Reason for economic and financial trouble

It is notable that some Eurozone countries have been in a financial and economic crisis. This has been brought about by various reasons that need to be evaluated and looked at for sustainability. It should be known that this crisis has led to sustained action by various governments.

Most of the Eurozone countries are in a financial and economic trouble because of the sovereign debt crisis. As a matter of fact, the debt crisis has been much higher than it had been projected (Mitchell 9). This can be blamed on the notable crisis of confidence. The possible widening of bond yields has also been a problem in a broad way. Credit default swaps as a result of risk insurance has also been a major concern.

There has been an argument that most of these countries are in a crisis because of chronic fiscal mismanagement. Therefore, it does occur that since these countries are tied to a single currency, any faltering will always be catastrophic. In this case, these problems have been spreading from one nation to the other as time goes.

This is because their economies are interlinked together in one way or the other (Poggioli 17). As a matter of fact, there is a lot of overdependence on a single currency and this is not good at all. Some countries have been trying to massage their books to try and hide the real problem and appear like nothing is happening.

The major reason behind the crisis can be traced on the exposure of the Eurozone countries to the US subprime problem. There was the inability to value existing and structured products and this extended the risk. Most financial institutions had overstretched their leveraging position and this made them vulnerable (Mitchell 22). This is as far as corrections in the asset market are concerned. The whole economic and financial trouble can be blamed on the US subprime market that has toppled the Eurozone structure.

Most Eurozone countries have found themselves in this crisis because they have not embraced protectionism that is supposed to have a good impact on their economies. This is as far as macroeconomic issues are concerned. In this case, there has been a loss of policy options because of the European monetary union.

As a matter of fact, they can not control their exchange rates. Lack of proper coordination can also be seen as a major problem that has brought these countries into such a crisis. As the global financial crisis has been escalating, most Eurozone countries have been having a sluggish demand and this has affected their economies (Poggioli 19). Policies have not changed considerably and this has reduced the growth potential of most of these countries.

Parts of the capital stock have been known to be obsolete and this has increased risks. Initially, there was a lot of capital that had flooded in Eurozone countries but they were not able to utilize it. Generally, the EU economy is very resilient and this has pulled many countries into a crisis.

The Eurozone has 15 countries and it should be know that their GDP has contacted by 0.2% (Deepankar 13). Monetization of public debt has been a problem and that is why it has been hard for these countries to evade this crisis. It should be known that the sovereign debt crisis has been spreading from one country to the other as time goes by and this explains why it has been escalating as time goes by.

Greece and Ireland

Greece and Ireland have been subjected to a barrage of bad news in 2010. In this case, there have been major economic and financial problems as far as the Eurozone crisis is concerned.

Greece has been in the limelight because of its budget deficit that was higher than what had been projected. In this case, the deficit was 13% of the GDP (Guardian 25). The country’s problems have been complicated by an attempt to massage its books. It should be known that the country has a mounting sovereign debt and this is a major concern for other Eurozone members.

In recent years, the credit default swaps have been increasing and this has been a major economic and financial problem. In the process, financial market participants have been anticipating for defaults. As a matter of fact, interest rates have increased thereby complicating financial markets in the country (Deepankar 25).

