Elevator Speech

Research shows that finding a job is not an easy undertaking in the contemporary society as it used to be mainly because of the large number of young professionals graduating from institutions of high learning. Based on this, I have engaged in extensive research to establish the dynamics of the small-scale businesses.

Various opportunities exist in the soft drinks industry hence my major aim is to establish a small-scale business that will meet the needs of customers. Through internet research, I have established that angel investor is a good source of funding, particularly when it comes to funding lucrative programs, such as the establishment of the soft drinks company. Angel investors are usually stable entrepreneurs with established capital bases.

They have the ability of funding projects that show profitability potential. Research shows that angel investors fund projects seeking capital of $25000 to $1 million. Many businesspersons prefer obtaining funds from angel investors as opposed to other sources due to their flexibility.

With angel investors, a program is destined to success since such investors help in equipping young investors with knowledge related to management and leadership.

Some angel investors have experience in trading in the stock markets hence their knowledge is highly admired as far as the establishment of the new venture is concerned. The main area of interest to angel investors includes the securities business, asset banking, clandestine equity, and administrative management.

My experience in the soft drinks industry will facilitate the making of adequate profits and the maximization of returns on capital once the new business comes into operation. Competition is stiff in the industry, but I have come up with adequate measures to ensure that the new company achieves its goals and objectives.

Angel investors provide skills that breed business interaction, education, and dialogue. These investors will be interested in the new business since the management shows a great potential of satisfying customers. I am certain that angel investors will be willing to commit their funds in the new project, but strategies ought to be laid down to convince them further.

Business Plan

Executive Summary

The new soft drinks company will mainly focus on customer satisfaction, particularly on the underlying values that customers need. This will enable the organization increase its sales in the first three months of operation, as well as sustaining the gross margin sales with focus on fiscal administration and working capital. The business plan is designed to ensure that the major objectives and missions are achieved.

The mission of the company is to add value to the targeted market segment, as well as reinforce ties with customers and other stakeholders in the soft drinks industry. Moreover, the plan offers a gradual process aiming at improving trade, gross margin, and productivity.

Mission

The mission of the project is to offer customers products of very high quality with a reliable brand name, specialized technical support, and unmatched client service. The organization will consider the interests of angel investors by ensuring that fair profits are achieved through the adoption of sound, ethical, and efficient business ethics.

Keys to Success

For the company to achieve its objectives, some of the best practices will have to be adopted. They include:

- Building and preserving tactical treaties with suppliers and other industry related cohorts

- Embracing client, as well as market-focused sales and promotional strategies

- Offering quality management practices through implementation of balanced scorecard, which will play a role in measuring consistently the performance of the firm

- Ensuring that balanced score card is applied in measuring the following:

- monetary objective vs. Results

- domestic business aspirations vs. Results

- worker education vs. Results

- client contentment vs. Results

Company Summary

The new soft drinks company will manufacture and distribute a variety of products, with focus on the neighborhood. The company will try to acquire other small-scale soft drink companies in order to strengthen its financial and managerial ability to counter other well-established companies.

Competition Comparison

As initially indicated, competition in the soft drinks industry is stiff meaning that any company intending to join it should have adequate policies to match the established units. For the organization to survive, it has to define its visions well. This will entail offering quality products, as well as services (Ferrell, 2011). The company will consider applying technology to manipulate the market.

In other words, the use of the social media will be of great help as far as advertising of products is concerned. In the modern world, technology determines the success of any organization. Any company wishing to compete favorably should be ready to embrace technology.

Service and Support

The company will present itself in the market as the best in terms of offering quality products and support services. In fact, the organization relies on quality service delivery to outmuscle competitors. Based on this, the organization will have to devise some strategies, including the following:

- Offering uptime assurances, with an aim of offering maximum efficiency to customers

- Facilitating internal training of staff that is aimed at boosting the morale of workers concerning service delivery. The balanced score card will be utilized effectively to measure the performance of all members of staff. All workers will be satisfied by the designated bodies before the beginning of the second year of operation

- Apart from training members of staff, the organization will set up a program aiming at sensitizing clients on the quality of company products given the fact that fraudsters are always on the run to ensure that the quality of company products is destroyed. The company will facilitate follow-up programs, as well as refresher training for all clients willing to take part in the exercise.

- Finally, an upgrade analysis program will be put in place and evaluation will be carried out after every three months to ensure that quality is maintained.

Capital Needed and the Time Frame

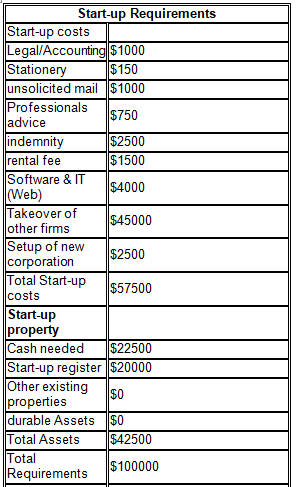

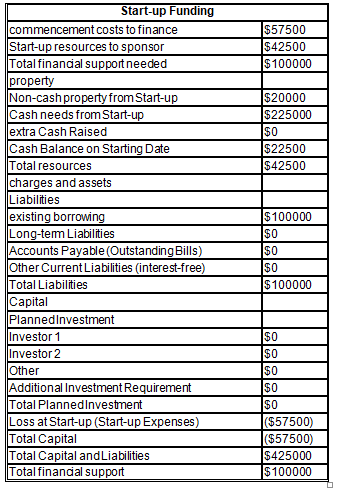

The cost of setting up the manufacturing facility is quite high, totaling to $100,000. The figure includes $ 35000 for the acquisition of other small-scale soft drinks companies facing financial and administrative challenges. Other funds will be used as indicated below:

- Initial inventory: $20000

- Initial capitalization: $22500

- Legal, insurance, rent, and miscellaneous: $12500

The initial capital will be sourced from the angel investors, even though the organization will still seek funding from banks in form of loans.

