Industry Analysis of Hyatt Hotels

Industry Classification

Hyatt Hotels Corporation is a multinational hospitality company that operates in the Travel and Leisure sector of the hospitality industry. Namely, it works in the ownership and leasing segment of the hotel industry in both Americas, Asia-Pacific, EAME (Europe, Africa, and the Middle East), India, and Nepal (“Hyatt Hotels,” 2017). The company specializes in luxury resorts, providing services to individual consumers, businesses, educational organizations, government officials, religious representatives, and the military. The company’s revenues as of 2016 are 4.4 billion dollars, placing it in the top four of US corporations in the Hotels and Resorts industry (“Revenue of Hyatt Hotels,” 2018). Other direct competitors of Hyatt Hotels include:

- Marriot International, with the revenue stream of circa 17 billion dollars (“Marriott international revenues,” 2017).

- Hilton Hotels, with reported revenues of 11-12 billion dollars (“Hilton revenues,” 2017).

- Wyndham Worldwide (5.6 billion dollars) (“Wyndham worldwide,” 2017).

Other competitors worth mentioning include Marriot Vacations Worldwide, a branch company of Marriot International, Vail Resorts, ILG, Extended Stay America, La Quinta Holdings, and Choice Hotels International, with accumulative revenues of over 8 billion dollars as of 2016. As it is possible to see, Hyatt Hotels remains firmly in 4th place, with a significant advantage in scope and revenue over a good half of the companies ranked lower in the top-10 list, but is substantially behind the giants of the luxury resorts segment, such as Marriot International and Hilton Hotels. Wyndham Worldwide, though significantly ahead in revenues (over 1 billion advantage), is the closest competitor within Hyatt Hotels’ reach.

The three top competitors of Hyatt Hotels have three main advantages over the company. These advantages are scope, reach, and reputation. Marriot International, Hilton Hotels, and Wyndham Worldwide have more properties (over 5000 for Hilton and Marriot vs. 777 properties for Hyatt) when compared to Hyatt and operate in more countries (105 for Hilton vs. 54 for Hyatt), which explains the differences in revenue between them (“Hyatt Hotels,” 2017). In addition, the competing companies were established at the beginning of the 20th century, roughly 40 years before the apparition of the first Hyatt Hotel, giving them more time to expand and a stronger brand name.

Although most high-end hotel chains provide similar quality of service due to high competition, larger hotel chains are more exposed to risks and economic threats, due to operating in more countries (Min, 2018). Hyatt Hotels focuses more on tourist resorts and countries with a relatively strong economy. Hilton and Marriot, on the other hand, operate in nearly every country. Thus, a worldwide economic crisis, like the one that struck in 2009, is more dangerous to these companies than to Hyatt.

Size and Growth

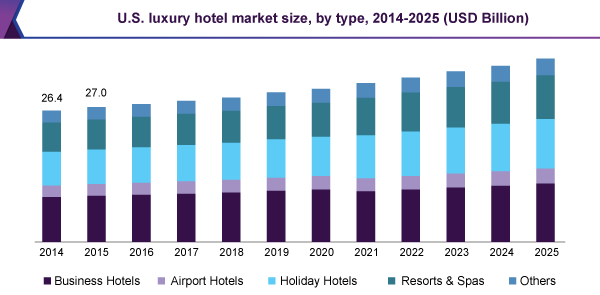

The luxury resorts segment of the hospitality industry has been in recession since 2013 when the global economy was hit by an array of shortages and crises largely revolving around the oil crisis, instability in the Middle East, political and economic sanctions, and trade wars. As a result, between 2013 and 2017, the market share for luxury hotels in North America (largest consumer), Asia-Pacific, and China fell from 36% to 32%, and 19.5 to 18.5% respectively (“Luxury hotel market,” 2018).

However, as the world economy continues to move towards globalization, as traveling becomes more and more available, and as the standards of service keep growing up, the perspectives for luxury resorts segment continue to improve (Dogru, 2016). As of 2017, the global luxury hotel market size stands at 171.1 billion dollars a year. It is expected to grow by roughly 3.9% every year, reaching 232.2 billion dollars by the beginning of 2026 (“Luxury hotel market,” 2018).

To demonstrate this tendency, Hyatt Hotels reported revenue growth of 2.3% in 2016, and the overall revenue growth for the luxury hotel segment was at 9.1% (“Luxury hotels market share,” 2018). Hyatt’s performance doubled to 5.78% in 2017, though the first half of 2018 failed to demonstrate any significant growth (“H’s revenue,” 2018). Therefore, it can be concluded that although the industry size and growth rates for luxury resorts have recovered from the recession and are showing impressive growth rates, Hyatt is lagging behind growth, which may potentially threaten its position as one of the leaders in luxury hotel segment of the hospitality industry.

Government Regulations

Luxury resorts segment and the hospitality industry, in general, is an area that suffers from loose government regulations. The term ‘luxury resorts’ is typically utilized towards 5-star hotels with the highest levels of service and accommodation. However, the conditions necessary for 5-star accommodations are not determined by any national or international legislative bodies (Aquino, 2015). Instead, the industry is using a self-regulating approach. Stars ratings are subjective and are assigned based on individual countries’ culture, perceived levels of comfort, and traditions of hospitality.

As such, there are many non-governmental evaluation boards that operate in the luxury segment of the industry. The most widely used standards are based on Forbes’ Travel Guide, its authority being supported by Forbes’ fame, reputation, and audience (Perkins, 2017). Other standards include Green Key International and Green Global, which concern themselves with eco-friendliness of luxury hotel businesses (Deraman, Ismail, Arifin, & Mostafa, 2017).

Lastly, there is the Salam Standard, which rates hotels based on Muslim-friendly criteria, such as providing spaces for prayer, banning games of chance and alcohol, as well as providing halal-based menus to customers. None of these standards, however, are operated by government bodies.

Government regulations regarding luxury industry are largely the same as those for hospitality services in general. Most law enforcement and regulatory bodies treat services provided to customers as contract-based. The only major regulations for hotels are fire safety regulations and food processing rules, which are applied to restaurants (Perkins, 2017). In the US, hotels are obligated to comply with universal standards of care for disabled individuals. Everything else, from room accommodation to security and quality of treatment is contract-based. The descriptions of services provided to the customer as per contract are typically vague or even left out, leaving many loopholes and resulting in lower customer satisfaction.

