Objectives

This paper seeks to achieve the following objectives:

- Appreciate the notion of working capital and evaluate issues that are associated with the monetary feasibility of a company

- Appraise the risks that SABIC/B&W may encounter in the present position

- Recommend answers to problems that relate to:

- Supplier associations

- Power and management

- Cost management

- Working capital

- Client associations

- Supplier affairs

- Prioritisation

- Utilise knowledge from the Corporate Award curriculum in matters concerning:

- Risk examination

- Interaction with people with service providers

- Cost breakdown

- Ratio scrutiny

- Mutual dealings

- Revenue making

- Successful developments

- Electronic procedures

- Prioritise actions in a suitable progression

Management Summary

The role or purchasing and supply chain management in any modern organisation cannot be ignored. Indeed, the concept of purchasing and supply chain management forms one of the major competitiveness factors that separate one organisation from the other in terms of efficiency, good service delivery, and most importantly, profits.

Therefore, it is easy to understand why there has been an increased focus on aligning organisation’s purchasing and supplier roles with the overall organisational goals in the recent past (Baier 52).

With reference to SABIC, it is commendable that despite its non-existent purchasing and supply function, it has achieved a substantial level of success in its business as evidenced by its recent acquisition plans for B&W, which has been a major supplier for a long time.

The recent realisation that its supply chain has been a one-man show with high-handedness towards suppliers is rather unfortunate. It indicates a high level of organisational inadequacies and ineffectiveness.

However, on the bright side, it is a clear indication that the opportunities that SABIC has are very high and that it can achieve great success if it can utilise its available human capital resources together with resources the to-be-acquired company, B&W.

B&W has a better organisation management structure and processes that are very enviable.

SABIC can integrate them in its quest of establishing a better purchasing and supply processes in its operations. For instance, apart from having a highly effective purchasing and supply management process, B&W has patented some of its processes that will be very handy in the efforts that SABIC will put forward.

The patented processes at B&W are owned through BoZ. They will be incorporated into SABIC through BoZ. This plan implies that it has acquired intellectual rights to use the knowledge resources of another organisation to ensure better operations.

However, inheriting the model of purchase and supplies for B&W introduces major risks to SABIC. For instance, adopting the system as it is may be a big shift for SABIC, which has different operations and requirements for its business.

As such, it will be very important for SABIC and B&W to work closely to ensure that the system can be adjusted accordingly to be well configured with the organisational requirements at SABIC. Without such an approach, the patented process will only introduce major challenges and inefficiencies that SABIC is seeking to avoid.

Consequently, it is essential for the two parties to work together to ensure that the new SABIC process will effectively meet its needs without jeopardising its activities. It will offer a better efficiency and more effectiveness, which will lead to healthier business, competitiveness, supplier engagement, and customer experience and loyalty.

Another major problem in the current management processes, especially in terms of purchasing and supplying processes is the lack of ethics and a well-defined code of conduct for dealing with its officers and suppliers.

It is evident that Albert led the business with an iron fist where the input of other employees in the department was non-consequential. His way of doing things mattered the most. In addition, his engagement with suppliers was very unethical.

It was marred by high hardness where the supplier input towards the purchasing and supply decisions did not matter. One of the suppliers said that Albert was enthusiastic on grasping the last coin out of them. Regrettably, he did not gain as much as he had invested.

Such a statement is a clear indication of the frustrations that suppliers experienced in their dealing with SABIC. The fact that they ‘did not offer more than what was paid for’ spells a bad relationship for the organisations.

It also indirectly shows that the suppliers were ready to compromise the quality or use other unknown measures to ensure that they got value for their money. In the end, if the suppliers were offering substandard products to SABIC, it was ideally a game of ‘you get what you pay for’, which may have disadvantaged SABIC and the suppliers.

For SABIC, it indicates that the organisation may have accessed poor quality supplies, which led to poor quality products, unsatisfied clients, and finally bad business for the organisation. The results were far much below what would be possible if it had ethical practices.

To sufficiently address the need for developing high-tech lightweight material for use in photovoltaic and solar panels, amid having a knowledge-based centre for design and development and equipment capability, SABIC needs to have ethical and accountable purchases and supplies organ.

This strategy ensures the provision of quality well-priced raw materials for its production process. Unfortunately, the business model that B&W has deployed is now charged with the purchasing and procurement operation. However, the model is both unethical and unaccountable.

