Starbucks Corporation (SBUX) is one of the leaders in the market of premium roasters and retailers of coffee over the globe that is widely known as a chain of coffeehouses. The company was established in Seattle, Washington, in 1985, and now it has more than 30,000 stores all over the globe. Starbucks specializes in offering different types of coffee drinks and tea, as well as other beverages, and confectionaries made out of high-quality products.

The corporation also uses such brands as Seattle’s Best Coffee, La Boulange, and Ethos among others in order to deliver their products. The company’s mission is to promote Starbucks as one of the most recognized and popular coffee chains in the world market to address customers’ needs regarding the quality of products and associated experiences (“Starbucks company profile,” 2019). Therefore, Starbucks actively expands not only in developed countries but also in developing nations in order to broaden the covered markets. The purpose of this report is to provide the detailed analysis of Starbucks’ financial profile with reference to assessing corporate governance, the capital structure, investment, and other aspects.

Corporate Governance Analysis

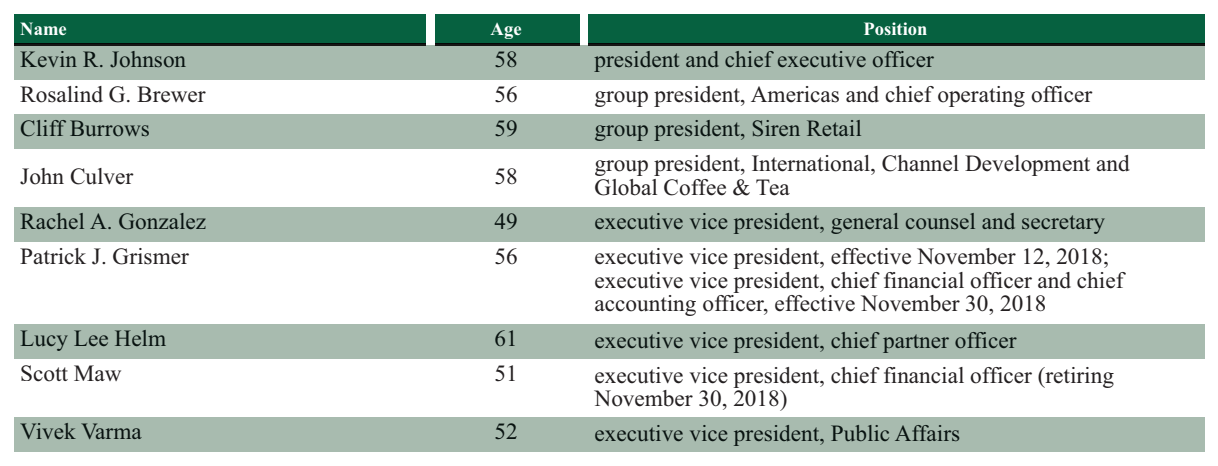

Starbucks Corporation has nine executive officers who are responsible for decision making in the organization (Appendix A, Table 1). The company’s CEO and President is Kevin Johnson, who replaced Howard Schultz in April 2017. Johnson performs as Director in the company since 2009, and he also served as the CEO of Juniper Networks, Inc. during 2008-2013 and the member of the Board of Directors in Juniper Networks during 2008-2014.

In 2009, Johnson became the member of the Board of Directors in Starbucks (“Starbucks: Fiscal 2018 – Annual report,” 2018). Johnson’s annual base salary is $1,300,000, and his minimum investment in the company equals minimally six times his annual base salary (“Starbucks: Fiscal 2018 – Annual report,” 2018). Thus, there is no strict separation between management and the Board of Directors in Starbucks, and Johnson as CEO and the member of the Board of Directors is interested in the company’s growth.

The Board of Directors includes 13 directors, who mainly adhere to the independence requirements provided by NASDAQ (“Starbucks company profile,” 2019). They all serve Starbucks for more than two years, and Myron E. Ullman, III has performed as Director in the company since 2003. Two executives can be regarded as “inside” Directors serving the company’s interests. Still, it is important to note that the majority of Directors are independent, performing as executives in other organizations, and this aspect can influence the quality of their decisions for shareholders. This aspect decreases the responsiveness of the managers to stockholders. Starbucks’s ISS Governance QualityScore is 3 because of the quality of the board and auditing procedures (“Starbucks Corporation (SBUX),” 2019). The score is comparably low, and the company requires more involvement of the Board of Directors in the company’s activities in order to address shareholders’ interests.