The company will need funding before it embarks on drawing the budget, which means that capital should be provided at the beginning of the project. In this regard, two months will be adequate to convince angel investors to commit their funds in the potential project. The capital needed for the company to kick-start its operations is $100000, which must be availed at the beginning of the project.

Attracting Venture Capital

As already discussed in the previous sections, angel investors are business executives with adequate capital that can perhaps fund huge projects. However, they always need to be assured of returns on their investments before they commit their capital.

Research shows that this category of investors is not an average financier, but instead they are individuals with extensive experience and skills on matters pertaining to business in their respective fields.

A distinctive angel investor has an estimated net worth of $1 million whereas some are believed to have a yearly income of at least $200000. Angel investors are of benefit to any business they intend to invest since they offer additional value apart from providing the much-needed capital.

They are usually successful businesspersons and they have the ability and the authenticity of offering professional advice to young business executives (Frynas, 2011). Their creativeness, experiences, managerial knowledge, and connections are of help to the company. A number of strategies must be put in place to attract angel investors since they are risk takers who have full knowledge of the market.

This implies that they do not release their funds easily without assurances that their capital will be invested in the best way. One of the strategies is to build a convincing case that might encourage angel investors to take risks.

This is easily done through drafting a sound business plan and hiring a competent team that will meet the market demands. Anyone intending to obtain funds from angel investors ought to analyze the competiveness of the market and assure these investors that competition strategies are in place.

Creating a prototype and lining up beta testers is another way of attracting capital from potential investors, such as angel investors. Research shows that many investors are often interested in joining the company at the early stage, but they must be presented with a working model of the product or service where customers have already tested the effectiveness of the product.

Designing a prototype is known to influence the decision of investors hence its introduction will be of much help as far as obtaining funding from angel investors is concerned (Spulber, 2007). Many business ventures will simply draft plans and come up with great ideas that are unrealistic. A good plan should be practical meaning that it can serve the interests of various stakeholders, including customers and investors.

The number of potential customers ought to be established in advance to convince investors that the company has the potential of growing in terms of revenue. Regarding attracting investors, ante up is an additional strategy that might convince many financiers to join the program. This implies that the owner should be willing to invest his or her own capital to show investors that he or she is serious with the business.

Benefits of Angel Investors

Research shows that a number of angel investors are always interested in ventures aiming at committing funds on small projects, but with high returns. This means that the new soft drinks company will be an ideal investment target for most angel investors. Large-scale ventures are advised to seek alternative funding programs since angel investors are not usually interested in them.

As early noted, angel investors are highly experienced in the field of business hence they can easily help the new small-scale business in matters to do with executive management. They play a major role in making critical decisions that are of help to the growth of the new business.

An alternative source of capital would be seeking loans from financial institutions, but they attract an interest, which is sometimes very high. Angel investment is cheaper as compared to loans since no interest is paid to owners.

Available Government Aid

The US government runs a program that aims at helping small-scale businesses achieve their aims. The SBA finances are usually offered to production units that are not capable of securing credit through regular channels. The new business establishment will also try to seek funding from the government program through SBA.

The program is run through the private lender sector, but the government acts as a guarantor to the institutions that are unable to provide collaterals. At least four programs exist under the SBA programs, but the new company will go for the cheapest. In reality, the company will go for the microloan program, which funds programs that need less than $35000.

Valuation of the Small Business

Valuation of any business unit is very important since no individual can perhaps establish the worth of the venture without conducting an assessment. The owner cannot be relied upon in revealing the value of the business. In this regard, one of the valuation methods ought to be applied in calculating the worth of the business. The new soft drinks company will be valued using one of the earning value approaches.

The method relies on the idea that the true value of the venture lies in its capability to generate wealth in the future (Loewen, 2008). Since the company is new, the use of past capitalization earning cannot be functional. This allows the use of discounted future capital where ordinary movement of expected future retribution is utilized and is divided by the capitalization factor.

Legal Issues

The company to be established is a sole proprietorship implying that it will not have major issues to do with ownership. However, three major legal issues will confront the company, one of them being the issue of copyright and patent. In the soft drinks industry, issues to do with copyright and patent are of high concern since they actually determine the profitability of companies.

Coca Cola Company has copyright over technology employed in making its products implying that it can sue any person with an intention of utilizing it to produce competing products. Similarly, the new company will come up with mechanisms that will ensure its technology is safeguarded.

Another issue is related to labor laws, which demand that all employees must be given contracts based on the national and international labor standards. Finally, the new company will have to deal with legal issues touching on the environment.

References

Ferrell, C. (2011). Marketing Strategy. New York: Cengage Learning.

Frynas, J. (2011). Global Strategic Management. Oxford: University Press.

Loewen, J. (2008). Money Magnet: Attract Investors to Your Business. New York: John Wiley & Sons.

Spulber, D. (2007). Global Competitive Strategy. Cambridge: Cambridge University Press.