Introduction

Background: Global Trade Imbalance

Within the context of international trade, the process of constantly changing patterns of trade is inevitable and, therefore, sustaining a trade balance is a serious challenge for the global community. Trade relations between different countries are not confined merely to the purpose of importing and exporting goods.

Rather, the importance of establishing trade contact is much more valued than the trade process itself. Tracing different patterns of trade and production, the problem of global trade imbalance is closely connected to trade determinants, including proximity, offshoring, natural resources, and different levels in technological development (Feenstra and Taylor 15).

Hence, the probability of importing goods from a country is primarily dependent on the degree of technological advancement, rather than on such important factors as proximity and natural resources. Hence, if one economy gains an advantage over manufacturing one product, other countries will definitely have fewer chances to compete with this country.

As a result, a concept of comparative advantage emerges at the international market that is largely affected by the level of development of specific countries.

Because of the relative fluctuation in the capital and labor in different markets, the shift in comparative advantages leads to the problem of global trade imbalances implying unequal allocation for the above-presented trade determinants. Such a situation excludes the consideration of the concept of comparative advantage.

The current issues of global trade imbalance have been highlighted with connection to the global financial crisis, is the major outcome of the former. In particular, current account surpluses in emergent market economies have imposed a significant pressure on global interest rates, which contributed to credit boom in developed economies because of account deficits (Feenstra and Taylor 15).

Within these perspectives, it is purposeful to consider the main factors contributing to the major global imbalances and highlight the main reasons and underpinnings of existing problems in terms of interest rates, cross-boundaries activities influencing capital flows.

Excess in saving in the developing countries has exerted serious pressure on the global interest rates. The decrease has forced a credit book and risks in major developed countries, such the USA, whose economic policy of credit share has become the premise for the global financial crisis.

In this respect, Borio and Disyatat argue, “…the international monetary and financial system lacks sufficiently strong anchors to prevent excessive credit growth and to contain the “elasticity” inherent in global finance” (200).

At this point, the major failure of the global imbalance lies in extreme flexibility and elasticity of the macroeconomic sphere, but not in excess saving. International financial and monetary systems, therefore, suffer from imbalance because of the excess elasticity leading to a financial crisis.

Purpose of the Study

The main purpose of the research is to define the main underpinnings of trade global imbalance and analyze which patterns have emerged as a result of the phenomenon. Evaluation of sustainability of global imbalance is also significant for defining future trends of international trade development.

Finally, specific policies addressing global trade imbalance should be considered in terms of their effectiveness and appropriateness. All these approaches are estimated through the analysis of internal and external dilemmas in the sphere of trade. Important insight should be made to the historical analysis to highlight the roots of the problem and analyze the shifts to be made to provide solutions.

Discussion

Factors Contributing to Global Trade Imbalance

U.S. Trade Deficit

The complex international relations of the United States with other countries, particularly China and Japan, have become a milestone in trade deflection from balance. American policymakers have viewed China’s exchange rate as the reason for extreme U.S. trade deficits.

At the end of 2008, China increased its foreign reserves up to $ 3 trillion, which was $ 2 trillion larger than two years before. Moreover, China managed to displace Japan and receive the largest trade surplus while holding trade with the USA (Liew 656).

Many US political players focused on the Yuan as the major scapegoat for the emerging trade gaps in the US. Using this beneficial strategy allowed to assume this is a sophisticated tactic that the Chinese policymakers chose to impair the US financial system and economy.

According to Liew, “….US trade deficit is constrained not just by the structural and behavioral factors…but also by the demands of China’s domestic political economy” (657). Because of these assumptions, the American policymakers have perceived the Chinese economy as a threat to the U.S. trade prosperity and superiority on the global arena.

The US authorities perceived the large US trade imbalance in partnership with China as a serious security issues. The danger of trade gap was due to a number of reasons. First, there is an assumption that continuous trade influenced current US industrialization (Liew 658).

