Abstract

The time value of money is not appreciated in Islam. It is forbidden to lend money and expects the money paid back in return with some interest. Islamic law claims that this form of practice is illegal and is the reason why many nations in the world are suffering. Islamic scholars say that the time value of money and the interest rates imposed on money lent are the reasons why the poor keep on getting poor and the rich richer.

These scholars claim that the ‘modern’ form of lending is responsible for the financial crises that the world has experienced in the twentieth century. Islam does not recognize the need of charging more for credit sales but instead sees it fit to have humane and ethical standards that protect and prevent exploitation of various parties by others. Islamic credit is far more flexible in comparison to conventional lending since the credit price is free to fluctuate according to market conditions. The Islamic approach to money has been found to offer new ways in which money should be looked at. Capitalism and globalization often look for answers in new things, in new ideas and in new concepts but on the other hand, fail to gain understanding from what already exists. The Islamic approach to money is indeed a more ethical way in comparison to the capitalist approach. Even as the world progresses and people become free to trade, free to move and free to set their own rules a new definition of money and interest is needed.

Introduction

History of money

Money is a very useful commodity and has become the main form of exchange all over the world. The money came about as a solution to a need that people had; how to trade and exchange goods and services in a fair and effective way. With the introduction of money came banks and financial institutions. The banks and private lenders later introduced the concept of interest; the generation of additional revenue from money.

The development of money in most markets started with gold coins and objects that had an inherent value. This made trade and work easier for people as they were able to avoid the tiring and cumbersome processes involved with barter trade. The early currencies were made of precious metals and this meant that the money itself could be sold or exchanged for something else of value (Surhone, 2010).

With the introduction of money made from precious metals, business and trade was able to boom. People all over the globe changed over from barter trade to monetary trade. With the thriving economic conditions came the need to store these monetary reserves. This was mainly due to security, convenience and storage reasons. This is where the banks came in and they were able to provide storage and transportation services for people.

The banks had huge monetary reserves and this meant that they had enough capital to fund and finance commercial projects. The banks went into financial lending where they lent money to people and in turn, got paid the principal amount with some added interest. This is where the commercialization of money was started; by banks and lending institutions.

Throughout history, banks have lent money to people in return for some interest. Money is therefore a commodity and the banks sell money as it is their commodity. The sale of money occurs when a person lends the other and in return gets the principal with some additional interest. Similar to a trader in the market who sells his products to prospective buyers the banks sell money to their clients (Choudhury, 1997).

Fiat money

With time money changed its form from a commodity that had intrinsic value like gold- that could be sold and smelted to having a value by virtue of guarantee. Many currencies are guarantees that the government gives to its citizens and traders. It is illegal to refuse to accept any form of legal tender and thus many people were bound to accept fiat currency in its introductory phases. Banks were the major players in the development of fiat currency and in the development of the time value of money. Without banking institutions there can be no time value of money and the interest system would cease to work.

The flow and regulation of fiat money are done by the Federal Reserve or Central Bank that acts as the central banking body. The central banks in most cases are responsible for issuing and regulating the flow of fiat money in an economy. The banks are also responsible for replacing worn-out and spoilt currencies and replacing them with new ones. The fiat monetary system is based on a guarantee or promise issued by a central bank to people thus making the fiat currency a representation of a certain unit (Drake, 2009).

Time value of money from a European perspective

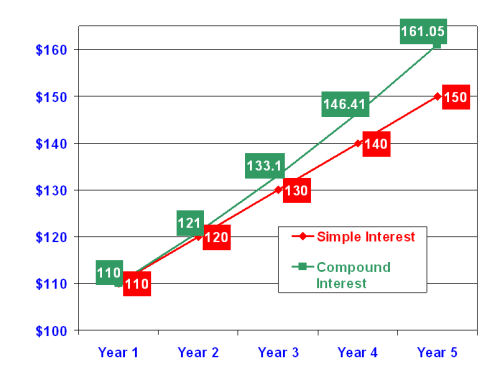

The time value of money is the ability of money to earn some interest with time. In the modern economy, the time value of money concept is practiced and accepted by many businesses. Modern banks charge some interest on money lent and also pay some interest on the money deposited by their policyholders.

This means that money on its own is a form of capital that is able to generate more money on its own. This is because a certain amount of money in the bank is able to generate a small interest on a monthly or yearly basis; by virtue of being deposited into a bank.

The concept of the time value of money was developed by a person named Martín_de_Azpilcueta who was an early economist and theologian. Azpilcueta proposed that money in itself was a commodity that could be sold, be bought and used to generate some revenue. He also came up with the monetarist theory that claimed that money is similar to any type of commodity and that its value is determined by its demand relative to its supply. This theory has come to shape and is used in economics to control the value and exchange rates of different currencies (Parameswaran, 2008).

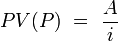

Money has different values that are dependent on time. The time value of money concept claims that money has a present value and a future value. The future value is calculated from the present value based on a certain interest rate. The time value formulae are used to calculate the present and future values of cash, annuities and perpetuities. There are a set of equations and formulas that are used to calculate the actual value of a certain sum in relation to time.

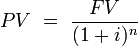

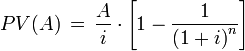

The present value is the current projection of an amount in the future. This value is calculated from a future promised or expected amount and discounted at a certain rate to get the present value. A typical example is where a person asks for a certain amount for example 100 units in the present instead of 500 units ten years. This is because 100 units in the present may be worth more in comparison to 500 in the future.

The present value of an annuity or periodical payment can also be derived using the time value formulae. These formulae are used to substantiate the present value of a set of annuities that will be paid or received in a prolonged period of time. The annuities are discounted and their present value is acquired (Rahman, 2008).