However, government barriers to luxury hotel segment of the industry are typically associated with political and economic situations in any given country. Pressure on the hotel industry is typically applied in order to protect regional providers, which is often the case in China, or to facilitate asymmetrical economic warfare. As an example, foreign luxury resort providers, such as Western Best, were forced out of Crimea following its occupation by Russia and the ensuing political and economic blockade (Zverev & Sichkar, 2018).

As it is possible to see, there are major discrepancies in the quality of provided luxury services, which are largely based on companies’ own internal standards. This makes competition more difficult and results in customers being unsatisfied, especially when moving from one hotel chain to another (Zervas, Proseprio, & Byers, 2017). In order to ensure a fair playing field and protect customers, major luxury hotel companies should examine the possibility of developing a unified system of ratings and conditions based not only on the objective investigation but also on customer feedback.

Despite the recession suffered in 2009-2013 due to economic and oil crises, which left a significant impact on the world economy, the luxury segment of the industry has been experiencing growth in revenues, amounting to roughly 9% ever since 2016 (see Appendix A). All major luxury resort companies, such as Marriot, Hilton, Wyndham, Hyatt, and others, have been experiencing an increase in revenue flows.

Although Hyatt has been lagging behind others, it remains firmly in the 4th place. The influence of government regulations on the luxury hotel segment remains limited, with the industry largely left to regulate itself. One of the major challenges for the industry remains the adoption of unified standards of quality of care in order to protect the customers and introduce a fair playing field for international competition.

Company Analysis of Hyatt Hotels Corporation

Company Profile

Hyatt Hotels Corporation is one of the four major multinational companies conducting business in the hospitality industry, providing services in luxury resorts. It has 777 properties in 54 countries around the world, working in all major countries in North and South Americas, Europe, Africa, the Middle East, and China. It operates under several different names, such as the Hyatt, Miraval, Grand Hyatt, Park Hyatt, Andaz, Hyatt Zilara, Hyatt Ziva, Hyatt Resorts, and several others (“Hyatt Hotels,” 2017). Brand distribution and trademark differentiation enable it to maintain a solid standing in residence countries. The services provided by the company include full-service lodging, select-service lodging, extended-stay lodging, and all-inclusive accommodations.

The company was founded 1954 and purchased in 1957 by Jay Pritzker, a wealthy entrepreneur, who later transformed Hyatt into one of the most famous hospitality brands in the USA. Hyatt business started with the opening of a single hotel space in Los Angeles, serving the guests and visitors of the local international airport. As of 2018, Hyatt has a diverse portfolio of residencies and luxury resorts, with over 750 individual hotels spread into eight product lines. The company is notorious for its high standards of service and a developed corporate culture, which often scored Hyatt as one of the best places to work at, according to Forbes and other ratings.

Industry classification

Hyatt Hotels is part of the luxury hotel industry, which aims for the high-paying customers by providing them with 5-star luxury resorts. The primary target audience of such services includes wealthy tourists, business owners, high-paying professionals, diplomats, working groups, and other individuals that possess the capability to pay premium prices for their accommodations. According to the market research report (2018), the US luxury hotel market size was valued at 83 billion dollars in 2017, out of which more than 50% (46.9 billion dollars) are accumulated by the top ten companies in the industry (“Luxury hotel market size,” 2018). Hyatt’s revenues for that year were at 4.6 billion dollars, which amounts to roughly 5% of the segment’s total.

The company’s revenues are largely tied with the situation in the US domestic hospitality market, where the majority of Hyatt’s assets are currently located. Hyatt Hotels competes with Mariott, Hilton, Wyndham, and other companies located in the US. The industry is very competitive, which is why Hyatt was unable to facilitate growth and claim more market share. At the same time, it missed the opportunities to consolidate in other countries, possessing minimal assets there, when compared to the bulk of properties located in the US. The industry is developing, however, promising to grow even more by the end of 2025, offering Hyatt potential opportunities to expand.

Size and growth

Hyatt Hotels is rated the 4th strongest luxury resort brand in the world, its revenues at 4.6 billion dollars in 2017. Its total assets amount to 7.7 billion dollars in 2017. The number of properties owned by the company is at 777, out of which over 500 hotels are located in the USA. Therefore, most of the yearly income for Hyatt Hotels comes from its domestic market. In total, the company provides its customers with over 180,000 rooms, and operates in 54 countries (United States Securities, 2017).

By the end of 2016, the company employed approximately 45.000 workers worldwide. These include corporate office employees, regional office employees, hotel service and management, and residential property management. Out of this number, approximately 25% of employees were unionized, while the rest worked under a labor agreement. Hyatt utilizes an additional number of third-party employees to address certain specialized needs of the business (such as reparations, plumbing, etc.), but these do not count as Hyatt employees. The average employee to establishment ratio is roughly 60 staff members per hotel.

The company focuses on cultivating the best people and evolving the culture. It is a strategy of retaining customers. Hyatt has proven to be very successful in generating a strong and loyal customer base in the USA and abroad. However, their existing strategy seems to lack in attracting new individuals, as benefits for long-term customers and loyal partners far outweigh any programs that are aimed at increasing the overall market share (United States Securities, 2017). Without a steady influx of new customers to facilitate growth in the loyalty sector, rapid strides in revenue growth seem unlikely.

Hyatt’s growth rates in the past three years, although present, have been largely unimpressive. Although, worldwide, the revenue growth for the luxury hotel industry went over 9%, the company’s own growth varied between 2.3% and 5.8% at its highest (United States Securities, 2017), which indicates a flat line in growth and an inability to continue expanding and claiming new market share. Consequently, the majority of Hyatt’s competitors managed to follow the industry growth rates by expanding into other markets, such as Europe, Asia-Pacific, and the Middle East.

Company profitability

There are many internal and external factors that may affect company profitability in the luxury hotel segment. Although Hyatt has complete control over the internal matters within itself, the external factors often play a bigger role in determining profit margins. This portion of the paper will cover these factors as well as product segmentation, degree of company concentration, and price factors.

Factors affecting profitability

Some of the main factors that influence a company’s profitability in the luxury hotel industry are market position, diversification, marketing capability, operational management, financial policies, capital structure, cash flow protection, and financial flexibility. Analyzing Hyatt hotels through the prism of these parameters would provide a more accurate picture of why their profitability remains subpar when compared to their direct competitors.