Because of China’s trade policies, the US manufacture base was put under the threat. Second, the attention should be given to the relationship between the U.S. trade gap and the growing U.S. international debt.

Because of deteriorating positions of the US international investment, the country, which had previously been recognized as a world’s net creditor, became the biggest debtor in the world in 1990. The growing U.S. trade deficits worsened the situation with the external debt and, as a result, they reinforced its position of the top debtor in the world, making the country depend on foreign purchases.

The third factor contributing to the U.S. deficit was considering the trade relations with China as a security concern in terms of the capacity that this financial advantage was provided to enhance China’s prosperity in the global economy (Liew 660).

While referring to the Richardian model of comparative advantage, China surpassed the US economy by means of introducing effective source powers, which is one of the determining factors in trade. China’s technological capacity was much stronger than that of the USA.

Finally, heavy dependence on the oil-importing countries put the United Stated out of competition with China and other developing economies. Improving its financial and technological strength, China managed to increase its financial independence because it introduced significant funding of a research and development field.

The above-presented factors revealed the actual reasons for the US dollar devaluation as a result of the aggressive and superficial policy of the United States with the developing countries. A failure to establish fruitful cooperation in the Asian region has left a serious imprint on the US economy and financial stability.

Current Account Imbalance

Current account imbalances should specifically be concerned with the most industrialized countries in the world, including the USA, Great Britain, Canada, Italy, France, Japan, and Germany. At this point, the current account deficits and surpluses in the identified economies with flexible exchange rates and open capital markets are considered a common equilibrium phenomenon.

Moreover, the concept of current account adjustment in the developing economies and the interaction between this adjustment and financial crisis recently became the major problem. In addition, the focus on the so-called Great Seven provides a comprehensive analysis of adjustment of the US trade deficit (Gourinchas and Rey 11).

At this point, it is reasonable to take a deep look at the historical perspectives of commercial development of the United States to define the origins of current account imbalances in the world.

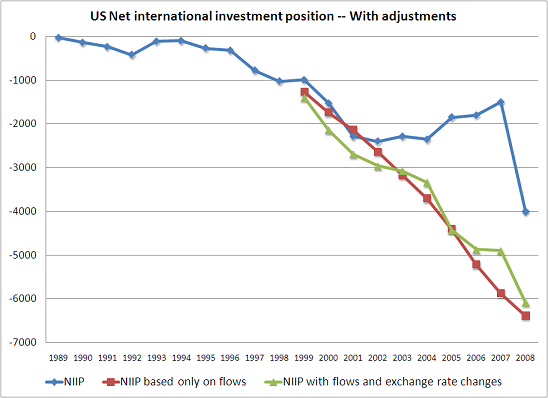

While measuring the U.S. net foreign asset situation from 1952 to 2004, one can view a remarkable decline from 15 % of GDP in 1952 to -26 % of GDP in 2004 (Gourinchas and Rey 12). Regarding the net investment position from period 1989- 2008, the recession tendency influenced further financial imbalances in the country (See Figure 1).

Judging from this figure, the valuation components – differences between net foreign assess and the current account series had a potent impact on the dynamics of the external position of the United States. Therefore, the rise of net liabilities in the country did not contribute to the overall rise in net income payments.

Despite the exceeding rate of gross liabilities, the US income account was still positive. To support the idea, Gourinchas and Rey state, “the income generated by the (smaller) U.S.-owned assets abroad is larger than the income paid on the (larger) foreign-owned assets in the United States” (18).

In addition to the above, the yield represents another important component of the total revenues of the United States external liabilities and assets.

The USA is considered as the world’s important trade center, despite the failure of the exchange rate regime. Represented as the World Banker, the United Stated managed to carry out short borrowing and lend long-termed credits. The US balance sheet is regarded as a venture capitalist with risky investments.

The currency prevalence of assets is a very sophisticated issue because it is able to denominate the price of liabilities in dollars, thus changing the exchange rate exposure in the other economies.

