Introduction

Innovation in Information Technology [IT] has led to the development of sophisticated smart devices, technologies, and systems. The technologies have transformed different economic sectors with one of them being the education sector. Different countries are implementing emerging technologies in the education sector to improve teaching and learning. This move has led to the emergence of the concept of smart education.

Green (2013) defines smart education as the “integration of educational institutions and faculty members to carry out joint educational activities through the Internet” (p. 437). Therefore, smart education involves the modernization of the entire education techniques, methods, and processes. Moreover, smart education advocates a collaborative development of education content. Europe and Asia are amongst the leading regions that have integrated the smart education concept.

It is projected that smart education will enable the young people to acclimatize to the rapidly changing environment because it leads to the creation of flexible and interactive learning environment. Furthermore, smart education enables students to access learning content from different parts of the world. Thus, smart education will expand the learning boundaries. Green (2013) corroborates that the core purpose of smart education is to transform the learning process by making it more effective.

Singapore ranks amongst the first East Asian countries that have integrated smart education. The country implemented smart education in 1997. The implementation of the smart education in Singapore is based on a well-designed Master Plan (Hunter, 2015). Similarly, Dubai is revolutionizing how education is offered within the country. The government launched a smart learning initiative in 2012 with the objective of integrating the students, parents, administrators, and teachers into a unified e-platform (Hunter, 2015). The purpose of this paper is to compare the implementation of smart education in Dubai and Singapore using diverse strategic analysis tools.