The present value of a perpetuity is also calculated when determining the time value of money. Perpetuities tend to involve an endless and constant stream of income through ‘eternity’. The present value of perpetuity can be calculated using the formula:

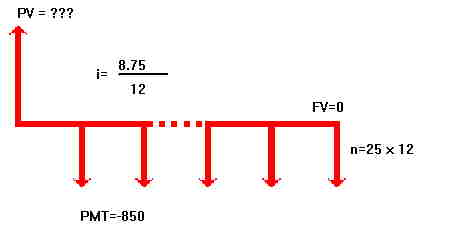

Cash flow diagrams

A cash flow diagram is an aide that is used to calculate the time value of money. This diagram is made up of a horizontal line that has the present time on one end and the future time on the other end. This diagram often has the various cash inflows and outflows plotted along the line.

The line is divided into equal portions or periods of time that could either be in days, months or years depending on whatever may be convenient to the user. All transactions are plotted along the line either as positive or negative transactions. Money paid out results in a reduction in the total balance and thus is recorded as negative cash flow. Negative cash flows are represented using arrows that are pointed downwards while positive cash flows are represented using arrows that point upwards.

There are several conditions that must be met so that the cash flow method can work; there must be equal time periods, all transactions must be carried out at the beginning and at the end of each time period, the interest rates must always remain constant and all transactions made throughout the diagram must be equal (Drake, 2009).

Interest rates in Islam

The time value of money is not appreciated in Islam. It is forbidden to lend money and expects the money paid back in return with some interest. Islamic law claims that this form of practice is illegal and is the reason why many nations in the world are suffering. Islamic scholars say that the time value of money and the interest rates imposed on money lent are the reasons why the poor keep on getting poor and the rich richer. These scholars claim that the ‘modern’ form of lending is responsible for the financial crises that the world has experienced in the twentieth century. According to Muslim scholars, the recent financial crisis of 2007 to 2010 was a result of capitalist businesses and systems of the modern world.

According to Islam the charging of interest rates, Usury is forbidden and whoever does so is likened to a person who is under the control of the devil. Unlike the modern viewpoint that sees usury as a form of commerce, it is evil in Islam to charge interest on money lent. This brings into question the time value of money in Islam as no interest is often charged. The basis of this argument is not financial in nature but is based on ethics and religion.

Interest rates are said to result in curses according to Islamic scholars, and whoever charges interest rates has poor regard for the teachings of the prophet Muhammad (pbuh). This has a significant impact on all businesses that operate in Islamic environments since some of the common practices in the modern world are not compatible with Islam. This means that businesses operating in Islamic societies need to take a different standpoint in regard to money. Islamic scholars claim that most financial institutions result in lower interest rates so as to deal with deficit issues in the face of economic hardships. This is a clear pointer that interest rates are an illegal way that banks and institutions use to exploit people. Deficits that economies face are owed to the interest rates that are charged on these debts. According to economists who support the Islamic model, interest rates result in an increase in debts and in the generation of economic deficits. Modern economies are in financial crises due to debt and this is a major shortcoming of the modern model of money lending. Scholars who are against the charging of interest claim that the modern form of banking is bound to collapse in a few generations due to un-backed currency and payment of interest on this ‘virtual’ currency (Surhone, 2010).

Literature Review

Rationale and Underlying consent

Islamic financing

Islamic financing are referred to as a type of financing that conforms to all the laws and principles of Islam in regard to money and interest. Most Muslim economies of the world employ an Islamic type of financing and banking. Islamic financial institutions are against the payment of interest on money lent and in the investment of capital in businesses that are regarded as haram according to Islamic sharia law.

Lending in Islam is considered to be a noble act that is both ethical and religious in nature. Lending is seen as a way of helping others and of fostering cooperation and self-sustenance in the Muslim community. Lending also allows those with no money to be able to start their own businesses and make their own money.

Those who lend to others and offer considerable repayment periods are seen to have carried out a form of worship and obedience to Allah. Lending in Islam is different from the secular form of lending that is driven by the need to gain profits from money lending. Those who refuse to lend and provide financial assistance to fellow men are believed to receive punishment from Allah as this is an act of unkindness (Choudhury, 1997).

Islamic financing can therefore be said to be driven by religion and culture rather than an economic incentive. This form of the financial system is advantageous as money for borrowing is easily available and costs less to borrow. Such a system can stimulate economic growth in instances where the borrowers are small business holders. On the other hand, this type of financial system is less profitable for banks as they are not able to exploit the time value of money so as to make profits.

There are three types of financing that are used by Muslim banks. These are investment financing, trade financing, and lending. Underinvestment financing there is Musharaka which refers to a joint venture between the bank and the other party. In a Musharaka both the bank and the lender have different roles and to play in the joint venture. The second type of investment financing that Islamic banks can provide is called Mudarabha. This involves the bank which is the main financier and the other party which provides management, supervision and labor services. This is the most common type of investment financing as it does not actively involve the bank in any operation of the business. This type of financing also eases managerial problems that could arise when the bank is actively involved in a business venture. The last type of investment financing that Islamic banks provide is called the estimated return method. In such a method the bank estimates the level of return that is expected by a certain business and then sets an amount that the lender is to pay in return for the financing. An advantage of this system is that if a business tends to do better than what was expected the lender will keep the extra earnings but if the business performs lower than expected the bank may opt to lower the rates so as to support the lender. This is unlike conventional banking that sets standard interest rates on money lent regardless of the economic prevail (Rahman, 2008).

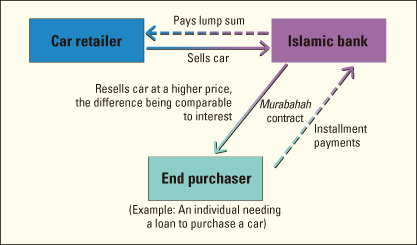

In trade financing services, Muslim banks offer mark-up services to their clients. This involves instances where the banks purchase a certain commodity for the client and then agree on the amount that the client is to pay the bank; with some added profit. Leasing is another method used in trade financing by Islamic banks. In this method, a bank purchases a given commodity for the client and leases it to him/ her for an agreed period of time before the client pays an agreed sum and takes full ownership of the commodity. Other trade finance services that Muslim banks offer include: hire purchase where the bank buys a product for the client and sells it to him/her in installments, sell and buy back services where the bank buys a client’s assets and sells it back to the client after an agreed period of time.