Starbucks actively interacts with financial markets and provides all the required information on its official website. It openly provides financial data, stock information, and data important for shareholders (“Starbucks: Investor relations,” 2017). All the reports related to the company’s activities are available for reviewing publicly, and the average trading volume is 6,464,323 (“Starbucks Corporation (SBUX),” 2019).

It is also important to note that the company is focused on promoting the principles of sustainability in its operations and decreasing the negative impact of activities on the community and environment. Much attention is paid to promoting the image of the company that is interested in greening practices and supporting communities in which it operates through its Global Social Impact strategy (“Starbucks: Fiscal 2018 – Annual report,” 2018). Therefore, Starbucks’s corporate reputation should be considered as rather good, but it is not one of the most reputable companies.

Stockholder Analysis

Describing the average investor in Starbucks’s stocks, it is important to note that the company primarily trades its stocks on NASDAQ. Large domestic institutions and hedge funds should be discussed as important stakeholders of Starbucks. The marginal investor in the company is an institutional investor because institutional ownership is about 72.15%. The key institutional investors are Vanguard Group Inc. (about 89 million shares), Blackrock Inc. (about 81 million shares), State Street Corp. (about 52 million shares) (“Starbucks: Fiscal 2018 – Annual report,” 2018). Thus, price movements are greatly influenced by hedge fund ownership.

General public ownership is also important as it represents about 21%. Individual and insider ownership is also important for the company’s development as insiders own more than 2.7% in Starbucks (“Starbucks: Fiscal 2018 – Annual report,” 2018). Among them, Howard Schultz owns 33 million shares, Mellody Hobson has 246,000 shares, John Culver owns about 366,000 shares, and Clifford Burrows owns about 248,000 shares (“Starbucks Corporation common stock (SBUX) institutional holdings,” 2019). This percentage allows for concluding about insiders’ comparably high role in making decisions regarding the company’s operations and finance distribution. The ownership related to private companies is less than 1%, and it is strategically insignificant for the company.

Risk and Return

Top Down Betas

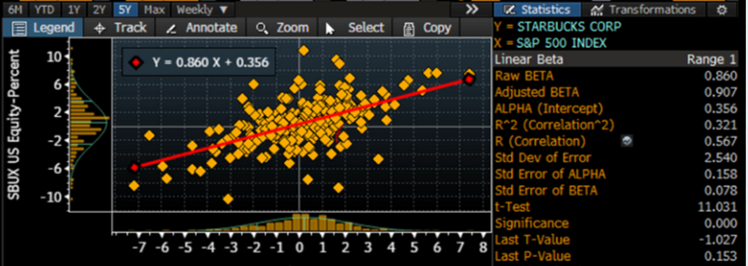

In order to estimate specific historical risk parameters for the risk profile and identify related regression betas, it is necessary to refer to the five-year period (2013-2018) and to use the Bloomberg beta calculation resource (Appendix A, Figure 1; “SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019). A regression test of Starbucks’s stock prices run against the S&P 500 indicates that the regression beta (slope) is 0.9. Referring to the data presented in Table 1, it is possible to state that the slope is 0.9% and the intercept is 0.36%, which indicates that Starbucks performed 0.36% better than it was expected for the period according to the CAPM. When focusing on R squared of the regression (32%), it is possible to suggest that 32% of the risk is related to market-related sources, when 68% are related to firm-specific factors, and much risk is related to business factors (Damodaran, 2014). Thus, the company’s performance profile should be improved in order to eliminate risks.

Table 1. Regression Results.

Bottom Up Betas and Expected Return on an Equity Investment

When comparing Starbucks’s beta to the sector (bottom up) beta that equals 0.85, it is important to note that Starbucks’s beta for five years is almost the same (“Starbucks Corporation (SBUX),” 2019). The levered beta for the company is 0.9, and it should be referred to as more reliable, reflecting the position of the company within the market (“Levered/unlevered beta of Starbucks Corporation (SBUX | USA),” 2019).