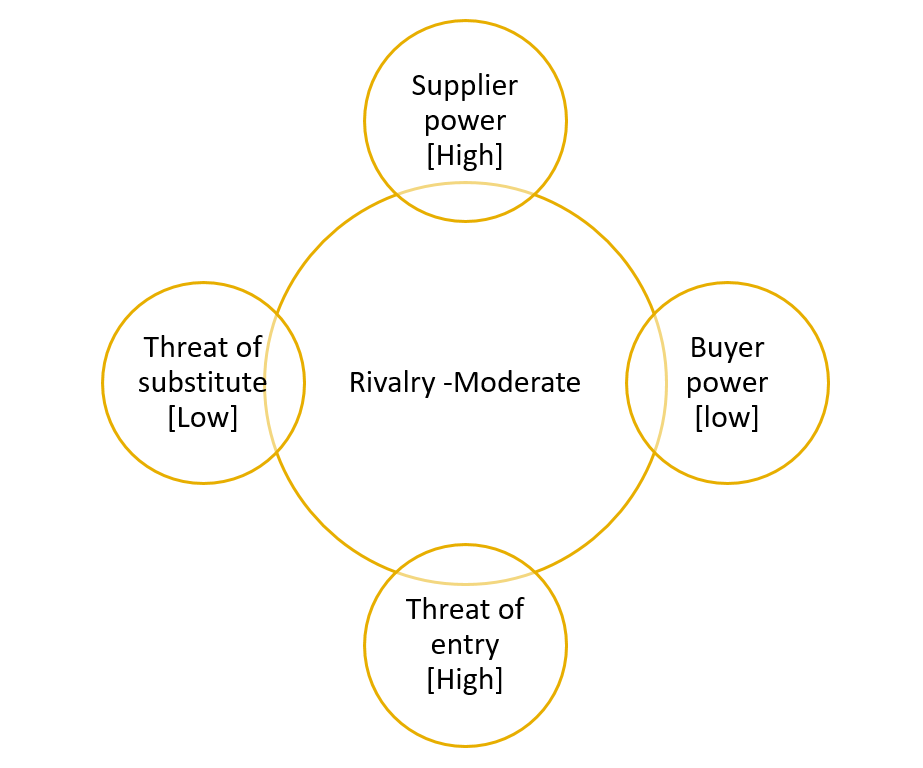

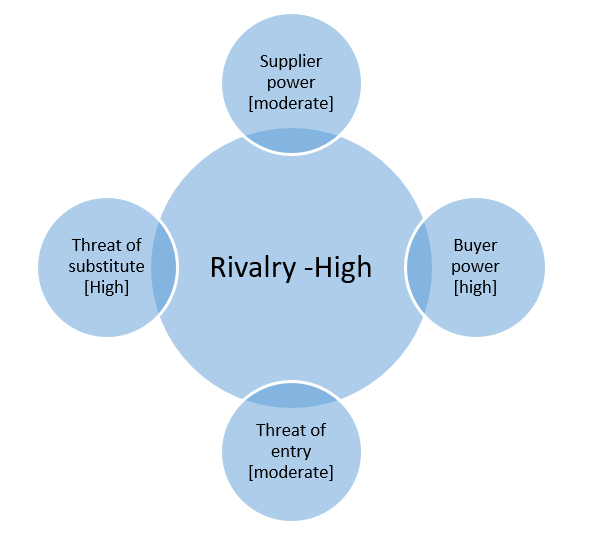

Porters Five Forces

Degree of Rivalry

Dubai is in the process of establishing smart learning in the education sector having introduced the program in public schools in 2012. The Dubai government launched the first smart learning program during the 2013/2014 academic year targeting 100 new schools. Thus, the degree of rivalry regarding the application of smart learning amongst the learning institutions in Dubai is moderate. One of the factors that have made the degree of rivalry moderate entails the view that the concept is in its formative stage. Smart learning in Dubai is mainly available in public schools as opposed to the private sector. The country does not have a well-established ICT infrastructure to enable extensive application of smart learning. The Dubai government is in currently rolling out high-speed networks, classroom smart boards, and the latest electronic technology in schools. These components form the basis of a vibrant smart education.

On the other side, the Singaporean education system ranks amongst the best systems globally. The quality of the education sector in the country has arisen from the integration of smart education. The intensity of rivalry in the country’s smart education sector is considerably high due to the existence of dominant players in the private and public sectors. Both the private and public sectors are implementing smart technology to improve their positioning in the market.

Supplier Power

Dubai currently relies on the leading global e-learning and Information Communication Technologies [ICT] companies for the different smart learning interactive technologies and other scientific equipment (Global Educational Supplies and Solutions, 2013). The suppliers do not face intense competition in the local market due to the low level of innovation in smart education. Thus, the global suppliers have a high supplier bargaining power and thus they can influence the price of the smart technologies.

Conversely, the Singaporean smart education market is characterized by a moderate supplier bargaining power. The moderate degree of supplier power arises from the entry of local and foreign smart learning technology vendors. The smart technology vendors have become very innovative, thus leading to the development of different smart learning technologies.

Threat of Entry

The smart education sector in Dubai is in its growth stage. The sector is characterized by a high rate of growth due to the increased adoption of smart technologies within the sector. Consequently, the sector has become very lucrative amongst companies that specialize in the production of smart learning technologies. Moreover, schools are increasingly purchasing smart technologies to transform how they impart knowledge to students.

On the other side, the threat of entry into the Dubai’s smart education sector will be sustainable into the future due to the establishment of new schools in the UAE. It is expected that private schools will increase to 250 by 2020 (Global Educational Supplies and Solutions, 2015). The threat of entry in the Singaporean smart education sector is relatively low. This assertion arises from the view that the market is in its maturity stage. The smart learning technology vendors are increasingly differentiating their interactive and other smart learning technologies to remain competitive.

Threat of Substitute

The integration of smart education in Dubai is in its initial stage. The Dubai government is considering rolling out the necessary infrastructure and technologies to entrench the application of smart learning. Currently, smart education in Dubai is facilitated through tablets issued to students by the government (Pennington, 2014). The government is training teachers on how to use the smart learning technologies. Therefore, the cost of switching to substitute products is considerably high. The threat of substitute to the tablets is considerably high due to the high rate of technological innovation regarding smart learning technologies.

Conversely, smart education in Singapore is more developed as compared to Dubai. The country has a well-established smart learning environment in the education sector. Furthermore, the country is characterized by different smart learning technologies that private and public institutions can adopt. Thus, the cost of switching is very low.

Buyer Bargaining Power

Smart education is a relatively new concept in Dubai. Thus, most consumers of the technology are not conversant with the different choices of smart learning technologies available in the market. Thus, the buyer power is low. On the other hand, smart education in Singapore is well established. The concept has been applied in the Singaporean education sector for close to two decades. Thus, consumers of the technology are well versed with the different smart learning technologies. Furthermore, the intense competition amongst the suppliers of the smart technologies increases the consumers’ [learning institutions] bargaining power. Figure 1 and 2 below illustrates the market forces in Dubai and Singapore’s smart education market.

SWOT Matrix

Stakeholders in the smart education sector in Dubai and Singapore should understand the prevailing conditions in the internal and external market environments. Gaining such knowledge will enable them determine the available strategic options available. Thus, they can improve their competitive advantage. The SWOT Matrix can aid in determining the strategic options.

