Yogesh Ambekar is the author of the article “Monetary Policy” published on August 15, 2004. He describes monetary policy as a tool to manage the supply of money in an economy to attain price stability, maintain the value of money, dealing with unemployment, etc.

He adds that the money circulation and short term interest rates prevailing in the economy determine whether the monetary policy is tight or loose. Ambekar further argues that short term interest rate is the elementary factor in regulating the monetary policy of an economy.

He says that before applying the monetary policy, money circulating in the economy and the viability of open market operations are considered. According to the author, though monetary policy is used for achieving short term objectives, it also provides means to attain price stability in the longer run by shrinking the fluctuation range in the business cycles. While concluding his article, Ambekar emphasizes that the monetary policy shall be carefully designed as it has a vital part in building a country’s economy.

Critical Reflections

In this article, Yogesh Ambekar intends to develop an understanding among the readers the concept of monetary policy and how it is used by the governments and central banks to counter inflation, unemployment, etc. While discussing that the monetary policy may be set tight or loose, Ambekar does not mention how the policy works and what are the objectives of doing so.

As for example, by a tight monetary policy the foremost objective is to obtain increased growth and employment by means of reduction in short term interest rates which improve the borrowing power of people leading to an increased aggregate demand and ultimately results in increased growth and decreased unemployment.

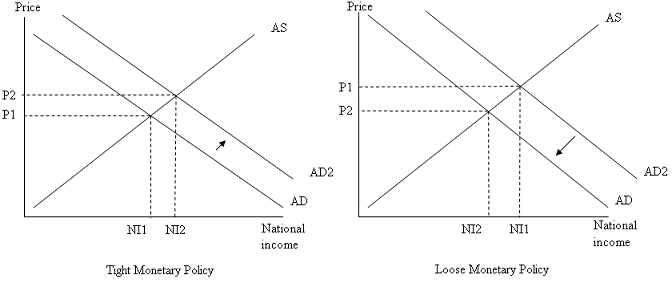

On the other hand, the central bank aims to reduce the inflation prevailing in the economy by a loose monetary policy. In doing so, interest rates are increased and hence money supply is decreased to deter borrowings and attract investments. Both of these processes are shown below.

Moreover, the author does not highlight the risks associated with the use of monetary policy as seen in the diagrams above. The tight monetary policy results in inflation whereas loose policy hampers growth and promotes unemployment.

Another important issue which Ambekar does not discuss is the time lag related to the implementation of this policy. Time lag refers to the time it takes to identify the issues and appropriately design and implement a monetary policy.

By the time this process is completed, the issues no longer remain the same and result in an ineffective monetary policy. Furthermore, Ambekar discusses the role of monetary policy in stabilizing prices. He shows how fundamental monetary policy proves to be in terms of prices stability by relating the monetary policy with business cycles and explains how fluctuations in business cycle are minimized.

At the end, he stresses on the fact that though long-term interest rates are considered in boosting economic growth of a country and monetary policies can only be used in short run but at the same time they should be designed carefully as in the longer run they effect the economic growth (Ambekar).

Work Cited

Ambekar, Yogesh. “Monetary Policy.” 2011. Buzzle.com. Web.