The US external balance sheet is instrumental in stabilizing the external account of the emerging economies (Gourinchas and Rey 22). In this respect, the US dollar depreciation positively contributed to the external position in terms of net exports and rise of the value of US assets.

With the United States in the centre of the current account imbalance, other countries have suffered from the financial gaps as well. In particular, the country has faced a serious challenge while adjusting the emerging imbalances at a domestic level because the causes of the problem are connected to foreign emergencies.

The focus on such Middle East countries as Saudi Arabia and Lebanon demonstrates the controversies occurred in terms of oil export and import operations. At this point, the average current account t in this region is positive and amounts to 9.5 % from 2000 to 2010 (Wille 26).

Therefore, the current account of the countries exporting oil equals to 13.4 %, whereas the oil-importing countries witness a negative current account of 0.8 % in the similar decade (Wille 27). This concrete example can be applicable to other oil-exporting countries having an underdeveloped industry sector unlike to the developed economies.

Phenomenon of Trade Savings Glut

As it has been determined previously, the U.S. trade deficit is strongly associated with the net foreign asset position. Due to the fact that U.S. investment rates surpass the U.S. saving rates, the foreign borrowing was the only way to fill in the financial gap.

As a result, many theorists believe that lack in the U.S. saving rate caused the trade deficit and, in order to address this emerging issues, the American policymakers strived to cut down the trade deficit by promoting national saving (Labonte 2). The chairman of the Federal Reserve, Ben Bernanke noted that the major reason for the trade deficit did not lie in insufficient domestic saving, but in the internal saving glut (Labonte 2).

At this point, the author provides Bernanke’s view on the saving glut who states, “…world saving is so abundant because foreign saving rates in the industrialized world are high and investment demand is low as a result of its rapidly aging populations” (Labonte 7). Such a situation contributed to a world’s change from “from a net borrower to a net lender” (Labonte 7).

To take a closer look at the situation, several reasons occur. To begin with, the period of the financial crisis at the end of 1990s put the developing world in the necessity to borrow. This was of particular concern to such countries as Mexico, Turkey, Argentina and Southern Asian (Labonte 8).

In this respect, the flowing capital in the third-world countries required a new direction. The financial crisis also triggered the improvement of fiscal position by involving less borrowing budget deficits and introducing foreign exchange reserves.

As a result of the foreign exchange accumulation, the central became as the source of capital outflows, which led to the current account surplus. Increasing foreign reserves is also a kind of national saving carried out by the central bank, but not by private citizens. In addition to the above, the oil prices boosting also caused increase in saving and income for most of the developing countries exporting oil.

The rise of global saving glut, therefore, supports the reasons for the U.S. saving recession. Because the capital inflows increased, the U.S. assets prices made the Americans wealthier in the 1990s (Labonte 8). Therefore, they U.S. citizens were more likely to consume more and save less.

At the same time, the foreign capital inflows led to lower interest rates, which increased the American housing prices. According to the Federal Reserve chairman, the rise in household welfare due to the price increase was also the main reason for decline in savings and intensity in consumption (Labonte 8).

With regard to the global saving glut as the major underpinning of imbalances, it can be assumed that current account imbalances can either temporary or permanent. Discrepancies in business cycle at domestic and foreign levels belong to a contemporary factor.

At this point, the United States has currently been promoted to the economic expansion in comparison with other industrial countries. The second factor is premised on the decrease in investment rate in some East Asian economies that strive to cut their foreign borrowing. Finally, the governmental intervention to lessen exchange rate value in the Asian region has also influenced the current account imbalance.

Evaluating Sustainability of Global Trade Imbalance

Estimating External Deficits

With regard to the investment and saving behavior and dynamic optimization, the external balances, along with the exchange rate, are consistent. Due to the U.S. trade deficit caused by the dollar expansion, the prices significantly increased and the employment rates did not correspond to the existing economic standards.