Lyzan has discovered that the purchasing function is non-existent since Albert made all purchasing deals at a personal level, but not in a structured and controlled manner.

This situation simply means that no codes of conduct and ethics have been put in place to guide the purchasing organ, which constitutes a major risk that SABIC has to overcome.

The negotiating capability of B&W is important to ensure that SABIC acquires inputs at lower prices. It is important to note that integrity should be upheld to have a considerable amount of negotiating power. Veracity allows the negotiating partners to be aware of the facts that are brought on the table for consideration.

Such facts represent the actual situation that the parties present (Maloni and Brown 14). Failure to uphold ethical concepts may push people into adopting unscrupulous methods to exploit each other.

This move is not good for a big organisation such as SABIC. For instance, looking at the current situation, there is lack of openness in almost all transactions. This situation poses a major risk to the suppliers who may lack confidence on the deals made with the BoZ/SABIC.

The newly acquired B&W also encounter compromised security and poor observation of regulations on intellectual property rights. For example, the MD of one of its major suppliers noted that even though he would engage Albert in talks, he was unwilling to listen.

He (the MD) had facts that Albert had stolen a supplier’s idea and used it in his business operations. The risk here is that such non-compliance with regulations on intellectual property may expose SABIC to legal liabilities, which can attract damage payments.

Hiding costs by applying overhead expenses to some items that BoZ sells is also an unethical practice, which SABIC needs to mitigate. The legal operation environment cannot permit it since it attracts legal consequences.

SABIC faces the challenge of changing B&W’s culture to align it with its culture. Its current culture has reflected badly on its image as a company that does not want to engage ethically with its suppliers and stakeholders.

For example, issues such as its lack of a code of ethics and bad supplier relations have only acted against its image and competitiveness. A good case in point is the current situation where individuals across the globe made cheap orders with 16,000 service providers in an attempt to evade Albert’s management systems.

Such people also treated all items in the same manner. Such a situation where suppliers show a high level of mistrust on an organisation cannot be allowed to continue in an organisation that wants to compete with other organisations in the global market.

Therefore, the current situation must be changed to eliminate the risk of becoming non-competitive in a market that is dominated by profit-oriented people who do not depict any ethical control when conducting their business.

Thus, SABIC will face the risk of convincing other players that its chain supplies and purchasing operations are not only ethical, but also sustainable for doing business.

There is a widespread lack of a full-time attention to credit control. This case may easily plunge SABIC into the risk of low operating capital, which can adversely affect its capacity to compete in its market. Minimal electronic processing at B&W increases time that is required to make strategic decisions such as computation of lead times.

The situation leads to B&W’s inability to integrate the purchase and supplies function with the rest of SABIC’s high-tech control operations.

Considering SABIC’s risks and capabilities, the organisation needs to make strategic decisions on various issues relating to B&W while attempting to integrate it (B&W) into its successful business model that is guided by innovation and creativity.

Analysis

Prioritisation within the Process and Function of Purchasing

Prioritisation is of critical importance in any organisation. This concept cannot be overlooked in the case of B&W that seeks to make its processes more efficient and customer responsive. According to Baier, prioritisation indicates the fact that there are more urgent and important activities in an organisation (31).

In other words, organisations must decide where to use their limited resources. They have to establish which of the identified activities will be given priority. For example, clients come in an organisation with different demands.

Each demand has its own requirements, which must be met according to the given specifications, including quality and quantity. The demands must be attained within a given timeframe. In addition, organisations do not operate in abundance of resources.

It is important to decide which areas are of greater importance to the organisation than others. Consequently, this plan helps them to decide where to put such resources. For example, at B&W, one the most important and prioritised role and areas is the purchasing role.

In this role, negotiations with suppliers to arrive at the best purchase price takes time, yet material and in-process products must be supplied in time. Inheriting B&W’s intense negotiation approach that is associated with Albert is important.

However, it delays the process of arriving at mutually beneficial supply deals (Maloni and Brown 35). The approach, which has been put forward under the leadership of Albert, leads to unnecessary delays. Albert’s case of getting money unethically from suppliers is no longer tenable.

It must be changed. For an organisation such as B&W, the purchasing option is very crucial, owing to the high number of customer demands that must be met on a daily basis.

It is important to ensure that the purchasing role in the organisation is well conceptualised and run by a group of staff members as opposed to a one-man show as witnessed in the case of Albert.

