Introduction

- Background.

- Research problem.

- Research Questions.

- Structure of the Presentation.

In this paper, I set off to investigate the effects of regional conflicts on the performance of the Dubai financial market. In this first part of the presentation, we will look at the background of the Dubai financial market, understand the research problem that justified my research, identify the research questions which guided my review and the structure of this presentation, which we will follow in this presentation.

Background

- Financial markets in the United Arab Emirates:

- Dubai Financial market (DFM);

- Abu Dhabi securities exchange market;

- NASDAQ Dubai.

- DFM was founded in 2000 and is a government-owned company.

- More than 60 companies are listed on the DFM.

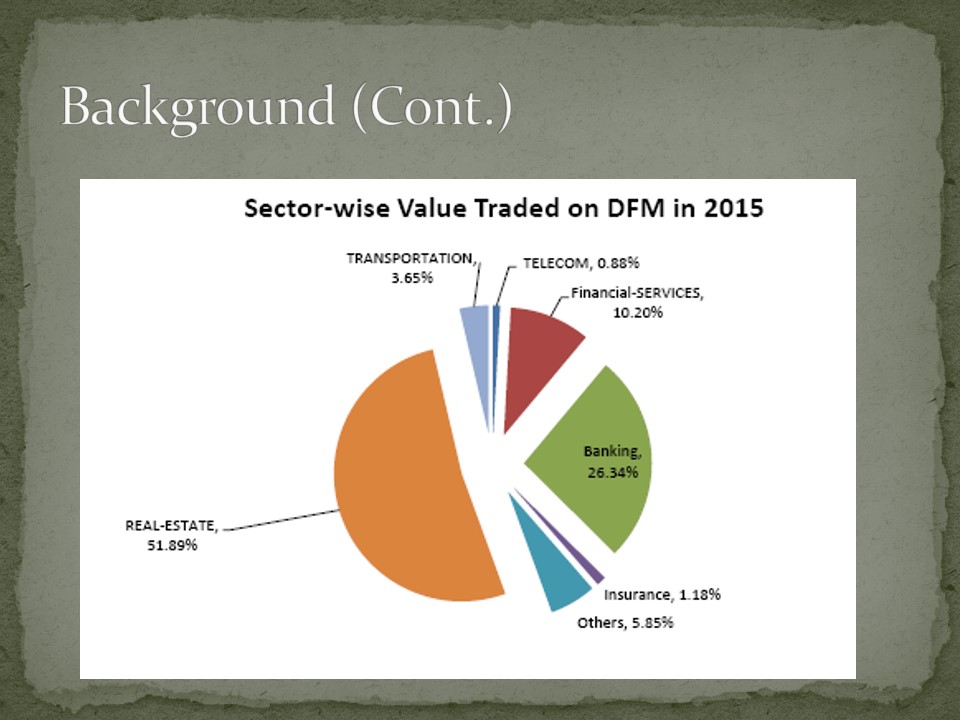

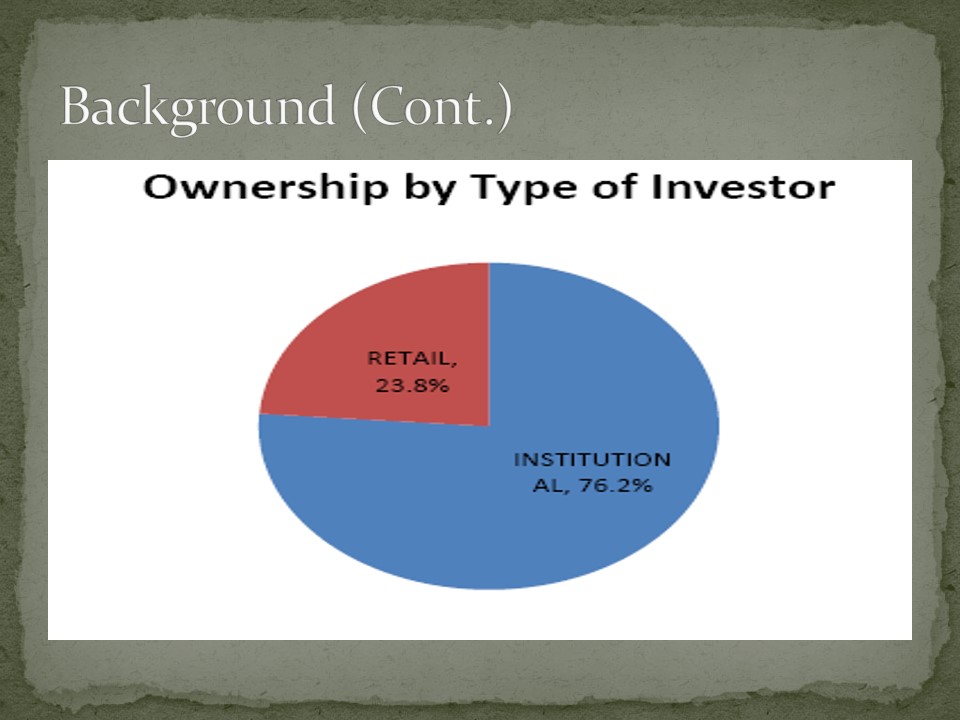

The DFM is one of three financial markets in the UAE. The others are the Abu Dhabi securities exchange market and NASDAQ Dubai. Founded in 2000, DFM is a government-owned company that acts as a platform for more than 60 companies to trade. In the next slide, I will show you the most active sectors in the DFM.

Research problem

- Few studies have investigated the impact of conflict on financial markets

- Many researchers have focused on explaining how conflicts affect the financial performance of major western economies, such as the United Kingdom and the United States (US), while neglecting developing countries

- Fewer studies have focused on comprehending the effects of conflict on the Middle East and more particularly the UAE