SWOT Matrix [Dubai]

Table 1: SWOT Matrix [Dubai smart education].

SWOT matrix [Singapore]

Table 2: SWOT Matrix [Singapore smart education].

Vertical integration strategies

Enz (2010) affirms that vertical integration “is determined by the degree to which a firm owns its upstream suppliers and downstream buyers” (p. 214). A fully vertically integrated organization handles all its production activities from the production to delivery to customers. The different vertical integration strategies that institutions can adopt in their operation include forward integration, backward integration, and horizontal integration. Institutions in the smart education sector in Singapore and Dubai have adopted different vertical integration strategies as evaluated herein.

The promotion of smart education in Singapore is based on backward integration. The backward integration strategy focuses on the importance of seeking ownership or increased control over suppliers. Smart education in Singapore has undergone a significant transformation over the past decades as evidenced by its growth. The Singaporean government has made it possible for the entry of local and foreign investors in the smart education sector. However, the investors are required to collaborate with the government’s master plan. The government, through the Infocomm Development Authority [IDA], outlined a series of smart technology initiatives that it intends to undertake.

The initiatives will be implemented under the Smart Nation Programme. The objective of the program is to harness network and ICT to create effective learning opportunities (IDA, 2015). Thus, the initiatives aim at enhancing the country’s infrastructural foundations for the development of smart education. The initiatives will improve connectivity within the country’s smart education sector.

In laying down the foundation, Singapore has collaborated with the smart technology providers to ensure that the necessary smart education aspects are considered. The intensive control of suppliers of smart technology companies by the government aims at promoting the chances of attaining the smart nation outcome. The government intends to achieve this goal through the backward integration strategy. IDA (2015) emphasizes that the “government is focused on encouraging the development of a culture of experimentation and building and working with companies in co-creating solutions” (par. 3). Some of the companies that the Singapore government has partnered with through the IDA in promoting smart education include StarHub, MyRepublic, M1, and Singtel (IDA, 2015).

On the other side, the development of smart education in Dubai is based on the forward integration. Kozami (2005) asserts that forward integration “moves an organization nearer to the ultimate customer” (p. 176). Thus, forward integration is concerned with gaining ownership or increased control over distributors or suppliers. To improve smart education in Dubai, the UAE government has adopted a key position in the sector to control the application of the smart learning technology. The implementation of smart education in the learning institutions is based on specific requirements.

Dubai is collaborating with well-established technology producing companies both locally and internationally such as the Swiss Research Centre in developing smart learning. The UAE participated in the Gulf Educational Supplies and Solutions [GESS] held in Dubai in February 2013. Some of the major participants in the GESS include the leading providers of smart learning technologies in the education sector such as Microsoft, Core Education, Rosetta Stone, Edutech, and ICC.

The motive of the GESS is to give the government, which is the leader in the implementation of the smart learning technology, an opportunity to preview the different smart learning technologies offered by leading smart technology providers. Conversely, the event gave stakeholders in the education sector an opportunity to engage in extensive discussion on how to adopt different smart technology devices in the learning process. Furthermore, the UAE government stipulated the requirements that the smart technology providers have to consider in developing the smart learning technologies. This aspect highlights the adoption of the forward integration strategy by the UAE government.

Intensive Strategies

Flouris and Oswald (2006) affirm that intensive strategies should be applied to businesses operating in markets characterized by a certain degree of growth. The smart learning markets in Singapore and Dubai are in different phases of growth. Therefore, different intensive growth strategies should be applied. Smart education in Dubai is in the introduction phase. Thus, the probability of the market undergoing significant growth is considerably high. Smart technology providers in Dubai should consider integrating the market development strategy. This strategy entails introducing a company’s existing products into new markets (Lamb, Hair & McDaniel, 2012).

Over the past two years, the UAE government has been committed to leveraging on education as a catalyst for economic growth. To achieve this goal, the Dubai government is currently in the process of laying down the foundation for smart education by developing the guidelines. The government has formulated the National Innovation Strategy that aims at fostering innovation in different economic sectors with the education sector being amongst them (Obeidat & Saleh, 2015).

The global IT companies partnering with Dubai in implementing the smart education platform should consider introducing their smart learning technologies, which are already applied in other countries, into the UAE market. Adopting the market development strategy will enable well established and leading global ICT companies in the UAE expand the market for their existing products. Moreover, the market development strategy will give the companies an opportunity to increase the market share of the existing smart learning technologies. By introducing the existing products in the new geographical market in Dubai, the smart learning technology developers will be in a position to develop their existing products to align with the prevailing smart education needs.