Thus, it is important to prioritise purchasing functions to lower lead times for requisition of materials. This strategy ensures the availability of different goods to augment SABIC’s production operations.

Prioritisation can ensure that SABIC procures materials in such a time that urgency of the production process for different products meets the exigency of material and finished products delivery.

Prioritisation helps in making specifications for purchasing practices that are likely to comprise a competitive priority. Thus, B&W can only implement practices that correlate with BoZ/SABIC strategy for competitive advantage.

Considering the speciality of SABIC on lightweight thermostatic products, its strategy for competitive advantage involves offering low-priced, lightweight, and superior products. Low price highlights the necessity of cost reduction in the process and purchasing functions.

Exploiting suppliers to the edge reduces supply costs for B&W. However, SABIC can achieve the same result through B&W by prioritising its processes and purchasing functions. Baier asserts, “Prioritisation of purchases practices depends on the chosen purchasing competitive priority” (56).

Similarly, with reference to Albert’s approach, a competitive approach focuses on reducing costs. Prioritising the processes and purchases function calls for an organisation to invest in leveraging information management systems. Organisations should integrate functions such as design and development, sales and marketing, and production.

Therefore, integrating Bergen op Zoom (BoZ) functions and capabilities with B&W purchasing can ensure a full utilisation of organisational resources, including the time for availing requisite materials for any process so that the organisation runs at its full capacity.

Therefore, the company lowers its costs by reducing some direct expenses that are associated with idle labour among other elements.

How People who work for B&W’s Suppliers can view B&W as a potential Customer

Although B&W served as SABIC’s long-time supplier, when acquired, it will serve as the purchases and procurement organ for its parent company, SABIC. As it did before under Albert’s management, this observation means that it must retain its suppliers or recruit others.

For effectiveness in its operations, B&W’s suppliers need to see it is as a potential and committed customer. This perception can only occur in an environment of a business relationship that is guided by trust and accountability.

Before Albert sold the company to SABIC, although he controlled his suppliers, the relationship between them and the company was not built on mutual trust. Albert insisted on open books. He could clearly see the company’s conduct of business transactions.

On his part, he never maintained open books. This state of affairs demonstrated his unaccountability. Thus, he did not engage in fair dealings with his business partners.

The above situation is not appropriate since suppliers may see B&W as an opportunistic entity that has no respect to the principles of corporate ethics. For them to see it differently and respect it as a potential customer, adherence to principles of corporate ethics and governance is inevitable.

B&W should not only serve its own interests, but also those of its stakeholder, including suppliers and its customers such as SABIC.

Issues such as attempting to hide costs that are incurred while dealing with SABIC and exploiting its suppliers to the end exemplify a profit maximisation behaviour that is inconsistent with the principles of good corporate ethics. The situation amounts to fraud.

Establishing successful relationships and closer alignment of strategic intentions in supply chains is important for sustainability in modern supply chains.

Consequently, unlike the case of B&W under Albert’s management, organisations want to deal with companies that integrate corporate ethics in their supply chain, purchases, and procurement initiatives.

Financial communities have recognised that sustainability is central to the improvement of shareholder value through cash flows (Maloni and Brown 41). Opposed to this situation, B&W only wanted to increase its cash flows by all means, including engaging in unethical practices.

Under such circumstances, suppliers who respect the principles of business transparency cannot see B&W as a good customer since it infringes on their corporate business operation principles.

Developing Better Relationships with the People at B&W’s Suppliers

In the world of business, a good relationship with stakeholders such as employees, suppliers, customers, and other interested parties such as government authorities is significant for the success of any organisation.

Good relationships are built on trust, openness, and integrity where each stakeholder’s role is well known and respected (Maloni and Brown 2). For example, the relationship with suppliers plays an important role.

Through supplies, an organisation obtains its inputs that are used in the production of the final products that meet customer specifications. The term garbage-in garbage-out is synonymous with computer science and related technologies. It finds application and relevance in this situation for an organisation such as B&W.

Without a good relationship with suppliers as witnessed in today’s businesses that are marked by mistrust, especially due to the approaches used by Albert, the likelihood of getting poor quality and substandard supplies is very high.

This situation can greatly affect an organisation’s capacity to fulfil its promise of delivering the highest quality to its customers. As SABIC takes over B&W, it is important to consider the current situation that is dominated by poor working relationship between B&W and its suppliers.