Islamic banking

The Islamic banking industry is similar to the conventional banking system but is guided by Muslim Law. For any type of banking to be referred to as Islamic banking, it must exhibit practices that are consistent with the Muslim Sharia law. Most Islamic banks were established in the 20th century in a bid to try and streamline business in Muslim states. The Islamic banks facilitated the implementation of Islamic principles in the way banks and institutions carry out business.

Early Islamic banks have been found to have charged interest on fiat money. This was applied to paper currency/ currency that was bound by a guarantee. However, no interest was charged on currency such as gold and silver units. The reason for this was that the value of gold and silver remained constant and thus the need to charge interest was not seen (Drake, 2009).

The formation of Islamic banks began in the early 1950s as a result of fundamentalist works by Muslim economists such as Muhammad Uzair. The Muslim economists of the time questioned the charging of interest rates in Muslim banks as this was against Muslim Sharia law. This resulted in a shift of Muslim opinion and the formation of Islamic banks was set on course. In the 1970s various Muslim governments were actively engaged in discussions on how to form Islamic banking institutions. In 1975 the Dubai Islamic Bank which was a pioneer Islamic bank was formed. This was one of the first banks to embrace the conventional banking principles and integrate these principles with Sharia law.

Islamic banks do not charge any interest on money lent but instead operate on a profit and loss sharing system. This is a method whereby the banks lend money to a business and expect to share the profit generated with the business. The business is often given a specific time period by the banks so as to have repaid the loan. This according to Islam is a fair and ethical way of lending money to individuals and businesses without exploiting them. Many Islamic scholars also claim that Muslim banks are more lenient when it comes to recovering bad debts in comparison to conventional banks. Another strength of the Islamic banking system is that the clients are considered the shareholders of their respective banks and thus receive a proportion of the bank’s profits (Choudhury, 1997).

The Muslim model of banking has not been without its fair share of problems and difficulties. The profit and loss sharing system used by these banks is difficult to implement and execute. Muslim banks have undergone difficulty in executing the no-interest policy in low yield investments, projects that span over long periods of time, financing small businesses and financing government expenditure. This has resulted in limited financing in these areas by Muslim banks as the returns and risks may not be worthwhile. This is a major shortcoming of Muslim financing; the goodwill of these banks expressed on paper is much more difficult to execute in real life. This results in poor financing of businesses that fall in this category.

Fig.6: Chart of different Islamic financing options

Islamic entrepreneurship

Business and entrepreneurship in Islam is driven by two major factors namely community and ethics. Entrepreneurship in Islam should ideally benefit the entrepreneur as well as the society and the less fortunate people in it. Muslim idealists claim that businesses should provide conducive environments for all people to prosper unlike in capitalism where the rich are more likely to get richer. Contrary to capitalist entrepreneurship, Islamic entrepreneurship does not support the notion “All men for themselves and God for us all”. In Islam, the entrepreneur is solely responsible for the success or failure of his/her business but at the same time is required to share the fruits of his/her labor with the community. Entrepreneurs in Islamic environments have a responsibility to others as commanded by Muslim law (Parameswaran, 2008)

Islam as a religion acknowledges business and entrepreneurship to be noble practices. In fact, the Quran praises businessmen as the Prophet himself (pbuh) was once a businessman. According to Islam entrepreneurs and businessmen have two roles: service to humanity and adherence to the commands of Allah. This means that entrepreneurship in Islam has a deeper purpose in comparison to conventional businesses; to make profits. Islamic business has also been found to be fair and free of discrimination. This is because the Quran condemns any kind of discrimination is it of race, color or religion. A significant difference between capitalist business and Islamic business is that profit takes a primary place in capitalist business while it takes a secondary place in Islamic business.

One of the major virtues promoted in Islamic business is trust. Trust is a major virtue in Islam and its practice is encouraged by the Quran. Justice and honesty are also promoted by Muslims when doing business with each other. Muslims are commanded to be truthful in all the business operations that they conduct regardless of whether it is with fellow Muslims or with non-Muslims. Muslims are required to be considerate of other people and not only be driven by their self-interest but by the general good of all people. Islam forbids entrepreneurs and businessmen from carrying out certain activities namely:

- Trade in products considered to be ‘haram’ e.g. Alcohol, Drugs etc

- Any kind of trade that has loopholes which are bound to create future conflicts

- Hoarding of products so as to control market forces and in an expectation of high profits

- Any fraudulent dealings and business operations

- Facilitating any illegal operation through business

- The paying and receiving of interest rates on money or any other commodity

Concept and nature of money

Global perspective

From global perspective money has three functions namely to store wealth, as a unit of keeping account and an accepted medium of exchange. Money in the modern world is mainly paper money that is guaranteed by financial institutions or governments. Another aspect that comes to play when considering money concepts in a global economy is the measurement of money; is the nominal value of liquid instruments that exist in an economy (Parameswaran, 2008).

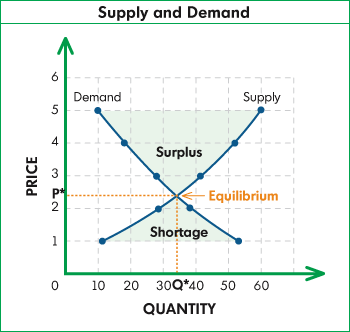

In global business, money is considered to be an asset and not just a unit of trade. Therefore similar to any other commodity the prices for money can be controlled by the laws of demand and supply. This theory was put in place by an economist called John Maynard Keynes in 1936 and has been at play in modern economics ever since. Since money is considered is to be an asset and has a price tag when the demand for money goes up then its prices also go up. According to Maynard, the prices for money refer to interest rates. Therefore the scarcity and availability of money is used by financial institutions in capitalist economies so as to regulate the value of money and control inflation.

The forces of demand for any form of money are affected by speculation, precautionary instinct and the transaction’s motive. The transactions motive refers to instances where a person may opt to have his/ her assets in a liquid state so as to cover for transaction costs that may arise, the precautionary motive is what causes people to store cash in banks so as to safeguard against unexpected occurrences while the speculative motive is when people have speculations that the prices of bonds may fluctuate in future.