The expected return on an equity investment will be 8.35%, where a long-term treasury bond rate is 3.4% and the geometric historical risk premium for stocks is 5.5% (3.4 + 0.9(5.5)) (“Starbucks Corporation (SBUX),” 2019). This percentage should be taken into account when determining a rate of return for investing in Starbucks primarily for long-term investors, but the figures indicate that the company’s equity is not risky.

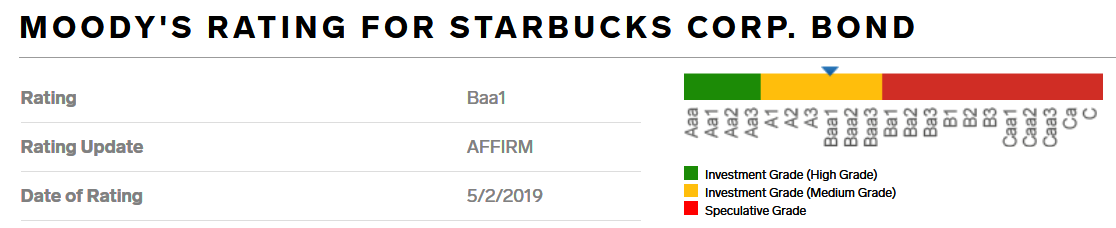

Default Risk and Cost of Debt

The recent rating for Starbucks provided by Moody’s Investors Service is Baa1 that means that Starbucks’s obligations are associated with the moderate credit risk, and they can be subject to some speculative characteristics (Appendix A, Figure 2; “STARBUCKS CORP.DL-NOTES 2018(18/48) Bond | Markets Insider,” 2018). The associated Accrued Interest is 0.05, the default spread is 2%, and yield is 3.73%. Furthermore, Starbuck’s marginal tax rate is 19.5%, and these figures indicate that the debt risk profile of the company can be improved as it is rather risky (“Starbucks Corporation (SBUX),” 2019).

Cost of Capital

When referring to the market values of equity and debts, it is possible to determine the weights of debt and equity. Additionally, it is also necessary to identify the cost of capital. According to Table 2, Starbucks can generate about 1.05x cash out of its debt capital, and the company’s cash fully covers its debts (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019). These figures can be regarded as average when comparing them to the market data in the industry.

Table 2. Equity Ratio, Debt Ratio, Cost of Capital.

Measuring Investment Returns

It is rather problematic to identify a typical investment project for Starbucks. However, when referring to the company’s annual report, it is possible to state that long-term projects are prioritized in Starbucks (“Starbucks: Fiscal 2018 – Annual report,” 2018). Assessing returns on the current projects in the company, it is necessary to identify Return on Equity (ROE) and Return on Capital (ROC). Other related data (e.g., EBIT, WACC) are provided in Appendix A, Table 2. Starbucks’s ROE is 38.6%, which is higher than 15% typical of the industry, and it can be considered as good and indicates the effectiveness of the firm’s approach to choosing projects. The company’s ROC is 18.3%, which is almost equal to the industry’s average in 18%. It is possible to conclude that current projects followed by Starbucks are rather effective as they contribute to increasing the company’s net income.

It is also necessary to calculate the Economic Value Added (EVA) in order to be able to provide the complete analysis of the situation. Thus, EVA for Starbucks is $1,361.06 million (Equity EVA = (Return on Equity – Cost of Equity) (Equity Invested in Project or Firm) (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019). In combination with WACC in 4.29% (Cost of Capital), these figures indicate that Starbucks has a substantial competitive advantage in the industry in comparison to the industry’s averages (Damodaran, 2014). Thus, it is possible to state that Starbucks seems to effectively create the value for stockholders.

Capital Structure Choices

Advantages of Debt

Sources of financing for Starbucks include selling the company’s products and attracting investors, and significant cash flows from selling services and products allow for covering debts. Referring to the data for 2017, 2018, and 2019, it is possible to state that the marginal tax rate in Starbucks is 20% that is lower than the average marginal tax rate in the industry (“Starbucks: Fiscal 2018 – Annual report,” 2018). In 2018, the company had a benefit of about $0.5 million with reference to the effective tax rate in 21.8% (“Starbucks: Fiscal 2018 – Annual report,” 2018).