Considering the experiences between suppliers and B&W, it is important for SABIC to improve its relationship with people at B&W’s suppliers. This mission can be accomplished by establishing an alliance with B&W’s suppliers and implementing collaborative purchasing strategies.

Establishing alliances with suppliers requires B&W to work with them (suppliers) more closely to strike deals of mutual benefit. This claim means that B&W should not dictate what its suppliers should do.

Rather, while managing supplier relationships, B&W should focus more on two-way communication approaches in an effort to ensure joint management of the relationships. This goal can be accomplished by selecting parties from both sides to address the underlining issues from either side.

With such an alliance, parties from both sides can deal with issues of mistrust such as pursuing strategies that are inconsistent with business models of either party.

Through sound supplier strategic alliance plan, B&W can develop the capacity to manage supplier talent pools. Such a strategic alliance allows the organisation to create supplier profiles.

It can then match the profiles with their strengths, specialties, and experiences, which ensure that suppliers are given an opportunity to supply products and services professionally while meeting quality expectations of the company (Clarke 79).

Further, it allows the organisation and its suppliers to work closely in the process of producing the required supplies while meeting the expectations of the organisation and hence allowing it to attain its quality specifications that meet the customer needs.

This strategy helps in the creation of sustained valued for building organisational competitive advantage around effective management of suppliers.

An effective supply chain alliance for B&W needs to reflect various objectives that enhance its relationship with stakeholders. The objectives include developing platforms for facilitating healthy and vibrant supplier-B&W relationships and the creation of a channel for solving various problems that arise from the relationship.

Other agendas include the development of continuous systems for improving and adding value to both parties to ensure the existence of tools for gauging performance indicators as set out by parties from the organisation and the service provider side.

Strategic sourcing that is based on building supplier collaborations forms a cornerstone for effective supply chains within an organisation that seeks to build competitive advantage around people.

Instead of leaving strategic sourcing chores to the organisation that does the purchases role, in this case the B&W, internal customers (SABIC) and suppliers need to be incorporated into the purchases decision-making processes.

The contribution of SABIC in purchases decision-making is important since it can provide important information that can lead to the development of an effective purchase prioritisation plan.

SABIC can provide crucial information about its functional areas, including the finance, engineering, quality assurance, market trends, and customer expectations and accounting. Such information can ease the process of supplier evaluations to ensure delivery of the correct supplies for the first time.

The information can also aid in research and development of new materials by the suppliers to guarantee continued business success.

This way, the relationships between suppliers and B&W can improve since suppliers consider SABIC through B&W as not only serving its own interests, but also pursuing competitive strategic plans and policies of mutual gain.

How Costing methods should be applied by B&W to the things that it makes for BoZ/SABIC

Costing methods are accounting techniques that are used by organisations to determine the value of their inputs and outputs in the production process. In other words, it helps an organisation to determine the cost per unit of production and other key performance indicators (Baier 36).

Such information is very critical for an organisation since it guides how the organisation is going to determine its production levels, competitive strategy, pricing, future investments, and many other concerns that are important in ensuring competitive advantage.

For instance, B&W has failed in this area as evidenced by its bad approaches to purchasing of supplies as adopted by Albert who has no regard for market trends. He is driven by the desire to exploit suppliers, yet he is not aware or concerned with other key areas of consideration other than pricing.

Through costing methods, an organisation becomes aware of the fact that the cost of production goes beyond financial factors to include other issues such as convenience, quality, and timelines, which are equally important in determining the organisation’s bottom line.

For example, it is inappropriate for B&W to arrive at sales price through approximation or by charging some costs twice as Albert did. A logical and verifiable costing method is required. One of such methods entails the Cost Volume Profit analysis (CVP).

Organisations, including B&W engage in business activities with a view of making profit. Thus, in arriving at a sales price, it important to determine the cost of the things that B&W makes for Boz/SABIC at a point in which no profit is made. Profit margin should then be added to the cost.

This process entails determining first the critical point of operation for B&W. At the point, the sum of returns is equivalent to the sum of expenses. The point forms the basic tenet for a detailed CVP analysis in costing.

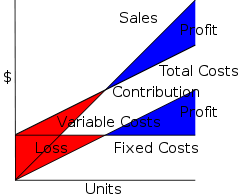

CVP constitutes an important costing approach for B&W, especially when making short-term decisions. Figure 1 shows how the various variables relate. In particular, while arriving at the cost for the things made by B&W for SABIC, the breakeven point is critical.