Hyatt has a relatively strong position at its domestic market in the USA. North America is the prime consumer of luxury hotel services, amounting for over 30% of global revenues. The company is firmly in the 4th place, as other competitors are at least 1 billion dollars behind in revenue (“Hyatt Hotels,” 2017). Hyatt holds assets in nearly every major city, its hotels strategically positioned near airports, sea resorts, railway stations, and other important and easily accessible locations. However, as it was already stated, the American luxury hotel market is saturated, so chances of growing or claiming significant market share are slim.

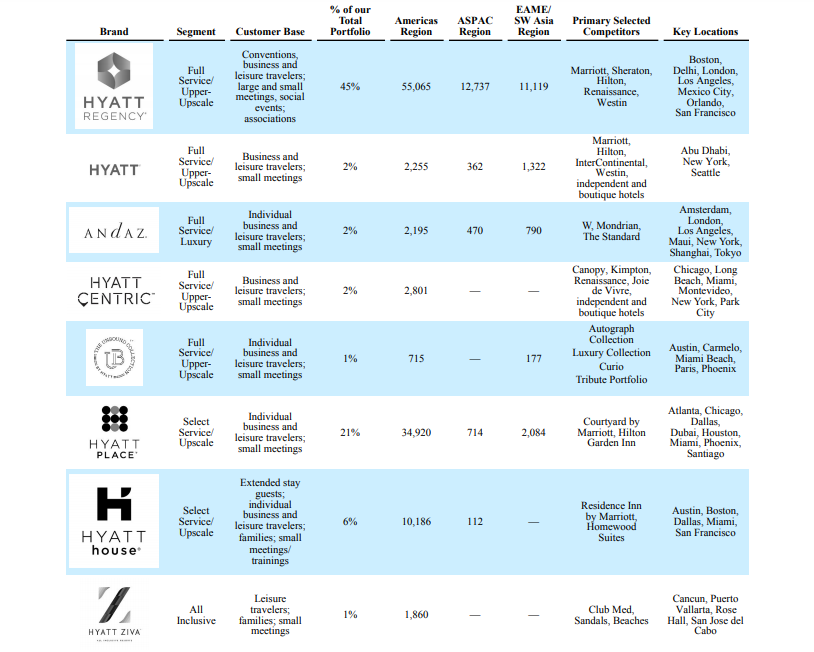

The company made a good effort to diversify its brands. As it stands, there are several famous brand names under the umbrella of Hyatt Hotels, such as the Hyatt, Miraval, Grand Hyatt, Park Hyatt, Andaz, Hyatt Zilara, Hyatt Ziva, Hyatt Resorts, and several others. These brands provide a diverse array of high-end luxury hotel services, aiming at individual leisure tourists, small events, conventions, sightseeing, training, business, and family fun. However, not all of its properties are all-inclusive. Zilara, in particular, brands itself as an adult-only hotel, providing no accommodations for families with young children (United States Securities, 2017).

In its marketing campaign, Hyatt focuses on the high-end traveler. The goal is to position the brand as the best possible choice in every operational marketing segment. The company advertises itself as a loyal and community-driven enterprise focused on providing its loyal customers with high quality of service, while at the same time remaining flexible and adaptable to every individual customer’s needs. Hyatt is focused at differentiating its brands and making them famous in their specific segments.

The marketing campaign makes use of big data and analytics, in order to track customer preferences. One of the biggest driving marketing points for Hyatt is its loyalty program, which is more advanced compared to its direct competitors. The company makes use of social media, online channels, and the internet to advertise its services and provide effective and autonomous booking and room management experience.

In regards to operational performance, Hyatt states that its goals are to maximize potential revenue through competent management and thrifty spending while providing a high standard of quality and service. Every individual hotel receives performance goals, whereas general managers have greater operational autonomy in order to achieve them. Compensations for managers and staff are based on property performance, in order to further motivate hotel staff to provide the best quality of service. Costs are managed at hotel and corporate levels, and savings are used to promote brands and facilitate growth.

The financial segment of the company is represented by financial policies, capital structure, cash flow protection, and financial flexibility. Hyatt has adopted a conservative economic policy, aimed at maintaining financial resources at an adequate level to pass through industry cycles and economic downturns. Its cash and short-term investments are always kept at around 550 million dollars, with circa 1.5 billion in borrowing capacity (United States Securities, 2017). In terms of investments, the company adheres to a formal investment process. Therefore, Hyatt hotels has the reserves to operate in unfavorable conditions and provide protection and compensation to its stakeholders and shareholders.

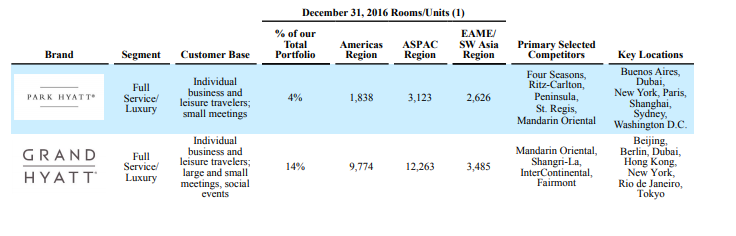

Product segmentation

Hyatt provides differentiated services in luxury, upper-upscale, and upscale-class hotels. The company differentiates its brands in order to provide a unique experience and cater to specific customer wants and demands. Park Hyatt chain of hotels is established in green areas and seeks to provide a cozy, comfortable, and intimate experience for its guests. These hotels are aimed to cater to a specific segment of the market, namely leisure travelers and small groups of individuals wishing to have a relaxing holiday.

Grand Hyatt hotels are placed in strategic areas, such as gateway cities and major resorts (United States Securities, 2017). They cater to high-end tourists and business professionals seeking to spend a few days between flights in an atmosphere of luxury and grandeur. These hotels are located near airports, railway stations, and other important transport locations, in order to ensure easy access.

Hyatt hotel chain is a series of smaller, home-type hotels aimed at individuals seeking to explore the countryside and various neighborhoods (United States Securities, 2017). These hotels are smaller in comparison to Grand Hyatt or Park Hyatt, due to lower intensity of visitors. However, they maintain high standards of quality and seek to provide visitors with a home base during traveling and exploration.