Free cash flows can also be discussed as high in comparison to the industry-related figures because the company’s EBITDA is $6,247 million, and the current EV-to-EBITDA for today equals 17.26 (“Starbucks: Fiscal 2018 – Annual report,” 2018). In quantitative terms, this comparably high value (17.26) indicates that the company has advantages of using its debts (Damodaran, 2014).

Disadvantages of Debt

Starbucks’s cash that is used in operating activities is 6,913,700 for the year 2018. Furthermore, cash flows that are used in investing activities (net cash) are -2,361,500 for 2018. Cash flows provided by financing activities include -3,242,800 for 2018 (“Starbucks: Fiscal 2018 – Annual report,” 2018). The company has both tangible and intangible assets, and it expands its operations in Europe and globally that provides Starbucks with more opportunities to use advantages of debt. Therefore, the company values flexibility in investment opportunities, and the loss of flexibility can become the potential disadvantage of debt (“Starbucks: Fiscal 2018 – Annual report,” 2018).

Still, in qualitative terms, Starbucks’s disadvantages from using debt can be regarded as insignificant. The company’s Debt-to-Equity (D/E) ratio is 58% (October 2019), which indicates that it is lower than 1, and the company is comparably stable in its business activities (“Starbucks Corporation (SBUX),” 2019).

Optimal Capital Structure

In order to determine the optimal financing mix for Starbucks, it is necessary to focus on the current cost of capital, which is 4.29%, and the debt ratio is 27% (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019; “Starbucks: Fiscal 2018 – Annual report,” 2018). When the debt ratio changes, the cost of capital also changes, but increases in the debt ratio can lead to both decreases and increases in the cost of capital (Damodaran, 2014). According to the table demonstrating the relationship between the debt ratio and the cost of capital, which is presented in Appendix A, Table 3, it is possible to state that the optimal debt ratio for Starbucks is 20%, as it is correlated with the desired decrease in the cost of capital (4.18%). Furthermore, at this debt ratio, the firm’s value can potentially maximize, but the comparison of the current capital structure with the optimal one demonstrates that Starbucks will not gain significant benefits changing its structure and moving to the optimal one (Damodaran, 2014).

It is important to state that no changes in the stock price are expected depending on this aspect. While taking into account an associated rating constraint, it is possible to note that Starbucks is almost in its specific optimal debt range, and no significant changes are required (“Starbucks: Fiscal 2018 – Annual report,” 2018). Being in this debt range, the company’s potential rating is A3, which only slightly changes the company’s overall profile. While conducting the relative analysis, it is important to note that Starbucks’s debt is comparably low in comparison to the sector and market competitors with the debt of equity in -1.79 (Table 3; “SBUX Debt-to-Equity,” 2019).

Table 3. Competitors’ Debt to Equity Ratio.

(“SBUX Debt-to-Equity,” 2019).

Mechanics of Moving to the Optimal

The analysis of the company’s capital structure indicates that Starbucks’s actual debt ratio is higher than the expected or optimal one, and it is possible to recommend the gradual movement of the company to the desired capital structure. The analysis of the current situation in the firm also indicates that Starbucks typically selects long-term projects, and business cycles remain stable (Table 4). This strategy should also be followed when changing the strategy in order to orient toward the optimal variant (Damodaran, 2014).

The period in several years can be selected for this initiative, and the focus needs to be on taking additional new long-term projects in order to gain some excess returns with reference to these projects (“Starbucks: Fiscal 2018 – Annual report,” 2018). From this perspective, long-term financing is more preferable for Starbucks in order to guarantee that the company changes the approach gradually. Moving to the optimal capital structure model, Starbucks can potentially gain $8,300.2 million (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019).

Table 4. Changes in the Capital Structure.

Dividend Policy

In order to ensure that the analysis of the financial situation in the company is full, it is important to assess the company’s historical dividend policy. The first step is the reference to the historical payments made in the organization. Starbucks’s dividends paid to stockholders in 2018 increased in comparison to previous years (Table 5). The company’s dividend yield is 2.7%, which is significantly higher than the average dividend yield of 1.8% (“Starbucks Corporation (SBUX),” 2019; “Starbucks: Fiscal 2018 – Annual report,” 2018).

