- The historical return and expected return and standard deviation

- A superannuation fund

- Features and the important characteristics of shares, property, bonds, and cash

- The expected return and risk in finance

- Diversification and how it impacts the risk and return

- Most suitable portfolio option for the three clients

- Management of Portfolio

- Reference List

The historical return and expected return and standard deviation

The method of calculating the expected return of portfolio works no matter how many assets there are in the portfolio. If we let x1 stand for the percentage of our money in Asset i, then the expected returns is:

E (Rp) = x1 x E (R1) + x2 x E (R2) +…….. xn x E (Rn) (Young and Berry, 2009).

This says that the expected return on portfolio is a straightforward combination of the expected returns on the assets in that portfolio.

A superannuation fund

Superannuation funds state specific investments objectives in their prospectuses. For example the main types of objectives are growth balanced income and industry-specialized funds. Growth funds typically possess diversified portfolios of common stocks in the hope of achieving large capital gains for their shareholders. The balanced fund generally hold a portfolio of diversified common stocks, preferred stocks and bonds with the hope of achieving capital gains and dividend and interest income while at the same time conserving the principal. Income funds concentrate heavily on high-interest and high-dividend-yielding securities. Bond funds vary also in the average duration of its holdings. Portfolios with low durations are significantly less sensitive to changes in interest rates than those with high durations. The industry-specialized Superannuation fund obviously specializes in investing in portfolios of selected industries such a fund appeals to investors who are extremely optimistic about the prospects for these few industries and are willing to assume the risks associated with such a concentration of their investment dollars(Graham, 2006).

A fee or sales charge is often assessed when a fund is purchased. When this occurs, the fund is referred to as a front-end local fund. When the fee is assessed upon redemption of the shares in a Superannuation fund, the fund is referred to as a back-end local fund. Often the exit fee is reduced as the investor’s holding period increases. This encourages the investor to leave the funds under the control of the management company for a longer time. Funds also charge operating expenses. These include investment advisory fees and administrative expenses. These are usually discussed in terms of the percentage of assets under management. Some funds also charge services fees. These fees cover the commission paid to brokers called trail commissions. These fees are assessed annually whereas the back-end and front-end loads are onetime charges(Lee, Chen and Rui, 2001).

The investors should carefully consider the nature and extent of fees that the various Superannuation funds and can significantly influence performance over time. The fees are disclosed in the fund’s prospectus as are many others facts about the fund its investment philosophy and management style. All investment companies are in business to make money. The investor needs to realize that a no-load fund still has expenses that the investor must pay. Thus, the investor must match the performance objectives of the fund and the way it charges for its services with his own objectives of the fund and the way it charges for its services with his own objectives and time horizon for investing in order to make a prudent investment selection(Harrington, 1987).

Features and the important characteristics of shares, property, bonds, and cash

Shares– These are units of ownership, of the company. They receive dividends as returns and it is regular.

Bonds– This is debt is against some form of collateral. This is nothing but money lent by creditors against the assets of the company and it has to repay irrespective of the performance of the company for which it is intended

Cash– this earns interest when held in the bank.

Property – This earns rent as returns.

The expected return and risk in finance

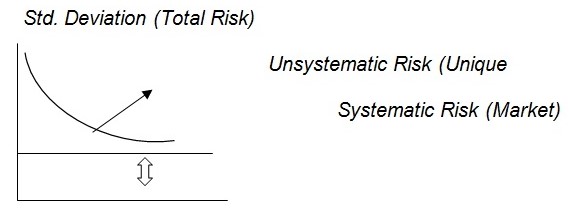

The standard deviation measures the risk of deviation from the mean. It shows the variability of the average mean thus the risk of not getting an average return. The risk is systematic, which affects the Superannuation fund, without financial or other industry without affecting other investors can be disposed of or mitigated by diversification, which was talked about by the theory of portfolio risk such as the industry caused by the conditions of their own. Diversification cushions the impact of fluctuation of a single asset on the portfolio thereby reducing the risk involved. Risk and return are of core consideration for a well-diversified portfolio. With reference to the figure (1), Risk is either systematic or unsystematic. The risk, which can be diversified away by increasing the number of securities is the unsystematic risk. The risk, which cannot be eliminated further, is the systematic risk. The specific risk is composed of factors specific to the security. The market risk is the risk related to Market-wide factors such as interest rates, inflation, economic activity, exchange rates, and unemployment. Thereby, diversification helps bring unsystematic risk towards zero so that the investor has to only deal with systematic risk. Thus, analyzing the investor’s portfolio we can conclude whether the investor is risk-loving, neutral or risk-averse. The figure below is Systematic and Unsystematic risk(Fisher and Jordan, 2006).

Diversification and how it impacts the risk and return

The diversification benefit does depend on the period over which returns and variance are calculated. Some of the riskiness associated with individual assets can be eliminated by forming portfolios. The process of spreading an investment across assets is called diversification. The principle of diversification tells us that spreading an investment across many assets will eliminate some of the risks. Not surprisingly, risks that can be eliminated by diversification are called “diversifiable” risks (Poterba and Summers, 1986).