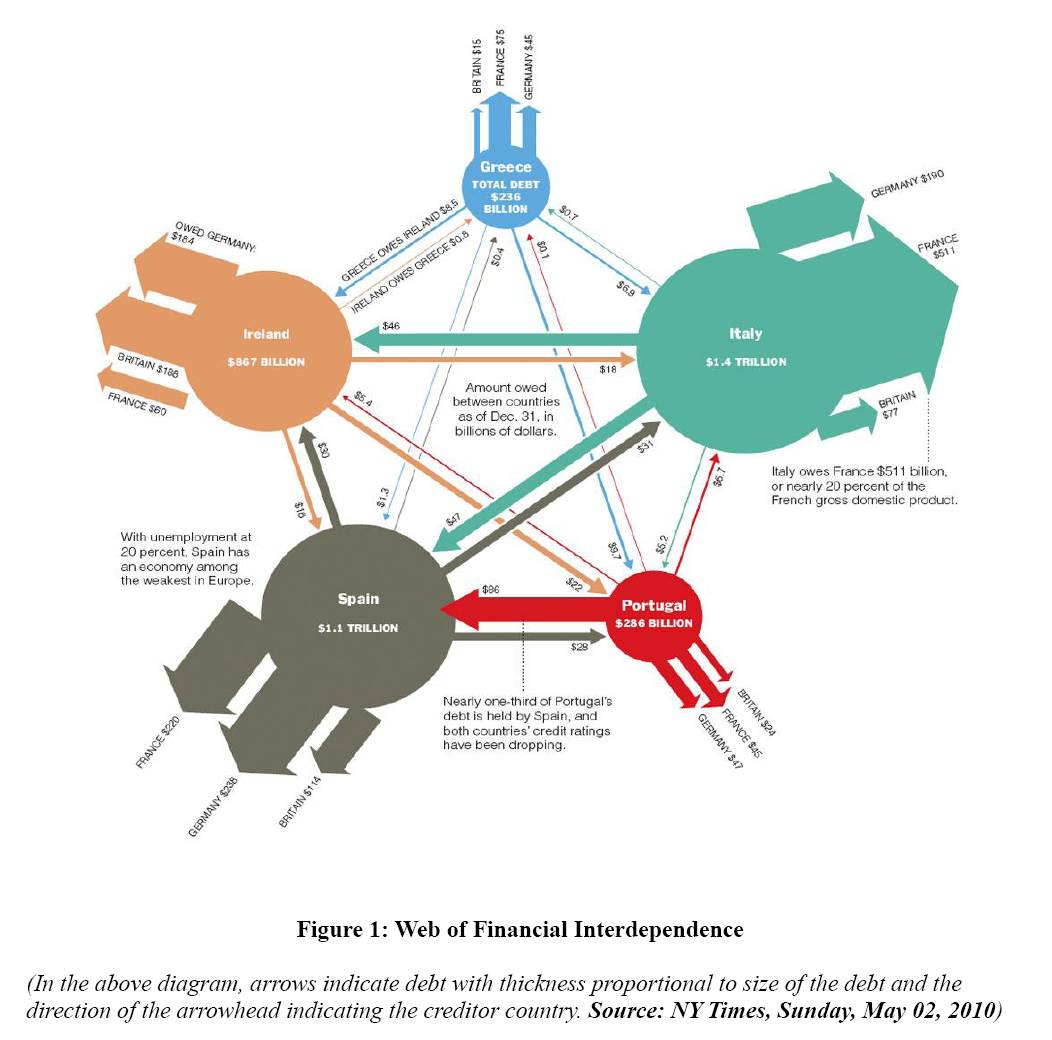

Whenever interest rates have increased, the debt burden has gone up thereby making the situation worse for Greece. The web of financial interdependence has seen the problem revolve around various countries like Greece, Spain, Ireland and others. This situation can be explained form the graph below.

Source: Deepankar.

Ireland’s major economic and financial problem is its own banking system. In this case, it’s ten times the GDP of the entire country and this is a very big problem. As a matter of fact, some banks have ended up engaging in risky operations thereby complicating the country’s economic and financial position (The Economist 29).

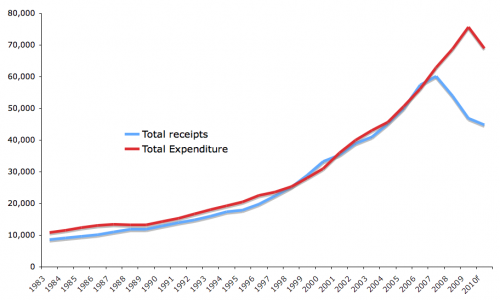

Therefore, the crisis in the country’s financial sector will still remain a big problem to its economy as time goes by. The scale of problem has been beyond measure and this poses a serious risk to the economy. It should be known that Ireland has also found itself in a big budget deficit that can be explained by the graph below.

Source: Mitchell.

