Introduction

The historical closing price of DOW Jones industrial average index is showing significant upward movements in the value. The value of the index has crossed over 20000 points in the year 2017 surpassing all the expectations of market participants, which seemed impossible to most of the financial analysts in 2010 (Ungarino 2016).According to DJI trading data (2017), on 9th November 2017 the index value was closed at 23406. Data inform that after absorbing a steep fall of 1500 points (from 17500 to 16000), in February 2016 the index had been gaining value until it reached to 18000 points, where it remained steady for the next seven months. The second phase of growth has started from 18000 points in November 2016, since then the index value has been increasing at a substantial rate. Unpredictably, the value has increased by more than 5000 points in the last 12 months. Observing this high growth, some analysts are predicting a stock market crash while some financial experts are claiming the index value will continue to gain for the next few months. Using the historical closing price data of the last four years of Dow Jones industrial average, a forecast of the index value on the last trading day of the year 2017 is done to predict the future of Dow Jones. It is projected that the current value of Dow Jones is way beyond the logical supports that shall be adjusted in the value by the end of the year.

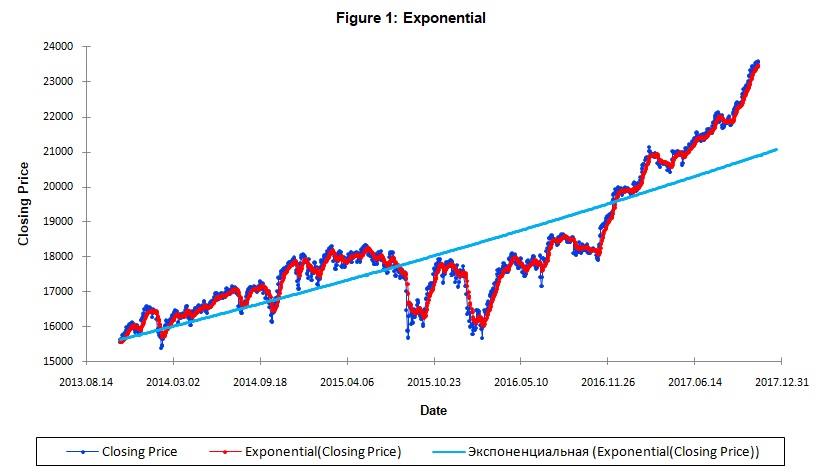

Exponential Smoothing of Dow Jones Data

The value of an index usually does not show any particular trend but the mean value of a time series data changes with the time. It is also difficult to identify seasonal movements from the trading data of an index. Hence, the use of exponential smoothing to forecast the index value would help to measure the accuracy of other time series models. Exponential smoothing is a weighted moving average model in which the weights are reduced exponentially with the time.

The exponential smoothing (Figure 1) is suggesting that the index is significantly overpriced. And the trend is demonstrating a support at 21000pointeven though the price is now 23461at the moment. The fluctuations in price do not display any seasonal trend rather it has disregarded the seasonal movements which is not a sign of natural growth. A test of hypothesis was conducted to measure the reliability of the outputs of the forecasting. The null hypothesis is rejected at 95% confidence level and with a significance level of 5%, which recommends that the index value is overpriced and highly volatile, and the index value is supposed to go downward from the current value. As the hypothesis testing is suggesting the current value of the index is above the mathematical supports, the value of the index can go down within a reasonable time. Therefore, a comprehensive analysis on the data using ARIMA model would provide more specific information regarding the current upward trend of the index value.