This negative shift was closely connected with the external deficit at the end of the 1990s. The problem is that US policy trade suffered a difficult situation because of the failure to mediate the supporters and opponents of the liberalization in the country. Judging from the above-presented assumptions, the high evaluation of dollar caused a growing external imbalance.

According to Institute of International Economics, “dollar overvaluation…is demonstrably the most accurate leading indicator of protectionist trade policies in the United States” (41). With regard to the assumption based on the historical facts, future trends can resemble the previous ones.

The consequences of the U.S. trade deficit had a significant impact on the European trade surplus and currency undervaluation. In particular, the external surplus of the European Union ranged between 1 % and 1.5 % at the end of 1990 (Institute for International Economics 42).

The unusual situation triggered an abrupt deterioration of the EU trade balance that was also followed by the deplorable unemployment rates. As soon as the European currency sets its credibility, the portfolio diversification will start.

In other words, a shift from dollars to euro appreciation will occur, which will result in a significant reversal of the EU’s external position. It will later move into a substantial deficit leading to a financial crisis and, as a result, the monetary dynamic in Europe and the United needs to be reevaluated to avoid overvaluation of the currency and eliminate the huge deficit.

Perspectives of Current Account Balance

While evaluating the exports and imports within the countries and outside them, the perspectives of current account balance provide a complicated picture. In particular, they are expressed in connection to the world GDP to provide an analysis of their global appropriateness.

In this respect, countries such as Asia, Japan, and oil-exporting countries confront the current account deficit in the United States. In contrast, the current account balance is observed in the European region. In order to understand the future trends of reversal and change, it is reasonable to link them to the development of current account balances for a longer period of time.

While focusing on the United States and Europe and their GDP levels, a negative movement of the current account can be observed (Lane et al. 7). This is of particular concern to the 1980s when both Europe and the United States undergo significant current account fluctuations.

At this point, the European countries underwent a positive trade balance, whereas the United Stated experienced a strongly negative trade balance. In 1990s, the international trade faced serious shifts due to the deterioration of current account balances in both regions.

Drawing the parallels between the periods, the 80s witnessed a negative balance of -0.68 whereas 1996-2006 witnessed a positive increase of balances up to 0.40 (Lane et al. 7). Within the perspectives and future trends, collective deficit will not exceed the current value, which about 3 % of GDP in 2006 (Lane et al. 8).

It is twice larger than in 1980s that reflected the extreme deficit in the USA. While combining the trade balances of Japan, Europe and the United States, future tendencies will not differ significantly from the figures established in the 80s of the past century.

With regard to the different roles and degrees to which current account balances fluctuations among the developed and developing countries, it should be stressed that the future trends in international trade will be preserved in terms of the entire external balance.

Evaluating International Capital Markets

Referring back to the problem of borrowing and lending, specific attention should be paid to the analysis of the international capital market to understand the main underpinnings of the global trade imbalance. In this respect, acting as lenders and borrowers, the emerging countries are under the greatest threat because of the possibility of default.

Because lenders often denominate their currency, they are unlikely to risk due to the constant discount rates they receive. As a result, the emerging economies can be detached from the international capital market, contributing to the rapidly growing global trade imbalances.

According to Flood and Marion, “because lenders to [emerging economies] countries understand that default is possible, they require a “spread” above the offshore safe rate to make EM lending profitable over the long run” (880). Otherwise, there is a possibility for the emerging economies to be excluded from the international capital market share with no lending rates becoming beneficial.

At this point, the risk-neutral lenders do not lend because they acknowledge that higher rates of lending can lead to the risk of default. Among the risk factors that the borrowing countries can face, it is possible to single out such issues as fluctuations in foreign interest rates, returns to output growth, and output variance.

In addition, in case of the countries’ default, the high probability of being out of the threat provides the borrowing countries with an incentive to take advantage of high-variance projects. Consequently, such countries are likely to have output variance as compared two the developed countries with a lower risk of default.