Unlike Dubai, smart education in Singapore can be defined as being in the growth phase. Despite the concept of smart education being in existence in Singapore for close to two decades, the opportunity for further growth cannot be ruled out. Singapore is currently ranked as a global education hub. Teoh, Bhati, Lundberg, and Carter (2013, p.64) affirm that education in Singapore is “highly established, globally competitive, national universities, and draws in international universities in twinning arrangements or establishing offshore brand campuses in the nation state”. The ICT companies specializing in the production of smart learning technologies should consider exploiting the opportunities available in the market. To achieve this goal, the ICT companies should consider adopting intensive growth strategies.

The most appropriate intensive growth strategy that ICT companies should consider is the product development strategy. The strategy entails innovating and developing new products to attract customers to the existing market. A significant proportion of learning institutions in Singapore has already adopted the concept of smart education. Students and teachers in the Singaporean learning institutions are conversant with basic learning technology.

A report released by Singtel (2012) emphasizes that there is a “common belief that merely digitalizing or making print versions of textbooks available online will not address adequately the smart learning needs in different institutions such as universities and the K-12 levels” (p. 2). This assertion underscores the need for ICT companies operating in Singapore to consider developing new and highly interactive smart learning technologies. One of the most effective smart learning technologies that ICT companies should consider promoting in Singapore entails the cloud computing technology. Other smart learning technologies that the companies should develop include gamification, electronic publishing, tablet computing, learning analytic, and the use of the mobile application (Singtel, 2012).

Competitive Profile Matrix [CPM]

The application of smart education in Singapore and Dubai has led to an increased development of diverse smart learning technologies. ICT companies are increasingly exploiting the opportunities available in the smart education sector within the two countries. Thus, the ICT companies operating in these markets have increased their investment in the development of different smart learning technologies. The major ICT companies operating in Singapore and Dubai include Samsung, Intel Corporation, and Samsung.

The performance of the smart technology providers in the two countries can be assessed using the competitive profile matrix. The CPM assesses the critical success factors amongst the different competitors. The weights on the critical factors are rated between 1.0, which represents high importance and 0.00, which is equal to low importance. Alternatively, the score range between 1 and 4, where 1= major weakness, 2=minor weakness, 3= minor strength, and 4= major strength. The leading players in the two countries can be assessed using the CPM as evaluated herein.

Table 2: CPM, Dubai.

The CPM above shows that Microsoft has developed optimal competitiveness in the Dubai and Singapore’s smart education markets. This assertion holds due to the overall rating on the critical factors, which is 3.5 as compared to the 3.10 and 2.80 rating in Samsung and Intel Corporation respectively. The high rating regarding Microsoft operation in Singapore and Dubai shows that there is a high probability of the company generating high revenues by offering smart learning technologies.

Boston Consulting Group [BCG] Matrix

Smart education in Singapore and Dubai will depend on the implementation of different smart learning products developed by various smart companies. However, the utilization of the various smart learning technologies in the two markets can be assessed using the BCG matrix. The matrix assesses businesses units or products based on two main dimensions, which include market share and growth rate. The market share dimension examines the size of the market share dominated by a particular product. On the other hand, growth rate entails assessing how rapid a market is growing. The BCG matrix groups products into four main categories based on the two dimensions. These dimensions include the star, cash cows, dogs, and question marks (Daft, 2008).

Dubai is in the initial stage of incorporating the concept of smart education. The UAE leadership can consider numerous products in implementing smart education. The main suppliers of the smart learning technologies in Dubai include Intel Corporation, Samsung Electronics Company Limited, Google Incorporation, Microsoft, and ITWork. Dubai is in the process of replacing textbooks with tablet computers. Furthermore, the Dubai government is replacing the use of pencils in K-12 institutions with stylus pens. Other technologies being applied in the classrooms include smart boards (Pennington, 2014). Using the BCG matrix, the smart learning technologies in Dubai can be categorized as illustrated herein.

![BCG Matrix [Dubai smart education].](https://ivypanda.com/essays/wp-content/uploads/2020/05/fig3-1200x756.png)

The BCG matrix above illustrates the different smart learning technologies in Dubai. However, the matrix shows that tablet computing, electronic publishing, and the Internet of things are the main smart learning technologies applied within the sector. Subsequently, they command a relatively high market share. However, the growth rate is relatively low. One of the reasons that explain the low growth rate arises from the view that the Dubai government is currently undertaking pilot projects on the application of smart learning technologies in the government K-12 schools. Consequently, smart education in Dubai is currently implemented in a small proportion of the country’s education sector.