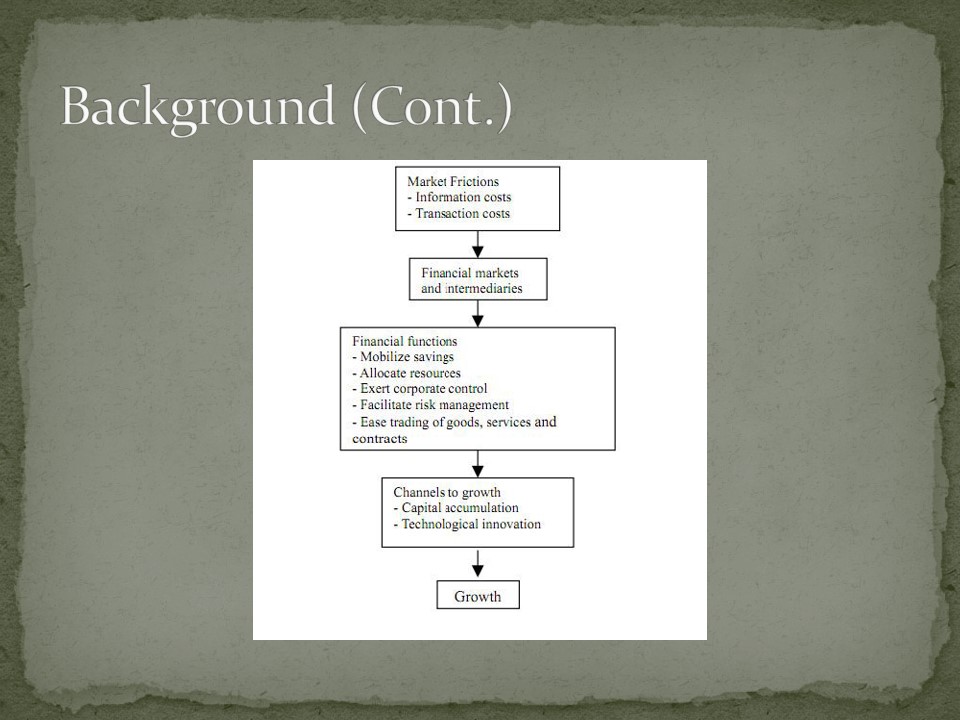

Although some studies have investigated the effect of conflict on financial markets, they are few in number and mostly focus on the effects of conflict on major western economies, such as the US and the UK. Consequently, there is a significant literature gap of research studies that explain the effects of conflict on financial markets in developing economies such as the UAE. I used the DFM as a perfect case study to fill this research gap because Dubai is a central economic hub of not only the Middle East, but Asia in general.

Research Questions

- Do regional conflicts have a positive impact on the Dubai capital market?

- What are the major drivers of such effect?

- Is there a similar effect through the various segments of the market?

In the study, I only had three research questions which strived to explain the main drivers of regional conflict on financial markets, the effects of conflict across different economic sectors, and whether regional conflicts have a positive impact on the DFM.

Results

- Secondary Literature Review Findings.

- Expert Findings.

- Event Methodology Findings.

My key findings came from a combination of secondary literature review findings, expert findings, and event methodology findings. I used the triangulation technique to merge them.

Secondary Literature Review Findings

- Conflicts generally have a negative effect on financial market performance.

- There is a significant drop in trading volumes during periods of political turmoil.

- Regional conflicts diminish the confidence of investors in local and regional markets.

- The DFM has a lot of significance in the Middle East because it is the business capital of the region.

- Dubai as the melting point of East and West cultures.

- The Dubai financial market is a unique Middle Eastern market.

- The DFM is central to the economic growth of the Middle East.

- Regional conflicts affect the Dubai financial market in the short run only.

- Regional conflicts do not have a strong effect on bond prices in the days following the outbreak of a conflict.

- Conflicts affect some aspects of the financial market, while having negligible effects on others.

The analysis of secondary literature revealed that conflicts have a negative effect on the DFM because it erodes investor confidence. A dip in trading volumes is a key characteristic of this fact.

In my review, I found out that many researchers have highlighted the UAE as a unique financial market and a melting point of East and West cultures. These findings highlight why DFM is central to the economic growth of the Middle East and why regional conflicts affect it in the short-run only.