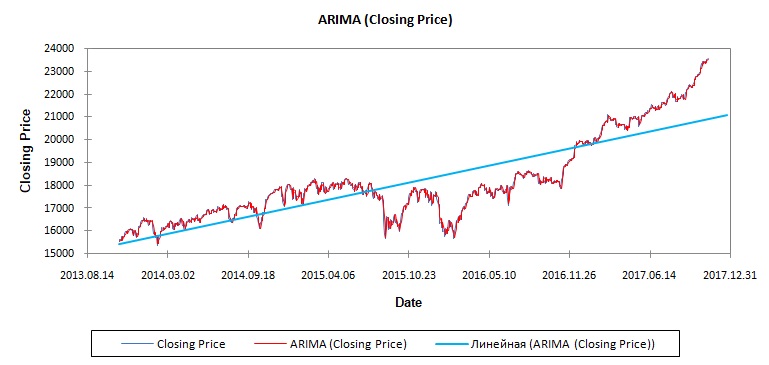

ARIMA Model

The autoregressive integrated moving average (ARIMA) model is usually considered as the best fit for forecasting non-stationary data. The closing price of DOW does not have a constant long-term mean rather it changes as the time moves. Also, the test of stationarity proves that the times series of Dow Jones is non-stationary. And from the figure1 it can be observed that the data trend is not a deterministic one, rather it is exhibiting a pure stochastic trend. The ARIMA model is used in the forecasting because the model can convert a non-stationary series into a stationary one. And forecasting of random walk series requires a reduction in the random movements pattern, also a test of fit is required to ensure the good fit of the model. Therefore, it is decided that ARIMA model will be used for forecasting the Dow Jones value at the end of the year 2017.

From the simulation (Figure 2) a fit plot can be found for the time series of DOW Jones industrial average. The outputs are suggesting that the index value is not moving upward due to a rational reason rather for an irrational variable. The time series trend line supports the value somewhere near 21,000. A similar value was found from the exponential smoothing model which suggests that the ARIMA model is exhibiting a good fit. Another interesting fact is the time series data clearly explaining that the index shows an upward bias for a year and then exhibits a downward bias for another year; and the usual range of deviation is 2000 points in either direction. Keeping the seasonality in mind, it can be forecasted that the index value was supposed to go upward as the year 2016 it was plummeting. The index started to move upward from 19000 points at the beginning of the year and the seasonality bias is suggesting a normal increase up to 21000 points but the index has crossed 23000 which is unusual and mathematically irrational. The price movements can only be justified with a strategic changes or decision taken by the organization.

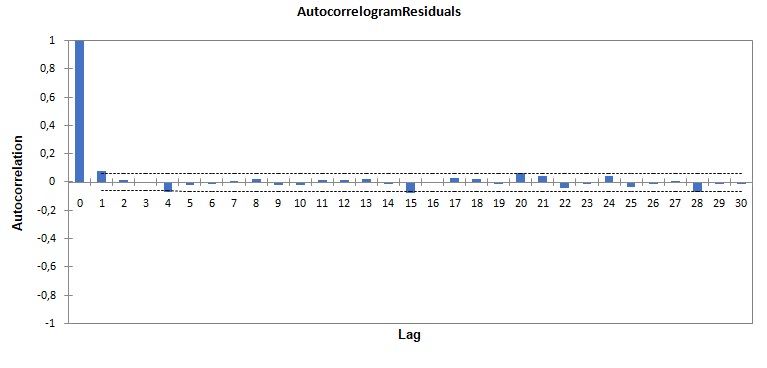

The auto correlogram fit (Figure 3) is showing that there are nine significant picks in k=1, k=4, k=15, k=20, k=21, k=22, k=24, k=25, and k=28 this could be happening due to the 5% sampling variation. The residual fit can provide more justification to the forecast, although the p value is more than.5 which is suggesting the times series is exhibiting a good fit.

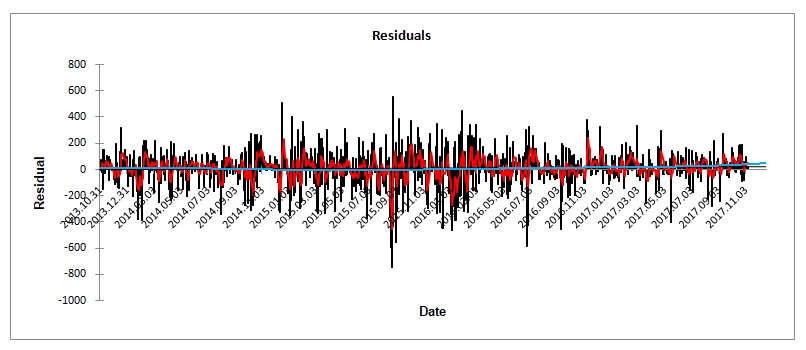

The residual fit (Figure 4) is suggesting an increase at the end of the year, which explains the difference between forecasted data and the daily closing price of DOW. The chart exhibits the magnitude of error in the price of the index, and the residual fits are the determinant of the seasonality. The polynomial trend line of residuals is showing a negative value at the beginning of the period, which started to grow at the end of 2016. Most significantly, the time series is suggesting the price of DOW would be around 21150 points; and if adjust an error of 5% is adjusted to the result then the estimated index value would be within 20000 to 22200 at the end of the year 2017.