A reasonable surrogate of risk is the variability of return. This measure in statistics is commonly the variance or standard deviation of the returns on stock around the expected return. In reality, the variation in return below what is expected is the best measure of risk but we saw that because the distributions of returns on stock are nearly normal in a statistical sense the semi-deviation or semi-variance below is expected value need not be calculated.

The total risk of an investment can be thought of as consisting of two components: diversifiable risk. The former risk can be almost entirely by holding a large enough mix of carefully selected securities. The only risk an investor compensates for taking is thus non-diversifiable risk. Efforts to spread and minimize risk take the form of diversification. The more traditional forms of diversification have concentrated upon holding a number of security types across industry lines. The reasons are related to inherent differences in bond and equity contracts, coupled with the notion that an investment in firms in similar industries would most likely do better than in firms within the same industry. Holding one stock each from mining, utility, and manufacturing groups is superior to holding their mining stocks. Carried to its extreme, this approach leads to the conclusion that the best diversification comes through holding a large number of securities scattered across industries. Many would feel that holding fifty such scattered stocks is five more diversified than holding ten scattered stocks.

Most people would agree that a portfolio consisting of two stocks is probably less risky than one holding either stock alone. However, experts disagree with regard to the “right “kind of diversification and the right reason. His approach to coming up with good portfolio possibilities has its roots in risk-return relationships. This is not at odds with traditional approaches in concept. The key differences lie in the assumption that investors’ attitudes toward portfolios depend exclusively upon (1) expected return and risk, and (2) quantification of risk. In addition, the risk is, by proxy, the statistical notion of variance, or standard deviation of return. These simple assumptions are strong, and many traditionalists dispute them (Norton, 2006).

The reduction of risk of a portfolio by blending into it security whose risk is greater than that of any of the securities held initially suggests that deducing the riskiness of a portfolio simply by knowing the riskiness of individual securities is not possible. The crucial point of how to achieve the proper proportions of stocks in reducing the risk to zero will be taken up later. However, the general notion is clear. The risk of the portfolio is reduced by playing offset of variations against another. Finding two securities each of which tends to perform well whenever the other does poorly makes more certain a reasonable return for the portfolio as a whole, even if one of its components happens to be quite risky(French and Roll, 1986).

Most suitable portfolio option for the three clients

A portfolio can consist of investments in stocks, bonds, mutual funds, and exchange-traded funds. The diversification benefit does depend on the time period over which returns and variance are calculated. Some of the riskiness associated with individual assets can be eliminated by forming portfolios. The process of spreading an investment across assets is called diversification. The principle of diversification tells us that spreading an investment across many assets will eliminate some of the risks. Not surprisingly, risks that can be eliminated by diversification are called “diversifiable” risks. The simple fact that securities carry differing degrees of expected risk leads most investors to the notion of holding more than one security at a time, in an attempt to spread risks by not putting all their eggs into one basket. Diversification of one’s holding is intended to reduce risk in an economy in which every asset’s returns are subject to some degree of uncertainty. Even the value of cash suffers from the inroads of inflation. Most investors hope that if they hold several assets, even if one goes bad, the others will provide some protection from an extreme loss(Graham, 2004).

A young Deakin Commerce graduate with a long and successful. This client does not have cash but investments that will provide future cash flows. This is 20% Australian shares, 50% Australian bonds and 30% property