The secondary literature review findings also brought to our attention the importance of understanding the impact of conflict on specific tenets of the Dubai financial market because different literatures highlighted mixed findings of the same relationship, based on the nature of the economy under study and the market subsets involved. This secondary literature review findings also brought to our attention the need to evaluate the Dubai financial market as a unique Middle Eastern market, especially considering the prevalent views of different literatures, which have tried to portray the uniqueness and centrality of the UAE market to the economic growth of the Middle East.

Expert Findings

- Global conflict was the number one risk factor for investors because it dramatically increased investment uncertainty in the market.

- Conflict exerted a negative pressure on the financial market growth of Dubai.

- Conflict eroded the creditworthiness of the UAE and made it difficult for investors to access funds.

- The uncertainty associated with conflict influences financial market performance of DFM.

- The economic and institutional development of the UAE affects its financial market performance.

- The economic structure of a country affects the performance of its financial markets.

- Duration of conflict influences financial market performance.

- Regional conflicts have a negative impact on the Dubai capital market.

- Conflict is bound to affect the views of investors towards the entire economic performance of the region and not just Dubai.

- Conflicts are bound to negatively affect commodity prices in the UAE.

- Conflicts would increase money market activities in the UAE.

- Conflicts would have a positive effect on the derivative market.

- Conflicts would have a positive effect on the futures market.

- Conflicts would have a knock-down effect on the insurance market.

- Conflicts would have a negative effect on the financial exchange market.

- Conflicts would have a negative effect on the commodities market.

These expert findings helped to complement the secondary literature review findings by proving whether the information gathered is true, or not. The experts interviewed claimed that conflict increased uncertainty in the market and exerted a negative pressure on the financial market growth in Dubai. They also said it eroded the creditworthiness of the UAE and made it difficult for investors to access funds.