Comparing the exponential smoothing fits with the ARIMA model output some differences were found, although the end results or both models are pointing to a similar outcome. Both the models are predicting the value of DOW Jones near 21,100 while the actual closing on November 8th is showing a huge difference. If the prediction is to be true then the index value is going to experience a gradual decline in the index value in the next 6 weeks. The test of hypothesis using descriptive statistics of the time series has forced the test to reject the null hypothesis, which implies the price cannot remain above the 23,000 rather it should be far lower than that. Therefore, it is concluded from the calculations that the Dow Jones Industrial Average will be at 21,100 in the last trading of the year 2017 (an error of 5% is expected). To understand the actual importance of the numerical forecasting a contextual analysis is also required to be incorporated in the forecasting of the index value.

Forecast Value of Dow Jones

The output of the exponential smoothing forecasting is showing the index value would be 21000 points and the ARIMA model is suggesting a forecasted value around 21100 pointed. From the calculated arithmetic mean of both the forecasts output 21050 points is found to be the final value of Dow on 31st December 2017.

Forecast of Experts

Forecasting of financial assets is largely depended on the mathematical models that are used in the analysis of numeric data. Additionally, use of news and text is also recommended for enhancing the accuracy of the prediction. Lee et al. (2014) showed that integrating documented information while estimating stock prices is significant as it improves the forecasting precision by 10%. The textual information is analysed based on the message content to assess the probable impacts of different news on stock prices. News content, which is an important element of financial forecasting, has an impact on the expectations of financial market participants which is sometimes hard to predict, implies an accuracy of 76.3% in future price prediction (Hagenau, Liebmann& Neumann 2013). Therefore, their findings are suggesting that an educated classification of textual contents can improve the forecasting accuracy, but failing to do so would have a negative impact on the analysis.

Cheng (2017), reported on CNBC that wall street experts are expecting a slight decline in the index value of DOW Jones at the end of the year. The Dow Jones Industrial Average Stock Market Index Forecast (2017), a professional forecasting service provider, has predicted that the 12 months price of Dow Jones industrial to beat 20655 points, suggesting the index value range of DOW can remain within the range of 18024-23285.An increase in the index value of Dow Jones is expected in the short run, but the market will fail to support this unexpected increase, and eventually will adjust at a lower point. The index value should hit the support at 21000 points and the year-end value is expected to be somewhere near 21000(Technical Analysis Dow Jones Industrial Average2017). The current bullish movement in the index was predicted to exhibit in the first quarter of 2018, but the movement seems to be taking off at the end of the year 2017 (Snitko 2017). Originally, Snitko (2017) predicted the index value to be at 20420 then it was expected to be a bullish. Focusing on the fundamental issue of average annual growth in the value of DOW, Buckingham (2017, para. 5) expressed “To be sure, all the Dow had to do to rise from 12500 in 2012 to 20000 in 2020 was to appreciate by the same 5.4% rate that has been the historical average since 1896”. According to the prediction of Buckingham, who is a chief investment officer of Al Frank Asset Management, following a yearly growth rate of 5.4% the value of Dow Jones should be around 21041 at the end of the year 2017, which has started trading from 19963 points at the beginning of the year.

Holodny (2017), an expert financial analyst from business insider, estimates the DOW will move over 21000 points because of a number of reasons. The positive attitude of President Donald Trump has increased the trust of market participants, and the US economy continues to grow at a rate of 3%.Moreover, personal income of the US people has improved by.04% while the growth of personal spending is only.02% which would increase the money supply in the market. On the other hand, an economic slack in Canada will further strengthen the US economy. Bulkowski (2017), an expert financial analyst, predicts that the index will start to move up at the beginning of November 2017 which will then plunge sharply at the support point 21000, after that the value would again start to gain and will finally stop at 21265 points on 31st December.

From the forecasts of renowned financial analysts, published in different online sources, it is found that the analysts have forecasted the value of Dow Jones would be around 21,000 points at the end of the year 2017. Apart from that, different factors such as economic conditions, government support, business condition, job market progress, and other financial indicators of the US is exhibiting a strong signal for the DOW index to stay above the 21,000 level. The average value of all the findings equals 20,990 which is almost 21,000. On the other hand, the time series analysis is also pointing towards a similar result that remains around the value 21,000.