The global concept of money has been found to lack in recent decades. In the early 1990s economists started to notice the various shortcomings of the current global money concept. The failure of the global money concept as an ideal solution for economics has become more noticed in recent years due to multiple failures of this concept. These are the financial crisis of 2007 to 2011 and the inability of the pure monetary policy between 2001 and 2003 to stimulate the economy in the United States of America (Surhone, 2010).

Notable economists who strongly oppose the conventional monetary policy include John Maynard Keynes, Milton Friedman and Anna Schwartz who brought to light the numerous shortcomings of the global monetary concept.

Islamic perspective

The Islamic concept of money is very different from the global concept. This is mainly because the Islamic concept of money is centered around religion and the teachings of the prophet Muhammad (pbuh). According to Islam, all money belongs to Allah and the improper use of money is forbidden. Islamic teachings claim that money is God’s property but that has been entrusted to man for proper use. Muslims believe that all money that they earn is a gift from Allah himself and not merely a reward for their work. This is very different from the global perspective where money is seen as a mere reward for work done or services rendered and thus belongs to people. According to Islamic teachings on money, all money belongs to Allah.

Islam says that money is a temptation and a ‘necessary evil’. Muslims need money to so as to be able to finance their daily activities but at the same time, they are warned of the evils that are associated with money. Money is seen as a tool to fulfillment yet at the same time has a great potential for self-destruction. This is very different from the global perspective that views money as good and a means to attaining anything. Another difference between the global and Islamic concepts is that in the global concept the means of acquiring money are not important as long money can be made unlike in Islam where money and religion are intertwined (Drake, 2009).

Islam prohibits exorbitant spending of money. This means that religion defines a way in which money should be spent and is against any wasteful spending of money. Quoting the Quran “Allah has prohibited three things: gossip, much questioning, and wasting money”

Women in Islam are regarded as the ‘keepers’ of the society and the source of continuity in the society. Islam acknowledges the ability of women to make money and their responsibility towards society. Islam bestows equal rights to both men and women when it comes to making and handling money. The Islamic concept of money says that with money comes great responsibility to both Allah and to society.

Islamic teachings also say that all money belongs to Allah and that he merely lends this money to men so that they could use it. Therefore men are bound to offer a certain percentage of their money to Allah. Together with taxes, Islamic societies give a certain percentage of their earnings for the propagation of Islam and for the assistance of the less fortunate. Below is a chart that highlights differences between the global and Islamic perspectives on money:

Fig. 7: Global concept vs Islamic concept

Money as commodity

money is referred to as a commodity in modern economies as it has evolved into an asset. Money is a short-term asset mainly because it has higher liquidity as compared to other types of assets. Money in itself has the ability to make more money. This is in the form of interest accrued due to lending or from depositing the money into a bank account (Rahman, 2008).

Money is also referred to as a commodity as it can be sold and bought. Common examples of markets where money is traded include forex markets that exchange different currencies at different prices. Factors that define money as a commodity include:

- Has varying supply and demand forces across a certain market

- Its price is often defined as a result of market functions

- Has uniform quality in all monetary units

- Has different producers

- Sold and bought in markets that are open to the public i.e. forex markets

Money has the ability to make more money and thus is a generator of wealth. This means that money just like land and labor is a factor of production that is used to generate revenue. All factors of production are sold or leased and therefore money is not an exception. Land can be leased or sold, labor is hired and money is lent. The reward for lending out money interests. When money is viewed as a commodity then charging interest rates becomes justified as it is a factor of production like the others.

Money can be sold but is often sold in for a much higher price than what is worth. This is because the seller forfeits the benefits that may he/she may have accrued as a result of investing the money. An example of this scenario is when a bank lends money to a business or individual. The bank in such an instance sells a certain sum of money to the business but expects payment after a certain period of time. The interest in such an instance is the profit that the bank accrues from the sale of the ‘commodity’. Money is the principal factor of production. This is because all other factors of production are either directly or indirectly related to money.

The definition of money as an asset stems from the fact that money can be stored in a bank. Money stored in a bank is an asset in that it can easily be converted into cash by simply authorizing the bank to release the said sum. Money is one of the most popular assets as it has its advantages such as easy liquidity and acceptability among many people. Money has an economic value as it can be controlled and can be exploited so as to satisfy human needs. Assets are also defined as anything that owns value thus qualifying money to be an asset.

Money however does not have an inherent value. A house has inherent value as it can shelter the owner and protect the owner from the vagaries of the weather and nature. The value of money is driven by market forces; money is simply paper but the forces of demand and supply result in these pieces of paper gaining value. Money gains value since many people want money but it is limited in supply thus it becomes a valuable commodity (Surhone, 2010).

Some analysts argue that the future value of money is sustained by the beliefs that people hold on this issue. They argue that if people cease to believe that money has a future value then it would actually cease to have a future value. This has been challenged by another set of economists who claim that money would never cease to be perceived as having value and that the only possibility that could occur is the shift of general opinion. It is said that if people lost faith in a certain currency and wanted to dispose of the currency then there would be a greater supply of this money compared to its demand. This would then result in a drop in the value of the money. Zimbabwe has one of the most valueless currencies in the world. This happened as a result of political instability and people who had assets in Zimbabwean currency were quick to dispose of them. This resulted in a global fall in the demand for Zimbabwean currency and thus the reason for the current inflation that the economy is facing. The numerous incidences of inflation in the world have proven that money is a commodity like all the rest and is greatly influenced by the general opinion of people.

Inflation is the increase in the value of goods and services in an economy. There are different concepts as to what causes inflation such as hoarding but the main reason behind inflation is the fall in the value of the ‘commodity called money in comparison to other commodities in the market. This causes people to want to exchange their commodities for a higher quantity of money. Money, therefore, has a very fragile value and thus governments and banks must always strive so as to regulate the flow and supply of money in an economy. If the value of money was left to balance on its own like other commodities then many economies would crumble. This shows that money is an artificially regulated commodity whose scarcity must always be ensured so as to ensure that the global monetary system remains in place.