Andaz is a series of ethno-centric hotels placed in various colorful destinations around the world. It seeks to cater to tourists and individuals wishing to visit exotic lands and countries. These hotels are made to resemble various authentic cultures in order to provide an immersive experience. They are built using national architecture and traditions, and serve local cuisine.

Zilara is an adult-only resort for individuals and couples. It caters to young families and tourists who do not wish to be bothered by children. It provides various services to help customers unwind and enjoy themselves in the company of others. Ziva, on the other hand, is an all-inclusive hotel chain that seeks to cater to customers of all ages, serving as an excellent spot for family fun.

Other hotel chains under the umbrella of Hyatt Hotels provide additional service segmentation, seeking to serve as business platforms, party houses (for Millenials), home vacation resorts, and shopping areas (United States Securities, 2017). As it is possible to see, Hyatt is using its vast properties to adhere to every segment of the luxury tourism market, reaching out to all customers. However, due to the majority of the company’s assets being located in the USA, some of these chains are more influential and widespread than others.

Degree of company concentration

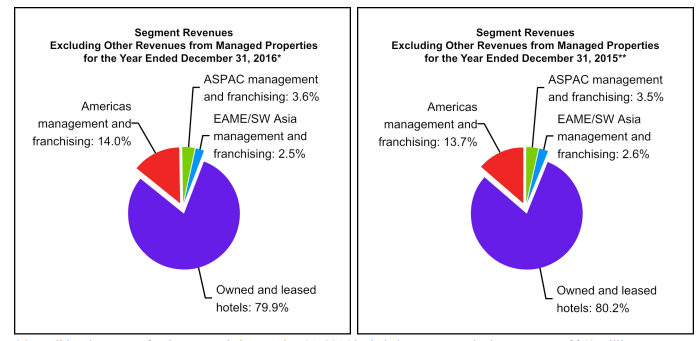

Hyatt Hotels is a company primarily concentrated in North America, with the majority of its revenues being generated at the domestic market. Although it recognizes the need to establish a presence in other regions, the amount of properties placed in there is relatively slim in comparison to the projected revenues to be derived from those regions. The company concentration for individual hotel brands is as follows (See appendices B and C):

- Park Hyatt: Residences can be found in the USA, Europe, Australia, the Middle East, and South America. Percentage of total portfolio: 4%.

- Grand Hyatt: Residences can be found in the USA, Europe, South-America, and the Asian-Pacific region (China, Japan, Malaysia, etc.). Percentage of total portfolio: 14%.

- Hyatt Regency: Residences can be found in the USA (primarily) and Europe. Percentage of total portfolio: 45%.

- Hyatt: Residences can be found in the USA and the Middle East. Percentage of total portfolio: 2%.

- Andaz: Residences can be found in the USA, Europe, Australia, the Middle East, Asian-Pacific region, and South America. Percentage of total portfolio: 2%.

- Hyatt Centric: USA-based chain of hotels. Percentage of total portfolio: 2%.

- Hyatt Place: USA-based chain of hotels. Percentage of total portfolio: 21%.

- Hyatt House: USA-based chain of hotels. Percentage of total portfolio: 6%.

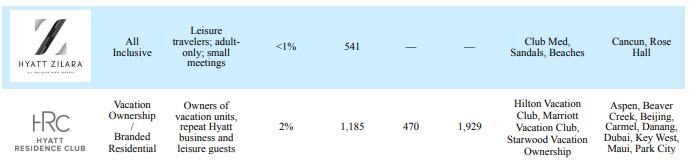

- Hyatt Ziva: Resorts are primarily located to the western coast of the USA and in Mexico. Percentage of total portfolio: 1%.

- Hyatt Zilara: Located in Cancun and Rose Hall. Percentage of total portfolio: less than 1%.

- Hyatt Residence Club: Residences are located in the USA, Europe, and China. Percentage of total portfolio: 2%.

As it is possible to see, Hyatt is overrepresented in the USA, with all of its chains being presented in the country, and some of them being US-exclusive. At the same time, chains operating outside of the US, such as Park Hyatt, Grand Hyatt, and others, are substantially smaller. This kind of company concentration is unhealthy for businesses that consider themselves global brands. According to the annual financial report, Hyatt recognizes the issue and seeks to expand into other regions, diverting more resources there. However, the progress is slow.

Price factors

Although Hyatt Hotels runs a high-end enterprise, the relative price of services still plays a major factor, especially when it comes to the lower end of upper-class travelers. Pricing in a luxury hotel industry is affected by internal and external factors. Internal factors help establish the prime costs for the services provided. These costs include payments for materials, foods, equipment, furniture, rent, employee compensation, and various other expenses associated with the hotel industry. These costs are closely tied with the presence of suppliers, the quality of workforce, the number of customers visiting, customer purchasing power, and other factors.

Naturally, to remain profitable, Hyatt keeps its prices above the prime costs. However, while the factors mentioned above determine the lower cost margins, the upper ceiling is determined almost completely by competition (Cox, 2014). In order to remain competitive, all major hotel brands compare services with one another, in order to find an equilibrium.

If we compare Hyatt with one of their main competitors, Hilton, we could see that the latter offers more for the same amount of money. A 190 sq. feet room with a king-sized bed in Hyatt costs roughly 379 dollars a day. At the same time, Hilton offers 330 sq. feet accommodations for the same price (“Hyatt vs Hilton,” 2018). However, there are differences in services both hotels provide. Hyatt features free Wi-Fi for all residents, whereas in Hilton only the holders of Hilton Honors program have access to the internet. It is a significant detriment, as internet has become a part of everyday life as much as hot water and air conditioning.

Another factor to count in when comparing prices is the members program. As Hyatt’s marketing strategy is aimed at retaining loyal customers, the majority of benefits, such as free breakfasts, discounts, and tours are available only to the holders of their Golden Passport. Thus, the company’s prices are calculated to obtain revenue by attracting the same people over and over, rather than generating trade turnover. To summarize Hyatt’s pricing strategy, it is more expensive for first-comers, and less expensive for loyal customers, with the difference between price tags aimed to make the loyalty program more attractive.

Company Vision, Mission, and Guiding Principles

According to the company’s 2017 annual report, Hyatt Hotels’ vision and mission statements are as follow (“Hyatt Hotels,” 2017):

- Vision Statement: A world of understanding and care.

- Mission Statement: To deliver distinctive experiences for our guests.