The formula applied in managerial accounting for CVP analysis is: px = vx + FC +Profit, p is the price per unit, v is the variable cost per unit, x denotes the produced units, which have been sold, while FC is the total fixed cost (Atrill and McLaney 19).

From this formula, it is clear that apart from determining the breakeven point, CVP endeavours to establish the appropriate sale mixes. It also helps in setting the variable cost per unit, unit-selling prices, volume of level of activity, and total fixed cost.

When fully acquired by BoZ/SABIC, B&W should become a functional unit within the parent company. Hence, it might be inappropriate to add the profit margin as shown in the CVP equation since the margin is charged for the final product.

Improving the Working Capital Situation at B&W

Working capital indicates the operational efficiency of an organisation. It also determines its effectiveness. However, while more working capital is good for the business, it is easier to achieve it theoretically that doing it practically. In other words, many organisations unsuccessfully seek to improve their working capital.

Consequently, there is a need for B&W to identify the demand for an improved working capital as an area of priority and hence putting the necessary efforts and resources to achieve the intended results.

Firstly, improving working capital requires the organisation to ensure that its cash collection system is tamper-proof and effective in ensuring that all the necessary funds for the organisation are received and recorded appropriately and without errors (Clarke 3).

For example, there is an evident lack of a good recording and collection system at B&W. While there is proof that the organisation offers invoices, such invoices are not backed by purchasing activity records.

This questionable situation can easily be used as a loophole through which non-existent purchases can be introduced to swindle the organisation of its money. A good collection record will also ensure that the organisation can easily issue clear and accurate invoices within the shortest time possible.

In addition, such a collection system allows the organisation to keep track of collection data such as average monthly receivables, average losses, late payments, and non-payments, which will ensure that it is aware of the amount of disposable capital and hence put the right measures in place to maximise its capital accordingly.

The second approach that the organisation can use to increase its working capital is the use of a well-functioning inventory management system. An inventory system allows an organisation to track its supplies effectively to guarantee no over-stocking or under-stocking at any given time (Baier 5).

However, of the two cases, overstocking is more costly to an organisation since it indicates the existence of a lot of capital that is idle in the form of goods and products that cannot be easily be diverted to other activities that may be of priority to the organisation.

Consequently, by having a good inventory system at B&W, it will ensure that the organisation can keep the adequate and required stock for its operations. The money that might have otherwise gone to overstocking will be dedicated to the working capital of the organisation.

Thirdly, one of the most effective methods of increasing working capital across the world in many organisations is increasing the sales revenues (Clarke 8).

It is with hope that the collaborations between SABIC/BoZ and B&W will open a period where the organisations will increase their marketing activities, which will warrant the selling of more of the organisation’s products, hence ensuring more cash-flow into the organisation.

The strategy will lead to more profits, which will finally attract increased working capital.

Fourthly, it is important for the organisation to ensure that it pays its suppliers on time. Such an approach is very important since it gives an organisation a competitive advantage over other organisations.

It allows a room for negotiation for better deals since the suppliers have more trust in dealing with the organisation. By getting better deals, the organisations can save more and hence use such savings as working capital.

In the case of B&W, customers and suppliers are important determinants of the magnitude of the available working capital. B&W needs to create mechanisms for managing customers while at the same time creating collaborative frameworks with them.

The company needs not to just think mainly about its own needs in a linear way. It should collaborate with its customers in terms of establishing feasible plans for inventory control to facilitate effective and efficient production process with an objective of cutting on wastes.

This strategy helps in reducing costs that are associated with inventory handling, which decreases the overall costs, hence availing more financial resources. A non-inventory situation can be achieved through matching production with customer consumption levels.

Baier supports this approach claiming, “While aligning ordering, production, and distribution processes, companies can increase inherent efficiency and achieve direct cost savings almost instantly (91).”

By building good customer relationships, B&W should also negotiate payment terms in a more efficient way to avoid bad debts or delaying payments.

B&W can increase its working capital through proper management of supplier relationships. Depending on the rate of use of materials that are acquired from the suppliers, B&W can gain more working capital by stock consignments negotiations.

This approach is important compared to pushing for extensions of different terms, especially in situations of high-lead times and/or when the placing of minimum-order amounts is needed. More importantly, B&W should not forget to ensure effective cash collection from customers by minimising potential issues that may delay payments.

