Policy Mix to Increase Output without Changing Interest Rates

It is the desire of policy makers to boost economic growth in all ways possible. One of their main problem is always how to increase economic output while maintaining interest rates as low as possible because high interest rates discourage some components of aggregate demand especially investments.

The fiscal policy uses the government resources to alter aggregate demand thus, influencing economic performance of a country (Arnold 2010). To raise output, policy makers will need to implement expansionary fiscal policy. This means that the government can either choose to reduce the amount of tax that citizens have to pay, increase it purchases or increase its level of transfers.

The effects of taxes cannot be expected with certainty since it is not automatic that when people’s disposable income increases their spending follows suit, because others may choose to save instead of spending. When the government increases its level of purchases then, the level of planned expenditure in the whole country increases thus, demand for goods and services increases. Increases in demand means that suppliers can sell more commodities than they are currently selling therefore suppliers increase their output.

On the same note, when government chooses to reduce the amount of taxes that are levied, people will have more disposable income and they are likely to increase their spending thus increasing aggregate demand. This will give suppliers incentive to produce more thus increasing output, which will in turn increase the average levels of income.

It should be noted that, the increase in output is always more than the increase in government spending due to government multiplier. Expansionary fiscal policy makes the IS curve to shift to the right due to increase in aggregate demand which in turn increases output (Mankiw 2011).

Regrettably, as the IS curve shifts to the right it is not the output only that increases but also interest rates and because policy makers do not want any effect in the interest rates the LM curve must be induced to shift to the right. If expansionary monetary policy is implemented, for example by increasing the amount of money in the economy, the LM curve will shift to the right (Froyen 2008).

When the amount of money in circulation increases, the supply of money exceeds its demand and to boost the demand for money, banks have to reduce the interest rates thus making it cheaper to borrow.

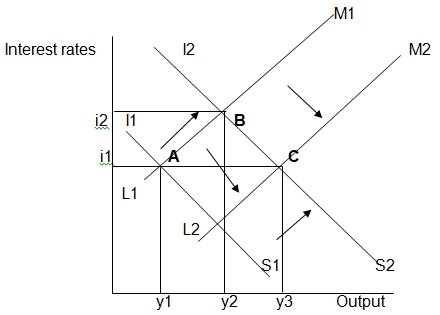

The graph above shows the effects of expansionary fiscal policy as well as monetary policy on the IS LM curve. If the economy is initially in equilibrium at point A with interest rates i1 and output y1. Implementation of expansionary fiscal policy will cause a shift of the IS curve from I1S1 to I2S2 thus, changing the equilibrium from point A to point B with interest rate i2 and output y2.

An expansionary monetary policy shifts the LM curve rightwards from L1M1 to L2M2 increasing output to y3 but reducing interest rates back to i1 and setting the new equilibrium at point C. Therefore, through mixing expansionary fiscal and expansionary monetary policy, policy makers can increase output without increasing interest rates (Gordon 2008).

Elasticity of Money Demand and its Effects

It is paramount to note that the quantity change in the demand for money is subjective to the elasticity of demand for money in relation to the factors that affect the demand for money.

Income elasticity of money demand is the percentage change in the quantity of money demanded as a result of unit change in income levels of people. Usually, people who have higher income levels tend to have higher expenses and thus demand more money for their transactions. However, it has been noted that the increase in real money demand is less proportional to increase in real income levels.

Alternatively, interest elasticity of money demand is the quantity change of demand in money caused by a unit change in interest rates. Interest rates represents the opportunity cost of holding money therefore, as they increase it becomes expensive to hold money.

Consequently, as the interest rates increases, rate of return on securities increases and people find it profitable to invest in securities instead of holding money. Accordingly, as interest rates increase, nominal demand for money decreases because people prefer to hold non-monetary assets as opposed to cash money.

Expansionary fiscal policy increases output and therefore, income of the people while at the same time it influences increase in interest rates. It will therefore be more effective if the income elasticity of money demand exceeds interest elasticity of money demand (Keynes 2006). This is because the quantity increase in demand for money to be spent will be higher than the quantity decrease in demand for money to be invested and thus the overall effect will be increase in output.

It should be noted that, the final quantity increase in aggregate demand and hence, the increase in output is highly influenced by the quantity decrease in investments as a result of increase in interest rates. The increase in output due to expansionary fiscal policy causes an increase in interest rates which is the cost of investments (Harford 2012).