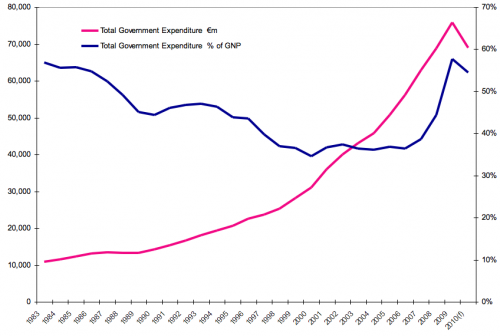

The burden of government spending has been seen everywhere as far as GDP is concerned. Notably, government spending has been diverting a lot of resources from the economy’s productive sector (Kitano 31). Therefore, the root cause of the country’s problem can be traced from the governments’ spending that was preceded by a housing bubble. The common currency has also created the current mess because the country can not come up with its own policies unilaterally. This can be explained by the graph below.

Source: Mitchell.

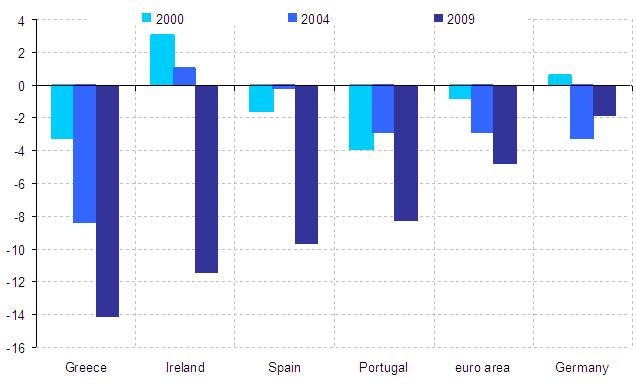

It should be known that Greece has had its own share of economic and financial problems based on various metrics and aspects. For instance, the table below shows the general government budget balance that has been witnessed in selected years.

Source: Mitchell.

There has been an argument that various economic problems will ultimately threaten Greece’s place in EU. This is because the country is experiencing a severe budget crisis that can be explained from the graph above. In this case, the country might end up loosing the Euro as its national currency based on various policy issues.

All along, the government has been resisting subsidies and it is keen on tax hikes and various sharp cutbacks (Kaletsky 12). These cutbacks are ultimately aimed at the country’s enormous public sector. It should be known that the country has a lot of tax evasion issues and this is a menace that needs to be sorted out for sustainability.

Proposed solution

It should be known that Eurozone leaders have tried to come up with a long term solution that will assist these countries to navigate through the economic and financial crisis. There has been a proposed 110 billion Euros fund that will be given as a loan to Greece (The Economist 38).

On the other hand, there is an 85 billion euro bailout that will be advanced to Ireland. These solutions have been crafted by the European Union and the IMF to help these two countries move out of the crisis. The EU and IMF have come up with the European financial stability facility that is aimed at stabilizing the two countries. This can be explained from the fact that there is a proposal to establish a big Euro fund.

Financial markets are not convinced that this crisis can be solved because they are still pessimistic. There is a proposed solution for the central bank buying program.

In this case, the ECB will purchase the sovereign debts of various countries. The ECB should therefore step up its buying program that is expected to be to the tune of 1-2 trillion Euros (Wearden 27). Another proposed solution is to enhance and enlarge the European financial stability facility. This is because after bailing out Ireland, it still has 650 billion Euros. In this case, there are plans to double up its size.

Another proposed solution will be the issuance of Pan-Euro Zone bonds. This idea has been floated around by various policy makers although some countries like France are reluctant because they have sustainable programs and they do not wish to share their status with other countries like Greece and Ireland.

The only problem is setting up the financial and legal structure that might take some time and this is an urgent matter (Connor 18). There is a proposed idea for China to buy large amounts of the Eurozone. This is based on the fact that China owns a large amount of US treasury bonds.

As a matter of fact, China has enough resources to purchase the Euro zone paper. In addition, China can lend money to various countries at an affordable interest rate of 3.5% (The Economist 34). In this case, preference should be given to countries that have a serious debt crisis like Greece and Ireland. Although this is a viable idea, it is likely to face a lot of opposition from other countries that might not be comfortable with such an arrangement. Countries are proposing a full fiscal union and this as far as different states are concerned.