These statements are succinct and are aimed to cater to a customer’s desire not only for physical, but also for the emotional comfort. It reflects on Hyatt’s philosophy of customizing the environment to every individual customer and deliver personalized comfort and care rather than standardized luxury treatment as seen in other hotel chains. The company has a very developed corporate culture, where the management teams are supposed to lead by example. The autonomy provided to general managers helps them address the needs of the customers directly, without having to wait for feedback from the regional offices.

The objective for the company is not just objectively high levels of service, but increased customer satisfaction. The perception of care is as important as the standards of care that makes the Hyatt brand famous. The corporate culture is meant to ensure high levels of engagement from the employees, as engaged employees provide better care and make the venture profitable to its owners. Lastly, Hyatt is hoping to achieve sustainable advantage by implementing these three key qualities, such as the focus on the customer’s perceptions, high levels of employee engagement, and high standards of care.

The company strives to create a familial environment and facilitate a relationship of trust with their customers. This type of personalized care, however, also results in increased complexity of the company’s supply and logistics chains, as a lack of standardization causes additional expenses. Overall, these statements set Hyatt apart from their competitors and make the company unique.

External Environment Evaluation

Hyatt’s external environment historically has been based on rigorous competition between various hotel chains. The two crucial factors that enable adopting a differentiated model in luxury hotel business is good choice of location comparative to the target demographic and quality of service. After all the potentially profitable locations for were claimed, the quality of treatment became one of the main tools for expanding customer base. However, Hyatt’s quality is matched by its direct competitors. Overall, the environment can be described as relatively stale.

Threat of new entry

On the domestic market, Hyatt is not being threatened by new entries. Historically, the hotel industry had one of the highest entry barriers (Cheng, 2013). This is due to the fact that hotels are intertwined with construction, as they need to be built first in order to function. Construction is a long-term financial investment with plenty of risks and fixed costs. Thus, chances of new entries into the competition are low, as it requires many resources to compete with hotel chains already established.

However, in the areas where Hyatt is not established as a dominant brand, there are possibilities of being challenged by domestic hotel chains and boutique hotels. In foreign markets, the threat of new entry for Hyatt is thus higher, as it prevents the company from effectively expanding into the regions other than America.

Power of suppliers

A luxury hotel typically produces most of the services it needs to function on its own. Its current list of suppliers include audio and visual suppliers (Vae Corp., DNA, Soundshine), cake and specialty desserts suppliers (Bechler, Go Espresso, Freedom bakery), flowers (Borgia, Salinas, Premiere), decorations (Illusions of Grandeur, Formal Creations, GBS), transportation, waiter services, and others.

This list is highly-diversified, meaning that no single supplier has too much potential to threaten Hyatt’s operations. Thus, Hyatt is not in danger of being threatened by the collective bargaining power of suppliers (Cheng, 2013). However, one supplier that may affect Hyatt’s operations on a local scale is labor and experienced personnel. Due to Hyatt’s corporate culture and high retention rates, it is unlikely for understaffing to become an issue in the foreseeable future. Bargaining power of suppliers is deemed as low.

Power of customers

The luxury hotel industry in the USA is an extremely competitive environment, where every major city and resort has several hotel chains that provide relatively similar services, both in terms of quality and pricing (Cheng, 2013). Thus, customers have a wide variety of choices when it comes to picking their hotels. In order to maintain parity with other competitors, such as Hilton, Marriott, and various boutique hotels found in individual cities, Hyatt requires to conduct market research and allow plenty of customization to adhere to their customers’ needs. This puts plenty of power in customers’ hands, as they profit from individual and collective bargaining. Buyer’s power level towards Hyatt, thus, is deemed as high.

Threat of substitutes

Luxury hotel industry does not sell luxurious accommodations only, but also offers experiences (Cheng, 2013). Hyatt operates in the luxury segment of the market, attracting wealthy customers, to whom the price is a secondary concern at best. Low-cost services such as Airbnb and various come-and-stay initiatives cannot threaten Hyatt. Almost all other innovations and substitutes in the hotel industry are aimed at the lower price range, where the competition is based around comparatively modest services and prices. The only way for Hyatt to lose clients and money to substitutes is in the event of a large-scale economic depression, which would force some of its customers to switch to cheaper alternatives. Thus, the threat of substitutes is deemed as low.

Intensity of rivalry

The hotel industry, despite being highly competitive, remained relatively static in the past 20 years or so. Hyatt, as well as most of its competitors, provide similar services and usually compete in terms of pricing and bonuses unique to individual providers. Each hotel chain has loyal customers that will keep them afloat. While the company has advantage in some cities, where it managed to coin strategic locations for its hotels, such as San Francisco, New York, London, Atlanta, and others, it did not push other hotel providers out of business, as these cities had more than one available airport.

This is what enabled Hyatt to compete to older hotel chains in the first place. But now, the domestic market has been filled, so Hyatt struggles just to maintain its current positions. Thus, despite intense competition, it is unlikely for Hyatt to lose its market share in the domestic market, so long as it matches others in terms of quality.

The situation is different in the Asia-Pacific segment of the market. The competition there is much higher, as Hyatt competes not only with the likes of Hilton and Marriott, but also with smaller domestic brands. Government involvement and geopolitical situation makes this competition even harder. Hyatt is trying to apply its standard strategy of building properties on strategic locations, but this effort is relatively slow.

As it is possible to see from Porter’s Five Forces analysis presented above, the reasons why Hyatt has seen subpar growth in the last decade or so is because of its external market situation. The company is in a position where intense competition is required just to hold on to the existing market share, and where customers have the power to choose between many of the same kind. Due to Hyatt’s holdings located in the USA, a market oversaturated with powerful competition, Hyatt’s growth in there is no longer possible.

Identification of Differentiators

There are many differentiators in luxury hotel industry that affect the overall performance and impression of the customers towards the particular brand or service. Some of these differentiators are as follows (Stotler, 2016):

- The use of internet technology.

- The choice of geographic locations.

- The quality of service

- The amenities offered to the customers.

- Customer engagement.

According to surveys regarding the state of luxury hotel segment of the hospitality market the main driving differentiators behind a company’s success or failure are top-notch quality of service and levels of customer engagement. As it stands, the rest of the differentiators are relatively similar from one luxury operator to another – all five-star hotels offer large and luxurious rooms with all the necessary amenities, e-booking technology is now a standard in the hospitality industry, and all major hotels are located in comfortable, economically-viable and picturesque locations. This leaves customer engagement and the quality of service to make the difference between a satisfied customer bound to return and a one-timer.