The Natural User Interfaces [NUIs], which entail the use of tablets, smartphones, ‘smart TVs’, and game consoles are likely to command a high market share, hence high growth rate and thus they are categorized as stars in the Dubai’s smart education. This assertion arises from the view that the technologies can be used easily in the teaching process. The Massively Open Online Courses [MOOCs] entail networked learning, and they are categorized as ‘dogs’. Singtel (2012) affirms that the application of the MOOCs is yet to attain the envisioned potential. On the other hand, a low market share characterizes cloud computing in the Dubai’s smart education sector. However, the low market share is has a high potential for growth due to its effectiveness in the development of an interactive smart learning environment

Similar to the Dubai smart education sector, different smart learning technologies have been implemented under the watch of the private and public institutions in Singapore. However, the smart learning technologies in Singapore are characterized by different market share and rate of growth as illustrated in the BCG matrix below.

![BCG Matrix [Singapore smart education].](https://ivypanda.com/essays/wp-content/uploads/2020/05/fig4-1200x742.png)

Figure 4 above shows the existence of considerable difference regarding the development of smart education between Singapore and Dubai. According to figure 4, the utilization of different smart learning technologies is relatively high. The main technologies used in the sector include tablet computing, electronic publishing, cloud computing, smartphones, mobile applications, and tablet computing.

These smart learning technologies are applied extensively in the education sector, and thus they command a high market share in the education sector. On the other hand, the application for gamification in the smart learning process is considerably low. However, the potential for experiencing high growth rate and market share is high due to the effectiveness of the use of gaming mechanics in improving the learning process and techniques. Considering the increased application of cloud computing in the Singaporean education sector, it is imperative for stakeholders to consider developing collaborative environments, which entail cloud-based online spaces. The current market share for a collaborative environment is low. Nevertheless, the potential for the technology attaining a high growth rate is remarkably high.

The technology will make it possible for group interaction no matter the location. This approach will make it possible for Singapore to address the demand for education by international students. The application for personal learning environments is low. Thus, the market share and growth rate of this technology is very low. Singtel (2012) defines the technology as “the use of self-directed and group-based learning and focuses on using individual learning tools in order to achieve a high level of customization and flexibility” (p. 12). The PLEs have been replaced by smartphones, mobile applications, and tablet computing.

Conclusion

The governments of Singapore and Dubai have appreciated the significance of smart education in developing a knowledge-based economy. The two countries are of the opinion that smart education will foster the development of a strong workforce. This assertion arises from the view that the smart learning technology will lead to the establishment of an interactive learning environment.

The technologies will simplify the learning process in addition to enhancing the techniques used in teaching. Moreover, the students will access content from different regions, hence improving their learning. However, smart education is more developed in Singapore as compared to Dubai, which is in its formative stages. To achieve and sustain the benefits associated with smart education, Singapore and Dubai should evaluate their smart education master plan continuously to identify the areas that need improvement.

References

Daft, R. (2008). New era of management. Mason, OH: Thomson South-Western. Web.

Enz, C. (2010). Hospitality strategic management; concepts and cases. Hoboken, NJ: John Wiley and Sons. Web.

Flouris, G., & Oswald, S. (2006). Designing and executing strategy in aviation management. Aldershot, UK: Ashgate. Web.

Global Educational Supplies and Solutions: Education poised for growth as GESS Dubai ends on a high note. (2015). Web.

Green, A. (2013). Proceedings of the 10th international conference on intellectual capital, knowledge management, and organizational learning. New York, NY: Academic Conference Limited. Web.

IDA: Innovation driven initiatives pave the way for Singapore smart nation vision. (2015). Web.

Kozami, A. (2005). Business policy and strategic management. New Delhi, India: McGraw-Hill Publishers. Web.

Lamb, C., Hair, J., & McDaniel, C. (2012). Essentials of marketing. Mason, OH: Cengage Learning. Web.

Obeidat, O., & Saleh, A. (2015). UAE officials declare 2015 as ‘Year of Innovation’. Web.

Pennington, R. (2014). Smart learning programme transforms education in UAE’s government schools. Web.

Singtel: Technology outlook; Singaporean K-12 education 2012-2017. (2012). Web.

Teoh, T., Bhati, A., Lundberg, A., & Carter, M. (2013). Evaluating new learning technology in Asia-Singapore as a case study. Web.