Lending money

Money vs Credit

The supply of money and credit has an overall effect on the value and the availability of money in an economy. Therefore, commercial banks are required to control the level of credit that they issue out to their clients so as to regulate the forces of demand and supply in an economy (Surhone, 2010).

The price and quantity of money in an economy at any point in time is determined by commercial banks and the amount of money and credit that they issue/ receive. Credit similar to money when issued in excess leads to inflation and the fall of value of currency. Therefore commercial banks are required to regulate the amount of credit that they release into an economy.

Banks depend on credit and as this is their major source of income. When banks sell credit they are able to make profits in the form of interest. Just like any commodity the demand for credit is affected by the laws of demand and supply. When the interest rates go up there is a pronounced increase in the overall credit due to a decrease in the loss and earnings ratio in comparison to the total bad debts (Choudhury, 1997).

The demand for credit according to analysts has been found to increase when the costs for borrowing are decreased. Therefore central banks often set the nominal interest rates below the expected interest rate so as to safeguard against the risks of credit driven monetary growth. The central bank is often in a position to buy an unlimited quantity of assets to be used in its portfolios by issuing out domestic money in exchange. This makes the central bank be able to lower or increase interest rates to the desired levels.

Credit unlike money is not a physical asset. This is because credit is not perfectly liquid and does not have an immediate purchasing ability but is instead a financial claim against institutions. Other limitations of credit are that it has an inherent credit risk (Choudhury, 1997).

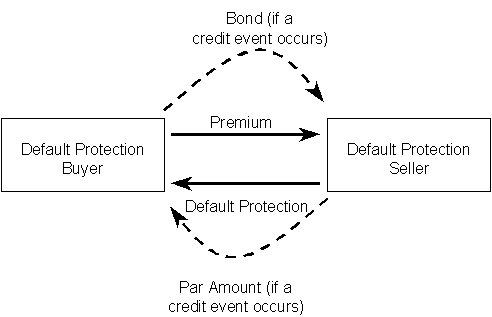

Credit transfers have a great effect on the movement of capital in an economy. The availability or scarcity of credit is dependent on the creditworthiness of the parties involved in an exchange process. Similar to money credit has value and is traded in markets. The credit default swap market is an example of a market where credit risks are traded. The market involves a seller who agrees to sell protection to a buyer so as to safeguard the buyer in an event of bad credit.

Islamic insurance

Insurance in Islamic economies is a relatively new concept. A very small percentage of the Islamic population actually uses any form of insurance. This is because many practices that are carried out in modern insurance are often contrary to Islam. This has resulted in many Muslims having a negative opinion on insurance and thus the poor spread of insurance among Muslims. Studies show that Muslim economies have a lower level of insurance service penetration in comparison to the emerging markets in the globe.

Common practices that are often carried out by insurance firms are contrary to Islam. This is the major reason why many Muslims do not want to provide or purchase insurance services. Practices in insurance that are contrary to Islam are the charging of interest rates, gambling/ excessive risk taking, vague and ambiguous contracts and the investment in outlawed businesses. Similar to banking the few insurance industries that operate in Muslim economies have been modified to fit in with Sharia law. The differences between Islamic insurance and conventional insurance are that Islamic insurance is designed to be non profit and mutual in nature, can only invest in non harams, and share profits with insurance policy holders. Credit in some cases is not insured as it involves excessively high risks that are contrary to Sharia law. This is what makes credit in Islamic economies to be different from credit in conventional economies; credit in and Insurance in Islam are governed by religion and culture and not entirely left to the laws of nature (Drake, 2009).

Sukuk in Islam

The term Sukuk in Islam is used to refer to all types of bonds. The issuing of bonds in Islam is regulated by the Sharia law. Since the Sharia law is against the charging of interest rates, there are no interest rates that are charged on sukuk. In the ancient Islamic era sukuk referred to a form of agreement or contract that promised a form of payment to the holder of the bond. Sukuk in Islam offers a way through which people can store their assets in the form of money i.e. bonds (Rahman, 2008).

There are different types of sukuks in Islam; agency-based sukuk, equity-based sukuks, debt-based sukuks and asset-based sukus. Islam distances the meaning of sukuk from the conventional definitions of bonds since sukuk refers to a contract that serves to represent the ownership of an asset or business while bonds are obligations of debt. The growth of sukuk in Islamic economies is in a way limited by Sharia law. This is because of the Muslim viewpoint on the time value of money and the existence of haram practices. Another hindrance to the growth of sukuk in Islamic economies is the ability of any third-party guarantee to be issued without any charges. The issuer of the sukuk also insures against any shortcomings in the capital that may arise (Rahman, 2008).

The Islamic concept on the time value of money has been found to regulate and control various sectors of Islamic finance including sukuk. A hybrid sukuk is needed so as to ensure profitability to the issuers and conformance to Muslim Sharia law.

Analysis

Duplicity of money: money versus credit

Money is said to have two values namely the implicit value and the explicit value. This is explained in the duplicity principle that talks about the varying in stock market prices in difficult economic times. A proper example of duplicity in economics is when stock markets fall. There are various factors that affect the price of a stock; these are the net worth of a company and the public opinion of a company. The principle also says that an institution cannot have an explicit value without an implicit value. This is because a company may be worth billions of dollars but if the public opinion of the company is poor this would result in a fall in stock prices of the company. Therefore the duplicity principle says that the implicit value and the explicit value often go hand in hand and are interdependent.

Similarly, money has been found to have two values one that is affected by the market value of the money and the other by the public opinion of the currency. When people have a poor opinion of a currency and have doubts as to its acceptability, stability or purchasing power this would result in a drop in the value of the said money. The aggregate value of money is greatly influenced by the implicit value as compared to the explicit value. For money to remain valuable institutions and banks must ensure that it is scarce so that its implicit value remains high (Drake, 2009).

The implicit aspect of money is ‘virtual’ and cannot be touched. This is an aspect that is difficult to quantify but can be felt and seen at play in the market. This is a value of money that is intangible and imaginary. The implicit value of money is what causes people to desire the commodity and want to acquire it. It is what causes people to work and offer services in exchange. The implicit value of money is concerned with what money can do and with what it can buy. This value has more to do with the perception than with the actual value of the money. Money in the world is used because it has an implicit value and is perceived to have some value by people. If people were to stop perceiving money as having value then its value would cease to be useful (Drake, 2009).