B&W should take early initiatives to seek communication with customers, especially in ensuring that all invoices have been received and that they are correct to warrant their timely settlement. This process calls for employing a full-time credit control officer and his or her assistants.

Parties that B&W can approach to discuss about the Strategy it can adopt for other areas of SABIC

The success of a business partnership or collaboration requires a close engagement and a good working relationship among all parties (Baier 6). In the case of SABIC and B&W, each organisation brings with it a vast amount of experience in its areas of operations, which cannot be easily transferred.

For instance, B&W has a long experience in dealing with suppliers. It has a patented process to show for it. However, the process is not meant for SABIOC. Hence, several adjustments will have to be made to ensure that the processes are aligned with the organisation’s goals.

In this case, it is important for the two organisations to work closely together to ensure seamless integration of each other’s operations to meet the overall organisation’s vision.

In this case, B&W can only know what it needs to do for SABIC by talking to SABIC’s leaders, employees, and other stakeholders.

SABIC’s leaders carry the business vision. In ensuring that B&W relationships with SABIC match SABIC’s vision, B&W must engage leaders in both entities in establishing a business framework that meets the needs of the two entities. Employees carry SABIC’s knowledge bases.

Therefore, knowing what to exactly deliver to meet the needs of the company calls for the facilitation of knowledge sharing between B&W and SABIC’s employees. This goal can be achieved through the establishment of a knowledge sharing culture between the two entities. Again, the situation calls for collaboration among leaders of the entities.

Through GApT, SABIC authenticates various claims and practices. Its implicit laboratory can establish links with SABIC’s equipment hubs across the world to enhance the utilisation of information. B&W should tap into this resource to develop awareness of new raw material needs for SABIC.

This case implies the need to talk to SABIC’s application developers and experts, scientists, and engineers on innovations. The goal is to share and assimilate the acquired knowledge in its business models. This way, B&W will remain a competitive supplier for SABIC.

An organisation operates to meet not only its interests, but also those of its stakeholders. Thus, B&W needs to talk to SABIC’s stakeholders, especially its owners and communities, to analyse their anticipations from SABIC.

This plan ensures that B&W only engages in activities that promote good relationships between SABIC and its stakeholders to build long-term positive corporate responsibility relationships. B&W also needs to adopt good corporate ethics by benchmarking ethical guidelines for its suppliers and BoZ/SABIC.

It needs to talk to the SABIC’s management.

Conclusions

Time-phased Plan for Action at B&W

From the above expositions, it is clear that B&W suffers from several challenges that need immense attention by the company’s leadership. It needs to formulate and implement a plan for organisational change. Its purchases function is almost non-existent. Therefore, the first step is to create a structured purchases department.

This step should be followed by developing a policy for accountability check of the operations of the department. Recruitment of staff members for overseeing the functioning of the department is also important. B&W also lacks an ethics policy.

Thus, it should establish a committee to lay out various ethical guidelines for B&W by surveying stakeholder expectations, including suppliers, owners, employees, the government through corporate regulatory frameworks, and the organisational leadership.

To ensure that the company does not suffer from bad debts, it also needs to employ full-time credit control officers. Since B&W remains in operation while still formulating policies that guide the recommended changes, recruitment and training of credit officers should be done in the shortest time possible.

Table 1: Time-phased Plan for B&W

Recommendations

The current situation at B&W, as well as SABIC, clearly shows that the leadership and organisational management processes are lacking and/or inadequate (Baier 73). However, the current management approaches have shown that B&W has gone against these important factors.

It has allowed bad leadership, poor decisions, poor supplier-organisation relationships, and poor customer relationship to creep in.

For example, the total disregard of suppliers’ concerns at B&W, despite their important role in the organisation’s success, is an important indicator of an organisational leadership that has lost its grounds and one that is driving the organisation towards oblivion.

In addition, the evident lack of records on purchasing activity at B&W is an important indicator of bad leadership and obvious questionable accountability processes for both organisation and suppliers. The situation can easily create loopholes that can be exploited to the disadvantage of the suppliers.

Such a condition can easily lead to deterioration of relationships within the organisation and/or among stakeholders and hence create a negative organisation’s image.

In addition, lack of ethical guideless and codes of conduct at the organisation shows a total disregard of accountability in terms of behaviour and interactions between employees and stakeholders. In other words, without a code of conduct, there is no benchmark for behaviour or dealings with stakeholders.