The expert review findings also pointed out that the economic structure and institutional development of the UAE affected the performance of the DFM.

Their views also alluded to the fact that regional conflicts would have a negative effect on the DFM by negatively affecting different subsets of the financial market, such as the commodities market.

Some of the respondents said conflicts would have a mixed effect on the DFM because it would positively affect certain aspects of the DFM subsectors, such as the money market, derivatives market and the futures market, while negatively affecting others, such as the financial exchange market and the commodities market.

Event Methodology Findings

- Positive and neutral events had the greatest effect on stock market performance in the UAE.

- Most investors tend to overreact to global political events.

- The Arab Spring had a mixed effect on the DFM.

- The Dubai Financial market tumbled amid fears of a US military strike on Syria.

The event methodology findings demonstrated that different political events in the Middle east have generally had a negative effect on the DFM. However, these effects have been short lived.

Discussion

- Effects of Conflict on Different Economic Sectors.

- What about the Positive Effects of Conflict?

- The Uniqueness of the UAE Market.

- Role of Market Sophistication.

- Diversification of the UAE Economy.

- The UAE is a Stable Market.

- The Fundamentals of the Dubai Financial Market are Strong.

- Vulnerabilities of the Dubai Financial Market.

In this part of the presentation, I will discuss the findings I described in the other slides.

Effects of Conflict on Different Economic Sectors

- Dubai banking sector had significant movements in price during Arab Spring.

- Investment sector had the second highest movements in price because of political conflict.

- Commodities market is resilient in the wake of financial conflict.

The banking sector was the most vulnerable to conflict, while the commodities market was the most resilient.

What about the Positive Effects of Conflict?

- Industries that drive the “war machine” benefit from conflict.

- Militarized economies such as America and Russia could benefit from conflict.

- The UAE is not a militarized economy.

- Few economies report positive effects from regional conflict.

In my analysis, I found out that Industries that drive the “war machine” mostly benefited from conflict. However, the UAE was not one of them and therefore it did not benefit from conflict.

The Uniqueness of the UAE Economy

- Dubai financial market has a strong insulation from the effects of regional conflicts.

- The UAE has strong economic fundamentals.

- The UAE has a stable political, economic, and social system.

- Speculative activities insulate the UAE economy from the negative effects of conflict.

- The UAE enjoys a positive reputation as the mainstream economic sector of the Middle East.

- The UAE economy is robust.

- The UAE has a strong political, economic, and governance structure.

- There is increased diversity of the UAE economy (compared to other Middle Eastern economies).

- The UAE economic policies have reduced market exposure to conflicts.

The unique attributes of the UAE market, such as its stability and strong economic fundamentals, calm down the jitters of investors whenever conflicts arise.

Other unique attributes of the UAE economy which make it resilient to conflict include its robustness, diversity, strong political and governance structures and the unique economic policies that have reduced market exposure to conflicts.

Role of Market Sophistication

- Investors have used financial innovation to protect their investments from adverse market risks.

- The UAE is a pacesetter in the adoption of globally accepted financial and investment practices.

- Adoption of sophisticated money market tools has improved the financial position of the UAE.

Market sophistication has influenced investor perceptions of conflict in the UAE by improving their confidence in the market, even in the wake of adverse political or economic effects. The development of sophisticated financial tools, such as derivatives, hedging tools and future markets has given investors more options of managing their risks.

Diversification of the UAE Economy

- The diversification of the UAE economy from oil-dependence has improved its resilience.

- The UAE government has adopted a market diversification strategy for a long time.

- Real estate and construction sectors contribute the greatest percentage to the UAE’s GDP growth.

- The UAE holds the reputation of having the most vibrant and successful service sectors in the GCC region.