The implicit value of money has the ability to affect the demand and supply of money. The dollar is perceived to have value throughout the globe. This is a major factor that contributes to the strength and the demand of the dollar. This is owed to the security and stability that the United States is known to have and thus this affects its money’s implicit value. The implicit value of a currency is controlled by political and social factors in an economy. During the Gulf War 2 when people had started to lose faith in the U.S government the value of the dollar had plummeted. This is because people who had stacked their reserves in dollars got jittery as to the possibility of experiencing losses if the dollar’s value was to plummet. This resulted in many people ‘offloading’ their dollar deposits. This in turn resulted in a surplus supply of dollar money and therefore a fall in the value of the dollar.

Credit on the other hand is strongly controlled by its explicit value and the demand for credit is seen to rise when the cost of credit goes down. Unlike money, it is not greatly affected by an implicit value as the major determinant of the demand and supply of credit in an economy is interest rates.

Cash versus credit price in Islam

The cash price of a commodity refers to the amount that the seller of the commodity is willing to accept in exchange for the commodity. The cash price usually includes all the expenses that the seller may have incurred in order to get the product to the market or may sometimes be just the market price. Most commodities are valued according to their cash prices as this is the most common type of pricing that many sellers and buyers are willing to use. Studies show that many business people prefer to sell their commodities in cash as compared to other types of sale. This is because selling on cash guarantees that the seller gets his money and the buyer acquires his product on the spot. Cash sales are also secure as the seller is guaranteed by the spot on payment. This form of payment is common among new traders and people who have not yet established enough mutual trust. This form of payment is the most secure and fraud-free way of making and accepting payments.

Credit payments refer to instances where the seller and the buyer agree on a method of payment that is different from the cash payment method. When a product is sold on credit this means that the seller gives the product to the buyer on debt and expects payment at a future date. This type of trade is common among acquaintances or people who know each other. However, credit sales have their own risks such as bad debts and defaulted payments. A credit sale could be settled in any manner that is agreed on by both the seller and the buyer and there is no standard way in which credit sales are settled. The debt could be settled in installments or in a full amount (Parameswaran, 2008).

The credit price is often higher in comparison to the cash sale. This is because of certain reasons:

- The time value of money

- The inherent risk in a credit sale

- An allowance made for bad debts

Money has time value and when a product is sold on credit this means that the seller will have foregone the benefits that he/she could have acquired as a result of having the money. For example if a product is to be sold on credit and the buyer is expected to make payments after a period of six months then the seller will have to compensate for the TVM (Time Value of Money) that he will have foregone for the six month period. It is for this reason that a certain interest rate is usually added onto the credit price so as to compensate for the TVM of money.

All credit sales have an inherent risk and therefore insurance for such sales is often needed. Banks and large institutions often insure against their debts and that is why credit often has an interest rate charged on it. In case of a small business the owner may insure him/herself from bad debts by charging an additional fee on all credit sales. Credit sales are a very sensitive issue and that is why businesses often offer credit to acquaintances or other businesses with good reputation (Rahman, 2008).

Credit is based on trust and mutual understanding. This is what makes credit a complicated way of doing business. Credit also eliminates the need for money and thus is a possible substitute for monetary transactions. Below is a chart of differences between credit and cash pricing:

Fig.10: Credit pricing vs cash pricing

Credit sales in Islam are very different from what is seen in the conventional world. Islam is against the charging of interest on money or any other commodity. Therefore many credit sales in Islam are often repaid without charging of interest rates. Thus this means that the lender often forfeits the time value of money and assumes the cost of insurance. Such sales in Islam are common among family members, close friends and business acquaintances. This means that such sales in an Islamic setting are based on trust and religious principle (Parameswaran, 2008).

Islam does not recognize the need of charging more for credit sales but instead sees it fit to have humane and ethical standards that protect and prevent exploitation of various parties by others. Islamic credit is far more flexible in comparison to conventional lending since the credit price is free to fluctuate according to market conditions. For example if a shirt was lent when shirts were going for 2 units and the debt was due in 5 months. If 5 months later a shirt is going for 1.5 units then the debtor is expected to pay 1.5 units and not the initial 2 units.

Monetary value of time in Islam

The time value of money is a principle that is accepted all over the world by businesses and institutions. However Islam does not recognize this principle and such ideology is found to be exploitative and unethical. Because Islam prohibits the charging of interest on money this means that it does not acknowledge the ability of money to make more money on its own (Rahman, 2008).

Islam does not recognize money to be a capital but instead views money as what enables people to gain capital. This difference in ideology is what causes the great rift between Islamic and conventional concepts on money. However some Muslim scholars claim that Islam recognizes that money gains value with time but is actually against setting predetermined values for money. The conventional TVM concepts can be able to project the value of money for up to 10 years in future. This is what Islam is against as it is an unfair and unsure way of determining the value of money due to market fluctuations. Islam acknowledges that money has a time value but it strongly prohibits this value from being used in any lending activity in the form of a predetermined value.

When trying to consider the concept of time value of money there various religious issues that must be considered; riba which is prohibited in Islam, it does not go against accepted ijma, qiyas, maslahah mursalah. Ijma refers to an agreed consensus, qiyas refers to analogy in thinking and maslahah mursalah refers to ethics and public welfare considerations. The time value concept from the Islamic perspective should also be free from evil; concept of the value of money increasing at a predetermined value is considered to be evil in Islam, thus the failure of these two concepts to marry (Rahman, 2008).

Technically Islam acknowledges that money lent in the present may have a higher value in future. This could be due to inflation or a change in market prices of commodities. However Islam is against the idea that the future value of money can be predetermined. Therefore according to Islam the formulae and the tools of calculating the time value of money are ineffective and unfair means of judging the future value of money. The issue of time value of money is still controversial as it has not yet been well expounded on. The Quran provides several rules and regulations that should guide money and lending. In the ancient world the recommendations of the Quran provided complete solutions to issues that were related to money. The world has changed and money/finance has become much more dynamic. This calls for Islamic scholars and economists to sit down and define a proper approach to the time value of money (Surhone, 2010).