Table 5. Cash Dividends.

When analyzing the company’s characteristics, it is also important to note that its dividend growth per year is about 24%, and it is comparably high. Furthermore, Starbucks easily discloses information on dividends to financial markets, and it is used by potential stockholders in their decision-making. It is possible to state that the used approach of returning cash to stockholders in the form of dividends through share repurchases is attractive for shareholders whose loyalty is high (“Starbucks: Fiscal 2018 – Annual report,” 2018). Increases in dividends and regular payments are the priority for Starbucks’s management, which indicates that the company has an effective dividend policy in comparison to other market actors.

A Framework for Analyzing Dividends

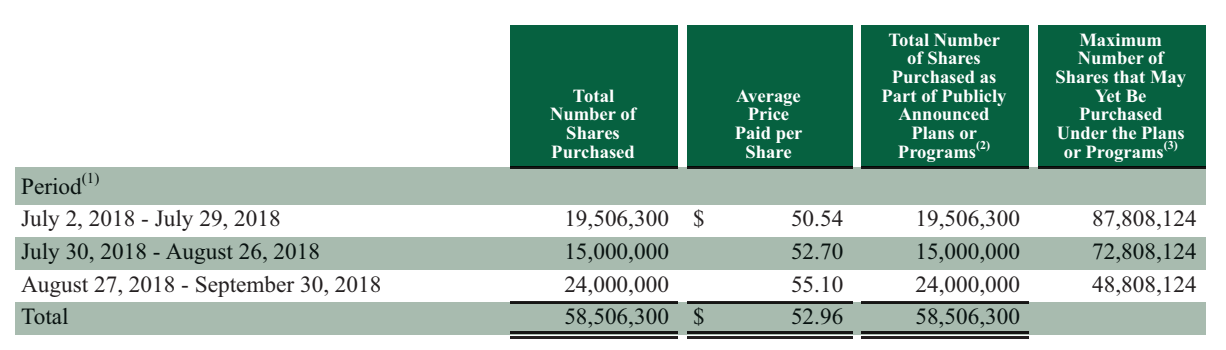

The dividends policy followed by Starbucks needs to be analyzed in detail with reference to assessing the returns to shareholders and comparing the policy to the industry trends. In order to state how much Starbucks could return to its stockholders, it is necessary to estimate the free cash flows to equity (FCFE). The company returned $8.9 billion to stockholders with the help of repurchases of shares, and the returned cash equals $1.7 billion for 2018 (“Starbucks: Fiscal 2018 – Annual report,” 2018. Starbucks also repurchased 131.5 million shares of common stock in the context of the developed repurchasing strategy (Table 6; “Starbucks: Fiscal 2018 – Annual report,” 2018).

Referring to FCFE, Starbucks could potentially pay $15,545.5 million in comparison to the actually paid $1,743.4 million (Appendix A, Table 4). The current FCFE per share is 4.14 in relation to the current share price of $83.75, and the intrinsic value of the company’s common stock is $140.9 (“Starbucks: Fiscal 2018 – Annual report,” 2018.

Table 6. FCFE and Cash Dividends.

The company’s FCFE and its overall stable position in the marker indicates that the dividend policy can be changed, and more cash should be returned to shareholders because the price to FCFE ratio is rather high: 20.24. Comparing Starbucks’s approach to competitors’ strategies, it is possible to state that the company is slightly overvalued (“Starbucks: Fiscal 2018 – Annual report,” 2018). The reason is that the company’s price to FCFE ratio is 20.24, when the group benchmark is 19, and the market benchmark is 18 (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019). Thus, Starbucks can be regarded as paying fewer dividends to their stockholders in comparison to some of the competitors.

Valuation

In order to conduct the valuation for Starbucks, it is necessary to choose the FCFE as a type of cash flow to discount for the company. The reason is that all the figures are available to make the required calculations for the following several years. The growth pattern that should be selected for Starbucks is stable because this growth tendency is more typical for the company (“Starbucks: Fiscal 2018 – Annual report,” 2018). According to the data presented in Appendix A, Table 5, the growth by 4-5% is expected for the period of 2019-2024. For these years, the stable growth in revenues is also expected (“Starbucks: Fiscal 2018 – Annual report,” 2018). It is also necessary to focus on the value of equity for Starbucks in 2019, which is 99,865.4 million, and the market value of equity is 82,234 million (“Starbucks WACC %,” 2019).