This in turn leads to decrease in the amount of investments thus, reducing the quantity change in aggregate demand, a process referred to as crowding out effect. If interest elasticity of money demand exceeds income elasticity of money demand, the crowding out effect is large to the extent that it might completely eliminate the increase in output resulting from expansionary fiscal policy (Baumol & Blinder 2011).

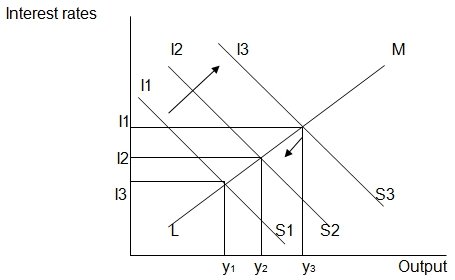

The graph above shows IS LM curve of an economy. Expansionary fiscal policy shifts the I1S1 curve to I3S3 increasing both output and interest rates. The increase in interest rates makes investment expensive while non monetary assets become cheap. This leads to decrease in the level of private consumption and specifically investments thus, causing the IS curve to shift leftwards from I3S3 to I2S2 thus reducing the actual output from y3 to y2.

It should be noted that, the leftward shift due to increase in interest rates is high when the interest elasticity of money demand is higher than the income elasticity of money demand, and in such a case it reduces the multiplier effect of fiscal policy. Therefore, the crowding out effect determines the quantity change in output due to expansionary fiscal policy and the higher it is the lower the quantity increase.

Fiscal Policy under Fixed and Floating Exchange Rate System

By operating a fixed exchange rate system, the government is ready to maintain exchange rate at the fixed level using all mechanisms that are available. When an expansionary fiscal policy is pursued in an economy where exchange rate is fixed, it leads to different results compared to a situation where the interest rates are floating (Tucker 2008). Let us first look at a situation where a country operates a fixed exchange rate system and the capital is perfectly mobile.

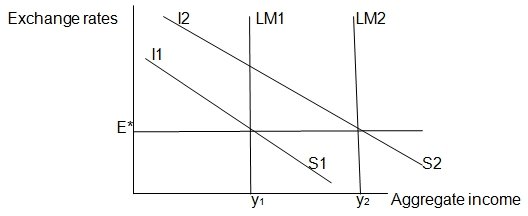

Expansionary fiscal policy will lead to increased aggregate demand hence, shifting the IS curve from I1S1 to I2S2 as shown in the graph above. This will exert pressure on exchange rates to go up, but since the central bank is determined to maintain exchange rate at the current level E*, it increases money supply through open market operations.

Increase in money supply causes the LM curve to shift to the right from LM1 to LM2 therefore pushing aggregate incomes upwards from y1 to y2. Since there is perfect mobility of capital, the capital can easily be transferred to production of commodities whose demand is high.

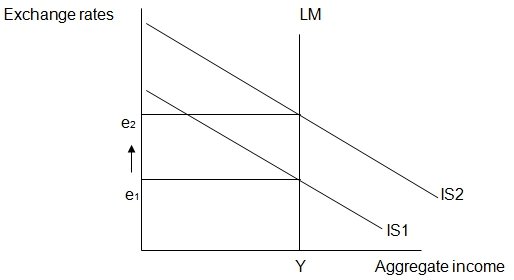

Let us now consider the outcomes of expansionary fiscal policy in case of a floating exchange rate. Expansionary fiscal policy shifts the IS curve rightwards from IS1 to IS2 as shown in the graph above. As a result, capital inflow increases which in turn increases demand for local currency therefore, increasing exchange rates from e1 to e2 while the aggregate income remains the same.

Therefore, under fixed exchange rate system expansionary fiscal policy has greater effects because it triggers expansionary monetary policy thus, increasing aggregate income even further. It is important to note that, since exchange rate is maintained constant, the problem of crowding out effect is minimized.

References

Arnold, RA 2010, Macroeconomics, Cengage Learning, Stanford.

Baumol, WJ & Blinder, AS 2011, Macroeconomics: Principles and Policy, Cengage Learning, Stanford.

Froyen, RT 2008, Macroeconomics: Theories and Policies, Prentice Hall, Upper Saddle River.

Gordon, RJ 2008, Macroeconomics, Addison-Wesley, Boston.

Harford, T 2012, The Undercover Economist, Oxford University Press, Oxford.

Keynes, JM 2006, The General Theory of Employment, Interest and Money, Atlantic Publishers, New Delhi.

Mankiw, NG 2011, Essentials of Economics, Cengage Learning, Stanford.

Tucker, I 2008, Economics for Today. Cengage Learning, Stanford.