Some critics argue that Islam is plagued by double standards and that its stand on money is confused. This is because Islam allows the selling price of a commodity to be increased in case its payment is deferred. Another group of Muslim scholars claim that credit is banned and illegal in Islam. This group of scholars claims that the prophet Muhammad (pbuh) forbid trade of all forms in credit. According to these scholars the Quran forbids the exchange of gold or silver on credit. In the ancient times gold and silver were the forms of currency and thus were money; this shows that Islam is against credit sales. In the modern world money is often exchanged for other commodities. Therefore if the teachings of Islam are interpreted in a modern day setting it would mean that the sale of products on credit is strictly prohibited. Scholars against this idea say that the Prophet (pbuh) was an advocate for credit sales and that he himself at one point bought food on credit from a certain Jew and mortgaged his shield in return.

Islam bans the overall change in price with time. This is in line with the views that money should not and does not change value in time. Another view is that money should not increase in value with time nor should it decrease in value with time. This is another controversial aspect of the time value of money in Islam as reduction in prices with time is not regarded as a forbidden practice (Drake, 2009)

Majority of Muslim economists have the notion that credit prices can be higher as long as there is mutual consent between the seller and the buyer. Without the mutual consent credit prices cannot be higher than cash prices as this would be termed as charging of riba. The only instance where this is allowed is if the seller and the buyer openly discuss on a credit price and on the terms of payment. Islam accepts that credit prices could be higher than the cash prices in regard to human nature and the preference that humans have for the immediate rather than the delayed. This is what causes Islam to give room for negotiations on credit prices but not because it recognizes the time value of money.

Muslims are motivated to lend as they expect a reward from Allah contrary to the conventional world where people expect monetary rewards in the form of interest rates. Muslims believe that when a person lends money he /she is able to acquire some rewards from Allah which he/she would not have otherwise acquired had he chosen not to lend the money. Therefore the rewards for lending in Islam are religious in nature and those who lend expect favours and blessings from Allah. Idle storage of money is considered unwise as it does not result in any form of rewards and thus lending to the needy is seen as an ethical and accepted way to deal with idle cash. General views among Muslims scholars on interest rates charged on accredit are:

- Interest rates exploit the poor and needy

- Interest rates are an unethical and unfair way of doing business

- Interest rates regulate and hinder the flow of money in an economy

- Interest rates promote the selfish amassment and accumulation of idle money

- Interest rates affect the economy of a nation as the poor are unable to access credit while the rich get obscenely richer

Another explanation against charging of interest on credit is that time on its own cannot generate any yield. Therefore from an Islamic view it is improper to assign a value to money on the basis of time. In Islam the time value of money is seen as a donation that the creditor gives to the borrower as a form of worship to Allah. These are the major differences between credit from a conventional perspective and lending from an Islamic perspective.

Capitalist theory and Muslim theory

The future value and present value of money are based on the time value of money. It has become greatly difficult to marry Islam with the time value of money. This means that money in Islam could only have one value.

In Islam the concept of money having different values is not accepted. According to Islam money in the present will have the same value in future. Islam does not give room for charging of interests or determining the value of money at a future date. Conventional finance claims that money is an asset and thus it appreciates value with time. From a Muslim stand point, money can have a future value but this future value is often negotiated and agreed upon by the parties involved in a trade. Islam agrees that though money at a future date may have a higher value this extra value could be forfeited as a form of donation and is dependent in market conditions (Rahman, 2008).

Modern capitalist finance is almost similar to Islamic finance but there are some distinct differences between these systems. Capitalist theories believe that money is a commodity and thus commodity is money. This is in the sense that money in itself is a commodity and cannot be differentiated from other commodities. The capitalist theories say that the value of money similar to other commodities can be negotiated and agreed upon. Capitalist theories also allow for the trading of money in free markets i.e. a person selling money can set any price similar to a person selling a bag of oranges. The capitalist theory takes a liberal stance towards money and its capacity to serve as a commodity. Islamic theory on the contrary does not classify money as a commodity. According to Islam money does not have a value on its own (intrinsic) and cannot satisfy human needs on its own. Islamic principle says that money is simply a medium of exchange and through which commodities could be purchased. Therefore the concept of money being able to generate value with time is strongly opposed in Islam. The only exception to this ideology is that the potential benefits of money could be forfeited in instances where money is lent and thus the lender could opt to compensate his creditor by offering an extra amount to the principle.

Islamic principles also claim that commodities tend to have varying and fluctuating values. For example an old car is worth less in comparison to a new one as a car depreciates with time. There a car could qualify to be called a commodity as its value is seen to change with time. However, money cannot be called a commodity as its value is not seen to change. A 100 dollar note is worth the same as a new 100 dollar note. Money is therefore not seen to have a differential quality in Islam and thus cannot be classified as a commodity (Choudhury, 1997).

Commodities in Islam have specifications and sizes. For example, a certain cargo shipment would have its unique weight, size and shape characteristics. However, money cannot be specified and differentiated from other money. This according to Islam disqualifies the concept that money is a commodity. An example used to highlight this is an example of an exchange of $1000 for $1000. Such an exchange is said to be meaningless. According to Islam commodities that have an intrinsic value can be exchanged for other commodities. The Islamic argument is that if money is a commodity indeed then why can’t a certain sum of money be exchanged for another? Islam says that charging interest on money by virtue of time is not justified since the extra amount charged will not reflect an improvement in quality of the money or an increase in utility but is merely based on time.

Compensation for money lent is often charged in Islam but this amount is often based on the commodity and not the money. The amount compensated for any form of delayed payment is usually preset and is independent of the time taken to repay the debt. This shows that time and money are independent in Islamic theory

Globalization and effect on finance in Islam

The globalization phenomenon has been felt in many regions of the world. The Muslim community is not an exception and there has been a significant effect on the Muslim economies as a result of globalization. There have been several changes felt in Muslim economies as a result of globalization and these include the revolution of the information technology industries, there has been an excess of trade flow in comparison to capital growth and the involvement of the services industry in the financial flows.