Hyatt Hotels understand this trend, as they, along with other companies in the luxury sector, are faced with indirect competition from the likes of companies like Airbnb and others (Stotler, 2016). They retain an omni-channel customer engagement platform in order to communicate with customers and potential customers and provide the ideal conditions of life for them. Interactivity between the customer and the hotel enables quick and efficient customization of the living space and solvation of any quarries or requests that the customer might have.

Centralized hotel chains like Hyatt can implement various value-adding services, ensuring the uniformity of service quality across its chains, which is something that decentralized hotel services cannot accomplish. In addition, Hyatt utilizes proactive customer care, which includes special offers about dining, shopping, and various events available in the area. The company has introduced an automated advice service to inform its customers about any important events and popular destinations.

Lastly, Hyatt implements an array of workforce optimization tools in order to achieve efficiency with its personnel. Using pace recorder systems and plotting out routine operations of individual employees can save time and improve efficiency of labor, which would mean lower waiting times for the customers while operating at full house. Thus, Hiatt is focusing on the two differentiators that matter the most while maintaining an adequate performance with the rest.

Analysis of Internal Environment

SWOT analysis

SWOT analysis is a tool often used in business planning as a means of analyzing the company on micro and macro levels, helping highlight its strengths, weaknesses, opportunities, and threats to the business. The success of Hyatt Hotels is largely based on its business model and its choice of residence locations. Hyatt Regency, one of the most profitable luxury branches of the company, has hotels in every major city in the US, scoring profitable locations near large international airports. This is why Hyatt is chosen by professionals who need to travel often.

Another strong suit of Hyatt is its brand recognition. Although it is less pronounced in Europe and Asia-Pacific, the company has over 500 hotels in the USA, which have been in service since 1954 (“Hyatt Hotels,” 2016). As such, the company is widely known and recognized in North America, which is the largest hospitality market in the world. Having received numerous awards over the years, Hyatt is a powerful brand known for its quality of service and loyalty to customers.

The focus on the customers and willingness to provide a personalized and comfortable environment result in extremely high customer retention rates for Hyatt. These customers allow the company to project future revenues and be less wary of customer losses due to price changes, which was invaluable during the economic crisis (See Appendix G).

Lastly, the company has experience diversifying its assets and money flows, which gives it a broad variety of incomes, making it more stable in times of crisis and promoting a greater recognition of the brand both domestically and abroad. It also allows for flexibility of opportunities in business, which is important in the ever-changing landscape of luxury segment of hospitality industry.

Some of the weaknesses that Hyatt suffers from internally include having a domestic brand, little product diversification, and strong competition. It prevents the company from effectively expanding abroad, as the USA is home to other strong and highly competitive brands, such as Marriott and Hilton. It is the reason why Hyatt has been perpetually stuck in the 4th place among international luxury hospitality providers (“Hyatt Hotels,” 2016). Another weakness involves global market penetration and discontent about salaries because of it. As Hyatt is being exposed to foreign markets, it balances its wages according to the national standards of the operating country, creating discontent among employees.

Opportunities for Hyatt emerge from the gradual shift from a standard of luxury care to personalized approaches to individual customers, which falls in line with the company’s vision and mission statements. Modern luxury hotels will be expected to provide room customization services based on virtual and 3-d technology. In addition, the increased importance on ecological and psychological friendliness might attract new customers to Hyatt.

Other opportunities include improving retention, setting higher standards of quality, and improving membership plans. These opportunities, should they ever be played upon, would quickly be scouted and copied by other companies. However, being the first to establish them will position Hyatt as the innovational leader of the segment.

Some of the largest threats to Hyatt are the presence of very strong competitors in the luxury industry, who could potentially match the company at every turn, rendering all the efforts at innovation moot. In addition, there are always threats of international and domestic terrorism as well as political sanctions on the company. These risks must be accounted for, especially in China and the Middle East. Other threats involve losing positions in the domestic market, either by them leading the quality of service race or through other means. Security risks, especially cybersecurity, are also dangerous, as Hyatt cannot afford to lose respectable clients because of a privacy breach.

Competitive Analysis

Value chain analysis

Value chain analysis identifies activities that could potentially create value for the company. Hyatt Hotels, just like its direct competitors, utilize similar approaches in organization of their service processes, a differentiation analysis would be more likely to provide a sustainable advantage. The company tries to create value by providing high-end general luxury services as well as various specialized resorts to cater to particular customer needs. Customization and high rewards for loyalty remain some of the main positions in Hyatt’s value chain.

VCA analysis:

- Value-creating activities. Present VCAs: Loyalty reward programs and customization options. Potential VCAs: Customers want full autonomy and interactivity starting from booking an apartment to determining its aesthetics, the positioning of furniture, and possible styles of design.

- Improving customer value. Hyatt Hotels should provide the customer with easily accessible mobile applications that will contain a variety of options for the customer to customize their room, entertainment program, and schedule according to their wishes and needs.

- Improving retention and relationships with suppliers. Hyatt Hotels can generate value by establishing better relationships with their staff and suppliers. Higher levels of motivation would ensure better prices and higher quality of service. The company could sell more for less.

- Inbound logistics. The company can generate additional value by simplifying and streamlining its logistics process. This can be done by including local providers into the logistics chain, thus avoiding extra costs associated with transportation and warehousing. This can be done in the domestic market and abroad. Hilton uses similar VCA.

- Amenities. The current list of high-end amenities provided by Hyatt includes in-room WI-FI, the Hyatt PlugPanel, toiletries provided by June Jacobs, KenetMD, Le Labo and bedding provided by Portico. These VCAs already outpace Hilton and Marriott, who do not provide in-roomWI-FI in some hotel rooms. The company can expand on this by providing additional services free of charge.

- Identifying best-sustainable differentiation. Hyatt Hotels could sustain this newfound advantage by charging customers extra fees for the ‘fully customizable’ option. As outfitting a room to an individual customer will take resources and decentralize the process, the extra fees should be imposed to cover these losses and help compensate the development of the smartphone application. This can be integrated into the existing SPIRIT system, currently used by Hyatt to service its clients and provide the existing customization options.