The shift from oil-reliance is a product of Dubai’s economic growth policy, which has mostly strived to diversify the economy from its reliance on oil. This policy change started in the late 1990s, when foreign firms started trooping to the UAE to invest in different sectors of the country’s economy. Today, their investments are in different parts of the country’s economy, including real estate, the petroleum industry, and financial services. The decreased reliance on the oil sector to support UAE’s economy adds to the growing body of literature that is highlighting the uniqueness of the UAE financial market in weathering conflicts.

The UAE is a Stable Market

- The UAE government has played a pivotal role in stabilizing its financial markets.

- The UAE has unique social, political, and economic dynamics that moderate the relationship between conflict and DFM performance.

- The UAE enjoys a stronger legitimacy as a robust investment market compared to other Middle East countries.

- The UAE has among the highest per capita incomes in the world.

- The UAE government does not deny its citizens their basic rights to good health care, good roads or good education.

- The UAE has a unique type of democracy that works well for its people.

The UAE has unique social, political, and economic dynamics that have stabilized the economy in the wake of political turmoil.

Therefore, the citizens have not been motivated to participate in political and social conflicts that have plagued its neighbors.

The Fundamentals of the Dubai Financial Market are Strong

- The strong market fundamentals underpinning the UAE market have made it resilient to regional conflicts.

- Strong market fundamentals have sustained the UAE’s economic growth for over two decades.

- A stable government underpins the UAE’s economic prosperity.

- Diversification remains a key economic policy in the UAE.

The UAE has strong fundamentals that have increased investor confidence in the wake of periodic conflicts. This advantage has increased its resilience during times of conflict.

Vulnerabilities of the Dubai Financial Market

- The Dubai financial market is vulnerable to the volatility of the dollar.

- The real estate and housing markets are vulnerable to liquidity squeezes.

- The lack of transparency in governance structures and the inconsistencies in trade policies amplify the market’s vulnerabilities to economic volatilities.

As recent studies have alluded to, changes in the UAE’s monetary and fiscal policies have effectively minimized some of the vulnerabilities of the UAE market. Others have disappeared because of improvements in corporate governance policies that continue to improve transparency in the management of companies. The establishment of several regulatory frameworks highlights this progress. This is why many economic experts say that, today, Dubai is booming with increased market activity, which observers have affirmed through the increased participation of foreign investors in the market.

Conclusion

- The Dubai financial market has a strong insulation from the effects of regional conflicts.

- The UAE has strong market fundamentals.

- DFM is sophisticated.

- There are positive investor perceptions of the UAE.

In this paper, we sought to answer three questions about the effects of regional conflicts on the Dubai financial market. In the first question, we investigated if regional conflicts have a positive effect on the financial market. The purpose of this investigation was to find out if the market responds well to tensions, as alluded to by some researchers who have highlighted the positive effects of conflict on some financial markets. In the second question, we sought to find out the major drivers of conflicts on the financial market. In the last question, we investigated if regional conflicts have the same effect on different segments of the financial market. Based on a review of expert opinions about the research questions, we found out that regional conflicts do not have a positive effect on the Dubai financial market. From the same source of information, we also established that the Dubai financial market is mostly insulated from the effects of regional conflicts because it has demonstrated unparalleled resilience in the midst of a turbulent political and economic environment in the Middle East.

Recommendations

- Researchers need to do more research to understand the extent that financial innovation has improved investor confidence.

- Future research should investigate the effects of financial innovation on the risk appetite of investors.

- There is a need to provide more context-specific research studies that explain the effects of conflicts on financial markets.

Since the UAE has a model economic framework for the Middle East economy, the findings of this study would also be useful in understanding the economic growth and direction that Middle East economies are following in today’s globalized market. Similarly, the findings of this study would be instrumental in understanding the measure of risk and market volatilities in the financial market (a measure that investors and portfolio managers often seek when making investment decisions about different kinds of securities and when advising their clients about the best business decisions to make). Lastly, the findings of this study would be useful in adding to the growing body of literature surrounding the impact of conflicts on capital markets and the wider financial sector.