There are three effects of globalization on the Arab world. These are: social aspect, political aspect and the economic aspect. However the Arab world has been found to have a slower globalization rate in comparison to other regions of the world. The reasons for the slower globalization witnessed are high population growth rates versus lower productivity, rigid cultural and religious framework, huge and inefficient public bodies, ineffective educational systems and numerous trade restrictions (Drake, 2009).

There are many arguments on the importance of globalization that exist. However many Islamic economists claim that globalization has its downsides. Complete globalization of the Muslim world would mean an erosion of its culture and religion. This would have negative effects on the Muslim way of life and thus it would be inappropriate to allow globalization to change the way Muslims live and operate. Therefore a controlled form of globalization is needed so that the Muslim society can be able to filter out what is appropriate from conventional systems.

Globalization has been found to affect the Arab economy in three ways. These are the culture, the institutions that exist, the organizations that are present and how business is transacted. Therefore in an attempt to streamline Islamic finance with global trends, special care must be taken so as to ensure that the culture, institutions, organizations and businesses conform to the teachings of the Quran. Contrary to this Muslim economies would cease to be Muslim and would instead be conventional.

The financial systems used in Muslim economies vary from those used in the majority of the globe. There have been substantial efforts to globalize Islamic finance while at the same time upholding religious teachings on money. The time value of money is a controversial aspect that differs greatly from the global and Islamic standpoint.

Conclusion

Money is a very important and sensitive aspect of any economy. The issue of money and finance is very critical in Islam. The study has shown that money is indeed a very important aspect of Muslim life and the Quran in full knowledge of this has spoken enough on this issue. According to Muslims money is good and the Quran does not condemn money in any way. In fact, the teachings of Islam encourage people to work hard and do trade so as to make money.

Islam acknowledges the need of people to earn a living and it respects the individual earnings of each person. Similar to capitalism Islam proposes that each and every person should be free to enjoy the fruits of his/her labor. This type of stance is what encourages people to work and build the economy of a nation as the fruits of individual labor are secured.

There are distinct differences that have been noted between the ideologies of Islam on money to capitalist ideologies. The root cause of the difference between these viewpoints is the definition of money. From a capitalist viewpoint, money is a commodity that can be sold and bought. This definition has resulted due to the modern banking and economic systems that exist. The capitalists propose that if money is a commodity then it can be able to generate value on its own. An example is a piece of land that is able to generate revenue even if it is not utilized. When money is viewed as a commodity then this also means that it can be able to generate revenue on its own by virtue of time. According to capitalism money can be able to generate interest with time.

Therefore an analytical view of the capitalist theory brings to light the modern concept of money. The modern concept believes that money is a commodity and whenever it is used to purchase another commodity it is in the real sense an advanced form of barter trade. This is because modern transactions involve the exchange of money-a commodity, for another commodity. The only difference between capitalist barter to ancient barter is that one commodity-money has a uniform standard and unit measure.

According to Islam money does not qualify to be called a commodity. There are various arguments used by Muslim scholars to disqualify money from being classified as a commodity. The study shows that a popular argument against capitalist claims on money as a commodity include the fact that money does not have a utility of its own. This is because money cannot be used on its own to do anything useful. The only utility that money could provide is if it is exchanged for something else. Without the exchange of money it would cease to be useful as it is merely made up of pieces of paper. The study also shows that from a Muslim perspective money is seen as a unit of exchange and not a commodity. It is merely a facilitator through which goods and services are exchanged.

The distinct difference between Islam and capitalism on the definition on money is what causes the differences in views on the legitimacy of interest. The study has shown that Islam does not allow the charging of interest on money lent. This stems from the perception of Islam on money; a unit of exchange. Islam says that money cannot acquire value by virtue of time and it is merely a tool of exchange and has no inherent value. It has also been noted that interest rates are forbidden in Islam and thus the possibility of merging some capitalist concepts with those of Islam is minimal. Money in Islam cannot gain value with time since the only factors that can affect the value of a commodity are said to change in the quality or an increase in utility. An example is an umbrella that trades for one unit in the dry season and two in the rainy season. The increase in the price of the commodity is allowed as it has increased in utility. Land can also increase in value as time progresses as land becomes scarcer. However money has not been found to have any of these aspects, thus the Muslim concept could be justified.

Muslim financial institutions must therefore remain unique and independent of global phenomena. This is because Muslim societies and economies are based upon the Quran and the teachings of Muhammad. Capitalism is contrary to the teachings of the Quran and thus the solutions and systems used in the conventional world may not work in an Islamic setting. Capitalism has not been without failures and it does not offer a foolproof way to define money and interest on money. Islamic economies have indeed come a long way in attempting to embrace global ideology but at the same time upholding their culture and religion.

The Islamic approach to money has been found to offer new ways in which money should be looked at. Capitalism and globalization often look for answers in new things, in new ideas and in new concepts but on the other hand, fail to gain understanding from what already exists. The Islamic approach to money is indeed a more ethical way in comparison to the capitalist approach. Even as the world progresses and people become free to trade, free to move and free to set their own rules the relationships between people and businesses need to consider the less fortunate and needy. The Islamic approach to money ensures that money can be acquired more easily and that the amount of idle money is reduced.

Capitalism if left on its own would be like a jungle where the powerful eat the weak. The Islamic approach regulates the level in which businesses and people relate to each other in regards to money and thus could offer a few if not all solutions to the problems faced in conventional economies.

References

Choudhury, M. (1997). Money in Islam: a study in Islamic political economy. New York: Routledge.

Drake, P. (2009). Foundations and Applications of the Time Value of Money. New Jersey: John Wiley and Sons.

Parameswaran, S. (2008). Interest Rates And Time Value Of Money. New Delhi: Mc Graw Hill.

Rahman, Z. (2008). Money and You in Islam. New York: True wealth.

Surhone, L. (2010). Time Value of Money. Washington: BetaScript Publishers.