Final Forecast

A weighted average result of both of the forecast improves the accuracy of the result, which motivates this analysis to apply a weighted average formula to the time series forecasted result and forecasted results of the experts on the value of Dow Jones industrial index. The time series forecasting is done based on ARIMA model that uses an autoregressive integrated moving average of the observations to forecast the future number of the data. ARIMA model is an effective time series models for forecasting stock price, and more robust and accurate in predicting short-term stock price (Adebiyi, Adewumi & Ayo 2014). In addition to that, the exponential smoothing model’s output justifies the accuracy of the ARIMA model. The ARIMA model predicts the future index value based on the movement of historical data. On the contrary, experts and technical analysts forecast the future price of a stock using different mathematical models as well as textual contents that influence the public sentiments. Participant’s sentiment has a positive impact on the outcome of a prediction especially in the case of financial analysis and forecasting (Li et al. 2014).

Moreover, experts and professional forecasting agencies use far superior model than the ARIMA model. Kazem et al. (2013) have shown that using a chaotic firefly model and vector regression model together can result in a more accurate forecasting result that considers financial data, participants’ sentiments, irrational movements of the market, and the rational changes in the macroeconomic factors. It can be concluded that, forecasting of professional analysts is more accurate than the ARIMA model as the experts consider different aspects while forecasting the price of a stock. Therefore, experts forecast should be given more weight than the calculated forecast.

It is decided, keeping all the facts in mind, the ARIMA model should have 45% of the weight and the experts forecasting should have55% weight. The ARIMA model should have 45%of the total weight because the accuracy of the forecasted value would be less accurate compared to an expert forecasting. The time series uses historical data and it does not analyse the current happenings. Also, the time series does not consider the probability of a financial disaster whereas experts consider this probability. And according to Lee et al. (2014) the analysis of these contextual information increases the forecasting accuracy by 10%, which is why the experts forecasting should receive 10% more weight than the ARIMA model.

The outcome of the weighted average model is 21,017. Hence, it can be concluded after a qualitative and quantitative analysis of the Dow Jones industrial average changes that the closing value of the stock is estimated to stop at 21,017 points.

Conclusion

To sum up, there are numerous models for estimating the future price of stocks using time series data, and the time series models are relatively good predictors of short-term stock prices. In addition to that, sentiment of people plays an important role in determination of price of a stock as well as an index value. The incorporation of both the factors reveals that although the value of DOW is above 23000 now it will plunge to 21017 by the end of the period on 31st December 2017.

Reference List

Adebiyi, AA, Adewumi, AO & Ayo, CK 2014,‘Comparison of ARIMA and artificial neural networks models for stock price prediction’, Journal of Applied Mathematics. Web.

Buckingham, J 2017, Forget Dow 20000, how about Dow 40000…by 2030. Web.

Bulkowski, T 2017,Bulkowski’sforecast. Web.

Cheng, E 2017, Dow stocks like Disney, Home Depot rally in the fourth quarter more than 80% of the time. Web.

DJI trading data. 2017. Web.

Dow Jones industrial average stock market index forecast. 2017. Web.

Hagenau, M, Liebmann, M & Neumann, D 2013, ‘Automated news reading: stock price prediction based on financial news using context-capturing features’, Decision Support Systems, vol.55, no. 3, pp. 685-697.

Holodny, E 2017, Dow roars above 21,000 tone record: here’s what you need to know. Web.

Kazem, A, Sharifi, E, Hussain, FK, Saberi, M & Hussain, OK 2013,‘Support vector regression with chaos-based firefly algorithm for stock market price forecasting’, Applied Soft Computing, vol.13, no.2, pp.947-958.

Li, X, Xie, H, Chen, L, Wang, J & Deng, X 2014,‘News impact on stock price return via sentiment analysis’, Knowledge-Based Systems, vol. 69, pp.4-23.

Lee, H, Surdeanu, M, MacCartney, B & Jurafsky, D 2014, On the importance of text analysis for stock price prediction. Web.

Snitko, O 2017,DJIA long term [2017 – 2022] forecast. Web.

Technical analysis Dow Jones industrial average2017. Web.

Ungarino, R 2016, The man who called for Dow 20,000 six years ago now sees this ahead. Web.