Assuming the fact that there is a rigid disparity between the developed and the developing economies, the international capital market share of the latter is the smallest one. Nevertheless, the third-world countries are greatly motivated by the ability to receive an option value of not being defaulted and, therefore, their projects are much more competitive than those proposed by the developed economies.

Policies and Solutions to Address the Problem of Global Trade Imbalance

With regard to the complicated and diverse nature of the global trade imbalance, the solutions should also approach the problem in a multi-dimensional way. More importantly, both domestic and international perspectives should be taken into consideration to define how those are interchanged.

At a domestic level, the country experiencing trade deficit should widen their perspective and consider issues other than inflation targeting regimes. Policy frameworks should strengthen the monetary policy and provide an opposition to the financial imbalances.

At the international level, complicated issues are involved. In particular, excess focus on the domestic trade can deprive the country of the possibility to global spillovers.

In this situation, the country can leave the problem unsolved because of the unfulfilled possibility of international cooperation. In addition, the excess elasticity of the financial system provides much wider policies to introduce. In particular, the focus n the fiscal policy is a beneficial point because this sphere should carefully be tackled so as to avoid the trade imbalances.

Judging from the above-presented problems and solutions, there is a potential need for a more systematic financial and monetary policies addressing to the macroeconomic issues. Increasing elasticity of the credit economy can allow the financial system to generate more approaches to gain revenue and stay afloat at the international market.

In other words, the role of money in the international economy is critical and, therefore, reference to the traditional economic paradigms can provide a fresh insight to solving the problem of global trade imbalance.

Conclusion

The importance of sustaining a global trade imbalance designates future successful development of fixed and emerging economies. The importance of establishing trade relations attains increasing importance because it identifying the constantly changing patterns of international trade.

In particular, input and output operations are closely associated with such trade factors as geographic location, natural resources, and technological development — all these determinants in complex shape the overall current account balance and international capital market.

More importantly, the financial aspects of international trade are largely dependent on the surpluses and deficits rates, as well as the stability of the currency exchange rates. Looking from these perspectives, the U.S. trade deficit, its complicated relationships with the Asian countries, as well as undervaluation of the European currency have greatly contributed to the trade imbalance.

Other nuances, such as impossibility of emerging economies to engage with the international capital market operation, are also considered as the underpinnings of the identified problems.

In order to address the issue, a more systematic and broader view should be introduced to define the positions and potential of the international market. Widening elasticity and focusing on money as the primary source of relations are obligatory for sustaining the trade imbalance.

Works Cited

Borio, Claudio, and Piti Disyatat. “Global Imbalances and the Financial Crisis: Reassessing the Role of International Finance.” Asian Economic Policy Review 5.2 (2010): 198-216.

Feenstra, Robert and Alan Taylor. International Trade. US: Worth Publishers, 2008. Print.

Flood, Robert, and Nancy Marion. “Getting Shut Out Of The International Capital Markets: It Doesn’t Take Much.” Review Of International Economics 17.5 (2009): 879-889

Gourinchas, Pierre-Olivier, and Helene Rey. “From World Banker to World Venture Capitalist U.S. External Adjustment and the Exorbitant Privilege”. G7 Current Account Imbalances: Sustainability and Adjustment, Issue 12194. Ed. Richard H. Clarida. US: University of Chicago Press, 2007. Print.

Institute for International Economics. Launching New Global Trade Talks: An Action Agenda. US: Peterson Institute, 1998. Print.

Labonte, Marc. “Is The U.S. Trade Deficit Caused By A Global Saving Glut?: RL33140.” Congressional Research Service: Report (2005): 1.

Lane, Philip R., Milesi-Ferretti, Gian Maria, and International Monetary Fund. Europe and Global Imbalances, Issues 2007-2144. US: International Monetary Fund.

Liew, Leong H. “US Trade Deficits and Sino-US Relations.” Journal Of Contemporary Asia 40.4 (2010): 656-673.

Wille, Adrian. Current Account Imbalances of Selected Middle Eastern Countries: Why and How to Solve it. Germany: GRIN Verlag, 2011. Print.