Rivalry analysis

Hyatt’s rivals vary from one location to another, as there are community favorites in nearly every location. The quality of resorts usually depends on the location, individual management decisions, quality of service, and a variety of other factors that influence the rivalry between various competitors. On the macroeconomic level, three main competitors of Hyatt are Marriott, Hilton, and Wyndham (“Hyatt Hotels,” 2016). These competitors are similar to Hyatt in terms of prices and quality of service.

However, Marriott and Hilton are widely recognized on the international markets, as they have existed for a longer time and managed to expand before anyone else. They have built hotels in many strategic location in large hub cities around the world, such as London, Berlin, Rome, Beijing, Tokyo, Singapore, and others. Therefore, they have access to those countries’ markets, while Hyatt does not. Its properties outside of the US are limited. At the same time, it is unlikely for Hyatt to gain substantial competitive advantage in North America due to high levels of competition against companies with longer history, stronger brands, and greater number of assets throughout the country.

Hyatt faces competition from local brands located abroad as well. Some of the most prominent competitors include Taj Hotels, Trident Hotels, and Starwood Hotels and resorts. These chains were created using foreign capital and have a long-standing relationship with Indian and Middle-Eastern governments. Due to the specifics of the Asia-Pacific markets, government interventions and protectionist policies are more likely to become a factor to hinder Hyatt’s entrance to the market.

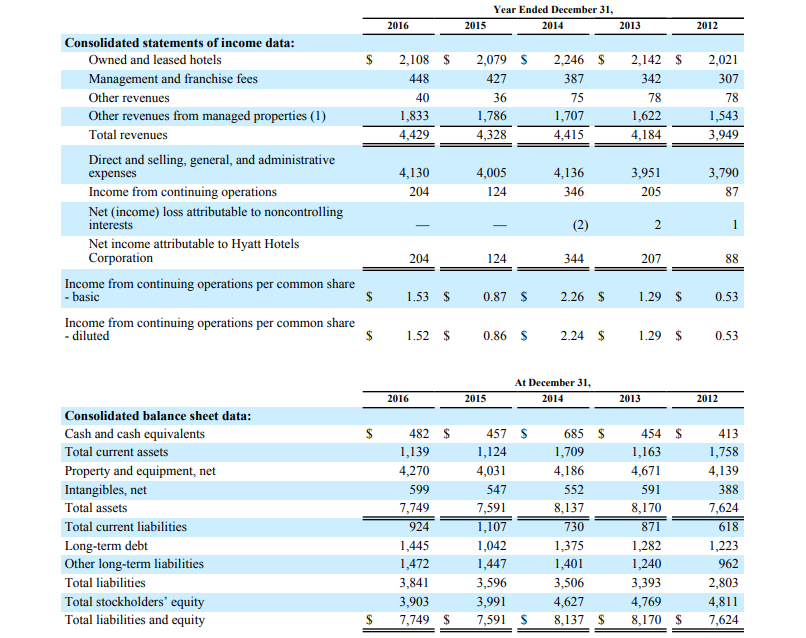

Financial analysis

Hyatt Hotels’ revenue by the end of 2017 totaled at about 4.68 billion dollars, with a small marginal growth increase of 5.8% when compared to 2016 (See Appendix F) (United States Securities, 2017). According to the financial statement report, around 78%-80.6% of the company’s total revenues were derived from operations in the United States (See Appendix E). The company’s return of assets (ROA) have been relatively modest, though have seen an increase when compared to the period between 2009-2011. The ROA has since increased from -0.6% to 1.5% (United States Securities, 2017).

Hyatt Hotels Corporation is rated below average in earnings per share when compared to their competitors. In that regard, the company totals at about 144,676,409 of EBITDA per earnings per share. The company derives its revenues primarily from hotel operations, with management and franchise fees generating a secondary revenue flow. By the end of 2016, the net income attributable to Hyatt totaled at 204 million dollars.

Adjusted EBITDA for that year was calculated at 785 million for its hotel operations (See Appendix D). Based on this information, it is possible to conclude that Hyatt has reached a point of small marginal growth close to that of a standstill. Its ability to grow is directly linked with its position in the domestic market as well as in various prospective markets located abroad.

By analyzing this financial data, it is possible to make some key conclusions:

- The USA remain the company’s main source of financial income. The connection between income and ROA shows that the company’s revenues are directly tied with the population’s economic prosperity. Financial crisis of 2009-2011 caused the ROA to drop to -0.6%, with subsequent recovery.

- Low EBITDA growth is financial proof of the company’s stagnancy. Nevertheless, its overall EBITDA scores are relatively high, indicating that Hyatt has no issues with profitability and cash flow management.

- Hyatt has relatively high reserves and borrowing power.

Executive Summary

Problem Identification

The analysis of Hyatt’s revenue flows for the past ten years in comparison with its competition reveals signs of serious problems that cause the company’s stagnation. If a company is unable to expand, it eventually starts losing its market share as well as its competitive edge. Hyatt’s main problems are as follows:

- Lack of expansion space in the domestic market. As it is possible to see, a recurring theme throughout this entire analysis is that Hyatt Hotels had fallen into a slump because of the oversaturation of the US luxury industry market. There is no more room for the company to grow and claim additional market share. Therefore, its only choices in the US market are limited to retaining their client base and seeing marginal expansion in the overall market.

- Poor expansion into other markets in the last few decades. Hyatt brand is not widely recognized abroad. Although the company possesses several properties in each of the strategic hub cities, these properties are vastly outnumbered by international and domestic competition. Without a strong international brand name, Hyatt does not have a chance of succeeding and outperforming its competitors, who benefit from a well-diversified property chain.

- Reactive approach to external challenges and threats. For the last decade or so, Hyatt has not been expanding as quickly as it should have, in comparison to other companies. In part, this is due to the inability to generate fresh and innovative ideas that would push the company ahead of its competition. The company does not have an R&D department that would help analyze the existing systems and generate improvements in customer services, logistics, employee rotations, and so on.

- Lack of a well-defined brand. Strictly speaking, neither Hyatt nor Hilton or Marriott do not provide anything special, which cannot be found in other hotel chains. Quality is standardized and uniform across the luxury segment of the hospitality market. Without a well-pronounced brand that has more to offer than simply quality, experiences, and loyalty programs, Hyatt will continue to stagnate.

