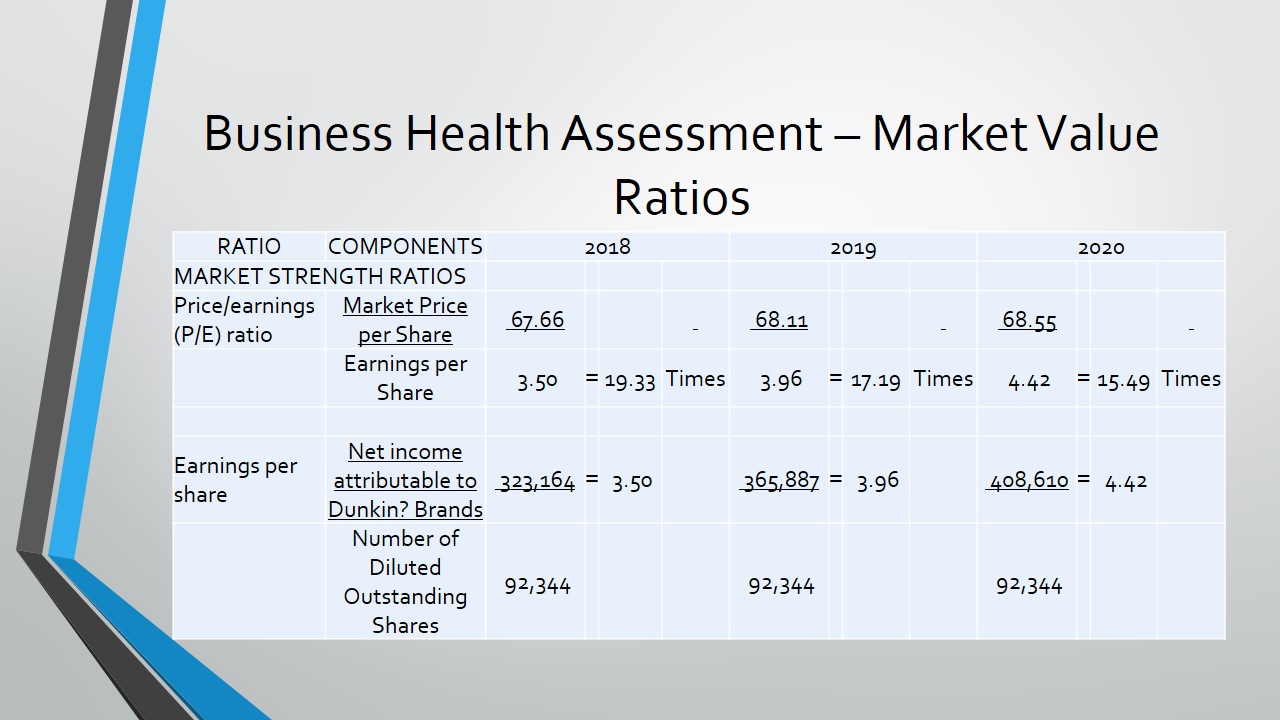

Business Health Assessment – Market Value Ratios

The company’s stock price is expected to increase in the next three years. It has been determined by analyzing its trend and also keeping in view the positive impact on its business decisions.

References

Australia – Oceania: Australia. (2019). Web.

Dunkin’ Brands, Inc. Form 10-K 2017. (2017). Web.

Dunkin’ Brands reports third quarter 2018 results. (2018). Web.

Dunkin’ without the ‘Donuts’? (2017). Web.