Eurozone countries have the same currency and interest rates. Therefore, this idea will create a lot of risk differentials and tension that is not good for the European Union. These two countries have come up with an initiative to correct this crisis that is threatening to affect and derail their own growth prospects and expectations. So far, the Ireland bailout has not restored the confidence that was expected (Wachman 31).

To restore confidence, the central bank will ultimately buy out government bonds albeit with much activity and vigor. The ECB wants to print out more money with an aim of bringing down costs in affected countries. This is because it will bring down the demand for bonds. There is an idea that Greece and Ireland should quit the single currency.

Role that the European Central Bank has been playing

The European Central bank has been instrumental in ensuring that the crisis that has been playing out in Greece and Ireland does not affect the rest of Europe. This is because it has a potential to lead to the collapse of the Euro Currency. The collapse of the Euro will be devastating and that is why the ECB is doing everything possible to avert this problem (Pearlstein 28).

So far, the ECB has already forced Greece and Ireland to accept bailouts as a way of correcting their sovereign debt crisis and this is commendable. As a matter of fact, the ECB has created a facility and fund that is supposed to be used to bail out other countries that are slowly facing the same crisis like Portugal and Spain.

Greece’s and Irelands bonds have been guaranteed by the European Central bank and this is aimed at restoring confidence and demand. All along, the European Central bank has been coming up with various initiatives that will bring together all stakeholders to find a long lasting solution to this problem (Kaletsky 21).

The bank has been effectively managing the Euro because it is used by various countries and any problem will be replicated and seen in others. This is a scenario that the Central bank will not like to see and that is why it has been effectively monitoring interest rates.

The financial system assessment program has been initiated by the central bank and this has played a big role in strengthening the markets in the two countries. This is aimed at making them more stable and in the process play an oversight role.

Some countries have been accused of chronic financial mismanagement and the central bank has been coming up with the right policies to strengthen financial markets.

The European Central bank has been providing liquidity to banks (Wachman 37). In the process it is planning to defend the Euro zone for long term sustainability. Through various initiatives, the ECB is forcing countries to restructure their debts as time goes by.

If the actions by these countries will lead to an acceptable solution to the crisis

The actions that have been taken by these two countries will lead to an acceptable solution because something needs to be done before the situation can become complex and serious. These bailouts will help the two countries to stabilize but any default will cause investors to lose confidence in the market (Connor 26). Ireland is a relatively wealthy country and as such will survive this crisis because it can finance various initiatives. All this approaches to the crisis will bear fruits because they have been done with a good legal and financial framework.

Generally, these actions will lead to an acceptable solution because apart from the debt challenge, other problems have also been taken care of. Apart from lack of accountability, these actions that have been taken by these governments will secure wealth that is needed to enhance growth (Kitano 36).

The crisis that has been seen in Greece and Ireland should not be taken for granted because it can still erupt in other countries (Connor 21). If this crisis is not handled well, it can lead to the end of the Euro. Monetization is good but it might lead to inflation as different politicians have argued. Wholesomely, there is a good safety net that will help to separate the two countries.

Reference List

Connor, Kevin. Goldman’s Role in Greek Crisis Is Proving Too Ugly to Ignore. UK: Huffington Post, 2010. Print.

Deepankar, Basu. The Eurozone Crisis: Macroeconomics and Class Struggle. 2010. Web.

Guardian. Eurozone crisis: the options. 2010. Web.

Kaletsky, Anatole. Greek tragedy won’t end in the euro’s death. London: The Times, 2010. Print.

Kitano, Masayuki. Euro surges in short-covering rally, Aussie soars. UK: The Economist, 2010. Print.

Mitchell, Dan. Don’t Blame Ireland’s Mess on Low Corporate Tax Rates. 2010. Web.

Pearlstein, Steven. Forget Greece: Europe’s real problem is Germany. Washington: The Washington Post, 2010. Print.

Poggioli, Sylvia. Economic Problems Threaten Greece’s Place In EU. 2010. Web.

The Economist. Fumbling the ball. 2010. Web.

Wachman, Richard. Greece debt crisis: the role of credit rating agencies. London: The Guardian, 2010. Print.

Wearden, Graeme. European debt crisis: Markets fall as Germany bans naked short- selling. UK: The Guardian, 2010. Print.