Introduction

The background of the present luxury car is extremely expensive, frequently the custom-bodied luxury sporting cars of 1920s to 1930s. Normally made by Bugatti, Alfa Romeo, Delahaye, Lincoln, Delage, Cadillac, and Mercedes-Benz among others, these highly stylish status cars were preferred by aristocrats, film stars, gangsters and playboys for projecting elegant and profligate images.

Two such examples were Mercedes-Benz SSK and Duesenberg Model SJ, very expensive and fast automobiles which avoided both complete sports performance and pure luxury in support of unique mixture of style, power and craftsmanship which combined to create cars that resulted to status symbols (Knowles 5).

This idea of luxury has evolved in diverse shapes since the start of civilisation. Its function was only vital in ancient eastern and western empires like it is in present societies; with obvious variances amongst the social classes in past civilisations, the use of luxury was restricted to prestigious classes and whatever the less privileged could not have was considered to be luxury (Knowles 5).

In economic terms, a luxury good’s demand raise exceeds proportional adjustment in revenue, plus it contrast with necessity good, which demand does not connect to income (Knowles 7). Luxury goods normally have “high income elasticity of demand” (Freepaper.com) as individual become rich; they increasingly buy luxury goods, which imply that decrease in income will result to decline in demand.

“Income elasticity of demand” contrast with income, plus its signal changes at diverging income levels but to be precise, the luxury good may turn out to be normal good or inferior good at varying income levels (Freepaper.com). For the firm to charge a higher price to the consumers it must carry out price discrimination, which is the purchase or sale of varying units of service or goods at price discrepancies indirectly matching to variances in cost of supply (Armstrong 14).

The question whether price discrimination is an ethical issue is a subject which when seeking the answer, one must comprehend the reasons why firms find this particular practice acceptable, whilst amongst the consumers it is perceived to be unfair.

In modern business world cultural division amongst those who recognize price discrimination to be acceptable and just way of conducting business, plus those who differ. However, Christians may be traced on the two sides of the division, where indifference does not play part. Price discrimination is recognised as ethical when efficiency is a matter of concern, plus fairness or justice does not matter (Chen 11).

Discussion

Price discrimination

Price discrimination can be found on a company’s ability to differentiate amongst its buyers, according to their demand characteristic differences for specific products. The price discrimination becomes perfect if the company is capable of discriminating more (Armstrong 14).

In economics, for price discrimination to exist, three conditions should prevail in order for the company to be able to profit from price discrimination: the company should have the marketplace power, the company should be able to differentiate amongst buyers according to their demand-linked characteristics plus it must be capable of restricting the resale between customers with low and high demand elasticity (Econpage.com).

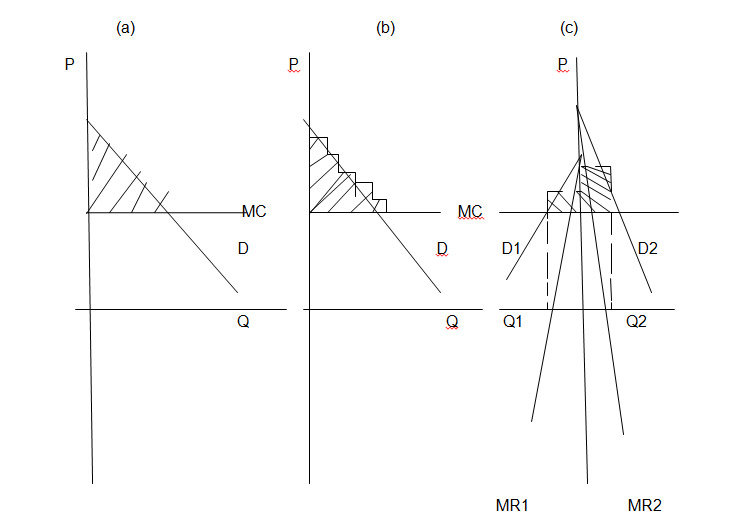

The company can charge each buyer (a or b) differently based on their demand of elasticity or either split the buyers into submarkets, with every submarket having its demand curve and autonomously maximize gains in every submarket (c) (Econpage.com).