Generation of Alternatives for Problem Solution

Here are some of the potential solutions to Hyatt’s identified problems:

- Solution A: Increasing efficiency in the domestic market. Underperformance of various properties in the domestic market is a problem, as it generates more expenses and lesser revenues. The entire Hyatt chain should undergo a comprehensive value analysis in order to determine which parts of the company are lagging behind, and why. This would help effectively shave off unnecessary enterprises, thus saving money, without suffering a loss of market share.

- Solution B: Quick expansion into foreign markets. The answer to Hyatt’s stunted growth problem is relatively simple. The company must cease being a US-based corporation and embrace other international markets. However, this is easier said than done. As it was already mentioned in the Porter’s Five Forces analysis, the barriers for entering a new luxury hotel market are high. Constructing new hotels takes time and money. In addition, all of the good geographic locations are likely occupied by now. Although Hyatt possess roughly 550 million dollars in cash to be used for short-term operation, and a 1.5 billion dollars in borrowing capability, the cost of an average 5-star hotel varies between 200 to 300 million dollars. The company must generate additional finances in order to sponsor an expansion to the Eastern continent.

- Solution C: Investing in an R&D department. We live in the 21st century, which is the century of technology and innovation. A company as large as Hyatt cannot operate without having a fully-fledged R&D department that would seek out new ways of integrating technology into services, analyzing the efficiency of current methods, and proposing improvements. As it stands, Hyatt relies on outside companies to perform these functions. The results of the last decade have shown the inefficiency of that approach.

- Solution D: New brand image. Hyatt should consider becoming the high-tech leader of Hotel industry through the integration of the Internet of Things and promoting advanced cybersecurity measures in its properties. The modern generation is more conscious about the internet, e-socialization, and cybersecurity. Hyatt could become the most high-tech and futuristic hotel chain out there, as it already outpaces Hilton and Marriott in terms of provided electronic amenities.

Strategic Recommendations

There are several goals for Hyatt to accomplish, if it wishes to increase its growth rates and expand into other regions. First goal is to generate enough money to acquire new hotels in Europe, the Middle East, and the Asia-Pacific region. It is advised to not get involved in long-term construction, as that course of action could effectively become a money sink for the next decade. Instead, Hyatt should look to purchase local hotel chains and boutique hotels in order to increase the company presence in key strategic areas around the globe. In order to generate enough money to afford such purchases, the company should consider selling off some of its properties in the USA.

These properties should be chosen based on their annual revenue generation rates. Underperformance of certain hotels could be explained by oversaturation of the US market, strong competition in the area, or a lack of potential customer interest. Lastly, the company must rebrand itself from mere high-standards and customer-loyal company into a high-tech company implementing the best cybersecurity practices to protect its clients. Thus, to summarize, strategic recommendations include the following:

- Recommendation I: Become an international hotel chain in the true sense of the word. Main profits should be generated relatively equally across all regions, not just the over-saturated North-American hotel market. Following this recommendation may cause temporary revenue drops, but will be benficial in the long run.

- Recommendation II: Optimize efficiency on the use of existing properties in the domestic market. This recommendation must be implemented before the one listed above. It would help reduce the losses and prevent the existing loyal customer base from switching to other hotels. Losses are inevitable, but they can be minimized.

- Recommendation III: Hiring specialists in hotel logistics, IT, and cybersecurity and reorganizing them into a full-fledged R&D department. Not only would it help with the optimization of existing processes, but would also help develop new services, such as the fully-customizable room project, which was recently featured in the newest trends and developments in hotel industry.

- Recommendation IV: Hyatt should develop a new brand image. Following this recommendation will help provide Hyatt with a new and improved brand image, which it could use to enter the Asia-Pacific region. There are many hotels that advertise themselves for their quality of service, but being the most high-tech and secure hotel chain is something neither of Hyatt’s competitors can claim. It would set the brand apart and attract new customers, especially among the younger generations.

References

Aquino, J. (2015). How hotels get their star ratings. Web.

Cheng, D. S. Y. (2013). Analyze the hotel industry in Porter Five Competitive Forces. The Journal of Global Business Management, 9(3), 52-57.

Cox, S. (2014). How do hotels figure out room pricing anyway? Web.

Deraman, F., Ismail, N., Arifin, A. I. M., & Mostafa M. I. A. (2017). Green practices in hotel industry: Factors influencing the implementation. Journal of Tourism, Hospitality, & Culinary Arts, 9(2), 305-316.

Dogru, T. (2016). Development of the hotel industry in China: Mega-events, opportunities, and challenges. E- Review of Tourism Research, 13(3), 471-489.

H’s revenue growth by quarter and year. (2018). Web.

Hilton revenues and revenue growth from 2012 to 2016. (2017). Web.

Hyatt Hotels. (2017). Web.

Hyatt vs Hilton: Compare locations, amenities, price and more. (2018). Web.

Luxury hotel market 2018 global growth, opportunities and industry analysis forecast to 2023. (2018). Web.

Luxury hotels market share, size, analysis and forecast to 2021-global industry currant & future demand scenario. (2018). Web.

Luxury hotel market size, share & trends analysis report by hotel type (business, airport, holiday, resort & spa), by region (North America, Europe, Asia Pacific, MEA, Latin America), and segment forecasts, 2018 – 2025. (2018). Web.

Marriott international revenues and revenue growth from 2012 to 2016. (2017). Web.

Min, H. (2018). Measuring the service quality of luxury hotel chains in the USA. International Journal of Services and Operations Management, 30(4), 1-14.

Perkins, E. (2017). What customer rights do hotel guests have? Not many. Web.

Revenue of Hyatt Hotels Corporation worldwide from 2008 to 2017 (in billion U.S. dollars). (2018). Web.

Stotler, L. (2016). Customer service: The ultimate differentiator in competitive hotel industry. Web.

United States Securities and Exchange Commission. (2017). Hyatt Hotels Corporation. Web.

Wyndham worldwide revenues and revenue growth from 2012 to 2016. (2017). Web.

Zervas, G., Proseprio, D., & Byers, J. W. (2017). The rise of the sharing economy: Estimating the impact of Airbnb on the hotel industry. Journal of Marketing Research, 54(5), 687-705.

Zverev, A., & Sichkar, O. (2018). Sanctions push last Western hotel chain out of Crimea. Reuters. Web.

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

Appendix F

Financial Information

HYATT HOTELS CORP.