At this stage of the analysis, it is important to note that the key variable that can be viewed as driving this determined value (99,865.4 million) is the growth rate. The company’s FCFE can be predicted with reference to these data, and it will grow in a stable manner, guaranteeing the increases in revenues. Additionally, it is also possible to calculate the fair value for Starbucks’s shares. Thus, the fair value is $72, and the current price per share is $84. This determined fair value suggests that Starbucks can be overvalued.

The valuation procedure indicates that Starbucks’s growth during the recent years has been stable, and this trend is expected to be observed during the next several years. Thus, the company’s revenues will increase with reference to the FCFF and the value of debt of $10,303.55 million (“Starbucks: Fiscal 2018 – Annual report,” 2018). The company will potentially sustain the competitive advantage in the industry and market (“Starbucks WACC %,” 2019). Still, stock prices can change in the future depending on the fact that, currently, the firm is overvalued. This fact supports the idea that Starbucks does not require enhancing in its operations in order to achieve more active increases in investments and sales.

Conclusion

The conducted analysis indicates that Starbucks remains a leader in the industry in terms of sales and its financial performance. In spite of the fact that the company’s rating is below the A level, Starbucks’s coverage of shareholders’ interests and expectations is still remarkable. It is possible to state that the value of the company is slightly overestimated with reference to the price per share, but the company’s stable financial growth observed during recent five years provides the reasons for the price. On the one hand, Starbucks needs to improve its financial performance and payments to shareholders.

On the other hand, the currently used strategy can be regarded as working, and it can also be followed in the future in order to guarantee the stable growth in the firm’s revenues. Much attention should be paid to the results of the valuation procedure based on the FCFE model. As the company’s current financial evidence indicates the probability for the further growth in gains, it is not necessary to take active steps in order to move to the optimal capital structure and change the currently used financial strategies. The movement to the desired debt ratio of 20% can be realized through comparably gradual actions.

References

Damodaran, A. (2014). Applied corporate finance (4th ed.). New York, NY: Wiley.

Levered/unlevered beta of Starbucks Corporation (SBUX | USA). (2019). Web.

SBUX Debt-to-Equity. (2019). Web.

SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets. (2019). Web.

Starbucks company profile. (2019). Web.

STARBUCKS CORP.DL-NOTES 2018(18/48) Bond | Markets Insider. (2018). Web.

Starbucks Corporation (SBUX). (2019). Web.

Starbucks Corporation common stock (SBUX) institutional holdings. (2019). Web.

Starbucks WACC %. (2019). Web.

Starbucks: Fiscal 2018 – Annual report. (2018). Web.

Starbucks: Investor relations. (2017). Web.

Appendix A

Corporate Governance Analysis: Executive Directors

Risk and Return: Top Down Betas

Details and explanations to pay attention to:

- Beta – Beta coefficient of the difference between Starbucks and the market;

- Slope of the regression – 0.86 (Starbucks’s beta, can changed depending on the period);

- Alpha (Intercept) – the measure of Starbucks’s performance, should be compared to Rf (1-BETA);

- Jensen Alpha (ER[a] – RFR * (1-BETA) – BETA * ER[b]) – a risk-adjusted measure for performance, where ER[a] is the expected return on investing in the company, and ER[b] is the expected return on market index (“SBUX:NASDAQ GS stock quote – Starbucks Corp – Bloomberg markets,” 2019).

Risk and Return: Default Risk and Cost of Debt

Measuring Investment Returns: Evidence for Starbucks

Table 2. Investment Returns.

Optimal Capital Structure

Table 3. Relationship between Debt Ratio and Cost of Capital.

The analysis indicates that the optimal cost of capital of 4.18% can be achieved with reference to the debt ratio of 20%.

A Framework for Analyzing Dividends

Valuation

Table 5. Valuation: Projected Growth for Starbucks, 2018-2024.