People can easily walk away with bad actions that cannot be tolerated in the civilised organisations of the 21st century.

To reverse the current negative and bad organisational management processes at B&W, there is a need to do an overhaul of the current organisational processes and incorporate corporate governance that upholds better leadership and ethical guidelines that dictate what acceptable and unacceptable behaviour is at the organisation.

Corporate governance involves all aspects of organisational control and management of interests that organisations serve. It addresses issues that relate to finance, regulations, and ownership systems of an organisation.

From this assertion, B&W suffered from serious corporate governance issues, as Albert did not follow any regulations while executing business deals. Apart from the invoices, no other records could be obtained for business transactions between B&W and suppliers.

Therefore, there were no mechanisms for evaluating the organisation’s level of transparency and accountability, especially after considering that Albert did not maintain open books.

At the heart of corporate governance is the need to mitigate inconsistencies by enacting conflict of interest control and prevention mechanisms among stakeholders. In any setting, which has different people, conflicts are bound to happen.

Consequently, it is important to have conflict resolution strategies to solve the clashes in a timely and satisfactorily manner. Conflicts in an organisational setting occur mostly when stakeholders feel that their interests are not being met or when they differ on how each stakeholder’s interests are going to be met.

Good conflict management approaches start with a good code of conduct that clearly sets the boundaries and responsibilities of each party (Clarke 88). Such a code helps an organisation to eliminate areas of conflict of interests.

In addition, a good conflict management strategy reduces the lead times for solving all emerging conflicts, thus ensuring little or no disruptions to the operations of other activities in the organisation. In this context, B&W needs to put in place strategies for enhancing corporate governance.

It needs to be accountable by maintaining accurate records of its business transactions. It should permit external auditors to access them. This way, B&W’s purchasing can become responsible to the SABC board. Unfortunately, Lyzan Bazzi inherited almost a non-existing purchases function.

Therefore, improving corporate governance requires the development of effective and structured functional purchases functions. Power can then be bestowed on the purchases and procurement positions, rather than bestowing it on an individual who occupies the position.

Considering Albert’s involvement in unaccountable business deals with suppliers, it is important for SABIC to restructure B&W in manner that encourages high levels of integrity in conducting the corporation’s purchases and supply functions.

For instance, after allocating power to different functional managerial positions within B&W, an internal audit committee for SABIC/B&W should be established.

Certain rules to regulate corporate audit committees should be established to promote accountability to both shareholders and other stakeholders of corporations in different geographical operational areas.

For instance, with reference to the UK operational geographical area, before the enactment of 2010 corporate codes of ethics, the UK corporate accountability check required corporations to prepare annual reports.

The reports were to explain “the basis on which the company generated or preserved value over a long-term and the model of delivering the company’s objectives” (Clarke 82).

This plan facilitated the provision of information that was necessary for B&W stakeholders to mitigate the perceived risks that resulted from fraud, which acted against its interests.

Consistent with 2010 accountability and business reporting code, B&W directors need to explain their responsibilities with reference to the preparation of accounts and annual reports. In addition, Financial Reporting Council reckons, “the directors should report ongoing concerns in annual and half-yearly financial statements” (7).

In the yearly reports, the codes require remuneration committees and audit committees while not negating all board committee members to be duly identified.

Upon complying with these legal requirements, B&W can track and adopt the necessary legal actions against parties such as Albert among other who are discovered to have participated in fraud, including falsification of financial records by introducing falsified costs after applying the overheads twice to some things that he had sold BoZ.

Works Cited

Atrill, Peter, and James McLaney. Accounting and Finance for non-specialists. New York, NY: Prentice Hall, 2007. Print.

Baier, Christian. The alignment performance link in purchasing and supply management: Performance Implications of Fit between Business Strategy, Purchasing Strategy, and Purchasing Practices. New York, NY: Springer Science & Business Media, 2008. Print.

Clarke, Timothy. International Corporate Governance. London and New York, NY: Routledge, 2007. Print.

Financial Reporting Council. The UK Corporate Governance Code. London: Financial Reporting Council, 2010. Print

Maloni, Michael, and Michael Brown. “Corporate Social Responsibility in the Supply Chain: An Application in the Food Industry.” Journal of Business Ethics 68.1(2006): 35-52. Print.