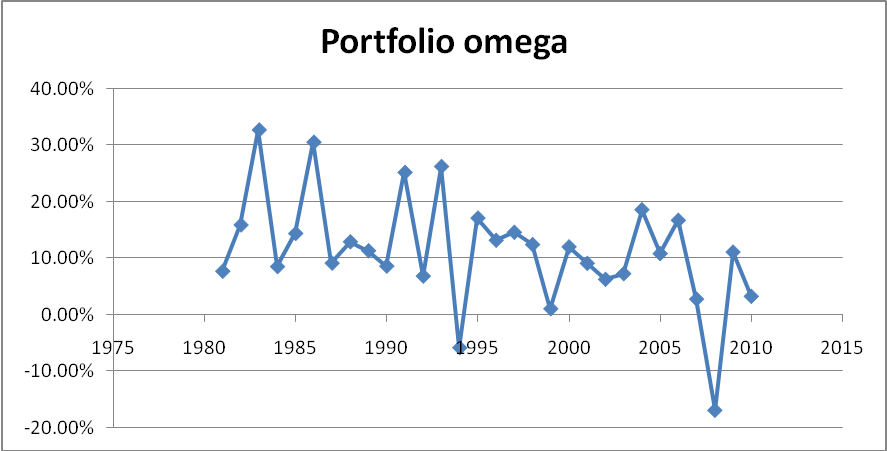

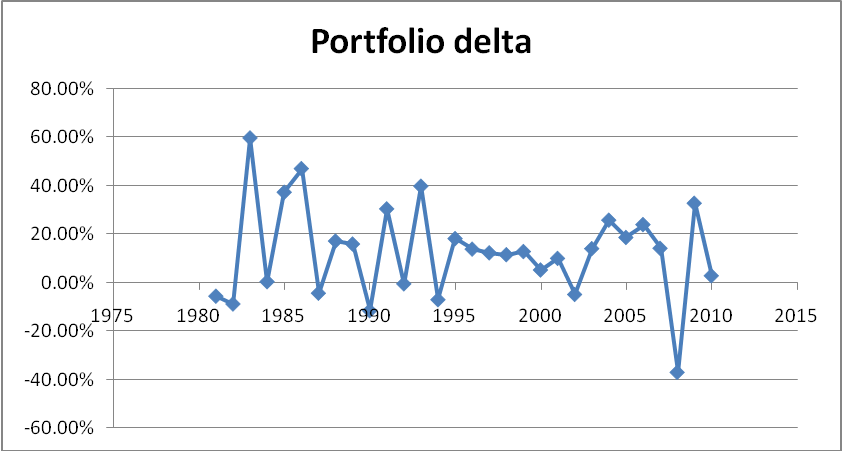

A married couple will invest in Portfolio Delta: 80% Australian shares; 10% property; 10% cash, which requires

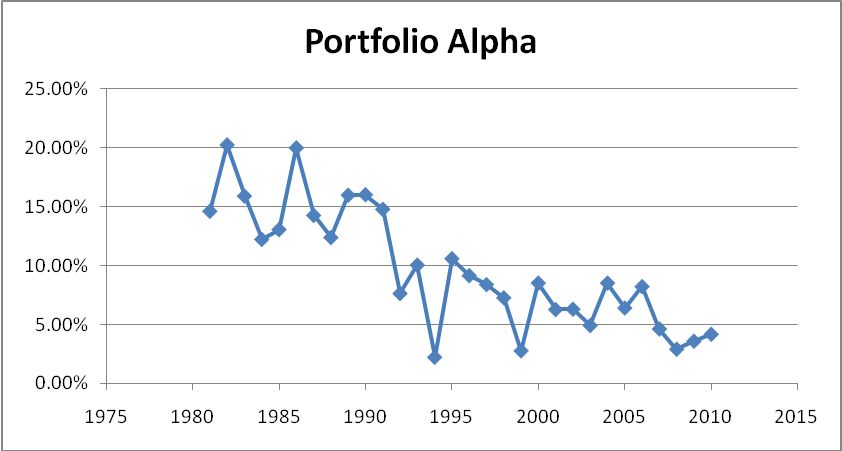

An older member of the workforce who is planning to retire in the next 12 months- This person requires cash to spend and those investments that provide regular returns; this can be provided by portfolio alpha. Which has 70% cash, 20% Australian bonds and 10% property. Shares do not have a regular cash inflow as they depend on the performance of the companies.

Management of Portfolio

The portfolio to be invested in should be Portfolio Alpha, which has 70% cash, 20% Australian bonds, and 10% property. This is because this portfolio has no shares that have high volatility in the returns. This is because most investors lack the education, background, time, foresight, resources, and temperament to carry out the proper handling of portfolios with shares. Most often, the source chosen takes the form of a mutual fund or open-end investment company whose mandate is to manage portfolios. The expenses involved in handling a truly managed portfolio because the construction of the index-fund portfolio is entirely based upon maintaining proportions of the index being followed. As such considerably lower transaction costs are involved because fewer purchases and sales of securities would take place. There would be much less need for expensive batteries of security analysts and portfolio managers. Thus, the overall administrative expenses would also be reduced. Second with the passage of the new pension reform law, the investment trust laws surrounding the liability of portfolio they manage.

When an investor invests in a single asset portfolio, asset variance is important, but as we keep on adding assets and the portfolio increases, the effect of individual asset variance decreases and the effect of portfolio variance increases.

The weighted sum of the asset variances and co-variances equals the portfolio variance. Despite the fact that an asset might be very risky, having a high variance of return, the risk might be canceled out by the covariance of the assets in the portfolio as a whole.

In a nutshell, as we broaden the investment spectrum to include a diversified portfolio, we can achieve a considerable decrease in the variance with which the investor can noticeably reduce the total risk.

Reference List

Fisher, D. & Jordan R, 2006. Security Analysis and Portfolio Management. New Delhi: Prentice-Hall of India Private Limited

Harrington, R. 1987. Modern Portfolio Theory. Englewood Cliffs: Prentice-Hall.

Graham, B., 2004. Securities Analysis. New York: McGraw Hill

Graham, B., 2006. The Intelligent Investor. New York: McGraw Hill.

French, K. R. & Roll, R., 1986. Stock returns variances: the arrival of information and the reaction of traders. Journal of Financial Economics, 17 (2), pp. 5-26.

Lee, C. Chen, R. & Rui, C., 2001. Stock returns and volatility on China stock markets. Journal of Financial Research, 24(1), pp.523-543.

Norton, R., 2006. Investments. New York: Thomson Higher Education.

Poterba, J.M., and Summers, L., 1986. The persistence of volatility and stock market fluctuations. American Economic Review. Vol. 76, pp.1142-1151.

Young, D. & Berry, M., 2009. Macroeconomic Forces, Systematic Risk, and Financial Variables. Journal of Financial and Quantitative Analysis.