Source: (Econpage.com)

Three major classes of price discrimination exist; one is the personal discrimination where prices are charged to consumers based on the differences amongst individual buyers, while the second is group discrimination which applies inter-group variances plus product discrimination which charges product in a discriminating way.

A luxury good will normally use the product discrimination, where the product is priced high based on its quality which enables the firm to attain a huge mark-up with high quality product compared to low quality goods (Econpage.com).

Economists merely considered price discrimination as proof of monopoly practice, thus an indication of failure of the market. Monopolists may utilise price discrimination just to increase their earnings, or utilize it as entry barrier to new entrants in the market. Any method basically makes all things bad.

The only occasions to make discrimination, are few instances which ensure goods ease of access that the marketplace will never support in any situation (Econpage.com). The degree of price discrimination reduces as new entrants in the sector increases, thus price discrimination may also apply in an oligopoly market structure, which is mainly subjected to few manufacturers, each having a certain market control (Armstrong 15).

Price discrimination splits the link between costs and prices, where prices must be linked to costs since price mirror costs on relative scarcities of commodities (Chen 12). Therefore, prices cannot be depended on as indicator of shortage to the clients on where they must cut down. However, the majority of price-sensitive consumers in discrimination may come across an incremental-cost charge, whilst others might not.

The sellers utilize price discrimination to increase earnings above the competition level and the high earnings ordinarily play the function of drawing new entrants in the sector; in case barriers exist no new entrants will follow. These barriers may include price discrimination, higher fixed costs and patents. In case higher earnings do not draw new entrants, then normally there is no social function and may merely be alleged as unfair, this is an indication of monopoly power (Econpage.com).

Price discrimination can be used to support requirement of higher fixed cost goods that may not be offered by the marketplace and may be accepted as fair in specific situations. For instance, luxury goods such as cars may appeal based on the fact that discrimination is practiced according to the product quality or model.

Poor individual will actually get a break in this type of practice, as the product discrimination is progressive in the allocation effect (Econpage.com). It also account for the common opinion that individual will purchase the luxury car when they have more income or has income increases, thus high prices will discourage individual from buying such cars. In case the high prices for wealthier discourages the most economical amongst them from purchasing the luxury car, the price system may be said to be inefficient (Chen 13).

On the other hand, all transactions or trades are just or fair only if they deliberate on either side, to be precise, so long as no bodily coercion was engaged to compel either party to engage in trade (Tiemstra 11).

A consummated transaction implies that the parties recognize themselves to be at an advantage after trading than if they had not traded at all. This therefore, makes the trade just despite how unequally the earnings from the transaction are divided amongst the parties, and notwithstanding how unevenly it may deal with equals (Tiemstra 11).

Conclusion

The justice assumes that even must be treated evenly. Besides, unrestrained justice would propose that the suitable reward for a manufacturer of products is recouping the production costs, with the opportunity cost of investment and time taken in that business.

In such a case earnings will be allocated equally between seller and buyer, and no party will exercise uneven power over the other, resulting to efficient allocation of resources.

For that reason, price discrimination must be alleged to be off beam, plus prices must mirror production costs. Particularly, it’s unethical for businesspersons to utilise their power in market to extort from consumers the bulkiness of value they gain from consumption of the product.

Work Cited

Armstrong, M. “Price discrimination”, 2006. Web.

Chen, Y. “Oligopoly price discrimination by purchase history”, 2005. Web.

Econpage.com. “Price discrimination: A summary”, 2009. Web.

Freepaper.com. “Arctic Monkeys Luxury car Market Trends”, 2011. Web.

Knowles, M. “Luxury news: Market Trends”, 2008. Web.

Tiemstra, J. “Price discrimination and fairness”, 2011. Web.